Project Appraisal, Planning & Control

advertisement

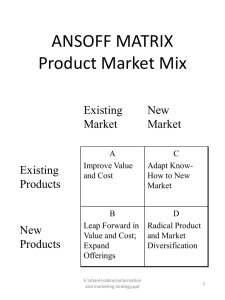

PES Institute of Technology – Bangalore South Campus Dept. Of MBA Lesson Plan Semester – IV 1 Planning & Analysis Overview: Phases of Capital Budgeting-Levels of decision making-Objective Lecture PPT # Class 2 Resource Allocation Frame work: Key criteria for allocation of resources Elementary investment strategies, Portfolio planning tools Lecture PPT “ Lecture Problem solving PPT/Black Boa rd “ 3 4 LAB-I II 5 6 Strategic position and action evaluation, aspects relating to conglomerate diversification, interface between strategic planning and capital budgeting. Understanding implementation of portfolio planning. Generation and screening of project ideas: generation of ideas, monitoring the environment: regulatory frame work for the projects Corporate Appraisal, Preliminary screeing,project rating index Pedagogical Tools Presentation Assignments / additional work Discuss ion # Test I # Case Present ation Lecture PPT “ Lecture/ PPT “ solving problems related to previous years question papers Lecture Cumulative Coverage I Contents Student Learning Evaluation Technique Session No. Total no of Lectures: 56 IA Marks: 50 Exam Hours: 03 Exam Marks: 100 Module No Subject Code: 10MBAFM425 Subject Title: Project Appraisal, Planning & Control Faculty Name: Dr.Prema Chandran / Mrs.Divya Mathur No of Hours / Week: 04 10% 28% PPT “ 7 8 LAB-2 II 9 10 11 12 Demand forecasting methods LAB-3 Case study on Demand forecasting Market Plan 13 14 15 16 LAB-4 17 III Sources of positive NPV,Qualities of a successful entrepreneur The porter model for estimation of profit potential of industries Construction of project rating index Market and demand analysis :Situational Analysis and specification of objectives Collection of secondary information, conduct of market survey Characterization of the market ,demand forecasting 18 19 20 Technical Analysis-Study of material inputs and utilities, manufacturing process and technology Product mixes, plant capacity, location and site Machineries and equipments, structure and civil works Discussion on charts and layout drawings Project charts and layouts, work schedules Estimation of cost of project and means of financing, estimates of sales and production Cost of production, working capital requirement and its financing Estimates of working results, breakeven points, projected Lecture PPT “ Lecture PPT “ Lecture PPT Lecture PPT “ Lecture Problem solving PPT “ Lecture Problem solving PPT Lecture PPT “ Lecture PPT “ Lecture PPT “ Lecture PPT “ Lecture PPT “ PPT “ PPT “ PPT “ Case study Case Study “ “ 28% Lecture/ solving problems Lecture/ solving problems Lecture/ solving 50% LAB-4 21 22 23 IV 24 LAB-5 25 26 27 28 LAB-6 V 29 30 31 cash flow statement, projected balance sheet. Case study on Financial estimates and Projections Project cash flows: Basic principles of measurement of cash flows, components of the cash flow streams Viewing a project from different points of view, definition of cash flows by financial institution and planning commission, biases in cash flow estimation Appraisal Criteria:NPV,Benefit cost ratio,IRR,PBP,ARR,investment appraisal in practice Types and measures of risksimple estimation of risk, sensitivity analysis, scenario analysis Case study on Project Cash Flows Monte Carlo simulation, decision tree analysis problems Selection of project, risk analysis in practice Lecture/ Special decision situations: Choice between mutually exclusive projects of unequal life, optimal timing decision Determination of economic life, interrelationship between investment and financial aspects, Inflation and capital budgeting Case study on Decision Tree Analysis Social Cost Benefit Analysis (SCBA)-Rationale for SCBA UNIDO approach to SCBA-1 UNIDO approach to SCBA-2 Lecture/ PPT Case study “ solving problems Lecture Lecture/ PPT PPT “ Case study “ solving problems Lecture/ PPT “ solving problems Lecture/ PPT Case study solving problems PPT “ solving problems Lecture/ PPT “ Case study 62% “ solving problems Lecture PPT “ Lecture PPT “ Lecture PPT “ Lecture question and answer PPT Case study “ 78% session 32 VI LAB-7 Problems on SCBA 33 Multiple Projects and Constraints-Constraintsmethods of rankingmathematical programming approach Linear programming model 34 VI Lecture Lecture/ 40 LAB-9 Presentations on Project Financing “ PPT “ solving problems lecture & solving problems lecture & Strategic planning and solving financial analysis, problems informational asymmetry and capital budgeting, organizational considerations Problems on Multiple Projects and Constraints Lecture Environmental appraisal of projects: types and dimensions of a project, meaning and scope of environment Lecture Environment-environment resources values, environmental impact assessment and environmental impact statement. Lecture Project financing in India:means of finance –norms and policies of financial institutions,SEBI guidelines, sample financing plans Lecture Structure of financial question institutions in India, schemes and answer of assistance, term loans session procedures. 39 PPT solving problems 36 38 “ Lecture/ Qualitative analysis:Qualitaive factors in capital budgeting, strategic aspects 37 PPT question and answer session 35 LAB-8 VII Little and Mirrlees approach to SCBA 82% “ “ PPT “ PPT “ PPT “ PPT “ 82% 90% 41 VIII 42 43 44 Project appraisal by financial institutions. Project Management: Forms of project organization, project planning, project control Human aspects of project management, prerequisites for successful project implementation Network techniques for project management, development of project network Lecture PPT “ Lecture PPT “ Lecture PPT “ PPT Lecture/ solving problems Case study Previous year question paper “ 100% LAB-10 Case study on Network 45 46 47 Techniques Time estimation, determination of critical path Scheduling when resources are limit, PERT and CPM models Lecture/ Lecture/ “ PPT “ PPT “ “ solving problems Lecture/ Network Cost System PPT solving problems solving problems Project review and administrative aspects: Initial review, performance evaluation, LAB-11 Problems on Project Review Lecture PPT 49 Lecture PPT VIII 48 50 abandonment analysis, administrative aspects of capital budgeting, evaluating the capital budgeting system of an organization REVISION 51 REVISION 52 REVISION Table – 2 Assignments & Additional Work Mod No 1 2 S.No. Assignment Topics Questions from module 1 Questions from module 2 “ 100% 3 4 5 6 7 8 1-8 Questions from module 3 Questions from module 4 Questions from module 5 Questions from module 6 Questions from module 7 Questions from module 8 Each student have to submit three questions from question bank 1 question for 3 marks 1 question for 7 marks 1 question for 10 marks Recommended Books 1. Prasanna Chandra-Project Planning: Analysis, Selection, Implementation and Review-TMH,5/e 2. Narendra Singh-Project Management and Control-HPH,2003 References & Additional Readings S.No. Mod. No. 1 I – VIII ” Nicholas-Project Management for Business and Technology: Principles and Practices-Pearson/PH1 Gray & Larson-Project Management :The Management ProcessTMH,3/e,2005 ” Vasant Desai-Project Management-HPH 2 3 4 5 Particulars Bhavesh M Patel-Project Management-Vikas ” ” Chitkara-Construction Project Management,Planning,Scheduling and Control-TMH,1/e Table – 6 IA Pattern Test Marks 60% Presentations 20% Assignments 20% For Internal Evaluation T1 marks and the best out of remaining two will be considered. 1st Test is mandatory. Question Bank: 3 Marks Questions: 1. What are the usual assumptions underlying CPM analysis? 2. What is the procedure of determining critical path? 3. What are basics of network cost system? 4. What is the difference between accounting break even and financial breakeven? 5. What are the means of finance for setting up a project? 6. What is project management? 7. What is a work schedule? What purpose does it serve? 8. What are items found in the cash flow statement? 9. Discuss the contents of the balance sheet. 10. What do you understand by risk of a project? 11. Define capital project. 12. What are the levels of decision making? 13. List out the methods of demand forecasting. 14. How would you evaluate secondary information? 15. How would you characterize the market? 16. What is the rationale for NPV method? 17. State the three important steps to be taken to strengthen the links between strategy and capital budgeting. 18. List out the pre-requisites for successful implementation of a project. 19. What do you understand by social cost benefit analysis? 20. What are the key issues that should be considered while analyzing any project? 21. State the various steps in project rating index. 22. What are the principal sources of discrepancies that need to be considered while undertaking Social Cost Benefit Analysis? 23. Discuss the key steps in sample survey. 24. What is meant by work break down structure? 25. What aspects are considered in technical analysis? 26. What factors have bearing on the choice of technology? 27. What factors have a bearing on the plant capacity? 28. List out the techniques of risk analysis. 29. What are the various sources of finance available for the projects in India? 30. What is technical analysis in the context of project management? 31. What are the constraints in ranking multiple projects? 7 Marks Questions: 1. Define the levels of decision making. What are their key characteristics? 2. What are the pros and cons of conglomerate diversification? 3. What are a firm do to stimulate the flow of project ideas? 4. Describe the aspects covered in market planning. 5. How would you determine the kinds of machinery and equipment required for a manufacturing industry? 6. Describe the important charts and layout drawings. 7. Discuss the importance of considering alternative ways of transforming an idea into a concrete project? 8. Show how various financial estimates and projections are inter-related. 9. Discuss in detail the major component of cost of production. 10. Discuss the items that are considered in estimating the working results. 11. Critically evaluate payback period criterion. 12. What problem are encountered in applying portfolio theory to capital budgeting? 13. Mention the assumptions underlying the standard capital asset pricing model. 14. Describe the procedure involved in obtaining a term loans. 15. Describe and evaluate the various forms of project organization. 16. What steps are involved in PERT analysis? 17. Discuss the procedure of CPM analysis with help of simple example. 18. Discuss the basic principle of network cost system. 19. What are the advantages of conducting a performance review? 20. Explain portfolio analysis according to BCG matrix. 21. Explain how financial institutions calculate cost of capital, with an illustration. 22. Explain the difference between PERT and CPM in project management. 23. Discuss briefly the capital budgeting techniques. 24. Explain the term loan procedure as followed in financing of projects. 25. Discuss the procedure for determining whether a project should be continued, terminated or divested. 26. Explain the steps involved in developing a project rating index. 27. What are the five stages involved in UNIDO method of project appraisal? (2) 28. Explain the steps involved in capital budgeting process. 29. Describe the important charts and layout drawings. 30. Evaluate the pay back period and accounting rate of return as investment criteria. 31. What is the procedure that is generally associated with term loan as a source of finance from financial institution? 32. What are the pre-requisites for successful project implementation? 33. What is environmental impact statement of a project? Explain the contents of an environmental impact statement. 10 Marks Questions : 1. Discuss the five broad phases of capital budgeting. 2. Define the link between strategic planning and capital budgeting. 3. Discuss suggestions helpful in scouting for project ideas. 4. What key issues would you examine in a preliminary screening exercise? 5. What qualities and traits are required to be a successful entrepreneur? 6. List the important general sources of secondary information available in India. 7. Discuss the uncertainties in demand forecasting. How can one cope with these uncertainties? 8. What are the components of cost of project? Discuss them in detail. 9. Explain how you would compare mutually exclusive projects of unequal life. 10. Discuss the procedure for determining optimal timing under conditions of certainty. 11. Distinguish between the physical life and the economic life of an asset. How would you determine the latter? 12. Define the two measures of benefit cost ratio. 13. Discuss the procedure commonly used in practice to test CAPM. 14. What are the similarities and differences between the UNIDO approach and the Little Mirrlees approach? 15. Critically evaluate the integer linear programming model as a tool for capital budgeting. 16. Discuss the following in the context of a goal programming model; objective function economic constraints, and goal constraints. 17. Discuss the keys issues considered by financial institutions while appraising a project for term financing. 18. Why does the control of projects in practice tend to be ineffective? 19. Discuss the pre-requisites for successful project implementation. 20. What is basic difference between PERT and CPM? 21. Illustrate the problem of scheduling in view of resource constraints with the help of an example. 22. What problems are encountered in performance review and how can be they overcome? 23. How would you evaluate the capital budgeting system of an organization? 24. Explain the various aspects to be considered in technical analysis of a project. 25. Explain the UNIDO method of project appraisal. 26. A project is having the following activities and their time estimates, Activity Time in weeks Optimistic Most likely Pessimistic 1–2 2 3 10 1–3 3 4 5 2–4 6 8 10 2–5 5 6 7 3–4 5 7 9 4–5 4 5 12 i) How the PERT network for the project. ii) Identify the critical path and calculate the expected time (Arithmetic average time) to complete the project. iii) What is the probability that project will be completed by 15 weeks (for z=-1.5, area of the normal distribution = 0.0668) 27. The Alpha Company limited is considering setting up two projects A and B. The investment outlays and cash inflows after taxation, expected from the two projects are as under: Investment outlays Project A: Rs.4,00,000 Project B: Rs.4,50,000 Cash inflows Rs. Rs. Years 1 40,000 1,20,000 2 1,20,000 1,60,000 3 1,60,000 2,00,000 4 2,40,000 1,20,000 5 1,60,000 80,000 The company has a target of return on capital of 10 percent and on this basis, you are required to compare the profitability of the projects and state which alternative you consider financially more profitable. (Present value of one rupee at 10 percent – 1st year 0.91; 2nd year 0.83; 3rd year 0.75; 4th year 0.68; 5th year 0.62) 28. What is abandonment analysis in project review? Describe the general procedure of the analysis. 29. Mitsubishi Corporation has a project to be evaluated under three different scenarios. It wants to manufacture a component used in the manufacture of machinery. In all the scenarios, the initial investment is 80,00,000. The unit selling price is Rs.1,500-/,1,000/,and 3,000-/ in three scenarios. The demand is 4000 units 7,000 units and 3,000 units and the variable costs are Rs.50, Rs.60 and Rs.70 per unit under the three scenarios. Fixed costs are Rs.5,00,000 and Depreciation Rs.3,00,000. The tax rate is 50%. What is the NPV under the three scenarios if the life of the asset is 5 years and the discount rate is 24%? 30. Prepare a sensitivity analysis statement from the following information pertaining to a project: (All figures are in Millions of rupees) Year Rs. in million Years 1 to 10 Investment (250) Sales 200 Variable cost (60% sales) 120 Fixed costs 20 Depreciation 25 Pre-tax profit 35 Taxes 10 Profit after taxes 25 Cash flow from operations 50 Net cash flow 50 What is the NPV of the project assuming a cost of a capital of 13%? The range of values of the underlying variable can take is shown as under: Underlying Variable Pessimistic Expected Optimistic Investment 300 Variable costs as a percent of sales 65 250 200 60 56 31. Shantha Murthy enterprises is considering a capital project about which the following information is available: a. The investment outlay on the project will be Rs.100 million. This consists of Rs.80 million on plant and machinery and Rs.20 million on net working capital. The entire outlay will be incurred at the beginning of the project. b. The project will be financed with Rs.45 million of equity capital, Rs.5 million of preference capital and Rs.50 million of debt capital. Preference capital will carry a dividend rate of 15% debt capital will carry an interest rate of 15%. c. The life of project is expected to be 5 years. At the end of 5 years, fixed assets will fetch a net salvage value of Rs.30 million where as net working capital will be liquidated at its book value. d. The project is expected to increase the revenues of the firm by Rs.120 million per annum. The increase in costs on account of the project is expected to be Rs.80 million per annum. (This includes all items of cost other than depreciation, interest and tax.) The effective tax rate will be 30%. e. Plant and machinery will be depreciated @25% per annum as per the written down value method. Hence the depreciation charge will be: First year Second year Third year Fourth year Fifth year Rs.20.00 million Rs.15.00 million Rs.11.25 million Rs.8.44 million Rs.6.33 million Given the above details, calculate the project cash flows. 32. Explain the BCG matrix and GE stop light matrix. 33. The Scientists at Vigyanik have come up with an electric moped. The firm is ready for pilot production and test marketing. This will cost Rs.20 million and take six months. Management believes that there is a 70 percent chance that pilot production and test marketing will be successful. In case of success, Vigyanik can build a plant costing Rs.150 million. The plant will generate an annual cash inflow of Rs.30 million for 20 years if the demand is high or an annual cash flow of Rs.20 million if the demand is moderate. High demand has a probability of 0.6; Moderate demand has a probability of 0.4. What is the optimal course of action using decision tree analysis? 34. Explain the strategic position and action evaluation (SPACE) approach with suitable diagram. 35. Hari Chandra Pvt. Limited is evaluating seven projects with the following characteristics: Project Net present value Cash outflow in Cash outflow in (NPV) Period 1 (CFj1) Period 2 (CFj2) 1 6 5 7 2 8 9 5 3 8 12 4 4 7 3 10 5 4 4 6 6 12 10 15 7 9 13 9 The budget available to the firm is limited to 35 in a year 1 and 30 in year 2. There are tow additional constrains: Power constraint and managerial constraint. The requirement and constraints applicable in this respect are as under: Project Power Managerial Requirement (Ej) Requirement (Mj) 1 2 6 2 4 5 3 5 7 4 3 2 5 4 4 6 7 8 7 6 3 ∑ XjEj ≤ 18 ∑ XjMj ≤ 20 Develop a Linear programming formulation of capital budgeting under various constraints mentioned above.