Mid-Term Exam # 1

advertisement

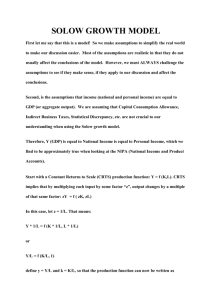

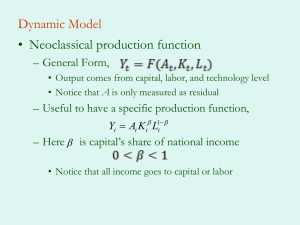

Please write your answers on this exam paper. Name____________________ Student ID____________________ Mid-Term Exam # 1 Economics 514 Macroeconomic Analysis Tuesday, October 18th , 2011 Write your answers on this white exam paper. Do not write your answers on the blue book! Do not hand in your blue book! 1. Substitution Effect and Capital 1 1 A. Price taking firms produce goods with the production function Yt Kt 3 Lt 3 , where Lt is labor and Kt is capital and sell their goods at price Pt, hire workers at wage Wt and capital at rental rate Rt. i. Write the first order conditions (FOCs) that determine the demand for capital and labor. FOC: K FOC: L 1 Please write your answers on this exam paper. ii. Assume that capital is always supplied elastically at the fixed relative R rental price of capital t .25 . Calculate the profit maximizing capital Pt labor ratio using the FOC for capital. Calculate the real wage rate W wt t at that capital labor ratio. Pt k _______________ w ________________ 2 Please write your answers on this exam paper. 2. Two Sector Total Factor Productivity Assume that production occurs with a Cobb-Douglas production function with α = .5. Assume a constant technology and labor level (i.e. gA = n = 0). To make things simple set Lt = At = 1 so labor productivity equals output Yt yt and the capital labor ratio equal capital: K t kt Yt Kt A. 1 2 Total factor productivity is a geometrically weighted average of labor productivity 1 Y 1 and capital productivity TFPt t yt 2 . Calculate total factor productivity in this Kt case. 2 Now assume output is made with two different capital stocks, i) equipment and ii) structures: K tQ and K tS each of which has the same depreciation rate, δ = .05. K Yt KtQ 1 4 S t 1 4 They are accumulated according to the standard equation KtQ1 (1 ) KtQ I tQ KtS1 (1 ) KtS I tS The investment rate for capital type Q is sQ =.25, ItQ sQYt while the investment rate of type B is sS, I tS sS Yt . 3 B. Equal investment case. First, assume sQ sS . i. Solve for the steady state productivity of capital of type A, Y Q APK SS Q K ii. SS Y and APK SSS S K SS . Define total capital as Kt KtS KtQ . Solve for the steady state SS Y productivity of total capital APK SS . Solve for steady state output. K 1 Y 1 Calculate steady state TFPt t yt 2 Kt 4 2 C. Different Investment Case Assume that investment in the housing sector is 4 enhanced to structures investment is relatively high sS 1.2 .25 .5184 Calculate steady state capital productivity, labor productivity, and total factor 4 productivity [Hint: 1.2 = 2.0736]. 5 Please write your answers on this exam paper. 3.Economic Growth and R & D In an economy, there is a fixed supply of labor (which we will normalize to 1), Lt = 1, so the growth rate of the labor supply is n = 0. The household can divide the labor supply between producing goods or to doing R & D. The amount of time spent on research is sr∙Lt = sr and the time spent on producing goods is equal to (1-sr) ∙ L = (1sr) . The amount of goods produced are given by a Cobb-Douglas production function where Kt is the capital stock and At is the technology produced. 1 1 1 1 Yt Kt 2 ( At (1 sr ) Lt ) 2 Kt 2 ( At (1 sr )) 2 Technological spillovers mean that the ability to produce new research is an increasing function of the technology level. The amount of new technology produced is given by At 1 At At sr Lt At sr The share of time spent in R & D is 2% (i.e. sr = .02). The accumulation of capital is done according to the function Kt 1 (1 ) Kt I t Assume that the depreciation rate of capital is 8% (i.e. δ = .08). Investment is a constant fraction of output It = s∙Yt. Assume that the investment rate, s = .2. A. What is the growth rate of technology? B. Calculate the growth rate of the capital-labor ratio and labor productivity when capital productivity is 2. C. Calculate the steady state capital productivity level. 6 4. Sobelo Model In an economy, the growth rate of the population is n= 0 and the population level is normalized to Lt = 1. The depreciation rate is .1. Assume that the investment rate, s = .2, It = s∙Yt. Technology is constant, At = 1. Capital is accumulated according to Kt 1 (1 ) Kt I t with a depreciation rate of = .07. Assume that the production function is given with a modified version of the Cobb-Douglass production function. 1 2 Yt Kt 3 Lt 3 .6Kt A. Show that the production function has constant returns to scale by writing down Y the productivity function. That is solve for yt t as a function of the capital Lt K labor ratio, kt t . Lt B. Calculate capital productivity and the growth rate of the capital-labor ratio when the level of the capital labor ratio is 1, 27, 125, 1000, and ∞. k Y K 1 27 125 1000 ∞ 7 gk Please write your answers on this exam paper. C. Explain in 6 sentences or less why capital can act as the long-term engine of growth in this model. D. E. sdsd 5. dsd ired by firms if labor was L*? 8