Document

advertisement

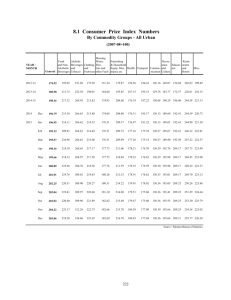

Global Financial Crisis: Impact on Bangladesh Dr. Salehuddin Ahmed Former Governor , Bangladesh Bank & Professor, Business School, BRAC University, Dhaka. 1) Started in - 2007 : Housing sector bubble 2008 : Sub-Prime crisis Failure of banks and Financial Institutions Liquidity and Insolvency Problems 2) Main Reasons : Lax Regulation : Low Lending Rates Added to these two is “greed” of top management people of the financial institutions. 3) “Immediate and long term impact” - Transmission through Financial, Real and Trade Sectors - Global Growth Scenario (estimates by some international organizations) : World USA Euro Zone Emerging Nations Bangladesh: 2009 0.5-1.0 -2.6 -3.2 1.5-2.5 2010 1.5-2.5 0.2 0.1 3.5-4.5 Growth in 2007-08 6.2% Projected growth in 2008-09 5.9% Projected growth in 2009-10 6% 4) Impact on Bangladesh - Financial Sector Real Sector Trade Sector Capital Inflow/ Outflow 1 - Likely impact on remittance, export etc. 5) BB Macro Situation - Forex Reserve 6.15 b$ (8/4.09) Forex market stable Remittance in 9 months (upto March’09) 7029.51 m$ Remittance on 2007-2008 (12 months) 7914.78 m$ Current A/C & BOP balance positive Government Budget deficit within satisfactory limit - Increase export earning and remittance Ensure liquidity & flow of credit in productive sectors Real sector impact to be minimized Inward looking development (SME, Agr, Thrust Sectors) & Employment Generation 6) Objectives of BB 7) Measures taken by Bangladesh Government 8) Global Responses - Bailout packages G-20 Meeting US Federal Reserve Bank to inject US $ 1 Trillion (March 2009) International Accounting Standard Board Financial Stability Board New roles of IMF/WB, Washington DC Annual Meetings, October 2009. 1. The Global and individual country responses to come out of the present global financial crisis have yielded modest results. The forecast of growth and economic activities have been adjusted downwards and these have implications on the performance of a developing country like Bangladesh. The immediate impact of the global crisis has not been felt in Bangladesh not only because Bangladesh economy is not highly integrated 2 with the global economy but also for some early actions taken in the macroeconomic management especially by the Bangladesh Bank from mid 2008. 2. It is therefore necessary that the macro situation of Bangladesh, key variables like exports, imports, remittances, money supply, inflation, credit growth, and foreign exchange are examined to see the impact on the macro economy and policy responses to mitigate the impact. The first presentation of mine deals with that. The global crisis has highlighted the transmission mechanism, particularly the role of banking system in the process. Therefore, the second part of my presentation focuses on the “credit view” of monetary transmission vis-à-vis the “meso” economy where bank credit has direct impact on various types of economic activities affecting growth and employment at the sub-aggregate level. 3. The first part deals with: a. Economic and Financial Developments: i. Real Sector ii. Monetary Sector iii. Fiscal Sector iv. External Sector v. Price Developments. b. Transmission Channels of Global Crisis & Impacts: i. Imports ii. Exports iii. Exchange Rate iv. Remittances v. Foreign Exchange Reserve vi. Import Payments & Tax Revenue vii. Foreign Aid & FDI c. Performance of Bangladesh Economy with the fall out of Global Crisis. d. Policy Responses: i. Government’s Fiscals & Tax Incentives ii. Livelihood Support iii. Agricultural Development iv. Exports and Remittances e. Projection of some key macroeconomic variables ? 3 i. In F y 10, export may rise by 5% to 6% compared to 11% in F y 09. ii. Remittances may grow by 15% to 19% as against 22% in F y 09. iii. Import may fall by 4% to 7.5% in Fy 10 against an increase of 4.2% in Fy 09. iv. Inflation may rise to more than 7% in Fy 10 compared to 5.2% on September 09. f. Further Policy Implications. 4. The second part, the review of ‘meso’ economy deals with: a. Bank lending trend in Bangladesh: Bank advances in all 4 quarters in Fy 09 higher than those of 2008. This is due rebound of some economic activities, rising prices of oil and other commodities in the international market. However, trade and miscellaneous purposes dominated than other sectors at the macro level. Subsequent sluggish growth, total credit growth in July and August came down sharply to 0.56% and 0.67% respectively over June 2008. There has been a growing demand for consumer loan. b. Gloomy picture of investment in recent months due to two factors: i. Downward rigidity in lending rates. ii. Lack of infrastructural support like gas and electricity. c. For meso picture 18 bank branches of 9 banks were selected for data from vulnerable and emerging geographical areas. The trend of credit from June 2008 to June 2009 at meso level gives a mixed picture. In December 2008, there was a decline which picked up in March 2009, going down again in June 2009, when there was a decrease by 5.5% over March 2009. The slow down at the meso level is more than that at the macro level. At the meso level trade and miscellaneous sectors received high advances because of private demand for quick yielding, less risky ventures, compared to credit in industry, storage, transport and communication. Moreover, the local economic activities at meso level was not given due importance by the bank. d. The private commercial banks (PCBs) have contributed more than the SCBs, BKB, and RAKUB. In March 2009; SCBs, BKB/RAKUB and PCBs provided BDT 179 Crore, 4 54 crore, and 3409 crore respectively. In June 2009 these banks provided 177 crore, 57 crore and 3205 crore respectively. e. It is high time that banks take proactive steps to provide credit in the vulnerable and emerging geographical areas of Bangladesh. The SCBs and specialized banks should be more aggressive and dynamic to invigorate local economic activities to create employment opportunities and improve livelihood of the poor and disadvantaged people. 5. The global financial crisis shows that there is no substitute of prudent government intervention and careful regulation even when market determined incentive structures operate. 6. Some issues for further consideration: a. How will the slowdown in global and regional growth impact Bangladesh economy, financial system, markets, and institutions? b. What is the risk that the Bangladesh Bank faces in addressing inflationary pressure given the preference for growth over inflation? c. What is the country’s current and historic experience in managing growth in private sector credit and how effectively Bangladesh Bank’s monetary policy stance can resolve the present excess liquidity in the banking sector? d. How effectively Fiscal, Monetary, Export-Import and Industrial policies can work in tandem in taking the country into higher growth path ensuring accelerated poverty reduction ? 5 Chart I.1 Growth of Real GDP Percent per annum 7 6 5 4 3 2 1 FY09* FY08 FY07 FY06 FY05 FY04 FY03 FY02 0 Per capita GDP growth * = Provisional. GDP growth Chart I.2 Production of M ajor Crops 200 Lakh MT 150 100 50 Aus Aman Boro Wheat * FY 09 FY 08 FY 07 FY 06 FY 05 FY 04 FY 03 FY 02 0 * Target Chart - 2 Trends of M2 RM & Credit 3500 Taka in billion 3000 2500 2000 1500 1000 500 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY10 FY '06 FY '07 Reserve Money actual Broad Money actual Domestic Credit actual Private sector credit actual FY '08 Program Program Program Program FY '09 6 Chart 3.1 : Trend in Government Revenue and Expenditure 6 Percent of GDP 5 4 3 2 1 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 FY05 FY06 FY07 Revenue FY08 FY09 Expenditure Chart 3.2: Financing of Budget Deficits 2 Percent of GDP 2 1 1 0 -1 -1 Q1 Q2Q3 Q4Q1 Q2Q3 Q4Q1 Q2Q3Q4 Q1Q2 Q3Q4 Q1Q2 Q3Q4 Q1 FY05 FY06 FY07 Bank financing Foreign Financing FY08 FY09 FY10 Non-bank financing Chart 4.1 Trends in Exports & Imports 7000 Million US Dollar 6000 5000 4000 3000 2000 1000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY06 FY07 Export FY08 FY09 FY10 Import 7 Chart 4.2 Trends of Current Account and Overall Balances 3.0 Percent of GDP 2.0 1.0 0.0 -1.0 -2.0 -3.0 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09P Current Account Balance Overall Balance Chart - 4.3 Import 6000 In million US$ 5000 4000 3000 2000 1000 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY '06 FY '07 Consumer Goods Indusrtial Raw Materials Capital & Other Machinery Total FY '08 FY '09 FY10 Intermediate Goods Petroleum & Petlm. Products Others 74 8.0 71 7.0 69 6.0 66 5.0 64 4.0 61 3.0 59 2.0 56 June 05 Sep 05 Dec 05 Mar 06 June 06 Sep 06 Dec 06 Mar 07 June 07 Sep 07 Dec 07 Mar 08 June 08 Sep 08 Dec 08 Mar 09 June 09 Sep 09 9.0 Billion US Dollar 76 Exchange Rate Chart 4.4 FOREX Reserve & Exchange Rate 10.0 Forex Reserve Taka-Dollar Exchange rate 8 1500 140 1300 120 1100 100 900 80 700 60 500 40 300 20 100 US Dollar/Barrel US Dollar/MT Chart 5.2 Commodity Prices in the International Market 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY06 FY07 FY08 FY09 FY10 Rice (US$/M.T) Wheat(US$/M.T) Soyabean oil (US$/M.T) Petroleum(US$/Barrel) Chart 5.1 12-Month CPI Inflation 14.0 12.0 8.0 6.0 4.0 2.0 Fo o d Sep 09 Mar 09 June 09 Sep 08 Dec 08 Mar 08 June 08 Sep 07 Dec 07 Mar 07 June 07 Sep 06 General Dec 06 Mar 06 June 06 Sep 05 Dec 05 June 05 Dec 04 0.0 Mar 05 Percent 10.0 No n-fo o d 9 1200 Chart 6 Trends in Market Capitalisation and DSE Index 4000 1000 3000 Billion Taka 800 600 Index 2000 400 1000 200 0 Dec 04 Mar 05 June 05 Sep 05 Dec 05 Mar 06 June 06 Sep 06 Dec 06 Mar 07 June 07 Sep 07 Dec 07 Mar 08 June 08 Sep 08 Dec 08 Mar 09 June 09 Sep 09 0 Market Capitalisation Index Chart-7 Export Earnings 5000 In million US$ 4000 3000 2000 1000 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY10 FY '06 FY '07 FY '08 FY '09 Woven Garments (Including Other Garments Products) Other exports Total Export Earnings 10 Chart 8 Exchange Rate Movements 100 90 80 70 60 Nominal ER REER Index Sep 09 June 09 Mar 09 Dec 08 Sep 08 June 08 Mar 08 Dec 07 Sep 07 Jun 07 Mar 07 Dec 06 Sep 06 Jun 06 50 NEER Index REER Based ER Chart 10 600 Chart - 9 Region-wise workers' remittances 300000 500 2400 250000 1800 200000 1500 150000 1200 900 100000 600 50000 300 No. of Persons (In million US$) 2100 (In million US$) 2700 Trends of Foreign Aid & FDI 400 300 200 100 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 0 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY '06 FY '07 Gulf region Asia Pacific region Total FY '08 FY '09 FY10 Euro region USA No.of persons left for abroad FY '06 FY '07 Net foreign aid FY '08 FY '09 FY10 Foreign Direct Investment 11 The Global Financial Crisis: Daunting Tasks Ahead . The global financial and economic crisis started in 2007 as an aftermath of the housing sector bubble coupled with aggressive lending practices in the US sub-prime mortgage market and lax regulation of the financial sector. To start with, these developments affected the companies holding mortgage-backed securities and credit derivatives. The early signs of the crisis were evident in 2007; but the financial crisis developed into a full blown global recession in late 2008 battered by continuous deepening and widening of the crisis. The recession created shockwaves though the global financial system and the global economy, and the advanced economies were affected most. The governments in these countries are bracing their financial sector and the real economy by stepping up various policy measures including injecting huge sums of money for bailing out the ailing financial institutions and other industries. What is worst is that the recession appears to hang on throughout 2014. The makings of the crisis were essentially in the US imbalances exported to the rest of the world, over the last couple of decades or so, in the form of persistent current account deficits. The position of US dollar as the dominant global reserve currency enable US to pursue lax macroeconomic policies indefinitely, with its deficits financed externally by economies running surpluses. Not since the beating down of US inflation in the nineteen eighties by US Fed under Paul Volcker at substantial pain of a domestic recession has the US opted again for domestic adjustments to correct imbalances; nor unlike the EU, has the US committed itself unequivocally to pursuing balanced policies (fiscal accounts were in balance in the Clinton era but private sector deficit unrestrained, and in the subsequent Bush era deficits of both public and private sectors ran amok). In the lax US monetary and fiscal policy regime the surfeit of cheap liquidity surged in several aberrant directions chasing higher returns; into speculation creating commodity and asset price bubbles (the incipient US house price bubble at the turn of the century actually eased the pains from the dot com bubble burst), into equity buybacks with reckless leveraging (improving return on equity but worsening the fragility of corporate finance), into loans to borrowers of dubious 12 credit and securities backed thereby, into derivatives of inscrutable complexity concealing the riskiness of the underlying assets. Close global integration transmitted these trends of the US financial markets and institutions quickly to the other open economies, including those pursuing balanced policies. Also, the laxities of US monetary policies immediately and automatically surfaced in the economies with currencies pegged to US dollar, including the Middle Eastern oil exporters. The surging wealth from price bubbles in commodities and assets flowed not into combating global poverty, environmental degradation or climate change; but largely into hedonism of private jets, yachts, mansions and other indulgences including such whimsical, fanciful pursuits as competition in mega scale fairytale-like construction projects, artificial islets curved in the Gulf with coastlines alien to known laws of hydrodynamics, mega dollar artworks like golden lamb and Kate Moss gold statue. Now the whole fantasy structure faces collapse as popping price bubbles triggered chains of debt default, paralyzing markets with freeze up of fresh lending to refinance maturing debts. Small economies like Bangladesh are however by no means invulnerable to fallouts from prolonged global downturns or to negative spillovers of policies of large economies, and therefore have strong stake in global stability. In forums like G-20 they need to argue forcefully for the same high priority to stability as to recovery; and also for stability action agenda going beyond addressing symptoms (lapses in risk managements, inadequacies of regulation and supervision) to addressing the underlying cause (lax policies allowing unbridled liquidity expansion, incubating bubbles). A safe path of global balance and stability will be a lot easier if global liquidity growth is tied to the growth of real global output in some mechanism that injects and withdraws liquidity countercyclically as global real output growth slackens or paces up. The IMF (reformed with appropriately rebalanced voting rights and quotas for member economies) can be mandated to craft and administer the tying mechanism, in a new role somewhat as the apex global monetary agency. Consensus building for such a new mechanism (in broad likeness of gold standard, with real global output substituting for gold) may be arduous, all the more reason for kicking off the consultation processes at the soonest possible. 13 Significant gain in global financial stability can be expected also from reforms limiting excessive leverage in corporate finance. In the current crisis the high fragility brought about by reckless substitution of equity with debt precipitated extended chains of debt defaults, paralyzing financial markets across major economies. A corporate generally favors debt over equity because debt servicing costs are tax deductible while income on equity is subject to taxation. However, in downturns, debt burden deepens a firm’s financial distress, even inviting demise, as made amply evident by the current global financial crisis. The Bank for International Settlement (BIS) in Basel, Switzerland for some years is engaged in developing global norms of capital adequacy for banks and financial institutions. BIS can also be mandated to develop global norms of debt equity balance and sound practices in corporate financing, limiting tendencies of excessive leveraging. To this end, some extent of tax break on income from equity, narrowing the gap in relative attractiveness of debt and equity as financing option, may also be well worth considering. 14