18 KW 12th ed Revenue Recognition

advertisement

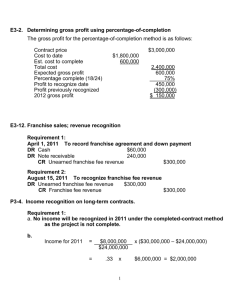

Revenue Recognition Chapter 18 Keiso Weygandt 12th edition Does priceline.com sell rooms or broker rooms ? sell airline tickets or broket tickers ? Guidelines Revenue is recognized fn # 6 page 907 1) when it is realized or realizable and 2) when it is earned recognition versus realization page 908 sale of product Services permitting others to use assets disposal of assets fn 11 page 909 1. 2. 3. 4. date of sale / date of delivery services are performed and billable the passage of time date of sale SEC revenue is realized or realizable and earnd remember this is only 1/2 of the requirement Persauasive evidence of an arrangement exits delivery has occured or services have been rendered price to the buyer is fixed or determinable collectibility is reasonably assured earned realizable What are we uncertain about? collection of cash will we collect the cash ? measuring revenue is the earnings process complete ? did we really sell it ? have we earned it ? measuring costs how much does the sold item costs ? 1 example to use with Chapter 18 Revenue recognition is a timing issue $19,600.00 10.8% 5 $5,275.95 Loan Interest rate Years Payment BEGIN BAL INT REV PRINC NEW BAL $19,600.00 $16,440.03 $12,938.91 $9,059.82 $4,761.95 $2,115.98 $1,774.83 $1,396.86 $978.08 $514.09 $3,159.97 $3,501.12 $3,879.09 $4,297.87 $4,761.86 $16,440.03 $12,938.91 $9,059.82 $4,761.95 $0.09 TOTALS $6,779.84 $19,599.91 $20,000.00 2.0% $400.00 $19,600.00 10.0% $5,275.95 $20,000.00 $16,724.05 $13,120.51 $9,156.61 $4,796.32 p. 910 Loan Points Loan Orig Revenue Net loan Interest rate Payment $2,000.00 $1,672.41 $1,312.05 $915.66 $479.63 $3,275.95 $3,603.54 $3,963.90 $4,360.29 $4,796.32 $6,379.75 $20,000.00 $16,724.05 $13,120.51 $9,156.61 $4,796.32 $0.00 Note Rec Cash 19,600.00 19,600.00 Note Rec 26,379.75 Cash Revenue 19,600.00 6,779.75 Note Rec 20,000.00 Orig fee Rev Cash 400.00 19,600.00 Cash 5,275.95 Interest Inc Note Rec 2,000.00 3,275.95 Buybacks - similar to a collateralized loan Right of Return page 910 1. price to the buyer is fixed or determinable 2. buyer's obligation to pay is not contingent on resale of the product 3. buyer's obligation would not change if the event of theft or damage 4. buyer has economic substance 5. seller does not have obligations for future performance 6. the amount of returns can be estimated 2 E 18-1 this is what we learned in 221/222 and in 321 Accounts Rec Sales Cost of Goods Sold Inventory Cash Accounts Rec 16,000,000 16,000,000 960,000 I made this up 60% 960,000 How do we deal with low levels (acceptable levels) of uncertainty with regard to collection of cash ? This is similar to allowances we set up for bad debt exp in 321. talk about the nature of the various accounts are they income statement accounts or balance sheet accounts what effect does the entry have on net income are they Contra accounts -- what account are they contra to RETURN PRIVILEGES page 910 Bad debt exp Acc Rec - allow Acc Rec - allow Acc Rec is the earnings process complete? Sales - est returns Acc Rec - allow for Inv - est returns CoGS 2,400,000 Acc Rec - allow for Acc Rec Inventory Inv - est returns 2,000.000 2,400,000 1,440,000 1,440,000 2,000,000 1,200,000 1,200,000 to account for the return of $2,000,000 of books if you want Sales Returns Sales - est returns 2,000,000 2,000,000 Revenue Recognition before Delivery page 913 PERCENTAGE COMPLETION/COMPLETED CONTRACT 1. contract clearly specifies enforceable rights 2. buyer can be expected to satisfy obligations 3. contractor can be expected to perform obligations 3 Problem 6 If everything went as planned - Completed Contract 2007 2008 2009 8,400,000 3,200,000 2,000,000 5,200,000 1,200,000 6,400,000 1,200,000 6,400,000 0 6,400,000 2,000,000 Total Revenues costs costs to date estimated costs to complete Est Total Costs Est Total Gross Profit Yr 1 Yr 2 Yr 3 3,200,000 6,400,000 Constr in progress cash etc. ?? Accounts receivable CiP - contra - BILLINGS Cash Accounts receivable 3,200,000 Constr in progress cash etc. ?? Accounts receivable CiP - contra - BILLINGS 2,000,000 Constr in progress cash etc. ?? Accounts receivable CiP - contra - BILLINGS 1,200,000 3,200,000 3,200,000 3,200,000 2,000,000 3,500,000 3,500,000 1,200,000 1,700,000 1,700,000 Cost of Construction - Exp 6,400,000 Constr in progress 6,400,000 CiP - contra - BILLINGS 8,400,000 Revenue 8,400,000 close the Constr in Progress account are recognize the revenue const in process 3,200 2,000 1,200 acc receivable CiP contra Billings 3,200 3,500 1,700 3,200 3,500 1,700 4 Problem 6 Costs exceed estimates - Completed Contract 2007 2008 Total Revenues 8,400,000 costs costs to date estimated costs to complete Est Total Costs Est Total Gross Profit Yr 1 Yr 2 Yr 3 2009 3,200,000 3,200,000 6,400,000 2,600,000 5,800,000 1,450,000 7,250,000 Constr in progress cash etc. ?? 3,200,000 Accounts receivable CiP - contra - BILLINGS 3,200,000 Constr in progress cash etc. ?? 2,600,000 Accounts receivable CiP - contra - BILLINGS 3,500,000 Constr in progress cash etc. ?? 1,450,000 Accounts receivable CiP - contra - BILLINGS 1,700,000 1,450,000 7,250,000 0 7,250,000 1,150,000 3,200,000 3,200,000 2,600,000 3,500,000 1,450,000 1,700,000 Cost of Construction - Exp 7,250,000 Constr in progress 7,250,000 CiP - contra - BILLINGS 8,400,000 Revenue 8,400,000 close the Constr in Progress account are recognize the revenue const in process 3,200 2,600 1,450 acc receivable CiP contra Billings 3,200 3,500 1,700 3,200 3,500 1,700 5 Problem 6 If everything went as planned - Percent Completion 2007 2008 2009 Total Revenues costs costs to date estimated costs to complete Est Total Costs Percent complete Est Gross Profit to date Yr 1 Yr 2 Yr 3 8,400,000 3,200,000 3,200,000 6,400,000 50.0% 1,000,000 2,000,000 5,200,000 1,200,000 6,400,000 81.25% 1,625,000 Constr in progress cash etc. ?? CiP - gross profit Cost of Construction - Exp Revenues Accounts receivable CiP - contra - BILLINGS Cash Accounts receivable 3,200,000 Constr in progress cash etc. ?? CiP - gross profit Cost of Construction - Exp Revenues Accounts receivable CiP - contra - BILLINGS 2,000,000 Constr in progress cash etc. ?? CiP - gross profit Cost of Construction - Exp Revenues Accounts receivable CiP - contra - BILLINGS 1,200,000 1,200,000 6,400,000 0 6,400,000 100.00% 2,000,000 2,000,000 3,200,000 1,000,000 3,200,000 4,200,000 3,200,000 3,200,000 2,000,000 625,000 2,000,000 2,625,000 3,500,000 3,500,000 1,200,000 375,000 1,200,000 1,575,000 1,700,000 1,700,000 6 const in process 3,200 2,000 1,200 acc receivable gross profit 1,000 625 375 CiP contra Billings 3,200 3,500 1,700 Percentage completion 3,200 3,500 1,700 the production period is long the contract price is known construction costs are reasonable estimated percentage completion is a method of allocating the Gross Profit over the remaining production period this is similar to how we allocate Gross Profit with Installment Sales, except the allocation is based on Costs instead of Cash Receipts the problem is ... the reason that we don't recognize Revenue when earned, just like ACTG 321, is that the project takes a long time to complete talk about the idea of including Profit in an Asset we allocate Expected Profit across accounting periods ... But an Expected Loss is recognized immediately 7 Problem 6 Costs exceed estimates - Percentage Completion 2007 2008 Total Revenues 2009 costs costs to date estimated costs to complete Est Total Costs Est Total Gross Profit Percent complete Est Gross Profit to date Yr 1 Yr 2 Yr 3 8,400,000 3,200,000 3,200,000 6,400,000 2,000,000 50.0% 1,000,000 2,600,000 5,800,000 1,450,000 7,250,000 1,150,000 80.00% 920,000 Constr in progress cash etc. ?? CiP - gross profit Cost of Construction - Exp Revenues Accounts receivable CiP - contra - BILLINGS Cash Accounts receivable 3,200,000 Constr in progress cash etc. ?? CiP - gross profit Cost of Construction - Exp Revenues Accounts receivable CiP - contra - BILLINGS 2,600,000 Constr in progress cash etc. ?? CiP - gross profit Cost of Construction - Exp Revenues Accounts receivable CiP - contra - BILLINGS 1,450,000 1,450,000 7,250,000 0 7,250,000 1,150,000 100.00% 1,150,000 3,200,000 1,000,000 3,200,000 4,200,000 3,200,000 3,200,000 2,600,000 80,000 2,600,000 2,520,000 3,500,000 3,500,000 1,450,000 230,000 1,450,000 1,680,000 1,700,000 1,700,000 8 const in process 3,200 2,600 1,450 acc receivable gross profit 1,000 80 230 CiP contra Billings 3,200 3,500 1,700 3,200 3,500 1,700 9 Problem 7 Costs exceed estimates - Completed Contract 2007 2008 2009 1,950,000 planned costs plannded expected gross profit 150,000 750,000 900,000 600,000 1,500,000 450,000 actaul costs actaul costs to date estimated costs to complete Est Total Costs Est Total Gross Profit 150,000 1,050,000 1,200,000 800,000 2,000,000 < 50,000 > 900,000 2,100,000 0 2,100,000 < 150,000 > Total Revenues Yr 1 Yr 2 Yr 3 1,350,000 1,500,000 Constr in progress cash etc. ?? Accounts receivable CiP - contra - BILLINGS 150,000 Constr in progress cash etc. ?? Loss CiP Loss Accounts receivable CiP - contra - BILLINGS 1,050,000 Constr in progress cash etc. ?? Loss CiP Loss Accounts receivable CiP - contra - BILLINGS 900,000 150,000 300,000 300,000 1,050,000 50,000 50,000 800,000 800,000 900,000 100,000 100,000 850,000 850,000 Cost of Construction - Exp 1,950,000 CiP Loss 150,000 Constr in progress 2,100,000 CiP - contra - BILLINGS 1,950,000 Revenue 1,950,000 close the Constr in Progress account are recognize the revenue 10 const in process 150 1,050 900 acc receivable Loss 50 50 CiP contra Billings 300 800 850 300 800 850 .Problem 7 Costs exceed estimates - Percentage Completion 2007 2008 2009 1,950,000 planned costs plannded expected gross profit 150,000 750,000 900,000 600,000 1,500,000 450,000 actaul costs actaul costs to date estimated costs to complete Est Total Costs Est Total Gross Profit percent complete 150,000 1,050,000 1,200,000 800,000 2,000,000 < 50,000 > LOSS 900,000 2,100,000 0 2,100,000 < 150,000 > Total Revenues 1,350,000 1,500,000 450,000 10% 11 Yr 1 Yr 2 Yr 3 Constr in progress cash etc. ?? CiP gross profit Cost of Construction - Exp revenues Accounts receivable CiP - contra - BILLINGS 150,000 Constr in progress cash etc. ?? CiP gross profit Cost of Construction - Exp revenues Accounts receivable CiP - contra - BILLINGS 1,050,000 Constr in progress cash etc. ?? CiP gross profit Cost of Construction - Exp revenues Accounts receivable CiP - contra - BILLINGS 900,000 const in process 150 1,050 900 CiP gross profit / Loss 150,000 45,000 150,000 195,000 300,000 300,000 1,050,000 95,000 1,050,000 955,000 800,000 800,000 900,000 100,000 900,000 800,000 850,000 850,000 acc receivable 45 95 100 CiP contra Billings 300 800 850 300 800 850 12 INSTALLMENT METHOD / COST RECOVERY METHOD p. 923 Installment method the collection period is fairly long unable to estimate uncollectible accounts - but we expect to collect it the installment sales method is a method of allocating the Gross Profit over the collection period (the percentage collected method) we use the GP as percent of sales to allocate the GP to the different years Problem 18-8 there is $100,000 of GP associated with the 2004 sales (40% GP) we will recognize $ 75,000 / 250,000 30% of the total GP in 2007 we will recognize 100,000 / 250,000 40% of the total GP in 2008 we will recognize 50,000 / 250,000 20% of the total GP in 2009 30,000 40,000 20,000 there is $96,200 of GP associated with the 2005 sales (37% GP) we will recognize 100,000 / 260,000 38.46 % of the total GP in 2008 we will recognize 50,000 / 260,000 46.15% of the total GP in 2009 36,999 44,396 there is $98,000 of GP associated with the 2006 sales (35% GM) we will recognize 110,000 / 280,000 39.29% of the total GP in 2009 38,504 P18-8 Accounts rec - 2007 Sales - 2007 CoGS Inventory 250,000 250,000 150,000 150,000 Sales - 2007 250,000 CoGS 150,000 2007 deferred GP- 40% 100,000 Cash contra to Acc Rec similar to allow for doubtful accounts 75,000 Accounts rec - 2007 2007 deferred GP- 40% 30,000 Recognized Gross Profit 75,000 30,000 Look closely at Financial Statement presentation on Page 930 an important concept Accounts Rec usually includes Gross Profit 13 Accounts rec - 2008 260,000 Sales - 2008 260,000 CoGS 163,800 Inventory 163,800 Sales - 2008 260,000 CoGS 163,800 2008 deferred GP- 37% 96,200 Cash 200,000 Accounts rec- 2007 100,000 Accounts rec- 2008 100,000 2007 deferred GP- 40% 40,000 2008 deferred GP- 37% 37,000 Recognized Gross Profit 77,000 Accounts rec - 2009 280,000 Sales - 2009 280,000 CoGS 182,000 Inventory 182,000 Sales - 2009 280,000 CoGS 182,000 2009 deferred GP- 35% 98,000 Cash 380,000 Accounts rec- 2007 50,000 Accounts rec- 2008 120,000 Accounts rec- 2009 110,000 2007 deferred GP- 40% 20,000 2008 deferred GP- 37% 44,400 2009 deferred GP- 35% 38,500 Recognized Gross Profit 102,900 14 Income Statement Miller Motor Co for the years ending Dec, 31st, 2009, 2008 and 2007 2009 Sales Cost of Goods Sold Gross Profit less: Deferred GP Realized Gross Profit current year prior years Gross Profit realized 2008 2007 250,000 260,000 280,000 150,000 163,800 182,000 100,000 96,200 98,000 70,000 59,200 59,500 30,000 0 30,000 37,000 38,500 40,000 64,400 77,000 102,900 Balance Sheet Miller Motor Co December 31st 2009 and 2008 2009 2008 Cash Investments Installment Receivables less Deferred Gross Profit Net Receivables 2009 2008 Accounts Payable Wages Payable 235,000 -89,200 235,000 -84,300 145,800 150,700 Cost Recovery Method cash collection is highly uncertain the collection period is fairly long unable to estimate uncollectible accounts - highly doubtful cost recovery method defers the recognition of gross profit until the amount of cash collected exceeds the Cost of Goods Sold Cost Recovery Mehtod is just like the Installment Method except we don't allocate Gross Profit to the different periods we recognize Gross Profit last, after we have recovered our costs if we have $150,000 Cost of Goods Sold then we will recognize the Gorss Profit after we recover $150,000 of the Account Receivable 15 there is $150,000 Cost of Goods to Recover associated with the 2007 sales we recovered $ 75,000 of the 150,000 as of 12/31/2007 0 we recovered $ 175,000 of the 150,000 as of 12/31/2008 25,000 we recovered $ 225,000 of the 150,000 as of 12/31/2009 75,000 - 25,000 there is $163,800 Cost of Goods to Recover associated with the 2008 sales we recovered $ 100,000 of the 163,800 as of 12/31/2008 we recovered $ 220,000 of the 163,800 as of 12/31/2009 0 56,200 there is $182,000 Cost of Goods to Recover associated with the 2009 sales we recovered $ 110,000 of the 182,000 as of 12/31/2009 0 P18-8 Accounts rec - 2007 Sales - 2007 CoGS Inventory 250,000 Sales - 2007 CoGS 2007 deferred GP Cash Accounts rec - 2007 250,000 Accounts rec - 2008 Sales - 2008 CoGS Inventory Sales - 2008 CoGS 2008 deferred GP 260,000 Cash 200,000 250,000 150,000 150,000 150,000 100,000 75,000 75,000 260,000 163,800 163,800 260,000 163,800 96,200 Accounts rec- 2007 100,000 Accounts rec- 2008 100,000 2007 deferred GP 25,000 Recognized Gross Profit 25,000 16 Accounts rec - 2009 Sales - 2009 CoGS Inventory Sales - 2009 CoGS 2009 deferred GP 280,000 Cash 380,000 280,000 182,000 182,000 280,000 182,000 98,000 Accounts rec- 2007 50,000 Accounts rec- 2008 120,000 Accounts rec- 2009 110,000 2007 deferred GP 50,000 2008 deferred GP 56,200 Recognized Gross Profit 106,200 17 FRANCHISE FEES Appendix 18A what is uncertain the earning process or the collection of cash E 18-19 (a) payment is non refundable and we need provide no additional services Cash 40,000 Note rec 30,000 discount on Note rec 5,131.48 Revenue 64,868.52 Cash 10,000 Note rec 10,000 discount on Note rec 2,486.85 Interest income 2,486.85 E 18-19 (b) substantial services to perform down payment is refundable very uncertain about collection Cash 40,000 Uneraned Revenue 40,000 Note Receivable 24,868.52 Deferred Revenue 24,868.52 Cash 10,000 Interest income Note Receivable Deferred Revenue Revenue 2,486.52 7,513.48 7,513.48 7,513.48 Unearned revenue 14,109.36 Revenue 14,109.36 If we assume we earn the revenue ratably over the three year period Deferred Revenue -contra to Accounts Receivable similar to Allowance for Doubtful Accounts 18 E 18-19 (c) down payment is not refundable collection is reasonably certain substantial services to remain but down payment reflects services completed Cash 40,000 Revenue 40,000 Note rec 30,000 discount on Note rec 5,131.48 Unearned Revenue 24,868.52 Cash 10,000 Note rec 10,000 discount on Note rec 2,486.85 Interest income 2,486.85 Unearned revenue 8,289.51 Revenue 8,289.51 Stop here the remainder is old stuff 19 completion of production the old fashioned way installment method year 1 year 2 year 1 year 2 year 1 year 2 year 3 Revenue CoGS Gross Profit selling exp Net Profit 30,000 11,000 18,900 1,500 17,400 0 0 0 0 0 22,500 8,325 14,175 1,125 13,050 7,500 2,775 4,725 375 4,350 18,000 6,660 11,340 1,125 10,215 8,250 3,053 5,197 375 4,822 3,000 1,110 1,890. 0. 1,890. 750 277 473. 0. 473. Cash Accounts rec Inventory Equipment accum dep 8,775 4,500 7,125 20,000 - 3,000 16,650 3,750 0 20,000 - 3,000 8,775 4,500 2,775 20,000 - 3,000 16,650 3,750 0 20,000 - 3,000 8,775 16,650 19,650 4,500. 3,750. 750 7,125. 0. 0 20,000. 20,000. 20,000 - 3,000. -3,000. - 3,000 20,400. 0 0 20,000 - 3,000 20,000 17,400 2,835 2,363 473 20,000. 20,000. 20,000 10,215 15,037 16,927 0 20,000 17,400. deferred Gross Profit Capital Stock 20,000 Retained Earn 17,400 20,000 17,400 20,000 13,050 year 4 20 Completion of Production E7-9 modify E7-9 15,000 bushels of grain at $2.00 per bu. = $30,000 the Old Fashioned way YR1 Dep exp Accum dep Inventory Dep exp Inventory Cash just like ACTG 214 3,000 3,000 3,000 3,000 8,100 8,100 Accounts rec 22,500 Sales 22,500 CoGS 8,325.00 Inventory 8,325.00 sold 11,250 bu. Cost/ bu. = $11,100 / 15,000 bu. = $0.74 Delivery exp Cash Cash 1,125 1,125. 18,000 Accounts rec YR2 Accounts rec Sales CoGS 18,000 7,500 7,500 2,775. 21 Inventory 2,775. sold 3,750 bu. Cost/ bu. = $11,100 / 15,000 bu. = $0.74 delivery exp cash Cash 375 375. 8,250 Accounts rec Accounts rec 2,250 6,000 10% of prior yr sales 80% of current yr sales 25% * 80% collections 25% * 80% collection 25% * 80% collection Completion of Production a form of percentage completion 100% complete ----- normally, we match costs to the year of the Sale , with Completion of Production we match both Revenues and Costs to the year of production YR1 Inventory Accum dep Inventory Cash 3,000 3,000 8,100 8,100 Inventory 18,900 CoGS 11,100 Revenue 30,000 entry at completion of production how do I recognize profit I include it in an asset account 22 Accounts rec Inventory Delivery exp Cash Cash 22,500 22,500 1,125 1,125. 18,000 Accounts rec 18,000 12/31 Delivery exp 375 Inventory 375 adjusting entry to adjust Inventory to NRV YR2 Accounts rec Inventory Cash Cash 7,500 7,125 375. 8,250 Accounts rec Accounts rec 2,250 6,000 10% of prior year deliveries 80% of current yr deliveries 25% * 805 collections 23