Finishline Project

advertisement

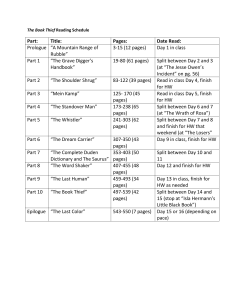

Dillman Company Background The Finish Line, Inc. is a company with a mission to “provide the best selection of sport inspired footwear, apparel and accessories to fit the fast culture of action addicted individuals.” “Finish Line, Inc. is a leading athletic retailer specializing in brand name footwear, apparel and accessories. Every Finish Line store offers the best selection of product built for your Sport.Life.Style. Finish Line began operations in 1976 in Indianapolis, Indiana, and currently serves customers in over nearly 700 Finish Line stores, nearly 90 Man Alive stores and 15 Paiva stores and online.” Finish Line, Inc. has introduced Sport.Life.Style to govern their core values. At Finish Line, Inc. Sport is in everything they do. It is reflected in their products, the environment of their stores, and is defined by their brands. The Life part of Sport.Life.Style is to show that their products are more than just between buzzers in a game, they are perfect for anytime between sunrise and sunset. Style guarantees that Finish Line, Inc. has the latest and “coolest” styles available in their stores and online. Finish Line, Inc. operates three different stores under their owndership. The first, and largest, store is Finish Line. This store is an athletic specialty retailer. They also own and operate Man Alive and Paiva. Man Alive is “one of the nation’s leading street fashion retailers bringing bold, cutting edge, brand name style from around the world into each store.” Paiva is a “unique, premium athletic store that offers integrated presentation of branded and private label apparel and accessories as well as branded footwear that blends performance with style, exclusively for active women who demand an elevated Dillman level of service.” Currently, Finish Line, Inc. operates 795 stored in 47 states in the United States. Of those stores, 86 were Man Alive retailers and 13 were Paiva stores. Year 2007 The Finish Line, Inc. endured an interesting year for the 2007 fiscal year. In the retail stores, there were weaknesses in performance, classics, women’s, and softgoods that is believed to be due to a “lack of differentiation in the mall.” In order to fix this issue, Finish Line is working to improve the shopping environment, differentiate the merchandise mix, and store layout. During the year, 40 new Finish Line stores were opened, 17 were remodeled, and 7 were closed. There was an increase of 5% in the amount of Finish Line stores in operation from 2006. The Finish Line, Inc. also opened 37 new Man Alive stores and 13 Paiva stores. The following sheets are The Finish Line, Inc.: balance sheet, followed by a horizontal and vertical analysis of the balance sheet, income statement, followed by a horizontal and vertical analysis of the income statement, cashflows sheet, shareholders’ equity sheet, a ratio analysis sheet, and a ratio analysis formula sheet showing the formulas used to obtain the numbers in the ratio analysis. Dillman Analysis Profitability Understanding a company’s profitability is very important. Measuring current and past profitability and trying to predict future profitability is crucial. Profitability is measured with income and expenses. Profitability ratios measure the income or operating success of an enterprise for a given period of time. Profitability is often used as the ultimate test of management’s operating effectiveness. The Finish Line, Inc.’s profitability ratios can be found on the Ratio Analysis sheet. The company’s profit margin was 2% and the gross profit margin was 30%. There was a 5.04% return on assets and a 7.37% return on common stockholders’ equity. There was a payout ratio of 14.7%. Operating Earnings According to Investopedia.com, operating earnings are “profits after subtracting expenses such as marketing, cost of goods sold, administration and general operating costs from revenue.” In 2007, The Finish Line, Inc. posted an operating earnings of $51,179. Profit Margin According to Investopedia.com, profit margin is “A ratio of profitability calculated as net income divided by revenues, or net profits divided by sales. It measures how much out of every dollar of sales a company actually keeps in earnings.” I calculated The Finish Line, Inc.’s profit margin to be 2%. This means that the company has a net income of $0.02 for every dollar of sales. This is not very good. Liquidity Dillman Investopedia.com defines liquidity as “the degree to which an asset or security can be bought or sold in the market without affecting the asset's price and/or the ability to convert an asset to cash quickly.” Liquidity ratios measure the short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash. Finish Line posted 0 marketable securities for the 2007 fiscal year, a drop of $49,075 from the 2006 fiscal year. According to my calculations, for every dollar of current liabilities, Finish Line, Inc. has $2.66 of current assets. The receivables are collected on average every 3.3 days. Inventory is sold on average every 108 days. This is because the stores sell specialized goods. Solvency Solvency ratios measue the ability of a company to survive over a long period of time. Finish Line posts a debt to total assets ratio of 21.8%. This means that creditors have provided 21.8% of Finish Line, Inc.’s total assets. A low ratio of debt to total assets is usually desirable. The times interest earned provides an indication of the company’s ability to meet interest payments as they come due. Based on my calculations, Finish Line, Inc. has a times interest earned of 2.68 times. This means that their interest expense is covered 2.68 times. Inventory Investopedia.com defines inventory as “the raw materials, work-in-process goods and completely finished goods that are considered to be the portion of a business's assets that are ready or will be ready for sale.” During the 2007 fiscal year, Finish Line, Inc. posted an amount of -$18,710 in merchandise inventories. As previously stated, Dillman their inventory turnover ratio was 3.3 times which translated into inventory being turned over every 108 days. Earning per Share (EPS) Earnings per share is a measure of the net income earned on each share of common stock. As reported in the 2007 Annual Report, The Finish Line, Inc. has 42,575,462 outstanding class A common stock and 5,141,336 outstanding class B common stock as of April 20, 2007. Given this data, I calculated the book value per share as $9.53. The earnings per share were $0.68. The price-earnings ratio was 19.28 times. This means that each share of Finish Line’s stock sold for 19.28 times the amount that was earned on each share. My Opinion If I wanted to invest in a long-term company, I would invest in The Finish Line, Inc. If I was looking to invest in a company that I could make quick money off of, I would not want to invest in The Finish Line, Inc. Given the data I gathered and reported in this analysis, The Finish Line, Inc. has longevity. It is a corporation that will be around for a long time. It is not, however, making a lot of money right now. Given the current state of the retail industry and the decreasing value of the US dollar, The Finish Line, Inc. will continue to post low profit margins. The company is optimistic about the future. There are current plans to open up 20-25 new Finish Line stores, 10-15 new Man Alive stores, and 2 Paiva stores within the next fiscal year. While their sales are down in stores, the internet continues to post positive numbers. They plan to have double-digit growth in both online and catalog sales Dillman next year. In order to do this, the company will increase catalog circulation and their online marketing program. Additionally, the company has initiatives in place with Nike and Under Armour which should improve the softgood apparel business in the 2008 fiscal year. The president of the company feels that “the investments to be made in fiscal 2008 with traditional athletic performance brand partners, along with the relationships they are developing with new and existing sport style brands, will be important to the future success. They expect that business will remain challenging in the short term, but are confident in the profitability and long-term growth of the company.”