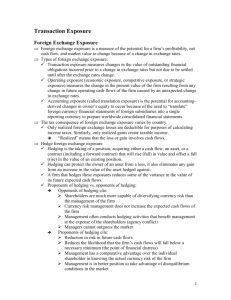

The hedge system of SFAS 133 requires that a hedge be highly

advertisement