Government Strategy Associates - ISVMA, Illinois State Veterinary

advertisement

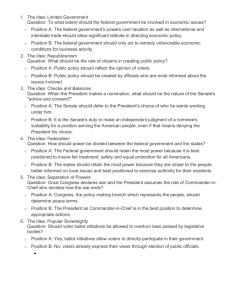

Government Strategy Associates 4023 Terramere Avenue Arlington Heights, Illinois 60004 MEMORANDUM To: Peter Weber Executive Director, ISVMA From: Terry Steczo Maureen Mulhall Re: Legislative Report Date: March 31, 2014 Agreement Reached With Advocacy Groups Legislation had been introduced earlier in the session that would have allowed a veterinarian licensed or veterinary technician certified in another state to practice in Illinois in connection with an investigation by law enforcement of an alleged violation of federal or State animal fighting or animal cruelty laws. Many questions arose after review of this proposal by the ISVMA and prompted a number of phone conversations with the groups and organizations advocating for this change. After review of the need, the ISVMA suggested that the most viable path toward accomplishing the objective was through the JCAR process rather than through a statutory change. During subsequent phone conversations it was agreed that the JCAR would be preferred and plans are being made to request a change in rules to attain that objective. That decision to use JCAR to accomplish what they originally sought by the legislative route may turn out to have been a wise decision because companion legislation that would have allowed the establishing of a temporary shelter to receive animals seized or impounded as a result of the investigation or prosecution if the law enforcement authority determines that the shelter is necessary was defeated in the Senate Agriculture and Conservation Committee after the Farm Bureau, Illinois Beef Association, breeders organizations and the Department of Agriculture all filed in opposition. Tough Choices and Contrasts After weeks of delay, Governor Quinn presented his FY 2015 budget proposal last week and surprised quite a few by calling early for a permanent extension of the now-temporary income tax increase. No stalling, no call for a temporary extension or a phase-out. His message was to make the tax increase permanent and in doing so help create an environment to overcome its lingering fiscal deficits. His published budget information also provided a glimpse as to the impact on programs and services with the loss of $1.6 billion that would vanish if the tax were to sunset. In an even more surprising turn of events, Speaker Madigan and President Cullerton suggested that they might push for a vote on the tax question before the scheduled May 31 legislative adjournment. The legislature is not known for taking on highly controversial issues just prior to an election, so if this happens it would make a substantial departure from past practice. The general rule of thumb has been to wait until after the election and hope that voters forget in the intervening two years. In addition to the permanent extension of the tax, the Governor also advocated for a $500 yearly property tax refund, a doubling of earned income tax credits, and tax credits for job training as part of what he described as a comprehensive tax reform package. But, the speech also offered a glance at his reelection strategy; one that is designed to show the contrasting views between Quinn and GOP nominee Bruce Rauner. He opened his speech by stressing that he wanted to be “forthright and specific”. During his primary election campaign Rauner often frustrated his opponents with his unwillingness to provide specific details of proposals while sticking to his main campaign themes of term limits, overabundance of union influence, and career politicians. The Governor also announced that he would never place taxes on service or tax retirement income. This, no doubt, was a response to two comments, likely gaffes, made by Rauner when he did attempt to explain his position on taxation at two voter candidate venues. The fact that they were mentioned in the budget address means we’ll be hearing about it from now until November 4. Why did Quinn decide to take this giant step rather than waiting? First, he did sign the last tax increase so he’s on record as having supported higher revenues. Second, everyone knows that if he wins and the legislature presents him with an income tax extension he’d sign it and he’s going to be asked the question time and time again during the upcoming months, so why couch it? Third, Quinn has not been a very strong leader and his favorability numbers are in the tank. Really, he has nothing to lose and everything to gain. In addition, he may also be trying to flush out Rauner, hoping that once Rauner provides specifics about how his administration would address state fiscal and other issues voters will be more likeable toward Quinn. Even though there seems to be some desire by the Democratic legislative leadership to move the plan before May 31, there may also be some reluctance by the rank and file so at this point the Quinn proposal is anything but a done deal. And one of the political questions being asked that has little to do with the policy considerations is what happens if the legislature approves the tax program and Quinn loses in November? The result will be giving Rauner, who has urged that the tax be allowed to expire, a boatload of extra money so he won’t have to make the hard decisions that would be necessary without it. To Serve … And Protect Only time will tell if a new tax plan devised a few weeks ago by Speaker Madigan has any traction, but as observers of the legislative process have marveled that if the only way out of a thicket is by having to kill three birds with one stone Madigan can at least think of a strategy to try to do it. And that’s what he has apparently attempted to do with the introduction of HJRConstitutional Amendment 51 that would impose an additional 3% income tax on any individual income over $1 million. All proceeds would go to schools and be distributed on a per student basis. Let’s count the birds. Bird 1: There has been a lot of clamor by some advocacy groups hoping to place a constitutional amendment on the ballot asking voters to approve a graduated income tax and pressure to do so has been mounting. Even though the three-fifths vote in the House and Senate to place it on the ballot probably aren’t there, and one thing for certain is that if it were to be approved and placed on the ballot it would be DOA. And, the voters who would be rushing to the polls to vote against it are not the ones that Democratic candidates, most especially Governor Quinn, want to see coming. In this age of government mistrust a graduated income tax proposal would be poison and go down in flames. Those legislators who voted for it would have huge targets on their back, whether the question made it to the ballot or not. But how do you appease the vocal constituency that was making the demands, not particularly caring about the electoral upheaval it could cause. That’s where Madigan’s alternate fills the bill. There is a smidgen over 13,000 millionaires out of almost 13 million Illinoisans so only a relative few would be paying. And, since most of those millionaires are situated in the northern part of the state and the money raised would be distributed per student, it means that the central and southern parts of the state would be gainers and maybe not so poised to come out the polls to vote no. In fact, the contrary might occur. Plus, there is more of a chance to solidify legislators to vote to get this on the ballot because it does impact so few, rather than a graduated tax that might influence many to most. And, what about those vocal advocates? While it may be too early to tell if they switch gears, they should also be aware that this proposal saves them from providing the ammunition to their own firing squad. Bird 2: January 1, 2015 marks the end of the temporary income tax. For the next fiscal year it represents a loss of $1.6 billion in revenue and $3.2 billion or more the year after if they don’t extend the temporary income tax before May 31 or even post-election. The amendment gives candidates at least some way to draw the focus away from the main tax issue. More importantly, it is estimated that if the “millionaire tax” is approved by voters in November it is estimated it would raise over $1 billion per year – enough to offset a good portion of the revenue loss for FY2015 if the General Assembly somehow says no to extending the temporary tax and lets it expire. If that were to occur, and if a candidate who opposes a tax extension would win in November, the legislature may just allow them to have it their way, even though the fiscal consequences could be enormous. The amendment not only would take some of that pressure off of the legislature, but also serves as a pseudo poll on taxes which could come in handy for legislators in post-election Springfield if it were to come to that. Bird 3: The gubernatorial candidates started swinging before the ink was even dry on the primary election returns and this amendment proposal will become part of that fray. In his first blast out of the gate at GOP candidate Bruce Rauner, Governor Quinn characterized his opponent as a “billionaire” out of touch with the middle class. The amendment draws attention to Rauner’s wealth (or at least allows the Governor to) and also tries to put him in an uncomfortable position if he opposes it. Quinn will no doubt ask if the opposition is for policy reasons or to protect his own pocketbook. There’s no way to predict at this point if the amendment will receive sufficient legislative support to make it to the ballot, or sufficient voter support if it does but last week the first step was taken as the House Revenue and Finance Committee moved the proposal to the Floor where it will be voted on, perhaps this week. In the sometimes high stakes game of Illinois government and politics this proposal has the possibility of becoming a game changer. Power To The People Pat Quinn’s claim to fame was the success of the 1980 legislative ballot initiative that reduced the size of the Illinois House by one-third. Before and after he was known for highly publicized petition drives that sought to put various advisory referenda on the ballot in the state, county and municipal elections. Throughout his political life he has advocated for the right of voters to have a say on relevant, sometimes controversial issues. Little did he expect that one day he himself would be the subject of the most important referendum of his life … his own campaign for reelection. In fact, in terms of the voting citizenry being asked to make decisions on various issues election day, November 4, will be one for the records with possibly as many as four or more constitutional amendments on the ballot, as well as the race for governor. The biggest question to be asked and answered on November 4 will be on Quinn himself. During his budget message last week he went “all in” with his request to permanently extend the temporary income tax. His opponent, Bruce Rauner, has taken a position for the expiration of the tax. While there is no telling for certain whether or not the General Assembly will act on the tax question before its May 31 adjournment, it is certain that no matter what they do the entire general election gubernatorial campaign will be framed in the context of taxes. Dawn Clark Netsch in her race for governor and Walter Mondale while running for president both tried to level with the public about revenues and they badly misjudged. Governor Quinn is now taking a turn at rolling the dice, hoping that the odds will be with him. Constitutional amendments and advisory referenda are sometimes placed on the ballot to drive voter turnout as well as to drive changes in public policy. 2014 could conceivably set a record for constitutional questions placed on the ballot. The Illinois Constitution limits the number of amendments approved by the legislature appearing on the general election ballot to three. The Constitution also allows questions of legislative “structure and procedure” to qualify by popular initiative. So far, two legislative questions are in the works as are two legislative issues driven by petition. There is also room for one more from the legislature before the first week in May deadline. Three of the four are definitely intended to drive election turnout. GOP gubernatorial candidate Bruce Rauner is behind a petition drive seeking to place a Constitutional Amendment on the ballot regarding term limits. The Illinois Supreme Court quashed an attempt by Quinn to do that a number of years ago but Rauner’s proposal contains a number of other elements, such as reducing the size of the Illinois Senate from 59 to 41, increasing the size of the Illinois House from 118 to123, carving three House districts out of every Senate district, changing Senate terms and the number of votes required to override a gubernatorial veto. If they get enough valid signatures the Supreme Court will have the final say as to whether it meets the Constitutional test and makes it on to the November ballot. If it does, it’s looks to boost turnout and provide an outlet for those who express frustration with government and elected officials. And, it’s very likely it would be approved. On the other side, Speaker Madigan is proposing his 3% “millionaire surcharge” that may be on the ballot and drive the Democratic constituency to the polls, especially downstate where few would pay but where schools would benefit to the tune of $550 per pupil. It helps equalize the term limit amendment should it make it to the ballot. Madigan has also proposed a voting rights amendment. It provides that no person shall be denied the right to register to vote or to cast a ballot in an election based on race, color, ethnicity, or status as a member of a language minority, sex, sexual orientation, or income. Officially, the explanation is that the amendment would place voting rights non-discrimination in the state Constitution to prevent some of the shenanigans occurring in other states. But, looking closely it appears that it’s also geared to drive the turnout of those who have been the target of such discrimination in other states … a valuable and necessary Democratic constituency. This amendment is expected to be heard and probably approved in a House committee this week. The fourth possible amendment proposal is one that would change the redistricting process. If it makes the ballot it will not drive turnout but it’s highly likely that voters would say yes. Here We Go Again Spring. Swallows make their way back to Capistrano and gaming expansion bills make their way back to the Illinois General Assembly. Last week amendments were filed to Senate Bill 1739 that mirror past attempts to expand casinos and provide slot machines at horse tracks but provide fewer positions at casinos and fewer slots at the tracks. The sponsor has indicated that he wanted to throw this modified idea on the table in order to restart the discussions. If there ever was a Guinness World Record for futility, the supporters of expanded casino gaming would win hands down. Year after year they’ve tried and have failed to even get through the legislative process … and when they did, the Governor was there with a big veto pen. But they persist through all of the hours of conversation and debate, knowing that the odds get longer every time they make the attempt. Rep. Bob Rita, the House sponsor, in his attempt to pare back the proposal somewhat, is trying to make it more palatable to the other established gaming interests. But since the last time the Governor axed a gaming bill a new kid in town has arrived and has had a profound impact on those more established players. Since the advent of legalized video poker most casinos have seen profits plummet, so even with a scaled down expansion bill they may be in no mood to see more erosion of profits and most assuredly will oppose. The other conundrum faced by the sponsor is trying to find the right balance. Your need enough goodies in the bill to secure enough votes but not too many so as to sink the ship. Anyone who has ever wanted to be part of legalized gaming in Illinois wants in this bill because it may be the last for maybe a generation or more. The only reason any gaming expansion is even seriously discussed is because Chicago wants a casino. Once they get one you can close the books on any further expansion. With a hot gubernatorial election campaign on the horizon there’s slim chance that we’ll see any serious gaming legislation before November, if not before hell freezes over. Pension Reform Update The pension reform train is barely moving since there was word last month that the three lawsuits that had been filed would be consolidated and be heard in Sangamon County. A fourth lawsuit was filed a few weeks ago in Champaign County and it is expected that this latest court filing would also be consolidated with the others. It appears that the first court appearances to argue the relevant issues may not occur until mid to late May. Session Schedule/Deadline Dates Here are relevant dates for the legislative session: April 11 – House/Senate 3rd Reading Deadline April 14-25 – No session scheduled May 16 – House/Senate Committee Deadline May 23 – House Senate 3rd Reading Deadline May 31 – Adjournment Bills of Interest The deadlines for bills introduced in the House and Senate has now passed. Listings reflect current status of bills. Note: Proposals that did not move out of committee could resurface on other bills as amendments before the end of the session. HB 3767 – Rep. Burke - Amends the Humane Care for Animals Act and the Humane Euthanasia in Animal Shelters Act. Prohibits the use of carbon monoxide as a euthanasia agent for companion animals. Provides that euthanasia of a companion animal shall only be performed using established injectable euthanasia agents. Provides that the use of other euthanasia agents on companion animals is aggravated cruelty. (Status – House – Rules Committee - Dead) HB 3768 – Rep. Burke - Amends the Humane Care for Animals Act. Provides that no person may knowingly beat, cruelly treat, torment, starve, overwork, or otherwise abuse any animal in the presence of a minor. Defines "in the presence of a minor". (Status – House – 2nd Reading) HB 4188 – Rep. Berrios - Creates the Animal Abuse Registry Fund. Amends the Humane Care for Animals Act. Provides that the Department of Agriculture shall create and maintain an animal abuse registry. Provides that any person 18 years of age or older that resides in or is domiciled in this State that has been convicted of cruel treatment, aggravated cruelty, or animal torture shall register with the Department of Agriculture within 30 calendar days after the date of conviction to be placed on the animal abuse registry. Failure to register is a Class B misdemeanor for a first offense and a Class 4 felony for a subsequent violation. Prohibits a registered person from owning a companion animal or being employed at an animal shelter, pound, pet shop, zoo, or other business where companion animals are present. (Status – House – Agriculture & Conservation Committee - Dead) HB 4195 – Rep. Vershoore - Amends the Humane Care for Animals Act. Provides that upon conviction of improper care, cruel treatment, aggravated cruelty, or animal torture, the court shall order the convicted person to forfeit to an animal control or animal shelter the animal or animals that are the basis of the conviction. (Status – House – Rules Committee - Dead) HB 4410 – Rep. D. Harris - Increases certain penalties that the Department of Agriculture shall impose upon a person or entity who violates any provision of the Act or rule adopted under the Act. Provides that an administrative fine of $500 (rather than $200) shall be imposed for the first violation; a fine of $1,000 (rather than $500) shall be imposed for a second violation that occurs within 3 years after the first violation; and that mandatory probationary status and a fine of $2,500 (rather than mandatory probationary status and a fine of $1,000) shall be imposed for a third violation that occurs within 3 years after the first violation. (Status – Passed House; Senate – Committee on Assignments) HB 4663 – Rep. Verschoore - Amends the Animal Gastroenteritis Act. Adds members to the Swine Disease Control Committee. Renames the Cattle Disease Research Committee to the Cattle Disease Control Committee. Corrects references. Adds members to the Cattle Disease Control Committee. Provides that meetings shall only occur in the event of a disease outbreak or other significant disease situation. Provides that the meetings shall be scheduled at the call of the Director with the Swine Disease Control Committee and the Cattle Disease Committee to address disease prevention, management, and control in the case of a disease outbreak. Provides that members of the Committees shall receive no compensation, but shall be reimbursed for expenses necessarily incurred in the performance of their duties. Repeals a provision that authorized the Department of Agriculture to coordinate research concerning the cause, transmission, treatment, and control of transmissible gastroenteritis and other diseases of swine and livestock. (Status – House – 3rd Reading) HB 5398 – Rep. Jackson, Sr. - Amends the Illinois Pseudorabies Control Act. Provides that members of the Pseudorabies Advisory Committee shall only serve for the duration of the pseudorabies outbreak within the State. Provides that the committee shall only meet during the duration of the pseudorabies outbreak. (Status – House – Rules Committee - Dead) HB 5603 – Rep. Sommer - Amends the Animal Control Act. Provides that a County Animal Control that is located in a county that has been declared a disaster area under the Disaster Relief Act due to a natural disaster, or in a county which a part of the county has been declared a disaster area under the Disaster Relief Act due to a natural disaster, shall retain impounded animals for a minimum of 3 days beyond its normal retention time before the County Animal Control may proceed with the adoption, transfer, or euthanasia of the impounded animal. Provides that a County Animal Control shall keep a detailed list of the impounded animals that were transferred to another facility for a minimum of one month after the disaster. Provides that facilities receiving transferred animals shall retain the impounded animals for an additional 3 days beyond its normal retention time. (Status – House – Agriculture and Conservation Committee - Dead) SB 3050 – Sen. Frerichs - Amends the Humane Care for Animals Act. Provides that a nonprofit organization qualified under Section 501 (c)(3) of the United States Internal Revenue Code of 1986 for the purpose of preventing cruelty to animals may, in connection with an investigation or prosecution by law enforcement of an alleged violation of federal or State animal fighting or animal cruelty laws, establish a temporary shelter to receive animals seized or impounded as a result of the investigation or prosecution if the law enforcement authority determines that the shelter is necessary, the law enforcement authority extends an official invitation to the organization, and the shelter complies with the requirements of the Veterinary Medicine and Surgery Practice Act of 2004. Defines "temporary shelter".standards under State law. (Status – Senate – Senate Agriculture & Conservation Committee - Dead) SB 3138 – Sen. Rezin - Amends the Humane Care for Animals Act. Upon entering a conviction for a violation of specified provisions of the Act, or of specified provisions of the Criminal Code of 2012, by a defendant 18 years of age or older, the presiding judge shall notify the defendant that the conviction will be reported to the national Do Not Adopt Registry. Provides that, for convictions that occurred on and after January 1, 2015, the clerk of the court shall send notice of the conviction and the defendant's name, date of birth, physical description (gender, ethnicity, eye color, hair color, height, weight), and offense for which the defendant has been convicted, to the national Do Not Adopt Registry. Provides that, for convictions that occurred before January 1, 2015, the clerk may send notice to the national Do Not Adopt Registry of convictions by a defendant 18 years of age or older. Provides that any animal shelter, pet store, animal breeder, or individual shall conduct a search of the national Do Not Adopt Registry prior to selling, transferring, delivering, or placing for adoption a companion animal to another person. (Status – Senate – State Government and Veterans Affairs Committee - Dead) SB 3337 – Sen. Koehler - Amends the Humane Care for Animals Act. Provides that each owner shall provide for each of his or her animals adequate shelter and adequate space. Defines "adequate shelter" and "adequate space". (Status – Senate – Agriculture & Conservation Committee - Dead)