balance sheet statement

advertisement

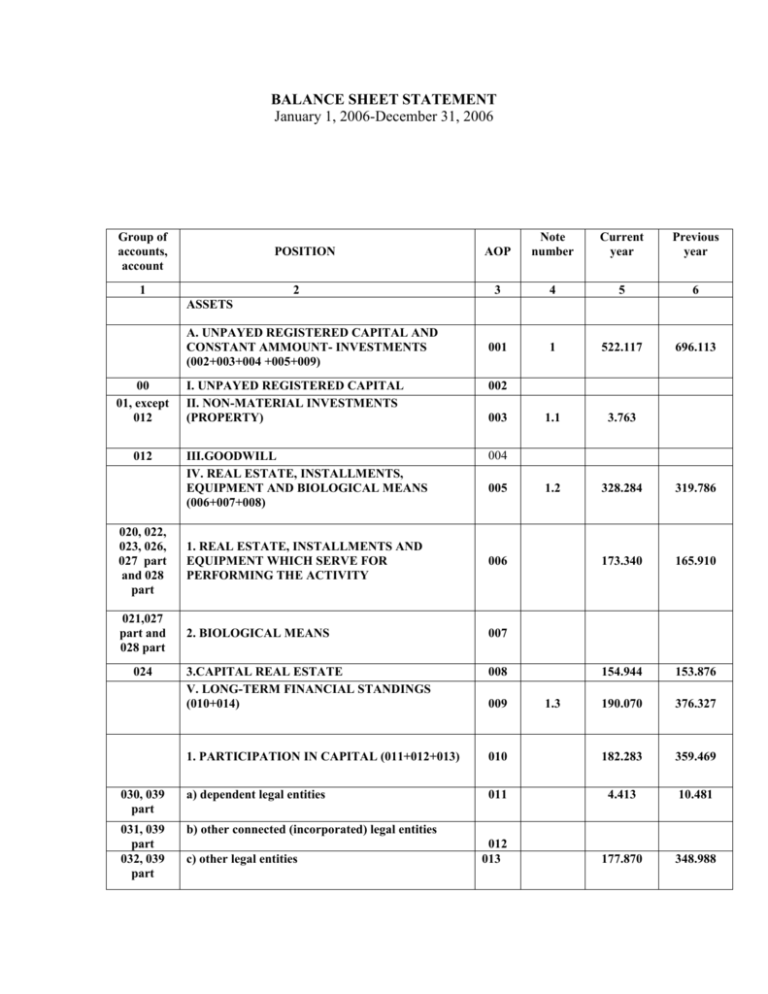

BALANCE SHEET STATEMENT January 1, 2006-December 31, 2006 Group of accounts, account POSITION 1 2 AOP Note number Current year Previous year 3 4 5 6 001 1 522.117 696.113 1.1 3.763 1.2 328.284 319.786 173.340 165.910 154.944 153.876 190.070 376.327 ASSETS A. UNPAYED REGISTERED CAPITAL AND CONSTANT AMMOUNT- INVESTMENTS (002+003+004 +005+009) 00 01, except 012 012 I. UNPAYED REGISTERED CAPITAL II. NON-MATERIAL INVESTMENTS (PROPERTY) 002 III.GOODWILL IV. REAL ESTATE, INSTALLMENTS, EQUIPMENT AND BIOLOGICAL MEANS (006+007+008) 004 003 005 020, 022, 023, 026, 027 part and 028 part 1. REAL ESTATE, INSTALLMENTS AND EQUIPMENT WHICH SERVE FOR PERFORMING THE ACTIVITY 006 021,027 part and 028 part 2. BIOLOGICAL MEANS 007 3.CAPITAL REAL ESTATE V. LONG-TERM FINANCIAL STANDINGS (010+014) 008 1. PARTICIPATION IN CAPITAL (011+012+013) 010 182.283 359.469 030, 039 part a) dependent legal entities 011 4.413 10.481 031, 039 part 032, 039 part b) other connected (incorporated) legal entities 012 013 177.870 348.988 024 c) other legal entities 009 1.3 033 part, 039 part 033 part 039 part From 034 to 039, except 037 10,13,15 14 20,21 and 22 except 223 223 2. Other long-term financial standings a) in incorporated legal entities- main and dependent 014 015 7.787 16.858 b) in other incorporated legal entities 016 c) other long-term financial standings 017 7.787 16.858 B. WORKING PROPERTY- DEMANDS (019+020+021+034) 018 2 1.348.916 463.941 019 2.1 10.774 9.248 020 2.2 III. SHORT-TERM DEMANDS, STANDINGS AND CASH (022+023+024+028+029+030+031+032+033) 021 2.2 1. Demands 2. Demands for overpaid income tax 3. Short-term financial standings (025+026+027) I. Supply II. Constant means intended for selling and means of managing that is to be suspended 0 1.338.142 454.693 022 244.872 206.720 023 83 3.651 024 817.732 6.969 230, 239 part a) in incorporated legal entities- main and dependent 025 231, 239 part b) in other incorporated legal entities 026 c) other short-term financial standings 4. Ready equivalents and ready money 5. Tax for the additional amount 027 028 029 817.732 102.564 6.969 82.161 6. Active time limits 030 1.738 3.674 7. Beforehand paid costs for obtaining insurances 031 167.954 143.709 3.199 7.809 1.871.033 1.160.054 1.871.033 1.160.054 From 232 to 239, except 237 24 26 27,except 274, and 278 274 275 276 278 8. Transferred premium of the insurance and coinsurance which goes on the burden of the coinsurer and reinsurer 9. Reserved damages of insurance and coinsurance which goes on the burden of coinsurer and reinsurer IV. DELAYED TAX MEANS C. BUSSINES PROPERTY (001+018) 2.2.1 032 033 034 035 2.3 29 D. LOSS ABOVE THE AMOUNT OF CAPITAL 036 E. TOTAL ASSETS (035+036) 037 88 F. OFFBALANCE ASSETS 038 LIABILITIES A. CAPITAL AND RESERVE (102+107+108+109+110-113) 101 3 573.046 163.970 I. BASIC AND OTHER CAPITAL (103+104+105+106) 102 3.1 303.317 227.239 1. Stock capital 103 302.400 201.250 303 and 304 2. State and social capital 104 306 and 307 3. Social deposits for mutual insurance 105 301 and 309 4. Shares and other capital 106 917 25.989 31 32 33 II. UNPAID REGISTERED CAPITAL III. RESERVE IV. REVALORIZED RESERVES V. UNARRANGED PROFIT (111+112) 107 108 109 110 158.500 171.209 82.413 6.243 72.881 0 340 1. Unarranged profit in previous years 111 341 2. Unarranged profit in current year 112 35 VI. LOSS UP TO THE AMOUNT OF CAPITAL 113 VII. REEDEMED PECULIAR SHARES OF STOCK 114 B. RESERVATIONS AND LIABILITIES (116+122+126+135) 115 4 1.297.987 996.084 I. LONG-TERM RESERVATION (117+118+119+120) 116 4.1 84.751 1.885 1. Mathematical reserve of life insurances 2. Reservations for participating in profit 3. Reservations for risk leveling 4. Reservations for bonus and reduction 117 118 119 120 84.751 1.885 300 037 and 237 400 401 402 405 3.2 3.3 3.4 82.413 3.5 142.393 142.393 403, 404, 409 5. Other long-term reservations 121 II. LONG-TERM LIABILITIES (123+124+125) 122 411 a) according to main and dependent legal entities 123 412 b) according to other connected legal entities 124 c) other long-term liabilities 125 III. SHORT-TERM LIABILITIES (127+131+132+133+134) 126 1. Short-term financial liabilities (128+129+130) 127 420 a) according to main and dependent legal entities 128 421 b) according to other connected legal entities 129 c) other short-term liabilities 130 427 2. Liabilities on the basis of constant 131 43 3. Liabilities on the basis of damages and arranged amounts 132 210 4. Liabilities for premium, gain profit and other liabilities 133 67.170 53.997 5. Liabilities for tax from result IV. PASIVE TIME LIMITS (136+14 1. Transferable premium (137+138+139) a) of life insurances b) of non-living insurances 134 135 136 137 138 6.471 1.127.715 722.281 928.779 609.309 722.281 609.309 410 and from 413 to 419 From 422 to 429 except 427 44, 45, 46, 47 except 474 490 491 4.2 4.3 4.3.1 4.4 4.4.1 1.328 1.677 1.328 1.677 73.851 53.997 0 0 492 c) of coinsurances, reinsurances and retrocession 139 493 494 2. Reserved damages (141+142+143) a) of life insurances b) non-living insurances 140 141 142 c) share in the damages of coinsurances, reinsurances and retrocession 143 3. Other passive time limits 144 V. POSTPONED TAX LIABILITIES C.TOTAL ASSETS (101+115) D. OFFBALANCE ASSETS 145 146 147 495 From 496 to 499 except 497 497 89 In Person responsible for the balance sheet Kragujevac February 28, 2007 M.P. 4.4.2 330.379 313.089 330.379 313.089 4.4.3 75.055 6.381 4.5 10.342 1.871.033 9.746 1.160.054 Manager INCOME STATEMENT January 1, 2006-December 31, 2006 Group of accounts POSITION AOP Note number Current year Previous year 1 2 3 4 5 6 201 6.1 1.347.735 721.891 202 6.1.1 1.309.790 703.771 1.445.753 1.141.661 A. BUSSINES INCOME AND EXPENSES I. BUSSINES (FUNCTIONAL) INCOME (202+209-215+216+217+218) 1. Income from insurance and reinsurance premium ( 203+204-205-206-207+208) 600, 601, 602 part 1.1. Balanced premium of life insurances and coinsurances 203 610, 611, 612, 613, 619 1.2. Balanced premium of non-living insurances and coinsurances 204 512 part, 523 part 1.3. Premium transferred to coinsurancepassive 205 512 part, 523 part 1.4. Premium transferred to reinsurance 206 23.022 6.438 60 part, 61 part 1.5. Increase of transferable premium of insurance and coinsurance 207 132.332 431.452 60 part, 61 part 1.6. Decrease of transferable premium of insurance and coinsurance 208 19.361 2. Income from premium of reinsurances and retrocession (210-211-212-213+214) 209 602 part, 614, 615 2.1. Balanced premium of reinsurances and retrocession 210 514, 525 2.2. Commission from the dealings in reinsurances and retrocession 211 512 part, 523 part 2.3. Premium transferred by retrocession of reinsurances and retrocession 2.4. Increase of transferable premium of reinsurances and retrocession 213 60 part, 61 part 2.5. Decrease of transferable premium of reinsurances and retrocession 214 61 part, 61 part 3. Increase of transferable premium of insurances, coinsurances, reinsurances and retrocession for unexpired risks 4. Income from the business directly connected to insurance business 608 part, 653 part, 655 part, 66 part 608 part, 609, 639, 64, 653 part, 655 part, 659 part 0 13.740 212 60 part, 61 part 606, 650, 654, 659 part 0 215 216 6.1.2 31.200 5. Income from depositing and investing of means of technical reserves of insurances, reinsurances and retrocession 217 6.1.3. 1.635 6. Other business income 218 6.1.4 5.140 4.380 219 5.1 531.685 456.223 162.126 72.067 II. Business (functional) expenses (220+228+236-245+246-247+248+249+250) 1. Expenses for long-term reservations and functional contribution (221+222+223+224+225+226+227) 1.1. Mathematical reserve of life insurances, 220 500 221 501 except voluntary old-age insurance 1.2. Mathematical reserve of voluntary old-age insurance 502 503 504 505 1.3 Contribution for the prevention 1.4. Fire company contribution 1.5. Contribution to Guarantee fund 1.6. Reserving for risk leveling 223 224 225 226 509 1.7. Other expenses for long-term reserving and functional contribution 227 2. Expenses of damage compensation and arranged amounts (229+230+231+232+233-234235) 222 228 510, 511 2.1. Liquidated damages and arranged amounts of life insurances 229 520, 521, 522 2.2. Liquidated damages of non-living insurances 230 513 part, 524 part 2.3. Liquidated damages- shares in the damages of coinsurances 231 513 part, 524 part 2.4. Liquidated damages- shares in the damages of reinsurances 232 53 part, 54 part and 55 part 603 part, 620, 621, 629 part 603 part, 622, 623, 624, 625, 629 part 2.5. Expenses of inspection, evaluation, liquidation and payment of compensations of damages and arranged amounts 2.6. Income from the participation of coinsurances in compensation of damages 2.7. Income from the participation of reinsurance and retrocession in compensation of damages 5.1.2. 2.788 931 75.107 83.300 6.055 1.424 64.588 362.595 238.442 313.255 219.336 233 234 235 5.894 3. Reserved damages- increase (238-239+240241+242-243+244-245)>0 236 5.1.3. 17.291 200.255 3.Reserved damages- decrease (238-239+240241+242-243+244-245)<0 237 5.1.3 0 0 3.1. Reserved damages of life insurance 3.2. Reserved damages of life insurance 238 239 526 3.3. Reserved damages of non-living insurances 240 330. 379 313.088 630 3.4. Reserved damages of non-living insurances 241 313.088 112.833 3.5. Reserved damages of coinsurances, 242 515 604 part 516, 527 reinsurances and retrocession 604 part, 632 3.6. Reserved damages of coinsurances, reinsurances and retrocession 513 part 3.7. Increase of reserved damages- participation of coinsurers, reinsurers and retrocessioners in damages 243 244 637, 635, 637 3.8. Decrease of reserved damagesparticipation of reinsurers, that is retrocessioners in damages 245 607, 652 4. Regress- income on the basis of regress 246 517, 529 5. Increase of other technical reserves 247 604 part, 631, 638 518, 528 53 part, 54 part, 55 part, 56 part 50 part, 51 part, 52 part 6. Decrease of other technical reserves 248 7. Expenses for bonus and discount 8. Expenses on the basis of depositing and investing of means of technical reserve 249 9. Other business expenses 251 III. Gain- gross business result (201-219) 252 816.050 265.668 IV. Loss- gross business result (219-201) 253 0 0 B. Expenses of insurance realization (255+260+265-266) 254 5.2 594.440 337.772 1. Expenses of supplying (256+257-258+259) 255 5.2.1 337.021 245.425 1.1. Commission 256 20.802 12.593 1.2. Other expenses of supplying 257 316.219 232.832 1.3 Change of restricted expenses of supplyingincrease 258 542 part 53 part, 54 part, 55 part 274 6.1.5 11.688 45.594 6.1.6 494 8.947 250 1.855 274 530 54 part 55 part 53 part, 54 part, 55 part 53 part, 54 part, 55 part 605, 651 66 part 56 part 1.4 Change of restricted expenses of supplyingdecrease 259 2. Management expenses (261+262+263+264) 2.1. Amortization 260 261 2.2 Expenses of material energy, services and non-material expenses 5.2.2 218.899 10.021 71.772 9.862 262 84.587 9.264 2.3 Profit expenses, of profit compensation and other personal expenses 263 91.042 51.139 2.4 Other management expenses 264 33.249 1.507 38.520 20.575 3. Other expenses of insurance realization 265 5.2.3 4. Commission from reinsurance and retrocession 266 I. Business profit- net business result (252-254) 267 221.610 0 II. Business loss- net business result (254252+253) 268 0 72.104 III. Financial income, except financial income on the basis of means of technical reserves IV. Financial expenses, except financial expenses on the basis of the means of technical reserves 269 6.2 16.765 24.875 270 5.3 57.344 5.915 67, 68 V. Income from leveling of the property value and other income 271 6.3 121.072 49.038 57, 58 VI. Expenses on the basis of property disparage and other expenses VII. Profit from regular functioning of the business (267+269+271-268-270- 272 5.4 193.720 136.140 108.383 0 273 VIII. Loss from regular functioning of the business (268+270+272-267-269-271) 274 69-59 IX. Net loss of business that is to be suspended 275 59-69 X. Net loss of business that is to be suspended 276 C. Profit before tax (273+275-274-276) D. Loss before tax (274+276-273-275) E. Income tax 1. Income tax Profit on the basis of creating 2. postponed tax means and decrease of postponed tax liabilities Loss on the basis of decrease of 3. postponed tax means and creating of postponed tax liabilities F. Net profit (277-278-280+281-282) G. Net loss (278-277+280-281+282) 277 278 279 280 I. Net loss which belongs to minority investors 285 J. Net loss which belongs to the owners of main corporation 286 K. Share profit 1. Basic share profit (in dinars) 287 288 2. 289 In Kragujevac February 28, 2007 Reduced (separated) share profit (in dinars) Person responsible for the sheet 0 140.246 0 5.5 18.903 89.480 0 0 140.246 65 6.471 7.2 596 2.147 82.413 0 0 142.393 281 282 283 284 M.P. Manager