Group 5: THE MORTGAGEE'S POWER OF SALE

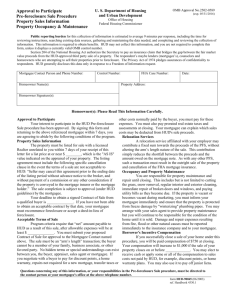

advertisement

THE MORTGAGEE’S POWER PROBLEMS AND SOLUTIONS OF SALE - SEMINAR PAPER PRESENTED TO THE SECURED CREDIT TRANSACTION 2010/2011 LL.M CLASS, FACULTY OF LAW, UNIVERSITY OF LAGOS BY: OMOSEDE OKPAIRU EFE UTAKE TAIWO LAKANU TEMIDAYO ODULAJA GABRIEL ONOJASON OLUWAPELUMI SIMPSON SUPERVISING AMOKAYE LECTURER: DR. OLUDAYO TABLE OF CONTENTS ABSTRACT INTRODUCTION CHAPTER 1: THE MORTGAGEE’S POWER OF SALE CHAPTER 2: PROBLEMS IN THE MORTGAGEE’S EXERCISE OF POWER OF SALE CHAPTER 3: SOLUTIONS TO THE PROBLEMS ASSOCAITED WITH THE MORTGAGEE’S EXERCISE OF ITS POWER OF SALE. THE MORTGAGEE’S POWER OF SALE - PROBLEMS AND SOLUTIONS ABSTRACT In the aftermath of the global economic depression, corporations and individuals alike are still toiling to re-position their business stakes, and this has led to the evolution of a wide array of financing solutions, of which collateralization is of prime concern to lenders. History would have us believe that trust, and not security weighed more for bankers in considering loan applications. Global trends now emphasise the quality of security in loan evaluations. In Nigeria, the weak economy has led to a high rate of loan defaults causing bankers to keep a keen eye on the quality of security. Laws also exist which make securities mandatory. Section 20 of the Banks and Other Financial Institutions Act (BOFIA) stipulates that facilities exceeding certain sums require security. It is also an offence under S. 15 (1) of the Failed Bank's Decree for bank Officers to advance unsecured or inadequately secured credit facilities to borrowers. The above are some of the reasons that compel the banking industry to pay a lot more attention to security issues. Land is generally accepted as prime security because it is fixed, it appreciates in value, and is an asset which may be easily liquidated. In enforcing the mortgage upon default by the mortgagor; particularly by exercising the power of sale, mortgagees have had to contend with a number of bottlenecks. It is against this background that we shall in this paper, review the mortgagee’s power of sale, highlight the attendant problems and attempt to proffer solutions. INTRODUCTION: “No one … by the light of nature ever understood English mortgage of real estate.” (Lord MacNaghten in Samuel vs. Jarrah Timber and Wood Paving Corporation1) We will take off on the assumption that the class has certain foundational knowledge of the different views on the concept of mortgage. Like law itself, there is no definition to foreclose all other definitions. Suffice to say, the essential nature of a mortgage is that it is a conveyance of a legal or equitable interest in property as an assurance of repayment of a loan, with a provision for redemption2. The law vests the mortgagor and the mortgagee alike with rights and obligations. The mortgagor has the right to the equity of redemption, the right to recover possession (where he parts with same upon the mortgage), and the mortgagor in possession has the power to make leases on the res. On the other hand, the mortgagor has an obligation to repay the loan (principal and interest). The rights and powers of the mortgagee include the right to enforce the covenant to repay, power to: a) enter into possession, 1 2 (1904) AC 323 at page 362 Megarry, A manual of law of Real property. (4th Edition) page 460 b) sell the mortgage property in satisfaction of mortgage debt, c) appointment a receiver, d) foreclose mortgagor’s equity of redemption. Of all these perhaps the most potent is the mortgagee’s power of sale. However, as with other rights of the mortgagee, over the years, the potency of the mortgagee’s power of sale upon the lapse of the contractual due date, has been whittled down by judicial and statutory authorities in a bid to juxtapose and balance the mortgagor’s equity of redemption with the interest of the mortgagee to recover the loan (principal and interest). The statutory power of sale is limited to only legal mortgages while an equitable mortgagee can only apply to the Court for judicial sale. CHAPTER ONE THE MORTGAGEE’S POWER OF SALE 1.1) INTRODUCTION: The ‘power of sale’ is a mortgagee's power to sell a mortgaged property when a mortgagor is in default of payments/repayments (subject to rules and conditions of law). In practice, this is the remedy of the mortgagee which is most commonly used, in conjunction with entry into possession. 1.2) ORIGIN OF THE POWER OF SALE In the early part of the eighteenth century while the mortgagee could only sell or foreclose through the proceeding of the court, it was significant that the delays of the Chancery courts were at their worst during that period. Moreover, it was also tedious and expensive. Hence, to avoid this problem England created the ‘power of sale’ principle, giving the mortgagee power to sell out of court. However it took almost 65 years for the development of this principle. In England prior to the passing of Lord Cranworth's Act the mortgagee only had power of sale if it was stated in the express power in the mortgage deed3 then in Lord Cranworth's Act 1860 a power of sale was implied in certain cases. The sections of Lord Cranworth's Act relating to implied powers of sale were repealed by the Conveyancing Act, 1881. The Conveyancing Act 1881 gave to a mortgagee whose mortgage was made by deed a power of sale except in so far as a contrary intention is expressed in the mortgage deed, and subject to the terms of the mortgage deed4. This position was further reinforced by the Law of Property Act 1925. S. 103 of the Act further provides that a mortgagee owes a duty of care to the mortgagor to: i. Act in good faith; ii. Take reasonable care to obtain the true market value of the mortgaged property at the date on which the mortgagee decides to sell5, iii. Ensure that the sale is genuine. A mortgagee cannot sell to him or herself. 6 Ashton v. Corrigan, 1871, L.R. 13 Eq. 76 This provision is similar to the provisions of the Ontario Mortgages Act, R.S.O. 1914. However one striking difference is that the length and form of notice is expressly stated to be 2 months notice in writing and same is required to be given to the mortgagor and every subsequent encumberancer 5 Tse Kwong Lam v Wong Chit Sen [1983] 3 All ER 54; 3 4 6 Corbett & anr v Halifax plc [2002] EWCA Civ. 1849 [2003] 1 WLR 964 CA 1.3) The Power of sale- QUO VADIS NIGERIA In Nigeria mortgages are almost always created over land as opposed to chattels, so it is most expedient to consider the system of land ownership in Nigeria, and its pros and cons as affects the creation and enforcement of mortgages over land in Nigeria. It is no longer news in Nigeria that after 1978 (the advent of the Land Use Act) no individual in the country or state has absolute ownership or what could be called interest in fee simple7. In other words, all an individual can lay lawful claim to now is a usufructuary right in the landed property8. But what exactly a Right of Occupancy is, the Act does not define.9 Although it can be deduced and placing reliance on its precursor, the Right of Occupancy is usufructuary, its exact legal nature remains obscure. The question remains is it a Lease, a license or a Freehold? By virtue of Section 1 of the Act, all Lands are vested in the governor of a state and individuals only enjoy a Right of Occupancy, whether granted or deemed. 8 Abioye vs. Yakubu, supra. 9 But a precursor, the Land Tenure Hold (of Northern Nigeria) defines it as “a title to the use and occupation of land.” 7 Knowing exactly its legal nature is very important to a mortgagee who wants to accept same to guarantee the repayment of his loan. He should know exactly the value or weight of what the mortgagor is willing to give him as security. Because a mortgagee can neither acquire nor transfer (upon default of the mortgagor) a better title than the mortgagor has in the mortgaged property. The Land use Act does not stipulate how a mortgage shall be created. It rather preserves the existing laws on mortgages10. Essentially, we can have a legal mortgage11 and an equitable mortgage12. It must be noted at this point in time that a Mortgage instrument may provide for the Mortgagee’s power of sale and stipulate conditions for the exercise of that power so that except the Mortgagee complies strictly, the sale shall be ineffectual. Section 48, Land use Act, Abioye vs. Yakubu (1991) 5 NWLR pt.190, p.130. This is effected by what is essentially an absolute conveyance subject however to a proviso for Redemption. 12 This is a charge on the property but does not convey any legal estate or interest to the creditor. The four different ways in which an equitable mortgage may be created are: (1) by mere deposit of title deeds with a clear intention that the deeds should be taken or retained by the creditor as security for a loan (2) by an agreement to create a legal mortgage (3) by an equitable charge on the mortgagors property and (4) by a mortgage of an equitable interest. 10 11 Also, it is important to note that the mortgagee’s power of sale is distinct and separate from the exercise of power by a judgment creditor. The power of sale under the deed of Mortgage may be exercised by the Mortgagee notwithstanding a debt recovery judgment in his favour and even where an appeal and a motion for a stay of execution are pending. This is well illustratrated in the case of Union Bank of Nigeria Plc vs. Olori Motors Co. Ltd.13 In that case, the Mortgagee (Appellant) sued the Mortgagors (Respondents) jointly and severally claiming the sum of N7, 947, 237.00 being the debit balance outstanding in the current account of the 1st Respondent and N84, 9710.00 being the balance outstanding in the loan account of the 1st Respondent. Both the overdraft and the loan were jointly guaranteed by the 2nd & 3rd Respondents. The Court entered judgment in favour of the Appellant and ordered that subject to any necessary consent being obtained, the Plaintiff is at liberty to sell the properties mortgaged by the Defendant as securities for the various facilities granted. The Respondent filed a notice of appeal and at the same time file a motion for stay of execution but did not serve the processes on the Appellants. While this was going on, the 13 1998) 5 NWLR (Pt. 551) 652 appellant resorted to its power of sale under the Mortgage deed executed b the parties and sold two of the properties. The Respondent filed a motion before the Higjh Court seeking to set aside the sale. The sale was set aside and the appellant appealed. The Court of appeal now held as follows: “the exercise of the power of sale under a mortgage deed is quite distinct and separate from the exercise of power by a judgment creditor to execute a judgment delivered in his favour. The two rights are in fact governed by separate and distinct relevant laws applicable to the exercise of each of the rights. A mortgagee can validly exercise his power of sale of the mortgaged properties under the deed of mortgage even if the judgment of court in his favour does not contain any order empowering him to sell the mortgaged properties…” 1.4) WHEN DOES THE POWER OF SALE ARISE? As soon as the mortgage money has become due, that is as soon as the date fixed for repayment has passed, the legal mortgagee has statutory power, which may be varied or extended by the parties or excluded altogether14 to sell the mortgage property provided that the mortgage has been 14 Alliance Building Society V. Share (1952) Ch. 581 All ER 1033 made by deed. If the money secured by mortgage is payable by instalments, the power of sale arises as soon as an instrument is due and unpaid15 1.5) WHEN CAN POWER OF SALE BE EXERCISED? Before the power of sale can be exercised, one of the three conditions laid down under S.125 of Property and Conveyancing Law 1959 or S.20 of Conveyancing Act 1881 must be satisfied. These are: a. Notice requiring payment of mortgaged money has been served on the mortgagor and default has been made in payment of the money for three months after such service; or b. Some interest is in arrears and remain unpaid for two months after becoming due notwithstanding that the principal sum to be advanced instalmentally under the mortgage deed has not been advanced in full; or c. There has been a breach of some provision contained in the mortgage deed or in the statute and which imposes an obligation upon the mortgagor. The Mortgagee may upon fulfilling the foregoing conditions, sell the mortgaged property at any time thereafter and at any price 15 Twentieth Century Banking Corporation V. Wilkinson (1977) Ch. 99 (1976) 3 All ER 361 obtainable. The sale may be by auction or by private treaty may be in one lot or several lots. Upon sale, the mortgagee is empowered to execute a deed vesting title in the purchaser and if the mortgagee exercises his power of sale bona fide for the purpose of realising his debt, and without collusion with the purchaser, the Court will not interfere even though the sale is disadvantageous unless the price is so law as in itself to be evidence of fraud.16 These conditions may arise in different forms, usually after a default of a shorter period than those provided under the law17. In practice, this is done by expressly providing in the mortgage when the powers of sale are exercisable. For example, ‘the legal right of redemption shall cease one calendar month after the due date of this deed and in favour of a purchaser, the power of sale shall be exercisable from that date’. It should be noted that defects in the exercise of the power of sale over mortgaged property would not invalidate the sale. This was recently confirmed in the case of OKONKWO V. CO-OPRATIVE AND COMMERCE BANK PLC18. It was held that ‘if a mortgagee I.O Smith: Practical approach to law of real property in Nigeria (1999) Ecowatch Publications Limited, pg 268 - 269 16 17 S.123 (3) of Property and Conveyancing Law and S. 19 (2) of Conveyancing Act 1881 (1997) 6 N.W.L.R (Pt. 507) at 50.; See also Eka _ Eket vs. Nigerian Development Society Ltd & Anor (1973) NSCC Vol. 8, p. 373 18 exercises his power of sale bona fide for the purpose of realizing his debt without collusion with the purchaser, the court will not interfere, even though the sale is disadvantageous, unless the price is so low, as in itself to be evidence of fraud’. Therefore, the title of a purchaser obtained by a conveyance from the mortgagee who has exercised his power of sale cannot be impeached. Any person damnified by an unauthorized or irregular exercise of the power of sale has the remedy in damages against the person exercising the power. Thus, in the instant case, the allegation by the appellant that the sale of his mortgaged property did not comply with the Auctioneers Law of Imo State would not vitiate the sale. The only obligation incumbent on a mortgagee exercising his power of sale is that he should act in good faith and obtain a proper price19 A mortgagee exercising the statutory power of sale has power to pass the entire estate (term of years) vested in the mortgagor to the purchaser20 1.6) FORM OF SALE Sale may be by (a) Private treaty, (b) By auction or (c) By tender. A mortgagee must take reasonable care to obtain the proper market value in a bona fide sale e.g. the mortgagee may sell to himself even indirectly as in Williams V 19 20 See Eka-Eteh V N.H.D.S Ltd (1973) 6 S.C 183 S.126 (1) of Property and Conveyancing Law 1959, S.21 of Conveyancing Act 1881. Wellingborough Council21 and he is not liable for sale at an under-value22 1.7) ORDER OF SALE The Court, at the instance of anyone interested in the mortgage money or the equity of redemption, may order sale23. The conduct of the sale is often given to the mortgagor because of his interest that the best price should be obtained24 Where sale is by the mortgagee, he must account to the mortgagor for the balance if the proceeds exceed the amount of the loan25 Any sale by a court order without the Governor’s consent cannot give the purchaser any right at all in the property. He is not entitled to be issued with a certificate of purchase, as was held in Danjara V. Mohammed Bai26. This is in accord with the provisions of the Land Use Act 1978. The question of consent arises when the sale has taken place but there is nothing in the land Use Act that makes it mandatory for a mortgagee to seek permission from any authority to advertise or convene an auction or other forum (1975) 1 W.L.R 1327 Eka-Eteh V. N.H.D.S Op. Cit. Note 17 23 S.114 of Property and Conveyancing Law 1959 or S.25 of Conveyancing Act 1881 24 Davies V Wright (1886) 32 Ch. 220 25 B. Visioni V N.B.N (1975) 1 N.M.L.R.8. See also Section 127 of Property and Conveyancing Law 1959 26 (1965) N.M.L.R 455 21 22 towards exercising his right of sale or foreclosure. Musdaper J.C.A in the case of Moses Ola and Sons Ltd V B.O.N27 said “With respect to the learned counsel for the appellants, I am of the view that his complaint on these grounds is not valid. There is nothing in either the Land Tenure Law or the Land Use Act that makes it mandatory for a mortgagee to seek permission from any authority to exercise his right of sale or foreclosure...A bank possesses the potent weapon of a mortgagee t exercise its power of sale on the only condition that it acts in good faith (Union Bank v. Ozigi (1991) 2 NWLR (Pt.176). The respondents are not under any duty statutory or otherwise; to first seek the consent of any authority before advertising the auction or sale of the mortgaged property. 1.8) MORTGAGEE’S OBLIGATION IN EXERCISING POWER OF SALE: In exercising the power of sale, the law requires the mortgagee to act in good faith and in the absence of fraud, unfair dealing with the mortgaged property or collusion with the purchaser resulting in gross undervalue, the sale cannot 27 (1992) 3 N.W.L.R (Pt.229) 337 at 391 be impeached by the Court even where the sale is disadvantageous to the Mortgagor. In W.A.B LTD vs. SAVANNAH VENTURES LTD28 the Supreme Court held that the Mortgagee or Receiver engagedd in selling a mortgaged property has a duty to act bona fide. In other words, the only obligation incumbent on a mortgagee selling under and in pursuance of a power of sale in a mortgage deed is that he should act in good faith. The Court of Appeal in TEMCO ENG & CO. LTD vs. S.B.N LTD 29also added that the law is clear that the Mortgagee in exercising his power of sale under a mortgage has a duty to take reasonable care to obtain the true market value, not the best value, of the property in order to realise his security by turning it into money when he likes, as he has a right to do, and has no obligation to wait for a favourable moment in the property market. According to Prof. I. O Smith 30 apart from the duty of good faith owed by the Mortgagee in exercising his power of sale, 28 (2002) 10 NWLR (Pt. 775) S.C 401, (1995) 5 NWLR (Pt. 397) CA 607 @ 628, paras. G – H; see also A.C.B. Ltd vs. Ihekwoba (2003) 16 NWLR (Pt. 846) S.C 249 29 I.O. Smith : Nigerian Law of Credit (2001) @ pg 83; In England and some other common law jurisdictions, the Mortgagee, when exercising his power of sale owes a duty to the Mortgagor to take 30 there is no judicial authority in Nigeria reflecting the position in modern times in other common law jurisdictions with regards to the requirement of a duty of care in negligence. This issue is very crucial in view of the obvious implications which the Mortgagee’s negligence may have on the outcome of sale. The Mortgagee might have conducted a sale in good faith, yet loss may be occasioned by an inadvertent insertion in auction particulars of a misstatement. While the Mortgagee is held liable for loss in such situations in England and some other common law jurisdictions, it is doubtful whether Nigerian Courts will follow suit. 1.9) EFFECT OF SALE When a contract for sale is entered into, the power of sale is exercised and so long as the contract subsists, the equity of redemption is lost31 When the sale is completed, the entire legal estate which is vested in the mortgagor passes to the purchaser32. The conveyance otherwise operates to confer on the purchaser a good legal title enabling him to over reasonable care to obtain a proper price. See Tomlin vs. Luce (1889) 43 Ch. Pg 191; Cuckmere Brich Co vs. Mutual Finance Ltd (1971) Ch. Pg. 949; etc. 31 32 Lord Warring v. London and Manchester Assurance Co. Ltd (1935) Ch. 310 S.126 of Property and Conveyancing Law or S. 21 of Conveyancing Act 1881 reach all interests, which are capable of being overreached (e.g. subsequent mortgages and mortgagor’s equity of redemption). In particular, it seems that the purchaser having taken conveyance from the selling mortgagee is unaffected by any estate contract entered into by the mortgagor during the course of the mortgage term. In EkaEket vs. N.H.D.S Ltd 33 the Supreme Court held that once the mortgagee in exercise of his power of sale alienates the mortgaged property, the purchaser who is a bona fide purchaser for value without notice of any encumbrance is protected. However, it should be noted that the statutory power of sale avails only a legal mortgagee. Before an equitable mortgagee can sell, he must obtain the order of court. When an equitable mortgagor by deposit of title deeds and an agreement to give a legal mortgage, if called upon to do so, the court usually decrees that the deposit operates as a mortgage and that in default of payments of what may be found du, the mortgagor is a trustee of the legal estate for the mortgagee and he must convey the estate to him34. On the other hand an order of foreclosure absolute of a legal mortgage vests ownership of the land in the mortgagee and 33 34 Op cit. Note 17 Ogundaini V Araba (1978) LRW 280 at 288 if the order is made absolute the mortgagee is not entitled to account to the mortgagor for any excess. For this reason foreclosure as a remedy is difficult to obtain. 1.10) PROTECTION OF THE PURCHASER The Purchaser acquires an unimpeachable title basically on condition that the power of sale has arisen, for the statute protects him and frees him from the shackles of constructive notice that the power of sale has not become exercisable - Section 21(2) of the 1881 Conveyancing Law and S. 126 (2) PCL Cap 100, LWN, 1959. This is to protect both the Purchaser and the Mortgagee acting in good faith so that where the mortgagee perpetrated fraud and sold the mortgaged property illegally or where the purchaser bought the property with actual knowledge that the power of sale has not become exercisable and that the title in the property cannot pass to him, the mortgagee would not pass an unimpeachable title to the purchaser. Also, where the Mortgagee cannot pass a valid title to the Purchaser may be as a result of his inability to obtain Governor’s consent under the Land Use Act, the Purchaser may sue to recover the purchase price paid. Sometimes, the Purchaser does not realise that the mortgagee does not have title until after conveyance. In such cases, the question is whether the deed of assignment contains a covenant for title. If it does, then the purchaser may recover damages for breach of covenant and the measure of damages is the purchase price paid to the Mortgagee. In the absence of a covenant for title, the rule is caveat emptor and the purchaser cannot recover the purchase price.35 1.11) INJUNCTION AGAINST MORTGAGEE’S EXERCISE OF POWER OF SALE: A mortgagor may bring an application for an order of interim or interlocutory injunction restraining the Mortgagee from exercising his power of sale on the following grounds: a. Where the Power of sale has not arisen or become exercisable b. Where the mode of sale contemplated by the Mortgagee deviates from the mode prescribed by the mortgaged instrument. c. Where the amount claimed by the mortgagee is excessive d. Where prevailing circumstances give rise to estoppels e. Where mortgage is a fraud or the mortgage deed is not executed by the Mortgagor. 35 I. O Smith: (supra) Pg 86 In all of the foregoing circumstances, the courts will assume its equitable jurisdiction in ensuring that title does not pass to the third party without due consideration of all equities. But equity will not assist a mortgagor who purports to stultify the transaction or render it nugatory by claiming that he has no title to the mortgaged property, or by setting up the rights of 3rd party to the property, or otherwise, by relying on his own wrongful conduct in not perfecting the mortgage. In all such cases, the mortgagor’s application shall be dismissed by the Court. In NIGERIAN HOUSING DEVELOPMENT SOCIETY LTD vs. MUMUNI36, the Court held that where the Mortgagee embarks on the exercise of his statutory power of sale consequent upon mortgage instalment falling into arrears, he cannot be restrained from selling the mortgaged property by the mortgagor merely paying off the arrears; only payment in full of the principal sum and interest can restrain the mortgagee from selling. In KASUMU vs. SCOTT & ORS37, the Supreme Court held that the Mortgagee’s power of sale is not affected by attachment and sale of mortgagor’s interest and any purchaser of the mortgagor’s title in property under attachment takes subject to the existing mortgage. 36 37 (1977) NSCC Pg. 65 (1967) NSCC Vol. 5, pg. 227 CHAPTER TWO PROBLEMS IN THE EXERCISE OF THE MORTGAGEE’S POWER OF SALE 1. THE OPERATION OF THE LAND USE ACT 1978 The operation of the Land Use Act has created a number of likely pitfalls which if not avoided in the creation of the mortgage will ultimately impede the mortgagee’s power of sale when same arises. We will x-ray some of the provisions; i. CONSENT PROVISIONS: The consent provisions38 of the Land Use Act have created quite a number of pitfalls which have shut out unsuspecting mortgagees from been able to exercise their power of sale. a. Given that the responsibility to obtain consent to alienate a statutory right of occupancy lies on the holder 39(i.e. mortgagor), sometimes unscrupulous mortgagor’s deliberately neglect to obtain consent, thereby making the mortgage prima facie void in S.21 (prohibits alienantion of granted customary right of occupancy without the requisite consent) and S.22 (prohibits alienation of Statutory right of occupancy-whether expressly granted or deemed granted under S.34 (1) (4), without the requisite consent). Savannah Bank V. Ajilo (1989) I NWLR (Pt. 77) p. 305. 39 S.22 of the LUA 38 law40, and upon default the mortgagee would not be able to exercise his power of sale. The Supreme Court did not have the opportunity of espousing the cardinal principle of equity on this issue in Savannah Bank Ltd. v Ajilo41 as the issue was not canvassed before it, so that it would be wrong to suggest that the decision in that case stand for the proposition that the mortgagor can impeach a mortgage on the ground that consent was not had and obtained by him. The correct proposition of the law can be found in a number of judicial authorities in recent years42 . For example, in Ugochukwu V. Co-operatiive and Commerce Bank (Nig) Ltd43 it was held that it would be unconscionable for the mortgagor to turn around and maintain that no consent was obtained or that such consent obtained was flawed having received valuable consideration in the form of a loan from the mortgagee. Section 26, Land Use Act I NWLR (Pt. 77) p. 305 42 See e.g Adedeji v National Bank of Nigeria Ltd. (1989) 1 (Pt. 96) p. 212; Anaeze v Anyaso (1993) 5 NLWR (Pt. 292 p. 1 at p. 39 43 (1996) 6 NWLR (Pt. 456) p. 524 40 41 b. Secondly there is a controversy as to whether the requirement of consent applies to equitable mortgages as it applies to legal mortgages. While section 51 (L.U.A) defines mortgages to include “a second and subsequent mortgage and equitable mortgage” without drawing a distinction between different types of equitable, case law does not espouse such clarity44. In JACOBSON ENG CO & ANOR VS UBA LTD 45 The facts of the case are that the 1st appellant obtained a facility from the Respondent. As security for this facility the 2nd appellant, Managing Director of the 1st appellant executed a personal guarantee in favour of the Respondent. In addition, he deposited his original title documents as further security for the facility. Following the failure of the 1st appellant to liquidate the debt as agreed, the Respondent filed an action claiming the debt plus interest, a It is also pertinent to review the provision of S. 22(1) of the L.U.A, which provides that where an equitable mortgage has been previously created with the consent of the governor, consent will not be required for a legal mortgage thereon. This implies that consent is required even for equitable mortgages. 45 (1993)3 NWLR part 283 at Page 586. 44 declaration that as an equitable mortgagee, it (the mortgagee) was entitled to sell, and an order of sale of the property covered by the title document deposited. Based on this, the lower court granted judgment in favour of the Respondent as claimed. In an appeal to the Court of Appeal, Lagos Division, the 1st and 2nd appellants sought to set aside the lower court's judgment. A major plank of their contention was that the deposit of title documents was an equitable mortgage which required the consent of the Governor under the Act. As none was obtained the transaction was null and void pursuant to section 26 of the Act. In a considered judgment, the Court of Appeal the court stated that after the commencement of the Land Use Decree, whatever was created upon the delivery of the Title deeds whether equitable or legal mortgage, the law is the same and that is to the effect that the bank cannot sell nor an order be made that the bank should sell without the consent of the Governor first had and obtained46. Three years after the judgment another panel of the Lagos Division of the Court of Appeal in OKUNEYE VS FBN PLC47 held that the deposit of a title document is an equitable mortgage not requiring the consent of the Military Governor on the basis that it is not an alienation, but an agreement to alienate. In this case the appellant had appealed the judgment of the lower court that granted the order of sale of his property deposited as security for loan on the premise that the consent of the Governor was lacking. Unfortunately, in coming to this conclusion, the court in Okuneye did not consider at all the Jacobson’s case with a view to distinguishing it. Therefore, there exists two conflicting decisions of the Court of Appeal on the same subject matter. The Jacobson case has very far implications for the banking industry. Due to the very cumbersome and lengthy process, and the huge costs incurred in seeking the consent of the Governor, bankers have always had to work a very delicate balance between satisfying the requirements of the law on one hand, and protecting their funds on the other. It is therefore common place to execute an equitable mortgage (hitherto believed not to require consent) as a substitute for a legal mortgage for which the cumbersome and expensive rigours of consent prevail. What the Jacobson case is therefore saying is that irrespective of the nature or type of mortgage, the consent of the Governor is required. 47 (1996) 6 NWLR AT PART 457 46 In the circumstances it is difficult to decide which of these authorities the lower courts would follow today. This is because in trying to guide the lower courts on the doctrine of stare decisis the Court of Appeal created more confusion. c. Section 36 (5) provides that a deemed customary right of occupancy over land in a non-urban area cannot be mortgaged. It would however appear that improvements on such land e.g agricultural produce growing on land may be mortgaged since there in no express prohibition against it in the Act48. d. Another noticeable impact of the L.U.A on mortgage transactions under this heading is what happens where subsequent to the consent entering into is obtained the mortgage transaction? As an obiter dictum in Savannah Bank (Nig) Ltd vs. Ajilo49, the Supreme Court of Nigeria said consent must be obtained prior to the mortgage. However, in order to give a human face It would thus seem that S.21 which provides that consent must be obtained to alienate land subject of customary rights of occupancy only deals with actual grant of customary r of o. 49 (1989) I NWLR (pt 97) 805 48 and protect the efficiency of mortgage transactions under the Act, the Nigerian courts have rather held such a mortgage transaction inchoate rather than illegal or void.50 So, despite the mandatory statutory consent requirement, “first had and obtained”, the courts have held it means no transaction more than concluded that becomes the mortgage inchoate (in complete) pending when the requisite consent is eventually sought and obtained. Departure from doing this would have drastically had a telling effect on efficiency of mortgage transaction in Nigeria.51 The consent provisions of the L.U.A have other incidental negative impacts on the operation of mortgages in Nigeria52 Awojugbagbe Light Industries Ltd vs. Chinukwe (1995) 4 NWLR (Pt. 390) p. 379 With this judicial activism, consent in this situation is retained as a “routine affair”. See: Omotola, J. A: “Interpreting the Land Use Act,.” Vol 1, The Journal of Nigeria Law, (1992) p. 108. 52 One of such incidental problems is the tedious and long consent application process. Sometimes the Governor may just refuse to give his consent without showing cause and it has been held that an order of mandamus cannot be obtained to compel the grant of consent See Queen V. Minister of Land and Survey, Ex-parte, the Bank of the North (1963) CCHCJ 1617/73 @ 61) . There is also the problem of high consent fees. Presently in Lagos consent fee is as high as 22.2%, Cross River 23.6%, Ogun 16.9% - of the property value). Furthermore, there is the problem of poor land registry practices. 50 51 ii. REVOCATION AND COMPENSATION Another major upsetting provision under the Act as it affects mortgage transactions is the definition given to a “holder” of a right of occupancy. A “holder” in relation to a right of occupancy means, “a person entitled to a right of occupancy”53. The unpalatable effect of this is that although the mortgagee may have been preserving his interest in the mortgage security (the right occupancy and improvements there on), although he may even be ensuring periodic payment of stipulated rents et cetera, once the Right of occupancy is revoked, his security is gone and cannot be attached automatically to the mortgagor’s interest in any changed form. So, whereas, the mortgagor may be entitled to compensation for the value of his un-exhausted improvements54 on the land, our dear mortgagee cannot lay claim to such compensation money. 53 54 Section 50(1) of the Act expressly excludes a mortgagee from the definition of a holder Section 29 (1) and (2) This is a major set-back in the efficacy of mortgage transaction under the Nigerian Laws. iii. It is important to note that the provision of the statute protects purchasers for whom the Mortgagee has executed a conveyance so that if an aggrieved mortgagor commences an action to impeach the purchaser’s title after sale but before conveyance, the purchaser cannot take advantage of statutory provision. iv. Also, since legal estate is not acquired until Governor’s consent had and obtained, statutory protection shall presuppose that in addition to the conveyance to the purchaser, Governor’s consent must have been obtained. v. A Mortgagee who takes mortgage in unregistered land in a Registration area and who failed to register as first registered owner under the Registration of Titles Act 55cannot in exercise of his statutory power of sale conveys a valid title to the purchaser. Thus in Lagos Island and some parts of Lagos Mainland where the Registration of 55 See Cap 166 Laws of Lagos State Titles Act applies, such a mortgage which ought to be registered within the statutory period will be void if it was not registered and since the title is void, the purchaser of the mortgaged property afterwards gets nothing. vi. CERTIFICATE OF OCCUPANCY56 One other innovation introduced by the Act is the issuance of a certificate of Occupancy by the Governor of a state. It should be noted that a certificate of occupancy is merely an evidence of a right of occupancy for which it does not on its own confer a title or interest in land. The Act has not provided any conclusive means of proving one’s entitlement to a right of occupancy. The certificate raises a rebuttable presumptive right of occupancy57. This means a certificate of occupancy may be set aside if it turns out that the holder had no right to the land58, or in favour of a pre-1978 The issuance of a certificate of occupancy is provided under section 9 of the Act. See: The Registered Trustees of the Apostolic church vs. Olowokemi (1987) 4 NWLR Pt 58, held No 4 (Sc), Ogunleye vs. Oni (1990) 2 NWLR (Pt 135) 745. 58 Adedeji vs Williams (1989) I NWLR (pt 99) 811. 56 57 conveyance or in favour of a deemed grantee of right of occupancy under section 34 of the Act59. The horror and hellish implication of this is that where the certificate of occupancy is set aside due to any reason, discussed/highlighted above, the mortgagee who has accepted it as security realizes he has burnt his own fingers. The certificate he is holding automatically becomes “a piece of paper having no value”60. 2. There is also the problem of our slow and porous judicial system. Mortgagor’s file all sorts of preliminary objections and interlocutory applications to prevent the mortgagee who approaches the court to enforce his power of sale from being able to exercise same. This could delay the realisation of the Security by the Mortgagee until the matter is finally disposed off at the Court. It could be frustrating for the Mortgagee. 3. The complex nature of documentation of title: Nigeria, being a common law jurisdiction, once there is a defect in the creation of the mortgage or what we call ‘perfection of Sir Adetokunbo Ademola vs. Amao & Ors (1982) CGSLR p.273 reported in Omotola J. A. “Cases on the Land Use Act” p. 132 60 Per Belgore, JSC in Ogunleye vs. Oni 59 title’, the mortgage will be defeated and the Mortgagee may not be able to sell. Moreso, in Lagos, there are different laws that regulates land transaction – The Registered Title Law (RTL), Registration of Instrument Law and the Conveyancing Act covers some part of Lagos State until the recent enactment of the new Lagos State Mortgage and Property Law, with its own attendants problems. CHAPTER THREE SOLUTIONS TO THE PROBLEMS ASSOCIATED WITH THE MORTGAGEE’S POWER OF SALE Having critically examined the potency of the mortgagee’s power of sale and the problems created by the Land Use Act, an attempt would be made to proffer some solutions to the itemised problems so as to enable the Mortgagee effectively enforce the Mortgage Security for the realisation of its credit to enable it continue in business. 1. The Land Use Act as it is presently must be amended, especially the provisions relating to Consent, Revocation and Compensation and the rights conveyed by the Certificate of Occupancy. 2. More protection should be afforded to the Purchaser who bought bona fide for value without any collusion with the Mortgagee. 3. The Courts should also be proactive in its intervention in the Mortgagee’s exercise of its power of sale. This is to guard against the Mortgagor bringing frivolous applications against the Mortgagee or the purchaser so as to impeach the sale.