Ethanol and gasoline prices, 2009 article

advertisement

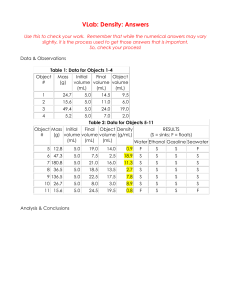

Does Ethanol Matter to Gasoline Prices? Dr. Thomas E. Elam, FarmEcon LLC, 9-22-08 A link between ethanol production and gasoline prices has been cited by the government and ethanol support groups in defense of federal ethanol support. Iowa State University researchers (Du and Hayes) have published a paper in which they claimed to show increasing ethanol production has depressed U.S. gasoline prices by $0.29 to $0.40 per gallon. The model relies on a complex set of assumptions to show reduced refiner margins are causing from lower gasoline prices. If increasing ethanol production is reducing gasoline refining margins we would expect to see gasoline prices decline relative to the price of crude oil. The chart below shows clearly that this is not the case. In fact, the gasoline/crude oil price spread has actually INCREASED as ethanol production has increased. Monthly Gasoline/Crude Oil Price Spread and Ethanol Production January 2000 – April 2008 20,000 Refinery Outages 18,000 70¢ MTBE 60¢ 16,000 14,000 Katrina 50¢ 12,000 40¢ 10,000 30¢ 8,000 6,000 20¢ 4,000 10¢ 2,000 - Ja n00 Ju l-0 Ja 0 n01 Ju l-0 Ja 1 n02 Ju l-0 Ja 2 n03 Ju l-0 Ja 3 n04 Ju l-0 Ja 4 n05 Ju l-0 Ja 5 n06 Ju l-0 Ja 6 n07 Ju l-0 Ja 7 n08 0¢ Gasoline/Crude Oil Price Spread Monthly Ethanol Production Gasoline/Crude Spread Trend The trend in the gasoline/crude price spread is positive while ethanol production is increasing. Statistical Models: Is there a relationship between gasoline prices or margins and ethanol production? To test the effects of ethanol production two similar models were constructed. The first is: Ethanol Production, 1,000 Barrels Cents/Gallon Difference to Crude Oil 80¢ PG = PC, EP, GI, Season, Supply Interruption The second model looks at the 3:2:1 refinery crack spread. The spread is the value of 2 gallons of gasoline plus 1 gallon of heating oil minus the value of 3 gallons of crude oil, all divided by 3 to get a value per gallon. The second model is: 3:2:1 CS = PC, EP, RU, CI, GI, Season, Supply Interruption Where: PG = New York Harbor conventional regular gasoline, spot price (cents/gallon) 3:2:1 CS = value of 2 gallons of gasoline plus 1 gallon of heating oil minus the value of 3 gallons of crude oil PC = Cushing, OK West Texas Intermediate crude oil spot price (cents/gallon) EP = Monthly fuel ethanol production GI = U.S. motor gasoline ending inventory (million barrels) Season = monthly seasonal price difference relative to December Supply Interruption = statistical corrections for Katrina (Aug-Sep 2005), MTBE (Apr-Aug 2006) and Refinery Outages (Mar-Jul 2007) RU = Refinery utilization rate (%) CI = Crude ending inventory, net of Strategic Petroleum Reserve (million barrels) Monthly data from 1/1/2000 through 4/30/2008 were used. Data came from the Department of Energy and are available at www.farmecon.com (Gasoline Price Study link). Results, First Model: Results show that ethanol production is not a statistically significant factor in gasoline prices. Although statistically not meaningful, results show a very weak POSITIVE, not NEGATIVE relationship between gasoline prices ethanol production. Crude oil price is the major factor in gasoline prices. A 1 cent per gallon increase in crude oil price means very close to a 1 cent per gallon increase in gasoline price. A one million barrel increase in gasoline inventories depresses gasoline prices by about 0.568 cents per gallon. Relative to December, prices April-June are higher - the summer season price peak. The three 2005-2007 supply interruptions caused price spikes that averaged 21.5 to 29.2 cents per gallon. Table 1: Regression of Ethanol Production, Oil Price, Gasoline Inventory, Season and Supply Interruptions on NY Wholesale Regular Gasoline Price Variable Constant Ethanol Production, 1,000 Barrels Cushing, OK WTI Spot Price FOB (Cents per Gallon) U.S. Motor Gasoline Ending Inventory (Million Barrels) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Katrina Effect Sept-Oct 2005 MTBE Effect Apr-Aug 2006 2007 Refinery Outages Mar-Jul 2008 Coefficient 124.810* 0.00102 Standard Error 22.945 0.0073 t Score 5.440 1.392 0.978* 0.051 19.176 -0.568* 5.659 4.974 2.901 7.363* 12.440* 7.863* 4.495 1.944 2.615 -6.589 -0.616 24.957* 21.547* 29.176* 0.112 3.487 3.487 3.412 3.465 3.596 3.643 3.590 3.693 3.604 3.697 3.494 5.450 3.683 4.091 -5.074 1.623 1.427 0.850 2.125 3.459 2.158 1.252 0.526 0.726 -1.782 -0.176 4.580 5.850 7.133 R-Squared = 98.79% (% of gasoline price variation explained) *Statistically different from zero, 95% confidence Results, Second Model: Results show that ethanol production has no statistically significant effect on the 3:2:1 price spread, and thus no effect on gasoline prices. The second model is very similar to the Iowa State study. Table 2: Regression of Ethanol Production, Oil Price, Refinery Utilization, Crude Oil Inventory, Gasoline Inventory, Season and Supply Interruptions on 3:2:1 Spread Variable Constant Ethanol Production, 1,000 Barrels Cushing, OK WTI Spot Price FOB (Cents/Gallon) Refinery Utilization Rate (%) U.S. Crude Oil Ending Inventory Excluding SPR (Million Barrels) U.S. Motor Gasoline Ending Inventory (Million Barrels) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Katrina Effect Sept-Oct 2005 MTBE Effect Apr-Aug 2006 2007 Refinery Outages Mar-Jul 2008 Coefficient Standard Error t Score 19.97285 0.00031 30.81738 0.00048 0.64810 0.63536 0.08372* 0.72736* 0.03326 0.29642 2.51725 2.45383 0.06529* 0.03057 2.13551 -0.48959* 6.39954* 5.36580* 1.47060 1.93555 3.25994 -0.40094 -3.12204 -4.68482 -1.37292 -6.48020* -2.21959 25.54203 12.48663 22.66495 0.07973 2.55920 2.62476 2.39818 2.36410 2.52700 2.58155 2.50774 2.61179 2.35307 2.47380 2.29635 4.17069 2.48704 2.85293 -6.14069 2.50060 2.04430 0.61321 0.81872 1.29004 -0.15531 -1.24496 -1.79372 -0.58346 -2.61953 -0.96657 6.12418 5.02067 7.94443 R-Squared = 85.95% (% of 3:2:1 price spread variation explained) *Statistically different from zero, 95% confidence As crude oil prices increase the spread increases. Some crude oil is used in refining, so cost increases as crude oil price increases. As refinery utilization rate increases so do refining margins. As crude oil inventories increase they pressure crude oil prices downward, increasing the margin. As gasoline inventories increase gasoline prices are pressured downward, causing the refining margin to decline. All these variables are statistically significant. Seasonal patterns show a strong margin in the January-February heating oil peak season and a weaker margin late in the year as heating oil stocks are increasing. The three supply disruptions had strong, significant, positive effects on the margin. This second model reinforces the conclusion of no ethanol production effect on gasoline prices. Implication: Increasing U.S. ethanol production is having no effect on U.S. gasoline prices or refining margins. Crude oil prices, gasoline inventories, crude oil inventories, refinery utilization rate, seasonal demand patterns and temporary gasoline supply issues of 2005-2007 have been the drivers of gasoline prices and margins. Reference: Xiaodong Du and Dermot J. Hayes. The Impact of Ethanol Production on U.S. and Regional Gasoline Prices and on the Profitability of the U.S. Oil Refinery Industry. Working Paper 08-WP 467. Center for Agricultural and Rural Development. Iowa State University. April 2008