Evangel College

advertisement

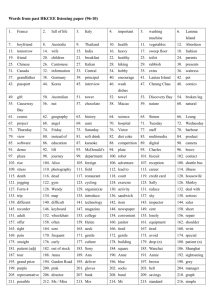

Evangel College 2011/2012 Term 1 Economics – Revision Exercise Final 14 Name:______________________________( Money & Banking 1. A 12. C 23. B 34. A 2. B 13. C 24. A 35. C 3. C 14. B 25. A 36. B 4. B 15. A 26. C 37. A 5. B 16. D 27. D 38. B 6. A 17. C 28. C 39. D 7. C 18. B 29. A 40. C 8. C 19. C 30. A 41. B 9. D 20. C 31. A 42. A 10. D 21. C 32. A 43. D 11. D 22. D 33. A 44. D ) 45. C 46. B 47. A 48. D 49. A 50. A 51. A 52. D 53. B 54. B 55. B Class:S.6 _______ 56. C 57. B 58. B 59. D 60. A 61. B 62. B 63. A 64. A 65. A 66. D 67. A 68. C 69. B 70. A 71. C 72. C 73. C 74. B 75. D 76. B 77. A 78. B 79. A 80. C 81. D 82. B 83. A 84. C 85. C 86. D 87. C 88. C 89. A 90. B 91. C 92. D 93. A 94. A 95. B 96. C 97. B 98. B 99. C 100. D 101. A 102. C 103. D 104. B 105. B 106. B HKCEE 2006CQ Answer HKCEE 2005CQ Answer - Medium of exchange: Money serves as a medium to facilitate people's buying and selling of goods and services. - Unit of account: Money is used to express the prices and value of goods and services. - Store of value: People can store up the purchasing power for future spending on goods and services. - Standard of deferred payment: Future payment is expressed in terms of money. [Mark the FIRST TWO points only.] [(1 + 1) @, max : 4] HKCEE 2004CQ Answer - Store of value / store of wealth. (1) - This is because the purchasing power / real value of cash continues to decrease in times of inflation (but continues to increase in times of deflation). (2) HKCEE 2003CQ Answer (a) - medium of exchange (1) - unit of account (1) [Mark the FIRST TWO points only.] 1 (b) - store of value (1) People can store up the purchasing power for future spending on goods and services. (1) standard of deferred payment (1) Future payment is denominated in terms of money. (1) [Mark the FIRST TWO points only.] HKCEE 2002CQ Answer - No because (1) - they are not generally accepted as a medium of exchange. (1) - Not generally accepted because they cannot be used to buy other goods and services. (1) HKCEE 1999CQ Answer - unit of account (1) - standard of deferred payment (1) - It is not a unit of account because the prices of other goods are not expressed in terms of Octopus cards. (1) - It is not a standard of deferred payment because payment is immediately debited to the Octopus card. (1) HKCEE 2002CQ - to issue currency (1) - to act as the banker of the government (1) - to act as an advisor to the government (1) - to supervise / monitor the monetary sector, e.g. private banks (1) - to act as the lender of last resort (1) - to administer the clearing house (1) - to carry out the monetary policy (1) - to manage the country's foreign exchange reserve (1) - any other relevant point (1) (1@, max : 2) HKCEE 2004CQ HKCEE 2002 - M1 increased (1) - by $90 000. (1) - because the legal tender notes and coins held by the public increased. (1) - M3 decreased (1) - by $60 000. (1) - because this amount was no longer included in the cash in public circulation in HK or in the deposits with the monetary sector of HK. (1) HKCEE 1999CQ - M1 = currency in the hands of the non-bank public + demand deposits (2) - M2 = M1 + saving deposits + time deposits held with banks + negotiable Certificates of Deposit issued by banks held outside the monetary sector. (2) 2 HKCEE 1996CQ Answer △ held by the non-bank public + change in the demand deposits with licensed banks = 0 + $(30 – 20) mn. / = + $(30 – 20) mn. (1) = +$10 mn. (1) △M2 =△M1 + change in the time and savings deposits with licensed banks + change in the negotiable certificates of deposit issued by licensed banks and held by the non-bank public =+10 mn + $[(40 + 30) – (40 + 40)] mn. (1) =0 (1) Alternative answer: △M1 =change in the amount of cash held by the non-bank public + change in the demand deposits with licensed banks =$(40 – 50) mn. + $(30 – 20) mn. =0 (2) △M2 =△M1 + change in the time and saving s deposits with licensed banks + change in the negotiable certificates of deposit issued by licensed banks and held by the non-bank public =0 + $[(40 + 30) - (40 + 40)]mn. / = + $[(40+30) – (40+40)] mn. = - $10 mn. (2) HKCEE 2006CQ (a) 10% (1) (b) Yes because (1) when total deposits reduce to $1 150 (=$1 500 - $350), it only needs a reserve of $115 (= $1150 x 10%) to back up the deposits. [Since] the reserve assets only reduce to $150 (=$500 - $350) [there is still an excess reserve of $35.] (2) HKCEE 2003CQ Answer legal reserve ratio = 1/5 or 0.2 (1) max. deposit = $250m x 1/0.2 (1) = $1250m (2) HKCEE 2002CQ Answer (i) - The required reserve ration = (20/100) = 1/5 or multiplier =5 (1) - max. amount of deposits created = $10m x 5 = $50m (1) - max. amount of money supply created = - max. amount of deposits created - decrease in cash in public circulation (1) - =($50m - $10m) = $40 m (2) (ii) - there is cash leakage - the banks decide to hold excess reserves - insufficient demand for loans (2@, max : 4) (Mark the FIRST TWO points only) 3 HKCEE 2000CQ HKCEE 1999CQ Answer The amount of deposits thus created in the economy $10 000 +$10 000 x (1 – 25%) (2) = $17 500 (2) 4