Tax understanding document for Indian bidders

advertisement

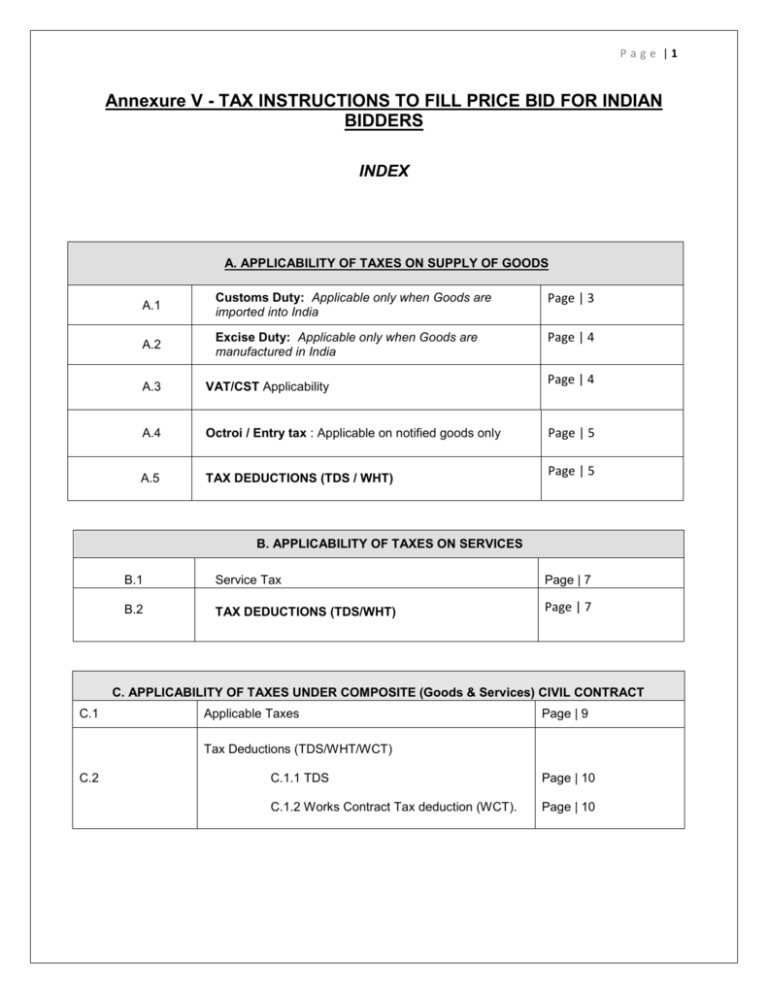

P a g e |1 Annexure V - TAX INSTRUCTIONS TO FILL PRICE BID FOR INDIAN BIDDERS INDEX A. APPLICABILITY OF TAXES ON SUPPLY OF GOODS A.1 Customs Duty: Applicable only when Goods are imported into India Page | 3 A.2 Excise Duty: Applicable only when Goods are manufactured in India Page | 4 A.3 VAT/CST Applicability Page | 4 A.4 Octroi / Entry tax : Applicable on notified goods only Page | 5 A.5 TAX DEDUCTIONS (TDS / WHT) Page | 5 B. APPLICABILITY OF TAXES ON SERVICES B.1 Service Tax Page | 7 B.2 TAX DEDUCTIONS (TDS/WHT) Page | 7 C. APPLICABILITY OF TAXES UNDER COMPOSITE (Goods & Services) CIVIL CONTRACT C.1 Applicable Taxes Page | 9 Tax Deductions (TDS/WHT/WCT) C.2 C.1.1 TDS Page | 10 C.1.2 Works Contract Tax deduction (WCT). Page | 10 P a g e |2 A. APPLICABILITY OF TAX ON SUPPLY OF GOODS P a g e |3 A.1 Customs Duty : Applicable only when “Goods are imported into India” PARTICULARS INDIAN BIDDERS Delivery terms: AT SITE Customs duty will be NIL on the Basis of Essentiality Certificate (“EC”) Delivery Terms Preferred (Please check with Company whether EC could be made available on such kind of goods or not) Bidder Responsibility for getting the EC Responsibility for Customs Clearance *(Refer Note a) below) (All associated cost and risks for availing the applicable exemptions and/or benefits will be in Bidder’s account). Bidder Goods for which Benefits available List 13 goods through EC issued by DG of HC in the MoPNG. (List 12 (now revised to List 13) . Please refer attached document List 13 *Note: (a) As the responsibility is on Bidder to obtain EC, Company will provide only reasonable assistance for EC, rest of the process needs to be understood and followed by the successful bidder to avail such exemption/benefits. Bidder should understand all related procedures to avail such exemptions and benefits at its cost and expenses. (b) Customs Duty related to non-List 13 goods shall be included in the Basic Price itself. (c) The customs duty benefits are available in accordance with notification no. 12/2012-Customs dated 17th March 2012 and any latest revisions (exclusively on matters related to petroleum operations) issued by the Government of India from time to time (the “Notifications”). P a g e |4 A.2 Excise Duty : Applicable only when “Goods are manufactured in India” Particulars INDIAN BIDDERS Current Rate Standard Rate12.36% Responsibility to Pay to Tax Authorities in India Bidder (Contractor) PAC issuance / Excise Benefits Excise benefits are available; PAC will be issued. Please refer detailed understanding attached below for such benefits. Bid issued under ICB (International Competitive Bidding) Excise Duty Benefits.doc Bid not issued under ICB Excise Benefits are not available, PAC will not be issued. A.3 Applicability of VAT/CST PARTICULARS DELIVERY TERMS REQUIREMENTS - Applicable VAT rate will be as per the respective states. VAT (if supply is made within same State) DELIVERY AT SITE - Input tax credit may be available to bidder against the Goods purchased from the registered vendors within same State. - Applicable rate will be the rate of supplying state. CST (if supply is made from different State where goods need to be delivered) DELIVERY AT SITE - Reduced rate @ 2% against Form C. - NIL under “in transit sales route”/ sale against E1/E2 forms, if, P a g e |5 PARTICULARS DELIVERY TERMS REQUIREMENTS goods has to be procured from the subcontractor’s and delivered without taking the delivery. - VAT/CST shall not be applicable Imported goods DELIVERY AT SITE on the goods imported into India under high sea sale basis. - Company can enter into HSS for import of the goods. Note : 1. The availability of C form for particular class of goods must be checked from the Company representative before submission of Bids. 2. Company shall not issue any C form / Road permit forms for goods meant for delivery at corporate office, Gurgaon. A.4 OCTROI / ENTRY TAX Applicable on notified goods when goods are brought to local area within a state in India (a) OCTROI (if applicable) shall be considered in the Basic Price itself with no further bifurcation. (b) Company will be responsible for Entry Tax / OCTROI, if any, on the goods sold to Company against Form C and/or where Company agrees to issue the way bills/road permit. (c) Apart from the goods as mentioned in para (b) above, Entry Tax liability shall be in Bidder’s account only. Bidders are advised to consider the classification of goods under Entry Tax as only notified items may be subject to Entry Tax and not all items. Such Entry Tax (if applicable) shall be considered in the Basic Price itself with no further bifurcation. A.5 Tax Deductions (TDS/WHT) TDS is not applicable in case of supplies made by Domestic Suppliers (successful bidder) P a g e |6 B. APPLICABILITY OF TAXES ON SERVICES P a g e |7 B.1 Service Tax Particulars INDIAN BIDDERS Standard 12.36% Current Rate (Lower/abated rate is applicable for various services – Refer List -A). Responsibility to Pay to Tax Department Service Provider/ Contractor and in some cases by Company ( Refer List – B) (a) For list of services where abatement is available please refer List – A. (b) For list of services where Company is also responsible to pay service tax directly to Tax Authorities is attached as List – B. (c) Please refer following document for List-A & B. List A and B.doc (d) Services Tax paid to the sub-vendors for the input services may be available for set-off against the output Service tax payable by the Contractor. (e) The price bid submitted by the bidder should specify the break-up of applicable Output Service Tax (which Bidder wants to charge to Company) after consideration of set – off/abatement, if any. B.2 Tax Deductions (TDS/WHT) B.2.1 TDS deduction in case of Indian Bidders Applicability - TDS shall be deducted as per the applicable rates under Income Tax Act. - PAN is mandatory in case of Indian Bidders. - If PAN is not provided, TDS will be deducted higher of following: 20% TDS rate applicable. The TDS/Withholding tax so deducted will be in Bidder’s account only. P a g e |8 C. APPLICABILITY OF TAXES UNDER COMPOSITE CIVIL CONTRACT This understanding is only for CIVIL Contracts for building structures etc. and not valid for other EPC Contracts. For other EPC Contracts, such as construction of entire facility with equipments etc and/or construction and installation of equipments at site, a separate tax understanding will be available with the ITT itself which will include available benefits under Excise, Customs, VAT/CST and Service Tax. If otherwise required, the same can be obtained on a separate request. P a g e |9 C.1 Applicable Taxes Particulars INDIAN BIDDERS Standard 12.36% Current Rate of Service Tax (Lower/abated rate is applicable for various Composite services) Responsibility to Pay to Tax Department Service Provider/ Contractor - CST / VAT shall be applicable as per the A.3.1 clause. - No C form will be issued to Civil Contracts. For other composite contracts please contact with Company representative. CST / VAT - Bidder may choose to opt Composition Schemes available under respective VAT laws to reduce the Tax Cost. (a) For list of services where abatement is available please refer List-A. Please refer following document for List-A. List A.doc (b) Services Tax paid to the sub-vendors for the input services may be available for set-off against the output Service tax payable by the Contractor. (c) The price bid submitted by the bidder should specify the Beak up of applicable Output Service Tax (which Bidder wants to charge to Company) after consideration of set – off/abatement, if any. P a g e | 10 C.2 Tax Deductions (TDS/WHT) C.2.1 TDS deduction in case of Indian Bidders Details Applicability - TDS shall be deducted as per the applicable rates under Income Tax Act. - PAN is mandatory in case of Indian Bidders. - If PAN is not provided, TDS will be deducted higher of following: 20% TDS rate applicable. The TDS/Withholding tax so deducted will be in Bidder’s account only. C.2.2 Works Contract Tax deduction (WCT). Details Applicability INDIAN BIDDERS On Composite / Civil Contracts. - Rajasthan – 3% (If contract value > Rs. 5,00,000) Rate of deduction - Gujarat – 2% (If contract value > Rs. 1,00,00,000) - Andhra Pradesh – 4% - Company will issue appropriate WCT certificates to bidder for tax deducted under VAT Act. Bidders may avail credit/refund. (as the case may be) against their tax liability at their cost and expenses. The WCT so deducted shall be in Bidder’s account. - If Bidder wishes to have deductions on lower rate or otherwise, than successful Bidder need to submit the appropriate certificate to be taken from the competent Vat Authority authorizing Company to deduct WCT at the prescribed lower rate.