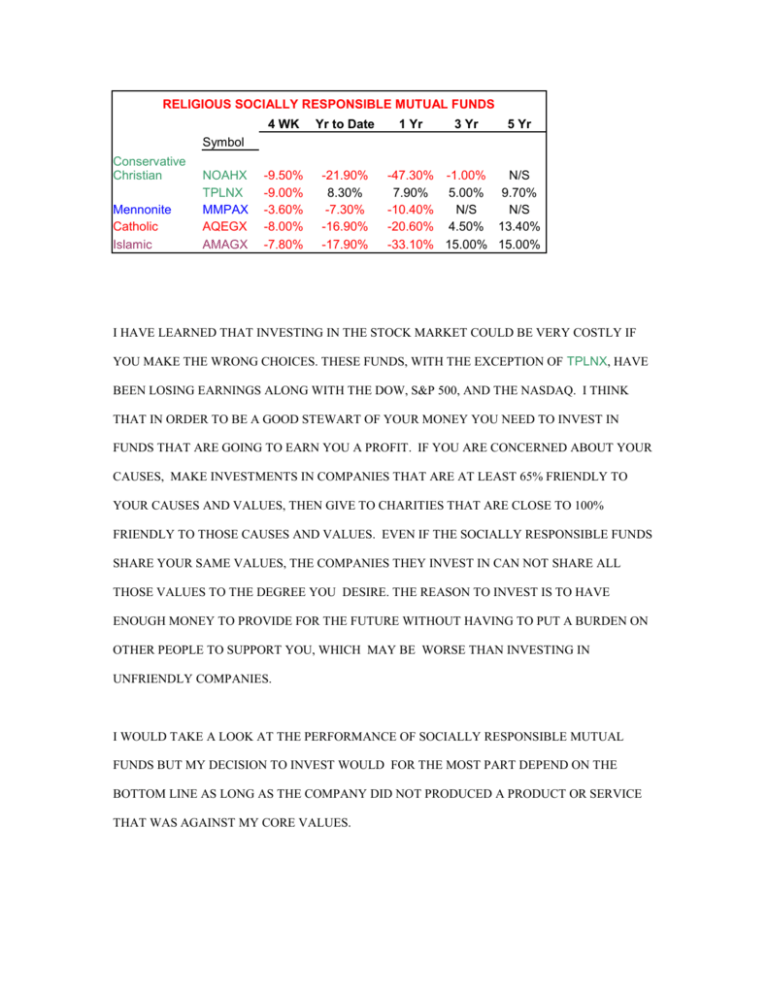

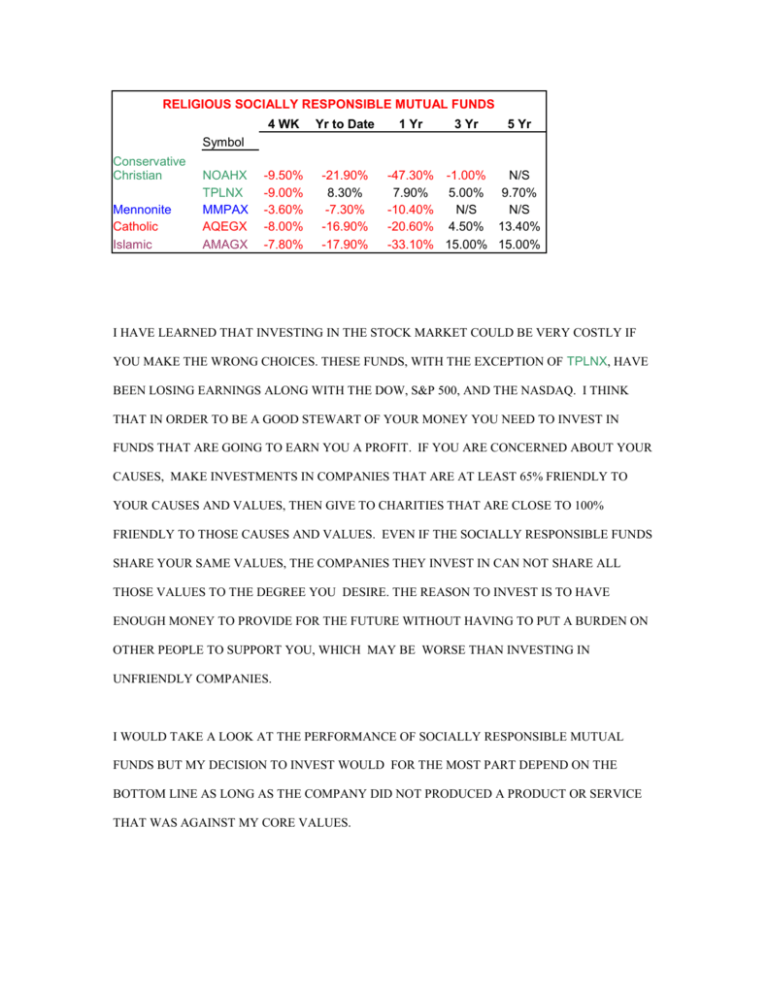

RELIGIOUS SOCIALLY RESPONSIBLE MUTUAL FUNDS

4 WK

Yr to Date

-9.50%

-9.00%

-3.60%

-8.00%

-7.80%

-21.90%

8.30%

-7.30%

-16.90%

-17.90%

1 Yr

3 Yr

5 Yr

Symbol

Conservative

Christian

Mennonite

Catholic

Islamic

NOAHX

TPLNX

MMPAX

AQEGX

AMAGX

-47.30% -1.00%

N/S

7.90%

5.00% 9.70%

-10.40%

N/S

N/S

-20.60% 4.50% 13.40%

-33.10% 15.00% 15.00%

I HAVE LEARNED THAT INVESTING IN THE STOCK MARKET COULD BE VERY COSTLY IF

YOU MAKE THE WRONG CHOICES. THESE FUNDS, WITH THE EXCEPTION OF TPLNX, HAVE

BEEN LOSING EARNINGS ALONG WITH THE DOW, S&P 500, AND THE NASDAQ. I THINK

THAT IN ORDER TO BE A GOOD STEWART OF YOUR MONEY YOU NEED TO INVEST IN

FUNDS THAT ARE GOING TO EARN YOU A PROFIT. IF YOU ARE CONCERNED ABOUT YOUR

CAUSES, MAKE INVESTMENTS IN COMPANIES THAT ARE AT LEAST 65% FRIENDLY TO

YOUR CAUSES AND VALUES, THEN GIVE TO CHARITIES THAT ARE CLOSE TO 100%

FRIENDLY TO THOSE CAUSES AND VALUES. EVEN IF THE SOCIALLY RESPONSIBLE FUNDS

SHARE YOUR SAME VALUES, THE COMPANIES THEY INVEST IN CAN NOT SHARE ALL

THOSE VALUES TO THE DEGREE YOU DESIRE. THE REASON TO INVEST IS TO HAVE

ENOUGH MONEY TO PROVIDE FOR THE FUTURE WITHOUT HAVING TO PUT A BURDEN ON

OTHER PEOPLE TO SUPPORT YOU, WHICH MAY BE WORSE THAN INVESTING IN

UNFRIENDLY COMPANIES.

I WOULD TAKE A LOOK AT THE PERFORMANCE OF SOCIALLY RESPONSIBLE MUTUAL

FUNDS BUT MY DECISION TO INVEST WOULD FOR THE MOST PART DEPEND ON THE

BOTTOM LINE AS LONG AS THE COMPANY DID NOT PRODUCED A PRODUCT OR SERVICE

THAT WAS AGAINST MY CORE VALUES.

How Do Socially Responsible Funds Stack Up?

by Emily Hall and Jon Hale | Socially responsible investing (SRI) has always had to fight

the perception that it may be better for your soul than for your bottom line. Most investment

professionals will agree in principle that adding social criteria on top of the things that

investors normally consider when selecting stocks--company fundamentals and stock

valuation--restricts one's investable universe in ways that are unlikely to improve returns.

If, for example, you started out with a universe of 100 stocks, and your social screens

disqualified 20 of them, you'd have only 80 choices available to try to outperform the market

and other active investors who have the entire 100 stocks at their disposal. The conventional

wisdom might be different if social criteria effectively screened out the worst-performing

stocks, but a lack of social graces is not necessarily an impediment to a company's stock price.

Academics studying the link between commonly used social criteria and stock performance

haven't found a clear-cut relationship, positive or negative.

Two years ago, when we took a look at the universe of socially conscious mutual funds, not a

single SRI fund merited a 5-star rating.

A lot can change in two years.

Today, 21% of the SRI funds in our database that have the necessary three-year record sport a

5-star rating. That's twice the rate of the overall fund universe. Moreover, only 19% of SRI

funds find themselves in 2-star or 1-star territory, while a third of the overall fund universe

rates that low.

SRI funds stack up even better when they are compared to their specific Morningstar

categories. One quarter of these funds currently sport a top category rating of 5, and half have

category ratings of 4 or 5.

The smaller group of SRI funds that have a five-year record (35 in all) is less impressive,

though still acceptable. A total of 19 have outperformed their category peers over the trailing

five years while 16 underperformed.

That doesn't mean social screens add value, but it's hard to make the case that they subtract it.

What happened? Have SRI funds discovered some magic formula for investing that didn't

exist before? Not really. Few, if any, funds have made notable changes in their screening

practices over the past couple of years.

But screening certainly has something to do with SRI funds' recent performance. Screening

out tobacco companies and nuclear power utilities has kept the funds away from some of the

market's worst performers over the past few years. Avoiding these and other firms with poor

environmental records leaves the typical SRI domestic-equity fund underweighted in value

stocks and overweighted in growth stocks. Indeed, in the SRI arena growth funds outnumber

value funds 14 to 5. Most SRI domestic-equity funds are also large-cap offerings.

That proved to be a potent combination in 1997 and 1998 when large-growth stocks fueled the

stock market's rise. Of the 14 funds that came of age between October 1997 (the date of our

earlier study) and August 1999, eight had significant exposure to large-growth stocks and

seven of those funds garnered 5-star ratings. Two older funds improved to five stars for the

same reason.

That's not the entire explanation, though. The large-growth tilt helps explain SRI funds'

improved star ratings, but not their improved category ratings. Lots of large-blend and largegrowth funds sport 5-star ratings because they are being favorably compared with smaller-cap

offerings, but SRI funds still do well when we compare apples to apples (i.e., compare funds

in the same style-box-based Morningstar category).

Some of this success owes to the impact of two socially screened indexes, which together are

tracked by six of the top-rated funds. The Domini Social index and the Citizens index have

prospered for the same basic reason that the S&P 500 index has over the past couple of years:

The stocks at the top of these capitalization-weighted indexes were those that led the market's

rise.

Domini Social Equity DSEFX and its institutional fund both have category ratings of 5, as do

two other funds based on the Domini Social index--Green Century Equity GCEQX and

Devcap Shared Return DESRX. Both share classes of Citizens Index Fund WAIDX have

recently passed their third anniversaries and now sport top category marks. In all, about half

of SRI funds that have category ratings of 5 are indexed offerings.

Even accounting for the index effect and the large-growth bias, though, SRI funds remain

skewed toward the top of the category ratings. If we throw out the large-growth and largeblend offerings, half of the remaining SRI funds have category ratings of 4 or 5 (multiple

share classes excluded). SRI offerings boast top category ratings in seven different categories.

With that many top performers in the SRI-fund stable, it's a relatively easy task for social

investors to pick out a good fund or two. But is it possible for social investors to build a welldiversified portfolio consisting solely of socially screened funds? It's one thing to show

concern about social issues by dropping a few bucks in a single fund, but quite another to put

an entire nest egg into social funds.

How do Socially Responsible Funds Stack Up? | continued

For those committed to the concept, we think a broad portfolio can be built-but just barely, and only for a certain type of social investor. For one thing,

few socially screened funds have really proven themselves over long time

periods. Of the nine funds with 10-year records, only Dreyfus Third Century

DRTHX (large-growth) and Pax World PAXWX (domestic hybrid) have 4- or

5-star ratings. For another, there aren't a lot of choices in many investment

categories, particularly fixed-income, international, and value-oriented

domestic equity. Socially screened funds can also be expensive. The typical

SRI fund charges 15% more than its average category peer. Apparently, many

SRI funds' sense of social responsibility doesn't extend to how much they

charge their shareholders.

And last, but certainly not least, SRI funds do not all follow the same social

investment policies. Social funds don't all use exactly the same screens, don't

all engage in the same level of shareholder activism, and don't all aim to have

a high social impact. Moreover, the term "socially responsible" encompasses

two groups of funds: religious and non-religious.

Religious offerings such as Amana Growth AMAGX (an Islamic fund) and

Timothy Plan TIMBX (a conservative Christian fund) screen out stocks that

violate particular religious tenets, and such screens vary considerably from

fund family to fund family. Many nonreligious funds, on the other hand, share

similar screens (although they are not the same by any means). Offerings such

as Domini Social Equity and Calvert Social Investment Fund Balanced CSIFX

search for companies with strong records on environmental, diversity, and

workplace issues. These same funds also tend to exclude alcohol, tobacco, and

weapons makers and many also reject nuclear power companies.

With these caveats in mind, though, it is possible to select a quality portfolio

of nonreligious SRI funds. (The same is not true of the religious funds. While

there are a number of religious funds available--and some have good track

records--there isn't a broad enough array to assemble a diversified portfolio of

funds that adequately accommodates a particular religious persuasion.) We

make one effort below, by highlighting some of the better secular SRI

offerings in each asset class--domestic equity, international equity, and fixedincome.

Large Cap

Domini Social Equity is a passively managed fund that tracks the Domini

Social index. All stocks in the index have passed a series of positive and

negative screens, and the final result is a list of 400 companies--approximately

250 from the S&P 500 and another 150 large- and mid-cap non-S&P 500

firms. Like many socially responsible funds, Domini Social Equity has a

growth tilt, although the fund still manages to land consistently in the largeblend column of the style box. That fondness for growth stocks has helped this

fund to a superb record: Its three- and five-year returns best the S&P 500

index. Domini's shareholder activism gives the fund added appeal. A great

core holding.

Alternative: Like Domini, Citizens Index is a large-cap fund, but it contains

even more growth names than its rival. Citizens' record is very good, but its

1.59% expense ratio is frustratingly high for an index fund.

Mid-Cap Value/Blend

Ariel Appreciation CAAPX is a solid fund that provides some much-needed

diversification to a socially conscious portfolio. Manager Erik McKissack

looks for undervalued stocks and finds a lot of his favorites in financials,

services, and industrial cyclicals. He doesn't invest much in technology,

making this offering a nice counterweight to the tech-heavy portfolios of most

other SRI offerings. The fund also holds a healthy dose of small caps.

McKissack runs a concentrated portfolio, though, which can lead to the

occasional rough spot, as this year's lackluster performance demonstrates.

Ariel isn't as aggressive in its social screening as many of its SRI peers.

Alternative: At Neuberger Berman Socially Responsive NBSRX, another

value-oriented fund, manager Janet Prindle does her social screening a little

differently than most. Rather than avoiding entire industries, she looks for the

companies in each sector with the best environmental and workplace records

that also meet her financial criteria. Thus, this fund owns more industrialcyclical names than many of its SRI peers. A solid record adds to the appeal.

Mid-Cap Growth

Citizens Emerging Growth WAEGX is an actively managed fund with a lot of

oomph. Manager Richard Little's earnings-momentum approach, along with a

concentrated portfolio and a huge technology stake (currently 40% of assets),

has delivered strong returns. Such aggressive traits will inevitably lead to

volatility, though. Unfortunately, the fund shares a family trait with Citizens

Index: an unpalatably high expense ratio. On the plus side, the fund uses

extensive positive and negative social screens.

Alternative: Calvert Capital Accumulation CCAFX has a less stellar--but

recently improved--record, and it's not as risky as Citizens Emerging Growth.

Calvert's social screens are wide-ranging, but its expenses are also high.

Fixed Income

Calvert Social Investment Bond CSIBX is a straightforward fixed-income

choice. It invests mostly in mortgages and mid- to high-quality corporate

bonds. Just as with its stock funds, Calvert avoids bonds issued by firms that

fail their screens. For example, management eschews companies with poor

environmental and workplace records. Moreover, manager Greg Habeeb

doesn't buy Treasuries because their proceeds could finance government

defense spending. The fund's long-term record is respectable, and it has a

category rating of 4.

International

Here, social investors have to settle for average. Calvert World Values

International Equity CWVGX is one of the few socially screened international

funds available, and the only one with a three-year record. Manager Andrew

Preston looks for cheap stocks within undervalued markets. The fund lands in

the middle third of the foreign-stock group.

Alternative: Citizens Global Equity WAGEX has an outstanding record, but

it's a world-stock fund with a third of assets in the United States, so its doesn't

provide the diversification of an all-foreign fund. Like other Citizens funds it

has a high expense ratio.

Posted

09-17-1999

What's So Great about Socially

Responsible Funds?

by Peter Di Teresa | 06-26-2000 | E-mail Article to a Friend | Ask the Professor a Question

Dear Professor,

I am trying to understand why all the socially responsible funds

always beat the S&P 500. I contacted Domini and Citizens, and I

understand their strategies, but I want the real reason these funds

beat the market.

Filippo B.

Is virtuous investing really profitable?

Not exactly.

What SRI Funds Really Do

Not all funds that do socially conscious or socially responsible

investing (or SRI) embrace the same principles. Some eschew all

companies in the nuclear-power and weapons industries, while

others won't buy liquor, gambling, or tobacco stocks. Other funds

score companies according to their worker relations, community

involvement, or product-safety records.

There is a host of SRI funds. Some base their stock picks on

religious principles, including:

Islamic principles: Amana Mutual Funds Trust Growth AMAGX.

Catholic principles: Catholic Values Equity M$-DEG, Aquinas

Equity Growth AQEGX.

Mennonite principles: MMA Praxis Growth MMPAX.

conservative Christian principles: Timothy Plan Small-Cap Value

TPLNX, Noah Fund NOAHX.

Other offerings, such as the following, use secular, broadly

progressive principles:

Domini Social Equity DSEFX.

Citizens Index WAIDX.

Calvert Social Investment Equity CSIEX.

Ariel Fund ARGFX.

Still other SRI funds focus on a specific social concern:

the environment: New Alternatives NALFX, Green Century Equity

GCEQX.

labor relations: MFS Union Standard Equity MUEAX.

gay and lesbian issues: Meyers Pride Value MYPVX.

women's issues: Women's Equity FEMMX.

Clearly, these funds aren't all going to agree on what they should

buy. Using the Stock Overlap feature in Morningstar.com's

Portfolio Manager, I found that most of them own Microsoft

MSFT, but that's an exception.

How SRI Funds Really Do

With so many funds following such different mandates, it would

be surprising if they performed alike. Indeed, Filippo overstated

the case. At the end of May, 28 of 55 SRI funds had 12-month

returns better than the S&P 500's. Over the past three years, 16 of

48 funds beat the index; over five years, 9 of 38 SRI offerings

triumph over the index.

SRI funds are no different from less virtuous competitors: Their

performances depend on the stocks they own. The two fund

groups that Filippo cites run index funds (Domini Social Equity

and Citizens Index). They both start with the largest U.S.

companies, then exclude tobacco, liquor, and weapons firms and

companies that harm the environment. They prefer companies

with good environmental records, progressive workplace

policies, and involvement in their communities.

Domini Social Equity and Citizens Index have myriad stocks in

common--Cisco Systems CSCO, Intel INCT, Microsoft, and

Lucent Technologies LU, to name a few. Such stocks are

representative of the funds' big technology stakes--at least 43% of

their assets are in tech stocks. That's precisely why those funds

clobbered the S&P 500 in recent years.

What Should You Do with SRI Funds?

If you're just looking for performance, there's no reason to buy a

socially responsible fund. It's no guarantee of high returns.

If you buy an SRI fund, it should be because of your religious or

ethical convictions. In that case, you want the fund to do what

you're expecting it to. Scan the prospectus and annual report to

see if the fund really sticks to its principles. As with any fund, its

performance should make it worth owning.

For a great guide to selecting SRI funds, read "How to Pick a

Socially Responsible Fund" .

Ask a Question, Win a Prize

I want to reward you for all the great questions you've been

asking. I was going to give everyone an A, but I thought I'd offer

something more useful instead. Here's the deal: At the end of

every month, I'll randomly select five winners from all the

questions I received that month. If you're one of the five, you'll

get three free months of Morningstar.com Premium Service. (If

you already subscribe, we'll extend your subscription.) I'll notify

you via e-mail to award your prize. So keep sending those

questions. After all, when's the last time you got a reward for

quizzing your professors?

Click here for complete contest rules.

Enterprise Capital Mgmt To Advise 11 Open-End

Funds

Dow Jones Newswires

WASHINGTON -- Investment advisory firm Enterprise Capital Management Inc.

is planning to advise 11 new funds as part of the Enterprise Group of Funds Inc.

series, according to a filing with the Securities and Exchange Commission.

The proposed funds are the Mid-Cap Growth Fund, the Deep Value Fund, the

Large-Cap Fund, the Emerging Countries Fund, the International Core Growth

Fund, the Worldwide Growth Fund, the Global Healthcare Fund, the Global

Socially Responsible Fund, the International Internet Fund, the Mergers and

Acquisitions Fund and the Convertible Securities Fund.

The Enterprise Mid-Cap Growth Fund will seek long-term capital appreciation by

investing in midsize companies that have market capitalizations corresponding to

the middle 90% of the Russell Mid-Cap Growth Index, the filing said. The fund

will invest at least 75% of its total assets in common stocks of U.S. midsize

companies. Portfolio managers from subadviser Nicholas-Applegate Capital

Management will manage the fund.

The Enterprise Deep Value Fund will aim for total return through capital

appreciation, with income as a secondary objective, by investing mainly in

undervalued - referred to as deep value - large-capitalization companies.

Wellington Management Co. will be subadviser. John R. Ryan, senior vice

president, will manage the fund.

The Enterprise Large-Cap Fund will seek long-term capital appreciation by

investing in companies whose capitalizations correspond to the upper 90% of the

Russell 1000 Growth Index. At least 65% of the fund's total assets will be

invested in large capitalization equity securities. Portfolio managers from

subadviser Nicholas-Applegate Capital Management will manage the fund.

The Emerging Countries Fund will aim for long-term capital appreciation by

investing at least 65% of its assets in equity securities of foreign companies

located in at least three countries with emerging securities markets. The fund will

select portfolio securities from 6,000 foreign companies. Portfolio managers from

subadviser Nicholas-Applegate Capital Management will manage the fund.

The Enterprise International Core Growth Fund will seek long-term capital

appreciation by investing in equity securities of companies located in foreign

countries whose market capitalization is in the top 75% of stock market

capitalizations for companies in each country. Portfolio managers from

subadviser Nicholas-Applegate Capital Management will manage the fund.

The Enterprise Worldwide Growth Fund will aim for long-term capital appreciation

by investing at least 65% of its assets in securities of companies that are located

in at least three countries, which may include countries with emerging securities

markets. The fund looks for companies with above average per-share earnings

growth, high return on invested capital and sound balance sheets, among other

criteria. Portfolio managers from subadviser Nicholas-Applegate Capital

Management will manage the fund.

The Enterprise Global Health Care Fund will seek long-term capital appreciation

by investing at least 75% of its assets in healthcare sector equity securities. The

remaining 25% of the fund's assets will be invested in equity securities of other

companies that will benefit from developments in the healthcare sector. Portfolio

managers from subadviser Nicholas-Applegate Capital Management will manage

the fund.

The Global Socially Responsible Fund will aim for total return by investing in

equity securities of companies that are socially responsible and that are located

in countries that are included in the MSCI World Index. The fund looks for

companies that demonstrate leadership in human rights, public health and the

environment, among other criteria.

The Global Socially Responsive Fund will be subadvised by Rockefeller & Co.

Inc. Farha-Joyce Haboucha, co-director of Rockefeller's Socially Responsive

Investments, will act as portfolio manager.

The Enterprise International Internet Fund will seek long-term capital

appreciation by investing at least 65% of its assets in equity securities of foreign

companies that are involved in the research, design, development and

manufacturing of products, processes or services, or in the business of

distributing products or services, on the Internet. The fund will be subadvised by

Fred Alger Management Inc. David Alger and Dan Chung will subadvise the

fund.

The Enterprise Merger and Acquisitions Fund will aim for capital appreciation by

purchasing shares of companies that are likely to be acquisition targets within 12

months to 18 months. The fund will engage in risk arbitrage by investing in equity

securities of companies that are involved in publicly announced mergers,

takeovers, leveraged buyouts and other corporate reorganizations, the filing said.

The fund will be subadvised by Gabelli Asset Management Co. Mario J. Gabelli,

the chief investment officer of the subadviser, will manage the fund.

The Enterprise Convertible Securities Fund will seek total return through capital

appreciation and current income by investing in convertible securities of

companies with market capitalizations above $500 million. At least 65% of the

fund's assets will be invested in income-producing equity securities. Portfolio

managers from subadviser Nicholas-Applegate Capital Management will manage

the fund.

Each fund will offer Class A, Class B, Class C and Class Y shares.

For general accounts, the minimum initial investment for each fund will be $1,000

and $50 for subsequent investments.

Enterprise Capital Management, Atlanta, was formed in 1986.

-By Marc A. Wojno, Dow Jones Newswires/Federal Filings Business News; 202628-9792

SMARTMONEY.COM: Global Good Will Hunting

By DAWN SMITH

NEW YORK -- As manager of the socially responsible Citizens Global Equity

fund (WAGEX), Sevgi Ipek scours the globe for fast-growing companies with a

conscience.

That mandate led her heavily into technology, and thus into troublesome times

since last March. But it's been a hard habit to break, as the fund focuses on

growth, and many Old Economy sectors, despite their recent progress, are offlimits because of the fund's social screens. As a result, the portfolio shed 19% in

2000 and is down 20% so far this year. Nonetheless, its long-term record is

intact: The fund gained 14.52% annualized over the past five years, slightly

better than the S&P 500 index.

Right now, about 55% of the fund's assets are invested overseas, with the largest

allocations in the U.K. (10%), Japan (7.5%) and Spain (5.8%). (For investors who

want foreign stocks primarily, Ipek also manages the Citizens International

Growth fund (sorry, no snapshot available), launched in December 2000.) Not

surprisingly, Ipek travels often; she's preparing to visit Japan later this week to

size up the country's recent progress. "It seems [the Japanese] are willing to

handle the bank-loan problems at the moment," she says. "We'll have to see if

they indeed act on it."

These days, Ipek is trying to steer her portfolio away from technology and

telecom; valuations, she says, have become much more important. As a result, a

mix of sectors is represented by the fund's largest holdings, which include AOL

Time Warner (AOL), Toyota Motor (TM) and Pepsico (PEP).

Ipek may head a socially responsible fund, but investors apparently needn't

worry about her listening to her heart and not her head. A native of Turkey, Ipek

says she has never invested in her homeland, though she has followed it

throughout her career. "Too much volatility, too much uncertainty," she says.

"They've never, ever delivered on the economic reforms, the political reforms.

They've always disappointed."

We spoke with Ipek recently to gain her international insights. You can chat with

her online tonight, March 27, at 8 p.m. ET, when she joins the ranks of our

SmartMoney Stock Pickers.

SmartMoney.com: Your investment strategy involves both a macroeconomic

view and individual company research. Could you explain how that works for

you?

Sevgi Ipek: It's a combination of top-down and bottom-up investing. The topdown view, the macroeconomic view, is dedicated to assessing which countries

and which sectors of the economy we favor going forward. That guides us in our

decision regarding the country and sector allocation of the fund. We look at the

broad macroeconomic data: gross domestic product growth, inflation, monetary

policy.

[On the company level,] we tend to take a growth approach and try to identify

companies that have demonstrated very strong market share and earnings in the

past on the top-line - on the revenue side - and on the bottom-line - on the profit

side. And we look for companies that not only have a good earnings track record,

but [stability in] those earnings. We tend to avoid companies that have high

volatility in their earnings trends and focus on stable growers.

SmartMoney.com: Could you give me a recent example of that process in

action?

SI: Spain has a very good track record within the European Union in terms of

economic growth. And in terms of growth, the construction sector has been in a

strong trend. With Spain catching up [to] the income level of other European

countries - in wages and salary in general - there's also been a change in

mentality toward home ownership. This created a very nice market for

construction companies both on the residential and commercial side. Also, the

government, which is upgrading the country's infrastructure, has been a big

spender. That combination provided a very good outlook for the companies in

this sector. We tried to pick the companies that are in the best position to take

advantage of that growth - the largest market share, the most competitive

situation in the market, strong management, good corporate governance - and

those that have consistently delivered on market expectations. And valuation, of

course. [We own] Dragados: It is both a homebuilder and in commercial

construction and is also involved in infrastructure, such as road-building. That's

our biggest position in Spain, where we have about 5% of our assets.

SmartMoney.com: According to the Citizens Global Equity fund's prospectus, you

must have at least 50% of your assets overseas.

SI: That has been a little bit of a problem. We've had lots of problems with the

currencies overseas over the past 12 months. The euro has been in a very

difficult situation since [it was launched], and also, we had the new Central Bank

to govern monetary policy for all the European Union countries. It seems that the

market has been on the cautious side, trying to see if this institution is going to be

able to gain the necessary credibility and conduct a monetary policy that has no

precedent in Europe. Also, there's the fact that there have been a lot of capital

outflows from Europe into the U.S. That has worked against the European Union.

SmartMoney.com: But we've witnessed a boost in the emerging markets this

year.

SI: That was a dead-cat bounce, more than anything else. Fundamentally, there

were very few reasons why those markets would rebound that fast and that

much. It was more on a liquidity basis, because the U.S. was cutting interest

rates and injecting liquidity into the system, and some of that spilled over into

emerging markets. [We have] very little exposure to [emerging markets] - less

than 5% of assets.

SmartMoney.com: You speak several languages, including Turkish. Does this

help when researching foreign companies?

SI: I was born in Turkey, but I was raised and educated in Belgium. [It has helped

me] to fit in culturally - to understand the mentality and how businesses,

especially management, operate and think. A lot of people, for example, believe

that we can have overseas the same kind of quick restructuring that we see in

U.S. corporations. Especially in Europe, people expect that companies can turn

around and restructure in a matter of a few months. Usually that is very difficult to

do because of all the labor and regulation handicaps that those companies have

in the markets in which they operate. So you have to have a good understanding

of the regulatory framework of the countries. Having lived there and having gone

through those regulatory situations, you get a better handle on the situation and

how things can happen - or not happen.

SmartMoney.com: How does the socially responsible element of the fund come

into play? Specifically, how do you work with Citizens' research department?

SI: I focus on investments and try to identify the best companies going forward.

Citizens uses two sets of social screens. One we call an exclusionary screen,

which means that we exclude companies involving tobacco, gambling, nuclearpower generation, animal testing, alcohol and so on. Since the exclusionary

screens are quite obvious, I do the initial screens on the companies myself. The

second set of screens is more in-depth - qualitative screens that Citizens

handles. When I identify good companies and good names for investment that

are not involved in tobacco, alcohol, gambling, petroleum industry and so on, I

send those names over to [Citizens] for in-depth screening.

SmartMoney.com: Are there sectors you avoid overall because of the

exclusionary screen?

SI: In general, the tobacco and personal care [sectors] and the beverage sector,

with a few exceptions, like Coca-Cola (KO) and Pepsico [two of the fund's

holdings]. Usually basic materials, like metals and mining; most of the chemical

sectors, and also the paper and forest-products sector. And in the energy sector,

the oil companies and oil-services companies usually do not pass the screens.

The personal-care companies, most of them still conduct animal testing, and also

the pharmaceutical companies that have skin-care and personal-products

divisions. [However] animal testing for drugs is OK, because you need to do that.

SmartMoney.com: A lot of socially responsible funds appear to be heavy in

technology because they exclude so many other sectors. Is that why your fund is

heavy in tech?

SI: Those stocks had been very good investments until March of 2000. They

were exceptional performers, and the fundamentals were in place, until we had a

little bit of overexcitement over the sector. Having said that, the social screens do

guide us to be more heavily weighted in this sector.

SmartMoney.com: Which technology stocks have you sold off completely in the

past few months?

SI: We had very good performers in many of those technology stocks, and we

decided to take our profits and stay on the sidelines on some names. We sold

Network Appliance (NTAP) in the storage-device sector. We sold Cisco Systems

(CSCO), and we reduced some other holdings. We had a position in Ariba

(ARBA), which did very well for us, but we sold it when the market's

fundamentals became a bit more uncertain.

SmartMoney.com: What sectors and stocks have you been moving into as a

result?

SI: I've been targeting more of the interest-rate-sensitive sectors of the economy

and looking more into the Old Economy. Although everything is suffering now

because of the economic slowdown, I believe ultimately that because of these

interest-rate reductions and increased liquidity, these Old Economy companies

are going to be the main beneficiary of the current situation world-wide. I've been

increasing some of the names in the retail sector with the addition of the homeimprovement company Lowe's (LOW) and also Staples (SPLS).

SmartMoney.com: Are you investing in any other energy stocks?

SI: In the natural-gas sector I own Enron (ENE) and Dynegy (DYN). They have

been growing very fast in the past and have very good prospects, because

natural gas is going to be one of the best choices in energy going forward. And I

still own my large position in the electric utility AES (AES). It's very well

diversified geographically, and it takes advantage of growth prospects overseas,

especially in emerging markets, which are in need of a lot of development as far

as power is concerned.

SmartMoney.com: What do you still like in the technology sector?

SI: I still like the storage sector. I'm still holding onto my EMC (EMC) position,

which is the leader in that field, and the stock is quite attractive after having

corrected since the beginning of the year. The growth prospects are still very

strong. And I still like the Internet-infrastructure sector. I did take profits and sold

out of Cisco, but recently I've been nibbling at their main competitor, Juniper

Networks (JNPR), which is growing faster than Cisco and gaining market share

nonstop. The valuation on the stock, which was much too expensive a year ago,

has now come down to very attractive levels. I'm not very enthusiastic about the

PC sector, so I'm not really investing in any PC companies or related companies.

I'd rather find attractive entry points in the next-generation-technology

companies. I started buying a little bit of Ciena (CIEN) in the optical-networking

[switching] sector.

SmartMoney.com: What's your outlook for the portfolio for the rest of the year?

SI: Everything is happening much faster than anyone had anticipated. Europe

was holding its own until very recently, and now we are seeing the spillover

effects of the U.S. slowdown. All the economic indicators over there are

suggesting that we are going to see a steep decline. [But] we are seeing the

excess capacity being worked out of the system. And companies are adjusting

much faster to the economic slowdown than we've seen in the past. That means

we should also, hopefully, have a much faster recovery, probably toward the end

of this year, because you have to take into account that monetary stimulus and

easing take a little while to act. I would think with the fourth quarter of this year

we should already see some improvement in the economic outlook. Having said

that, this is a very big shock in some countries. Right now I'm a little bit worried

about what's going on in Argentina. If we were to have a big crisis in a major

country in Latin America - if we were to see a devaluation coming out of

Argentina - that would aggravate the situation.

For more information and analysis of companies and mutual funds, visit

SmartMoney.com at http://www.smartmoney.com/

Noah Investment Group, Inc: Noah Fund

Enter Symbol:

Friday, March 30, 2001

NOAHX

Source: Lipper Inc.

NET ASSET VALUE

Last:

14.36

Change:

+0.16

Percent

Change:

+1.13%

PERFORMANCE

4-Week:

Year-to-date:

1-Year:

3-Year (annualized):

Fund Return

-9.5%

-21.9%

-47.3%

-1.0%

5-Year (annualized):

N/S

10-Year (annualized):

N/S

52-Week High:

52-Week Low:

27.91

13.94

Vs. all Funds in Objective

Rank

D

D

E

D

Percentile

33

30

15

20

Objective: Large-Cap Growth

How to read these charts

INFORMATION

Investment

Objective:

Investment

Policy:

Large-Cap Growth

Free Fund

The Fund seeks capital appreciation consistent with preservation of Prospectus

capital, as adjusted for inflation, and current income.

Fund Manager

(Tenure):

William L. Van Alen,

Jr.

(since 1998)

Total Net Assets:

$13.3 Million

Phone:

800-794-6624

Distribution Channel:

Minimum Initial Investment:

$1000

Maximum Sales Charge:

0%

Maximum Redemption Charge:

0%

Total Expense Ratio:

2.15%

Convertible

Cash/Equiv.

0%

0%

Direct

HOLDINGS

Asset Allocation

Stocks

Bond

Other

91.2%

0%

8.8%

Top Sectors

Top Holdings

Total Net

Assets

Electronic Technology

Retail Trade

Health Technology

Technology Services

Consumer Services

Communications

Commercial Services

Finance

Consumer Non-Durables

Transportation

Total Net

Assets

CISCO SYSTEMS INC

WAL-MART STORES INC

PFIZER INC.

AMERICA ONLINE INC

HOME DEPOT INC (USA)

APPLIED MICRO CIRCUITS CORPORA

MERCK & CO (USA)

COMVERSE TECHNOLOGY INC

QUALCOMM (USA)

JDS UNIPHASE CORP

43.8%

16.2

13.6

8

4.3

4.1

3.1

2.5

1.6

0.7

DISTRIBUTION HISTORY

8.3%

6.2

4.7

4.2

4

3.5

3.5

2.3

2.2

2.1

(as of 2/28/01)

Income Capital Gains

Year Distribution Distribution

2001

$0

$0

2000

$0

$0

1999

$0

$1.59

1998

$0.44

$0

1997

$0

$0.09

1996

$0.04

$0

Return to top of page

Copyright © 2001 Dow Jones & Company, Inc. All Rights Reserved.

Timothy Plan: Timothy Plan Small Cap Value Fund;

Class A Shares

Enter Symbol:

Friday, March 30, 2001

TPLNX

Source: Lipper Inc.

NET ASSET VALUE

Last:

12.05

Change:

+0.20

Percent

Change:

+1.69%

PERFORMANCE

4-Week:

Year-to-date:

1-Year:

3-Year (annualized):

5-Year (annualized):

Fund Return

-9.0%

8.3%

7.9%

5.0%

9.7%

10-Year (annualized):

N/S

52-Week High:

52-Week Low:

14.04

11.13

Vs. all Funds in Objective

Rank

E

A

A

B

C

Percentile

7

98

82

76

54

Objective: Small-Cap Core

How to read these charts

INFORMATION

Investment

Small-Cap Core

Objective:

Investment

Policy:

Other Share

Classes:

The Fund seeks long-term capital growth and its secondary objective is current

income. The Fund seeks to achieve its objective while abiding by the ethical

standards established for investments by the Fund. The Fund invests primarily in

small-cap stocks and ADR's.

Timothy Plan: Timothy Plan Small Cap Value Fund; Class B Shares

Fund Manager (Tenure):

Awad & Associates

(since 1997)

Total Net Assets:

Phone:

$16.5 Million

800-662-0201

Distribution Channel:

Minimum Initial Investment:

$1000

Maximum Sales Charge:

5.5%

Maximum Redemption Charge:

0%

Total Expense Ratio:

1.6%

Dealer

HOLDINGS

Asset Allocation

Stocks

Bond

Other

79.2%

0%

20.9%

Convertible

Cash/Equiv.

Top Sectors

0%

0%

Top Holdings

Total Net

Assets

Finance

Electronic Technology

Consumer Services

Commercial Services

Health Services

Producer Manufacturing

Non-Energy Minerals

Industrial Services

Process Industries

Technology Services

30.5%

21.5

12.9

11.6

4.7

4.6

4

3.1

2.7

2.6

DISTRIBUTION HISTORY

Total Net

Assets

DORAL FINANCIAL CORP

INVESTMENT TECHNOLOGY GROUP

AVID TECHNOLOGY INC

JOHN WILEY & SONS INC 'A'

NORTH FORK BANCORP INC

RESEARCH IN MOTION LTD

VENTIV HEALTH INC

ANNUITY AND LIFE RE (HOLDINGS)

MARTIN MARIETTA MATERIALS INC

PENTON MEDIA INC

8.6%

6.9

5.3

5.2

5

5

4.1

4.1

4

3.9

(as of 2/28/01)

Income Capital Gains

Year Distribution Distribution

2001

$0

$0

2000

$0

$2.51

1999

$0

$0

1998

$0

$0

1997

$0

$1.38

1996

$0.10

$0

Return to top of page

Copyright © 2001 Dow Jones & Company, Inc. All Rights Reserved.

MMA Praxis Mutual Funds: MMA Praxis Growth Fund;

Class A Shares

Enter Symbol:

Friday, March 30, 2001

MMPAX

Source: Lipper Inc.

NET ASSET VALUE

Last:

13.52

Change:

+0.16

Percent

Change:

+1.20%

PERFORMANCE

Fund Return

-3.6%

-7.3%

-10.4%

4-Week:

Year-to-date:

1-Year:

3-Year (annualized):

N/S

5-Year (annualized):

N/S

10-Year (annualized):

N/S

52-Week High:

52-Week Low:

16.04

13.06

Vs. all Funds in Objective

Rank

B

D

E

Percentile

66

23

12

Objective: Multi-Cap Value

How to read these charts

INFORMATION

Investment

Objective:

Investment Policy:

Multi-Cap Value

The Fund seeks capital appreciation. To a lesser extent, it seeks current

income.

Other Share Classes: MMA Praxis Mutual Funds: MMA Praxis Growth Fund; Class B Shares

Fund Manager

(Tenure):

Horning (since 2000)

Nussbaum (since

2000)

Total Net Assets:

$17.7 Million

Phone:

800-977-2947

Distribution Channel:

Minimum Initial Investment:

Maximum Sales Charge:

$500

5.25%

Maximum Redemption Charge:

Total Expense Ratio:

0%

1.203%

NA

HOLDINGS

Asset Allocation

Stocks

Bond

Other

1.8%

0%

0%

Convertible

Cash/Equiv.

Top Sectors

93.1%

5.1%

Top Holdings

Total Net

Assets

Finance

Electronic Technology

Producer Manufacturing

Consumer Non-Durables

Health Technology

Industrial Services

Retail Trade

Communications

Process Industries

Technology Services

17.1%

16.9

11.6

11.2

11.1

7.1

6.5

6.4

5.2

4.1

DISTRIBUTION HISTORY

Total Net

Assets

FEDERAL NAT'L MRTGE ASSN.

PEPSICO INCORPORATED

PFIZER INCORPORATED

WELLS FARGO COMPANY

TELLABS

WILLIAMS CO. INC.

ST. JUDE MEDICAL, INC.

WILLAMETTE INDUSTRIES INC

PROCTER & GAMBLE CO.

BROADWING INC.

3.7%

3.6

3.3

3.2

2.9

2.9

2.7

2.7

2.6

2.6

(as of 2/28/01)

Income Capital Gains

Year Distribution Distribution

2001

$0

$0

2000

$0

$0.38

1999

$0

$2.14

1998

$0

$0

1997

$0

$0

1996

$0

$0

The Aquinas Funds, Inc.: Aquinas Growth Fund

Enter Symbol:

AQEGX

Friday, March 30, 2001

Source: Lipper Inc.

NET ASSET VALUE

Last:

14.47

Change:

+0.16

Percent

Change:

+1.12%

PERFORMANCE

4-Week:

Year-to-date:

1-Year:

3-Year (annualized):

5-Year (annualized):

Fund Return

-8.0%

-16.9%

-20.6%

4.5%

13.4%

10-Year (annualized):

N/S

52-Week High:

52-Week Low:

22.51

13.94

Vs. all Funds in Objective

Rank

B

B

A

C

B

Percentile

75

76

89

43

69

Objective: Multi-Cap Growth

How to read these charts

INFORMATION

Investment

Multi-Cap Growth

Objective:

Investment

The Fund seeks long-term capital appreciation by investing a diversified portfolio of

Policy:

equity securities that are believed to offer above average potential for growth in

revenues, profits, or cash flow.

Fund Manager

(Tenure):

Total Net Assets:

Minimum Initial Investment:

Team Managed

$64. Million

Phone:

800-423-6369

Distribution

Channel:

Affinity with an

organization

$500

Maximum Sales Charge:

0%

Maximum Redemption Charge:

0%

Total Expense Ratio:

1.41%

HOLDINGS

Asset Allocation

Stocks

93.2%

Convertible

1.5%

Bond

Other

0%

0%

Cash/Equiv.

5.3%

Top Sectors

Top Holdings

Total Net

Assets

Consumer Services

Electronic Technology

Finance

Technology Services

Health Technology

Health Services

Producer Manufacturing

Commercial Services

Retail Trade

Industrial Services

Total Net

Assets

RADIO ONE, INC. CVT 6.5%, 7/15

TENET HEALTHCARE CORP.

GENERAL ELECTRIC CO.

KINDER MORGAN, INC.

PFIZER, INC.

CONCORD EFS, INC.

PAYCHEX, INC.

HEALTH MGMT ASSOC. INC.

CISCO SYSTEMS, INC.

WATERS, CORP.

36.1%

12.1

10.1

7.4

7

5.3

4.9

4.5

3.9

3.1

DISTRIBUTION HISTORY

32.9%

3.5

2.3

1.9

1.8

1.8

1.7

1.5

1.4

1.3

(as of 2/28/01)

Income Capital Gains

Year Distribution Distribution

2001

$0

$0

2000

$0

$2.57

1999

$0

$2.15

1998

$0

$0.85

1997

$0

$2.21

1996

$0

$1.46

http://www.homepage.villanova.edu/john.mcfadden

Amana Mutual Funds Trust: Growth Fund

Enter Symbol:

AMAG

Friday, March 30, 2001

NET ASSET VALUE

Source: Lipper Inc.

Last:

Change:

Percent

52-Week High:

52-Week Low:

11.64

+0.20

Change:

+1.75%

18.69

Vs. all Funds in Objective

PERFORMANCE

4-Week:

Year-to-date:

1-Year:

3-Year (annualized):

5-Year (annualized):

Fund Return

-7.8%

-17.9%

-33.1%

15.0%

15.0%

10-Year (annualized):

N/S

Rank

B

B

B

A

B

11.44

Percentile

77

75

70

92

79

Objective: Multi-Cap Growth

How to read these charts

INFORMATION

Investment Objective: Multi-Cap Growth

Investment Policy:

The Fund seeks long-term capital appreciation consistent with Islamic

principles.

Fund Manager

(Tenure):

Total Net Assets:

Nicholas Kaiser

(since 1994)

$23.8 Million

Phone:

800-728-8762

Distribution

Channel:

Affinity with an

organization

Minimum Initial Investment:

$100

Maximum Sales Charge:

0%

Maximum Redemption Charge:

0%

Total Expense Ratio:

1.45%

Convertible

Cash/Equiv.

0%

0%

HOLDINGS

Asset Allocation

Stocks

Bond

Other

90.8%

0%

9.2%

Top Sectors

Top Holdings

Total Net

Assets

Electronic Technology

Health Technology

Technology Services

Transportation

Total Net

Assets

QUALCOMM (USA)

BUSINESS OBJECTS SA ADR

CISCO SYSTEMS INC

INTUIT INC

33.2%

12.1

11.5

6.9

16.4%

6.1

4.7

4.1

Industrial Services

Commercial Services

Communications

Consumer Services

Producer Manufacturing

Consumer Durables

5.2

5.1

4.8

4.8

3.5

3.4

ADVANCED DIGITAL INFORMATION C

SOUTHWEST AIRLINES INC

SBC COMMUNICATIONS INC (USA)

SYMBOL TECHNOLOGIES INC

CONVERGYS CORP

WILLIAMS COS

DISTRIBUTION HISTORY

(as of 2/28/01)

Income Capital Gains

Year Distribution Distribution

2001

$0

$0

2000

$0.46

$0

1999

$0

$0.22

1998

$0

$0

1997

$0

$0.16

1996

$0

$0.23

Saturday, March 31, 2001

Markets Data Bank at 12:57 p.m.

Closing Stock Data Bank is available using the link at left.

Dow Jones Averages

30 Industrials

20 Transportation

15 Utilities

65 Composite

DJ U.S. Total Market

DJ U.S. Small-Cap

DJ U.S. Mid-Cap

DJ U.S. Large-Cap

New York Stock Exchange

Compositea

Industrialsa

Utilitiesa

Transportationa

Financea

Standard & Poor's Indexes

500 Index

Industrials

Utilities

3.9

3.7

3.4

3.3

3.3

3.3

Last

9878.78

2771.36

381.42

3059.97

267.02

270.09

266.68

265.31

Last

595.66

729.20

394.69

454.83

585.48

Last

1160.33

1330.63

323.57

Change

79.72

17.93

8.25

33.28

2.98

4.45

2.28

2.99

Change

6.98

6.76

5.62

5.57

10.57

Change

12.38

9.98

6.97

Source: Reuters

% Change

0.81 %

0.65

2.21

1.10

1.13

1.68

0.86

1.14

% Change

1.19 %

0.94

1.44

1.24

1.84

% Change

1.08 %

0.76

2.20

400 MidCap

600 SmallCap

Nasdaq Stock Market

Composite

Nasdaq 100

Industrials

Insurance

Banks

Computer

Telecommunications

Other U.S. Indexes

Amex Compositea

Russell 1000

Russell 2000

Russell 3000

Value-Line (geom.)

U.S. Stock

Market Diary

New 52 Week Highs

New 52 Week Lows

Advancing Issues

Declining Issues

Unchanged Issues

Total Issues Traded

Advancing Volume

Declining Volume

Unchanged Volume

Total Volume

Internet Indexes

DJ Composite Internet

DJ Internet Commerce

DJ Internet Services

TheStreet.com Internet

AMEX Interneta

CBOE Internet

Non-U.S. Stock Indexes

Toronto, 300 Index

Tokyo, Nikkei 225

Hong Kong, Hang Seng

London, FTSE 100a

Frankfurt, Xetra Dax

Paris, CAC 40

Brussels, Bel-20

Milan, MIBtel

459.92

204.78

Last

1840.26

1573.25

1230.11

2066.26

1883.23

888.01

328.08

Last

877.04

610.36

450.53

635.67

369.25

3.61

4.22

Change

19.69

10.11

11.20

55.49

39.95

7.36

3.73

Change

15.59

6.63

9.00

7.32

5.66

0.79

2.10

% Change

1.08 %

0.65

0.92

2.76

2.17

0.84

1.15

% Change

1.81 %

1.10

2.04

1.16

1.56

NYSE

94

67

2100

965

206

3271

836,132,260

433,557,220

11,202,380

1,280,891,860

Last

69.70

43.57

86.26

224.20

167.47

155.90

Last

7608.00

12999.70

12760.64

5633.70

5829.95

5180.45

2838.41

25937.00

AMEX

23

35

444

244

98

786

65,773,595

8,443,275

1,458,700

75,675,570

Change

4.32

2.84

5.11

11.10

5.09

6.90

Change

163.22

-72.66

82.75

45.30

-49.35

22.53

76.03

658.00

Nasdaq

122

279

2363

1416

571

4350

1,207,391,940

873,178,460

65,735,897

2,146,306,297

% Change

6.61 %

6.97

6.30

5.21

3.13

4.63

% Change

2.19 %

-0.56

0.65

0.81

-0.84

0.44

2.75

2.60

Zurich, Swiss Market

Amsterdam, AEX

Johannesburg, All Share

Madrid, IBEX 35

Stockholm, General

DJ Stoxx 50

DJ Stoxx 600

DJ Europe/Africa

DJ World Stock Index

Treasury Securities

Two-Year Notec

Five-Year Notec

Ten-Year Notec

30-Year Bondc

Currency Markets

Japanese Yen (per dollar)

Euro (in dollars)

British Pound (in dollars)

Euro/Sterling

Swiss Franc (per dollar)

Commodities

7167.80

558.36

8053.20

9308.30

3867.96

4004.89

321.70

155.00

182.46

Change

6/32

14/32

21/32

25/32

Last

126.25

0.8700

1.4163

0.6140

1.7433

Change

122.90

5.59

-263.00

85.50

-51.10

24.77

1.58

-0.53

0.61

Yield %

4.209 %

4.551

4.915

5.445

Prior Day*

126.21

0.8780

1.4159

0.6197

1.7413

Last

Dow Jones-AIG Commodity Index -1.258

105.399

Goldman Sachs Commodity Index

Gold, April ($ per ounce)d

Gold, June ($ per ounce)d

Oil, May W. Tex, int. ($/bbl.)b

Oil, June W. Tex, int. ($/bbl.)b

S&P 500 Index, Juneb

S&P 500 Index, Sepb

DJ Industrial Average, Juneb

DJ Industrial Average, Sep b

212.74

257.90

259.20

26.70

26.75

1180.50

1184.70

10045.00

9780.00

-2.48

-0.90

-1.20

0.22

0.27

7.50

7.50

95.00

95.00

1.74

1.01

-3.16

0.93

-1.30

0.62

0.49

-0.34

0.34

Settle**

258.80

260.40

26.48

26.48

1180.00

1189.70

10043.00

10124.00

Footnotes:

* Late Friday in New York.

a Delayed 20 minutes.

b Nymex, CBOT, CME and after-hours electronic trading.

c As of 5:30 p.m. EST

d At close of day session on Friday.

** Settle prices for commodity futures reflect the most recent close of trading as

follows:

Gold (Comex) - 2:30 p.m. EST, M-F

Oil (Nymex) - 3:10 p.m. EST, M-F

| Most Active Stocks | Percentage Gainers | Percentage Losers |

| Volume Percentage Leaders | Dow Jones Averages Charts |

| Index to Market Data |

Return to top of page

Copyright © 2001 Dow Jones & Company, Inc. All Rights Reserved.