Beta: Know The Risk

advertisement

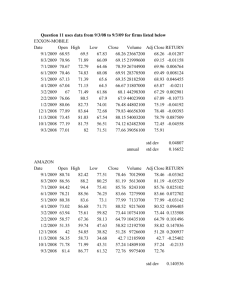

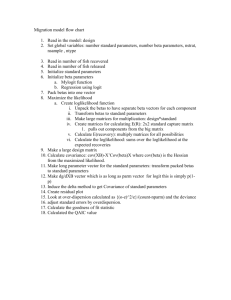

Beta A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), a model that calculates the expected return of an asset based on its beta and expected market returns. Also known as "beta coefficient." Investopedia Says... Beta is calculated using regression analysis, and you can think of beta as the tendency of a security's returns to respond to swings in the market. A beta of 1 indicates that the security's price will move with the market. A beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 indicates that the security's price will be more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market. Many utilities stocks have a beta of less than 1. Conversely, most high-tech, Nasdaqbased stocks have a beta of greater than 1, offering the possibility of a higher rate of return, but also posing more risk. Related Terms Capital Asset Pricing Model - CAPM A model that describes the relationship between risk and expected return and that is used in the pricing of risky securities... Related Terms Unlevered Beta A type of metric that compares the risk of an unlevered company to the risk of the market. The unlevered beta is the beta of a company without any debt. Unlevering a beta removes the financial effects from leverage.. Related Terms Alpha 1. A measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund's alpha... Beta: Know The Risk August 07 2012| Filed Under » Financial Theory, Formulas, Investing Basics, Investment, Stock Analysis How should investors assess risk in the stocks they buy or sell? As you can imagine, the concept of risk is hard to pin down and factor into stock analysis and valuation. Is there a rating - some sort of number, letter or phrase - that will do the trick? One of the most popular indicators of risk is a statistical measure called beta. Stock analysts use this measure all the time to get a sense of stocks' risk profiles. SEE: Beta: Gauging Price Fluctuations Here we shed some light on what the measure means for investors. While beta does say something about price risk, it has its limits for investors looking for fundamental risk factors. Beta Beta is a measure of a stock's volatility in relation to the market. By definition, the market has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market. A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than the market, the stock's beta is less than 1.0. Highbeta stocks are supposed to be riskier but provide a potential for higher returns; lowbeta stocks pose less risk but also lower returns. Beta is a key component for the capital asset pricing model (CAPM), which is used to calculate cost of equity. Recall that the cost of capital represents the discount rate used to arrive at the present value of a company's future cash flows. All things being equal, the higher a company's beta is, the higher its cost of capital discount rate. The higher the discount rate, the lower the present value placed on the company's future cash flows. In short, beta can impact a company's share valuation. Watch: Understanding Beta Advantages of Beta To followers of CAPM, beta is a useful measure. A stock's price variability is important to consider when assessing risk. Indeed, if you think about risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. Intuitively, it makes plenty of sense. Think of an early-stage technology stock with a price that bounces up and down more than the market. It's hard not to think that stock will be riskier than, say, a safe-haven utility industry stock with a low beta. Besides, beta offers a clear, quantifiable measure, which makes it easy to work with. Sure, there are variations on beta depending on things such as the market index used and the time period measured, but broadly speaking, the notion of beta is fairly straightforward to understand. It's a convenient measure that can be used to calculate the costs of equity used in a valuation method that discounts cash flows. Disadvantages of Beta However, if you are investing in a stock's fundamentals, beta has plenty of shortcomings. For starters, beta doesn't incorporate new information. Consider a utility company, let's call it Company X. Company X has been considered a defensive stock with a low beta. When it entered the merchant energy business and assumed high debt levels, X's historic beta no longer captured the substantial risks the company took on. At the same time, many technology stocks are relatively new to the market and thus have insufficient price history to establish a reliable beta. Another troubling factor is that past price movements are very poor predictors of the future. Betas are merely rear-view mirrors, reflecting very little of what lies ahead. Furthermore, the beta measure on a single stock tends to flip around over time, which makes it unreliable. Granted, for traders looking to buy and sell stocks within short time periods, beta is a fairly good risk metric. However, for investors with long-term horizons, it's less useful. Re-Assessing Risk The well-worn definition of risk is the possibility of suffering a loss. Of course, when investors consider risk, they are thinking about the chance that the stock they buy will decrease in value. The trouble is that beta, as a proxy for risk, doesn't distinguish between upside and downside price movements. For most investors, downside movements are risk while upside ones mean opportunity. Beta doesn't help investors tell the difference. For most investors, that doesn't make much sense. There is an interesting quote from Warren Buffett in regards to the academic community and its attitude towards value investing: "Well, it may be all right in practice, but it will never work in theory." Value investors scorn the idea of beta because it implies that a stock that has fallen sharply in value is more risky than it was before it fell. A value investor would argue that a company represents a lower-risk investment after it falls in value - investors can get the same stock at a lower price despite the rise in the stock's beta following its decline. Beta says nothing about the price paid for the stock in relation to its future cash flows. If you are a fundamental investor, consider some practical recommendations offered by Benjamin Graham and his modern adherents. Try to spot well-run companies with a "margin of safety" - that is, an ability to withstand unpleasant surprises. Some elements of safety come from the balance sheet, like having a low ratio of debt to total capital. Some come from consistency of growth, in earnings or dividends. An important one comes from not overpaying. Stocks trading at low multiples of their earnings are safer than stocks at high multiples. The Bottom Line It's important for investors to make the distinction between short-term risk - where beta and price volatility are useful - and longer-term, fundamental risk, where big-picture risk factors are more telling. High betas may mean price volatility over the near term, but they don't always rule out long-term opportunities. Read more: http://www.investopedia.com/articles/stocks/04/113004.asp#ixzz2DvzlOAIc Beta: Gauging Price Fluctuations November 25 2012| Filed Under » Investing Basics, Risk Management, Stocks In investing, beta does not refer to fraternities, product testing or old videocassettes - in investing, beta is a measurement of market risk, or volatility. It is because of this risk that some people don't want to invest in stocks. These risk-averse investors can't stomach stocks' greater tendency to fluctuate in price. Sure, there is always the possibility that a stock will lose some or all of its value, but volatility also makes it possible for investors to make a great deal of money - if they make the right choices. What Is the Beta? Beta measures a stock's volatility - the degree to which its price fluctuates in relation to the overall market. In other words, it gives a sense of the stock's market risk compared to the greater market. Beta is used also to compare a stock's market risk to that of other stocks. Investment analysts use the Greek letter 'ß' to represent beta. This measure is calculated using regression analysis. A beta of 1 indicates that the security's price tends to move with the market. A beta greater than 1 indicates that the security's price tends to be more volatile than the market, and a beta less than 1 means it tends to be less volatile than the market. Many utility stocks have a beta of less than 1, and conversely, many high-tech Nasdaq-listed stocks have a beta greater than 1. Watch: Understanding Beta Essentially, beta expresses the fundamental tradeoff between minimizing risk and maximizing return. Let's give an illustration. Say a company has a beta of 2. This means it is two times as volatile as the overall market. Let's say we expect the market to provide a return of 10% on an investment. We would expect the company to return 20%. On the other hand, if the market were to decline and provide a return of -6%, investors in that company could expect a return of -12% (a loss of 12%). If a stock had a beta of 0.5, we would expect it to be half as volatile as the market: a market return of 10% would mean a 5% gain for the company. Here is a basic guide to various betas: Negative beta - A beta less than 0, which would indicate an inverse relation to the market - is possible but highly unlikely. However, some investors believe that gold and gold stocks should have negative betas because they tended to do better when the stock market declines. Beta of 0 - Basically, cash has a beta of 0. In other words, regardless of which way the market moves, the value of cash remains unchanged (given no inflation). Beta between 0 and 1 - Companies with volatilities lower than the market have a beta of less than 1 (but more than 0). As we mentioned earlier, many utilities fall in this range. Beta of 1 - A beta of 1 represents the volatility of the given index used to represent the overall market, against which other stocks and their betas are measured. The S&P 500 is such an index. If a stock has a beta of one, it will move the same amount and direction as the index. So, an index fund that mirrors the S&P 500 will have a beta close to 1. Beta greater than 1 - This denotes a volatility that is greater than the broadbased index. Again, as we mentioned above, many technology companies on the Nasdaq have a beta higher than 1. Beta greater than 100 - This is impossible as it essentially denotes a volatility that is 100 times greater than the market. If a stock had a beta of 100, it would be expected to go to 0 on any decline in the stock market. If you ever see a beta of over 100 on a research site it is usually the result of a statistical error, or the given stock has experienced large swings due to low liquidity, such as an overthe-counter stock. For the most part, stocks of well-known companies rarely ever have a beta higher than 4. Why You Should Know What Beta Is Are you prepared to take a loss on your investments? Many people are not and therefore opt for investments with low volatility. Other people are willing to take on additional risk because with it they receive the possibility of increased reward. It is very important that investors not only have a good understanding of their risk tolerance, but also know which investments match their risk preferences. And, by using beta to measure volatility, you can better choose those securities that meet your criteria for risk. Investors who are very risk averse should put their money into investments with low betas such as utility stocks and Treasury bills. Those investors who are willing to take on more risk may want to invest in stocks with higher betas. Many brokerage firms calculate the betas of securities they trade and then publish their calculations in a beta book. These books offer estimates of the beta for almost any publicly-traded company. The problem is that most of us don't have access to these brokerage books, and the calculation for beta can often be confusing, even for experienced investors. However, there are other resources. One of the better websites that publishes beta is Yahoo!! Finance (enter your company name, then click on Key Statistics and look under Stock Price History). The beta that is calculated on Yahoo! compares the activity of the stock over the last five years and then compares it to the S&P 500. A beta of "0.00" simply means that the stock either is a new issue or doesn't yet have a beta calculated for it. Warnings About Beta The most important caveat for using beta to make investment decisions is that beta is a historical measure of a stock's volatility. Past beta figures or historical volatility does not necessarily predict future beta or future volatility. In other words, if a stock's beta is two right now, there is no guarantee that in a year the beta will be the same. One study by Gene Fama and Ken French called "The Cross-Section of Expected Stock Returns" (published in 1992 in the Journal of Finance) on the reliability of past beta concluded that for individual stocks past beta is not a good predictor of future beta. An interesting finding in this study is that betas seem to revert back to the mean. This means that higher betas tend to fall back towards one and lower betas tend to rise towards one. The second caveat for using beta is that it is a measure of systematic risk, which is the risk that the market as a whole faces. The market index to which a stock is being compared is affected by market-wide risks. So, as beta is found by comparing the volatility of a stock to the index, beta only takes into account the effects of market-wide risks on the stock. The other risks the company faces are firm-specific risks, which are not grasped fully in the beta measure. So, while beta will give investors a good idea about how changes in the market affect the stock, it does not look at all the risks the company alone faces. Let's look at an old example. While numbers have changed significantly since 2005, this illustration still serves its purpose in describing the uses for beta. The following is a chart of IBM's stock for the trading period of June 2004 to June 2005. The red line is the IBM percent change over the period and the green line is the percent change of the S&P 500. This chart helps to illustrate how IBM moved in relation to the market, as represented by the S&P 500 during the one-year period. Data Source: Barchart.com On June 8, 2005, the beta for IBM on Yahoo! was 1.636, meaning that up to that point, IBM had the tendency to move more sharply in either direction compared to the S&P 500 - and the chart above demonstrates IBM's tendency for higher volatility. When the market moved up, IBM (red line) tended to move up more (see the October-toDecember range), and IBM's stock fell more than the market when it declined (see the Jan-to-Mar range). The large drop in IBM stock from March to April 2005, while coinciding with a smaller drop in the S&P, resulted from a firm-specific risk: the company missed earnings estimates. By showing IBM's behavior over this period, this chart demonstrates both the value that comes with the use of beta and the caution that needs to be shown when using it. It helps measure volatility, but it is not the whole story. The Bottom Line We hope this has helped shed some light on an often-underestimated financial ratio. Analysts, brokers and planners have used beta for decades to help them determine the risk level of an investment, and you should be aware of this risk measure in your investment decision-making. Read more: http://www.investopedia.com/articles/01/102401.asp#ixzz2Dw2mqK5u