RISING INTERNATIONAL ECONOMIC INTEGRATION

advertisement

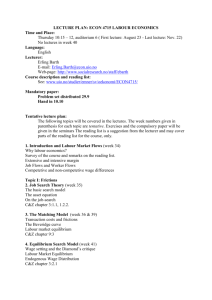

EUROPEAN COMMISSION DIRECTORATE GENERAL ECONOMIC AND FINANCIAL AFFAIRS RISING INTERNATIONAL ECONOMIC INTEGRATION Opportunities and Challenges September 2005 1. Introduction Public perceptions of how rising international economic integration affects the EU economy are often beset by anxieties concerning job losses and downward pressures on wages and working conditions, with potential detrimental impact on economic well-being. Fears appear to be running strong, in particular in the EU countries where wages are highest, that increased import competition from low wage countries puts too much pressure on local producers and workers; import penetration of products from countries endowed with cheap labour may render domestic industries uncompetitive, enforce the closing of factories or parts of them at home and induce the re-location of plants and operations abroad. Clearly, such perceptions of the impact of “globalisation” fuel widespread anxieties that this process will be associated with rising employment and earnings insecurity, or may even lead to a mass-exodus of wellpaid jobs in high-wage countries and induce a “race to the bottom” which is deemed as inescapable by many. These concerns are not new, of course, given the rapid pace of international economic integration in recent decades as reflected in the steadfastly growing volumes of world trade and foreign direct investment. However, more recently, a number of factors appear to have heightened public apprehensions about the negative impact of the increasingly open character of the EU economy. The pace of international economic integration has accelerated in the second half of the 1990s and new key economic players, such as China and India, have emerged at the world trading scene. The new international trading partners are endowed with a large labour force and, when compared with other episodes of emerging developing countries, with relatively high technical capacities. Moreover, a lower wage than elsewhere constitutes an even more attractive competitiveness factor when it comes with a well educated labour force; indeed, many of the new actors in the world trade system fare relatively well in that respect or are catching-up quite rapidly. Production activities in both manufacturing and services have become increasingly fragmented and international sourcing according to the principle of relative comparative advantage has been continuously growing. The advance in information and communication technologies has led to a fundamental change in the tradability of service sector jobs. Many jobs previously considered as being located in sheltered sectors of the economy are now suddenly exposed to international competition and risk being off-shored. Indeed, while manufacturing outsourcing mainly impacted bluecollar jobs, services outsourcing is likely to affect white-collar workers; furthermore, since services outsourcing is structurally easier in terms of resources, space and equipment requirements, it may proceed more quickly. Migration (labour mobility in the case of the recently acceded Member states) may constitute another mechanism whereby previously non-tradable economic activities become exposed to intensified competition as domestic workers find themselves in more contestable positions in activities such as construction, hotels and restaurants, and social and personal services. Last, but not least, the proposals for further liberalisation of trade and investment flows in the context of on-going WTO negotiations and the Doha Development Agenda also appear to carry with them intensified competitive pressures for workers, farmers and firms in high-wage countries. -1- In a nutshell, the combination of technological advance and policy liberalisation is allowing economic activity to become increasingly specialised and dispersed across countries and continents. The boundary of what can and cannot be traded is being steadily eroded, and the global economy is encompassing an ever-greater number of tradable goods and services. Set against a background of sluggish economic growth and persistently high unemployment in much of the EU, these developments have led to a sometimes highly charged debate about European competitiveness and the allegedly negative impact of rising economic integration on jobs and wages. The widespread popular ambivalence towards globalisation stands in stark contrast to the sanguine view shared by most economists that trade and investment liberalisation are an important source of rising living standards for the overall population. The broad consensus view, backed up by solid economic theorizing and robust empirical evidence, holds that the most important long-run impact of international trade and investment on labour markets has been to raise average real wages without undermining the aggregate employment base, thus providing substantial payoffs to the representative household.1 Indeed, the historical record strongly suggests that increased international integration has never let to a net reduction of employment over more than short periods of time, if at all. Notwithstanding the overall benefits from deeper international economic integration, both economic theory and empirical evidence demonstrate that in this process the welfare of some people may be reduced even as aggregate productivity and income improve. There is no shortage of individual case studies and anecdotic evidence indicating significant labour market adjustment costs arising from intensified international competition for certain groups of the workforce, as reflected in higher job displacement rates and the social hardship associated with ensuing long spells of inactivity and unemployment and/or large wage losses once re-employed. Obviously, reaping the potential gains from globalisation will necessarily entail adjustment towards further specialisation, innovation and diversification into new areas of relative comparative advantage, inducing shifts in the sectoral and occupational composition of employment. Thus, the trend increase in international economic integration may well be a cause for increased “turbulence” in labour markets; and, almost inevitably, the re-allocation of resources generates short-run frictions, in particular in the labour market as it can be hard for people to acquire additional skills and/or to move between jobs, sectors, occupations and regions. From this perspective, finding an adequate response to globalisation should best be seen as being part of the broader policy challenge for dynamic economies to successfully cope with structural economic change. Against this background, Section 2 of this note sketches recent trends in international economic integration, focusing mainly on trade in goods and services and foreign direct investment flows; this also encompasses phenomena such as growing trade in intermediate inputs and business services and the re-location of production activities abroad. Section 3 reviews the available evidence of the impact on jobs and wages, a focal point of the current debate. Section 4 simply concludes with some policy implications. 1 Estimates of the resulting income gains from deeper economic integration are typically quite substantial. For example, analysis prepared in the context of the forthcoming EU Annual Economic Review suggests a potential gain in living standards of about € 2500 annually, in 2004 prices, for every EU citizen over the next few decades. In a June 5, 2005 Op-ed in the Washington Post, Hufbauer and Grieco (2005) of the Institute for International Economics estimate that after a half-century of shrinking distances and commercial liberalisation, the average US household enjoys an income gain of about $10,000 per year. The payoff comes through the same routes as other economic gains: lower prices at the check-out counter, more product choices, and fatter pay-checks. They argue that the payoff could be even bigger: Future policy liberalization could produce an added $5,000 per household each year. Much of the benefit would come from sectors that were essentially left out during earlier rounds of liberalisation: services, agriculture, transportation, and trade with developing countries. -2- 2. Recent trends in international economic integration Both mirroring and amplifying the effects of foreign direct investment and trade driven integration, global financial integration has developed dynamics of its own. Based on a process of progressive financial market liberalisation and advances in technology since the 80ies, economic performance of countries across the world is increasingly supported by – and depending on – international capital flows – notably in the form of consortial bank loans as well as the equity, bond and derivatives based portfolio investments of the international institutional players. Obviously, the introduction of the euro in 1999 was a major change in the international financial system as well. EMU both built on previous trade and financial integration in the common market and reinforced it. On the external side, the new currency has quickly established itself as the second currency in all major segments of international financial markets. Graph 1 depicts the development of financial integration. Cross border holdings of assets began to increase steadily from the mid-1970s on, with the accumulation of foreign assets accelerating sharply in the 1990s. The most remarkable feature in foreign direct investment in recent years was the acceleration in mergers and acquisitions activity from the mid-1990s on. It drove global FDI inflows to a peak of 1.4 trillion USD in 2000. This was followed by a sharp slump of FDI flows: In 2003, global inflows amounted to 560 bn USD, of which 367 bn (two thirds) flew to developed countries. Excluding Luxembourg, China was in 2003 the biggest recipient of FDI, followed by France and the USA. Still, FDI flows are the largest capital flows to developing countries, where they represented 10% of gross fixed capital formation in 2003 (7 % in developed economies). In a global perspective, FDI flows rose from 5% of world GDP in 1985 to over 15% by the late 1990s. World trade has grown at an annual average rate of around 8 ½ % over the period 1992-2003. 250 While overall EU15 trade has Industrial Countries been running at considerably 200 Emerging Market Countries lower rates, this relatively poor 150 performance essentially reflects a lack of buoyancy in intra100 EU15 trade flows rather than problems at the extra-EU level, 50 where growth rates are close to those of the world average. 0 Consequently, at the extraEU15 level, which is the area of focus for the present analysis, Source: The EU Economy: Annual Review 2005; forthcoming the EU15 countries have been largely holding their own. The acceleration of international economic integration in the second half of the 1990s is also clearly visible in the EU’s rising trade and foreign direct investment (FDI) linkages (see Graphs 1 and 2). FDI activity became buoyant in the late 1990s, though numbers were inflated by the simultaneous equity price bubble. Despite some normalisation in FDI flows after 2000, cross-border investment has remained on a substantially higher level than in past decades. Alike trade flows, FDI has been particularly strong among industrialised countries and less so with the developing world. 19 70 19 72 19 74 19 76 19 78 19 80 19 82 19 84 19 86 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 Graph 1: Stock of foreign assets as percentage of GDP -3- Graph 2: Trade openness, EU-15 Graph 3: Foreign direct investment, EU-15 4 16 Services 3.5 Goods 12 3 10 2.5 % of GDP % of GDP 14 8 6 Average value of inward and outward FDI 2 1.5 4 1 2 0.5 0 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Source: commission services Source: Commission services Perhaps the most striking development over the last decade is the rapidly growing role of China in world trade. In 2003, Chinese exports accounted for 6.2% of world exports, up by almost 4 percentage points when compared to 1992; however, as imports rose almost in parallel, China absorbed 5.6% of world imports as well. In consequence, China’s trade surplus increased only moderately from 1% of GDP in 1992 to 1.6% in 2003. India’s share in world exports and imports of about 1% each is still relatively small; moreover India ran a trade deficit with the rest of the world in 2003, amounting to 2.2% of its GDP, which was even somewhat wider than 10 years ago. Graph 4: World export market shares for different countries/country groupings 18 % Sh are o f W o rld Exp o rts % Sh are o f W o rld Exp o rts EU15 16 Americas (excl. US) 10,4 South East Asia 14 8, 4 12 6, 4 EU Neighbours US 10 China 4, 4 Japan EU10 8 2, 4 India 6 1992 1994 1996 1998 2000 2002 0, 4 1992 1994 1996 1998 2000 2002 Source: The EU Economy: Annual Review 2005, forthcoming From a bird’s eye perspective, Europe has embraced the process of rising trade integration, well defending its position on world markets. In fact, the share of extra EU-15 exports in world exports rose from 15% in 1992 to 15.9% in 2003, while the corresponding import share fell by 0.8 percentage points to 15.8%. In consequence, over this period, EU-15 trade has -4- remained in broad balance with the rest of the world, with its position somewhat improving over time. The external trade deficit of the 10 new Member States, however, expanded from 2.8% of their GDP in 1992 to 6.6% in 2003. US imports accounted for 17.7% of world imports in 2003, up by 2.6 percentage points compared to 1992; over the same the period, the US export share in world exports fell from 12.6% to 10.2%, resulting in a significant widening of the trade deficit. The Japanese trade surplus shrank by 0.8 percentage points to 2.1% of GDP, and Japan’s world market shares in both exports and imports are now somewhat smaller than ten years ago. Changes to the EU15’s overall market positions (graph 5) indicate large and rising deficits with Asia compensated by surpluses with most of the rest of the world. All 3 areas of Asia have opened up significant trade gaps with the EU, with the Chinese trade deficit of nearly ½% of GDP at similar levels to that of Japan, with which we have had a persistently large deficit since the early 1990’s. In addition, the EU’s small surplus with the rest of south east Asia in the 1992-1997 period has now been replaced with a deficit of about 0.3% of GDP. These negative developments at the bilateral level are to a large extent being offset at the aggregate level by the buoyancy of the US market where the EU has seen a sharp turnaround in its trading position. The new Member States as well as the EU neighbours / Americas group of countries also provide the EU with small but relatively stable trading surpluses. However, upon closer inspection there is some evidence that the EU may be less than ideally % of GDP positioned to fully realise the potential gains from deeper US Americas EU international economic EU10 (Excl US) Neighbours integration. Examining the geographical direction of EU India trade and FDI flows suggests that the EU is generally quite inward South East Asia looking and may be missing (Excl China) China opportunities in newly emerging Japan B92-97 B98-03 markets. With the bulk of trade and FDI for the EU being intraSource: The EU Economy: Annual Review 2005, forthcoming EU15, the most dynamic part of the intra-EU flows is nevertheless the one between the new Member States and the EU15, reflecting inter alia the benefits from recent enlargement. Extra-EU flows have grown too, but adjusting for the rapid growth in these markets, it appears that the EU may not have grasped all opportunities here, especially with regard to the fastest growing areas, like China. Obviously, trade and FDI with these fast developing countries are not only motivated by low costs, but also by access to skills and markets. Graph 5: Extra-EU-15 Trade Balances 0,6 0,4 0,2 0 -0,2 -0,4 -0,6 -5- Graph 6: Shifts in the Geographical Focus of EU15 Trade 35 % Share of Extra EU15 exports % Share of Extra EU15 exports EU Neighbours 30 10,4 25 20 8,4 US 15 10 EU10 12,4 Americas (excl USA) 6,4 South East Asia China 4,4 Japan 5 2,4 0 1992 1994 1996 1998 2000 2002 India 0,4 1992 1994 1996 1998 2000 2002 Source: The EU Economy: Annual Review 2005, forthcoming Table 1: EU-15 FDI outflows – Geographic destination 1997 1998 1999 2000 2001 2002 Bn Ecus/euros Bn Ecus/euros Bn Ecus/euros Bn Ecus/euros Bn Ecus/euros Bn Ecus/euros 109,8 218,8 307,1 403,0 257,8 130,6 USA 49,0 128,7 191,4 182,1 141,9 45,1 New Member States 6,0 9,8 12,1 19,9 16,3 16,1 China 1,8 0,4 2,2 2,2 3,1 2,6 India 0,6 0,8 0,8 0,9 1,0 0,7 EU-15 outflows of which Source : Eurostat With regard to the issue of company relocation and outsourcing specifically, taking into account the problems of identifying the phenomenon, the available evidence on FDI and trade offers an anything but dramatic picture. As argued above, developed countries continue to be the main recipients of EU FDI outflows, with the US the major destination. In comparison, in 2002 12.4% of all EU foreign direct investment went to the new Member States, and only 2% was directed to China and 0.5% to India. However, there is growing evidence for rising fragmentation and vertical integration of production processes; accordingly, trade in intermediate goods accounts for an increasingly large proportion of total trade. Intermediate goods trade represents around 30 per cent of world trade in manufactures. While the outsourcing of intermediate inputs appears to have -6- contributed to increased productivity, the available evidence also suggests that it was associated with a quite substantial drop in the relative demand for less-skilled workers. The current skill-content of EU trade raises additional concerns in that respect. Although the EU’s trade balance in high-tech sectors is improving, a good deal of the EU’s positive trade performance is due to intermediate skills sectors. Indeed, an investigation of indices of revealed comparative advantage shows that the EU economy is specialised in sectors with intermediate labour skills, Source: See EU Sectoral Competitiveness Indicators: op. cit., whereas other high-income footnote 1, Graph VI.9 regions are more specialised in products requiring high to high-intermediate skills. This illustrates that the EU is lagging behind in technology and human capital intensive production. Graph 7: EU-15 trade by labour skills categories (Net exports divided by exports plus imports) 0.4 0.3 0.2 High High-intermediate 0.1 Low-intermediate Low 0 -0.1 -0.2 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Another indicator pointing to potential shortcomings in the structure of EU exports is the relatively low share of high-technology, in particular when compared to the US. While hightechnology now accounts for a considerably higher share of EU manufacturing exports than 10 years ago, the gap to the US has not diminished. Remarkably, although of course still much smaller in absolute levels, the Graph 8: Share of high-technology in manufacturing exports share of high-technology in manufacturing exports in China is comparable to that of the EU. In those areas where most of the growth in world exports is realized (semiconductors, passenger cars, telecommunications, computers, computer parts and pharmaceuticals), the EU has managed to keep its position, but could not make improvements either. Clearly impressive is the speed with which China has advanced in these areas (the only exception for the moment being passenger cars and pharmaceuticals). -7- Graph 9: World export market share in Telecommunications and Computers Te le com m unications 30 Com pute rs % Share of W orld Export Markets 30 % Share of W orld Export Markets South East Asia South East Asia South East Asia 25 20 25 EU15 20 US 15 15 Japan US Japan 10 10 EU15 China 5 5 China 0 1992 1994 1996 1998 2000 0 2002 1992 1994 1996 1998 2000 2002 Source: ECFIN, Annual Review 2005 forthcoming Trade integration has also quickly proceeded in services and international outsourcing of business services has been growing. However, insourcing – i.e. exports of business services – has also increased substantially in recent years. In fact, countries such as the US and UK are net exporters in business services, and for several other EU countries the balance of trade in business services is broadly in equilibrium. Looking ahead, however, some authors see a large potential for eventual off-shoring of ICT-intensive using occupations; among the reasons mentioned for the job outflow are overpricing of scarce skills at home and a strong emerging skill basis abroad, while low-cost communication and global cost competition facilitate and enforce, respectively, the most efficient allocation of resources. Graph 10: Net immigration flows in the EU, in thousands 1400 1200 1000 800 600 400 200 0 -200 -400 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 Source: New Cronos, EUROSTAT Although there is still little evidence that the EU is losing R&D jobs on a large scale, available indicators show that, relative to the USA and Japan, the EU has become a less attractive place for location of R&D. Attracting foreign talent is likely to become an ever more important challenge, in particular for migration policy. Net immigration flows into the EU rose again in the second half of the 1990s. In general, the EU appears to be significantly less successful than the US in efficiently absorbing migrants into its labour markets, having to cope with a larger share of low-skilled immigrants. -8- 3. The impact of deeper economic integration on jobs and wages Similar to the introduction of new technologies, international trade even with low-wage countries has never led to a net reduction of employment over more than a short period of time, if at all. At the aggregate level, there is no evidence that countries with a higher (increase in the) degree of openness to trade, suffer from a higher (increase in the) rate of unemployment. Graph 11: Unemployment and openness, industrial countries Graph 12: Change in unemployment and change in openness, industrial countries EL 10 ES FR IT 8 FI DE BE CA 6 US JP 4 Rate of unemployment (avg 2001-05 relative to early 1980s) Rate of unemployment (avg 2001-05) 12 AU PT UKNZ SE DK AT NO CH IE NL IS 2 0 0 20 40 60 80 Openness (trade in g+s relative to GDP, avg 2001-05) Source: Commission services. -10 100 6 EL 4 FI DE JP 2NO ISFR IT NZ 0 -2 -4 -6 AU PT DK US CHSE ES AT CA BE UK NL -8 IE -10 0 10 20 30 Change in openness (trade in g+s relative to GDP, avg 2001-05 to early 1980s) 40 Source: Commission services. However, trade integration is likely to have had a negative impact on the decline of manufacturing jobs. Manufacturing sectors, in which the import-penetration ratio increased, seem to have recorded a stronger decline in employment than those where import competition has been weaker. Graph 13 illustrates this relationship for the period 1980-2000 based on aggregated industrial data for 8 EU Member States, showing that employment shrinkage has been much stronger in the textile industry, where import-penetration doubled from 25 to about 50%, than in food industries where the 2000 import-penetration index was comparatively small. Indeed, the index was smaller in the food industry in 2000 than it had been in textiles 20 years ago and increased by less than in textiles over the 2 decades analysed. The overall picture does not change if different periods are looked at (1990-2000 and 1995-2000). The relationship between industrial employment and foreign trade is less clear cut when the export-import ratio is considered. A large part of the EU’s foreign trade takes place in the form of intra-industry trade. This is evidenced by a strong correlation between changes in import penetration and the export share of production across sectors. Sectors exposed to strong import competition are also those that export a large share of their production. No relationship between changes in the export-import ratio and relative employment across sectors is visible in Graph 14. -9- Graph 13: Change in employment and import-penetration by manufacturing sector, EU-8, 1980-2000 Coke, petroleum Wood Pulp, paper NEC Non-metallic Food minerals -0.5 Chemicals Transport eq Machinery and eq nec -1 Electrical eq Metals -1.5 -2 Rubber, plastics 0 Rubber, plastics Change in employment (relative to total economy), % pts Change in employment (relative to total economy), % pts 0 Graph 14: Change in employment and export-import ratio by manufacturing sector, EU-8, 1980-2000 Textiles -2.5 Coke, petroleum Wood Non-metallic minerals Chemicals -0.5 Transport eq Machinery and eq nec Electrical eq -1 Pulp, paper NEC Food Metals -1.5 -2 Textiles -2.5 0 5 10 15 20 25 30 Change in import penetration, % pts 35 40 Note: 2000 figures are averages 1999-2001, eq stands for equipment, -40 -30 -20 -10 0 Change in export/import ratio, % pts 10 20 Note: 2000 figures are averages 1999-2001, eq stands for equipment, nec for not elsewhere classified. Source: OECD STAN, Commission services. nec for not elsewhere classified. Source: OECD STAN, Commission services. Analysis of data from household surveys in the OECD Employment Outlook (2005) suggests that in the US and 14 EU countries manufacturing workers face a higher risk of displacement than employees in services. Among manufacturing industries, displacement rates also tend to be higher in the industries where international exposure is intense. If one assumes that these differences reflect the extra job displacement by international competition, it follows that international trade and investment account for somewhere between zero and 20% of all permanent layoffs in these countries.2 While this is certainly a non-negligible number, it appears to be safe to conclude that international competition is far from being the dominant cause of job displacement and the trend decline in the share of manufacturing employment. Furthermore, data from the European Monitoring Centre of Change demonstrates that the impact of company relocation on job losses has been very small, in particular when compared to total employment or total restructuring. Table 2: Displacement rates by industry, average in per cent of total employment 14 EU countries 1994-2001 USA 1979-99 Manufacturing 3.7 4.6 - High international competition 3.7 5.9 - Medium international competition 4.4 6.2 - Low international competition 3.5 4.3 Services (and utilities for USA) 3.2 1.7 Total employment 2.8 2.2 Source: OECD Employment Outlook (2005) on the basis of the ECHP for the EU-15 countries excl. SE; and Kletzer (20001) for the USA. 2 Clearly, such a calculation can only provide an imprecise estimate. - 10 - Some authors have linked the observed degree of wage moderation in developed countries to the emergence of China, India and Russia as trade partners, endowed with a huge labour force. Moreover, some high-profile cases and anecdotic evidence suggest that the mere threat of relocation and off-shoring could weaken the bargaining stance of workers and unions over wages and working conditions. However, it is anything but evident that at the aggregate level movements in the wage share can be directly linked to an increase in international competition. Graphs 15 and 16 clearly demonstrate that there is no systematic relationship between the change in openness and the wage share in a cross-country perspective, neither for the total economy’s wage share nor for the wage share in manufacturing. The same observation holds if the length of the period is reduced from two decades to one decade (1992-2002). In general, thus, domestic labour market conditions continue to be the main driver of movements in aggregate real wage growth around the productivity trend over the medium to long-term. Graph 15: Change in openness and wage share, 1980-2002 Graph 16: Change in openness and wage share in manufacturing 1980-2002 30 20 IE BE 15 20 change in openenss change in openenss 25 BE 15 AT ES 10 DK 5 FI IT FR CA SE NL DE AU 0 JP PT US EL UK IS AT 10 ES SE NL DK 5 AU FR PT DE FI IT US UK 0 JP NO NO -5 -5 -25 -20 -15 -10 -5 0 5 10 -25 change in wage share Source: Commission services. -20 -15 -10 -5 0 5 10 15 change in wage share Source: Commission services. Evidence is more robust that trade and vertical integration caused a shift in relative demand for unskilled labour, in particular in manufacturing. While the outsourcing of intermediate inputs has contributed to increased productivity, the available evidence also suggests a quite significant drop in relative demand for unskilled workers. This development has contributed to increasing wage inequality in the USA, estimated to account for as much as one third of the overall increase in wage inequality. The case is less obvious in the EU Member States. Wage inequality has increased little, while unemployment among the low-skilled has picked up. Obviously, the feasibility to reap the benefits from deeper economic integration depends largely on the capability to reallocate employment. The adjustment process with its shift in the sectoral and occupational composition of employment cannot be expected to run without friction. Thus, ensuring a smooth reallocation of labour will help to minimise the hardship for the workers affected by job displacement and the off-shoring of production. In fact, the magnitude of net benefits from economic integration strongly depends on costs of adjustment, which are largely determined by the time displaced workers spend in unemployment and/or inactivity, and any lower income once they are reemployed. Box 1 below, which is based on calculations published by the consultancy firm McKinsey, illustrates that reemployment of labour is indeed a crucial parameter. Whereas the USA - 11 - benefits considerably by relocation of services, Germany and France are estimated to benefit much less from foreign investment, basically due to the less successful reintegration of displaced workers into the labour market. Box 1: An estimate of the distribution of gains from the outsourcing of services A comparison of the gains from service off-shoring in the USA and Germany undertaken by the international consultancy firm McKinsey forcefully demonstrates that rigid labour markets mean that the benefits from globalisation are not fully reaped. The table below gives an intriguing illustration of how the benefit from relocating a service job from the USA, Germany or France is distributed among the source and the host country. According to the calculations, the US economy captures 1.1 USD for each USD of corporate spending in India whereas France would capture 85 cent and Germany just 80 cent for each euro invested in India, North Africa or Central and Eastern European countries. The authors of the study calculate that the host country captures 33% of the corporate spending, benefiting from local wages etc. Under perfect competition, the company would be forced to fully pass-through its cost savings to lower prices, implying that it is the consumer who benefits most from the investment abroad. This amounts to 50-53% in the USA and 36% in Germany and France. The cost saving for the European countries is lower because differences in language and culture are considered to raise the transaction costs involved. Moreover, it is argued that infrastructure and labour costs are higher in the case of the CEECs, reducing the magnitude of cost savings. The direct benefits accruing for the source countries in the form of additional exports and repatriated earnings are also higher in the USA than in Germany and France because the US is more specialised in exporting IT goods and European firms have negligible ownership in Central and Eastern European business service companies. A further benefit for the source economy accrues in the form of redeployed labour. The authors quote estimates for the USA according to which the workers set free through off-shoring move to another job and this reallocation of jobs adds value of 57 cent for every US dollar invested in Indian services. Because of higher unemployment and more rigid labour markets, the authors estimate that benefits from reemployment are considerably lower in Germany and France than in the USA. Table : The distribution of income generated by 1 USD/euro spent on a service job in a low wage country in per cent India/North Africa, CEEC (host) Wages paid to local workers, profits of local agents, local taxes Corporate savings Additional exports to source countries and repatriated earnings Sum of direct benefits Redeployed labour Sum of total benefits Source country of investment USA DE FR 50-53 36 36 7-9 67 57 114-119 3 39 34 73 5 41 44 85 33 33 33 Source: McKinsey Global Institute (June 2005), “The emerging global labor market”. In fact, there appear to be significant obstacles to the reallocation process in Europe, locking resources into inefficient use. This is particularly troublesome for labour, with displaced workers experiencing undue difficulties finding new employment. Indeed, displaced workers in the EU suffer from a lower probability of finding a new job compared to those in the USA. In the USA, on the other hand, displaced workers have to accept larger shortfalls in earnings when getting re-employed. Furthermore, search efforts among displaced workers in EU Member States appear to be stronger geared towards jobs in the same industry than in the USA. Occupational and regional labour mobility is low and has hardly increased over the last years in the EU-15 Member States. However, estimates based on the European Community Household Panel indicate that training increases the probability to find a new job, especially for those who have received training prior to being laid off. - 12 - Table 3: Labour market prospects of displaced workers EU 1994-2001 High compt. mftg. Total mftg. Share re-employed two years later 52 Share with no earnings loss or earnings more Share with earnings losses greater than 30% USA 1979-99 Services High compt. mftg. Total mftg. Services and utilities 57 57 63 65 69 44 46 50 36 35 41 5 7 8 25 25 21 Notes: Columns relate to manufacturing with high international competition, total manufacturing and services (and utilities for USA) Sources: OECD Employment Outlook (2005) for EU-15 (excl SE) on the basis of ECHP data and Kletzer (2001, “Job Loss from Imports: Measuring the Loss”, Institute for International Economics, Washington, DC) for USA on the basis of bi-annual Displaced Worker Surveys. 4. Conclusions The European economy is inextricably linked to the world economy. Happily, upon closer inspection many of the allegedly negative implications of rising international trade and investment for jobs, wages and living standards are belied by the evidence. Deeper international economic integration offers huge opportunities for European firms in rapidly growing large markets, to exploit efficiency advantages, and to source strategic assets globally in order to stay competitive. However, policy makers may be well advised not to dismiss widespread public concerns all too easily. In order to realise the potential gains from this process, production structures will have to shift considerably towards further specialisation and diversification into new areas of relative comparative advantage. Throwing sand into the wheels of deeper international economic integration in order to reduce adjustment costs, as contemplated by some observers, is not an attractive option. Clearly, when faced on the one hand with dispersed gains from economic integration that materialise in the medium to long-term, and on the other hand with the concentrated and localised shortterm adjustment needs, it is challenging for policy makers to withstand protectionist tendencies. However, in addition to reducing economic efficiency, income and employment opportunities in the long run, protectionist solutions weaken the governments bargaining stance against trade barriers in other countries, thereby undermining job creation in those sectors that would benefit from economic integration. Moreover, the experience with “defensive” policies which try to shield established firms/industries from new sources of competition and/or which have tried to protect people within specific jobs has largely been negative. The initiative to foster European financial integration and the impact of the euro on financial integration in the EU has to be seen in the context of globalisation, advances in technology and regulatory reform. Concrete evidence that the introduction of the euro has made a specific contribution to integration can be found in more homogeneous markets, a wave of consolidation among intermediaries and exchanges and the emergence of new and innovative products and techniques since 1999. This creation of broader, deeper and more efficient financial markets has clearly the potential to foster European growth by attracting international funds – if pursued regulatory and structural reforms support the necessary rentable investment opportunities in this increasingly competitive global environment. - 13 - As with respect to other drivers of structural change such as technological progress, the response to globalisation cannot be to bring the process to a halt, but rather to develop a policy design that is conducive to the full realisation of the opportunities offered by deeper international economic integration, while minimising unavoidable adjustment costs. Obviously, well-functioning labour markets that enable workers to move smoothly from declining to expanding activities have a key role to play in the adjustment process; in practice, this may often mean ensuring a better balance between income support for job losers, adequate job-finding assistance, training, and proper re-employment incentives. Moreover, structural funds could be used to assist structural adjustment and ease transition costs. Meeting the broader challenge from globalisation requires policy responses that extend far beyond labour-market and social safety-net policies. The EU must enhance its ability to create new activities and jobs in order to take the “high road” in the emerging new international division of labour. Producing only goods and services reflecting traditional comparative advantage will not be sustainable in the long-run. However, creating new high value-added activities with deeply rooted comparative advantage requires a dynamic framework where innovation and R&D, fostered by excellent education systems, can spur productivity and job growth. Clearly, without such a dynamic approach, no new jobs will be created to replace the jobs lost, and public support for economic openness is likely to erode. A stable macroeconomic environment, efficient and integrated financial markets, an open and dynamic internal market, flexible labour markets and a well trained and highly skilled workforce appear to be essential elements of such a strategy. - 14 -