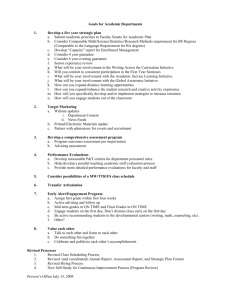

financial management and accounting procedures

advertisement