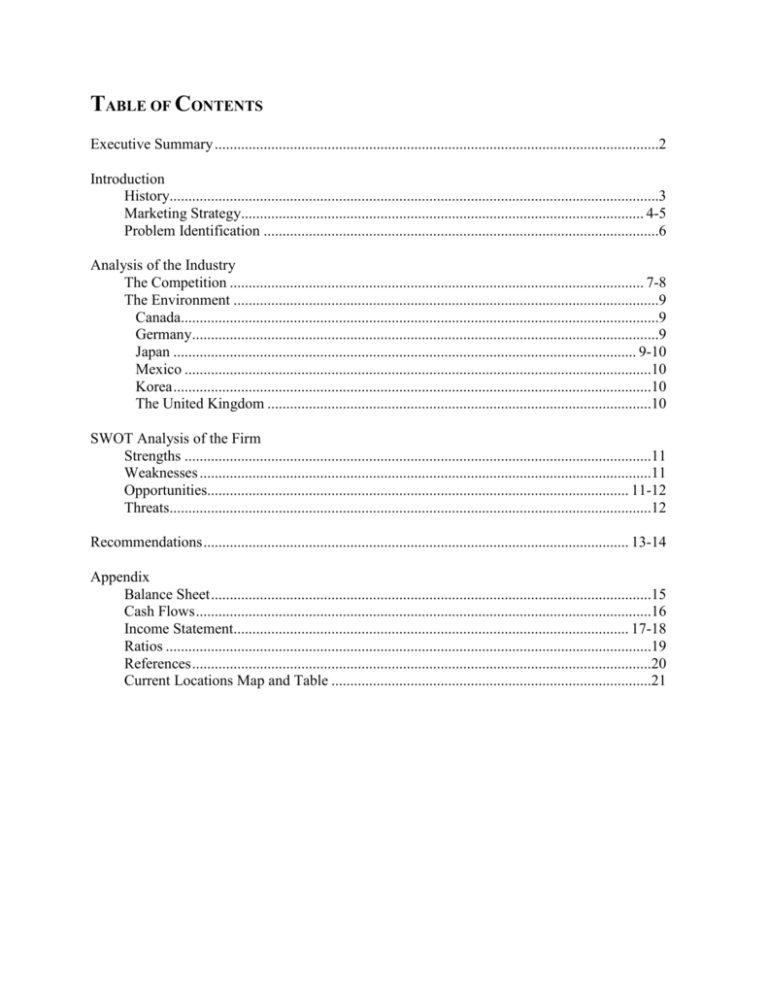

TABLE OF CONTENTS

Executive Summary ......................................................................................................................2

Introduction

History..................................................................................................................................3

Marketing Strategy........................................................................................................... 4-5

Problem Identification .........................................................................................................6

Analysis of the Industry

The Competition .............................................................................................................. 7-8

The Environment .................................................................................................................9

Canada...............................................................................................................................9

Germany............................................................................................................................9

Japan ........................................................................................................................... 9-10

Mexico ............................................................................................................................10

Korea ...............................................................................................................................10

The United Kingdom ......................................................................................................10

SWOT Analysis of the Firm

Strengths ............................................................................................................................11

Weaknesses ........................................................................................................................11

Opportunities................................................................................................................ 11-12

Threats................................................................................................................................12

Recommendations ................................................................................................................. 13-14

Appendix

Balance Sheet .....................................................................................................................15

Cash Flows .........................................................................................................................16

Income Statement......................................................................................................... 17-18

Ratios .................................................................................................................................19

References ..........................................................................................................................20

Current Locations Map and Table .....................................................................................21

EXECUTIVE SUMMARY

Outback Steakhouse is faced with the issue of expanding into international markets

because of U.S. market saturation. To facilitate the decision-making process for expanding

overseas, certain guidelines for going global have been developed.

The first guideline for Outback is to adapt accordingly to their international target

markets. Each market will be different and must be treated as such. Outback must keep its own

identity, while adapting to the cultural trends of each country. To do this, Outback should

incorporate local management into its restaurants. The local management will be able to advise

Outback on traditions, taste preferences, and even local etiquette. Outback may even find it

necessary to change some dishes offered on their menu.

The second guideline mentions Outback’s locations in foreign markets. Instead of the

usual “B-locations with A-demographics,” Outback might have to locate in bigger, more

trafficked areas. In international markets, these are the areas that typically attract the most

tourism – an important aspect to Outback’s movement overseas. They are also areas that include

a higher concentration of people who are more progressive and who have higher incomes.

The third guideline for going global focuses on Outback’s suppliers. With their current

suppliers, Outback is likely to incur high costs in transportation of supplies overseas. This will,

in turn, cause Outback’s menu prices to rise. Instead of this, Outback should use its local

management teams to identify new suppliers. The local management will, once again, be able to

guide Outback in determining which suppliers are likely to carry on their quality standards.

Supplier can then be found in either the host country or surrounding countries and new long-term

relationships can be formed.

2

INTRODUCTION

History

In 1988, four business partners, each who had previous restaurant experience, opened

Outback Steakhouse in Tampa, FL. They wanted to create an eating establishment that provided

its customers outstanding food at an excellent price in a casual Australian atmosphere. At the

time, the four entrepreneurs saw a reduction of in-home red meat consumption due to price and

health factors, but consumers were still going out to restaurants for great steaks. Therefore, they

saw an opportunity to open a restaurant that provided quality steaks at an affordable price. The

Australian theme, fun atmosphere, and quality food has made Outback one of the greatest

restaurant successes in America, where the failure rate of other restaurants is 75%.

The success of Outback is measured by its sales and profits, but they are the results of

putting their People- customers, purveyors, neighbors, and partners- first. The heart of Outback

is their solid foundation on core beliefs, purpose, principals, and goals. In creating Outback, the

founders used its principals and beliefs as a guide to everything that the company does. Outback

believes that if they take care of their People, then the institution of Outback will take care of

itself. Five principals support their guide to success- hospitality, sharing, quality, fun, and

courage. These principals require that Outback deliver the following commitments to its

Outbackers: clear direction, preparation, involvement, affecting one’s own destiny, a fair

hearing, sharing in the success of Outback, commitment, having a good time, and compassion.

Outback’s commitments to their principals and beliefs ensure that the institution will take care of

itself.

Now that Outback has almost reached market saturation in the United States, they plan to

develop new dining themes and expand into the international market. Some of the new dining

themes that the company has created are Carrabba’s Italian Grills, Flemming’s Prime Steakhouse

and Wine Grill, Roy’s, Zazarac, Lee Roy Selmon’s, and Bonefish Grills. Now their

concentration is on growing their international presence. In doing this, it is very important for

the company not to jeopardize their principals and beliefs. Therefore, how should Outback

expand into the international markets while holding true their principals and beliefs?

3

Marketing Strategy

Outback’s commitments to concentrated service and serious food are the main driving

forces of their marketing strategy. Their strategy centers on the basic concept of providing a

quality product, excellent service, and generous portions at moderate prices in an atmosphere

that suggests the Australian Outback. Outback has positioned itself between expensive and

bargain steakhouses, thus increasing their target market. They seek to capture a target market

whose consumers prefer quality food in a fun atmosphere, but do not wish to pay the high prices

like those at expensive steakhouses. Since Outback does not heavily rely on advertising, they

market the company through PR events, such as sponsorships.

Since quality is one of the most important aspect of Outback, they buy only the best

ingredients and the best supplies. Forty percent of Outback’s total costs are attributed to their

high quality food. Although this is higher than the industry’s average, they feel that the best

competitive advantage to have in the restaurant industry is having the highest quality food. Their

commitment to serious food is also the number one reason why Outback opens up at 5:00 PM.

This allows time for a prep crew to come in during the morning and prepare everything fresh for

the evening. Everything from the salad dressings to the croutons are made fresh daily. The only

thing in the restaurant that is precooked are the ribs, which are prepared during the day. Right

before the restaurant opens, the manager performs a line check to ensure that all the food tastes

perfect. The manager also checks every plate of food before it goes out to the customer to ensure

that everything looks perfect.

The target market is also very important to Outback. Their primary market consists of

people who are between the ages of 20 to 40 who enjoy a fun atmosphere, quality food, full

flavor, concentrated service, and is often considered middle-class. Since they are very concerned

about their customers, they try to cater to their needs in order to attract them to the restaurant.

One way they do this is by their “No Rules, Just Right” motto. This means that any changes or

additions that a customer wants to any entrée are no problem. This also includes preparing

dishes that are not even on the menu.

Outback’s location is also important to their success. They try to avoid the high-traffic

lunch areas, and instead locate their restaurants in areas that are more suited for the dinner and

night crowds. The company describes its locations as being “B-locations with A-demographics”.

They also like to be one of the first restaurants in a growing and upcoming city so that in the

future they are considered to be well established and a community favorite.

In the past, Outback had not relied much on advertising, but instead they relied mostly on

word of mouth. As the company grew and developed, national ad campaigns were initiated that

focused on television commercials and billboards. Outback avoids coupons and print ads, and

these are usually only offered as part of a package being offered by a charity or sports event. In

fact, Outback is very focused on community involvement and charity events. Each restaurant is

involved in community participation and service. The corporate office is also involved in nonprofit activities such as the Outback Bowl. However, they are most involved with charity events.

Every time a new restaurant is opened in a community, they choose a charity in which all of the

first night’s profits are donated towards. Outback is constantly looking for community charities

and events to provide food for and to help raise money. People want to be associated with and

feel like a part of a restaurant and this is one way Outback advertises itself. The main reason

they do this is to give back to the community and show the community that they are concerned

about its well-being.

4

In order to achieve a fun and laid-back atmosphere, the founders chose an Australian

theme to set Outback apart from others. The Australian theme is part of everything - from the

décor on the walls and the color of the ceiling to the uniforms that the Outbackers wear. Instead

of calling their workers employees, they call them “Outbackers”, which creates a sense of pride

in the workforce. The Outbackers are valued and given more benefits than most of the

competitors in the industry, which enables the restaurants to have the best employees and the

best service. The Outbackers are important to the restaurant because they connect the restaurant

to the customers. In order to give the best possible service, the servers are limited to a threetable section. This allows for concentrated service, which also helps to distinct Outback from the

rest of its competitors.

5

Problem Identification

Given the fact that Outback Steakhouse Inc. is nearing market saturation, but wish to

continue their sales and revenue growth, the decision must be made as to if and how they should

expand internationally. Management believes that Outback can accommodate 550-600

steakhouses, but by growing at a rate of about 70 stores annually, U.S. market will hit saturation

within 4-5 years. Therefore, Outback must consider expanding worldwide like other U.S.

restaurants, and capitalizing on foreign markets. It is evident that given the company’s past

financial position, they must seek other markets to continue their growth. Graph 1 shows how

the company’s revenue continues to grow as they add more restaurants to the company. The

company has already explored opening new restaurant concepts within the U.S, but an

international expansion gives an even greater opportunity for the company to grow. This report

seeks to identify guidelines for Outback to use when considering each foreign market.

Graph 1

3,000

2,500

Sales are in

Millions.

2,000

Sales

# of Restaurants

1,500

1,000

500

0

1994 1995 1996 1997 1998 1999 2000 2001

Table 1

Years

Sales

Restaurants

1994

$577,000

224

1995

$827,000

320

1996

$1,077,000

421

1997

$1,368,000

519

1998

$1,668,000

604

1999

$1,992,000

686

2000

$2,329,000

756

2001

$2,621,000

870

6

ANALYSIS OF THE INDUSTRY

The Competition

In a broad sense, Outback is classified as a casual dining restaurant and is compared to

others such as Red Lobster, Olive Garden, and Macaroni Grill, just to name a few. However,

Outback’s true competitors are those who have a mid-price range and who serve the same types

of foods. These competitors include Applebee’s, Chili’s, TGI Friday’s, Bennigan’s, Hooters,

Ruby Tuesday, and other local steakhouses. If you consider the fact that Outback makes every

food item from scratch, the restaurant has no competitors. It is also the only restaurant that

focuses on such extreme service. In food quality and service, they have no competitors. Table 2

reports the top 10 casual dining restaurants in 2002:

Table 2

Ranking

1

2

3

4

5

6

7

8

9

10

Restaurant

Applebee’s

Red Lobster

Outback

Chili’s

Olive Garden

TGI Friday’s

Ruby Tuesdays

Bennigans

Macaroni Grill

Hooters

Applebee’s was founded in Atlanta, Georgia by Bill and T.J. Palmer. The Palmers

envisioned a restaurant that would provide full service, consistently good food, reasonable prices

and quality service in a neighborhood setting. In 1998, Applebee’s became the first casual dining

concept with 1,000 restaurants. Today, with more than 1,500 restaurants, Applebee’s is the

world’s largest casual dining concept. For each of the past 10 years (1993-2002), Applebee’s has

opened more than 100 new restaurants. The company estimates the development potential of the

Applebee’s concept in the United States to be at least 2,300 restaurants.

In 1968, the original Red Lobster was introduced to America in Lakeland, Florida.

Company founder Bill Darden had a vision that great service was fundamental to success. By the

late 1970s and early 1980s, Red Lobster had 350 restaurants. In 1995, Red Lobster (along with

the Olive Garden and, later, Bahama Breeze) was integrated into Darden Restaurants. The menu

changed and became broader and more upscale. To maintain their leadership position in a

changing environment, they paired their menu with a new, attractive atmosphere. Their

architecture took on the new life that people see today.

Brinker International is one of the largest restaurant corporations. They operate Chili’s,

Macaroni Grill, On The Border, Maggiano’s, and Cozymel’s. Founded in 1975, the company has

grown to over 1,200 restaurants worldwide with 90,000 employees and system-wide sales

exceeding $3 billion annually. The culture is driven by integrity, teamwork, passion, and a

7

commitment to make sure each guest has an enjoyable dining experience when they visit one of

the restaurants. Brinker International's mission is to be the very best in the business.

T.G.I. Friday’s is credited as being the first American casual dining chain and has

been a favorite pastime for millions of guests since 1965. It has become a leader in the

industry by creating a unique atmosphere with great food and beverage presentation as

well. T.G.I. Friday’s has popularized many items, including potato skins and frozen

drinks. Friday’s offers a wide selection of appetizers, entrees salads, pasta dishes and

innovative entrees in an attempt to stay on top of trends. Realizing that an important part

of a restaurant appeal is its atmosphere, T.G.I. Friday’s offers a comfortable, relaxing

environment.

Exhibit 1 displays the number of stores that some of the various restaurants have.

Restaurant

Outback

Applebee’s

Darden Restaurants1

Brinker International2

TGI Friday’s

Hooters

Domestic Stores

689

819

1,211

1,268

682

300

International Stores

50

9

US & Canada only

90

37

12

Exhibit 2 displays the number of countries in which the restaurants have stores in for 2000.

Restaurant

TGI Friday’s

Chili’s

Outback

Applebee’s

Red Lobster

Number of Countries

53

20

13

10

0

Exhibit 3 displays the sales from various casual dining restaurants in 2001.

Restaurant

Darden Restaurants1

Brinker International2

Outback Steakhouse Incorporated3

Applebee’s

1

Sales in 2001

$4,368,701

$3,040,377

$2,621,000

$744,344

Darden Restaurants includes all restaurants owned by the company including Red Lobster, Olive Garden, and

2

Bahama Breeze. Brinker International includes Chili’s, Macaroni Grill, On The Border, Maggiano’s, and

3

Cozymel’s. Outback Steakhouse Incorporated includes all restaurants owned by OSI, including Carrabba’s Italian

Grill, Fleming’s Prime Steakhouse and Wine Bar, Roy’s, Zazarac, Lee Roy Selmon’s, and Bonefish Grills.

8

The Environment*

Even though Outback’s consideration is for a venture abroad, it is important that the

environment of the U.S. is looked at as well. A strong domestic foundation is necessary for the

success of an international expansion. For the past two years, the US has been experiencing a

recession, resulting in more unemployment. Because of this unemployment, rising gas prices,

and the threat of war, the U.S. population is more reluctant to spend money. As people start to

cut back on their spending, dining out could be one of the first things taken out of their budgets especially dining out at a restaurant with prices like those of Outback. The threat of war has a

great impact on the economy of the United States and creates a large amount of economic

uncertainty. It is hard to know when, if at all, this economic downturn will change its direction.

Many countries abroad may develop a negative perception of the U.S. if it decides to go to war

with Iraq. As a result, a large part of the international market might not be supportive of a

restaurant based out of the United States.

Canada

Canada serves as a somewhat hopeful prospective location for Outback. In the past, U.S.

goods and services have been well received in their stable market. It is important to note,

however, that there are significant cultural and language differences between the US and Canada,

as well as between certain regions of Canada itself. Conflict often arises between the Englishspeaking and French-speaking areas and has even gone as far as possibly separating Canada into

two separate countries. This threat has made foreign investors hesitant to move into the country

in the past.

Germany

A unique feature of Germany is the unusually even distribution of industry and

population. This can serve as a challenge to a firm because there is not much opportunity for

regional concentration around a heavily populated area. On a positive note, Germans do

appreciate high quality food products, such as those of Outback, and will reject less expensive

items if they do not possess a sufficient amount of quality. Consequently, Germans also have the

philosophy that German products are “simply the best”, which might make them reluctant to

even try an American-based restaurant.

Japan

It has been well known that Japan’s market is not as open as the United States’. While

the US government has made efforts to help U.S. business people “open doors”, most of the

responsibility has remained in the hands of the individual firm. Entering the Japanese market is

expensive and generally requires four things: financial and management capabilities and a

Japanese-speaking staff within the country, modification of products to suit Japanese consumers,

a long term approach to maximizing market share and achieving reasonable profit levels, and

careful monitoring of Japanese demand, distribution, competitors, and government. Even though

all of these challenges to market entry exist, Japan has ranked as the second largest importer of

U.S. goods and services in the past. Japanese consumers have previously been characterized as

conservative and brand conscious but have recently become more individualistic. This is largely

due to the 18 to 21 year olds who have a large amount of disposable income. Japanese

consumers are willing to pay high prices for quality goods, but their standards of quality are very

high. U.S. firms whose products and services possess this level of quality, along with a

competitive edge, must still be willing to take on the high cost of initial market entry. For those

9

that are willing to pay the price, Japan can offer a respectable market share and promising profit

levels.

Mexico

Mexico has experienced some economic struggle due to a large devaluation of the peso.

Despite the government’s efforts to stabilize the peso, the country has been experiencing a

serious recession, seeing inflation as high as 50%. With U.S. financial assistance, Mexico has

been restoring stability to its financial markets. Although the PRI party was in power for 60

years, Mexico is slowly evolving into a multi-party democracy. Even though Mexico has not

had a great amount of economic success over the years, it has remained the third largest trading

partner of the United States.

Korea

Although the Korean War left South Korea in ruins, the country has experienced

tremendous growth and has been identified by the U.S. Department of Commerce as a “Big

Emerging Market”, led by export development and entrepreneurship. Over the years, North

Korea has often been seen in the media as a politically disrupt country through stories of student

demonstrations, nuclear problems, and trade disputes. However, the political environment of

South Korea has been stable enough over the last few years to support a great amount of

economic expansion. South Korea is a “modern, cosmopolitan, fast-paced, and dynamic

country” that has a vast amount of opportunities for American businesses. Even though South

Korea has ranked as high as the United States’ sixth largest export market, US firms still face

obstacles when entering its market, such as customs clearance procedures and regulations for

labeling, sanitary standards, and quarantine.

United Kingdom

Common language, legal heritage, and business practices have built a strong business

relationship between the United Kingdom and the United States. The UK has been the U.S.’s

fourth largest trading partner and the largest market for U.S. exports in Europe. The UK has

recently become more efficient by making changes to their taxation, regulation, and privatization

policies. The country also possesses a high degree of labor flexibility. Thanks to a shared

cultural heritage and a warm relationship with the U.S., the United Kingdom sees U.S. goods and

services as attractive purchases. British policy emphasizes free enterprise and open competition,

making the UK the target of 40% of all U.S. investments in the European Union. Due to their

successful relationship, the United Kingdom now serves the United States as a gateway to the

rest of Europe. The close relationship between the U.S. and UK is expected to continue with the

help of excellent physical and communications infrastructure and a friendly business and

political environment.

*The environment mentioned in our report is current as of 2003. The analysis of each individual

country is current as of the publication of our reference (see Appendix: References: Country

Summaries).

10

SWOT ANALYSIS OF THE FIRM

Internal Strengths

Outback Steakhouse possesses many internal strengths. In 1994 and early 1995, it was

regarded as one of the biggest success stories in corporate America and was the fastest growing

U.S. steakhouse chain. Outback’s restaurants generate $2.10 for every $1 invested in the facility

- an amount is well over the $1.20 to $1 that is considered strong for the industry. One of their

many strengths lies in their connection to their suppliers. The company views their suppliers as

“partners” in their success and is committed to working with their suppliers to develop and

maintain long-term relationships. As a result, Outback has never changed suppliers. Outback is

committed to purchasing only the highest quality ingredients and supplies for its restaurants.

Outback also has a phenomenal relationship with its employees. The company uses

aptitude tests, psychological profiles, and interviews as part of its employee selection process

and requires every applicant to interview with two managers. Its wait staff enjoys higher income

from tips than in restaurants that serve lunch and dinner, thanks to its dinner-only concept. This

concept has also led to effective utilization of systems, staff, and management. Additionally,

their wait staff also reports feeling less worn out than other restaurant employees because each

waiter or waitress handles no more than three tables at a time. This allows their employees to

offer customers more individualized attention and provides for better tip opportunities.

Restaurant management staff works only 50-55 hours per week, compared to the average of 70

hours found in the industry. Store managers also earn an annual salary and bonus of over

$100,000, compared to an industry average of about $60,000-$70,000. What’s more, Outback’s

management turnover is only 5.4 percent as opposed to the industry average of 30-40 percent.

Internal Weaknesses

Outback’s biggest internal weakness is its food costs, which make up about 40% of its

total costs. Because of the company’s dedication to providing the highest quality ingredients, it

does maintain one of the highest food costs of the industry. Along with this, Outback limits

itself to only a few suppliers in order to maintain long-term relationships. These relationships

may prove to be too costly once Outback expands into the international market. The costs of

using their current suppliers internationally could then raise the food prices of their international

locations and limit the size of the market that can afford their food.

External Opportunities

Several opportunities are available to Outback as they consider going abroad. So far,

several other U.S. restaurants have found success overseas with substantial sources of revenue.

Some of this success is contributed to the popularity of U.S. food themes abroad and the driving

force of universal cultural trends, rising incomes, improved international transportation and

communication, rising educational levels, increased numbers of women entering the work force,

demographic concentrations of people in urban areas, and the willingness of younger generations

to try new products. Also, franchised restaurants generally performed better than freestanding

units overseas. Finally, the GATS, or General Agreement on Trade in Services, was designed to

liberalize trade in services. GATS seeks to “reduce or eliminate governmental measures that

11

prevent services from being freely provided across national borders or that discriminate against

firms with foreign ownership.”

External Threats

Outback must also consider the threats of entering an international market. For example,

while several U.S. restaurant chains have moved into the foreign market, casual dining operators

are slower about entering these markets than fast-food operators. Franchising abroad is also an

issue with two sides to it. While franchiser-franchisee relationships often bring in favorable

sales and profits, these relationships are also often difficult to maintain. International franchisers

frequently encounter problems finding supplies in sufficient quantity, of consistent quality, and

at stable prices compared to those in domestic markets. Related to this, there is the issue of

infrastructure. A weak infrastructure in international markets may cause problems in

transportation, communication, or even utilities such as electricity. This can then complicate the

process of sourcing supplies, overseeing operations, or providing quality management services to

franchisees. Additionally, there are the issues related to restrictive trade policies. While GATS

has made a positive step in this direction, not all countries openly accept it. Many countries have

not even made their feelings about franchises publicly known. Finally, Outback must take each

country’s market into account. Religion, age distribution, and educational level – including

literacy rates – influence the location, operations, and menu of restaurants in foreign countries.

12

RECOMMENDATIONS – GUIDELINES FOR GOING GLOBAL

1.

When going global, it is important that Outback determine its international target market,

whether it will be travelers or locals. Regardless of the market, Outback must examine the

foreign market that it plans to enter and adapt to its culture in a number of ways. Failure to adapt

to each market could lead to the failure of their restaurants overseas.

With the help of a local management team, the transition from America to a location

abroad should not be too difficult to handle. The company must examine the tastes of each

potential country and customize the menu to fit the needs and tastes of that market. In addition,

Outback should become familiar with cultural expressions, values, and common behaviors that

characterize the market that it is going to enter. Then, management will be able to train the

employees of that restaurant accordingly, making sure that customers are treated in a way to

which they are accustomed. While it is important that Outback molds its locations abroad to fit

the appropriate cultures, it is also important that the Australian theme and American feel are

maintained.

2.

Outback should locate in larger cities where there is a bigger market of travelers, higher

income levels, and areas that are fairly Americanized. In order for Outback to be able to survive,

they must be able to tap into a target market as suggested before. This target market will most

likely be located in the urban markets where there is more diversity and technology. This

recommendation will not follow the usual Outback strategy of “B-locations with Ademographics” because their usual strategy might limit their target market overseas.

Outback’s target market in the United States is the consumer who wants a great dinner

with good food at a quality price. However, the availability of food differs in other countries as

well as the tolerance for new food choices. Larger cities will have more people who have

different tastes and preferences. Outback would be offering products totally different than the

tradition in many foreign countries and the consumers in larger cities will be more progressive

and receptive to new concepts. Also, the larger urban areas will have more business and industry

as compared to the more agricultural and blue-collar nature of rural areas. The people with

higher incomes will be better able to afford Outback’s menu, which might be unaffordable to

people in other countries as compared with our own. One last important aspect of locating in

urban areas is that the restaurant would have more available suppliers and be closer to

transportation and communication channels.

In choosing locations in other countries, Outback should also consider the actual

placement of their restaurants in the cities. Outback needs to locate near business districts and

tourist areas. This is where there will be many travelers who are accustomed to Outback and will

feel comfortable with the quality and familiarity. Business people and tourists would also fit into

the international target market. Many countries are very receptive to American concepts and

Outback would be able to capitalize on this opportunity.

13

3.

The pricing of the menu will be a major concern because the incomes are not as high

overseas as they are in the United States. For instance, in China, McDonald’s is considered a

luxury to many people, and Outback is considerably higher priced than McDonald’s. If Outback

does not change its menu prices and supply options, it might limit its customer base. Supplies

will be more expensive if they continue to use their current suppliers so Outback will need to

find alternative supply options. This recommendation is important because Outback will have to

find a way to keep their food costs from getting out of hand in international locations. On the

other hand, this recommendation may not be consistent with the company’s current philosophy

since Outback has such a close relationship with its current suppliers. Despite this, it is still

something that will have to have careful consideration. Outback will severely limit themselves

by only using their current suppliers and incur high costs in the process.

Outback should resolve this issue with the help of local management. The management

should be able to guide Outback and give recommendations as to the best suppliers in the

country or surrounding countries. This will cut down on shipping costs and allow Outback to

form personal relationships with those who are best suited to meet their needs in each

international market. Local management can also inform Outback of each country’s quality

standards. Standards vary from country to country and are very important in the food industry.

With help, Outback will be able to become updated on the standards of each country and choose

suppliers that help them deliver quality food. By taking all of this into consideration, Outback

will be able to provide quality food at the lowest possible cost to its public and create additional

long-term relationships.

14

APPENDIX

Selected Financial Statements

Balance Sheet: *all values in millions unless otherwise specified*

Assets

FY End

12/01

FY End

12/00

FY End

12/99

FY End

12/98

Current Assets

Cash & Equivalents

$136

$132

$93

$84

Accounts Receivable

$11

$11

$12

$9

Inventories

$39

$28

$26

$20

$206

$182

$143

$123

$1,100

$925

$786

$672

$94

$0

$0

$0

$1,238

$1,023

$852

$719

Total Current Assets

Gross Fixed Assets (PP&E)

Intangibles

Total Assets

Liabilities & Stockholders’ Equity

FY End

12/01

FY End

12/00

FY End

12/99

FY End

12/98

Liabilities

Accounts Payable

$47

$37

$34

$38

Short-Term Debt

$13

$5

$2

$2

$130

$126

$95

$78

$190

$168

$131

$118

$14

$12

$2

$39

$296

$215

$159

$170

Preferred Stock Equity

$0

$0

$0

$0

Common Stock Equity

$942

$808

$693

$548

$942

$808

$693

$548

$1,238

$1,023

$852

$719

Other Current Liabilities

Total Current Liabilities

Long-Term Debt

Total Liabilities

Stockholders’ Equity

Total Stockholders’ Equity

Total Liabilities & Stockholders’ Equity

Cash Flows: *all values in millions unless otherwise specified*

15

Cash Flow from Operating Activities

FY End

12/01

FY End

12/00

FY End

12/99

FY End

12/98

Net Cash from Continuing Operations

$229

$240

$192

$187

Net Cash from Operating Activities

$229

$240

$192

$187

Cash Flow from Investment Activities

FY End

12/01

Net Cash used for Investments

($234)

FY End

12/00

($146)

FY End

12/99

($127)

FY End

12/98

($109)

Cash Flow from Financing Activities

FY End

12/01

Net Cash from (used for) Financing Activities

FY End

12/00

FY End

12/99

FY End

12/98

($11)

($55)

($56)

($34)

Net Change in Cash & Equivalents

($16)

$39

$9

$44

Cash & Equivalents at Beginning of Period

$132

$93

$84

$40

Cash & Equivalents at End of Period

$116

$132

$93

$84

16

Income Statement: *all values in millions, except per share items*

Income Statement Summary

FY End

12/01

Revenue

FY End

12/00

FY End

12/99

FY End

12/98

$2,127

$1,906

$1,646

$1,403

$808

$715

$620

$544

$1,319

$1,191

$1,026

$859

$1,014

$882

$752

$638

$305

$308

$273

$220

Depreciation & Amortization

$69

$58

$51

$41

Operating Income after D & A

$236

$250

$223

$180

Other Income (net)

($33)

($36)

($33)

($24)

$2

$4

$1

($1)

Pre-Tax Income (EBT)

$206

$219

$191

$155

Net Income from Continuing Operations

$133

$141

$124

$101

Net Income from Discontinued Operations

N/A

N/A

N/A

N/A

Net Income from Total Operations

$133

$141

$124

$101

Normalized Income

$136

$141

$128

$101

Income from Extraordinary Gains/Losses

N/A

N/A

N/A

N/A

Total Net Income

$133

$141

$124

$96

Preferred Stock Dividends

N/A

N/A

N/A

N/A

Net Income available for Common Shareholders

$133

$141

$124

$96

$1.74

$1.82

$1.61

$1.27

N/A

N/A

N/A

N/A

Basic EPS from Total Operations

$1.74

$1.82

$1.61

$1.33

Basic EPS from Total Net Income

$1.74

$1.82

$1.61

$1.27

Basic Normalized Net Income/Share

$1.78

$1.82

$1.66

$1.33

Diluted EPS from Continuing Operations

$1.70

$1.78

$1.57

$1.24

N/A

N/A

N/A

N/A

Cost of Sales

Gross Profit

Operating Expenses

Selling, General & Administrative

Operating Profit Before Depreciation & Amortization

Interest Expense

Earnings per Share (in Dollars)

Basic EPS from Continuing Operations

Basic EPS from Discontinued Operations

Diluted EPS from Discontinued Operations

17

Diluted EPS from Total Operations

$1.70

$1.78

$1.57

$1.30

Diluted EPS from Total Net Income

$1.70

$1.78

$1.57

$1.24

Diluted Normalized Net Income/Share

$1.74

$1.78

$1.61

$1.30

Dividends Paid/Share

$0.00

$0.00

$0.00

$0.00

18

Ratios: All ratios based upon fiscal year end data, as indicated.

Ratios

FY End

12/01

Valuation

Price to Earnings

15.0

Price to Revenue

1.12

Price to Book

2.48

Price to Cash Flow

11.8

Book Value per Share

$12.25

Efficiency

Return on Equity

15.2%

Return on Invested Capital

14.0%

Return on Assets

11.8%

Asset Turnover

1.9

Receivable Turnover

194.1

Inventory Turnover

24.2

Profitability

Gross Profit Margin

61.7%

Net Profit Margin

6.3%

Liquidity

Current Ratio

1.1

Quick Ratio

0.8

Debt to Equity Ratio

0.03

Leverage Ratio

1.3

Comparison to Industry

Sales (Revenue)

3.2%

Earnings

178.8%

Price to Book Ratio

6.5%

References

History:

19

“Outback Steakhouse Overview.” Taken from http://www.corporateir.net/ireye/ir_site.zhtml?ticker=osi&script=100&layout=11. © 2002 Outback

Steakhouse.

Problem Identification:

Graph 1 & Table 1. Take from http://www.outback.com. Financial Documents.

The Competition:

“Applebee’s International Company History.” Taken from

http://ir.applebees.com/ireye/ir_site.zhtml?ticker=APPB&script=1800&layout=-7. ©

2003 Applebee’s International, Inc.

“Red Lobster Seafood Restaurants – Our Company.” Taken from

http://www.redlobster.com/discover/our_company/index.asp. © Red Lobster.

“Diversity – Company Information – Brinker Family Restaurants.” Taken from

http://www.brinker.com/company/diversity.asp. © Brinker International. All rights

reserved.

“T.G.I. Fridays ® Worldwide.” Taken from http://www.tgifridays.com/News/fri_bg.htm. ©

2003 TGI Friday’s, Inc.

Table 2. “Top 10 Casual Dining Restaurants.” Taken from http://www.franchisinghelp.com.

Country Summaries:

Peter, J. Paul and Donnelly, James H. “Appendix B: Country Summaries.” Marketing

Management: Knowledge and Skills, 6th Edition. Pages 823-826. © 2001 by The

McGraw-Hill Companies, Inc. All rights reserved.

Financial Statements and Ratios:

Balance Sheet: http://www.corporateir.net/ireye/ir_site.zhtml?ticker=osi&script=950&layout=11&item_id='ps=1*pg=4'

Cash Flows: http://www.corporateir.net/ireye/ir_site.zhtml?ticker=osi&script=950&layout=11&item_id='ps=1*pg=6'

Income Statement: http://www.corporateir.net/ireye/ir_site.zhtml?ticker=osi&script=950&layout=11&item_id='ps=1*pg=8'

Ratios: http://www.corporateir.net/ireye/ir_site.zhtml?ticker=osi&script=950&layout=11&item_id='ps=1*pg=3'

20

Current International Locations Map

Taken from http://www.outback.com/locator/

Current International Locations

Country

Number of

Restaurants

21

19

8

6

6

6

4

3

3

3

2

1

1

1

1

1

1

1

1

Korea

Canada

Brazil

Hawaii

The Caribbean

Japan

Mexico

Philippines

Hong Kong

United Kingdom

China

Venezuela

Thailand

Singapore

Malaysia

Indonesia

Australia

Guam

Costa Rica

21