Detailed Solution to Practice Exam I

advertisement

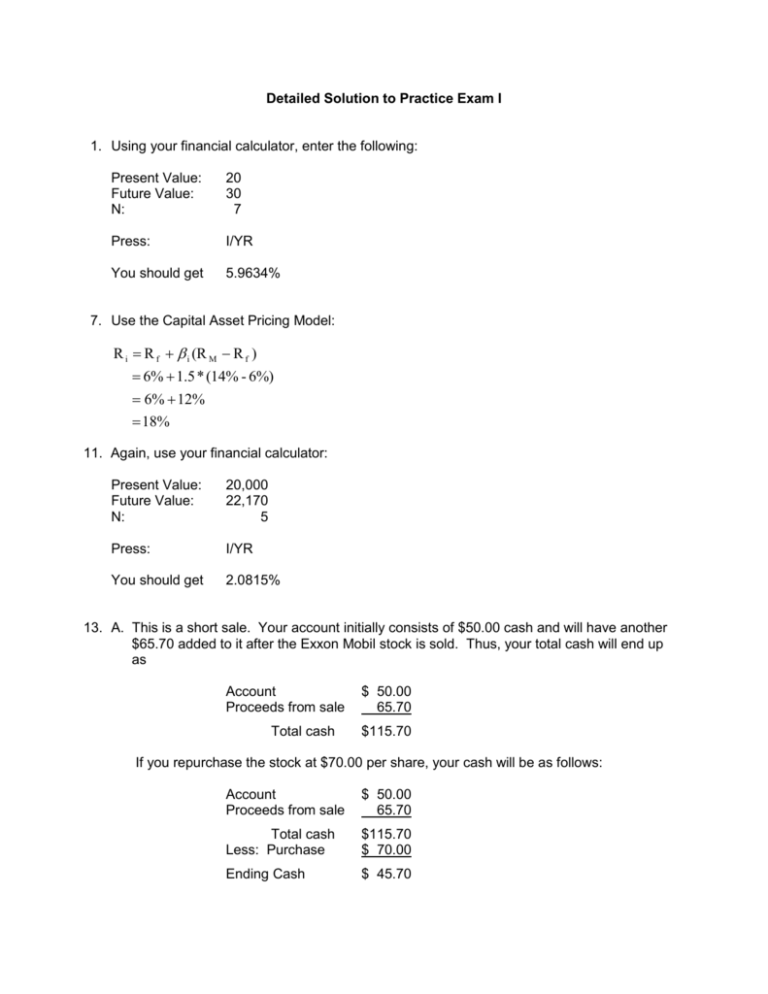

Detailed Solution to Practice Exam I 1. Using your financial calculator, enter the following: Present Value: Future Value: N: 20 30 7 Press: I/YR You should get 5.9634% 7. Use the Capital Asset Pricing Model: R i R f i (R M R f ) 6% 1.5 * (14% - 6%) 6% 12% 18% 11. Again, use your financial calculator: Present Value: Future Value: N: 20,000 22,170 5 Press: I/YR You should get 2.0815% 13. A. This is a short sale. Your account initially consists of $50.00 cash and will have another $65.70 added to it after the Exxon Mobil stock is sold. Thus, your total cash will end up as Account Proceeds from sale Total cash $ 50.00 65.70 $115.70 If you repurchase the stock at $70.00 per share, your cash will be as follows: Account Proceeds from sale $ 50.00 65.70 Total cash Less: Purchase $115.70 $ 70.00 Ending Cash $ 45.70 The $45.70 that you end up with is a loss of $4.30 per share on an equity investment of $50.00 (the original account balance), or (Ending Value - Beginning Value Beginning Value ($45.70 - $50.00) $50.00 $(4.30) $50.00 (8.6%) Rate of Return B. Repeat the solution to Part A, but using a repurchase price of $55.00 per share. Account Proceeds from sale $ 50.00 65.70 Total cash Less: Purchase $115.70 $ 55.00 Ending Cash $ 60.70 The $60.70 that you end up with is a profit of $10.70 per share on an equity investment of $50.00 (the original account balance), or (Ending Value - Beginning Value Beginning Value ($60.70 - $50.00) $50.00 $10.70 $50.00 21.4% Rate of Return C. Use the equation for a short position margin that we had in Homework #1: Margin Equity Initial Price Initial Equity - Current Price Current Price Current Price $65.70 $50 - P 0.3 P or $115.70 - P 0.3 * P or $115.70 1.3 * P or $89.00 P 14. A. To calculate the arithmetic average, just add up the returns and divide by the number of periods of time: Stock X Stock Y -10% 5% 12% 7% 10% - 6% 4% 8% 4% 6% 24% 16% Total Average Return on Stock X 24% 4.8% 5 Average Return on Stock Y 16% 3.2% 5 B. The standard deviation formula for historic returns is the following: (X i X) 2 N -1 (X X X) 2 X 5 -1 (-0.1 - .048) 2 (0.05 - .048) 2 (0.12 - .048) 2 (0.07 - .048) 2 (0.1 - .048) 2 5 -1 (-0.148) 2 (0.002) 2 (0.072) 2 (0.022) 2 (0.052) 2 5 -1 (0.021904) (0.000004) (0.005184) (0.000484) (0.002704) 5 -1 0.03028 5 -1 0.00757 0.087 or 8.7% Y (X Y X) 2 5 -1 (-0.06 - .032) 2 (0.04 - .032) 2 (0.08 - .032) 2 (0.04 - .032) 2 (0.06 - .032) 2 5 -1 (-0.092) 2 (0.008) 2 (0.048) 2 (0.008) 2 (0.028) 2 5 -1 (0.008464) (0.000064) (0.002304) (0.000064) (0.000784) 5 -1 0.01168 5 -1 0.00292 0.054 or 5.4% C. Stock X has a higher standard deviation so it is more risky. D. The rate of return on a portfolio is a weighted average of the rates of return on the individual assets: RP Ri * wi i 4.8% * .7 3.2% * .3 3.36% 0.96% 4.32% E. Use the Capital Asset Pricing Model: R X R f X (R M R f ) 3% 0.5 * (9% - 3%) 3% 3% 6% R Y R f Y (R M R f ) 3% 0.75 * (9% - 3%) 3% 4.5% 7.5%