2002 Fearless Forecast Investment Consulting William M. Mercer Limited

advertisement

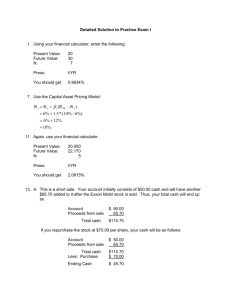

Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 1 Investment Consulting William M. Mercer Limited 2002 Fearless Forecast Forecasts by 81 Canadian and International Investment Managers The Economy and Capital Markets Issues and Trends Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 2 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 3 O P E N I N G N OT E We are pleased to present the results of our 2002 Fearless Forecast, which presents the views of institutional investment managers on the economy and capital markets. For this eleventh edition of the Fearless Forecast, we have received a record 81 responses from both Canadian and Foreign managers. We would like to extend our gratitude to the 81 fearless managers listed on the inside page before the back cover for taking the time to respond to our questionnaire. H I G H L I G H T S O F 2 0 0 2 R E S U LT S A large proportion of money managers (74%) believe that the most important issues for 2002 in terms of the capital markets are corporate earnings and US interest rates. We did not ask any specific questions about corporate earnings, but we did ask about US interest rate levels. The average response was that the US Fed Funds rate would rise by 75 basis points over the year, ending at 2.5%, and that mid and long term US interest rates would also rise from current levels. In contrast, managers believe that Canadian interest rates will fall in the mid and long end of the curve, and they expect inflation to stay around the 2% level for the next 24 months. Managers are not expecting these modest increases in US interest rates to have a negative impact on equity markets for the next year as they are forecasting, on average, double digit returns for the TSE300, the S&P500 and MSCI EAFE. Managers are expecting that the IFCI Emerging Composite (an emerging market index) will provide the best return for 2002. On the currency side of the equation managers are expecting both the Canadian dollar and the Euro to strengthen significantly against the US dollar, with the loonie expected to go to 65 cents by year end and the Euro to be at 95 cents. Perhaps the most interesting result from the survey is the relationship between managers’ expectations for bond returns versus stock returns. For the Canadian market, managers are expecting the TSE300 Total Return Index (TRI) to beat the Scotia Capital Universe TRI by 3.5% over the next five years. Assuming a positively sloped yield curve (as we have now), this probably translates to a 3.0% equity risk premium over long Canada bonds. While this number is lower than the historical average, and lower than expectations we have seen in recent Fearless Forecasts, it is higher than the 0% that some analysts believe reasonable to expect. Our own research has produced an expected equity risk premium in the neighbourhood of 2.0% to 2.5%. The equity risk premium debate continues. We wish you all the best for 2002. Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 4 S U M M A RY O F R E S U LT S F R O M 2 0 01 F E A R L E S S F O R E C A S T Forecast The Canadian Economy Bank of Canada Rate Annual Inflation Rate (CPI) Canadian Exchange Rate ($U.S./$CDN) Unemployment Rate Real GDP Growth Rate Investment Benchmarks TSE 300 Total Return S&P 500 Total Return ($CDN) MSCI EAFE Total Return ($CDN) MSCI World Total Return ($CDN) IFCI Emerging Composite Total Return ($CDN) SC Universe Bond Total Return SC 91 Day T-Bills Total Return Actual 5.5% 2.5% 0.68 7.0% 3.4% 2.5% 0.6% 0.63 8.0% 1.7% 12.0% 10.0% 12.0% 11.0% 10.0% 7.0% 5.3% -12.6% -6.5% -16.3% -11.4% 8.1% 8.1% 4.7% Top Performing Canadian Sectors (Ranking out of 14 sectors in the TSE 300) Financial Services Industrial Products Oil & Gas 1st 2nd 3rd 11th 14th 9th Top Canadian Equity Investment Styles (Ranking out of 4 major equity investment styles) Large Cap Growth Large Cap Value Small Cap Value Small Cap Growth 1st 2nd 3rd 4th 4th 2nd 1st 3rd Dec 31/2001 Dec 31/2001 Dec 31/2001 Dec 31/2001 Dec 31/2001 Dec 31/2001 Dec 31/2001 Actual Top 3 Sectors Top Performing Countries within the MSCI World Index (Ranking out of 22 countries within the MSCI World Index) U.K. 1st Germany 2nd Canada 3rd U.S. 3rd Japan 5th 2 Dec 31/2001 Nov 30/2001 Dec 31/2001 Dec 31/2001 Estimated Annualized 9th 17th 12th 8th 21st 1. Transportation & Env. 2. Conglomerates 3. Merchandising Actual Top Performing Countries within the MSCI World Index 1. New Zealand 2. Austria 3. Australia 4. Ireland 5. Belgium Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 5 THE ECONOMY – 2002 Charts indicate the 95th percentile, median and 5th percentile forecasts. Bank of Canada Rate Federal Fund Rate (U.S.) 5% 5% 4.6 4% 4% 4.0 3.7 3% 3.0 2.5 3% 3.0 2.5 2% 1.9 1.8 2% 1% 1.75 1.5 2.5 2.0 1.7 1% 0% 0% Level at Dec 31/01 June 30, 2002 Level at Dec 31/01 December 31, 2002 Annual Inflation Rate (CPI) June 30, 2002 December 31, 2002 Canadian Exchange Rate ($U.S./CDN) .75 5% 4% .70 3% 2.8 2.7 2% .68 2.0 2.0 1.5 1.4 .66 .65 0.63 1% .62 .62 June 30, 2002 December 31, 2002 0.6 0% .65 .64 .60 Level at Nov 30/01 June 30, 2002 Level at Dec 31/01 December 31, 2002 Real GDP Growth Rate Unemployment Rate 5% 9% 4% 8.5 8% 3% 8.0 8.2 3.0 7.7 7.5 2% 1.7 1.5 7.0 7% 6.9 1% 0.2 0% 6% Estimated annualized 2001 rate 12 Months Ending December 31, 2002 Level at Dec 31/01 June 30, 2002 December 31, 2002 3 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 6 T H E E C O N O M Y – LO N G T E R M Charts indicate the 95th percentile, median and 5th percentile forecasts. Annual Inflation Rate (CPI) 5% 4% 3.8 3.2 3% 2.5 2% 2.0 2.0 1.8 1% 0% 2 Years Ending December 31, 2003 5 Years Ending December 31, 2006 INVESTMENT BENCHMARKS – 2002 Charts indicate the 95th percentile, median and 5th percentile forecasts. SC Universe Bond Total Return SC 91 Day T-Bills Total Return 15% 15% 10% 10% 8.1 8.3 6.3 5% 1.3 5.0 5% 4.7 2.5 0.0 0% 2.7 1.0 0% -5% 1.5 4.0 2.0 2.9 -5% One Year Total Return Ending 12/01 6 Months Ending June 30, 2002 One Year Total Return Ending 12/01 12 Months Ending December 31, 2002 6 Months Ending June 30, 2002 TSE 300 Total Return Nesbitt Burns Small Cap Total Return 30% 30% 20% 20% 12 Months Ending December 31, 2002 25.5 20.0 13.8 10% 11.5 6.0 13.5 7.0 5.0 2.1 3.4 0.0 0% 15.3 10% -1.2 0% -10% -10% -12.6 -20% -20% One Year Total Return Ending 12/01 4 6 Months Ending June 30, 2002 12 Months Ending December 31, 2002 One Year Total Return Ending 12/01 6 Months Ending June 30, 2002 12 Months Ending December 31, 2002 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 7 INVESTMENT BENCHMARKS – 2002 Charts indicate the 95th percentile, median and 5th percentile forecasts. S&P 500 Total Return ($CDN) Russell 2000 Total Return ($CDN) 30% 30% 23.4 20% 16.4 14.8 10% 11.0 12.0 10% 8.9 6.0 0% 23.8 20% 7.0 3.0 2.8 -0.8 0% -1.2 -6.5 -10% -10% -20% -20% One Year Total Return Ending 12/01 6 Months Ending June 30, 2002 One Year Total Return Ending 12/01 12 Months Ending December 31, 2002 6 Months Ending June 30, 2002 MSCI EAFE Total Return ($CDN) MSCI World Total Return ($CDN) 30% 30% 20% 20% 20.0 17.7 10% 11.5 11.0 6.0 10% 12.0 12.0 6.0 3.4 0.0 0% 0.0 0% -10% 12 Months Ending December 31, 2002 3.0 -10% -11.4 -16.3 -20% -20% One Year Total Return Ending 12/01 6 Months Ending June 30, 2002 One Year Total Return Ending 12/01 12 Months Ending December 31, 2002 6 Months Ending June 30, 2002 12 Months Ending December 31, 2002 IFCI Emerging Composite Total Return ($CDN) 30% 25.0 20% 19.8 14.0 10% 8.5 8.1 0% -1.9 -2.1 6 Months Ending June 30, 2002 12 Months Ending December 31, 2002 -10% -20% One Year Total Return Ending 12/01 5 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 8 I N V E ST M E N T B E N C H M A R K S – LO N G T E R M Charts indicate the 95th percentile, median and 5th percentile forecasts. SC 91 Day T-Bills Total Return SC Universe Bond Total Return 15% 15% 10% 10% 7.9 5% 7.2 5.0 4.0 5.5 5% 2.1 0% 5.0 3.5 -5% 2 Years Ending December 31, 2003 2 Years Ending December 31, 2003 5 Years Ending December 31, 2006 TSE 300 Total Return S&P 500 Total Return ($CDN) 30% 30% 25% 25% 20% 20% 15% 15% 15.0 10% 10.0 9.0 16.7 10% 3.4 10.0 6.2 5% 0% 9.0 3.0 0% -5% -5% 2 Years Ending December 31, 2003 2 Years Ending December 31, 2003 5 Years Ending December 31, 2006 MSCI EAFE Total Return ($CDN) MSCI World Total Return ($CDN) 30% 30% 25% 25% 20% 20% 15% 5 Years Ending December 31, 2006 14.7 13.0 7.0 5% 4.0 2.0 0% -5% 15% 15.0 10% 17.1 10.0 6.0 9.0 10% 10.0 6.6 5% 5% 0% 0% -5% 5 Years Ending December 31, 2006 15.0 14.4 6.0 9.0 3.5 -5% 2 Years Ending December 31, 2003 6 4.5 2.0 5 Years Ending December 31, 2006 2 Years Ending December 31, 2003 5 Years Ending December 31, 2006 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 9 I N V E ST M E N T B E N C H M A R K S – LO N G T E R M Charts indicate the 95th percentile, median and 5th percentile forecasts. Managers estimate the value added (before fees) on an annual basis for each of the following asset classes over their respective benchmark for a market cycle: 600 580 500 510 500 500 Basis points 400 375 300 300 300 200 200 200 175 100 Canadian Equity (TSE 300 TRI) U.S. Small Cap Equity (Russell 2000 TRI) U.S. Equity Canadian (S&P 500 TRI) Small Cap Equity (NB Small Cap TRI) 100 11 55 49 11 0 0 200 156 100 71 50 200 Non-North American Equity (MSCI EAFE TRI) 50 Emerging Canadian Markets Bonds (IFCI (SC Composite TRI) Universe TRI) 1 50 0 50 42 0 28 50 Market Timing/ Asset Mix Shifts (Balanced Mandates) Cash (SC 91 Day T-Bill TRI) Mortgages Global Bonds (SM Aggregate (Solomon World Bond) Mortgage TRI) 0 10 CANADIAN PENSION FUND INVESTMENTS Managers recommend the following asset mix for a balanced pension fund as at June 30, 2002: Managers recommend the following asset mix for a balanced pension fund as at December 31, 2002: 50% 40% 50% 48.5 45.0 40% 42.0 35.0 39.0 30% 30.0 20% 10% 40.0 35.0 39.0 34.0 30% 35.0 30.0 20% 10.0 10.0 16.0 13.0 5.0 14.0 10.0 0% 0.0 Canadian Equity U.S. Equity Non-North American Equity Canadian Bonds Cash 3.0 13.3 10% 10.5 2.5 0.0 10.0 15.0 13.0 12.5 4.0 0.0 0% Canadian Equity Other 13.0 10.0 5.0 Non-North American Equity U.S. Equity Canadian Bonds 0.0 2.5 Other Cash Managers rank the following as the most attractive (top 3) and least attractive (bottom 3) asset classes in 2002: Canadian Equity 2 U.S. Equity 64 60 9 Global Equity 0 Canadian Small Cap 0 U.S. Small Cap 38 33 26 2 Emerging Markets Equity 21 18 High Yield Bonds 17 9 Hedge Funds 14 Canadian Universe Bonds 12 5 23 3 5 Private Equity 2 9 Real Estate Venture Capital 16 Real Return Bonds 5 3 23 Mortgages 0 25 Global Bonds 2 36 Canadian Long Bonds 46 5 64 Cash 80% 70% 3 60% 50% 40% 30% 20% % of managers who found it unattractive 10% 0% 10% 20% 30% 40% 50% 60% 70% 80% % of managers who found it attractive 7 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 10 CANADIAN PENSION FUND INVESTMENTS Investment managers were asked if they employ currency hedging strategies: Why hedge currency? No 52% Opportunistic Reasons 10% Yes 48% Other 4% Defensive Reasons 45% Investment managers were asked if they believe ethical mandates will increase in 2002: Both 41% % of managers currently offering alternative investments: If yes, what type? No 51% No 51% Yes 49% Hedge Funds 48% Private Equity 25% Yes 49% Other 27% C A N A D I A N C A P I TA L M A R K E T S Managers rank the following as the top issues affecting Canadian markets in 2002: Performance of Canadian Economy 11% U.S. Interest Rates 7% War on Terrorism 4% Domestic Interest Rates 2% Performance of U.S. Economy 74% 8 Unemployment Rates 2% Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 11 C A N A D I A N C A P I TA L M A R K E T S Best Canadian equity investment style for 2002: Large Cap. Growth 27% Small Cap. Value 15% Small Cap. Growth 28% Large Cap. Value 30% Managers expect the following to be the best performing (top 3) and worst performing (bottom 3) equity sectors of the TSE 300 Index in 2002: 8 Industrial Products Financial Services 13 Metals & Minerals 15 Communications & Media 15 Consumer Products 38 33 20 27 Paper & Forest Products 10 Merchandising 10 22 20 13 Oil & Gas 16 45 Gold & Precious Metals 13 Transportation & Environmental 10 Utilities 9 4 45 2 10 Conglomerates Real Estate 2 33 Pipelines 55 70% 60% 2 50% 40% 30% 20% 10% % of Managers who Predict Bottom Sector Managers were asked to predict the price of Nortel at the end of 2002: Under $10 10% 67 44 0% 10% 20% 30% 40% 50% 60% 70% % of Managers who Predict Top Sector Managers’ outlook on the technology sector for 2002: Negative Return 5% 0 to 10% Return 35% $10 to $15 30% Above $20 17% $15 to $20 43% Above 20% Return 27% 10 to 20% Return 33% 9 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 12 C A N A D I A N C A P I TA L M A R K E T S Government of Canada Bonds Government of Canada Bonds 7.0% 7.0% 6.2 6.0% 5.8 5.0% 4.0% 3.0% 6.2 6.0% 5.6 5.6 5.0% 5.3 5.0 4.0 4.0% 3.5 4.0 Mid. (5 – 10 Yrs.) Long (30 Yrs.) 4.0 Short (1 – 5 Yrs.) 6 Months Ending June 30, 2002 Average Yield at 12/01 Mid. (5 – 10 Yrs.) Long (30 Yrs.) 12 Months Ending December 31, 2002 Forecast Median Yield Average Yield at 12/01 Managers were asked if merger/acquisition activity in Canada would increase, decrease or stay the same in 2002: Same 36% 5.3 4.7 3.0 3.0% Short (1 – 5 Yrs.) 5.9 Decrease 15% Forecast Median Yield Managers were asked to rank the top 3 Canadian sectors/ industries that would experience the most consolidation in 2002: Financials 74 Industrial 55 Oil & Gas 52 Paper & Forest 25 Metals & Min. 20 0 Increase 49% 10 20 30 40 50 60 % of Managers who ranked it in their top 3 Managers ranked the 5 best performing Canadian stocks for 2002: ➣ Nortel ➣ Bombardier ➣ Talisman ➣ Biovail ➣ Magna Based on the number of times Managers chose each stock in their top 5 10 Forecast Median Total Return 70 80 90 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 13 G L O B A L C A P I TA L M A R K E T S Managers were asked to rank the following as the top issues affecting global markets for 2002: Middle East Crisis 8% U.S. Dollar 7% Technology Sector 3% Corporate Earnings 36% Inflation 2% Japanese Market 2% Oil Price 2% U.S. Interest Rates 38% Unemployment Rate 2% Managers were asked if merger/acquisition activity globally would increase, decrease or stay the same in 2002: Same 26% Managers were asked to rank the top 3 global sectors/ industries that would experience the most consolidation in 2002: Financials Decrease 17% 63 Telecom. 45 Technology 45 Energy Increase 57% 21 0 10 20 30 40 50 60 70 80 90 % of Managers who ranked it in their top 3 Managers predict the following to be the best country/region allocation for a global equity portfolio in 2002: 70% LEGEND 95th Percentile 64.7 60% 56.1 Median 50% 50.0 5th Percentile 40% 39.0 30% 30.0 30.0 20% 10% 10.8 10.6 8.4 4.0 10.0 20.0 20.0 11.0 5.3 2.8 0% U.S. Japan U.K. 20.0 20.0 10.0 6.0 1.0 0.0 Far East excl. Japan Continental Europe 0.0 5.0 Emerging Markets MSCI World ex-Canada Country Weighting at Dec.31/01 Managers were asked to choose the top 5 performing equity markets in 2002: Managers were asked to choose the top 5 performing sectors in 2002: U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(21) Canada . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(16) U.K. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(16) Japan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(13) Hong Kong . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(12) Information Technology . . . . . . . . . . . . . . . . . . . . . . . . . .(24) Financial Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(18) Health Care . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(16) Telecommunication Services . . . . . . . . . . . . . . . . . . . . . .(14) Industrial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(12) ( ) indicates the number of times mentioned by managers ( ) indicates the number of times mentioned by managers 11 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 14 G L O B A L C A P I TA L M A R K E T S Managers were asked to predict the real global GDP growth rate in 2002: Investment managers were asked if they thought the emerging markets would be attractive over the next 3 years: 5% No 22% 4% Yes 78% 3% 2.8 2.4 2% 1.7 1% 0.5 0% Estimated annualized 2001 rate 12 Months Ending December 31, 2002 Investment managers were asked to list their top 3 global equity stock picks for 2002: United States Treasury Bonds ➣ Nokia Short (1 – 3 Yrs.) Mid. (5 – 10 Yrs.) Long (30 Yrs.) ➣ Microsoft, Vodafone ➣ General Electric 10.0% 6.0 5.5 4.9 5.8 5.0% 0.0% 5.0 3.5 2.2 4.8 3.6 Based on the number of times Managers chose each stock in their top 3 Yen/$U.S. Exchange Rate -5.0% YIELD at December 31, 2002 150 150.0 10.0% 8.8 6.6 5.0% 0.0% 140 5.0 4.3 3.0 0.8 4.5 130 0.2 131.0 -0.9 RETURN – 12 Months Ending December 31, 2002 Legend: 95th Perc Median Perc 115.0 110 5th Perc 100 Level at Dec 31/01 $U.S./Euro Exchange Rate June 30, 2002 December 31, 2002 $U.S./Pound Sterling Exchange Rate 1.60 1.15 1.57 1.10 1.10 1.10 1.50 1.05 1.40 0.95 1.45 0.89 1.40 June 30, 2002 December 31, 2002 1.30 0.88 0.85 0.85 Level at Dec 31/01 1.45 1.40 0.95 0.93 12 1.52 1.45 1.00 0.90 130.0 128.9 120.0 120 -5.0% 135.8 June 30, 2002 December 31, 2002 1.20 Level at Dec 31/01 Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 15 2002 FEARLESS FORECAST RESPONDENTS Listed below are the 81 investment managers who have contributed their forecasts to this survey. Aberdeen Murray Johnstone Jarislowsky Fraser Limited Addenda Capital Inc. Jones Heward Investment Counsel Inc. Aeltus Investment Management, Inc. JPMorgan Fleming Asset Management AIG Global Investment Corp. (Canada) KBSH Capital Management Inc. AIM Funds Management Inc. Laketon Investment Management Ltd. Altamira Investment Services Inc. Leith Wheeler Investment Counsel Ltd. American Express Asset Management Group Inc. Lincluden Management Limited AMI Partners Inc. Lombard Odier International Portfolio Management Ltd. Aurion Capital Management Inc. London Life Investment Management Ltd. Baillie Gifford Overseas Limited Lotsoff Capital Management Baker Gilmore & Associates Inc. Magna Vista Investment Management Barclays Global Investors Canada Ltd. Marvin & Palmer Associates Inc Bernstein Investment Research & Management McLean Budden Limited Beutel, Goodman & Company Ltd. Mellon Capital Management Corporation Bissett Investment Management MFS Institutional Advisors, Inc. BLC - Edmond de Rothschild Asset Management Inc. Middlefield Group BonaVista Asset Management Ltd. Montrusco Bolton Inc. Brandywine Asset Management, LLC Morrison Williams Investment Management Ltd. Brinson Canada Co. Mulvihill Capital Management Inc. Capital Guardian Trust Company Newton Capital Management Limited Centerfire Capital Management Inc. Oechsle International Advisors, LLC Clarica Asset Management Oppenheimer Capital Connor, Clark & Lunn Arrowstreet Capital Ltd. Optimum Asset Management Inc. Connor, Clark & Lunn Investment Management Ltd. PanAgora Asset Management, Inc. Co-operators Investment Counselling Ltd. PCJ Investment Counsel Ltd. Deutsche Asset Management Perigee Investment Counsel Inc. Dresdner RCM Global Investors Philippe Investment Management, Inc. Edinburgh Fund Managers PLC Pictet International Management Ltd. Elantis Inc. QVGD Investors Inc. Elliott & Page Limited Sceptre Investment Counsel Ltd. Fiduciary Trust Company International Scheer, Rowlett & Associates Foyston, Gordon, & Payne Inc. Standard Life Investments Inc. Franklin Templeton Institutional State Street Global Advisors Goldman Sachs Asset Management Sun Life Quantitative Management Inc. Grantham, Mayo, Van Otterloo & Co. LLC Synergy Asset Management Inc. Greystone Managed Investments Inc. TAL Global Asset Management Inc. Guardian Capital Inc. TD Quantitative Capital Hillsdale Investment Management Inc. Turner Investment Partners, Inc. Invesco, Inc. Walter Scott & Partners Limited J. Zechner Associates Inc. YMG Capital Management Inc. J.R. Senecal & Associates Investment Counsel Inc. Mercer Fearless_02 Eng 1/14/02 1:02 PM Page 16 Investment Consulting Practice of William M. Mercer Limited The Investment Consulting Practice of William M. Mercer Limited provides comprehensive investment services to pension plans, foundations, endowments and other institutional investors. We are dedicated to partnering with clients in providing quality investment consulting and financial risk management services employing leading edge research and innovative tools. • Investment Policy Consulting • Transaction Cost Analysis • Fund Governance • Defined Contribution Services • Optimal Asset Allocation • Recordkeeper Searches • Asset/Liability Modelling and Risk Analysis • Design of Investment Option Packages • Applied Immunisation Strategies • Investment Planning Assistance • Designing Investment Manager Structure • Group Annuity Purchases • Investment Manager Search and Selection • Master Trustee/Custodian Selection • Investment Manager Monitoring and • Special Projects Evaluation Montréal ▼ Toronto ▼ Calgary ▼ Vancouver ▼ ▼ For further information on the investment consulting services listed above, please call one of our offices: Halifax Mike Mills Wes Peters Irshaad Ahmad Marcel Larochelle Calvin Jordan 604 609 3119 403 269 4945 Ext 268 416 868 2988 514 841 7830 902 490 2115 For information on the services of William M. Mercer Limited, please contact: Vancouver 604 683 6761 Winnipeg 204 947 0055 Mississauga 905 277 7000 Ottawa 613 230 9348 Québec City 418 658 3435 Calgary 403 269 4945 London 519 672 9310 Toronto 416 868 2000 Montréal 514 285 1802 Halifax 902 429 7050 St. John’s 709 576 7146