Pharmaceutical Market in Mexico

Confederation of Indian Industry

Background Note

On

“Pharmaceutical Market in Mexico”

Cygnus Business Consulting & Research

4 th & 5 th Floors, Astral Heights, Road No. 1, Banjara Hills, Hyderabad-500034, India,

Tel: +91-40-23430203-07, Fax: +91-40-23430208,

E-mail: info@cygnusindia.com,

Website:

www.cygnusindia.com

Knowledge partner for profitable growth

Pharmaceutical Market in Mexico

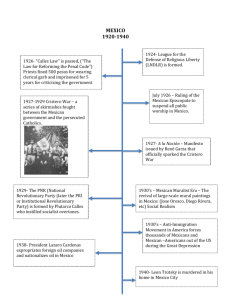

Mexico, which has over a hundred million inhabitants, is the world's ninth biggest pharmaceutical market and the largest in Latin America, surpassing Brazil for the first time in its

Growth rate of the Pharmaceutical history. The sector represents 1.18% of the national GDP, generating US$9,244 million (source Canifarma). The private sector market is valued at US$7,394 million, and the governmental market, through social security, is estimated at

US$1,850 million.

10

8

6

4

Industry is Stablizing

45

40

35

30

25

20

15

After years of protectionism during the

80's, the Mexican market has gradually opened up and liberalized. Unlike in

Brazil and Argentina, national laboratories have lost ground to the multinational companies that have now become the country's largest manufacturers, with Pfizer and Roche

Source: Cygnus Research

Drug Market expenditure as % of GDP

Prescription drug market

(US$bn)

Generic market as % of total market

Health

(%GDP)

Health expenditure per captia(US$)

Source: Latin American Monitor f: forecast

2

0

Percaptia drug market expenditure(US$)

1999 2000 2001 2002 2003 2004

Market size Grow th Rate

10

5

0 leading the way. The country's manufacturing infrastructure has also become one of the most modern in the world, with many factories FDA approved. Growth potential remains high

Pharmaceutical Industry : Vital Facts

Drug Market expenditure

(US$bn)

2000

6.7

2001

7.4

2002 2003 2004f

8.1 8.4 8.7 with a large chunk of the population not yet integrated, increasing life expectancy resulting in the apparition of 'developed countries' pathologies those alongside traditionally found in developing economies, the introduction of modern medical practices and potential for exports.

Industry Structure

The pharmaceutical industry in Mexico is one of the most developed in

Latin America, with significant local production of bulk active ingredients and finished

OTC market(US$bn)

Exports (US$mn)

Imports(US$mn)

Balance(US$mn) expenditure

67

1.2

5.4

1.3

Generic market (US$bn) 0.07

1

695

1295

-600

5.4

311

73

1.2

5.9

1.5

0.07

2

770

1420

-650

5.4

317

79

1.3

6.5

1.6

81

1.3

6.7

1.7

0.08 0.08

2

810

2

890

1590 1750 1925

-780 -860

5.4

332

5.5

347

83

1.3

7

1.7

0.09

2

980

-945

5.5

352

Knowledge partner for profitable growth products. This situation is partially due to Mexican health regulations, which practically allow only manufacturers to register and therefore import pharmaceutical products into Mexico. Despite having an established domestic industry, the Mexican market is heavily reliant on imported drugs, especially for raw materials. Market expenditure is equal to around 1.3% of Gross Domestic Product (GDP) as shown in the table adjacent.

The Mexican pharmaceutical industry is highly fragmented with just over 400 companies that produce pharmaceutical products in the country. These include both Mexican and multinational companies, of which 9 percent account for about 80 percent of total pharmaceutical sales in Mexico.

The Mexican pharmaceutical market is largely dominated by multinational companies – to the extent of 80 percent of total pharma production in the country. Domestic companies are small and fragmented. Private and public sectors account for 80 percent and 20 percent of the total market in terms of value and vice versa in terms of volume. The prices of public sector are five times lower compared to prices of private sector. This results in a minor share for Mexican pharmaceutical firms in the private sector.

Traditionally, Mexican firms have been focused on the

Parallel markets of drugs in Mexico:

1. Branded patented products.

2. Branded generics.

3. Interchangeable Generics (GIs).

4. Similares.

5. Public health sector generics. manufacture of generic products, for which patents have expired, targeting the public sector as their main customer. Innovative pharmaceuticals are almost entirely limited to multinational firms that transfer advanced technologies from their parent companies.

Generics Market

Ideally, there should only be two markets: patented and generic. Although the Mexican government took a step forward in 1997 when it created a market for GIs, this market segment is still far from actually working due to economic, political, and social factors. Due to budget pressures, the public health care system is increasingly unable to provide the insured population with medicines and other health care products free of charge.

The Mexican generics drug market has grown at 50% p.a. over the last years. The generic sector accounts for 6% of the Mexican pharmaceutical market, in terms of volume, and around 2% in value.

This contrasts with other countries such as Denmark, the U.S., the U.K. and Germany, where the rate of generic substitution is within a 40-60% range.

“Similares”—generics that have not obtained bio-equivalence certification—are the largest drug category sold in Mexico, representing approximately 60% of the market. However, more stringent regulatory requirements, higher pressure for lower healthcare costs, and increasing awareness and acceptance by service providers, doctor and patients are driving forces that favor the growth of the bio-equivalent generics in lieu of similares. With time, similares are expected to be driven out of the market and only two drug categories will prevail: original patented products and generics with proven bio-equivalence. Mexico thereby offers a significant untapped growth potential for generic drugs.

The total market for generics is projected at US$2.2 billion or 11 times larger than the current market estimates of US$200 million.

Knowledge partner for profitable growth

OTC Market

The Mexican OTC market has continued its upward trend in terms of value over the past few years, as a consequence of the rising population, greater tendency for consumers to self-medicate and a steady increase in the prices of OTC products.

Implications According to AFAMELA, the popularity of OTC medicines contributed to 33% of local drug unit sales in the first eleven months of 2004, and roughly 18 % of the market in terms of value. As a result, multinational firms have begun to take notice, and consolidation in the sector is expected to enhance availability.

The OTC market's value is currently estimated at US$1.7 billion, and the sector is expanding as prescription drug prices outpace real earnings growth, and demand increases steadily. During 2003,

OTC value sales grew by almost 7% in current value terms, to reach a record high sales figure of 15.4 billion pesos (US$1.39 billion). Per capita consumption of OTC products stood at almost 150 pesos

(US$13.53) in 2003, when cough, cold and allergy remedies remained the biggest-selling OTC drugs, with a share of 24.1%. The second-most important line was vitamins and dietary supplements (VDS), with a 22.7% stake. Analgesics and medicated skin care products each also accounted for over 15% of the market's value. Research suggests that the relative size of each sector within the OTC market is due to the degree of information that Mexicans receive about these products. By contrast, eye care, ear care, adult mouth care, calming and sleeping products, which are not so vigorously promoted, each accounted for less than 2.5% of value in 2003.

Major Therapeutic segments

Cardiovascular: Cardiovascular, anti-infectives, respiratory, vitamins, digestives, anti-tuberculosis, anti-malarial, anti-diabetic and analgesics are the leading therapeutic segments in Mexico. The three therapeutic groups of Cardiovascular, CNS and Anti-invectives represent a market of US$2.2 billion per year, based on estimates of the Mexican Ministry of Health. In Mexico, Cardiovascular disease

(CVD) is the most prominent disease. Cardiovascular disease is the major cause of about 25% of deaths in Latin America. Every year, approximately 800,000 cardiovascular deaths occur in the region. In Mexico, total number of CVD deaths are around 0.09 million. Isosorbide dinitrate,

Verapamil, Diltiazem, Propranolol, Nitroglycerine; Procainamide, Lidocaine, Enalapril, Nifedipine,

Furosemide, Minoxidil, Pravastatin, Simvastatin, Chlorthalidone, Spironolactone are some of the cardiovascular drugs used for treatments in these areas in Mexico.

Mexico is dealing with two trends at the same time: a large young population and an ageing population, hence specialty care products are becoming increasingly important as diseases considered exotic in Mexico 7-8 years ago, are becoming a major source of growth for pharma companies.

Diabetes Market: Mexico could boasts the world's fifth largest diabetes population estimated at 7 million patients; but many are simply not yet diagnosed. Diabetes is growing every day in Mexico, and the Ministry of Health has declared it one of the most important health issues. Diabetes is of major concern in Mexico, specifically with reference to Type 2 diabetes when compared to Type 1.

Estimated diabetic patients in Mexico are 4.4 million. Prevalence rate of adult population is estimated to be 14.2%. By the end of 2002, there were about 90,215 cases for Type 2 disease and 1682 cases for

Type 1 disease. On an average, everyday 547 new cases are reported. There would be 12 million people living with diabetes by the end of 2005. Type 2 disease is more frequent in Mexico as evident

Knowledge partner for profitable growth from the above statistics. Tolbutamide, tolazamide, glimipiride, etformin, pioglitazone, rosiglitazone, insulin etc are used in the treatment of Type 2 diabetes.

HIV/AIDS: Another disease of major concern is AIDS with a prevalence rate of 0.3%. Mexico is the second country in Latin America with highest reported cases of HIV. By current estimates, the people infected with HIV are around 116,000 to 177,000. In 2003, Mexico ranked 13 th in terms of number of people infected with HIV. Anti-retroviral therapy is the most common therapy for AIDS. lamivudine/zidovudine (COMBIVIR), zidovudine (AZT), ritonavir, indinavir, didanosine (ddI), lamivudine (3TC), zalcitabine (ddC), stavudine (d4T), nevirapine, saquinavir and efavirenz are the common drugs used for treatment of AIDS in Mexico. These drugs got listed on the Essential drugs list in the country.

Infections: Though incidence of tuberculosis is low in Mexico, such instances are being

(18/100,000) recorded due to prevalence of AIDS. Drugs such as isoniazid and rifampicin are most commonly used against tuberculosis. Malaria, typhoid fever and dengue fever are the other infectious diseases that are prominent in Mexico. Chloroquine, proguanil, mefloquine, doxycycline and primaquine are the bulk drugs used in treating malaria. The most preferred antibiotic used against typhoid fever is Chloramphenicol (Chloromycetin). Dengue and Meningitis are other most frequent medical cases in Mexico. Anti-pyretics (avoiding NSAIDS and aspirin) are usually used for treatment of dengue.

Major Players

MNCs are leading manufacturers in Mexico. There is no single company in the Mexican pharma market that occupies more than 10 percent in the private sector. Almost 80 percent of the market is covered by 36 companies. Leading local producers include Armstrong Laboratorios, Laboratorios

Liomont and Sicor. Most MNCs have subsidiaries in Mexico because of regulations laid down by local health authorities. In order to import and resell pharmaceutical products in Mexico, it is mandatory for any manufacturer to register pharmaceutical products by holding a sanitary license.

Leading generic drug manufacturers include Apotex, Eli Lilly, Glaxo, Merck, Novartis, Pharmacia &

Upjohn, Roche, Schering Plough and Wyeth etc. Production of innovative products is limited to

MNCs. Patentability of chemical molecules was introduced by GoM in late 1980s for a period of 20 years with the possibility of extension till 3 years.

Germany-based Boehringer Ingelheim (BI) initiated commercial operation in Mexico in 1954.

Promeco Boehringer Ingelheim was formed from the acquisition of BI and Laboratorios Promeco in

1971. GSK established its subsidiary in Mexico in 1964 and is a leader in producing antibiotics, vaccines and asthma-related products. GSK Mexico holds around 8 percent share in the prescription drug market. The Mexican subsidiary of Bayer, Bayer de Mexico SA de CV is the largest subsidiary of

Bayer in the Central American region. Merck Mexico, one of the first companies to produce pharma products in Mexico and was established in 1930. Sanofi-Synthelabo acquired Mexican-based Rudefsa in 1997 to produce immunological products for the Mexican market. BMS Mexico, Eli Lilly

Compania de Mexico S.A, Armstrong Laboratorios de Mexico S.A.C.V and Roche Mexico are other

MNC subsidiaries in Mexico. Armstrong recently obtained approval to market and distribute modafinil under the brand name Modiodal in Mexico. Mid-size player, Sinbiotic International S.A.

C.V. was established in 1990 for the production of analgesics, antibiotics, anticancer and sulphonamide drugs.

Knowledge partner for profitable growth

In 2003, the Pfizer made sales of US$505 million in Mexico garnering a share near about 10 percent due to the star performance of the drugs like Viagra, Lipitor, Novax, Terramicina and Pentrexil. It also invested US$72 million in its plants for research.

Indian Players

The Indian pharma industry is a reputed bulk drug supplier to this region. Indian drug major,

Ranbaxy opened a representative office in Mexico in April 2004 and has plans of establishing a joint venture shortly. Dr.Reddy’s Laboratories Ltd is expected to build a presence here for enhancing branded formulation business. Elder Pharmaceuticals was the first Indian company to get a drug registered in Mexico. India’s leading generics player, Strides Acrolab Limited (Strides) has a manufacturing facility in Mexico.

Wockhardt has signed a joint venture agreement for a 51 percent stake in Wockhardt Mexico S.A. de

C.V., with the remaining 49 percent held by Representaciones E Investigaciones Medicas, S.A. de

C.V. The joint venture will initially market insulins made by Wockhardt. Later, it will market other dibetology products and biopharmaceutical products.

OTC Market

The overall Mexican pharmaceutical market, estimated at more than US$9 billion, with annual growth rates of 10%, attracts a lot of interest from foreign companies. Germany's Boehringer

Ingelheim is the leading company in the Mexican OTC market, ranking top in the VDS and cough, cold and allergy sectors, number two in adult mouth care, and fourth in child-specific OTC and analgesics. It also has a presence in digestive remedies and medicated skin care. Other leading companies include Bayer (Germany), Sanofi-Aventis (France), Novartis (Switzerland) and Wyeth

(US), as well as major multinationals from different industries, including Proctor & Gamble (US) and

Nestlé (Switzerland). Some Mexican firms manufacture and market their products successfully, but their reach and economies of scale are limited in comparison to those of the multinationals.

Consolidation in the sector is also expected to enhance availability, with the recent purchase by Bayer of Swiss drug-maker Roche's OTC business expected to give the company pole position in the

Mexican sector. The acquisition will bring together leading OTC brands such as Alka-Seltzer and

Redoxon. Meanwhile, local companies with a strong OTC presence include drug group Techsphere and skincare products specialist Laboratorios Darier, which recently formed an alliance with

Germany's Merz Pharmaceuticals. The share of OTC medicines in Mexico's drug market is expected to increase, with the products' low cost and easy availability bringing the segment's value to US$1.9 billion by 2007.

The concept of wellness is beginning to develop in Mexico, and is expected to become an increasingly important factor in creating demand for OTC healthcare products. As such, consumers awareness of preventative health measures, nutrition and physical fitness is expected to continue expanding. As a result of this, vitamins and dietary supplements (VDS) are expected to show considerable growth.

Generics Market

Starting in 1998, the pharmaceutical industry in Mexico has gone through a major consolidation, whereby the number of players, particularly local companies, has been significantly reduced. In the generics market, multinational laboratories such as IVAX, Perrigo, Sandoz, Teva, and Apotex have

Knowledge partner for profitable growth established operations in Mexico, but only a few local manufacturers, Kendrick among them, are fully equipped to demonstrate bio-equivalence and bio-availability compliance on their products.

Distribution Channels

There are 23,500 pharmacies operating in Mexico, including in-house chemists at supermarkets and hypermarkets, pharmacy chain stores and local pharmacies. However, given the entrance of retail chains such as Comercial Mexicana, Gigante and Wal-Mart to this field, dedicated pharmacies have started to feel the pinch; it is estimated that approximately 1,500 small pharmacies and drugstores went out of business during 2003. As part of a general trend in Mexico, people are shifting to onestop shopping trips, with pharmacies within hypermarkets becoming more popular and gaining share.

In addition, a poor law-and-order situation, especially in the capital Mexico City, has led to more customers using pharmacies located at retail stores such as Wal-Mart, because they feel safer at such outlets.

Generic products in Mexico are normally 50% cheaper than regular medicines, but they lack brand promotion and special packaging design. In recent years, generics have become more widely available, through pharmacies within shopping centres, chain pharmacies and parapharmacies. Some drugstores also carry generic products.

Regulations

Cofepris, a newly created Federal Commission in charge of sanitary risk protection, amongst other things, is at the heart of the regulatory process. Cofepris is the highest Mexican authority in terms of production, transformation, distribution, commercialization and advertisement for health related products and services, and acts as an independent body.

Patent Protection

Innovators have long had a place in the Mexican pharmaceutical market, and at least 30 companies are now present and active in the country. Strong patent protection legislation was amended in 1991 so as to permit patenting of pharmaceutical products and again in 1994 to align it with that of the most developed countries in the world. Following the 1991 patent protection law, research and development increased five fold in Mexico, according to Amiif, which represents most international companies present in Mexico. As a result, annual investment in production has increased reaching

US$150 million in 2003. These investments are expected to reach US$200 million in 2004 with the majority going towards the upgrade or expansion of production facilities.

In September 2003 a decree completed the intellectual property law, linking Cofcpris's sanitary register to that of the Mexican patent office. Patents in Mexico are granted for a period of 20 years, during which time companies can conduct the necessary additional studies, launch their product on the market and enjoy exclusivity. Companies are now supplying the national market while exports, often to international subsidiaries of companies with operations in Mexico, have increased. Patent protection also stimulated the development of clinical trials: "the number of clinical trials has considerably increased: from 400 in 2002 to 1,000 in 2003. This figure would reach 2,500 in 2004.

Knowledge partner for profitable growth

Outlook: The Mexican Pharmaceutical market is expected to grow significantly in the next few years with the government tightening up the regulations relating to generics and the improving economic conditions. The advantage still would be continued due to the devaluation of the Brazilian real to strengthen its number one market position in Latin America. Prescription drug market is expected to reach US$ 7 bn in 2005 and the OTC market to US$1.8bn.

Nevertheless there is increasing concern about the future, as growth in recent years has mainly been fuelled by price hikes rather than by increases in unit sales. And the model seems to be reaching its limits, for although Mexico's macro economics have improved, the purchasing power of many

Mexicans has decreased, which will directly affect the industry as for many Mexicans, medicines are

"out of the pocket" expenditures that they cannot afford. In fact the secretary of Health indicates that 20% of Mexicans postpone or renounce healthcare because of their inability to afford it.

Apart from being largest market of the region, with 100 million people, Mexico is also the gateway to the US and Canada through NAFTA.

Opportunities:

The Mexican Pharmaceutical Industry would be benefited by expertise of the Indian generic players who can provide the generic drugs at an affordable lower costs in addition to the government intentions of making the safer drugs (Generic drugs for which Bio-Equivalence studies are done) available in the market. On the other side, it is a good potential market of near about US$2bn

(combining OTC and generics markets). Apart from being largest market of the region, with 100 million people, Mexico is also the gateway to the US and Canada through NAFTA. Moreover the

Latin American market itself is approximately around US$28bn. Some of the Indian companies have made their presence in this region either through Brazil and Argentina. But still as the Mexican market is growing at a good pace with the increasing Percaptia drug expenditure of about US$15 in the last 5 years would make the entry into the market a profitable proposition.

Indian Companies like Biocon, Lupin, Wockhardt, Bal Pharma, Torrent, Ranbaxy, etc can have a better opportunities in the rapidly growing sectors like diabetes in the Mexican market The other segments for which the market growth is considerably high is for Cardiovascular and HIV/AIDS segments.

---------------