4 Completing the Stage 1B Full Business Case template

advertisement

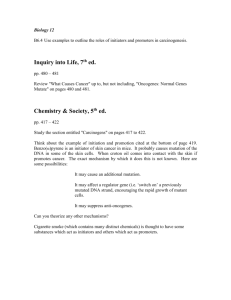

Sheffield City Region Executive SCRIF Appraisal Process Guidance notes on completion of Stages 1A, Stage 1B, Stage 2 and Stage 3 DRAFT FINAL - v4 issue September 2013 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Sheffield City Region Executive SCRIF Appraisal Process Guidance notes on completion of Stages 1A, Stage 1B, Stage 2 and Stage 3 DRAFT FINAL - v4 issue September 2013 Reviewed and approved by: September 2013 Signature(s): Name(s): Graeme Collinge Job Title(s): Partner Date: 24 September 2013 GENECON This report contains 28 pages Ref: GC/st Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Contents 1 Introduction 1 1.1 1.2 1.3 1.4 1.5 1.6 What is the Sheffield City Region Investment Fund? Fund Objectives and Priorities The Approval Process How and when will Schemes be Assessed? Compliance with the DfT’s WebTAG appraisal guidance Submitting your Business Case 1 1 2 3 4 4 2 Completing the Stage 1A Outline Business Case template 5 2.1 2.2 2.3 2.4 2.5 2.6 Introduction Opening section of the template: Scheme Details and Summary Section 1: The Strategic Case Section 2: The Commercial Case Section 3: The Economic Case Section 4: The Management Case 5 6 6 7 7 8 3 Task between Stage 1A and 1B – completion of the Appraisal Specification Report 9 3.1 Completion of the ASR 9 4 Completing the Stage 1B Full Business Case template 10 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 Introduction Opening section of the template: Scheme Details and Summary Section 1: The Strategic Case Section 2: The Commercial Case Section 3: The Economic Case 22 Section 4: The Financial Case Section 5: The Management Case 10 10 10 12 13 5 Beyond Stage 1B 25 5.1 5.2 5.3 5.4 Moving from Stage 1B to Stage 2 Stage 2 – Non-transport schemes Stage 2 - Transport Schemes Stage 3 25 25 27 28 Annex 1: Guidance on the content and the structure for the completion of the Appraisal Specification Report (ASR) 23 23 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 1 Introduction 1.1 What is the Sheffield City Region Investment Fund? The Sheffield City Region Investment Fund (SCRIF) is a framework of funding streams to deliver essential strategic infrastructure to increase economic growth and jobs in the Sheffield City Region. As one of the key elements of the Sheffield City Deal, SCRIF provides local partners with the opportunity to make long term strategic investments which will make a significant contribution to economic growth. The primary objective of SCRIF is to increase GVA across the City Region through productivity gains and job creation. The impact of the programme will be measured through the net Sheffield City Region GVA growth delivered per £ spent from SCRIF. It will fund a range of transport, regeneration, energy and water and environmental schemes by pooling resources from a variety of different sources, and will be managed by the SCR Authority. 1.2 Fund Objectives and Priorities The Sheffield City Region Executive will consider investing in schemes which contribute to delivery of the SCR Growth Strategy. Successful schemes will need to demonstrate their contribution to: Increasing the Sheffield City Region’s GVA; Increasing the number of jobs in the Sheffield City Region / the overall employment rate; Rebalancing the economic base of the City Region by: 1) Increasing the proportion of the workforce employed in the private sector and 2) helping address the economic performance gap that exists between the City Region and the Greater South East; and; Capitalising and enhancing the quality of life in the Sheffield City Region and delivering sustainable economic growth. In order to be eligible schemes must: Be based in the Sheffield City Region area; Focus on promoting economic growth; Make a positive impact on GVA within the SCR; Create or protect jobs; Engage with the private sector; and Be unable to be funded elsewhere. The principle objective of the Fund is to increase GVA across the City Region. This is defined as jobs and productivity. Value for money will be a key indicator in assessing the suitability of proposed schemes and this will be assessed in terms of net Sheffield City Region GVA created per £ of whole life cost. The SCR Authority can withdraw a scheme from the Programme should the business case, and any subsequent data analysis not provide the required assurance of value for money. In appraising proposed schemes the SCR Executive will also give due regard to the secondary criteria against which the success of the SCRIF programme will be measured: Distribution of growth in access to jobs; 1 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Distribution of growth in jobs. This is to ensure an acceptable level of equity across the region. The programme as a whole aims to ensure that disconnected communities and people most disconnected from the economy are not left behind. 1.3 The Approval Process In order to meet the requirements of the different Departments and agencies which will be contributing funding to SCRIF, a 5 stage approval process has been developed (with Stage 1 also being divided into Stages 1A and 1B). Schemes (from Stage 0 - Stage 3) have to be approved at each stage of the process in order to progress to the next. The level of information required from scheme promoters at each Stage will vary depending upon the scheme typology. Due to DfT requirements, transport schemes will be required to provide information in line with WebTAG requirements. The majority of this work (i.e. traffic modelling and appraisal work) will be focused at Stage 1B. The 5 stages as set out in the Assurance Framework [note to SCR: the Assurance Framework will need amending] are: SCRIF Stages SCR Assurance Framework Applicant Process Stage 0 Prioritisation The development of a set of SCR infrastructure priorities based on the application of FLUTE Completion of Stage 0 SAF Proforma Stage 1A Development Authority Scheme promoters demonstrate the strategic fit and deliverability of the scheme Completion of Stage 1A Outline Business Case Template Task for completion – completion of Appraisal Specification Report (ASR) setting out approach to transport modeling. Applicants are advised that it is anticipated that in the majority of cases, the ASR will be completed between Stage 1A and Stage 1B, although applicants can progress earlier if they so choose to strengthen their Stage 1A Outline Business Case Stage 1B Development Authority Stage 2 Procurement Authority Stage 3 Implementation Approval Scheme promoters undertake further work i.e. modelling and appraisal for transport schemes in line with WebTAG. Completion of Stage 1B Full Business Case Template The business case detail and level of assessment at each Stage is to be agreed between promoters and the SCR. Providing schemes have a satisfactory business case and contribute as anticipated at the prioritisation Stage, they progress to Stage 2. Further scheme development and business case development would take place leading to authorisation to go to the market for letting of key contracts. Refinement of the Stage 1B Full Business Case, addressing any appraisal queries from the CIAT team Subject to tender prices and any necessary further business case work, this Stage would conclude with the contract signing. The following sections set out guidance to scheme promoters to complete the outline and full business case templates (Stage 1A and Stage 1B). By the end of Stage 1B, the SCR Authority anticipates that the combination of Stage 1A and 1B business cases will provide a robust assessment of strategic fit; economic contribution to SCR; whether the scheme is attractive to the market; and whether it can be delivered within an acceptable 2 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue timescale; and, where it includes DfT transport investment, that it would be acceptable to the DfT in terms of the appraisal work completed, if the DfT were to call the project in for audit. The structure of the business cases and assessment will be structured around the five case model in line with HM Treasury guidance: 1.4 The Strategic case – why is the scheme needed? The commercial case – Is there demand for the scheme and can it be procured? The economic case – Is the scheme good value for money? The financial case – Is the scheme affordable and financially sustainable? The management case – Is the scheme deliverable? How and when will Schemes be Assessed? At Stage 1A outline business cases will be submitted to SCR’s Central Independent Appraisal Team (CIAT) for assessment. The specific questions which assessors will consider have been included within the business case template to assist promoters in preparing their submission. Following assessment, the CIAT will make a recommendation to the SCR Investment Board for either: Further information/points of clarification from promoters or make recommendations for amendments to be considered and the business case to be re-submitted; Further information/points for clarification or make recommendations for amendments to be considered, but approval for progression to Stage 1B if it is agreed that these points will be attended to in the full business case; or Approve the scheme to progress to Stage 1B. A SCRIF programme outcome of Stage 1A is that schemes can be tiered based on a combination of the outcome of the FLUTE prioritisation process (i.e. contribution to GVA and VfM) and Stage 1A assessment of scheme deliverability. At Stage 1B full business cases will be submitted to the CIAT for assessment. Following assessment, the CIAT will make a recommendation to the SCR Investment Board for either: Further information/points of clarification from promoters or make recommendations for amendments to be considered and the business case to be re-submitted; Additional information in support of the business case with approval to Stage 2 once this has been provided/reviewed; or Approve the scheme to progress to Stage 2. Where schemes are recommended for approval by the Investment Board for progression to Stage 2, this will be passed to the SCR Authority for final approval. It is expected that discussions/contact between the scheme promoter and SCR will be an on-going and iterative process. The timescales for the assessment of business cases will vary depending upon the nature and complexity of the scheme. As a guide, it is anticipated that the CIAT will complete its assessment within the following timeframes: Stage 1A: 4 weeks Stage 1B: 12 weeks 3 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 1.5 Compliance with the DfT’s WebTAG appraisal guidance During the preparation of this guidance, consultation discussions have been held with scheme promoters. A key issue for discussion was the question of whether promoters in the presentation of their business case submissions will have to comply fully with the requirements of the DfT’s WebTAG appraisal guidance, given the importance of the devolved major transport funding making up the SCRIF. Advice from the DfT is still emerging on this issue. At this stage therefore, and given that Part 3 of the Assurance Framework is still to be agreed between SCR and the DfT, it has been agreed in the consultation discussions with scheme promoters that the following is likely to be incorporated into the Part 3 process: 1.6 From a review of the Stage 1A Outline Business Case, the CIAT team will retain ultimate discretion on whether a project has to comply with WebTAG, but in general (unless CIAT decide otherwise on a case by case basis) the principle will be: i. If a project / scheme is going to cost < £5m to SCR’s ‘Local Growth Fund’ (which may or may not include SCRIF funding), then it will not have to follow the WebTAG process, and scheme promoters will use the Stage 1A/Stage 1B business case and appraisal templates for the development of their business case, excluding the sections in the Economic case for Transport schemes; and ii. If a project / scheme is going to cost > £5m to SCR’s Local Growth Fund, scheme promoters will agree their Appraisal Specification Report with the CIAT team for the modeling that will need to be done at Stage 1B. In developing their ASR, scheme promoters are advised to refer to WebTAG 3.10.1 which outlines the tests that can be made to determine the level of WebTAG appraisal work likely to be appropriate given what they know of their scheme. Submitting your Business Case Completed submissions should be returned to [for SCR input] by [for SCR input]. Please direct any queries regarding your submission to [for SCR input]. 4 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 2 Completing the Stage 1A Outline Business Case template 2.1 Introduction The guidance follows the structure of the Stage 1A outline business case. Throughout the template, approximate word limits have been provided for some sections. This is an approximate guide for scheme promoters to indicate the level of detail assessors require and to ensure responses are focused on the pertinent issues. We would encourage promoters to adhere to the word limits as closely as possible as this will minimise the amount of time required for completion of the template and its assessment. Submissions will not however be penalised for going over the suggested word limits, within reason. Within this guidance, some examples and prompts have been provided where relevant. Promoters should not feel compelled to reference these in their response, and these examples do not provide definitive lists of considerations. It is intended that over the Stage 1A, 1B and Stage 2 approval processes promoters build the evidence base to create a robust business case demonstrating strong strategic, economic, commercial, financial and management cases. Where questions are repeated between stages it is expected that previous responses will be enhanced and refined over the approval stages. Figure 1 below provides an illustration of how it is anticipated the strength of each of the 5 cases will develop at each stage of the approval process. Figure 1: Illustration of the development of the 5 cases at Stage 1A, Stage 1B and Stage 2 Development of the Business Case 100 90 80 70 60 50 40 Stage 1A OBC 30 Stage 1B FBC 20 Stage 2 10 Stage 2 0 Stage 1A OBC Management Financial Commercial Economic Stage 1B FBC Strategic % 5 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 2.2 Opening section of the template: Scheme Details and Summary This section of the template is designed to provide a succinct overview of the scheme. All Promoters should complete this section fully. The majority of this is straight-forward, but promoters should note the following: 2.3 Promoters are asked to categorise their schemes by “type” (see also annex 1 of the template). If the scheme is equally split between two or more categories, please list all categories. Otherwise list the category within which the majority of the scheme falls; Schemes should benefit the Sheffield City Region and demonstrate that they will increase GVA at the SCR level. Promoters should retain this as their focus when completing the summary of the business case. Section 1: The Strategic Case This section of the template should clearly demonstrate the strategic fit of the scheme to the SCR strategic vision and objectives as set out in the SCR Growth Plan, as well as local and national plans. Responses should convey the direct contribution the scheme will make to economic growth, and justify the rationale for the scheme, making reference to market failure where appropriate. All Promoters should complete this section fully. Schemes need to demonstrate a strong strategic fit with SCR Growth Plan objectives if they are to progress beyond Stage 1A. Sub-section 1.1: Scheme Rationale (5 questions) SCRIF investment is intended to support schemes where the market cannot or will not fully/partly deliver the investment without public support. Responses should seek to demonstrate why SCR should be involved and invest in this scheme rather than another agency. Responses should outline the economic development rationale for the scheme ahead of the benefits the scheme will being in terms of transport, social or environmental impacts. Promoters should set out a reasoned argument for what would happen should SCRIF investment not be secured. This may include consideration of: Go ahead anyway without SCRIF investment Go ahead, but with other public investment (specify the source) Not go ahead at all Go ahead on a reduced scale (specify what a reduced scheme would look like) Go ahead on a slower timescale (specify the length of delay) A combination of the above When setting out linkages and dependencies with other projects/investment, promoters should consider instances where the wider economic benefits being claimed by the scheme are beyond the immediate control of the proposed scheme and dependent upon other investment. Where there dependencies, promoters should seek to indicate the level of risk these dependencies pose to SCRIF investment e.g. are dependent projects/investments underway; are plans in place; has funding been secured; when are they likely to be completed etc? 6 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 2.4 Section 2: The Commercial Case The purpose of the commercial case is to present a summary of the evidence of how it is anticipated the market will respond to the SCRIF investment bringing forward private sector investment which will deliver jobs and GVA outcomes. Promoters should complete this section fully. A sound and evidenced commercial case will need to be demonstrated in order to progress to Stage 1B. Promoters of transport schemes should note that for SCR purposes, ‘demand’ is demonstrated in terms of response of the private sector investment market generating contribution to GVA rather than on transport-related demand case. Sub-section 2.1: Demand Case (3 questions) Promoters should set out any evidence (referencing the source) that they have that there is market demand for the scheme. Care is needed here in the interpretation and demonstration of ‘demand’, and emphasis is made again that this should be about supporting / evidencing the economic development case for the scheme. Demand should be articulated in terms of projected take-up by the market, for example if an infrastructure scheme is proposed which opens up employment land, what evidence is there that the market will take this up within a reasonable time period. Evidence of discussions held with land owners, developers; letters of correspondence that can demonstrate market appetite or that investment via SCRIF will help provide the confidence to accelerate private sector investment decision-making will be particularly strong. This will certainly need to go beyond demonstrating a policy fit – for example, that the scheme will meet an SCR Growth Plan objective or that the site is allocated within a Borough local plan. If updated or additional research needs to be undertaken to provide a robust evidence case, promoters should outline the scope/scale of this and any plans that are in place/timescales to acquire the necessary evidence, which would then be completed at Stage 1B. The commercial case will need to demonstrate any consultations that have been held. If for example, any market testing or negotiations e.g. with developers, the business sector which has been undertaken. Promoters should use this to support their case. If no market testing has been undertaken, promoters could set out why this has been considered necessary up to this point, what alternative information/demand evidence they have used in developing the proposed scheme, and when this work will be strengthened to ensure that the promoter can, with a reasonable degree of certainty be sure that the private sector will respond to the opportunity once opened up by SCRIF investment. 2.5 Section 3: The Economic Case The economic case included at Stage 1A is for completion by transport schemes only, although it is highlighted that it is not mandatory for Stage 1A. The purpose of this section is for promoters to add weight to their case by demonstrating that the scheme provides good value for money, does not harm the environment, and benefits the vulnerable as much as everyone else. The economic appraisal is important for transport schemes because the Department for Transport has to report on the Value for Money that has been delivered by devolving decision making on major transport schemes to local authorities. Normally schemes would only be approved if they offer high value for money on the Department for Transport’s standard criteria (Benefit to Cost Ratio > 2.0). Any scheme failing to exceed this guideline will need to present a robust argument in the Strategic Case with appropriate evidence if it is to gain approval at local level. 7 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue At this stage in the process, it is not necessary to model the scheme in a fully WebTAG compliant model. Calculations from estimated unit benefits and observed demand would be acceptable. If even this level of information is unavailable, promoters could present an estimate of the value for money derived by using a similar scheme as a comparator. A description of the appraisal methodology is required so that the assessors can make any adjustments necessary to make the estimates consistent with other schemes in the programme. At this stage, the environmental appraisal of the scheme will go only as far as desk based research. Promoters need not have conducted habitat surveys. It would be helpful to submit an environmental constraints map. At this stage, it is expected that social and distributional impact appraisal will go only as far as Step 0, the initial scoping step set out in WebTAG 3.17. 2.6 Section 4: The Management Case The management case explores whether the proposed scheme is deliverable. Schemes will be prioritised in terms of their contribution to GVA, their value for money, and their deliverability. Promoters should outline the current Stage of the development of their scheme and demonstrate that it can be delivered within a reasonable timeframe. The questions within the management case aim to identify any potential delivery risks and help SCR understand how likely it is the scheme will get off the ground and the timescale for delivery of the scheme and therefore drawdown of SCRIF investment. Schemes will be assessed against how much delivery risk they pose and the level of work/measures promoters have taken in order to address or mitigate potential delivery risks. Promoters are required to provide a reasoned and direct assessment, drawing on their own experience and best judgement, of where they feel their scheme may face real rather than theoretical delivery challenges. It is not the intention of SCR to remove schemes facing delivery challenges from the SCRIF programme. However, SCR need scheme promoters to provide a realistic assessment of the timescale for delivery and to help SCR to identify where schemes may require additional support to enable them to be brought forward. Unresolved issue for discussion with SCR: Should we consider “Pass” or “Pass with conditions” or “Fail” type scoring for the assessment questions? Would we require business cases to “Pass” or “Pass with conditions” all questions in order to progress from Stage 1A? 8 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 3 Task between Stage 1A and 1B – completion of the Appraisal Specification Report 3.1 Completion of the ASR The Appraisal Specification Report (ASR) allows all stakeholders related to a project to understand the assessment and appraisal work that will be required to be undertaken for SCRIF Stage 1B. Important stakeholders within this process are: the Central Independent Appraisal Team (CIAT), the scheme promoter and their consultants. The ASR will operate as a reference to ensure that the technical work is carried out in the approved manner. This will help smooth the process for attaining approval at Stage 1B. Whilst the ASR is intended to be agreed, written and signed off before work commences on Stage 1B, it is also intended to function as a living document that can be updated when a change to the methodology is proposed. For this reason, the ASR should be written in a manner that allows these changes to be easily identified. Although it is anticipated that in the majority of cases, the ASR will be completed between SCRIF Stages 1A and 1B, if scheme promoters consider that their scheme is sufficiently advanced, then the ASR can be completed ahead of Stage 1A to better inform the completion of Stage 1A Outline Business Case. Further guidance on the content and the structure for the completion of the Appraisal Specification Report is included at Annex 1. 9 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 4 Completing the Stage 1B Full Business Case template 4.1 Introduction A number of questions within the business case are repeated from the Stage 1A document. If still relevant, promoters can use their response from their Stage 1A submission to complete these questions, providing any additional information felt necessary or addressing any queries raised during the Stage 1A assessment process. It is intended that the evidence to be provided will build on previous submissions until a Full Business Case is achieved. For completeness, Stage 1A guidance notes are repeated here as the opening for each section. The guidance follows the structure of the Stage 1B Full Business Case. Throughout the template, approximate word limits have been provided for some sections. This is an approximate guide for scheme promoters to indicate the level of detail assessors require and to ensure responses are focused on the pertinent issues. We would encourage promoters to adhere to the word limits as closely as possible as this will minimise the amount of time required for completion of the template and its assessment. Submissions will not however be penalised for going over the suggested word limits, within reason. Within this guidance, some examples and prompts have been provided where relevant. Promoters should not feel compelled to reference these in their response, and these examples do not provide definitive lists of considerations. 4.2 Opening section of the template: Scheme Details and Summary This section of the template is designed to provide a succinct overview of the scheme. All Promoters should complete this section fully. The majority of this is straight-forward, but promoters should note the following: 4.3 Promoters are asked to categorise their schemes by “type” (see also annex 1 of the template). If the scheme is equally split between two or more categories, please list all categories. Otherwise list the category within which the majority of the scheme falls. Schemes should benefit the Sheffield City Region and demonstrate that they will increase GVA at the SCR level. Promoters should retain this as their focus when completing the summary of the business case. Section 1: The Strategic Case This section of the template should clearly demonstrate the strategic fit of the scheme to the SCR strategic vision and objectives as set out in the SCR Growth Plan, as well as local and national plans. Responses should convey the direct contribution the scheme will make to economic growth, and justify the rationale for the scheme, making reference to market failure where appropriate. All Promoters should complete this section fully. Schemes need to demonstrate a strong strategic fit with SCR Growth Plan objectives. Sub-section 1.1: Scheme Rationale (5 questions) SCRIF investment is intended to support schemes where the market cannot or will not fully/partly deliver the investment without public support. Responses should seek to 10 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue demonstrate why SCR should be involved and invest in this scheme rather than another agency. Responses should outline the economic development rationale for the scheme ahead of the benefits the scheme will being in terms of transport, social or environmental impacts. Promoters should set out a reasoned argument for what would happen should SCRIF investment not be secured. This may include consideration of: Go ahead anyway without SCRIF investment Go ahead, but with other public investment (specify the source) Not go ahead at all Go ahead on a reduced scale (specify what a reduced scheme would look like) Go ahead on a slower timescale (specify the length of delay) A combination of the above When setting out linkages and dependencies with other projects/investment, promoters should consider instances where the wider economic benefits being claimed by the scheme are beyond the immediate control of the proposed scheme and dependent upon other investment. Where there dependencies, promoters should seek to indicate the level of risk these dependencies pose to SCRIF investment e.g. are dependent projects/investments underway; are plans in place; has funding been secured; when are they likely to be completed etc? Sub-section 1.2: Scheme Objectives (2 questions) Scheme Objectives (SMART): Section 1.2 asks promoters to set out the scheme objectives. Promoters are recommended to provide a series of short paragraphs/bullet points describing the specific objectives their scheme will achieve. Each of the objectives should be described in SMART terms i.e. Specific: The objective should be precise and well-defined so that everyone can understand it Measurable: You will be able to determine when it has been achieved and could collect evidence to confirm it Achievable: It should be within the capabilities/capacity of the scheme to deliver it Realistic: It should be possible for the scheme to deliver it and sensible given the activities of the scheme and wider socio-economic context Timely: It should be achievable by a specific point in time and it should be feasible to achieve this deadline For example, the objectives of a scheme to build a new section of link road may include: To release the first phase of a major brownfield residential development opportunity by September 2016 (e.g. of short term objective directly deliverable by the scheme) To reduce non-local traffic from existing roads, particularly Main Road, by not less than 40% by September 2016 (e.g. of short term objective directly deliverable by the scheme) To improve the internal connectivity of High Village and Smithsfield for other modes of traffic, leading to at least a 30% increase in walking and cycling by March 2017 (e.g. of longer term objective not immediately observable upon completion of the development) To improve access for Smithsfield residents to new employment opportunities on Enterprise Court by September 2018 (e.g. of longer term objective not immediately observable upon completion of the development) 11 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Adverse consequences / disbenefits: Responses should identify any significant adverse consequences (economic, social, or environmental) from delivering the scheme. This could include a description of the disbenefit, why/how this will occur, the likely scale of the impact, any measures in place to mitigate adverse impacts, and your reasons/justification for why the proposed scheme should still go ahead. Responses can be qualitative in nature, but should make reference to research or studies undertaken to support their response. Sub-section 1.3: Options review Before applying to SCRIF promoters should have prepared a long and short list of scheme options which considers the range of different actions which could be taken to deliver the required outputs/outcomes. This analysis can be attached to support your submission, but should not be submitted in place of completing the business case template. The options review within the business case should outline what the proposed scheme could deliver with different levels of SCRIF funding. Promoters are asked to articulate this in terms of ‘no SCRIF investment’, ‘reduced SCRIF investment’ or ‘the full/preferred SCRIF investment’. Options may include varying the size/timescale of the scheme, accessing alternative funding sources, considering non-financial interventions, or a wholly private sector led investment. Section 1.3 requires promoters to set out these options (a minimum of 3) and outline what the scheme would look like under each: its strengths and weaknesses, expected outcomes and reasons for rejecting it or taking it forward. Promoters are expected to provide a robust assessment of the alternative options and explain why SCRIF is the preferred investment for the scheme and why other funding options are less viable or unsuitable/inferior. No word limits have been provided for this section in order to allow promoters to set out fully their options. 4.4 Section 2: The Commercial Case The purpose of the commercial case is to present a summary of the evidence of how it is anticipated the market will respond to the SCRIF investment bringing forward private sector investment which will deliver jobs and GVA outcomes. Promoters should complete this section fully. A sound and evidenced commercial case will need to be demonstrated in order to progress to Stage 1B. Promoters of transport schemes should note that for SCR purposes, ‘demand’ is demonstrated in terms of response of the private sector investment market generating contribution to GVA rather than on the transport-related demand case. Responses are expected to elaborate and build upon promoters’ Stage 1A submissions. 12 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Sub-section 2.1: Demand Case (3 questions) Promoters should set out any evidence (referencing the source) that they have that there is market demand for the scheme. Care is needed here in the interpretation and demonstration of ‘demand’, and emphasis is made again that this should be about supporting / evidencing the economic development case for the scheme. Demand should be articulated in terms of projected take-up by the market, for example if an infrastructure scheme is proposed which opens up employment land, what evidence is there that the market will take this up within a reasonable time period. Promoters should support their response with a robust evidence-base, and any research studies to support submissions should have been completed or near to completion. Evidence of discussions held with land owners, developers; letters of correspondence that can demonstrate market appetite or that investment via SCRIF will help provide the confidence to accelerate private sector investment decision-making will be particularly strong. This will certainly need to go beyond demonstrating a policy fit – for example, that the scheme will meet an SCR Growth Plan objective or that the site is allocated within a Borough local plan. If updated or additional research has been undertaken between Stage 1A and Stage 1B to provide a robust evidence case, promoters should outline the scope/scale of this. The commercial case will need to demonstrate any consultations that have been held. If for example, any market testing or negotiations e.g. with developers, the business sector which has been undertaken. Promoters should use this to support their case. If no market testing has been undertaken, promoters could set out why this has been considered necessary up to this point, what alternative information/demand evidence they have used in developing the proposed scheme, and when this work will be strengthened to ensure that the promoter can, with a reasonable degree of certainty be sure that the private sector will respond to the opportunity once opened up by SCRIF investment. Sub-section 2.2: Procurement Strategy (1 question) Section 2.2 requires promoters to set out their intended procurement strategy and to demonstrate that the scheme can be procured. Promoters should provide details of how the proposed scheme will be procured, the evaluation criteria, key milestones/timescales for procurement, and any foreseeable challenges. 4.5 Section 3: The Economic Case The economic case is about satisfying both the national case for investment in value for money terms (BCR for transport) and the local case (GVA increase in Sheffield City Region). It should provide detailed analysis of the costs-benefits of the preferred option and reference case in order to assess the scheme’s value for money and additionality. Section 3 is split into two sections. Section A covers the local case and Section B covers the national case. Section 3A: Local Economic Case The preferred option is the option that scheme promoters would like to progress assuming all SCRIF investment sought is secured. The reference case is the scheme if no SCRIF investment is secured and is important as it enables the ‘additionality’ of the SCRIF investment to be properly tested by posing the question what would be the outcome in the event of no SCRIF investment. This section should set out the gross and 13 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue net economic impacts of the scheme; whether it offers good value for money; and whether there are any wider impacts which scheme promoters would like to highlight. In all cases, promoters should provide an accurate description of scheme outputs and costs, clearly setting out any assumptions or benchmark data which have been used in their calculations. The outputs presented should be based on promoters’ own calculations and project design work rather than any outputs information generated by the FLUTE model during scheme prioritisation. Sub-section 3.1 asks to provide a brief summary of your preferred option and the reference case (i.e. with no SCRIF investment). These two schemes should be used to complete the subsequent data tables in section 3.2. Sub-section 3.2: Gross outputs are the total outputs generated without any adjustment for deadweight, leakage, displacement or multiplier effects. Direct outputs are those expected to be directly delivered by or dependent on the scheme and differ from indirect outputs which are in effect leveraged from the scheme investment - for example, if the SCRIF scheme leads to the development of business space by leveraged private sector investment, the jobs accommodated in that space will be ‘indirect’ outputs. If a new road is opening up an initial phase of employment land for development, again the jobs ultimately accommodated will be ‘indirect’ outputs. Job outputs should be expressed as Full Time Equivalent (FTE) jobs. At table 3.4 please insert the number of direct and indirect outputs to be generated and profile by year. When reviewing output data, assessors will consider how likely it is that the proposed scheme will deliver the scale and type of outputs described. Promoters should therefore provide any benchmark evidence or research which supports and justifies their output assumptions. When converting gross to net employment outputs, promoters may have their own benchmark data from similar schemes, or may like to draw upon the following: Cambridge Economic Associates “Research to Improve the Assessment of Additionality” (2009) https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/191512 /Research_to_improve_the_assessment_of_additionality.pdf English Partnerships “Additionality Guide https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/191511 /Additionality_Guide_0.pdf PWC “Evaluation of RDA Impact” http://www.berr.gov.uk/files/file50735.pdf Input-output multiplier tables, providing multipliers by industry sector (Scottish Government) http://www.scotland.gov.uk/Topics/Statistics/Browse/Economy/InputOutput/Downloads ADDITIONALITY DEFINITIONS / GUIDANCE Leakage: The proportion of outputs that benefit those outside of the intervention’s target area or group When assessing leakage it is important to be clear about why the intervention is to be undertaken and what the intended outcome is. Promoters should consider who the target beneficiaries are intended to be and whether outputs/outcomes are likely to benefit non-target groups at the expense of the target group(s). Typical ready reckoners utilised in economic development case making are presented overleaf: 14 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Level Description All the benefits go to people living in the target area/the target None group The majority of benefits will go to people living within the target Low area/target group A reasonably high proportion of the benefits will be retained within Medium the target area/target group Many of the benefits will go to people living outputs the area of High benefit/outside of the target group A substantial proportion of those benefiting will live outside of the Very High area of benefit/be non-target group members Total None of the benefits go to members of the target area/target group Source: English Partnerships Leakage 0% 10% 25% 50% 75% 100% Displacement: The proportion of intervention outputs/outcomes taken from elsewhere in the target area Displacement is where an intervention takes market share (product market displacement) or labour, land and capital (factor market displacement) from elsewhere in the target area. For instance a housing scheme may reduce demand for housing in adjoining community. Promoters should consider whether the intervention will reduce existing activity from within (or outside) the target area and if so, by how much. Typical ready reckoners are as follows Level None Description No other demand affected There are expected to be some displacement effects, although only Low to a limited extent Medium About half of the activity would be displaced High A high level of displacement is expected to arise Total All of the activity generated will be displaced Source: English Partnerships Displacement 0% 25% 50% 75% 100% Multiplier Effects: Further economic activity (jobs, expenditure or income) associated with additional local income and local suppliers purchases. Multiplier effects are the knock-on effects experienced within the local economy. Promoters should consider how many (if any) additional outputs and outcomes will occur through purchases along local supply chains, employee spending rounds and longer term effects as a result of the intervention. Level Low Medium High Description Limited local supply linkages and income (or induced) effects Average linkages. The majority of interventions will be in this category. Strong local supply linkages and income (or induced) effects Multiplier 1.3 1.5 1.7 Example of an Additionality Calculation The public sector is considering an investment of £800,000 in the demolition or a derelict building and construction of 8,000 sq m of workspace. The businesses likely to be occupying the new space will be at the lower end of the skilled manufacturing and service sectors although some hi-tech businesses may also locate there. Displacement is expected to be low and without the intervention it is expected that approximately 1,500 sq m of floorspace would be refurbished anyway. The following calculations would be made to determine net additional floorspace created: 15 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue A B = A*25% C = A-B D = C*20% E = C-D F = N/A G = E+F H=G (intervention option) – G (reference case) Gross direct floorspace (sq m) Estimated leakage – 25% Gross local direct effects Displacement – 20% Net local direct effects Multiplier Total net local effects Total net additional local effects Intervention option 8,000 sqm -2,000 6,000 -1,200 4,800 N/A 4,800 Reference case 1,500 sqm -375 1,125 -225 900 N/A 900 Additionality 3,900 sq m Consideration could be given to factors which may impact the proposed scheme which may mean it is appropriate to use additionality factors which vary from the ready reckoners suggested above. This is perfectly acceptable if supported by reasonable argument. Promoters should also identify any wider social or environmental outcomes attributable to the scheme. In answering this question, promoters should focus their response on any wider benefits which can be directly linked to the scheme, can be evidenced/supported by research and directly contribute to the objectives of the SCR Growth Strategy. Responses should seek to avoid listing wider outcomes which may be difficult to directly attribute to the scheme and are likely to happen anyway. When setting out the Net additional Value for Money position, promoters can include any comparable benchmark data (stating their source), to support their application. DfT is to publish VfM benchmark data in Autumn 2013 which could be used in submissions. GVA Calculation: When calculating GVA promoters should consider the total achieved and future potential GVA generated by the investment. Promoters will need to consider: The period over which benefits will accrue until they reach their full potential i.e. will this be from the start of the investment period, during the investment period, on its completion etc? The persistence of the benefits i.e. how many years the benefits are expected to persist. The rate at which benefits will decay i.e. the proportion of annual benefits expected to be lost from one year to the next due to economic changes, other investment decisions etc; Calculation of the Net Present Value of the GVA benefit stream over the appropriate persistence time period by discounting back utilising an appropriate discount rate. HM Treasury Green Book recommends discounting by 3.5% in order to determine Net Present Value PWC’s very detailed analysis of Regional Development Agency expenditure provided some guidance on methodological assumptions for calculating GVA impacts. The most appropriate for SCRIF-type investments are likely to be as follows: 16 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Intervention Time to deliver (years) Years over which benefits build Persistence of benefits (years) Decay (% per annum) Bringing land back into use 5 3 10 10 Public realm 3 2 10 10 The following table sets out GVA per filled job by sector (based on 2010 data) which should be used by promoters in their calculations in order to aid consistency. Where promoters use different/additional data, an explanation should be provided as to why this approach has been adopted and any assumptions made. Sector GVA per filled job (£) Agriculture, forestry and fishing 352,000 Production 52,890 Construction 59,447 Distribution; transport; accommodation and food 29,543 Information and communication 56,468 Financial and insurance activities 86,787 Real estate activities 256,726 Business service activities 27,051 Public administration; education; health 28,636 Other services and household activities 27,341 Notes: Sector based GVA per filled job data for Sheffield City region has been derived using GVA estimates from ONS Sub-national GVA Estimates 2010 (Income Approach), 2012, and employment estimates via ONS Business Register and Employment Survey 2011. All data is for 2010. Due to local level GVA data reporting from ONS, Sector GVA figures include authorities in the East Midlands outside of SCR. Employment data has been aligned accordingly to account for this Example of GVA Calculation A development project is expected to create 30 net additional jobs within the business service sector. The benefits will accrue over a 3 year period (10 jobs per year) and persist for 10 years. Within this sector one job would generate £27,051 of additional GVA. Assuming a 10% decay of benefits per annum. Annex 2 provides a spreadsheet example of the GVA calculation. Optimism bias: In order to ensure benefits are not overstated adjustments should be made for optimism bias by increasing estimates of the costs and delaying the receipt of estimated benefits. Recommended adjustment ranges for different scheme types, is set out below. It is anticipated that the assumptions made for Optimism Bias will be adjusted at each Stage as the business case develops. It is usual for mitigation arguments to be introduced as the quality of the cost estimate improves as the business case develops, and this would be expected through the Stage 1A, 1B, 2 process. 17 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Scheme Types Standard buildings Non-standard buildings Standard civil engineering Non-standard civil engineering Optimism Bias Works Duration Capital Expenditure Upper % Lower % Upper % Lower % 4 1 24 2 39 2 51 4 20 1 44 3 25 3 66 6 Source: HM Treasury Green Book Scheme Types in the table above are defined as follows: Standard building projects are those which involve the construction of buildings not requiring special design considerations Non-standard building projects are those which involve the construction of buildings requiring special design considerations Standard civil engineering projects are those that involve the construction of facilities, in addition to buildings, not requiring special design considerations e.g. most new roads and some utility projects. Non-standard civil engineering projects are those that involve the construction of facilities, in addition to buildings, requiring special design considerations due to space constraints or unusual output specifications e.g. innovative rail, road, utility projects, or upgrade and extension projects. Additional information is available from: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/191507/Op timism_bias.pdf Section 3B: National Economic Case for Transport Schemes Under the SCR Assurance Framework, the preparation of a business case for transport is governed by WebTAG. The section of the Stage 1B template covering Economic Case for Transport Schemes provides an opportunity for promoters to summarise the case that has been developed by following the WebTAG guidelines. To support their business case promoters will need to provide the full set of documentation as set out in their agreed Appraisal Specification Report (ASR) – see below. To help promoters the Department for Transport also provides a checklist of documentation which ideally should support a full business case. A robust approach would be for promoters to complete the checklist and include it with their Stage 1B submission. The checklist is available from the DfT website by following this link. The Economic Case needs to be supported by evidence set out in documents covering the following topics: 1. Economic Case Assessment 2. Cost Benefit Analysis 3. An Existing Data and Traffic Surveys Report 4. An Assignment Model Validation Report 5. A Demand Model Report 6. A Forecasting Report As outlined above, before embarking on the modelling and appraisal for Stage 1B, promoters will need to complete an Appraisal Specification Report and get it signed-off by 18 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue the Central Independent Appraisal Team. The Appraisal Specification Report must set out the approach for completing each element of the analysis required for a transport business case. Any reductions in scope of the appraisal for ‘proportionality’ need to be agreed in the Appraisal Specification Report. As their business case develops, promoters should submit a revised Appraisal Specification report if they want to make a change to the agreed methodology. For any transport scheme costing more than £5m to SCR’s Local Growth Fund (which may or may not include SCRIF) the approaches set out in WebTAG must apply. Promoters should refer to WebTAG 10.1 to find guidance on the tests that need to be applied to work out what level of proportionality can be applied to the appraisal. The starting point is an assumption that schemes need a full variable demand multi-modal model. However, public transport schemes affecting only a single corridor can be assessed with a simplified model. Schemes with very little mode-shift may also be modelled in a simplified way. To confirm that a full variable demand model is not required, promoters should carry out the modelling tests from WebTAG 3.10.1. The tests compare benefits using a fixed trip matrix with benefits estimated using a simple demand model. If the two results are sufficiently similar, the scheme can be modelled using a fixed matrix approach, WebTAG sets out the thresholds. As set out at section 1.5, if a project / scheme is going to cost less than £5m to SCR’s Local Growth Fund, then it will not have to follow the WebTAG process, and scheme promoters will use the Stage 1A/Stage 1B business case and appraisal templates for the development of their business case, excluding the sections in the Economic case for Transport schemes. SUPPORTING EVIDENCE TOPIC 1: Economic Case Assessment Report For the Economic Case Assessment, promoters will need to supply the full set of Appraisal Summary Table worksheets. To complete the worksheets Promoters will need to follow the guidance set out in level 3 of WebTAG, which is aimed at “experts”. It is best to complete the worksheets before starting to write the Economic Case because the results set out in the worksheets shape the business case. Promoters should supply hard copies of all the worksheets in an appendix to the Economic Case Assessment Report and supply electronic copies of the following worksheets: Appraisal Summary Table Transport Economic Efficiency Table Analysis of Monetised Costs and Benefits Public Accounts Table –for highway schemes or for other schemes The economic case covers the Value for Money appraisal, the environmental appraisal and the appraisal of social and distributional impacts. At Stage 1B these appraisals must be fully completed. Subsequent stages will refresh the headline results from these appraisals. The economic case report can be usefully structured around the headings in the Appraisal Summary Table. In most cases, WebTAG has individual documents that provide guidance on the appraisal of each of these headings. However, WebTAG and the checklist are both still grouped around an older set of headings that matched an earlier version of the Appraisal Summary Table. For example, the Accidents and Security sub-objectives in the Social Objective of the Appraisal Summary Table appear in Workspace under the heading of the Safety Objective. Promoters will find that for the majority of transport schemes they need to refer to all the guidance documents within WebTAG Units 3.1 to 3.10, and Unit 3.17. The headings in the Appraisal Summary Table are: 19 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Economy Benefits to business users and transport providers Reliability impact on business users Regeneration Wider Impacts Environmental Noise Greenhouse Gases Landscape Townscape Heritage of historic resources Biodiversity Water Environment Social Economic benefits to commuters and other users Reliability benefits to commuters and other users Physical Activity Journey Quality Accident Security Access to services Affordability Severance Option values Public Accounts Cost to Broad Transport Budget Indirect Tax Revenues Promoters may find it less repetitive to present a single methodology section that describes how they have modelled and appraised benefits to business users and to commuters and other users. Thus the structure of their Economic Case Assessment may not match the precise order of the Appraisal Summary Table headings. The report must include: Completed Appraisal Summary Table Completed AST Worksheets Completed TEE Table Completed AMCB Table Completed PA Table TOPIC 2: Cost Benefit Analysis A second report should set out the detail of how the cost-benefit appraisal has been undertaken: Assumptions in the analysis Information on local factors e.g. growth and annualisation Details of assumptions about operating costs and analysis of commercial viability Full inputs and outputs or TUBA or COBA (also provided electronically) Evidence that all TUBA or COBA warnings have been checked Spatial (sectoral analysis of TEE benefits) Details of maintenance delay costs/savings Details of delays during construction 20 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue TOPIC 3: An Existing Data and Traffic Surveys Report The Stage 1B submission should include a report covering the data gathered for the modelling and appraisal of the scheme. The report should cover: Details of the sources, locations (illustrated on a map), methods of collection, dates, days of week, durations, sample factors, estimation of accuracy, etc. Details of any specialist surveys (e.g. stated preference). Traffic and passenger flows; including daily, hourly and seasonal profiles, including details by vehicle class where appropriate Journey times by mode, including variability if appropriate. Details of the pattern and scale of traffic delays and queues Desire line diagrams for important parts of the network Diagrams of existing traffic flows, both in the immediate corridor and other relevant corridors. TOPIC 4: An Assignment Model Validation Report The Stage 1B submission requires an assignment model validation report for each assignment model. Normally one report would cover the road traffic model and another would cover the public transport model. If any other transport models have been used, the submission should include the appropriate model validation report. For examples an additional validation report would be needed if a micro-simulation model had been used. The assignment model validation report should cover the development of the transport model. IT Description of the development of the model Zone Plan Network Plan Details of the treatment of congestion on the roads and crowding on public transport Description of the data used for validation and calibration with a clear distinction made between the two Evidence of the validity of the networks covering checks of range and logic, link lengths, and route choice Details of the segmentation of demand and the rationale for that selection Validation of the trip matrices including estimation of measurement and sampling errors Details of any ‘matrix estimation’ techniques used and evidence of the effect of estimation on the scale and pattern of the base travel demand matrices Validation of the trip assignment including comparisons of flows (on links and across cordons and screenlines), and for traffic models turning flows at key junctions; Journey Time Validation, including for road traffic models, checks on queue patterns and the magnitude of delays/queues Details of the assignment convergence Present Validation if the model is more than 5 years old A Diagram of modelled traffic flows, both in the immediate corridor and other relevant corridors. 21 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Topic 5: A Demand Model Report The Stage 1B submission requires a demand model report that must cover: Where no demand model has been used the evidence should be provided to support this decision, following the guidance in WebTAG Unit 3.10.1 Variable Demand Modelling – Preliminary Assessment Procedures Description of the demand model Description of the data used in model building and validation Details of the segmentation used, including the rationale for that chosen. This should include justification for any segments remaining fixed Evidence of model calibration and validation and details of any sensitivity tests. Details of any imported model components and rationale for their use. Validation of the supply model sensitivity in cases where the detailed assignment models do not iterate directly with the demand model. Details of the realism testing, including outturn elasticities of demand with respect to fuel cost and public transport fares. Details of the demand/supply convergence. TOPIC 6: A Forecasting Report The Stage 1B submission should include a forecasting report that includes: Description of the methods used in forecasting future traffic demand Description of the future year demand assumptions (e.g. land use and economic growth - for the do minimum, core and variant scenarios) An uncertainty log providing a clear description of the planning status of local developments Description of the future year transport supply assumptions (i.e. networks examined for the do minimum, core scenario and variant scenarios) Description of the travel cost assumptions (e.g. fuel costs, PT fares, parking) Comparison of the local forecast results to national forecasts, at an overall and sectoral level. Presentation of the forecast travel demand and conditions for the core scenario and variant scenarios including a diagram of forecast flows for the do-minimum and the scheme options for affected corridors. If the model includes very slow speeds or high junction delays evidence of their plausibility An explanation of any forecasts of flows above capacity, especially for the do-minimum, and an explanation of how these are accounted for in the modelling/appraisal Presentation of the sensitivity tests carried out (to include optimistic and pessimistic tests). 4.6 22 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 4.7 Section 4: The Financial Case The aim of the financial case is to determine whether the proposed scheme is affordable and financially sustainable. Appraisers will also consider the level of financial risk associated with the proposed scheme. The data provided should be robust with any assumptions clearly articulated. Table 4.3: The total investment for all years should equal the total cost of the scheme i.e. all scheme costs need to be accounted for under these cost headings and additional fields can be added if required. The “status” of the cost should indicate to appraisers whether the costs presented are estimates and will therefore require further work, or are definitive. There is scope to elaborate on this in the following question which asks for evidence on which any cost assumptions have been based and any additional work required. If additional work is required, responses should set out what this will involve and timescales for its completion. It is expected however that costs will be developed to an appropriate level of detail to allow robust assessment of the scheme and to allow the scheme to be put out to tender should the business case be approved. Detailed cost plans should be appended to support the Stage 1B Full Business Case. Promoters should discuss the real and tangible financial risks to the scheme using their best judgement and previous experience. These could include consideration of: Construction/operating costs; the financial stability of contractors; external market conditions; securing other investment; political support etc. The strategy for dealing with cost overruns should be set out. The key question which should be addressed is - Who will be responsible for/liable for cost over-runs and how will they be dealt with by the project management team? SCR will not be liable for any cost over-runs and will expect funds to be defrayed as set out in the final funding agreement. Please give an indication of the nature and extent of any revenue costs beyond the SCRIF investment which will need to be met by the public sector, and how this will be managed and funded. 4.8 Section 5: The Management Case The management case explores whether the proposed scheme is deliverable, and seeks to ensure that governance, management, monitoring and evaluation processes are in place and fit for purpose. Please provide an overview of the governance and decision-making arrangements which are in place. This could include who is involved, their roles/responsibilities, the structure, the process through which decisions will be made, where use will be made of existing structures/processes, opportunities for external scrutiny, any resident/public involvement, and the lead organisation’s credentials in governing similar schemes etc. Set out the project management arrangements in place e.g. who will be involved, their roles/responsibilities, processes to ensure delivery on time and budget, quality assurance procedures, how any division of project management responsibilities will be managed, how delivery will be monitored and reported, links between project management and governance structures, project management capabilities/experience of key personnel, whether external appointments will need to be made etc. Outline who will own/control any capital assets developed by the scheme, who will be responsible for their maintenance, any on-going costs and whether a management plan is in place. Outline how maintenance costs will be secured and measures in place to ensure the outputs and outcomes of the SCRIF investment are sustainable over the long term. 23 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Section 5.2 - outline the measures that will be put in place to ensure the public benefits from the scheme will be delivered and will be sustainable. Responses could consider who will be responsible for this and details of the benefits realisation plan. Analysis of management risks should provide an update of the delivery risks identified at Stage 1A: whether these are still applicable, have been resolved or still pose a threat to delivery. 24 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 5 Beyond Stage 1B 5.1 Moving from Stage 1B to Stage 2 Once schemes have been assessed and approved at Stage 1B, SCR will engage with the scheme promoter to discuss requirements for Stage 2. The content of Stage 2 will depend upon the nature of the scheme, the findings of the Stage 1B assessment and any outstanding actions still to be undertaken. It is not anticipated that there will be a ‘Stage 2 Business Case template’ per se, but that this Stage will involve a refinement of the Stage 1B Business Case through the provision of additional information or answers to queries raised through the Stage 1B assessment process, and should in effect provide the information necessary for the due diligence accompanying the completion of the Funding Agreement at Stage 3, so that this exercise for SCR is ideally limited to a straight forward collation of the information that has been provided. Each case will of course be different depending upon the nature of the scheme, but in broad terms, it is anticipated that the types of activities to be undertaken will include: Refinement of procurement arrangements Refinement of costs Refinement of the Transport modelling case if assessment queries remain outstanding at the end of Stage 1B Due diligence on delivery partners Securing statutory powers still outstanding Providing any additional market evidence required by SCR The culmination of Stage 2 will be a final VfM check by the CIAT to ensure that the scheme still offers VfM based upon any revised costs. This will be followed by approval to procure contractors for the proposed scheme and agreement of key Heads of Terms which will form the basis of the SCRIF funding agreement between SCR and the scheme promoter. UN-RESOLVED ISSUE FOR SCR: IF OUTPUTS NOT MET, WILL SCRIF FUNDING HAVE TO BE REPAID / CLAWED BACK? 5.2 Stage 2 – Non-transport schemes For non-transport schemes, the types of activities undertaken at Stage 2 may include: 5.2.1 Cost refinement The work may include: Securing actual costs from scheme developers/contractors based on the approach approved at Stage 1B; Sources and nature of other public/private sector investment in the scheme and evidence of third party support/any relevant funding conditions; consideration of any state aids issues; Consideration of land costs and whether land has already been acquired; 25 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 5.2.2 Development costs (site preparation, demolition, refurbishment, decontamination, infrastructure and engineering works, construction costs for new build). This should include on and off site costs; Planning obligations such as contributions towards affordable housing, transport works, education/social infrastructure etc. (S106 contributions and CIL). Professional fees from design through to implementation and sales/marketing Finance costs e.g. the phasing of development and analysis of discounted cashflow, inflation factors, and interest charged on money borrowed/borrowing arrangements and risks associated with servicing the repayment/interest Sensitivity analysis Cost contingencies to cover the risk of cost overruns, details of any risk sharing arrangements Returns e,g, end sale values/rental returns where applicable Other revenue streams e.g. long term ownership and maintenance/management A high level review of the market context within which the scheme sits. This will reflect on the supply of such space/development in the local area and the scale of demand for this particular investment – to review the risk associated with its sale or occupation and therefore the risks associated with realisation of benefits. Analysis of market values: analysis of the construction costs set out by the applicant in the submission, to assess their robustness and validate the approach taken, and to set out any identified concerns for further analysis/negotiation. This should also include a review of the property and site values/rents set out in the submissions, to establish their validity in terms of defining the need for investment and the scale of the funding (drawing on the construction cost analysis set out above). A description of any financial savings and efficiencies achieved. Financial Standing Work will involve: Financial standing of delivery partners Evaluate each organisation’s financial position, its ability to deliver each proposed scheme and identify relevant issues and risks. For private sector partners, this will include: Commentary on key balance sheet attributes and indicate those items for which there is limited or no visibility An assessment of the working capital and cash profiles of each organisation in order to assess solvency and the potential for default; and An overview of the current debt structure of the business and the quality of any security available with specific regard to interest and gearing cover Parent company guarantee (for private sector partners) Clarify the group structure of each organisation to identify parent companies and the nature of the guarantees to be provided. Identify any mortgages in place (with reference to Companies House records and other public information) and their impact on the strength of covenant. 26 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue At a high level and based on publicly available information, evaluate the financial position of each relevant parent to assess the quality of any guarantee provided. State Aid 5.2.3 Confirm the nature of the scheme in terms of definition of expenditure as set out in the State Aid rules. For transport projects, confirm if investment is compatible with the EU’s State Aid regime for the coordination of transport purposes and that the aid is necessary for the project and does not distort competition. Confirm any legal advice obtained by the recipient in this respect and set out the case for considering project exempt from Sate Aid support limits. Where there is not a general exemption for a project from State Aid consideration, identify the eligible costs associated with the project and how the level of grant funding sits against the funding ceilings set out within the State Aid rules. Deliverability This element of the due-diligence process brings together the key elements of the financial appraisal and the financial standing sections, to provide the recommendations on the deliverability of the scheme and any associated risks. It includes key elements associated with practical delivery – such as the risks around planning permission, securing ownership or access to the land to construct the project, and any other site constraints. The work in this Stage will include analysis of the physical deliverability of the scheme, compiling evidence on: Land ownership, Heads of Terms Planning permissions Joint venture or other legal agreements; including any penalties for breaking them Site work requirements It may also explore deliverability in terms of the scheme management and governance i.e. 5.3 Timescales/milestones and detailed workplans Details of the benefits realisation plan Communication/stakeholder management arrangements and processes Detailed job specifications and details/timescales of any recruitment processes Stage 2 - Transport Schemes For transport schemes, Stage 2 will focus on going out to tender in order to firm up scheme costs, and developing the management case to ensure deliverability and risk mitigation. An application can be made when any necessary statutory powers have been obtained and when the scheme appraisal and project information has been updated to reflect the latest position. At this stage detailed design work will have been undertaken and the promoter will have a much better appreciation of the likely cost of the scheme. An updated risk register and project plan should be provided. CIAT will require details of the commercial aspects and the procurement strategy. This will include the draft OJEU notice, draft tender evaluation criteria and draft contract documents. 27 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue MVA to add additional notes on the Stage 2 process on the procurement process / securing of statutory powers expected to be undertaken at Stage 2. 5.4 Stage 3 Stage 3 will involve drawing up firstly the Heads of Terms followed by negotiation of the funding agreement between the SCR Authority and the scheme accountable body, and will need to be supported by the preparation of a scheme due diligence file compiling all the business case information collected at Stages 1A, 1B and 2. As a minimum, it is anticipated that this will set out: Details of the scheme being supported The nature of funding agreed e.g. grant, loan The outputs and outcomes/impacts to be delivered All scheme costs and detailed funding/expenditure profile Agreed milestones Funding conditions e.g. use of assets, material changes to the scheme Any funding claw-back clauses to be incorporated Any security to be offered Liability for cost over-runs Monitoring of scheme delivery and claims processes Monitoring of outputs delivery Evaluation processes and requirements 28 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Annex 1: Guidance on the content and the structure for the completion of the Appraisal Specification Report (ASR) TO BE INCLUDED ONCE ASR FORMAT AGREED WITH SCR 29 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue 1 Sheffield City Region Executive SCRIF Appraisal Process Guidance notes – September 2013 Draft Final - v4 issue Annex 2: Example GVA calculation spreadsheet 2