Economics – Chapter One

advertisement

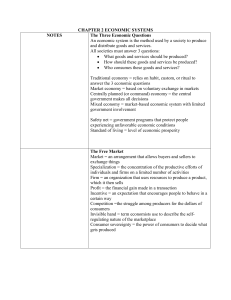

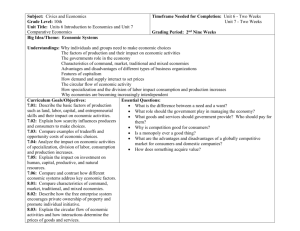

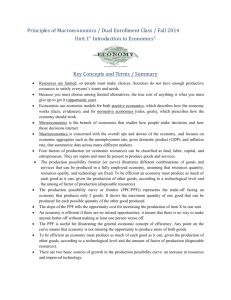

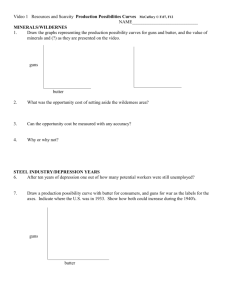

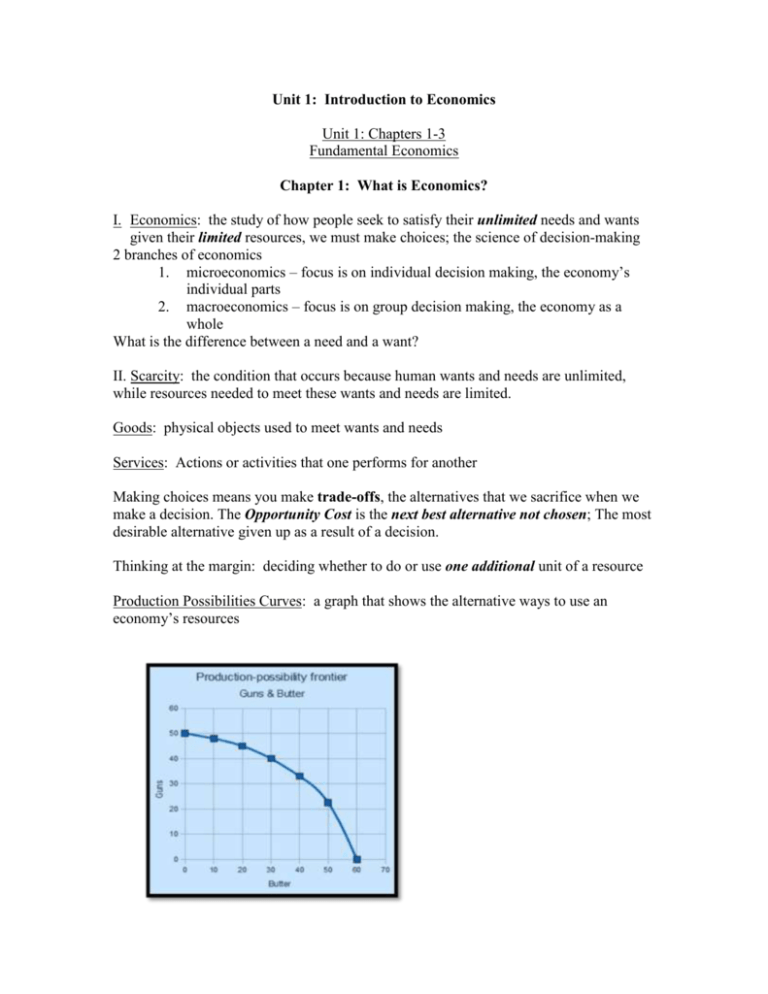

Unit 1: Introduction to Economics Unit 1: Chapters 1-3 Fundamental Economics Chapter 1: What is Economics? I. Economics: the study of how people seek to satisfy their unlimited needs and wants given their limited resources, we must make choices; the science of decision-making 2 branches of economics 1. microeconomics – focus is on individual decision making, the economy’s individual parts 2. macroeconomics – focus is on group decision making, the economy as a whole What is the difference between a need and a want? II. Scarcity: the condition that occurs because human wants and needs are unlimited, while resources needed to meet these wants and needs are limited. Goods: physical objects used to meet wants and needs Services: Actions or activities that one performs for another Making choices means you make trade-offs, the alternatives that we sacrifice when we make a decision. The Opportunity Cost is the next best alternative not chosen; The most desirable alternative given up as a result of a decision. Thinking at the margin: deciding whether to do or use one additional unit of a resource Production Possibilities Curves: a graph that shows the alternative ways to use an economy’s resources Guns or Butter PPF Application Questions 1 How many guns can be produced when no butter is produced? ____________ 2 How much butter can be produced when no guns are produced? ___________ 3 Imagine that a country wants to go from producing 0 guns to 40 Guns. What is the opportunity cost in terms of butter?____________ 4 If the production decision was to produce at the (20, 45) point; What does this society care more about?_______________________________ Law of increasing costs: as we shift factors of production from making one good or service to another, the cost of producing the second item increases; this is why PPF curves drastically downward to the right. Chapter 2: Economic Systems All societies deal with scarcity by implementing an economic system which distributes the scarce resources by answering the following BASIC ECONOMIC QUESTIONS: 1. 2. 3. What goods and services should be produced? How should these goods and services be produced? For whom are these goods and services produced? Factors of Production: Land, Labor, Capital, Entrepreneurship (L,L,C,E) Land: natural resources, anything of the Earth Labor: the effort that people devote to a task for which they are paid Capital: any human-made resource that is used to create other goods and services; physical, financial, human Entreprenuership: risk taking to combine resources for potential profit Factor payments: the income people receive for supplying the factors of production Land – Rent Labor – Wages Capital – Interest Entrepenuership – Profit 4 types of economic systems: 1. Traditional 2. Market (Private) 3. Command (Public) 4. Mixed Defining characteristics: essential traits that must be present in order to know what a system is 1. A Market system: an arrangement that allows buyers and sellers to exchange; a place where buyers and sellers freely interact with nearly perfect information; based on voluntary exchange. Market economies are also called free markets or capitalism. Individuals choose; private goods and services. 2. A Command system: is characterized by the presence of strong, central authority. Government makes all decisions regarding the distribution of resources. This produces public goods and services. 3. A Traditional system: is characterized by habit, custom, and ritual to decide the questions of production and consumption. Traditional economies are usually small, close communities. This generally means there is a large agricultural segment of this society. 4. A Mixed system: a society that has some combination of the above 3 systems. How the three basic questions are answered in command (social) economies: What to Produce: a committee of experts pool their knowledge and work out a central plan based on the needs of society. Goods and services produced do not have to pass the “test” of the market. Consumer choice involves purchasing or not. Producers meet quotas established by committee. Profits are not an incentive. How to produce: determined by central committee. Managers have some choice involved in the process, but no control of resources provided to produce the goods. For whom to produce: Equity for all is the goal. An even distribution of goods and services among society’s members. In a market economy, social decision-making occurs. 5 basic Economic Goals of the US economy: 1. Economic Freedom: freedom of consumers to decide how to spend or save their incomes; freedom of producers to make decisions; freedom of workers to choose their jobs 2. Economic Efficiency: achieving maximum benefit from a given amount and combination of resources; it is improved only if the additional benefits exceed the additional costs 3. Economic Equity: fairness to all members of society 4. Economic Security and Predictability: protection against economic risks such as work injuries, unemployment, inflation, business failures, and poverty 5. Economic Growth and Innovation: increasing the production of goods and services over time. Target growth rate of GDP is 3% per year Public Goods: goods and services available to all members of society; one member can consume it and it is still available for other members e.g. schools, parks, roads, army, police… Private Goods: individuals own Effective Social-decision making: Use basic economic decision-making model 1. Define the problem 2. List alternatives 3. List criteria 4. Evaluate the alternatives 5. Make a decision that minimizes social cost and maximizes social benefit Chapter 2 vocabulary terms to know: Specialization: the concentration of the productive efforts of individuals and firms on a limited number of activities Factor market: market in which firms purchase the factors of production from households Profit: a financial gain made in a transaction Product market: the market in which households purchase the goods and services firms produce Self-interest: one’s own personal gain Incentive: an expectation that encourages people to behave in certain a way Competition: the struggle among producers for the dollars of consumers Invisible hand: term economists use to describe the self-regulating nature of the marketplace Consumer sovereignty: the power of the consumers to decide what gets produced Socialism: a social and political philosophy based on the belief that democratic means should be used to evenly distribute wealth throughout society Communism: a political system characterized by a centrally planned economy with all economic and political power resting in the hands of the central government Authoritarian: requiring strict obedience to an authority such as a dictator Collective: large farm leased from the state to groups of peasant farmers Laissez faire: the doctrine that states that government generally should not intervene in the marketplace Private property: property owned by individuals or companies not by the government or the people as a whole Free enterprise: an economic system characterized by private or corporate ownership of capital goods; investments that are determined by private decisions rather than by state control; and determined in a free market Continuum: a range with no clear divisions Transition: period of change in which an economy moves away from a centrally planned economy toward a market based system Privatize: to sell state run firms to individuals Chapter 3:American Free Enterprise Taxation: The Constitutions provides the Government with the right to tax in Article 1, sections 2 & 9; the 16th Amendment provides the federal government the right to tax income. Profit motive: the force that encourages people and organizations to improve their material well-being Open opportunity: the concept that everyone can compete in the marketplace Legal equality: the concept of giving everyone the same legal rights Free contract: the concept that people may decide what agreements they want to enter into Voluntary exchange: the concept that people may decide what and when they want to buy and sell E.1.6 Recognize that voluntary exchange occurs when all participating parties expect to gain. Competition: the rivalry among sellers to attract customers while lowering costs Private sector; market economy, capitalism, Adam Smith, Milton Friedman, Gary Becker, F.A. Hayek, and University of Chicago Consumers signal to producers what to produce by their “votes” in the economy; and they signal how much they want produced (for whom to produce). Consumers can also join Interest groups: private organization that tries to persuade public officials to act or vote according to their interests. Public sector; command economy, centrally planned, socialism, Karl Marx, John Kenneth Galbraith, John Maynard Keynes, and Harvard University The Limited Role of Government: The 5th amendment in the Bill of Rights provides the constitutional authority to protect property from the federal government. The 14th amendment protects property from State governments. Federal and State statutes protect property from private individuals. Promoting Growth and Stability In order to promote growth, you have to first track it. Microeconomics: the study of economic behavior and decision making in small units, such as individuals, families and businesses. Macroeconomics: the study of the behavior and decision making of entire economies. Governments deal with entire economies so is studied in Macro. Business cycles: a period of macroeconomic expansion followed by a period of contraction. (growth, peak, recession, trough) GDP: gross domestic product, the total dollar value of all final goods and services produced in a nation’s economy in a given period of time (usually one year). We have had 9 cycles since 1942, we may be about to complete a 10th. Full employment: 5% of the workforce (anyone who wants to work) is actively seeking another job. The US economy policy goal is to grow at 3% a year, and keep prices stable. CPI: consumer price index tracks changing prices of consumer goods and services. Manipulating interest rates helps to stabilize prices. Increasing worker productivity and technological advances helps shift the PPF outward to the right at 3% a year. Providing Public Goods Public good: a shared good or service, which is available to all members of society, and you, cannot exclude non-payers Public goods rationale: some goods can be provided for a society more efficiently if produced by Government due to Economies of Scale: some economic activities are more efficient when done on a large scale 1. the benefit to each individual is less than the cost that each individual would have to pay if it were provided privately 2. the total benefits to society are greater than the cost Free Rider problem: a person who benefits from the public goods and services without sharing equally in its costs Providing a Safety Net (Redistributing the wealth) Welfare system: government aid to the poor Cash transfers are direct payments to the poor Temporary Assistance for Needy Families (former AFDC) Social Security (Medicare) FICA pays for this Unemployment Insurance Workman’s Compensation Also: In-Kind benefits: food stamps, subsidized housing, legal aid Medicaid Public Education