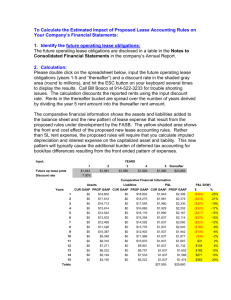

Another anonymously contributed property outline (2006)

advertisement