Coleman Lloyd Associates

advertisement

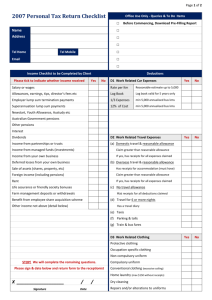

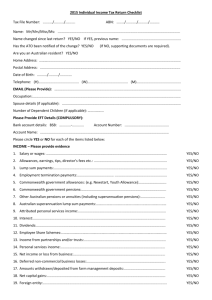

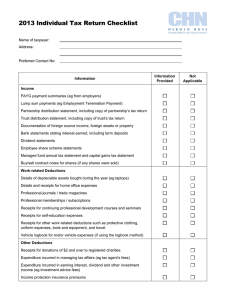

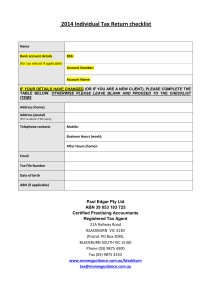

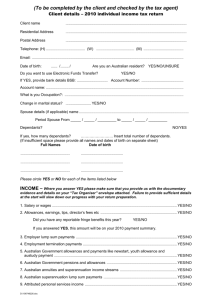

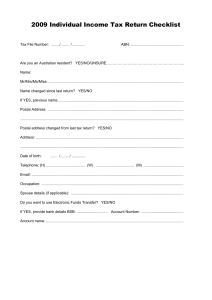

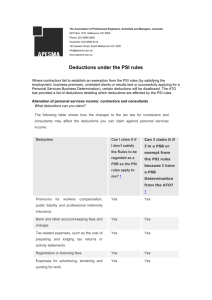

Page 1 of 2 2012 Personal Tax Return Checklist Office Use Only - Queries & To Do Items Name □ Before Commencing, Download Pre-Filling Report Address □ □ DOB / / Tel Home TFN □ Tel Mob □ Email □ Occupation □ Income Checklist to be Completed by Client Please indicate income received Yes Deductions No D1 Work Related Car Expenses Salary or wages including insurance for lost wages Rate per Km Reasonable estimate up to 5,000 Allowances, earnings, tips, director’s fees etc Log Book Log book valid for 5 years only Employment termination payments 1/3 Expenses min 5,000 annualised bus kms Australian Government allowances 12% of Cost min 5,000 annualised bus kms Yes No Yes No Yes No Australian Government pensions Annuities and superannuation income streams Superannuation lump sum payments Interest Dividends D2 Work Related Travel Expenses Discount(s) on employee shares or rights (a) Domestic travel & reasonable allowance Income from partnerships or trusts Claim greater than reasonable allowance? Income from managed funds (investments) If yes, has receipts for all deductions claimed Income from your own business (b) Overseas travel & reasonable allowance Deferred losses from your business (new clients) Has receipts for accommodation (must have) Net farm management deposits or repayments Claim greater than reasonable allowance? Sale of assets (shares, property, etc) If yes, has receipts for all deductions claimed Foreign income (including pensions) (c) No travel allowance Rental income Has receipts for all deductions claimed Life assurance company or friendly society bonuses (d) Travel for 6 or more nights in a row Farm management deposits or withdrawals Has a travel diary (unless domestic travel and Forestry managed investment scheme income claiming less than the reasonable amount) Other income not shown above (detail below) (e) Taxis (f) Parking & tolls (g) Train & bus fares D3 Work Related Clothing Protective clothing & footwear Occupation-specific clothing Compulsory uniform STOP! We will complete the remaining questions. Non-compulsory uniform reg with AusIndustry Please sign & date below Home laundry (max $150 without receipts) Dry cleaning X ___________________ Client Signature / Date / Repairs and/or alterations to uniforms Page 2 of 2 Deductions Continued D4 Self-education Expenses (formal qualifications) Tax Offsets Yes No T2 Senior Australian Location T3 Pensioner (ignore if T2 above completed) Nexus with current work activities satisfied T4 Australian superannuation income stream Student union fees T5 Private health insurance (if not claimed thru fund) Course fees (not HECS-HELP, HELP or SFSS) T6 Education tax refund no longer claimable Tuition fees (FEE-HELP, VET FEE-HELP, OS-HELP) T7 Spouse superannuation contributions Textbooks T8 Live in remote zone/serve in overseas forces Stationery T9 Net medical expenses over $2,060 Travel (kms between home & place of education) T10 Dependent relative Home office & decline in value of computer T11 Landcare and water facility Yes No No Yes No T1 Spouse (without dependent child or student) Course Name D5 Other Work Related Expenses Yes T12 Mature age worker (55yrs + and earns < $63,000) Computer expenses and software T13 Entrepreneur (SBE taxpayer & turnover < $75,000) Depreciation of computers & other equipment T14 Other tax offsets (describe below) Home office ($0.34/hour for heating & lighting) Internet access Overtime meals (max $26.45 per meal without receipts) Other Information Postage Medicare Levy – no of dependant children Reference books, technical magazines & journals Medicare Surcharge – private hospital cover held Safety Equipment (hard hats, safety glasses & sunscreen) If not covered – does family income exceed threshold Seminars, courses, conferences & workshops If covered – is the whole family covered Stationery Became or ceased being a resident during year Subscriptions Under 18 years of age at 30/06/2012 (complete A1) Telephone – home HELP debt $ Telephone – mobile PAYG Instalment Credits Tools and equipment Spouse Details (if we are not preparing that return) Union fees Name: Date of Birth Taxable Income RFBs Govt Pensions/Allows Exempt Pensions Net Invest. Loss Child Support Paid Reportable Super Target Foreign Inc Other Deductions D6 Low value pool deductions D7 Interest deductions D8 Dividend deductions D9 Gifts or donations Yes No SFSS debt $ $ / / Comments D10 Cost of managing tax affairs including GIC D11 Deductible amount for foreign pensions D12 Personal superannuation contributions D13 Project pool deductions D14 Forestry managed investment schemes D15 Other (incl income protection insurance premiums) L1 Losses from earlier income years __________________________ Preparer’s Signature / / Date