agency - Penn APALSA

advertisement

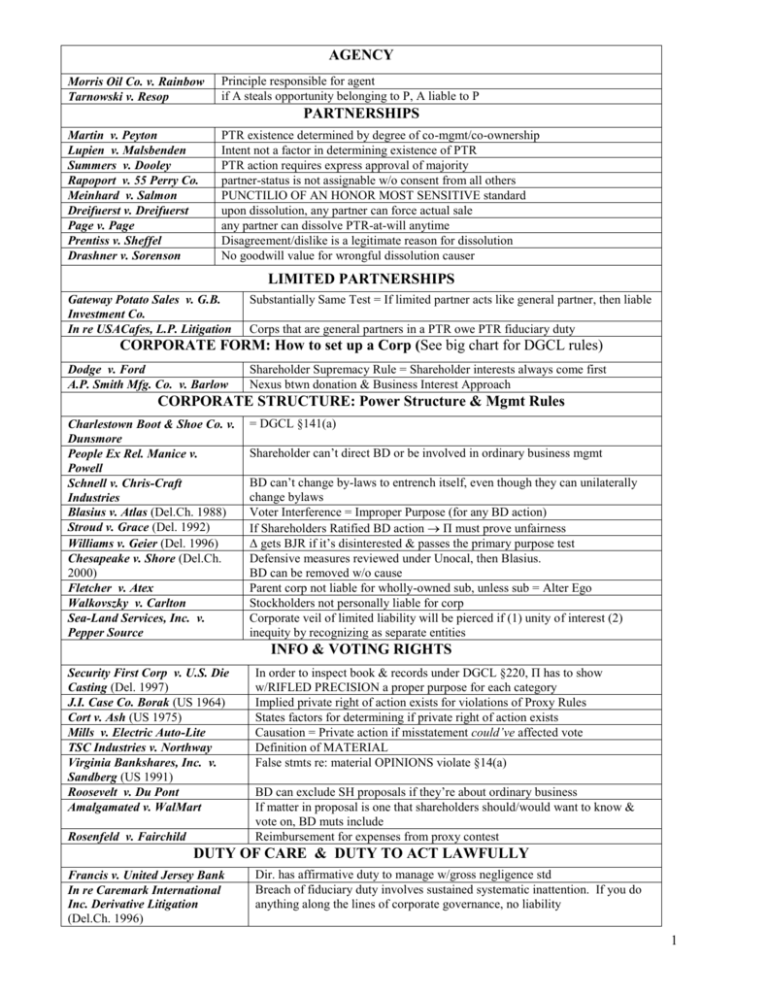

AGENCY Morris Oil Co. v. Rainbow Tarnowski v. Resop Principle responsible for agent if A steals opportunity belonging to P, A liable to P PARTNERSHIPS Martin v. Peyton Lupien v. Malsbenden Summers v. Dooley Rapoport v. 55 Perry Co. Meinhard v. Salmon Dreifuerst v. Dreifuerst Page v. Page Prentiss v. Sheffel Drashner v. Sorenson PTR existence determined by degree of co-mgmt/co-ownership Intent not a factor in determining existence of PTR PTR action requires express approval of majority partner-status is not assignable w/o consent from all others PUNCTILIO OF AN HONOR MOST SENSITIVE standard upon dissolution, any partner can force actual sale any partner can dissolve PTR-at-will anytime Disagreement/dislike is a legitimate reason for dissolution No goodwill value for wrongful dissolution causer LIMITED PARTNERSHIPS Gateway Potato Sales v. G.B. Investment Co. In re USACafes, L.P. Litigation Substantially Same Test = If limited partner acts like general partner, then liable Corps that are general partners in a PTR owe PTR fiduciary duty CORPORATE FORM: How to set up a Corp (See big chart for DGCL rules) Dodge v. Ford A.P. Smith Mfg. Co. v. Barlow Shareholder Supremacy Rule = Shareholder interests always come first Nexus btwn donation & Business Interest Approach CORPORATE STRUCTURE: Power Structure & Mgmt Rules Charlestown Boot & Shoe Co. v. Dunsmore People Ex Rel. Manice v. Powell Schnell v. Chris-Craft Industries Blasius v. Atlas (Del.Ch. 1988) Stroud v. Grace (Del. 1992) Williams v. Geier (Del. 1996) Chesapeake v. Shore (Del.Ch. 2000) Fletcher v. Atex Walkovszky v. Carlton Sea-Land Services, Inc. v. Pepper Source = DGCL §141(a) Shareholder can’t direct BD or be involved in ordinary business mgmt BD can’t change by-laws to entrench itself, even though they can unilaterally change bylaws Voter Interference = Improper Purpose (for any BD action) If Shareholders Ratified BD action Π must prove unfairness Δ gets BJR if it’s disinterested & passes the primary purpose test Defensive measures reviewed under Unocal, then Blasius. BD can be removed w/o cause Parent corp not liable for wholly-owned sub, unless sub = Alter Ego Stockholders not personally liable for corp Corporate veil of limited liability will be pierced if (1) unity of interest (2) inequity by recognizing as separate entities INFO & VOTING RIGHTS Security First Corp v. U.S. Die Casting (Del. 1997) J.I. Case Co. Borak (US 1964) Cort v. Ash (US 1975) Mills v. Electric Auto-Lite TSC Industries v. Northway Virginia Bankshares, Inc. v. Sandberg (US 1991) Roosevelt v. Du Pont Amalgamated v. WalMart Rosenfeld v. Fairchild In order to inspect book & records under DGCL §220, Π has to show w/RIFLED PRECISION a proper purpose for each category Implied private right of action exists for violations of Proxy Rules States factors for determining if private right of action exists Causation = Private action if misstatement could’ve affected vote Definition of MATERIAL False stmts re: material OPINIONS violate §14(a) BD can exclude SH proposals if they’re about ordinary business If matter in proposal is one that shareholders should/would want to know & vote on, BD muts include Reimbursement for expenses from proxy contest DUTY OF CARE & DUTY TO ACT LAWFULLY Francis v. United Jersey Bank In re Caremark International Inc. Derivative Litigation (Del.Ch. 1996) Dir. has affirmative duty to manage w/gross negligence std Breach of fiduciary duty involves sustained systematic inattention. If you do anything along the lines of corporate governance, no liability 1 Aronson v. Lewis (Del. 1984) Kamin v. American Express Smith v. Van Gorkom (Del. 1985) Miller v. American Telephone & Telegraph Co. Under BJR, director liability is predicated upon concepts of gross negligence BJR protects BD decisions if process was sound, even if end result isn’t great If decision uninformed & bad process, NO BJR. Shareholder ratification only cures bad process if vote was fully informed. BJR doesn’t apply to duty to act lawfully. NO BJR for illegal acts DUTY OF LOYALTY Lewis v. S.L. & E., Inc. (2d 1980) Talbot v. James (1972) Rosenfeld v. Fairchild Engine & Airplane Corp. Cooke v. Oolie (Del.Ch. 1997) Cookies Food Products v. Lakes Warehouse Lewis v. Vogelstein (Del.Ch. 1997) Northeast Harbor Golf Club, Inc. v. Harris (Maine 1995) Broz v. Cellular Information Systems (Del. 1996) Sinclair Oil Corporation v. Levien (Del. 1971) Zahn v. Transamerica Corp. (3d 1947) Kahn v. Tremont (Del. 1997) McMullin v. Beran (Del. 2000) Zetlin v. Hanson Holdings Gerdes v. Reynolds (1941) Harris v. Carter (Del. 1990) Perlman v. Feldmann Brecher v. Gregg (NY 1975) Essex Universal v. Yates If interested directors NO BJR, Burden on Δ = EF If dir interested, must fully disclose interest to other dirs & shareholders Shareholder ratification cures self-dealing as long as the shareholders were fully informed about the interested parties Where there are interested directors involved in transaction, if BD can prove that only disinterested directors approved, BJR still applies. If self-dealing is approved by fully informed vote & entirely fair, no breach of fiduciary duty Executive compensation standard of review is WASTE. Very hard hard std to meet b/c no reasonable personable could’ve thought decision reasonable ALI approach: if there’s any possibility of there being a corp opportunity, fiduciary must first formally disclose to BD Delaware approach: First it must be determined if a corp opportunity existed. If yes, then there’s a duty to formally disclose. In parent-sub deals, std depends on pro-rata benefit If the controlling shareholder is a director, he owes duty to minority Entire Fairness can’t just be superficial. RUNNING DOGS Case BD can delegate negotiating power but not approval power BLACK LETTER LAW: Controlling interest is a property interest that can be sold at a premium barring any knowing of looting, harm to corp. (1) Can’t sell to looters. (2) Can’t sell corporate office by itself. If there’s a reasonably foreseeable risk to corp from sale of controlling interest seller has duty of inquiry Controlling shareholder can’t sell corp opportunity Sale of control must be via shares not just office/mgmt Controlling interest is sufficient for transfer of control. Don’t need majority CLOSED CORPORATIONS Donahue v. Rodd Electrotype Nixon v. Blackwell (Del 1993) Wilkes v. Springside Nursing Home Non-Delaware case that imposes a higher std of fiduciary duty for close corps Fairness equality. Close-corp minority gets no special treatment in Delaware unless they choose to become a “statutory close-corp” Non-Delaware Legitimate Business Purpose Test INSIDER TRADING In the Matter of Cady, Roberts & Co. (SEC 1961) SEC v. Texas Gulf Sulphur US v. Chestman Basic v. Levinson (US 1988) In Re Verifone Securities Litigation Blue Chip Stamps v. Manor Ernst & Ernst v. Hochfelder Santa Fe Industries v. Green Goldberg v. Meridor Novak v. Kasaks Current SEC Disclose-or-Abstain Law insiders w/nonpublic, material info must DISCLOSE OR ABSTAIN If you have inside info but no fiduciary duty to anyone, no duty to disclose/abstain under 10b-5 Presumption of Reliance for Π b/c fraud-on-the-market theory Π can only claim reliance based on fraud-on-the-market, if the market price really did reflect the misstatement. It’s possible that the stmt didn’t change price A 10b-5 private action requires an actual PURCHASE/SALE of security A 10b-5 private action requires SCIENTER = wrongful intent to deceive/fraud 10b-5 Action requires manipulation/deception. Mistake in info not enough this might be a state law issue (e.g., duty of care) 10b-5: must show causation & actual damages Scienter = Strong inference of intent to deceive 2 Chiarella v. United States Dirks v. SEC (US 1983) US v. Carpenter (US 1987) US v. O’Hagan (US 1997) Kern County v. Occidental Colan v. Mesa Petroleum Malone v. Brincat (Del. 1998) Nondisclosure Fraud unless there’s a duty to disclose Tippee has derivative duty to disclose or abstain Employment relationship sufficient for duty to disclose/abstain Misappropriation theory If either end of short-swing trade or both trades are involuntary, no 16(b) liability economic coercion involuntariness not a sufficient excuse for 16(b) direct suit but should’ve been derivative SHAREHOLDER SUITS: DIRECT vs. DERIVATIVE Sax v. World Wide Press Grimes v. Donald (Del. 1996) Barth v. Barth (Ind. 1995) Bagdon v. Bridgestone/ Firestone Glenn v. Hoteltron Systems Perlman v. Feldmann Bangor Punta Operations, Inc. v. Bangor Aroostook R.R Rifkin v. Steele Platt Marx v. Akers Aronson v. Lewis (Del. 1984) Auerbach v. Bennett Zapata Corp. v. Maldonado direct suit requires special & distinct harm to Π Declaratory judgmt/injunctions = direct trial ct has discretion to allow direct suit w/close-corp Delaware courts won’t give close-corps special treatment in determining whether a suit can be direct or derivative Recovery in derivative suit goes to corp Direct suit may be allowed if recovery would go to new corp Contemporaneous Ownership Rule for direct suits Upholds Bangor Punta contemporaneous ownership rule No demand required if you can rebut BJR If director/transaction is interested NO BJR = demand excused Even if there’s a Special Lit. Comm, Ct can still review if it was disinterested & used proper process Special Litigation Comm. 2 step test protects BD’s decision to reject demand CORPORATE COMBINATIONS: APPRAISALS, MERGERS, SALES, TAKEOVERS Katz v. Bregman Gimbel v. Signal Sterling v. Mayflower Hotel Weinberger v. UOP (Del. 1983) Smith v. Van Gorkam (Del. 1985) Unocal Corp v. Mesa Petroleum (Del. 1985) Moran v. Household International, Inc. (Del. 1985) Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc. (Del. 1985) Barkan v. Amsted Industries, Inc. (Del. 1989) Mills Acquisition Co. v. MacMillan Co. (Del 1989) Paramount Communications, Inc. v. Time Inc. (Del. 1989) Paramount Communications, Inc. v. QVC Network (Del. 1994) Unitrin, Inc. v. American General Corp. (Del. 1995) Quickturn Design Systems, Inc. v. Shapiro (Del. 1998) sale of all assets requires shareholder approval Shareholder vote not required for every major corp restructuring, only if it’s a sale of substantially all assets If merger is an interested transaction, Director bears burden of EF EF = fair price+ fair dealing & Rescissory damages BJR Test (informed decision/good process), see infra In evaluating defensive measures against takeovers, BD’s action must be reasonable & proportional to threat before it can get BJR Poison Pill is a per se LEGAL takeover defense, but is can’t violate Unocal Once BD has decided to sell corp in a cash-out merger, BD must get best price possible. Only applies to cash-out deals, not stock-for-stock Revlon doesn’t require BD to have a heated auction every time there’s change in corp control You can’t use a lock-up of crown jewels when that effectively ends a live auction. Upholds Revlon. BD determines best deal for corp under DGCL §141(a). Absent Revlon Duty, BD doesn’t have to abandon deal for short-term profits upholds Revlon upholds Unocal, but adds Blasius Dead-hand/no-hand poison pill plans violate DGCL 141(a) b/c it prevents BD member from exercising mgmt duty 3