FSA,RNS - Spidi - Indian Institute of Management Bangalore

advertisement

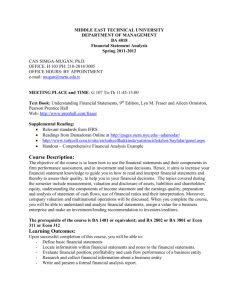

Indian Institute of Management Bangalore Financial Statement Analysis PGP and PGSEM Elective Term 4, 2009 Course Outline I LEARNING OBJECTIVES 1. To develop a framework for using financial statement information in a variety of business analysis and valuation contexts. 2. To differentiate between good accounting and bad accounting. 3. To write an equity research report, credit evaluation report or internal management report based on analysis of financial statements and other relevant reports. 4. To analyze business strategies to understand the value that they add. 5. To integrate accounting principles and finance concepts. II COURSE CONTENTS Session 1 Topic Part I OVERVIEW OF FINANCIAL STATEMENTS Introduction to Investing and Valuation Investment Styles and Fundamental Analysis The Role of Financial Reporting in Capital Markets Stock Market Bubbles The Professional Analyst and the Investor Business Analysis Valuation Technology Read: Chapter 1 of SP. Assignment: E1.5; E1.6; M1.1. 2 Introduction to the Financial Statements The Financial Statements: Income Statement, Balance Sheet, Statement of Cash Flows, etc. Measurement in the Financial Statements Comparisons using Financial Statements Read: Chapter 2 of SP. Assignment: E2.11; E2.12; M2.1. 3 How Financial Statements are Used in Valuation Multiple Analysis Asset-Based Valuation Fundamental Analysis The Architecture of Fundamental Analysis Dividend Discount Model Read: Chapter 3 of SP. Assignment: E3.8; E3.13; E3.17; M3.1. 4 Cash Accounting, Accrual Accounting, and Discounted Cash Flow Valuation The Discounted Cash Flow Model The Statement of Cash Flows 1 Cash Flow, Earnings, and Accrual Accounting Read: Chapter 4 of SP. Assignment: E4.8; E4.11; E4.14; M4.1. TEST 1 5-6 7 8 Accrual Accounting and Valuation: Pricing Book Values The Concept Behind the Price-to-Book Ratio Prototype Valuations A Model for Anchoring Value on Book Value Read: Chapter 5 of SP. Assignment: E5.3; E5.6; E5.14; E5.15; E5.16; E5.17; M5.2; M5.3. Accrual Accounting and Valuation: Pricing Earnings The Concept Behind the Price-to-Earnings Ratio Prototype Valuation A Model for Anchoring Value on Earnings Read: Chapter 6 of SP. Assignment: E6.1; E6.5; E6.8; E6.13; M6.4. PART II THE ANALYSIS OF FINANCIAL STATEMENTS Business Activities and Financial Statements Business Activities and Reformulating Statements Accruals Read: Chapter 7 of SP. Assignment: E7.1; E7.5; M7.1. 9 Analyzing the Statement of Shareholders’ Equity Reformulating the Statement of Owners’ Equity Clean Surplus and Dirty Surplus Read: Chapter 8 of SP. Assignment: E8.7; E8.12; E8.13; M8.2. 10 Analyzing the Balance Sheet and the Income Statement Reformulation of the Balance Sheet Reformulation of the Income Statement Comparative Analysis Read: Chapter 9 of SP. Assignment: E9.8; E9.9; E9.10; M9.2. 11 Analyzing the Cash Flow Statement Free Cash Flow Reformulating Cash Flow Statements Read: Chapter 10 of SP. Assignment: E10.3; E10.8; E10.12; M10.1. 12 Analyzing Profitability Effect of Leverage Drivers of Profitability Read: Chapter 11 of SP. 2 Assignment: E11.1; E11.4; E11.8; M11.2. MID-TERM EXAMINATION 13 14 Analyzing Growth and Sustainable Earnings What is Growth? Analyzing Changes in Profitability and Sustainable Earnings Analyzing Growth in Investment Read: Chapter 12 of SP. Assignment: E12.5; E12.6; E12.11; E12.13; E12.14; M12.2. PART III FORECASTING AND VALUATION ANALYSIS Valuation of Operations and Analysis of Price-to-Book Ratios Forecasting and Valuation with Balance Sheets Modifying Residual Earnings The Cost of Capital in Valuation Read: Chapter 13 of SP. Assignment: E13.9; E13.12; E13.13; M13.2. 15 Simple Forecasting and Simple Valuation Simple Forecasts and Simple Valuation Simple Forecasts of Growth and Return on Net Operating Assets The Applicability of Simple Valuations Simple Valuation as an Analysis Tool Read: Chapter 14 of SP. Assignment: E14.7; E14.12; E14.14; M14.1. 16 Full-Information Forecasting and Valuation Knowing the Business Financial Statement Analysis: Focusing the Lens on the Business Full-Information Forecasting and Pro Forma Analysis Value Generated in Share Transactions Read: Chapter 15 of SP. Assignment: E15.41; E15.5; E15.8; E15.12; M15.1. TEST 2 17 18 PART IV ACCOUNTING ANALYSIS AND VALUATION Creating Accounting Value and Economic Value Value Creation and the Creation of Residual Earnings Accounting Methods, PB Ratios, PE Ratios, and Valuation Hidden Reserves Conservative and Liberal Accounting Read: Chapter 16 of SP. Assignment: E16.4; E16.5; E16.6; M16.1. Analyzing the Quality of Accounting Accounting Quality Earnings Quality Detecting Accounting Manipulation and Transaction Manipulation 3 Disclosure Quality Read: Chapter 17 of SP. Assignment: E17.7; E17.10; E17.15; M17.1. 19 20 PART V ANALYZING RISK Analyzing Equity Risk and the Cost of Capital Understanding Risk Betas Price Risk Read: Chapter 18 of SP. Assignment: E18.1; E18.4; E18.5. Analyzing Credit Risk Ratio Analysis for Credit Evaluations Forecasting and Credit Analysis Liquidity Planning and Financial Strategy Read: Chapter 19 of SP. Assignment: E19.1; E19.2; E19.3; M19.1. END-TERM EXAMINATION III EVALUATION AND SCHEDULE Case presentation, 10 per cent, to be scheduled through the course. Project, 10 per cent. Proposal due 5 p.m. Friday, July 3, 2009; report due Friday, August 21, 2009. Test 1, 10 per cent. Chapters 1 to 4, multiple-choice questions and short problems, one hour, Saturday, July 4, 2009 after classes for the day. Mid-term examination, 20 per cent, Chapters 1 to 9, detailed problems, three hours, Sunday, July 26, 2009. Test 2, 10 per cent. Chapters 10 to 13, multiple-choice questions and short problems, one hour, Saturday, August 8, 2009 after classes for the day. End-term examination, 40 per cent, analysis of company financial statements, analyst reports and other material, five hours, Sunday, August 30, 2009. Tests and exams are open-book. The student may bring anything except laptop and mobile phone. IV READING MATERIAL Prescribed Reading: Stephen Penman. 2009. Financial Statement Analysis and Security Valuation. Fourth edition, McGraw-Hill (SP for short). In addition, selected articles will be distributed. Additional Reading: 4 1. Krishna Palepu, Paul Healy and Victor Bernard. Business Analysis & Valuation Using Financial Statements, Third Edition. Cincinnati, Ohio: South-Western College Publishing, 2004. 2. Sidney Cottle, Roger F. Murray, and Frank E. Block. Graham and Dodd's Security Analysis. Reprint by Tata McGraw-Hill, 2002. This is a FSA classic. 3. Financial Analysts’ Journal, Journal of Applied Corporate Finance. Popular Reading: 1. Alex Berenson. The Number. New York: Random House, 2003. 2. Howard Schlitz. Financial Shenanigans. Second edition. Reprint by Tata McGraw-Hill, 2003. V MARKING, COMPLAINTS AND REVIEW, AND GRADING Answer-sheets will be usually marked within one week from the date of the test or examination. Students will have the opportunity of inspecting their respective answer scripts and the instructor's model answers at the instructor's office. Students must not remove answer scripts and instructor's model answers. Any complaint regarding marking should be given in writing a brief and precise note immediately after inspecting the answer script. The instructor will examine the complaint and revise the marks, if appropriate. The instructor is not able to discuss (in person, over the phone or by e-mail) marking or grading matters. On the basis of the student’s total marks in the course, there will be an overall grade and a grade point average. The various components of evaluation will not be graded separately. VI INSTRUCTOR R. Narayanaswamy Office: A Block 2nd Floor Room # 205 3135 narayan@iimb.ernet.in Student meeting time: Wednesday and Thursday 2 to 5 p.m., and depending on availability at other times. 5