Group Work Solutions 10/9/14 - Chapters 1-4

advertisement

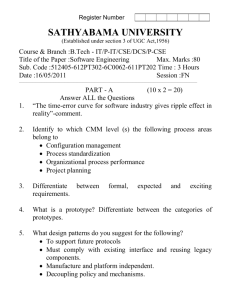

Group Work – Chapters 1-4 1. Prepare an adjusting journal entry for XYZ Co. for each of the following transactions. Assume the date is December 31, 2012, and XYZ Co. is adjusting account balances in order to prepare and distribute yearly Financial Statements. a. XYZ Co. borrowed $40,000 on a 8-mth note at 9% on October 1, 2012. Interest and Principal are due at June 1, 2013. Today is December 31, 2012. Prepare an adjusting entry regarding this borrowing. Interest Expense 900 Interest Payable 900 b. The Supplies asset account had a December 1, 2012 beginning balance of $1,200. During the month of December, Supplies costing $6,200 were purchased. A count of the Supplies on hand at December 31, 2012 indicates $2,900 of Supplies remain in the storeroom. Prepare an adjusting entry for supplies at December 31, 2012. Supplies Expense 4,500 Supplies (Asset) 4,500 c. XYZ Co. purchased Equipment last year for $25,000. The equipment has an estimated useful life of 10 years and an estimated salvage value of $3,000. XYZ Co. uses straight line depreciation. Prepare an adjusting entry for equipment at December 31, 2012. Depreciation Expense 2,200 Accumulated Depreciation 2,200 d. On November 1, 2012, XYZ Co. paid $2,400 to the building landlord for 3 months rent in advance. The Prepaid Rent account increased on that date. Prepare the adjusting entry at December 31, 2012. Rent Expense Prepaid Rent 1,600 1,600 e. During December XYZ Co. received $7,000 cash from a customer for special ordered goods to be delivered at a later date. At the time of the cash receipt, Unearned Revenue was increased. At December 31, 2012, $3,000 worth of goods for the special order has been delivered to the customer. Prepare an adjusting entry regarding this delivery. Unearned Revenue Sales Revenue 3,000 3,000 2. ABC Co. started the year with a beginning balance for total Assets of $305,000 and total Liabilities of $180,000. During the year, total Revenues were $205,000; total Expenses were $218,000; and Dividends of $25,000 were paid at year end. Assume no additional Contributed Capital was received in the year, what would the Ending Balance of Owners’ Equity for the year? $87,000 3. On January 1, ABC showed a balance in the Supplies Asset account of $9,200. The Income Statement shows that Supplies Expense (amounts used up) for the period was $9,900. The ending balance of the Supplies account at December 31st is $10,800. How much in Supplies must have been purchased in the current year? $11,500 4. XYZ had a $28,000 balance in Accounts Receivable at the beginning of the year and a $39,000 balance at the end of the year. All Sales for XYZ are sold on account [all sales go through Accounts Receivable]. XYZ reported Sales of $180,000 during the year. How much cash must have been collected from customers during the year? $169,000 5. Identify the following accounts as Temporary (T) or Permanent (P). Temporary accounts are closed to Retained Earnings at Year-end. Permanent accounts are not closed out – their balances carry forward to the new year. 6. Accounts Receivable __P__ Dividends __T__ Cost of Goods Sold __T__ Building __P__ Common Stock __P__ Retained Earnings __P__ Note Payable __P__ Interest Revenue __T__ Interest Expense __T__ Inventory __P__ XYZ had the following accounts balances at year end. Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Operating Expenses Unearned Revenue Retained Earnings (Beginning Balance) Taxes $15,100 $18,200 $12,600 $15,500 $40,000 $104,200 $2,600 $32,500 $10,200 Interest Expense Interest Revenue Inventory Notes Payable (due in 2 years) Operating Revenues Prepaid Rent Equipment Dividends What is the total of Current Assets? $81,100 What is Total Assets? $150,500 What is the total of Current Liabilities? $17,700 What is Total Liabilities? $52,700 What is Operating Income? $50,000 What is Pretax Income? $49,500 What is Net Income? $39,300 What should be the end-of-year balance in Retained Earnings on the Balance Sheet? $4,100 $3,600 $45,800 $35,000 $154,200 $1,600 $82,000 $14,000 $57,800

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)

![waiver of all claims [form]](http://s3.studylib.net/store/data/006992518_1-099c1f53a611c6c0d62e397e1d1c660f-300x300.png)