Global Economic Outlook: Interest Rates, Bond Yields, and Currencies

advertisement

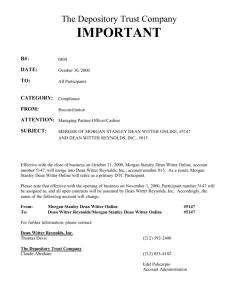

MORGAN STANLEY DEAN WITTER Multi-Asset Research Global Economics Global Investment Research July 2001 Stephen Roach, Chief Economist +1 (1)212 761 7153 stephen.roach@morganstanley.com Global Rebalancing Please refer to important disclosures at the end of this report. MORGAN STANLEY DEAN WITTER Morgan Stanley Dean Witter Global Economics Stephen S. Roach David A. Jones Robert S. Brown Chief Economist Associate Director of Research 1-212-761-7153 1-212-761-8019 1-212-761-4574 Global Joachim Fels Currency Economics Karin Kimbrough Stephen Li Jen Currency Economics Melanie Baker Joseph Quinlan Global Economics Rebecca McCaughrin 44171-425-6138 44171-425-6642 44171-425-8583 44171-425-8607 1-212-761-4361 1-212-761-6295 Europe Eric Chaney Christel Rendu Joachim Fels Elga Bartsch Mark Miller Donui Agbokou Euro Zone Euro Zone Euro Zone UK 331-5377-7305 44171-425-4182 44171-425-6138 44171-425-5434 44171-425-6643 44207-425-7189 Emerging Markets Europe Riccardo Barbieri Serhan Cevik Oliver Weeks Emerging Markets Europe Emerging Markets Europe 44171-425-6259 44171-425-6234 44171-425-4241 The Americas and Dollar Bloc Richard Berner David J. Greenlaw Ted Wieseman Gray Newman United States United States Robert A. Feldman Karin Ri Takehiro Sato Andy Xie Denise Yam Daniel Lian Anita Chung Chetan Ahya Japan Japan Japan Non-Japan Asia Latin America Asia Non-Japan Asia India 1-212-761-3398 1-212-761-7157 1-212-761-3407 1-212-761-6510 813-5424-5385 813-5424-5387 813-5424-5367 852-2848-5220 852-2848-5301 65-834-6745 65-834-6746 91-22-2297940 Note: Daily updates of Morgan Stanley’s Global Economic Forum — a compilation of dispatches filed by the firm’s economists around the world —can be found on the World Wide Web of the Internet, at the following address: http://www.msdw.com. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 1 MORGAN STANLEY DEAN WITTER Global Relapse So far this year, we have slashed our estimate of world GDP growth for 2001 to 2.5% from 3.5%. Relative to our baseline growth scenario of 4.2% prevailing early last October, these changes bring the cumulative downward revision to 1.7 percentage points over the past eight months. Our current baseline for 2001 represents nearly a 50% slowing in the pace of global activity relative to the boom-like outcome of 4.8% for 2000. The risk remains that there will be more cuts to come -- especially for 2002, where we are currently forecasting a rebound in global growth to 3.7%. Our call for a global downshift is dominated by a US economy that we think is now in mild recession. The US accounted for nearly 40% of total global growth in the five years ending in mid-2000. Not only is that 40% now in the process of going to “zero,” but the world is lacking an alternative growth engine to fill the void. Reflecting the new connectivity of globalization -- global trade, globalized supply chains, and balance-sheet adjustments of multinational corporations -an engineless world is now on the brink of a rare synchronous recession. The balance of our forecast cuts have been spread around the world, initially skewed toward non-Japan Asia and the NAFTA bloc — regions of the world we judge to be most sensitive to US-led IT and other inventory linkages. We expect Europe to be hurt the least, given the region’s structural autonomy, fiscal support, and improving domestic demand; our downwardly revised European growth estimate for 2001 is 2.1%, still about double the gain we now expect in the US. In the climate we foresee, the world economy will have to face two “firsts” — the first recession of the Information Age and the first recession of globalization. That raises great uncertainty about the severity and duration of the crossborder repercussions of a US economy in recession. Four downside risks are most disconcerting: the possibility of further cuts to the developing world, a deeper recession in the US, the downside of the global IT and manufacturing cycles, and financial-market distress. With these revisions, our global growth forecast has pierced the lower bound of the 3.0–3.5% range that has been associated with global soft landings of the past. It is now right on the cusp of the 2.5% global recession threshold. For financial markets, the debate will shift increasingly to the shape of the coming recovery in the US and global economies. Given a likely purging of America’s structural excesses — negative personal savings, excess IT capacity, and a record current-account deficit — the odds favor more of a U- or L-shaped recovery than the V-shaped upturn now being discounted by the markets. Annual Percent 10 9 2000 8 7 6 5 World 4 Europe 3 2 1 0 -1 World Growth at a Glance 2001E 2002E U.S. Other Latin Dollar Bloc America Japan Source: Morgan Stanley Dean Witter Research Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Non-Japan Asia 10 9 8 7 6 5 4 3 2 1 0 Page 2 MORGAN STANLEY DEAN WITTER Global Relapse We have cut our baseline global growth estimate to 2.5% in 2001, depicting a world economy on the cusp of recession. World GDP Growth Percent 8 7 6 5 4 3 2 1 0 8 7 6 5 4 3 2 1 0 Average 1970-1999: 3.7% Forecast Years of Global Recession 71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 Source: IMF, Morgan Stanley Dean Witter Research Share of Global GDP: 2000 Europe 21% Non-Japan Asia 23% With the US apparently in recession, the engine of global growth has likely been temporarily derailed. Japan 7% US 22% Our estimates suggest global trade growth is slowing from 12.8% in 2000 to 4.3% in 2001 -- the sharpest slowdown on record. World Trade Growth Percent Change 14 12 10 8 6 4 2 0 -2 -4 1970 1974 Global Trade volume of goods and services Global Real GDP 1978 1982 Source: IMF, MSDW Research Estimates Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Other 20% Latin America 8% 1986 1990 1994 1998 2002E Page 3 MORGAN STANLEY DEAN WITTER World without an Engine US Share of World GDP Growth Percent 40 30 America’s leadership role in the global economy has been sharply diminished. 20 10 0 -10 90 91 92 93 94 95 96 97 98 99 00 01E Exports to the US as a Share of GDP Percent 35 30 Trade linkages spread the US-led downshift, especially to East Asia and America’s NAFTA partners. 25 20 15 10 5 0 Euroland Japan China Korea Taiwan Mexico Canada Where's the Next Engine? Percent, YOY 12 Industrial Production 9 6 The world is lacking a candidate to fill the growth void left by a faltering US economy. 3 0 -3 -6 US -9 -12 Jan-98 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Jul-98 Jan-99 Jul-99 Jan-00 Europe Jul-00 Japan Jan-01 Jul-01 Page 4 MORGAN STANLEY DEAN WITTER Global Transmission Trade as % of World GDP Percent 25 20 Globalization is central to convergence; it reflects the increased connectedness of the world economy though trade flows . . . 15 10 5 0 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 Source: International Monetary Fund, Morgan Stanley Dean Witter Economic Research Multinational Corporate Activity US$, Trillions 14 Global Exports 12 . . . as well as through sharply expanded activity of multinational corporations. Global Foreign Affiliate Sales 10 8 6 4 2 89 A ubiquitous and transparent Internet adds a new technology-led dimension to globalization and international convergence. 90 91 92 The Millions of Users 180 U.S. 160 Western Europe 140 Non-Japan Asia 120 Japan 100 Latin America 80 60 40 20 0 1997 1998 1999 93 Please refer to important disclosures at the end of this report. 95 96 97 98 99 Internet Explosion 2000E Source: Morgan Stanley Dean Witter Estimates Global Investment Research – July 2001 94 2001E 2002E 2003E 2004E Page 5 MORGAN STANLEY DEAN WITTER Sources of Global Downshift Real Short-Term Interest Rates Percent 7 G-10 G-10, ex-US 6 The lagged impacts of last year’s monetary tightening are restraining global growth in 2001. 5 4 3 2 1 0 Jan-84 Jan-86 Jan-88 ACWI 40 Jan-92 Jan-94 Jan-96 Jan-98 Jan-00 Jan-02 Faltering Equity Markets Percent Return 50 A flattening of the wealth effect is also constraining global activity, especially in the wealth-dependent United States. Jan-90 S&P 30 20 10 0 -10 -20 -30 90 Percent 12 10 8 Rising corporate financing costs are also impeding economic activity. 91 92 93 94 95 96 97 98 99 00 1-Jul U.S. Credit Quality Percent 3.0 Default Rate (Speculative Grade, left) AA Corporate Spread (right) 2.5 2.0 6 1.5 4 1.0 2 0.5 0 0.0 Jan-90 May-91 Oct-92 Feb-94 Jul-95 Nov-96 Apr-98 Sep-99 Jan-01 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 6 MORGAN STANLEY DEAN WITTER Unwinding the Energy Shock Natural Gas Shock? $/MMBtu 12 $/Barrel 40 Henry Hub Natural Gas Spot (Left) 10 While crude oil prices are down from their highs, consumers are now feeling the full force of surging natural gas prices . . . 35 Brent Crude Oil Spot (Right) 30 8 25 6 20 15 4 10 2 5 0 0 Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Jan-00 Jan-01 Nominal vs Real Oil Prices US$/Barrel, West Texas Crude 50 . . . yet in real terms, oil prices remain below levels of the early 1980s. Nominal 40 Real 30 20 10 0 Jan-70 Jan-76 Jan-82 Jan-88 Jan-94 Jan-00 Saudia Arabia: Response to Oil Shocks Billions of US Dollars 120 Domestic Investment 100 OPEC producers tend to save, or recycle, petrodollar windfalls — usually providing a boost to dollardenominated assets. Domestic Savings 80 Petroleum Export Earnings 60 40 20 0 1971 1974 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 1977 1980 1983 1986 1989 1992 1995 1998 Page 7 MORGAN STANLEY DEAN WITTER Post-Bubble Global Economy ACWI Index US$ 400 350 World equity prices have fallen 30% below their highs of last year. 300 250 200 150 Jan-95 Jan-96 80 Jan-98 Jan-99 Jan-00 Jan-01 Equity Market Capitalization as a Share of GDP Percent 120 The sell-off in global equities should hit the US the hardest. Jan-97 US Europe Japan NJA 40 0 90 91 92 93 94 95 96 97 98 99 Percent 150 125 America’s households are most exposed to the negative wealth effects. 00 150 H ousehold equity holdings (percent of disposable incom e) 100 125 1990 1998 100 75 75 50 50 25 25 0 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. U.S. Japan Germany 0 Page 8 MORGAN STANLEY DEAN WITTER A New Culture of Risk Equity Market Valuations (Last Plotting: July 2, 2001) Percent 100 80 Europe US 60 Valuation strains are finally starting to take a toll on global equity markets. 40 20 0 -20 -40 Jan-80 Jan-82 Jan-84 Jan-86 Jan-88 Jan-90 Jan-92 Jan-94 Jan-96 Jan-98 Jan-00 Overly-Optimistic 2002 2001 While markets have capitulated on the near-term earnings outlook, optimism remains for 2002. ACWI Consensus Earnings S&P 500 Consensus Earnings World GDP As of 1/1/01 As of 6/22/01 11% -1.0% 10% -5.6% 3.5% 2.5% 2002 17% 19.1% 3.8% US Stock Market: A New Era or Irrational Exuberance? 1600 1200 120 S&P Composite Prices (Left) Major Innovations S&P Composite Real Earnings (Right) 1. National Railway 2. Car 3. Factory Assembly Line 4. Nationwide Telephone 5. Radio 6. Rural Electrification 800 1 400 2 4 3 6 5 0 90 60 30 0 1871 1882 1894 1906 1918 1929 1941 1953 1965 1976 1988 2000 Source: Robert Shiller, Yale University, Morgan Stanley Economic Research Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 9 MORGAN STANLEY DEAN WITTER Rebalancing: Globalization of the Information Age Global growth is likely to be increasingly driven by a convergence of global IT demand toward US norms. Percent of Nominal GDP 28 26 Europe should lead the demand catch-up, becoming the world’s largest IT buyer over the 2000–05 period. 28 Catching up scenario: ICT Capital Stock 26 24 24 22 22 20 20 US Europe Japan 18 16 14 90 91 92 93 94 95 96 97 98 99 00E 01E 02E 03E 04E 05E Greatest Engineering Achievements of the Twentieth Century 1. Electrification 2. Automobile 3. Airplane 4. Water Supply and Distribution 5. Electronics 6. Radio and Television 7. Agricultural Mechanization 8. Computers 9. Telephone 10. Air Conditioning and Refrigeration Source: National Academy of Engineering, 2000 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 11. Highways 12. Spacecraft 13. The Internet 14. Imaging 15. Household Appliances 16. Health Technologies 17. Petroleum and Petrochemical Technologies 18. Laser and Fiber Optics 19. Nuclear Technologies 20. High Performance Materials 18 16 14 Page 10 MORGAN STANLEY DEAN WITTER Rebalancing: Globalization of Shareholder Value Equity Market Capitalization/GDP Percent 140 120 The globalization of the equity culture is a key element of convergence toward America’s New Economy norms. 90 100 99 80 60 40 20 0 Latin America Far East Free Free ex-Japan US$, Billions So, too, is a surge of cross-border M&A activity. Europe US UK Japan Cross-Border M&A for the US, Japan and Euroland 450 400 350 300 250 200 150 100 50 0 1990 1992 1994 1996 1998 2000 Source: Thompson Financial Service Percent Venture Capital Investment as a Percentage of GDP 0.18 0.15 1995 1998 0.12 Moreover, there is now reason to believe that America’s venture capital culture is starting to go global. 0.09 0.06 0.03 Ca na da U N eth SA er lan ds U Be K lg i N um or wa Fi y nl an Eu d ro G pe er m an Fr y an Sw ce Sw e d itz en er la n Ire d la n Po d rtu ga l Ita ly Sp D ain en m a A rk us tri G a re ec e Ja pa n 0.00 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 11 MORGAN STANLEY DEAN WITTER Rebalancing: Globalization of Labor Markets Percentage of Service Sector to Total Output The service intensity of America’s work force has increased the potential for IT-led white-collar productivity enhancement. Percent 80 70 60 50 40 30 20 10 0 1984 US UK 1998 Japan Germany Source: OECD Ratio of University to Non-University Workers Increased enrollment in higher education has separated America from the pack, making it better equipped to boost knowledge-worker productivity. Ratio 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 Total Services US Business Services Personal Services OECD Average Manufacturing Construction Source: OECD Share of Silicon Valley Start-ups by Ethnic Origin Percent 25 20 Immigration has played a key role in driving start-ups in America’s New Economy. Indian Chinese 15 10 5 0 1980-84 Source: Saxenian and OECD Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 1985-89 1990-94 1995-98 Page 12 MORGAN STANLEY DEAN WITTER Rebalancing: Globalization of Innovation Trends in National Innovative Capacity Innovation 300 Germany 250 America’s lead in the global innovation sweepstakes is starting to narrow. Japan Switzerland US 200 150 100 50 0 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 Source: Stern, Porter and Furman “The Determinants of National Innovative Capacity” Researchers per 10,000 in the Labor Force 100 Japan 85 The share of a nation’s workforce engaged in research activities is key to its innovative potential. US OECD EU 70 55 40 25 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 Source: OECD Business-Funded R&D as a Percentage of GDP Percent 3.0 1990 2.5 1998 2.0 R&D spending also is an important driver of innovative capacity. 1.5 1.0 0.5 0.0 Finland Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Sweden Germany US Japan Page 13 MORGAN STANLEY DEAN WITTER Cyclical Rebalancing Unemployment in the G-7 12 1990 10 Cyclical imbalances should work against the US; the absence of American labor market slack is notable in that regard. May-01 8 6 4 2 0 Japan USA UK Germany Canada France Italy Source: National Statistical Agencies Note: 1990 Germany data are for West Germany only; Italy data are from 1993 Household Savings as a Percentage of Disposable Household Income United States Japan Germany Percent 20 15 A savings-short US economy may well have to pay a premium to import foreign capital. 10 5 0 82 84 86 88 90 92 94 96 98 00 Source: OECD Current Account as a Percentage of GDP 8 USA 6 Given America’s massive external imbalance, that premium may take the form of a sharp depreciation in the dollar. Japan Germany 4 2 0 -2 -4 -6 80 82 Source: OECD Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 84 86 88 90 92 94 96 98 00 Page 14 MORGAN STANLEY DEAN WITTER Perils of the Digital Divide Connectivity and Computer Literacy: 1998 (per 1000) High-Income Countries Low-Income Countries A wide gap currently exists between the haves and have-nots of Internet access. Telephone Mainlines Mobile Penetration Television Cable Subscribers College Enrollment (% 1997) Personal Computers 1990 PPP Dollars 20,000 Will the digital divide — income and wealth disparities between computer users and non-users — spark new global inequalities? 567 265 662 184 59 311 37 8 138 28 6 6 Global Income Disparities Differential Income Growth in per capita GDP 16,000 Low-income quartile countries Middle-low-income quartile countries Middle-high-income quartile countries High-income quartile countries 12,000 8,000 4,000 0 Source: OECD and IMF 1900 2000 United States There is evidence of a digital divide within countries as well — at both ends of the prosperity spectrum. China Percent of Group Using the Internet in 1998 White non-Hispanic 37.7% Distribution of Internet Users by Province in 2000 Beijing 21.24% Black non-Hispanic AIEA non-Hispanic API non-Hispanic 19.0% 29.5% 35.9% Guangdong Shanghai Jiangsu Hispanic 10.0% Other 12.94% 11.21% 5.91% 50.0% Source: US Department of Commerce and China Internet Network Information Center (CNNIC) Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 15 MORGAN STANLEY DEAN WITTER Global Pension Challenge Dependency Ratios: Working Age per Retiree Ratio 14 World 12 A demographic time bomb is ticking around the world that makes the task of pension reform increasingly urgent. Developed Countries 10 US 8 Less Developed Countries 6 China 4 2 0 1999 2050E Source: United Nations Development Program Demographic Headwinds: Shifting Mix of Global Aging by 2030 (Share of population growth of elderly 60+ cohort) Asia will account for a disproportionate share of global aging over the next 30 years. China 29% Asia ex China 29% OECD countries 14% Transitional economies 28% Source: World Bank Pension Spending as a Percentage of GDP Percent 20 OECD Countries Pension spending will rise sharply as a share of global GDP over the next 50 years. 15 China Asia (less China) 10 5 0 1990 2000 Source: World Bank Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 2010E 2020E 2030E 2040E 2050E MORGAN STANLEY DEAN WITTER Page 16 A New Financial Architecture • Likely Changes – Infrastructure enhancements: Transparency, standards, compliance incentives, eliminating pegged exchange rates – Coping with volatility: Expanded FX reserves, prearranged credit lines, debt restructurings, taxing capital inflows, new contagion lending facility – Curbs on private creditors: Bail-ins, collective action clauses, encouraging longer-term financing, heightened oversight of highly leveraged borrowers – IMF and World Bank: Refocusing and reform — less is more • Unlikely Reforms – New international authority – IMF with expanded lender-of-last-resort capabilities – Global credit insurance schemes – Currency target zones • Message from G-7 – Reluctant to coordinate, except in crises – No endorsement of radical change in architecture – Best international policy is collection of best domestic policies – Exchange-rate regimes shift from fixed to floating Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 17 MORGAN STANLEY DEAN WITTER Europe’s Competitive Challenge Hourly Compensation in Manufacturing Europe is finally making progress in narrowing the global competitiveness gap. US$ per Hour 32 Wages 28 24 20 16 12 8 4 0 Benefits Compensation Total UK US Eur. Jpn. Fra. Ger. UK US Eur. Jpn. Fra. Ger. 1985 UK US Eur Jpn. Fra. Ger. 1995 1999 Benefits: Share of Total Hourly Compensation Percent 60 50 The European model places a greater emphasis on the social contract of outsized benefits. 40 30 20 10 0 UK US Jpn. Fra. Ger. 1985 UK US Jpn. Fra. Ger. 1995 UK US Jpn. Fra. Ger. 1999 PCs per Worker: 1997 120 100 80 Europe lags the US in its commitment to information technology. 60 40 20 0 Nor. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. US Swe. Switz. Den. Neth. Fra. EU Bel. Ger. Ita. Page 18 MORGAN STANLEY DEAN WITTER More to Come on Japanese Restructuring RoA = Recurring Profit / Total Assets Percent 16 14 12 Japanese restructuring is focused on boosting ROA back toward historical norms. 10 8 6 4 2 55 60 65 70 75 80 85 90 95 00 Compensation/GDP Percent 60 55 Restructuring tactics should focus on slashing labor compensation costs, we believe. 50 45 40 35 55 60 70 75 80 85 90 95 00 Capital Stock Relative to GDP Ratio Corporate Japan will also have to rationalize excess capacity. 65 2.5 2.3 2.1 1.9 1.7 1.5 1.3 1.1 0.9 0.7 0.5 55 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 60 65 70 75 80 85 90 95 00 -2 Page 19 MORGAN STANLEY DEAN WITTER A Resilient Chinese Economy Chinese GDP Growth Percent 16 14 After seven years of GDP deceleration, Chinese growth now seems to be picking up. 12 10 8 6 4 2 0 90 91 92 93 94 95 96 97 98 99 00 01E 02E China's Export Recovery Percent, Y/Y 50 40 30 China’s export dynamic is beginning to feel the chill of the global slowdown. 20 10 0 -10 -20 Sep-97 Mar-98 Sep-98 Mar-99 Sep-99 Mar-00 Sep-00 Mar-01 Sep-01 Source: Ministry of Foreign Trade and Economic Cooperation FDI in China US$, Billions 70 60 In anticipation of WTO accession, foreign direct investment into China appears to be rebounding sharply. 50 40 30 20 10 0 1993 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 1994 1995 1996 1997 1998 1999 2000 2001 Utilized Signed MORGAN STANLEY DEAN WITTER Latin American Risks Latin America remains dependent on foreign trade — although less so than Asia. Current-account deficits remain more of a problem than fiscal shortfalls in this region. Latin America’s external financing needs are increasingly covered by foreign direct investment. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 20 Page 21 MORGAN STANLEY DEAN WITTER US Overview After five years of extraordinary vigor, we believe the US economy has slipped into a mild recession. After decelerating to a 1.5% pace in the three quarters ending in 1Q01, we now look for real GDP growth to contract by a 0.5% annual rate in the second and third quarters of this year before rebounding in the fourth quarter by just 2.5%. Risks remain on the downside of our short and shallow recession call. Three factors are most worrisome in this regard — the excesses of an IT overhang, a negative consumer wealth effect, and a current-account/dollar crisis. Should any of these pressures intensify, there is a distinct risk we could deepen and lengthen our recession call. In a still-subdued inflationary climate, a shortfall in volume growth should lead to significant pressure on corporate profits. This could well be exacerbated by a margin squeeze resulting from pressures on energy costs, financing costs, technology costs, and labor costs. Reflecting these concerns, we now look for after-tax corporate profits to contract by 11.0% in 2001 — a dramatic reversal from the 13.1% increase we estimate for 2000 and at odds with more optimistic earnings expectations still embedded in the stock market. This could heighten the risks of a further stock market correction and its concomitant wealth effect. Despite aggressive Fed easing, US recovery prospects should be restrained by the confluence of cyclical and structural factors. The former are traceable to the cost-cutting stemming from the ongoing earnings recession, and the latter reflect the post-bubble excesses of a negative personal saving rate, an outsized capacity overhang, and a record current-account deficit. The result could well be an “American-style L” -- with US GDP growth averaging just 1.5% to 2.0% over the 2001-03 interval. US Forecast at a Glance 2000 2001E 2002E (%, Year-Over-Year Change) Real GDP Inflation (CPI) Industrial Production Capacity Utilization (%) Corporate Profits (After-Tax) 5.0 3.4 5.6 81.3 13.1 QI QII 1.1 3.2 -2.5 75.7 -11.0 2001E QIII QIV 3.0 2.4 1.0 74.3 8.4 QI 2002E QII QIII QIV (%, Sequential Quarterly Change at Annual Rates) Real GDP Gross Domestic Demand Unemployment Rate 1.3 0.0 4.2 -0.5 0.2 4.6 E = Morgan Stanley Research Estimate Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. -0.6 -0.8 4.9 2.5 2.5 5.0 4.3 4.6 5.0 4.7 5.1 5.0 4.0 4.5 5.0 3.1 3.1 5.1 Page 22 MORGAN STANLEY DEAN WITTER America Heading for Recession Morgan Stanley US Growth Forecast Percent 6 Average 1996 to mid-2000: 4.5% 5 Our baseline case calls for a short and mild recession, followed by a Ushaped recovery; risks remain to the downside. Forecast 4 3 2 Average 2001-2002: 2.4% 1 0 -1 00Q1 00Q2 00Q3 00Q4 '01Q1 01Q2 01Q3 01Q4 02Q1 02Q2 02Q3 02Q4 Manufacturing Inventory-to-Sales Ratio Ratio 2.0 Trend: 1981-2000 1.8 An inventory correction seems likely to keep the economy contracting through mid-year. 1.6 1.4 1.2 Jan-81 Jan-84 Jan-87 Jan-90 Jan-93 Jan-96 Jan-99 Watch the Second Derivative Percent Change in Year-over-Year Real US GDP Growth from Previous Year 12 Recessions 8 The sharp slowing of the US economy over the past year falls short of the downturns that have sparked the V-shaped rebounds in the past. 4 0 -4 -8 I-59 II-63 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. III-67 IV-71 I-76 II-80 III-84 IV-88 I-93 II-97 III-01 Page 23 MORGAN STANLEY DEAN WITTER Cost-Cutting at Work Corporate Profits: Cyclical Comparison Index, Peak = 100 115 After-Tax Corporate Profits/GDP 110 105 This is likely to be an unusually steep earnings recession. 100 95 90 Present Cycle* 85 Average, Previous Four Cycles 80 -5Q -4Q -3Q -2Q -1Q 0 1Q 2Q 3Q 4Q 5Q 6Q 7Q 8Q Cost-Cutting: Capital Index, Peak = 100 110 Cost-cutting initially has been focused on the pruning of capital spending, especially IT. Business Fixed Investment 100 90 Present Cycle* 80 Average, Previous Four Cycles 70 -8Q -7Q -6Q -5Q -4Q -3Q -2Q -1Q 0 Index, Peak = 100 100.5 1Q 2Q 3Q 4Q 5Q 6Q 7Q 8Q Cost-Cutting: Labor Nonfarm Payroll Employment 100.0 Businesses have just started to cut labor costs in an effort to boost profit margins. 99.5 Present Cycle Average, Previous Four Cycles 99.0 98.5 -8M -7M -6M -5M -4M -3M -2M -1M * Peak tentatively designated as October 2000. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 0 1M 2M 3M 4M 5M 6M 7M Page 24 MORGAN STANLEY DEAN WITTER Purging Structural Excesses An unprecedented decline in personal savings leaves the American consumer highly vulnerable to a negative wealth effect. Where Has All the Saving Gone? Percent 16 14 12 10 8 6 4 2 0 -2 1947 Personal Savings Rate, NIPA Measurement Personal Savings Rate, Flow of Funds, FRB 1953 1959 1965 1971 1977 1983 1989 1995 2001 Capital Spending Overhang? Percent 15 Non-Residential Fixed Private Investment as a Percentage of GDP 12 Driven by surging IT, there is a risk of a classic capacity overhang. 9 6 Jan-46 Jan-54 Jan-62 Jan-70 Jan-78 Jan-86 Jan-94 Jan-02 Twin Excesses Percent 2 1 A savings-short US economy has become overly dependent on foreign capital to finance booming investment. 0 -1 -2 -3 -4 Current Account as a Percentage of GDP (Left) -5 Jan-60 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Jan-66 Jan-72 Jan-78 Jan-84 Jan-90 Jan-96 Jan-02 Page 25 MORGAN STANLEY DEAN WITTER Capacity Overhang in the New Economy IT Overhang Percent 60 IT/Capital Equipment and Software (Left) Capital Equipment and Software/GDP (Right) 50 Under the guise of the New Economy, America has embarked on a massive IT binge. 10 40 8 30 6 20 4 10 2 0 0 Jan-46 Much of this investment has been justified on the basis of increasingly shorter product cycles — a dubious assumption, in our opinion. Percent 12 Jan-55 Jan-64 Jan-73 Jan-82 Jan-91 Jan-00 Replacement Share of Gross Investment: Equipment and Software Percent 80 70 60 50 40 30 20 10 0 1961-64 1965-69 1970-74 1975-79 1980-84 1985-89 1990-94 1995-99 Growth in “Potential” Productivity 3.5 If IT spending slows, productivity gains could fade quickly. 3.0 Percent change from year ago, smoothed 2.5 Labor Productivity 2.0 1.5 Capital deepening impact Time-varying (TFP) 1.0 0.5 0.0 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 26 MORGAN STANLEY DEAN WITTER Pruning White-Collar Bloat Shifting Mix of Employment Over the past 17 years, white-collar growth has averaged 2.3%, double the 1.1% growth in other occupations. Percent, YoY 6 5 4 3 2 1 0 -1 -2 1984 1986 Other Employment 1988 1990 1992 1994 1996 1998 More Managers, More in Services Percent 26 White-collar hiring has been increasingly skewed toward services and has become increasingly top-heavy with managers. White-Collar Employment 2000 Percent 72 70 24 68 22 66 20 Managerial Share of White-Collar (left) Private Services' Share of Managers (right) 18 62 1983 1985 1987 1989 1991 1993 1995 1997 1999 White-Collar Efficiencies? Ratio Ratio 1.2 1.8 Managers/Professionals (left) 1.7 Within the white-collar function, back-office efficiencies have been offset by an ominous build-up of managerial bloat. 64 1.1 Knowledge Workers/Information Support (right) 1.6 1.0 1.5 0.9 1.4 0.8 1.3 0.7 1.2 1.1 0.6 1983 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 1985 1987 1989 1991 1993 1995 1997 1999 2001 Page 27 MORGAN STANLEY DEAN WITTER Consumers at Risk Loss of Confidence Index 160 140 As layoffs mount, the American consumer has turned increasingly skittish. Conference Board Confidence Index U of Michigan Index 120 100 80 60 40 Jan-90 It will take a sharp consolidation of consumption to bring consumer demand in better alignment with purchasing power. Percent 7 6 5 4 3 2 1 0 -1 Jan-90 The excesses of consumption have been financed by a record surge in household debt. Percent 130 120 110 100 90 80 70 60 50 40 Jan-80 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Jan-92 Jan-94 Jan-96 Jan-98 Jan-00 Jan-02 Spending Overhang? Real Consumer Expenditures Real Disposable Income Jan-92 Jan-94 Jan-96 Jan-98 Consumer Credit Bomb Jan-00 Percent 15 14 13 12 Total Outstanding Consumer Credit -- Installment + Mortgage (Left) 11 10 Consumer Debt Service (Right) 9 Jan-84 Jan-88 Jan-92 Jan-96 Jan-00 Page 28 MORGAN STANLEY DEAN WITTER Perils of the Wealth Effect A Shaky Foundation % of GDP 2 Current Account Deficit (left) 1 America’s growth dynamic is built on the shaky foundation of a still overvalued stock market and excessive reliance on foreign capital. Jan-1980 = 100 1600 S&P 500 (right) 1400 1200 0 1000 -1 800 -2 600 -3 400 -4 200 -5 0 Mar-86 Mar-88 Mar-90 Mar-92 Mar-96 Mar-98 Mar-00 Mar-02 The Wealth Effect at Work $, Trillions 14 Percent 14 Household Equity Holdings (Left) Personal Savings Rate (Right) 12 The $8 trillion appreciation in household equity holdings since late 1994 enticed wealth-dependent consumers into depleting their personal savings. Mar-94 12 10 10 8 8 6 6 4 4 2 2 0 0 -2 -2 90Q1 91Q1 92Q1 93Q1 94Q1 95Q1 96Q1 97Q1 98Q1 99Q1 00Q1 01Q1 Composition of US Private Trusteed Pension Assets Percent However, as pension regimes shift from defined-benefit to definedcontribution schemes, wealth preservation will likely become a paramount objective of individual investors. 100 90 80 70 60 50 40 30 20 10 0 Defined Benefit Defined Contribution 77 79 81 83 Estimates by Federal Reserve Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 85 87 89 91 93 95 97E 99E Page 29 MORGAN STANLEY DEAN WITTER Cyclical Dynamics Consumer Resilience Percent 12 10 While real income growth remains solid, consumer confidence is starting to weaken — an ominous portent for the US economy. Index 180 Real Disposable Income (Left) Conference Board Consumer Confidence (Right) 140 8 6 100 4 60 2 20 0 -2 Jan-80 -20 Jan-84 Jan-88 Jan-92 Jan-96 Jan-00 Productivity growth typically slows at the end of a long-cycle expansion. US Unit Labor Costs Percent Consequently, we believe that there is still upside risk to unit labor costs. 6 5 4 3 2 1 0 -1 Apr-91 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Current Cycle Forecast Oct-92 Apr-94 Oct-95 Apr-97 Oct-98 Apr-00 Oct-01E Page 30 MORGAN STANLEY DEAN WITTER Inflation Dichotomy Decomposing the Core CPI Percent 7 Commodities Less Food & Energy Services Less Energy 6 There is a marked contrast between the inflation dynamic in laborintensive services and that in the goods-producing sector. 5 4 3 2 1 0 -1 Jan90 Jan91 Jan92 Jan93 Jan94 Jan96 Jan97 Jan98 Jan99 Jan00 Jan01 Jan02 US Cost Squeeze Percent 6 Unit Labor Costs 5 Average Spread 1990-1996 1.5% 4 There has been a noticeable loss of pricing leverage in recent years. Jan95 CPI Average Spread 1997-2002E 0.5% 3 2 1 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Reversion to the Mean? Percent 6 Total CPI 5 4 Most still expect inflation to remain well below its secular norms. Core CPI 2000 CPI: 3.4% Implied 10-Year Inflationary Premium: 1.67% 3 2 1 0 1950-98 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. ex-1970s 1960-98 ex-1970s Page 31 MORGAN STANLEY DEAN WITTER Bond Market Risk Inflation and the Bond Market The recent rally in bonds reflects both a drop in real interest rates and a sharp reduction in the inflationary premium. 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Real Rate on 10-Year TIPS Implied Inflation Premium 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Jan-97 Jul-97 Dec-97 Jun-98 Nov-98 May-99 Oct-99 Mar-00 Sep-01 Feb-01 Jul-01 Net National Saving as a Share of GDP Percent 15 Total Savings Unfortunately, a reduction in private saving appears to be offsetting the elimination of public sector “dissaving.” Private Savings Government Savings 10 5 0 -5 1960s 1970s 1980s 1990s 01Q1 Social Security Trust Fund Balance A demographic time bomb will transform the social security surplus into deficit by 2015 under the baseline scenario, putting renewed pressures on America’s fiscal position. 4 2 0 -2 -4 -6 -8 -10 -12 -14 2 1 0 -1 -2 -3 -4 -5 -6 -7 Trillions of Dollars (Left) Percent of GDP (Right) 2000 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 2010E 2020E 2030E 2040E 2050E 2060E 2070E Page 32 MORGAN STANLEY DEAN WITTER The Cyclical Clock Average Length of Business Cycle Expansion Months 140 123 120 100 There has been a dramatic lengthening of the business cycle over the past 140 years. 4 Cycles 73 80 6 Cycles 60 11 Cycles 40 9 Cycles 27 23 1854-1899 1900-1929 46 20 0 1933-1960 1961-1991 Current Cycle Length of Recent Business Cycle Expansions Months 140 123 120 The current expansion has now exceeded the long-cycle outcomes of the 1960s and 1980s, making it the longest postwar expansion on record. 106 92 100 80 58 60 36 40 20 0 1961-1969 Months 25 The current cycle may bear greater resemblance to those of the preWorld War II era than to those of the more recent period. 1970-1973 1975-1980 1982-1990 Current Cycle Tale of a Different Business Cycle? Average Length of Recessions 21 20 15 11 10 5 0 1854 - 1945 19 Peacetime Cycles Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 1945 - 1991 7 Peacetime Cycles MORGAN STANLEY DEAN WITTER Page 33 U.S. Economic and Interest Rate Forecast Real GDP and Related Items, 2000-2002E Forecast Date: June 4, 2001 Year over Year Real GDP Domestic Final Sales+ Personal Consumption Expenditures Business Fixed Investment -- Structures -- Equipment Residential Investment Exports Imports Federal Government State & Local Government 2000 5.0 5.6 5.3 12.6 9.1 13.7 -0.5 9.0 13.5 1.5 3.5 2001E 1.1 2.0 2.5 -0.6 7.2 -3.1 0.2 -0.2 1.5 2.8 2.1 2002E 3.0 3.1 2.7 2.3 -4.8 5.0 15.9 4.3 6.3 2.7 1.6 Business Indicators++ Nominal Merchandise Trade Deficit Current Account as a % of GDP Change in Real Nonfarm Inventories $459.9 -4.4 55.8 $461.8 -4.2 -14.3 $498.5 -4.4 21.4 1,575 17.2 5.6 4.0 1,666 16.3 -2.5 4.7 1,935 16.8 1.0 5.1 After-Tax Profits $641.4 -- Percent Change from Prior Year 13.1 Disposable Personal Income (Pct Chg) 2.8 Personal Saving Rate -0.1 $570.8 -11.0 2.4 -0.3 $621.4 8.9 3.3 0.2 Prices and Costs (Percent Change) GDP Chain Price Index 2.1 Consumption Prices ex Food & Energy 1.6 Consumer Price Index 3.4 Consumer Price Index ex Food & Energy 2.4 Producer Price Index 3.7 Compensation Per Hour 5.1 Productivity 4.3 Unit Labor Costs 0.7 2.2 2.0 3.2 2.7 3.9 5.6 1.2 4.4 2.1 1.9 2.4 2.4 2.2 5.3 2.5 2.7 Housing Starts (Thous) Light Vehicle Sales (Millions) Industrial Production (Pct Chg) Civilian Unemployment Rate (Percent) Percent Change From Prior Quarter** Q4 to Q4* 2000 3.4 4.5 4.5 10.5 12.7 9.8 -2.6 6.7 11.3 -1.3 2.7 2001E 0.7 1.4 2.0 -4.3 0.7 -5.9 6.5 -1.3 -0.1 3.4 1.8 2002E 4.1 3.9 3.0 7.6 -3.6 11.9 12.3 7.1 7.9 2.4 1.9 Actual 4Q00 1Q 01E 1.0 1.3 2.2 2.9 2.8 2.9 -0.1 2.1 10.4 17.2 -3.3 -2.6 -3.6 2.9 -6.4 -2.7 -1.2 -9.1 3.8 4.9 2.5 4.7 2Q 01E 3Q 01E 4Q 01E -0.5 -0.6 2.5 -0.4 0.8 2.3 0.8 2.2 2.0 -7.7 -9.7 -1.4 4.3 -8.7 -8.0 -11.6 -10.0 1.2 -2.4 6.0 20.9 -3.5 -1.3 2.2 3.1 3.6 2.8 1.7 4.7 2.5 0.0 0.6 2.0 $488.1 $449.4 -4.6 -3.9 50.5 -25.1 $461.7 $469.2 $467.1 -4.3 -4.4 -4.3 0.1 -19.5 -12.5 1,539 16.2 -0.9 4.0 1,625 17.2 -6.5 4.2 $626.4 $607.2 4.4 -4.3 0.7 2.3 -0.7 -0.9 2.3 1.6 3.4 2.5 3.7 5.7 3.3 2.3 *Annual average for Business Indicators **Annualized percent change from prior period, unless noted E = Morgan Stanley Dean Witter Research Estimates 2.1 2.2 2.9 2.7 3.6 5.2 0.4 4.8 2.2 1.7 2.5 2.3 1.9 5.3 3.3 1.9 2.0 2.6 2.9 3.2 4.1 6.6 2.0 4.5 1,554 16.3 -3.6 4.6 1,675 15.9 -6.2 4.9 $572.8 $543.3 $559.9 -11.9 -17.0 -10.6 1.2 7.7 -0.1 -0.8 0.4 -0.1 3.2 2.3 4.2 2.7 5.5 5.2 -0.1 5.2 1.7 2.0 3.4 2.5 4.3 5.2 0.3 4.9 1.5 1.9 1.7 2.5 2.2 5.3 -0.4 5.7 2.0 1.8 2.4 2.4 2.5 5.3 2.0 3.2 +Final sales less net exports ++Billions of dollars; real in billions of chain-type 1996 dollars Interest Rate Outlook Fed Funds Target Prime LIBOR 3-Mo. 3-Mo. 6-Mo. May 31, 2001 01Q2 01Q3 01Q4 4.00 4.00 3.75 3.75 7.00 7.00 6.75 6.75 3.99 4.35 4.15 4.25 3.61 3.75 3.60 3.75 3.56 3.90 3.78 4.00 4.17 4.00 3.95 4.25 4.90 4.20 4.11 4.38 5.37 5.10 4.90 5.00 5.75 5.55 5.30 5.30 02Q1 02Q2 02Q3 02Q4 4.00 4.50 5.00 5.00 7.00 7.50 8.00 8.00 4.50 5.15 5.60 5.60 4.00 4.60 5.00 5.00 4.30 4.80 5.05 5.05 4.60 5.00 5.10 5.10 4.73 5.13 5.23 5.18 5.20 5.35 5.45 5.35 5.30 5.40 5.45 5.35 Date* 1,811 16.0 -1.8 5.0 *All forecast values are for the end of the designated period. *All forecast values are for the end of the designated period. E = Morgan Stanley Estimates Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Treasury Yield Curve 2-Yr. 5-Yr. 10-Yr. 30-Yr. MORGAN STANLEY DEAN WITTER Page 34 Global Economic Outlook: GDP and Inflation 1998 GNP/GDP Growth (%) 1999 2000 2001E 29-Jun-01 2002E 1998 1999 CPI Inflation (%) 2000 2001E 2002E Global Economy Industrial World 2.8 2.7 3.5 3.4 4.8 4.1 2.5 1.3 3.8 2.5 3.7 1.2 2.3 1.3 2.6 2.5 2.6 2.3 2.5 1.7 US 4.4 4.2 5.0 1.1 3.0 1.6 2.2 3.4 3.2 2.4 5.3 3.3 –0.4 4.7 4.5 3.6 3.7 4.7 3.5 1.8 1.5 2.1 3.7 3.3 2.7 0.9 1.0 1.3 1.5 1.7 –0.1 4.5 2.7 2.6 4.0 2.6 2.6 2.2 2.2 1.9 Europe EMU 2.8 2.8 2.5 2.5 3.3 3.4 2.1 2.2 2.7 2.7 1.4 1.1 1.2 1.1 2.4 2.3 2.4 2.6 1.8 1.6 Austria Belgium Denmark Finland France Germany Greece Ireland Italy Netherlands Norway Portugal Spain Sweden Switzerland UK 3.3 2.4 2.8 5.5 2.8 2.7 2.1 4.0 3.2 4.0 2.9 5.7 3.5 3.0 3.3 2.0 3.7 8.6 1.8 4.1 1.6 3.5 9.8 1.6 3.9 0.9 3.3 4.0 4.1 1.5 2.3 3.0 4.1 11.0 2.9 3.9 3.3 4.1 3.6 3.5 3.0 2.1 2.5 1.5 3.0 2.5 1.5 3.2 6.8 2.1 2.4 1.3 2.8 2.8 2.4 1.8 1.9 2.4 2.8 1.9 4.5 2.8 2.5 4.0 8.0 2.6 3.1 2.6 3.0 3.2 3.4 2.2 2.8 0.9 1.0 1.9 1.4 0.7 1.0 4.8 2.4 2.0 2.0 2.3 2.8 1.8 -0.1 0.0 3.4 0.6 1.1 2.5 1.5 0.5 0.6 2.6 1.6 1.7 2.2 2.3 2.3 2.3 0.5 0.8 1.5 2.3 2.6 3.0 3.4 1.7 1.9 3.2 5.5 2.5 2.5 3.1 2.9 3.4 1.4 1.6 2.9 2.6 2.4 2.1 2.7 1.6 2.6 3.0 4.7 2.8 4.4 3.2 3.8 3.7 2.3 1.4 2.0 1.6 1.6 2.3 2.0 1.1 1.6 3.2 4.8 1.8 2.5 2.6 3.2 2.5 1.9 1.3 2.9 Australia Canada New Zealand Emerging Europe 3.2 3.8 4.3 3.7 2.4 2.6 1.6 0.8 1.2 5.6 1.7 4.8 39.2 23.0 21.0 18.2 16.4 Czech Republic Hungary Israel Poland Russia Turkey South Africa –2.3 4.9 2.3 4.8 –4.9 3.3 0.6 –0.8 4.5 2.1 4.1 3.2 –5.1 1.2 3.1 5.2 5.8 4.1 6.7 7.2 3.1 2.6 4.1 1.6 3.4 4.1 -7.2 2.6 3.5 4.5 4.2 4.7 5.3 5.2 3.1 10.7 14.2 5.5 11.8 84.4 86.7 6.9 2.1 10.0 5.3 7.3 36.6 64.8 5.2 3.9 9.8 1.1 10.1 20.5 56.4 5.3 4.3 8.9 0.5 6.2 15.0 55.8 5.9 4.6 6.5 2.1 5.8 10.0 59.2 4.0 Japan Asia Ex-Japan –1.1 2.1 0.8 6.5 1.7 7.3 -0.8 5.4 0.2 6.5 0.6 6.2 –0.3 1.7 –0.6 1.5 –0.8 2.4 –0.6 3.3 7.8 –5.3 6.4 –13.1 –6.7 –7.4 –0.6 0.1 4.6 –10.2 7.1 3.0 6.4 0.8 10.9 5.8 3.3 5.9 5.4 4.2 8.0 10.5 5.7 4.8 8.8 8.5 3.9 9.9 6.0 4.3 7.5 3.2 6.4 2.7 4.5 3.0 2.5 4.1 2.5 2.0 7.8 4.3 6.5 4.0 6.5 5.0 4.0 7.0 4.5 4.5 –0.8 2.8 13.2 58.0 7.5 5.3 9.7 –0.3 1.7 8.1 –1.4 –4.0 4.8 24.1 0.8 2.8 6.7 0.4 0.2 0.3 0.4 –3.7 4.2 3.8 2.3 1.6 4.3 1.3 1.3 1.6 1.0 -1.0 4.5 9.0 4.1 1.7 7.0 1.3 1.0 2.0 3.0 1.0 5.1 6.5 3.0 2.5 6.0 2.0 2.0 2.5 China Hong Kong India Indonesia Korea Malaysia Philippines Singapore Taiwan Thailand Latin America 2.1 0.1 4.3 3.2 4.4 9.4 8.6 6.5 5.5 5.4 Argentina Brazil Chile Colombia Mexico Peru Venezuela 3.9 0.2 3.9 0.5 4.9 -0.4 0.2 –3.4 0.8 –1.1 –4.3 3.8 1.4 –6.1 -0.5 4.5 5.4 2.8 6.9 3.6 3.2 2.0 3.6 4.5 3.0 3.0 0.5 5.0 3.0 4.0 5.5 3.5 6.2 3.0 3.0 0.7 1.7 4.7 16.7 18.6 6.0 29.9 –1.8 8.9 2.3 9.2 12.3 3.7 20.0 –0.7 6.0 4.5 8.7 9.0 3.7 13.4 0.5 5.1 3.5 9.5 5.5 4.0 15.0 1.0 4.7 3.0 9.0 4.5 4.0 20.0 Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. MORGAN STANLEY DEAN WITTER Page 35 Global Economic Outlook: Interest Rates, Bond Yields, and Currencies 3-Month Euro Rates (%) Jun 29 Sep01 Dec01 10-Year Bond Yields (%) Mar02 Jun 29 Sep01 Exchange Rates Dec01 Mar02 Jun 29 Sep01 Dec01 Mar02 G-3 Countries US Euro Japan 3.8 4.4 0.08 3.9 4.1 0.10 4.0 4.1 0.10 4.4 4.3 0.10 5.4 5.0 1.2 5.3 4.8 1.1 5.4 5.3 1.0 5.5 5.5 1.1 0.85 124 0.96 120 0.91 115 0.95 110 Dollar Bloc Canada 4.4 4.2 4.3 4.6 5.9 5.6 5.7 5.7 1.52 1.56 1.50 1.48 Non-EMU Europe Denmark Switzerland Sweden UK 4.8 3.1 4.5 5.2 4.5 2.8 3.9 4.5 2.8 3.6 5.0 5.1 4.6 2.8 3.6 5.4 5.3 3.3 5.3 5.3 5.0 3.3 5.4 5.2 5.4 3.6 5.2 5.4 5.6 3.8 5.1 5.6 7.45 1.52 9.18 0.60 $/GBP 1.41 7.46 1.56 9.25 0.66 1.45 7.46 1.52 8.70 0.66 1.38 7.46 1.56 8.80 0.67 1.42 Note: Data are end-of-period values. European exchange rates are against the Euro except where noted. More detailed exchange rate forecasts are available in Morgan Stanley’s FX Pulse weekly. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. E = MSDW Research Estimates MORGAN STANLEY DEAN WITTER Page 36 May 29, 2001. Tipping Point Stephen S. Roach (Stephen.Roach@msdw.com) Tipping Point is a delightful little book by Malcolm Gladwell that made the rounds last year. The thesis is simple and inarguable: Under certain critical conditions, the cumulative effect of lots of little things can eventually make a big difference. Based on the principles of epidemics, Gladwell maintains that many tectonic changes in the world have come about from very small origins — from product breakthroughs (Hush Puppies) and criminal activity (New York City’s falling crime rate) to technological change (cell phone penetration) and medical discoveries (cancer treatments). The tipping point comes at the moment a slowly starting dynamic reaches a critical mass and then boils over into an irreversible sea change. I am beginning to suspect that the world economy is nearing a critical tipping point, one that could pose a formidable challenge to the US-led strain of globalization. The Law of the Few. Gladwell has identified three rules of the tipping point, each of which may well be applicable to what lies ahead. The first is the Law of the Few — that epidemics start small, and their transmission is dependent on the unique nature of the messenger. The US-led downturn in the global economy fits this script to a tee. America went from boom to bust in just six months, and the rest of the world has been quick to follow. Underscoring that point, we have again cut our below-consensus global growth forecast, trimming our 2002 estimate for world GDP growth to 3.7% from 3.9%. At work are downward adjustments to Euroland, the UK, Malaysia, Hong Kong, and Taiwan. Once again, I would stress that we may not be done yet. I would continue to place the downside risks to our 2002 global growth forecast in the 3.0–3.5% range. Moreover, our downward revisions to 2002 follow yet another reduction to our near-term prognosis. We have just pared our 2001 GDP forecast for Mexico, to 3.0% from 3.3%, and we think the odds are rising that currencyinduced pressures on Argentina will spill over into Brazil. Nor does there appear to be any let-up in sight from the original instigator of this global slowdown — the United States. That was hammered home by a downward revision to the government’s original estimate of 1Q01 GDP growth, to 1.3% from 2.0%. On a revised basis, we now expect world GDP growth to average 3.2% over the 2001– Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. 02 interval — 0.5 percentage point below the longer-term trend of 3.7%. The persistence of such subpar growth is what could lead to a tipping point. The Law of the Few tends to spread because of what Gladwell calls “connectors.” Globalization, of course, rests on the foundations of such connectivity — through capital markets, cross-border trade, and information technology. Thus, contagion is likely to be the rule rather than the exception. That’s especially the case as the world economy loses its major source of dynamism, a once highflying US economy. With the rest of the world lacking in self-sustaining domestic demand growth — especially an IT-dependent Asia, a NAFTA-dependent Canada and Mexico, and a global-trade-dependent Europe — it is all the more susceptible to a US-led downshift. Lacking a candidate to fill the void, an engineless world is more vulnerable to contagion than a more balanced world would be. The world economy could be nearing a critical tipping point that challenges the US-led strain of globalization. The Stickiness Factor. The second rule of the tipping point is the Stickiness Factor — the tendency of an important trend to become increasingly entrenched as it spreads. That’s what the globalization of the New Economy is all about. The rapid growth of e-based connectivity makes it virtually impossible to turn back the clock on this new era of global commerce. The worldwide build-out of a telecommunications infrastructure is a given. The questions pertain more to efficiencies on the supply side — both profitability and capacity excesses — than to the demand side of this equation. Like it or not, such stickiness probably solidifies the dependence of the rest of the world on this US-led strain of globalization. So, too, does the rapid expansion of global trade. By our calculations, world trade hit a record of close to 25% of global GDP in 2000, more than four times the share prevailing in 1970. Now this trade dynamic is running in reverse. Our estimates suggest that the nearly 13% surge in 2000 will be more than cut in half in 2001. The confluence of e-based and trade linkages underscores the stickiness of MORGAN STANLEY DEAN WITTER globalization — yet another reason to stress the heightened possibility of cross-border spillovers, or contagion. The Power of Context is the third ingredient of Gladwell’s tipping point. It speaks mainly of the sensitivity of individuals to their environment — and to forces that may prompt unexpected and/or unusual reactions to such conditions. Here, again, the context is globalization. As I see it, the individual sensitivities that most stand out could well be on the dark side of globalization, namely, widening income disparities between the haves and the have-nots. The risk is that these growing inequalities could worsen in the context of the new strain of globalization. That could arise from the “digital divide” — whereby the profusion of new information technologies exacerbates the disparities between the computer literate and those lacking such skills. That sets up a tug-of-war, not only within nations but also across borders, that could strain the fabric of globalization. Page 37 the costs. In tougher economic times, that resistance can only intensify. Protectionism is antithetical to everything that globalization stands for. However, if a backlash arises, protectionism could be the gravest risk of all. Second, any ascendancy of labor could well push the pendulum of economic power away from the decidedly procapital position it has occupied for much of the past decade. The effects of such a development could be manifested in two forms — sustained corporate earnings pressure and/or higher inflation. Inasmuch as a persistently sluggish global economy hardly points to a restoration of pricing leverage, the cost pressures arising from a backlash should take a disproportionate toll on business profits. In the climate we envision, such cost pressures will squeeze margins rather than trigger inflation. Inflation scares will turn out to be false alarms, and earnings rebounds will end up being short-lived. Those tensions seem likely to be all the more acute in a sluggish growth climate. It’s not that vigorous growth is the rising tide that lifts all boats. But to the extent that it does spark rapid hiring and income generation, it can temporarily mask economic hardship. Sluggish growth, by contrast, unmasks the pain. The new math of the New Economy leaves little doubt of how this downside plays out. In the boom phase, scale and scope were everything. Hypergrowth was the stuff of open-ended IT spending and rapid hiring. The math of subpar growth turns these trends inside out. As growth slows, cost excesses must come out of the system, eliminating overhangs in both capital accumulation and hiring. In the jargon of the tipping point, rapid growth is a very favorable context for globalization. The risk is that subpar growth may not be. A third potential impact of such a backlash could show up in the form of an especially sharp toll on the perceived rates of return on dollar-denominated assets. The dollar looks especially vulnerable to me in this regard. I am the first to concede that I have held this view for longer than I care to remember. Yet I continue to believe that the offshore overhang of US dollars brought about by a record current-account deficit leaves the United States highly vulnerable to the whims of ever-fickle global investors. I still maintain that the day will come when global investors demand a premium for holding dollar-denominated assets. When that occurs, then something has to give — either the dollar, US equity prices, or bond yields, or some combination of the above. Financial markets are totally unprepared for such a possibility. What are the implications of such a backlash? Three key possibilities come to mind — the first being that trade liberalization might give way to some form of protectionism. To the extent that slow growth prompts mounting layoffs, the political winds could well shift. The outcome might lead to the erection of new competitive barriers that would supposedly shield workers from the harsh winds of globalization. The body politic is already sympathetic to just such a possibility. From Seattle to Quebec City, recent demonstrations of antiglobalists drive this point home. So, too, do public opinion polls revealing that US workers oppose several aspects of globalization — especially trade liberalization, immigration, and foreign direct investment. Even during goods times, according to these polls, the benefits of such trends are thought to be largely outweighed by Tipping Point is a great read and a provocative intellectual exercise. It is also well grounded in reality, fitting the script of many a Big Change in the world. Like all such historical analytics, however, it works best after the fact, lending itself all too well to the classic rearview mirror critique. The problem, of course, is knowing whether a tipping point is actually at hand for the global economy. That’s what intrigues me the most. The US has been on an extraordinary ride, and the rest of the world may simply have become overly dependent on the American way. It is the excesses of that ride — and their likely purging — that might lie at the heart of the next tipping point. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. MORGAN STANLEY DEAN WITTER Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 38 MORGAN STANLEY DEAN WITTER The New Global Contagion Page 39 June 19, 2001 Stephen S. Roach (Stephen.Roach@msdw.com) technology (IT) cycle, and the European manufacturing recession starting to broaden out, the world economy is essentially The global currency crisis of 1997–98 was widely billed as the engineless — lacking a new source of growth to fill the void first recession of the era of globalization. Like a fast-moving left by a once-booming US economy. Without an alternative epidemic, the contagion of cross-border currency depreciation growth engine, the global economy is probably now in recesswept the world for 18 months — from Thailand in mid-1997 sion. to Brazil in early 1999, and many points in between. Today, a new strain of contagion is at work. And it could be even more A new strain of global contagion is at lethal than the financial-market contagion that afflicted the work — driven by world trade, globalworld 3–4 years ago. It’s a contagion across the real economies of the world, transmitted by the confluence of crossized supply chains, and powerful multiborder trade, globalized supply chains, and multinational cornational corporations. porations. And the risk is that this new global contagion has only just begun. To a large extent, this global recession is traceable to a new The impact of a US-led economic slowdown on the rest of strain of contagion — enhanced connectivity that both amthe world is one major channel for this new strain of con- plifies and accelerates the linkages between the real econotagion. America’s role in precipitating this contagion is un- mies of the world. Three types of linkages are at work, the first being cross-border trade. According to our estimates, derscored by the downward revisions we have made to our global trade now accounts for nearly 25% of world GDP, esglobal forecast in recent months. Our 2001 world GDP sentially double the share prevailing in the 1970s. With the growth estimate now stands at 2.4%, down sharply from the major economies of the world simply trading more with each 4.2% prognosis that prevailed as recently as October 2000. Fully 35% of that reduction is traceable to the direct effects of other, fluctuations in one country quickly spill over into other countries. That’s especially the case when the world’s largest cuts we have made to our US growth estimates; our current economy — the United States — screeches to a virtual standUS GDP growth forecast for this year stands at just 1.1% — less than one-third the 3.7% growth pace we were forecasting still as it did in the latter half of 2000. Foreign trade accounted for about 15% of US GDP in 2000, nearly double the share last fall. The balance of the reduction to our 2001 global prevailing over the 1980s. This increased openness of the US growth forecast stems from cuts we have made to the rest of economy is a double-edged sword; when America booms, the the world, especially Europe, non-Japan Asia, and Latin rest of the world benefits, but when America sneezes, the rest America. Moreover, we have just cut our below-consensus of the world can quickly catch a cold. 2001 growth prognosis for Japan to –0.8% from +0.2%. It should be no surprise that the US economy has led the world to the downside. After all, it played a disproportionate role in driving global growth for the past five years. In 1995 through 2000, our estimates suggest that the 4.5% average annual expansion of the US economy directly accounted for 26% of the cumulative increase in world GDP. Adding in the indirect effects of US imports from non-Japan Asia, its NAFTA partners, South America, and Europe, the US appears to have accounted for about 40% of the total increase in world GDP over the five years ending in mid-2000. Courtesy of the dramatic slowdown in the US economy that has subsequently occurred, that 40% contribution is now in the process of going to zero. Moreover, with Japan back in recession, non-Japan Asia getting hit hard by the downturn of the US informationGlobal Investment Research – July 2001 Please refer to important disclosures at the end of this report. Increasingly globalized supply chains are a second characteristic of the new global connectivity that magnifies the crossborder impacts of a US-led slowdown. This, of course, is a by-product of the worldwide trend toward outsourcing — the creation of a network of offshore suppliers that reduces the cost of production in the industrial world. Non-Japan Asia has led the charge as the world’s leading IT outsourcer. Our greater China economist Andy Xie estimates that IT exports to the US accounted for as much as 40% of non-Japan Asia’s total GDP growth in 2000. America’s NAFTA-based supply chains are just as well developed. US exports account for 25% of Mexican GDP and 32% of Canadian GDP. Given the extent of the linkages in global supply chains, America quickly exports the macro impacts of any inventory adjustments to MORGAN STANLEY DEAN WITTER Page 40 its offshore outsourcers. Little wonder that growth prospects last 50 years — the recession of 1990–91, when export growth are now fading quickly in non-Japan Asia, Mexico, and Cana- slowed to an anemic positive comparison of around 3%, and da. Those are the footprints of the new global contagion. the contraction of 1960–61, when exports declined by only about 2%. But exports generally decline during a global reThe increased role of multinational corporations in the world cession, and I am hard-pressed to believe that this time will be economy is a third means by which the new global contagion an exception. The same verdict comes through loud and clear is conveyed. Joe Quinlan, our resident expert on transin our own internal estimates of global trade. We now reckon national flows of multinational corporations, has long stressed that world trade growth will slow to just 4.3% in 2001, onethat the trade statistics on exports and imports seriously under- third the 12.8% growth pace of 2000. That would represent state the full extent of commercial linkages that bind the the sharpest year-to-year slowdown in global trade on record. world’s economies together. Of far greater importance in The case for US export resilience in such a climate is a stretch, driving cross-border linkages are the combined balance-sheet to say the least. impacts of foreign direct investment and foreign affiliate sales and transfers of multinational corporations. This is particular- All this suggests that there could still be several shoes yet ly the case in Europe, which accounts for 75% of all earnings to fall in the US economy. The American consumer is high of US-based affiliates of multinational corporations. Signifi- on everyone’s watch list, but, in my opinion, exports aren’t too cantly, sales of Europe’s US-based affiliates were running at far behind. With exports accounting for about 11% of the US nearly four times the pace of US imports from Europe in 1998 economy, our forecast of 7% export growth in 2002 accounts (latest data available). For that reason, alone, Europe’s direct for nearly 20% of the 4% growth in overall GDP we are estiexposure to the US through cross-border trade — with Euro- mating over the four quarters of next year. That means every land exports to the US accounting for only 2% of the region’s five-percentage-point shortfall in export growth — not an unGDP — misses the true vulnerability of the region to a US-led reasonable assessment of the downside risks to our own foredownturn (also see comment by Charles de Boissezon). The cast, in my view — would translate into a 0.5 percentage point American downshift is hitting the US subsidiaries of European haircut on overall GDP growth. Of course, any such shortfall multinationals especially hard. That, in turn, puts pressure on would then trigger a new round of global repercussions the parent to cut costs in order to shore up global earnings. through America’s offshore supply chain, further exacerbating Add to that the 15% share of Euroland GDP that goes to exthe downshift in the world economy through yet another wave ports — greater than shares in either the US or Japan — and of cross-border contagion. it’s not terribly difficult to fathom why the European economy There can be little doubt of America’s outsized role in is now slowing noticeably. sparking the current global downshift. The very fabric of The US response to global weakening is another manifesta- globalization is woven with the threads of increased worldtrade linkages, newly globalized supply chains, and the growtion of the new strain of contagion bearing down on the global economy. With the growth dynamic in the rest of the ing scope of multinational corporations. In an upcycle, such world slipping ominously toward recession, risks are building connectivity is the stuff of virtuous circles. In a downcycle, of unexpected weakness on the US-export front — driven not the circle quickly turns vicious. Courtesy of the new contajust by slippage in the external growth climate but also by the gion of globalization, these shifts are now coming faster and lagged impacts of the prolonged strengthening in the US dol- with greater force than ever before. lar. We are currently looking for US exports to rebound by 7% over the four quarters of 2002. In light of the rapidly dete- On the heels of the US growth crunch, the world has gone from boom to bust in less than a year. Sure, the authorities are riorating global climate, I believe that the risks are tipping trying to kick-start the US and the broader global economy. decidedly to the downside of this forecast. But just as virtuous circles tend to last longer than we think, In past recessions, the peak cyclical decline in real US exports the same could be true of the vicious circle. Such are the perwas in the 6–20% range. There were two exceptions in the ils of the new global contagion. Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. MORGAN STANLEY DEAN WITTER Global Investment Research – July 2001 Please refer to important disclosures at the end of this report. Page 41 MORGAN STANLEY DEAN WITTER The Americas Europe Japan Asia/Pacific 1585 Broadway New York, NY 10036-8293 Tel: (1) 212 761-4000 25 Cabot Square, Canary Wharf London E14 4QA, England Tel: (44 20) 7513 8000 20-3, Ebisu 4-chome Shibuya-ku, Tokyo 150-6008, Japan Tel: (81) 3 5424 5000 Three Exchange Square Hong Kong Tel: (852) 2848 5200 4th Floor Forbes Building Charanjit Rai Marg Fort Mumbai 400 001, India Tel: (91 22) 209 6600 BCE Place, 181 Bay Street, Suite 3700 Toronto, Ontario M5J 2T3, Canada Tel: (1) 416 943-8400 Morgan Stanley Dean Witter SV SA Serreno, 55 Madrid 28006, Spain Tel: (34 91) 412 11 00 23 Church Street #16-01 Capital Square Singapore 049481 Tel: (65) 834 6888 The Chifley Tower, Level 33 2 Chifley Square Sydney NSW 2000, Australia Tel: (61 2) 9770 1111 ____________________________________________________ The information and opinions in this report were prepared by Morgan Stanley & Co. Incorporated (“Morgan Stanley”). Morgan Stanley does not undertake to advise you of changes in its opinion or information. Morgan Stanley and others associated with it may make markets or specialize in, have positions in and effect transactions in securities of companies mentioned and may also perform or seek to perform investment banking services for those companies. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. Morgan Stanley & Co. Incorporated, Morgan Stanley DW Inc. and/or their affiliates or their employees have or may have a long or short position or holding in the securities, options on securities, or other related investments of issuers mentioned herein. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors as they believe necessary. Where an investment is denominated in a currency other than the investor’s currency, changes in rates of exchange may have an adverse effect on the value, price of, or income derived from the investment. Past performance is not necessarily a guide to future performance. Income from investments may fluctuate. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. To our readers in the United Kingdom: This publication has been issued by Morgan Stanley and approved by Morgan Stanley & Co. International Limited, regulated by the Securities and Futures Authority Limited. Morgan Stanley & Co. International Limited and/or its affiliates may be providing or may have provided significant advice or investment services, including investment banking services, for any company mentioned in this report. Private investors should obtain the advice of their Morgan Stanley & Co. International Limited representative about the investments concerned. This publication is disseminated in Japan by Morgan Stanley Dean Witter Japan Limited and in Singapore by Morgan Stanley Dean Witter Asia (Singapore) Pte. To our readers in the United States: While Morgan Stanley has prepared this report, Morgan Stanley & Co. Incorporated and Morgan Stanley DW Inc. are distributing the report in the US and accept responsibility for it contents. Any person receiving this report and wishing to effect transactions in any security discussed herein should do so only with a representative of Morgan Stanley & Co. Incorporated or Morgan Stanley DW Inc. To our readers in Spain: Morgan Stanley Dean Witter, SV, SA, a Morgan Stanley group company, supervised by the Spanish Securities Markets Commission (CNMV), hereby states that this document has been written and distributed in accordance with the rules of conduct applicable to financial research as established under Spanish regulations. To our readers in Australia: This publication has been issued by Morgan Stanley but is being distributed in Australia by Morgan Stanley Dean Witter Australia Limited A.B.N. 67 003 734 576, a licensed dealer, which accepts responsibility for its contents. Any person receiving this report and wishing to effect transactions in any security discussed in it may wish to do so with an authorized representative of Morgan Stanley Dean Witter Australia Limited. To our readers in Canada: This publication has been prepared by Morgan Stanley and is being made available in certain provinces of Canada by Morgan Stanley Canada Limited. Morgan Stanley Canada Limited has approved of, and has agreed to take responsibility for, the contents of this information in Canada. Morgan Stanley is a service mark of Morgan Stanley Dean Witter & Co. Additional information on recommended securities is available on request. This report may not be resold or redistributed without the prior written consent of Morgan Stanley Dean Witter & Co. © 2001 Morgan Stanley Dean Witter & Co.