Finance

advertisement

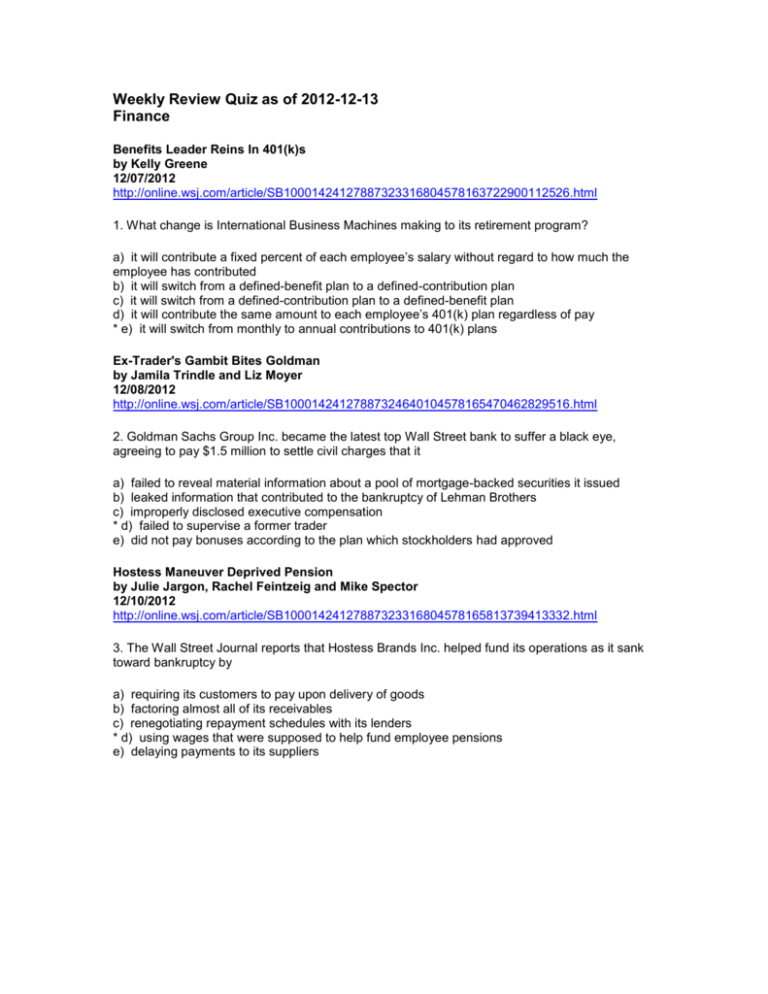

Weekly Review Quiz as of 2012-12-13 Finance Benefits Leader Reins In 401(k)s by Kelly Greene 12/07/2012 http://online.wsj.com/article/SB10001424127887323316804578163722900112526.html 1. What change is International Business Machines making to its retirement program? a) it will contribute a fixed percent of each employee’s salary without regard to how much the employee has contributed b) it will switch from a defined-benefit plan to a defined-contribution plan c) it will switch from a defined-contribution plan to a defined-benefit plan d) it will contribute the same amount to each employee’s 401(k) plan regardless of pay * e) it will switch from monthly to annual contributions to 401(k) plans Ex-Trader's Gambit Bites Goldman by Jamila Trindle and Liz Moyer 12/08/2012 http://online.wsj.com/article/SB10001424127887324640104578165470462829516.html 2. Goldman Sachs Group Inc. became the latest top Wall Street bank to suffer a black eye, agreeing to pay $1.5 million to settle civil charges that it a) failed to reveal material information about a pool of mortgage-backed securities it issued b) leaked information that contributed to the bankruptcy of Lehman Brothers c) improperly disclosed executive compensation * d) failed to supervise a former trader e) did not pay bonuses according to the plan which stockholders had approved Hostess Maneuver Deprived Pension by Julie Jargon, Rachel Feintzeig and Mike Spector 12/10/2012 http://online.wsj.com/article/SB10001424127887323316804578165813739413332.html 3. The Wall Street Journal reports that Hostess Brands Inc. helped fund its operations as it sank toward bankruptcy by a) requiring its customers to pay upon delivery of goods b) factoring almost all of its receivables c) renegotiating repayment schedules with its lenders * d) using wages that were supposed to help fund employee pensions e) delaying payments to its suppliers Insider-Trading Probe Widens by Susan Pulliam, Jean Eaglesham and Rob Barry 12/11/2012 http://online.wsj.com/article/SB10001424127887323339704578171703191880378.html 4. After a recent Wall Street Journal article, federal prosecutors and securities regulators have launched investigations into possible insider trading by a) cleaning crews on Wall Street b) editors at Wikipedia c) bank examiners * d) corporate executives e) relatives of investment bankers HSBC to Pay Record U.S. Penalty by Devlin Barrett and Evan Perez 12/11/2012 http://online.wsj.com/article/SB10001424127887324478304578171650887467568.html 5. HSBC Holdings on Tuesday plans to acknowledge that for years it ___________, part of a record $1.9 billion settlement with U.S. authorities that caps the bank's disastrous foray into the U.S. market. a) paid less interested to depositors than required given the APYs on the accounts b) collected more interest from borrowers than allowed given the APRs on the loans * c) ignored possible money laundering d) failed to report to the U.S. government interest income on deposits held in the Cayman islands e) all of the above