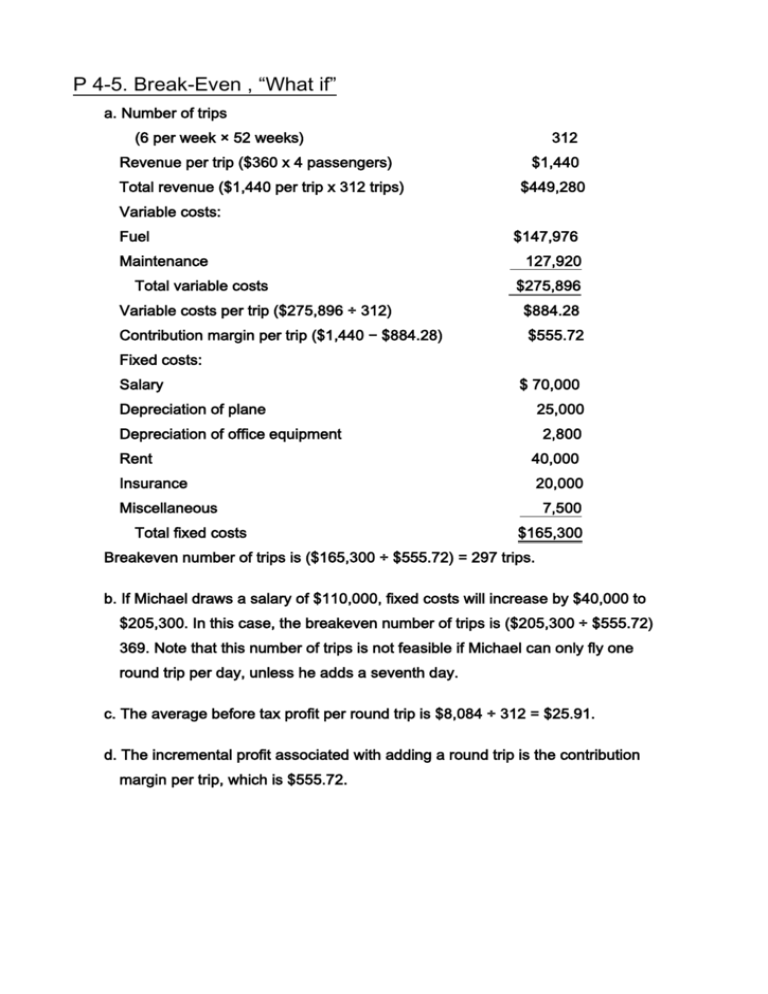

P 4-5. Break-Even , “What if” a. Number of trips (6 per week × 52

advertisement

P 4-5. Break-Even , “What if” a. Number of trips (6 per week × 52 weeks) Revenue per trip ($360 x 4 passengers) Total revenue ($1,440 per trip x 312 trips) 312 $1,440 $449,280 Variable costs: Fuel Maintenance Total variable costs $147,976 127,920 $275,896 Variable costs per trip ($275,896 ÷ 312) $884.28 Contribution margin per trip ($1,440 − $884.28) $555.72 Fixed costs: Salary $ 70,000 Depreciation of plane 25,000 Depreciation of office equipment 2,800 Rent 40,000 Insurance 20,000 Miscellaneous Total fixed costs 7,500 $165,300 Breakeven number of trips is ($165,300 ÷ $555.72) = 297 trips. b. If Michael draws a salary of $110,000, fixed costs will increase by $40,000 to $205,300. In this case, the breakeven number of trips is ($205,300 ÷ $555.72) 369. Note that this number of trips is not feasible if Michael can only fly one round trip per day, unless he adds a seventh day. c. The average before tax profit per round trip is $8,084 ÷ 312 = $25.91. d. The incremental profit associated with adding a round trip is the contribution margin per trip, which is $555.72. P 4-11. Break-Even Analysis, Margin of Safety, Increase in Profit a. Total Sales ($1,200 x 1,500 apps) Per unit Percent $1,800,000 $1,200 100% Less variable expenses 1,100,000 $740 61.67% Contribution margin $690,000 $460 38.33% Less fixed expenses 300,000 Operating income $390,000 Breakeven point (in number of apps) = $300,000 / $460 = 652 units (rounded) Contribution margin ratio = $460 / $1,200 = 38.33% Breakeven point (in sales dollars) = $300,000 / 38.33% = $782,677 (rounded) b. Margin of safety in units = 1,500 – 652 = 848 units Margin of safety in dollars = $1,800,000 - $782,677 = $1,017,326 c. Target profit (in units) = ($300,000 + $450,000) / $460 = 1,630 units Target profit (in dollars) = ($300,000 + $450,000) / 38.33% = $1,956,692 (rounded) d. New income statement: Sales Less variable expenses Contribution margin Less fixed expenses Operating income $ Total Per unit Percent $2,124,000 $1,200 100% 1,309,800 $740 61.67% 814,200 $460 38.33% 380,000 $434,200 Yes, they should increase their advertising, since their operating income will rise to $434,200 from $390,000 in the original scenario. P 4-12. Multiproduct CVP a. Contribution margin Sales Audio Video Car $1,120,000 $ 460,000 $ 614,400 3,200,000 1,920,000 1,280,000 0.3500 0.2395 0.4800 Contribution margin ratio (CM ÷ sales) b. A $125,000 increase in Audio sales would increase profit by $43,750 while the effect for Video would be $29,938 and $60,000 for the Car product line. All else equal, it would be better to increase sales of Car products. c. The weighted average contribution margin ratio is $2,194,400 ÷ $6,400,000 = .342875 The break-even level of sales is: (Direct fixed + common fixed) ÷ contribution margin ratio = $4,360,190. ($785,000 + 710,000) ÷ .342875 = $4,360,190 d. Sales need to achieve a profit of $1,800,000 is ($1,800,000 + $785,000 + $710,000) ÷ .342875 = $9,609,916. e. Audio sales = ($3,200,000 ÷ 6,400,000) × $9,609,916 = $4,804,958 Video sales = ($1,920,000 ÷ 6,400,000) × $9,609,916 = $2,882,975 Car sales = ($1,280,000 ÷ 6,400,000) × $9,609,916 = $1,921,983