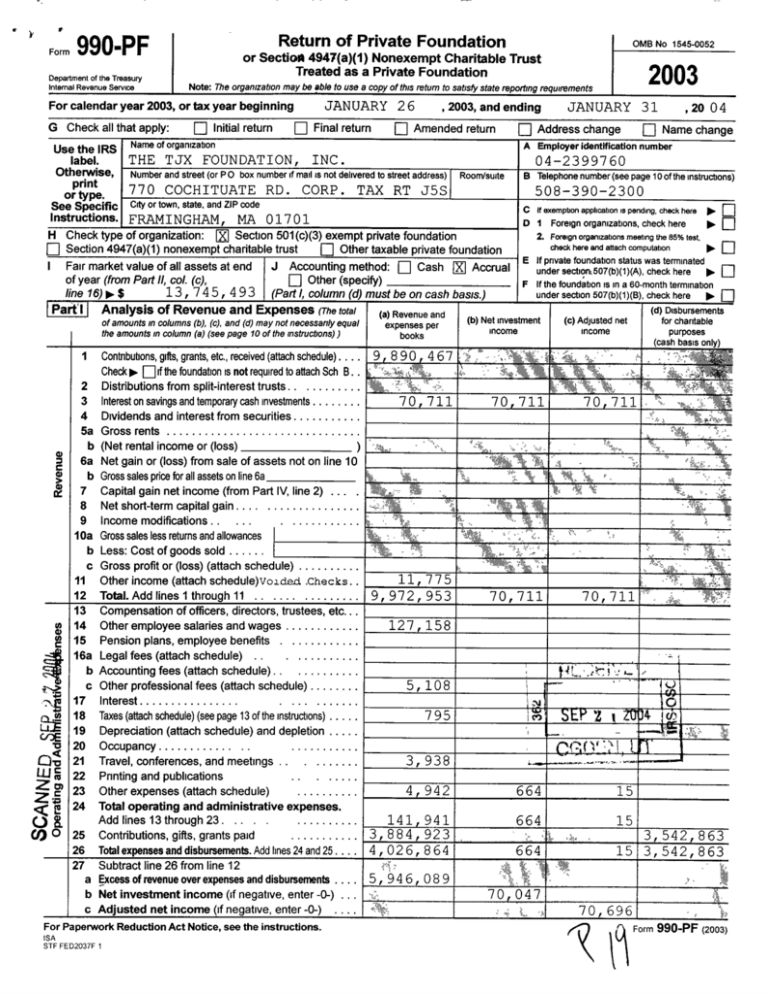

Return of Private Foundation

advertisement

Return of Private Foundation

Form

Department of the Treasury

Internal Revenue Service

Use the IRS

label.

Otherwise,

print

or type .

See Specific

0 Initial return

Name of organization

JANUARY 2 6

E] Final return

THE TJX FOUNDATION,

, 2003, and ending

E] Amended return

INC .

770 COCHITUATE RD . CORP . TAX RT J5S

E] Name change

04-2399760

Room/suite

B Telephone number (see page 10 of the instructions)

508-390-2300

City or town, state, and ZIP code

of year (from Pest /l, coil. (C),

, 20 0 4

A Employer identification number

Number and street (or P O box number if mad is not delivered to street address)

Fair market value of all assets at end

JANUARY 31

0 Address change

C

Instructions. FRAMINGHAM, MA 01701

H Check type of organization : 0 Section 501(c)(3) exempt private foundation

0 Section 4947(a)(1) nonexempt charitable trust

E] Other taxable private foundation

I

20

Note : The organization may be able to use a copy of this return to satisfy state reporting requirements

For calendar year 2003, or tax year beginning

G Check all that apply:

OMB No 1545-0052

or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

If exemption application is pending, check here

El

10.

D 1 Foreign organizations, check here

t

2. Foreign organizations meeting the 85% test,

check here era attach computation

I,.

E if private foundation status was terminated

J Accounting method : 0 Cash ~X Accrual

El

under sectiorE507(b)(1)(A), check here

F If the foundation is in a so-month termination

0 Other (specify)

line 16) lo. $

13,745,493 (Part l, column (d) must be on cash basis .)

under section 507(b)(1)(B), check here

Part`i Analysis of Revenue and Expenses (The total

cap Disbursements

~a~ Revenue and

(b) Net investment

(c) Adjusted net

for charitable

of amounts m columns (b), (c), and (d) may not necessarily equal

the amounts in column (a) (see page 10 of the instructions) )

1

2

Contributions, gifts, grants, etc., received (attach schedule) . . . .

Check No. F-] if the foundation is not required to attach Sch B . .

Distributions from split-interest trusts . . . . . . . . . . .

4

5a

b

6a

b

7

8

9

10a

b

c

11

Dividends and interest from securities . . . . . . . . . . .

Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Net rental income or (loss)

Net gain or (loss) from sale of assets not on line 10

Gross sales price for all assets on line 6a

Capital gain net income (from Part IV, line 2)

Net short-term capital gain . . . . . . . . . . . . . . . . . . .

Income modifications . . . . .

. . . . . . . . . . . . !.

Gross sales less returns and allowances

Less : Cost of goods sold . . . . . .

Gross profit or (loss) (attach schedule) . . . . . . . . . .

Other income (attach schedule) vozded Checks . .

13

14

15

16a

b

c

17

18

Compensation of officers, directors, trustees, etc. .

Other employee salaries and wages . . . . . . . . . . .

Pension plans, employee benefits . . . . . . . . . . .

Legal fees (attach schedule)

Accounting fees (attach schedule) . . . . . . . . . . . .

Other professional fees (attach schedule) . . . . . . .

Interest . . . . . . . . . . . . . . . .

. . . . . . . . . .

Taxes (attach schedule) (see page 13 of the instructions) . . . .

Depreciation (attach schedule) and depletion . . . .

Occupancy . . . . . . . . . . . . . .

. . . . . . . . . .

Travel, conferences, and meetings . . . . . . . . .

Printing and publications

.. . ....

3

12

4

G3~

LJJ a

M

20

21

22

Z 0)

S 23

Q ` 24

9

8 90

.

.

.

.

.

.

.

.

.

.

.

Other expenses (attach schedule)

. . . . ... .. .

Add lines 13 through 23 . . . . .

. . . . . .. ...

70 , 711

11, 775

70 1 711

70 , 711

¢r

~----

'x

70,711

.'`^`

70,711

t!,~,~~--, ;

~

v

1 r~

'.

795

3, 938

4

O

4 1 c/)19

SEP 2

~

~~ . .

MO ..

942

664

15

141 941

664

15

5,946, 089

STF FED2037F 1

f

5, 108

a Excess of revenue over expenses and disbursements . . . .

For Paperwork Reduction Act Notice, see the instructions .

isa

purposes

(cash basis only)

127 , 158

3,884, 923

4,026, 864

b Net investment income (if negative, enter -0-) . . .

c Adjusted net income (if negative, enter -0-) .

income

I

Contributions, gifts, grants paid

. . . . . . ... . .

Toil expenses and disbursements . Add lines 24 and 25 . . . .

Subtract line 26 from line 12

income

467

Total. Add lines 1 through 11 . . . . . . . . . . . . . . . 9,972, 953

Total operating and administrative expenses .

C/) 0 25

26

27

Interest on savings and temporary cash investments . . . . . . . .

expenses per

books

664

70 ,

,

~

3,542,863

15 3,542,863

70,696 ,

Form 990-PF (2003)

Form 990-PF (2003)

''P~1'f~11

Balance Sheets

Attached schedules and amounts m the description column

should be for end-of-year amounts only. (See instructions )

Cash - non-interest-bearing . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Savings and temporary cash investments . . . . . . . . . . . . . . . . . . .

Accounts receivable

Less : allowance for doubtful accounts

4 Pledges receivable

Less : allowance for doubtful accounts

. . . . . . . . . . . . . . . . . . .... . .

5 Grants receivable . . . . . . . .

6 Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see page 15 of the

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Other notes and loans receivable (attach schedule)

Less : allowance for doubtful accounts

8 Inventories for sale or use . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Prepaid expenses and deferred charges . . . . . . . . . . . . . . . . . . .

10a Investments- U.S . and state government obligations (attach schedule) . . . . . .

b Investments - corporate stock (attach schedule) . . . . . . . . . . . .

c Investments - corporate bonds (attach schedule) . . . . . . . . . . . .

11 Investments-land, buildings, and equipment basis

Less. accumulated depreciation (attach schedule)

12 Investments - mortgage loans . . . . . . . . . . . . . . . . . . . . . . . .

13 Investments-other (attach schedule) . . . . . . . . . . . . . . . . . . . . .

14 Land, buildings, and equipment: basis

Less: accumulated depreciation (attach schedule)

15 Other assets (describe p.

)

16 Total assets (to be completed by all filers - see page 16 of

the instructions . Also, see page 1, item I) . . . . . . . . . . . . . . . . . .

17 Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . .

18 Grants payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 Loans from officers, directors, trustees, and other disqualified persons . . . . . . .

21 Mortgages and other notes payable (attach schedule) . . . . . . . . .

25

22 Other liabilities (describe "

)

1

2

3

23

24

25

pp 26

0

Y!

y

a

27

28

29

30

31

Total liabilities (add lines 17 through 22) . . . . . . . . . . . . . . . . .

Organizations that follow SFAS 117, check here . . . . . . Jo.

and complete lines 24 through 26 and lines 30 and 31 .

Unrestricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Temporarily restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Permanently restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Organizations that do not follow SFAS 117, check here Jo.

and complete lines 27 through 31 .

Capital stock, trust principal, or current funds . . . . . . . . . . . . .

Paid-in or capital surplus, or land, bldg , and equipment fund .

Retained earnings, accumulated income, endowment, or other funds . . . . . .

Total net assets or fund balances (see page 17 of the

instructions)

Toil liabilities and net assets/fund balances (see page 17

of the instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part II

1

2

3

4

5

6

. .

.

. .

3eginmng of year

(a) Book Value

112,826

7,342,633

End of year

(b) Book Value

90,434

6,153,844

7 , 500 , 000

(c) Fair Market Value

90,434

6,153,844

7 , 500 , 000

777

2 , 010

1 , 215

1 , 215

7,457,469

13,745,493

13,745,493

125

808 , 385

808,5101

1 , 150 , 445

1,150,445

48,959112,595,048

E]

. .

. .

6, 648, 959 I 12, 595, 048 ~,

7,457,469113 .745,493

Analysis of Changes in Net Assets or Fund Balances

Total net assets or fund balances at beginning of year - Part II, column (a), line 30 (must agree with

.. . . . . . . . . . . . . . . . .

end-of-year figure reported on prior year's return) . . . . . . . . . . . . . .

I,

line

27a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. . . . . . . . . . . . . . . .

Enter amount from Part

. . . ..

Other increases not included m line 2 (itemize) jo.

Add lines 1, 2, and 3 . . . . . .

. .

... . . . . . . . . . .

Decreases not included in line 2 (itemize) jo.

Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30 . . . . .

STF FED2037F 2

Page 2

6,648,959

5,946,089

12,595,048

Form 990-PF (2003)

Form 990-PF

IV

Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kind(s) of properly sold (e g , real estate,

2-story brick warehouse; or common stock, 200 shs MLC Co )

1a

Page 3

(b) How acquired

P - Purchase

D - Donation

(c~ Date acquired

(mo , day, yr )

(d) Date sold

(mo , day, yr )

c

(e) Gross sales price

(f) Deprecation allowed

(or allowable)

a

b

(g) Cost or other basis

plus expense of sale

(h) Gain or (loss)

(e) olus (fl minus (a)

d

for assets showing gain in column (h) and owned by the foundation on 12/31169

(i) F M V as of 12/31/69

I

U) Adjusted basis

as of 12/31/69

(k) Excess of col (i)

over col Q), if any

(I) Gains (Col (h) gain minus

col (k), but not less than -0-) or

Losses (from col (h))

C

e

If gain, also enter in Part I, line 7 . . .

{ If (loss), enter -0- in Part I, line 7 . . } 2

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):

If gain, also enter in Part I, line 8, column (c) (see pages 13 and 17 of the instructions)

.

.

If (loss), enter -0- in Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ~ 3

,art V

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

2

Capital gain net income or (net capital loss) .

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Was the organization liable for the section 4942 tax on the distributable amount of any year in the base period?

If "Yes," the organization does not qualify under section 4940(e) Do not complete this part .

1

0 Yes FXJ No

Enter the appropriate amount in each column for each year ; see page 17 of the instructions before making any entries .

a

Base period years

Calendar year (or tax year beginning in)

2002

2001

2000

1999

1998

(b)

Adjusted qualifying distributions

4 , 069 , 290

3 , 571 , 468

2 , 675 , 456

2,016 177

1,506,005

(c)

Net value of nonchanhable-use assets

Distribution ratio

(coI (b) divided by col (c))

7 , 613 , 177

11 , 395 , 835

14 , 561 , 782

16 701,502

9,999,465

0 .5345

0 .3134

0 .1837

0 .1207

0 .1506

2

3

Total of line 1, column (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by .

.

the number of years the foundation has been in existence if less than 5 years . . . . . . . . . .

4

Enter the net value of noncharitable-use assets for 2003 from Part X, line 5 . . . . . . . . . . . . . .

1 4 1

6,468,673

5

Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . .

1 5 1

1,685,607

6

Enter 1 % of net investment income (11% of Part I, line 27b) .

1 6 1

700

7

Add lines 5 and 6

1 7 1

1,686,307

8

Enter qualifying distributions from Part XI I, line 4

. . . . . . . . . . . . . . . . . . . .

1 g 1

3,542,863

If line 8 is equal to or greater than line 7, check the box m Part VI, line 1 b, and complete that part using a 1 % tax rate . See the Part VI

instructions on page 17

STF FED2037F 3

. . .... . . . . . . . . . . . . . . .

.

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . ....

. . . . . . . . . . . . . . . . ... .. . .

2

1 .3029

3

.26058

Form 990-PF (zoos)

Page 4

Form 990- PF ( 2003)

Excise Tax Based on Investment tricomei

or4948-see gage 17 of the instructions)

1 a Exempt operating foundations described in section 4940(d)(2), check here 10. M and enter "N/A" on line 1

Date of ruling letter :

(attach copy of ruling letter if necessary - see instructions)

b Domestic organizations that meet the section 4940(e) requirements in Part V, check here 0. XD

and enter l% of Part l, line 27b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c All other domestic organizations enter 2% of line 27b Exempt foreign organizations enter 4% of Part I, line 12, col (b) . . . . .

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) . . . . . . . . . . . . . .

3 Addlines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) . . . . . . . . . . . . . .

5 Tax based on investment income . Subtract line 4 from line 3. If zero or less, enter -0. . . . . . . . . . . .

6 Credits/Payments :

a 2003 estimated tax payments and 2002 overpayment credited to 2003 . . 6a

2,010

b Exempt foreign organizations - tax withheld at source . . . . . . . . . . . . . . . 6b

c Tax paid with application for extension of time to file (Form 8868) . . . . . . . 6c

d Backup withholding erroneously withheld . . . . . . . . . . . . . . . . . . . . . . . . . 6d

7 Total credits and payments . Add lines 6a through 6d . . . . . . . . . . . . . . . . .

. . . .. . . . .

8 Enter any penalty for underpayment of estimated tax. Check here M if Form

. . 2220

. . . . is

. attached

. . . .

. . . . . .

9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed . . . . . . . . . . . . . . . . . oo.

10 Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid . . . . . .

11 Enter the amount of line 10 to be : Credited to 2004 estimated tax oo.

1, 310 Refunded

arEVf(, .A

Statements Regarding Activities

700

3

4

5

700

700

~

2 , 010

7

8

9

10

11

0

1 , 310

0

1a During the tax year, did the organization attempt to influence any national, state, or local legislation or did it

participate or intervene in any political campaign? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page 18 of

the instructions for definition)? . . . .

. . . . .

. . . . . . . . . . . . .

. . . .

If the answer is "Yes" to 7a or 1b, attach a detailed description of the activities and copies of any materials

published or distributed by the organization in connection with the activities .

c Did the organization file Form 1120-POL for this year? . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . ..... . . . . .

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year :

(1) On the organization . " $

(2) On organization managers t $

e Enter the reimbursement (if any) paid by the organization during the year for political expenditure tax imposed

on organization managers . p. $

2 Has the organization engaged in any activities that have not previously been reported to the IRS? . . . . . . . . . . .

If "Yes," attach a detailed description of the activities.

3 Has the organization made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, or other similar instruments? If "Yes,"attach a conformed copy of the changes . . . . .

4a aid the organization have unrelated business gross income of $1,000 or more during the year? . . . . . . . . . . . . . .

b If "Yes," has it filed a tax return on Form 990-T for this year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year? . . . . . . . . . . . . . . . .

If "Yes,"attach the statement required by General Instruction T.

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either :

" By language in the governing instrument or

By state legislation that effectively amends the governing instrument so that no mandatory directions that

conflict with the state law remain in the governing instrument? . . . . . . . . . . . . . . . . .

. . . . . . . .. ... .....

7 Did the organization have at least $5,000 m assets at any time during the year? If "Yes,"complete Past II, col (c), and PaftXV . . . . . . . . . .

8a Enter the states to which the foundation reports or with which it is registered (see page 19 of the

MASSACHUSETTS

instructions)

b If the answer is "Yes" to line 7, has the organization furnished a copy of Form 990-PF to the Attorney General

(or designate) of each state as required by General Instruction G? If "No," attach explanation . . . . . . . . . . . . . . .

9 Is the organization claiming status as a private operating foundation within the meaning of section 4942(j)(3) or

4942(j)(5) for calendar year 2003 or the taxable year beginning in 2003 (see instructions for Part XIV on page

25)? If "Yes," complete Part XIV . .

. . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . ..... . . . . . . . . . . . . . . . .

10 Did any persons become substantial contributors during the tax years If °Yes,"attach a schedule listing theirnames and addresses . . . . . . .

11 Did the organization comply with the public inspection requirements for its annual returns and exemption applications . . . . . . . . . . . . 1

Web site address t

12

The books are in care ofd JEFFREY G .

13

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here . . . . . . . . .

and enter the amount of tax-exempt interest received or accrued during the year

. ~ ~ 13

LOCeted 2t " THE TJX COS .,

STF FED2037F 4

NAYLOR,

770 COCHITUATE

RD .

TREASURER

FRAMINGHAM,

MA

`° Yes No

la

X

1b

X

1c

X

s

w'

-~

2

a

< ~

3

4a

4b

5

A

~`

~

N

6

7

t

X

X

8b

X

9

10

11

°a

X

All

X

F

X

}{

A

X

`, '

`

X

X

Telephone no. OP. 508-390-2300

ZIP+4 o,. 01701

.

. . .

Form 990-PF (2oos)

Form 990-PF (2003)

,PrtVI1-B

Statements Re g ardin g Activities for Which Form 4720 Ma

Page 5

Be Required

File Forth 4720 if any item is checked in the "Yes" column, unless an exception applies .

1a During the year did the organization (either directly or indirectly) :

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? . . . . . . E]

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a

disqualified person? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .F~

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? . . . . . [ :J

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . . . . . . n

b

c

2

a

b

c

3a

b

4a

b

5a

b

c

Yes

No

_

N

A

Yes [K No

Yes N No

Yes FX-J No

Yes OX No

(5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person) *? . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . [] Yes nX No

(6) Agree to pay money or property to a government official? (Exception. Check "No" if the

organization agreed to make a grant to or to employ the official for a period after

termination of government service, if terminating within 90 days .) . . . . . . . . . . . . . . . . . . . . 0 Yes OX No

If any answer is "Yes" to 1a(1) - (6), did any of the acts fad to qualify under the exceptions described in Regulations section

53 4941(d)-3 or in a current notice regarding disaster assistance (see page 19 of the instructions)? . . . . . . . . . . . . . . . . . . .

Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . . . . 0. 0

Did the organization engage in a prior year in any of the acts described in 1 a, other than excepted acts, that

were not corrected before the first day of the tax year beginning in 2003? . . . . . . .

. . . . . . . . . . . . . ..... . . . .

Taxes on failure to distribute income (section 4942) (does not apply for years the organization was a private

operating foundation defined in section 4942(j)(3) or 4942(j)(5)) :

At the end of tax year 2003, did the organization have any undistributed income (lines 6d

and 6e, Part X1 11) for tax year(s) beginning before 2003? . . . . . . . . . . . . . . . . . . . . . . . . . . . . E] Yes [Z No

If "Yes," list the years 0. 20

, 20

, 20

, 19

Are there any years listed in 2a for which the organization is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to

all years listed, answer "No" and attach statement - see page 19 of the instructions .) . . . . . . . . . . . . . . . . . . . . .

If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

X20

,20

,20

,19

Did the organization hold more than a 2% direct or indirect interest in any business

enterprise at any time during the year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . FI Yes FX~ No

If "Yes," did it have excess business holdings in 2003 as a result of (1) any purchase by the organization or

disqualified persons after May 26, 1969 ; (2) the lapse of the 5-year period (or longer period approved by the

Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest; or (3) the lapse of

the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine if the

organization had excess business holdings in 2003.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the organization invest during the year any amount in a manner that would jeopardize its charitable purposes? . . . . . . . . . . . . . . . . .

Did the organization make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that

had not been removed from jeopardy before the first day of the tax year beginning in 2003? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

During the year did the organization pay or incur any amount to

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? . . . . E] Yes FX-] No

(2) Influence the outcome of any specific public election (see section 4955) ; or to carry on,

directly or indirectly, any voter registration drives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E] Yes [K No

(3) Provide a grant to an individual for travel, study, or other similar purposes ? . . . . . . . . . . . .

Yes nX No

(4) Provide a grant to an organization other than a charitable, etc ., organization described

in section 509(a)(1), (2), or (3), or section 4940(d)(2)? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes FX-1 No

(5) Provide for any purpose other than religious, charitable, scientific, literary, or educational

purposes, or for the prevention of cruelty to children or animals? . . . . . . . . . . . . . . . . . . . F-1 Yes FX] No

If any answer is "Yes" to 5a(1) - (5), did any of the transactions fad to qualify under the exceptions described in Regulations section 53 4945

or in a current notice regarding disaster assistance (see page 20 of the instructions) . . . . . . . . .

... . . . . . . . . . . . . . ..... .

Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . . . . lo.

If the answer is "Yes" to question 5a(4), does the organization claim exemption from the tax

because it maintained expenditure responsibility for the grant? . . . . . . . . . . . . . . . . . . . . . . . F-1 Yes E] No

if "Yes, " attach the statement required by Regulations section 53.4945-5(d) .

6a Did the organization, during the year, receive any funds, directly or indirectly, to pay

premiums on a personal benefit contracts

. . . . . . . . . . . . . . . .. ..

. . . . E] Yes ~X No

b Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? . . .

If you answered "Yes" to 6b, also file Form 8870

1b

X

1c

'~ .

2b

40

lI

A

N

; .

A

`

3b

4a

X

4b

5b

X

N

A

4

6b

xX

Form 990-PF (2oos)

STF FED2037F 5

1

1

Form 990-PF (2003)

Page 6

Information About Officers, Directoes, Trustees, Foundation Managers, Highly Paid Employees, and

Contractors

1

List all officers, directors, trustees, foundation managers and their compensation (see page 20 of the instructions) :

(b) Title, and average

(c) Compensation

(d) Contributions to

(e) Expense account,

(a) Name and address

hours per week

(If got paid,

employee benefit plays

other allowances

devoted to position

enter -0-)

and deferred compensation

SEE ATTACHED

-----------------------------------------------------

2

Compensation of five highest-paid employees (other than those included online 1 -seepage 20 of the instructions). If

none, enter "NONE."

(a) Name and address of each employee p aid more than $50,000

(b) Title and average

hours pe r week

I

devoted to position

NONE

(c) Compensation

(d) Contributions to

employee benefit

(e) Expense account,

I plans and deferred I other allowances

, -r ,

-------------------------------------------------------------------------------------------------------------------------I

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . .

. . . . .. .. . . . . . . . . . .. . . . . . . . . .

3 Five highest-paid independent contractors for professional services - (see page 20 of the instructions). If none, enter

"NONE."

NONE

(a) Name and address of each person paid more than $50,000

(b) Type of service

(c) Compensate

---------------------------------------------------------------------------------------------------------------------Total number of others receiving over $50,000 for professional services

arl

1

. .

... . . . . . . . . . . .... . . . . . .

.

. . .

Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year Include relevant statistical information such as the number

of organizations and other beneficiaries served, conferences convened, research papers produced, etc

Expenses

NONE

-------------------------------------------------------2

-------------------------------------------------------3

-------------------------------------------------------4

-------------------------------------------------------Form 990-PF (2003)

STF FED2037F 6

4

Form 990-PF (2003)

Page 7

-» , a IX W,

Summa of Program-Related Investments see a e 21 of the instructions

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2

1

NONE

Amount

-------------------------------------------------------2

-------------------------------------------------------3

A11 other program-related investments See page 21 of the instructions

--------------------------------------------------------

TotaI.Addlines lthrough 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00. ,

Pact X

Minimum investment Return (All domestic foundations must complete this part . Foreign foundations, see

page 21 of the instructions .)

1

Fair market value of assets not used (or held for use) directly in carrying out charitable, etc.,

purposes :

a Average monthly fair market value of securities . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . la

b Average of monthly cash balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . 1b

413,337

c Fair market value of all other assets (see page 22 of the instructions) . . . . . . . . . . . . . . . . . . . . . . . 1c

6, 153,844

d Total (add lines 1a, b, and c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1d

6 567 , 181

e Reduction claimed for blockage or other factors reported on lines 1 a

and 1c (attach detailed explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1e

2 Acquisition indebtedness applicable to line 1 assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 d . . . . . . . .

. . . . . . . . . . . . . . . ..... . . . . . . . . . . . . . . ..... . . . . . . . . 3

6,567,181

4 Cash deemed held for charitable activities . Enter 1'/z% of line 3 (for greater amount, see page 23

4

of the instructions) . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . .

98,508

5 Net value of noncharitable-use assets . Subtract line 4 from line 3 Enter here and on Part V, line 4 . . . . . . . . . . 5

6,468 , 673

6 Minimum investment return . Enter s% of line 5 . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . r6 T

323,434

Distributable Amount (see page 23 of the instructions) (Section 4942(j)(3) and Q)(5) private operating

art'xI

foundations and certain foreign organizations check here lo- E] and do not complete this part.)

1

2a

b

c

3

4a

b

c

5

6

7

Minimum investment return from Part X, line 6 . . . . . . . . . . . . . . . . . . . .

.

. . . . . . . . .

Tax on investment income for 2003 from Part VI, line s . . . . . . . . . . . . . . . 2a

Income tax for 2003 . (This does not include the tax from Part VI .) . . . .

~ 2b

Add lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Distributable amount before adjustments . Subtract line 2c from line 1 . . . . . . . . . . . . . . . . .

Recoveries of amounts treated as qualifying distributions . . . . . . . . . . . . . 4a

Income distributions from section 4947(a)(2) trusts . . . . . . . . . . . . . . . . . 4b

Add lines 4a and 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 3 and 4c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deduction from distributable amount (see page 23 of the instructions)

. .. . . .. . . .

Distributable amount as adjusted . Subtract line 6 from line 5. Enter here and on Part XIII,

line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . ... ..... .

PartX11

Quali

in

Distributions ( see pa ge 23 of the instructions

.. . . . . . .

700

1

323,434

. . . . .. . .

. . . . . . . .

2c

3

~,

.

700

322,734

-

5

322 F 734

7

322,734

.

. .

.

.

. .

. . . . . .

. . . . . .

. . . . . .

. . . . .

4c

6

1

Amounts paid (including administrative expenses) to accomplish charitable, etc ., purposes :

a Expenses, contributions, gifts, etc . - total from Part I, column (d), line 26 . . . . . . . . . . . . . . . . . . . . . .

la

3,542,863

b Program-related investments-Total from Part IX-B . . . . . . . . . . . . .

. . . . . . . . . . . . ... . . . . .

1b

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc .,

purposes . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . .. ... . . .

. . . . . . .. . . . . ... . . . . .

2

3 Amounts set aside for specific charitable projects that satisfy the :

a Suitability test (prior IRS approval required) . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . ... . . . .

3a

b Cash distribution test (attach the required schedule) . . . . . . . . . . . .

. . . . . . . . . . . . .. ... . . .

3b

4 Qualifying distributions. Add lines 1a through 3b Enter here and on Part V, line 8, and Part XIII, line 4 . . . . . . . .

4

3,542,863

5 Organizations that qualify under section 4940(e) for the reduced rate of tax on net investment

700

income . Enter 1 % of Part I, line 27b (see page 24 of the instructions)

. . . . . . . . . . . . . . . . . .

5

6 Adjusted qualifying distributions . Subtract line 5 from line 4 .

. . .. . . . . . . . . . . . . . . ~ 6 ~

3,542, 163

Note: The amount online 6 will be used In Part V, column (b), in subsequent years when calculating whether the foundation qualifies

for the section 4940(e) reduction of fax in those years

STF FED2037F 7

Form 990-PF (2003)

I

r

Form 990-PF(2003)

Part Xlll,

Page 8

Undistributed Income (see page 24 of the instructions)

Distributable amount for 2003 from Part XI,

line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Undistributed income, if any, as of the end of 2002

a Enter amount for 2002 only . . . . . . . . . . . . . . . . .

b Total for prior years 20

, 20

, 19

3 Excess distributions carryover, if any, to 2003:

a From 1998 . . . . . . .

. . ...

1 506 005

b From 1999 . . . . . . . . . . . .

2 016 177

c From 2000 . . . . . . . .

.. .

2 675 , 456

d From 2001 . . . . . . . . . . . .

3 571 , 468

e From 2002 . . . . . . . . . . . . .

4 070 , 943

f Total of lines 3a through e . . . . . . . . . . . . . . . . . .

4 Qualifying distributions for 2003 from

3,542,863

Part XII, line 4: o. $

a Applied to 2002, but not more than line 2a . . . . . .

b Applied to undistributed income of prior years (Election

required - see page 24 of the instructions) . . . . . . . . . . . .

c Treated as distributions out of corpus (Election

required - see page 24 of the instructions) . . . . .

d Applied to 2003 distributable amount . . . . . . . . . .

e Remaining amount distributed out of corpus . . . .

5 Excess distributions carryover applied to 2003 . .

(If an amount appears in column (d), the same

amount must be shown in column (a).)

6 Enter the net total of each column as

indicated below:

a Corpus . Add lines 3f, 4c, and 4e . Subtract line 5 .

b Prior years' undistributed income . Subtract line

4b from line 2b . . . . . . . . . . . . . . . . . . . . . . . .

c Enter the amount of prior years' undistributed

income for which a notice of deficiency has been

issued, or on which the section 4942(a) tax has

been previously assessed . . . . . . . . . . . . . . . . . .

d Subtract line 6c from line 6b . Taxable amount see page 24 of the instructions . . . . . . . . . . . . . . .

e Undistributed income for 2002 . Subtract line 4a

from line 2a . Taxable amount - see page 24 of

the instructions . . . . . . . . . . . . . . . . . . . . . . . . .

f Undistributed income for 2003 . Subtract lines 4d

and 5 from line 1 . This amount must be

distributed in 2004 . . . . . . . . . . . . . . . . . . . . . . . .

7 Amounts treated as distributions out of corpus to

satisfy requirements imposed by section

170(b)(1)(E) or 4942(8)(3) (see page 25 of the

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

S Excess distributions carryover from 1998 not

applied on line 5 or brie 7 (see page 25 of the

instructions . .

. . . . . . . . . . . . . . . . . . . . . . .

9 Excess distributions carryover to 2004.

Subtract lines 7 and 8 from line 6a . . . . . . . . . . . .

Analysis

of line 9

10

a Excess from 1999

2,016,177

. . . . . .

b Excess from 2000 . . .

2,675,456

. . .

c Excess from 2001

3,571,468

. . . .

.

.

.

4,070, 943

d Excess from 2002

e Excess from 2003

3 , 542 , 863

(a)

corpus

1

STF FED2037F 8

(b)

rears Pnor to 2002

(c)

2002

~

(d)

Zoos

322 , 734

,

t 1 UT-J E

I I ONE

I

13

840

Y

0 43

~x

`.

NONE

~,

NOME

~

3 542 8 63

322 , 734

17

0 60

N ON E

N ~~NE

3 ?2

734

17 -3

0

NONE

0 ^bK

P

~

%

~_

`0

NONE

1,183,271 ,

15,876,907

"

~

"-

Form 990-PF (2oas)

Page 9

Form 990-PF (2003)

IPart~ Private Operating Foundations (see~paQe 25 of the instructions and Part

uestion 9)

1a If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2003, enter the date of the ruling . . . . . . . . . . jo. N /A

b Check box to indicate whether the organization is a private operating foundation described in section 049420)(3) or E]49420)(5)

2a Enter the lesser of the adjusted net

Tax year

Prior 3 years

income from Part I or the minimum

(b) 2002

(c) zoos

d) 2000

(a) 2003

(e) Total

investment return from Part X for

each year listed . . . . . . . . . . . . . . . . .

b 85% of line 2a . . . . . . . . . . . . . . . . . . .

c Qualifying distributions from Part XI I,

line 4 for each year listed . . . . . . . . . .

d Amounts included in line 2c not used directly

for active conduct of exempt activities . . . . . .

e Qualifying distributions made directly for active

conduct of exempt activities . Subtract line 2d

from line 2c . . . . . . . . . . . . . . . . . . . . . . .

3 Complete 3a, b, or c for the

alternative test relied upon :

a "Assets" alternative test - enter:

(1) Value of all assets . . . . . . . . . . . . .

(2) Value of assets qualifying under

section 4942G)(3)(B)(i) . . . . . . . . .

b "Endowment" alternative test - Enter 21a of

minimum investment return shown in Part X,

line 6 for each year listed . . . . . . . . . . . . . .

c "Support" alternative test - enter:

(1) Total support other than gross

investment income (interest,

dividends, rents, payments on

securities loans

(section 512(a)(5)), or royalties) . .

(2) Support from general public and 5

or more exempt organizations as

provided in

section 4942(j)(3)(B)(iii) . . . . . . . .

(3) Largest amount of support from . .

an exempt organization . . . . . .

(4) Gross investment income . . . . . . .

lftgXV

Supplementary Information (Complete this part only if the organization had $5,000 or more in assets

at any time during the year-see page 25 of the instructions .)

Information Regarding Foundation Managers :

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before

the close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

N/A

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership

of a partnership or other entity) of which the foundation has a 10% or greater interest .

1

N/A

2 Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here lp~ E] if the organization only makes contributions to preselected charitable organizations and does not accept unsolicited

requests for funds. If the organization makes gifts, grants, etc. (see page 25 of the instructions) to individuals or organizations under

other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

CHRISTINE STRICKLAND, TJX FOUNDATION

C/0 THE TJX COMPANIES, INC .,

770 COCHITUATE RD ., FRAMINGHAM, MA 01701

b The form in which applications should be submitted and information and materials they should include :

(508)

390-3199

SEE ATTACHED

c Any submission deadlines:

NONE

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors.

NONE - SEE ATTACHED

STF FED2037F 9

Form 990-PF (zoos)

Form 990-PF (2003)

Part XV

Page 10

Supplementary Information (continued)

3

Grants and Contributions Paid Durin g the Year or Approved

If recipient is an individual,

Recipient

show any relationship to

any foundation manager

Name and address (home or business)

or substantial contributor

a Paid during the year

for Future Pa y ment

Foundation

status of

recipient

Purpose of grant or

contribution

Amount

SEE ATTACHED

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Approved for future payment

3a

SEE ATTACHED

Total . . . . . . . . . . . .

STF FED2037F 10

... .

. .

3b I

Form 990-PF (zoos)

Form 990-PF (2003)

Port' 3EV7-A i

Page 11

Analysis of Income-Producing Activities

Enter gross amounts unless otherwise indicated .

Unrelated business income

Business code

Amount

Excluded by section 512, 513, or 514

Exclusion code

1 Program service revenue:

a

b

c

d

e

f

g Fees and contracts from government agencies . . .

.

2 Membership dues and assessments . . . . . . . . . .

3 Interest on savings and temporary cash investments . . . . . .

4 Dividends and interest from securities . . . . . . . . .

5 Net rental income or (loss) from real estate :

a Debt-financed property . . . . . . . . . . . . . . . . . .

b Not debt-financed property . . . . . . . . . . . . . . .

S Net rental income or (loss) from personal property . . . . . .

7 Other investment income . . . . . . . . . . . . . . . . . . .

8 Gain or (loss) from sales of assets other than inventory . .

9 Net income or (loss) from special events . . . . . .

10 Gross profit or (loss) from sales of inventory . .. . .

11 Other revenue: a

b

c

d

e

-12 Subtotal . Add columns (b), (d), and (e) . . . . . . . .

13 Total. Add fine 12, columns (b), (d), and (e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

(See worksheet in line 13 instructions on page 26 to verify calculations.)

PiX11-B

Line No.

STF FED2037F 11

Amount

(e)

Related or exempt

function income

(See page 26 of

the instructions

70 , 711

_ .-

701711

70,711

Relationshi p of Activities to the Accomplishment of Exempt Pur poses

Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to the

accomplishment of the organization's exempt purposes (other than by providing funds for such purposes) (See page 26

of the instructions .)

Form 990-PF (2003)

Form 990-PF (2003)

Wo it XA 1

1

Page 12

Information Regarding Transfers Tb and Transactions and Relationships With Noncharitable Exempt

Orcianizations

Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c)

(other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting organization to a noncharitable exempt organization of:

(1) Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Other Transactions :

- Yes No

of the Code

. . . . . . . . . .

. . . . . . . . .

1a1

la(2)

(1) Sales of assets to a noncharitable exempt organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2) Purchases of assets from a noncharitable exempt organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3) Rental of facilities, equipment, or other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b(l)

1b(2)

1 3

1 4

X

'

X

X

X

X

X

(4) Reimbursement arrangements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(5) Loans or loan guarantees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 5

X

(6) Performance of services or membership or fundraising solicitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 6

X

Sharing

of

facilities,

equipment,

mailing

lists,

other

assets,

or

paid

employees

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1c

X

c

d If the answer to any of the above is "Yes," complete the following schedule . Column (b) should always show the fair market value of

the goods, other assets, or services given by the reporting organization . If the organization received less than fair market value in any

2a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations

described in section 501(c) of the Code (other than section 501(c)(3)) or in section 527? . . . . . . . . . . . . . . . . . . . 0 Yes [Z No

b If "Yes," complete the following schedule.

(a) Name of organization

(b) Type of organization

(c) Description of relationship

Under penalties of penury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct and mplete Declar

rep rer (other than taxpayer or fiduciary) is based on all information of which preparer has any knowledge

'

d

Z

C

N

Signatur of

~' 0~

a~

STF FE02037F 12

i

or ru

Preparer's ,

signature

Firm's name (or yours if '

self-employed), address,

and ZIP code

Date

Date

' TREASURER

Title

Check if

self-employed 1 0

Preparer's SSN or PTIN

(See Signature on page 28

of the instructions )

EIN t

Phone no

Form 990-PF (2003)

Schedule B

,Schedule of Contributors

(Form 990, 990-EZ,

or 990-PF)

OMB No 1545-0047

2003

Supplementary Information for

line 1 of Form 990, 990-EZ, and 990-PF (see instructions)

Department of the Treasury

IMemal Revenue Service

Name of organization

Employer identification number

THE TJX FOUNDATION,

04-2399760

INC .

Organization type (check one) :

Filers of:

Section:

Form 990 or 990-EZ

D 501(c)(

) (enter number) organization

4947(a)(1) nonexempt charitable trust not treated as a private foundation

0 527 political organization

Form 990-PF

X~ 501(c)(3) exempt private foundation

4947(a)(1) nonexempt charitable trust treated as a private foundation

501(c)(3) taxable private foundation

Check if your organization is covered by the General Rule or a Special Rule. (Note: Only a section 501(c)(7),(8), or (10)

organization can check boxes) for both the General Rule and a Special Rule - see instructions .)

General Rule OX For organizations filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more (in money or

property) from any one contributor . (Complete Parts I and II .)

Special Rules o For a section 501(c)(3) organization filing Form 990, or Form 990-EZ, that met the 33'1s% support test of the regulations

under sections 509(a)(1)/170(b)(1)(A)(vi) and received from any one contributor, during the year, a contribution of the

greater of $5,000 or 2% of the amount on line 1 of these forms. (Complete Parts I and II .)

D For a section 501(c)(7),(8), or (10) organization filing Form 990, or Form 990-EZ, that received from any one contributor,

during the year, aggregate contributions or bequests of more than $1,000 for use exclusively for religious, charitable,

scientific, literary, or educational purposes, or the prevention of cruelty to children or animals. (Complete Parts I, II, and

III .)

For a section 501(c)(7),(8), or (10) organization filing Form 990, or Form 990-EZ, that received from any one contributor,

during the year, some contributions for use exclusively for religious, charitable, etc., purposes, but these contributions did

not aggregate to more than $1,000 . (If this box is checked, enter here the total contributions that were received during

the year for an exclusively religious, charitable, etc., purpose. Do not complete any of the Parts unless the General Rule

applies to this organization because it received nonexclusively religious, charitable, etc., contributions of $5,000 or more

during the year) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111~ $

Caution: Organizations that are not covered by the General Rule and/or the Special Rules do not file Schedule 8 (Form 990,

990-EZ, or 990-PF), but they must check the box in the heading of their Form 990, Form 990

.EZ, or on line 1 of their Form

990-PF, to certify that they do not meet the filing requirements of Schedule B (Form 990, 990-EZ, or 990-PF).

For Paperwork Reduction Act Notice, see the Instructions

for Forth 990 and Form 990-EZ.

ISA

STF FED1956F 7

Schedule B (Form 990, 990-EZ, or 990-PF) (2003)

1

1

Schedule B (Form 990, 990-EZ, or 990-PF) (2003)

Name of organization

THE TJX FOUNDATION,

Page

-1

to __L of Part I

Employer identification number

04-2399760

INC .

Contributors (See Specific Instructions .)

(a)

No.

1

(b)

Name, address, and ZIP + 4

(c)

Aggregate contributions

(d)

MARSHALLS

.

- -- OF

- -- MA,

------ INC

-----------------------770 COC H I T UAT E _ ROAD _________________ .___ .___ .___

Person

Payroll

$ ------- 9 ,_ 7 5 0 ,-00 0

Noncash

(Complete Part II if there is

a noncash contribution )

FRAMINGHAM,

MA 01701

--------------------------------------------------(a)

No.

(b)

Name, address, and ZIP + 4

2

THE

TJX COMPANIES, INC .

-----------------------------------------------------------------

(c)

Aggregate contributions

770 COCHITUATE ROAD

------------------------------------------------------------------

(d)

pe of contribution

Person

Payroll

140,467

$ --------------------------

(b)

Name, address, and ZIP + 4

----------------------

(Complete Part If if there is

a noncash contribution .)

(c)

Aggregate contributions

(d)

Type of contribution

-------------------------------------

------------------------------------------------------------------

Person

Payroll

Noncash

(Complete Part II if there is

a noncash contribution .)

1 $ --------------------------

----------------------------------- ------------------ -------(a)

No .

(b)

Name, address, and ZIP + 4

(c)

contributions

(d)

Type of contribution

Person

Payroll

------------- ------------------------------- --------------------

(Complete Part II if there is

a noncash contribution

------------------ -- -----------------------------------------(b)

Name, address, and ZIP + 4

(c)

contributions

(d)

Type of contribution

Person

---------------------------------------------------------------------------------------------------------------------------

Payroll

Noncash

1 $ --------------------------

Name, address, and ZIP + 4

contributions

---------------------------------------------------------------------------------------------------------------------------------------~--------- -------------------------------------------------STF FED1956F 2

$ --------------------------

0

(Complete Part II if there is

a noncash contribution )

-------------- ---------------------------------- ---------------(a)

No.

0

Noncash

---- f $ --------------------------

(a)

No.

0

Noncash

FRAMINGHAM,

MA 01701

-----------------------------------------------------------(a)

No.

X[~

I

(d)

Type of contribution

Person

Payroll

Noncash

0

(Complete Part 11 if there is

a noncash contribution-)

Schedule B (Form 990, 990-EZ, or 990-PF) (2003)

Schedule B (Form 990, 990-EZ, or 990-PF) (2003)

Name of organization

THE TJX FOUNDATION,

Page 1to 1of Part II

Employer identification number

04-2399760

INC .

Noncash Property (See Specific Instructions .)

(a) No .

from

Part I

Description of noncash property given

PAYROLL

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------(a) No.

from

Part I

2

o

from

Part 1

2

2

2

(a) No.

from

Part 1

(d)

-------------------------------------------------------------------------------------------------------------------------------------

3'311

$ ------------- ----------

_ .____ VARIOUS

- - - -------

Description of noncash property given

FMV (or cestimate)

SUPPLIES

(see instructions)

Date received

PROFESSIONAL SERVICES

Description of

no(b)

cash property given

5,- 1- 0-8

FNN (or cestimate)

(see instructions)

______ VARIOUS

Date received

TRAVEL

Description of noncash property given

3 , 938

---- -- VARIOUS

M

FNN (or estimate)

Date received

952

$ ------------------------

..____ VARIOUS

-----------------

FNN (or estimate)

(see instructions)

Date rdeceived

(see instructions)

MISC

.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Description of noncash property given

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

STF FED7956F 5

______ VARIOUS .

ate received

------------------------------------------------------------------------------------------------------------------------------------(a) No.

from

Part I

127'158

$ ---------- -------------

Date received

(a)

FNIV (or estimate)

(see instructions)

Description of noncash property given

------------------------------------------------------------------------------------------------------------------------------------(a) No .

from

Part I

M

FMV (or estimate)

(see instructions)

$ ------------------------

---------------------------

Schedule B (Form 990, 990-EZ, or 990-PF) (2003)

z220

Underpayment of Estimated Tax by Corporations

t See separate instructions .

Department of the Treasury

Internal Revenue Service

THE TJX FOUNDATION,

OMB No 1545-0142

" Attach to the co rporation's

20103

tax return.

Identification number

I 04! 23I99t7'6p

INC .

Note : In most cases, the corporation does not need to file Form 2220. (See Part I below for exceptions.) The IRS will figure any penalty

owed and bill the corporation. If the corporation does not need to file Form 2220, it may still use it to figure the penalty. Enter the

amount from line 36 on the estimated tax penalty line of the corporation's income tax return, but do not attach Form 2220.

,/ Reasons for Filing - Check the boxes below that apply . If any boxes are checked, the corporation must file

Form 2220, even if it does not owe the penalty . If the box on line 1 or line 2 applies, the corporation may be

able to lower or eliminate the penalty .

1 [:1 The corporation is using the adjusted seasonal installment method

2 f I The corporation is using the annualized income installment method

3 [ :1 The corporation is a "large corporation" figuring its first required installment based on the prior years tax

90Ma

Fi g urin g the Unde rp ay ment

. . . . . . . . . . . . . . . .

4

Personal holding company tax (Schedule PH (Form 1120), line 26) included on line 4

b Look-back interest included on line 4 under section 460(b)(2)for completed long-term

contracts or section 167(8) for depreciation under the income forecast method . .

5a

' ,

c Credit for Federal tax paid on fuels (see instructions)

d Total . Add lines 5a through 5c

. .

5c

4

Total tax (see instructions) . . .

. . . .

.

. .

.

. . . . . . .

. . . . .

5a

. . . . . . . . . .

. . . . .

. . .

. . . .

700

5b

5d

6

Subtract line 5d from line 4 If the result is less than $500, do not complete or file this form The corporation

does not owe the penalty . . . . . . .

. .

6

700

7

Enter the tax shown on the corporation's 2002 income tax return (see instructions) . Caution : If the tax is zero

or the tax year was for less than 12 months, skip this line and enter the amount from line 6 on line 8 . . .

7

1 , 653

8

Enter the smaller of line 6 or line 7 If the corporation is required to skip line 7, enter the amount from line 6

(a)

(b)

(c)

Installment due dates . Enter in columns (a) through (d) the

15th day of the 4th (Form 990-PF filers : Use 5th month), 6th,

0 6/16/03 0 7 /15/03 10/15/03

9

9th, and 12th months of the corporation's tax year . ,

9

g

(d)

700

(e)

01/15/04

Exception . If one of your installment due dates is September

15, 2003, or September 15, 2004, see the instructions.

10

11

Required installments . If the box on line 1 and/or line 2

above is checked, enter the amounts from Schedule A, line

38 If the box on line 3 (but not 1 or 2) is checked, see

instructions for the amounts to enter If none of these boxes

are checked, enter 25% of line 8 above in each column

175

10

175

175

175

1,835 .

1,660

1,485

1,835

0

1 , 835

1,660

0

1 , 660

1,485

0

1 , 485

0

0

0

Estimated tax paid or credited for each period (see

instructions) For column (a) only, enter the amount from line

11 on line 15 . . . . . .

.. . . . . .

Complete lines 12 through 18 of one column before

going to we next column.

11

12

13

14

75

Enter amount, if any, from line 18 of the preceding column

. . . . .

Add pines 11 and 12 .

. . . . . . . . . .

Add amounts on lines 16 and 17 of the preceding column

Subtract line 14 from line 13 If zero or less, enter-o-

12

13

14

15

16

If the amount on line 15 is zero, subtract line 13 from line

14. Otherwise, enter -0- . . . .

. .

,s

17

Underpayment If line 15 is lessthan or equal to line 10, subtract

line 15 from line 10 . Then go to line 12 of the next column

0

0

0

17

. .

. .

Otherwise, go to line 18 . . .

Overpayment If line 10 is less than line 15, subtract line 10

from line 15 Then go to line 12 of the next column

18

1,835

1,660

1,485

Complete Part 111 on page 2 to figure the penalty. If there are no entries on line 17, no penalty is owed.

18

For Paperwork Reduction Act Notice, see separate instructions.

isa,

STF FED4449F 1

2,010 .

~

010

0

0

1,310

1 310

0

1 , 310

0

1,310

Form 2220 (2003)

THE TJX COMPANIES, INC.

The TJX Foundation, Inc.

Giving Guidelines And Mission Statement

Thank your for your interest in receiving funding from The TJX Foundation, Inc.

Enclosed you will find a copy of the Foundation's mission statement and guidelines.

The Foundation would be happy to review a proposal from your organization that is

consistent with our mission and funding guidelines.

The TJX Foundation Allocation Committee meets approximately every other month to

consider grant proposals and corporate contribution requests . All requests are reviewed

on a case-by-case basis . The deadline for the submission of grant proposals is four weeks

prior to a meeting; however, this is a first-come, first-served deadline and does not

guarantee inclusion in an upcoming meeting. Please call to inquire about the current cutoff date . In addition, time-sensitive / deadline driven corporate contribution requests

must be submitted three months prior to the actual date of the event.

Please note that support for special events and table sponsorship through The Foundation

is yM limited. Also, we adhere strictly to our policy of funding an organization or

program only one time per fiscal year . In addition, the Foundation will not review any

proposals for programs and organizations that have not been in operation for twelve or

more months.

Grant proposals and corporate contribution requests must be submitted in writing and

sent to:

Christine A . Strickland

TJX Foundation Manager

The TJX Foundation

c/o The TJX Companies, Inc .

770 Cochituate Road, Route XSN

Framingham, MA 01701

General Application Information

The primary focus of our contributions is toward programs that help disadvantaged

families, women and children . We support organizations in communities where one or

more of our divisions operate a store and whose programs help to:

"

"

"

"

Promote sound mental and physical health ;

Provide shelter;

Enhance education /job readiness; and

Build community ties

The TJX Foundation Giving Guidelines / Mission Statement

In an effort to prevent a delay in the processing of your grant request, proposals to The TJX

Foundation must include everything outlined on this page. Please limit items 1 through 6 to three to

five pages in total :

1 . Description of organization and its purpose (not to exceed more than 2 paragraphs), and the year

your organization was founded.

2. If your organization has multiple programs, please be specific about the one program for which

you are seeking funding. Please provide a program description including the program's goals

and objectives, and an explanation of precisely how this program helps the target audience .

3. Detailed description of the nro~ram's target audience (please include the age of the target group,

the number of people served, different ethnic backgrounds, etc.).

4. Evidence of program need and organization's past history in dealing with a similar problem.

5. Method of evaluation .

6. Outline of alternative plan if all necessary funds are not raised .

7. Copy of your IRS 501(c)(3) exemption letter, (note: this is the Federal IRS letter ; a state tax

exemption certificate is not acceptable). If the required Federal IRS 501(c)(3) letter is not

included, it may result in the disqualification of your request.

8 . Program budget and dollar amount requested from the Foundation; (with the exception of

certain types of programs or other extenuating circumstances, salaries, as a percent of budgeted

expenses, should not exceed certain limitations) .

9 . Current audited financial report and statement of functional expenses .

10. Current operating budget .

11 . List of Board of Directors.

12. List of contributors and amounts received in last fiscal year .

The TJX Companies, Inc.

The TJX Companies, Inc. is the leading off-price retailer of apparel and home fashions in the

United States and worldwide. As of January 31, 2004, the Company operates 745 T.J . Maxx, 673

Marshalls, 182 HomeGoods, 99 A.J. Wright, and 31 Bob's Stores in the United States . In Canada,

the company operates 185 Winners and HomeSense stores, and in Europe, 147 T.K. Maxx stores .

Sincerely,

Christine A. Strickland

TJX Foundation Manager

2

The T3X Foundation Giving Guidelines / Mission Statement

The TJX Foundation, Inc .

Contribution Program Mission Statement

The TJX Foundation, Inc . has a primary mission of contributing to programs that help

disadvantaged women, children and families in communities in which we do business. The

foundation's mission is to promote sound mental and physical health, provide shelter, enhance

education and job readiness, and build community ties .

Contributions will conform to the following guidelines:

"

Civic/ Community:

Emphasis will be on programs that promote improved race

relations, community development and housing.

"

Education :

Support will go to programs that benefit children of preschool age

through college, which provide scholarship or vocational education

for the disadvantaged; strengthen leadership in the public schools;

teach people to speak, read and write English; and encourage

collaboration between community agencies and the schools.

Health:

Support will go toward organizations that provide health care to

underserved populations. We will seek programs that provide early

and comprehensive prenatal services, immunizations and health

screening for children who lack them, as well as preventative care and

alternatives to hospitalization.

Social Services :

Families and children will be the chief beneficiaries of our social

service contributions. We will give to programs that strengthen the

family unit; help single-parent families ; deal with the problems

associated with domestic violence; and help the physically impaired .

Art/ Culture:

While not the main focus of our funding, we will favor proposals

which bring art or artists to new audiences, and support initiatives that

encourage people, especially the handicapped, young or

disadvantaged, to express themselves through art.

"

Our charitable contributions will be directed toward those priority or targeted markets in which The

TJX Companies, Inc.'s stores, home office and distribution centers are located.

3

The TJX Foundation Giving Guidelines / Mission Statement

The TJX Foundation, Inc.

Corporate Giving Program

The TJX Foundation's program is an investment . . .in our communities . . .in our children . . .and in

our future . TJX takes this investment very seriously. We manage our Foundation program as we

do any other part of our business . . .by setting standards and measuring against them. The TJX

Companies, Inc.'s Corporate Giving program consists of:

The TJX Foundation, Inc.

The TJX Foundation, sponsored solely by The TJX Companies, Inc., was established in 1989 to

carry out the social responsibility of the Company, by providing assistance to the communities in

which it operates .

The overriding concern of The TJX Foundation is to support qualified, tax exempt, 501(c)(3),

nonprofit organizations that provide services which promote and improve the quality of life for

children, women and families in need .

Support is focused on services, programs and organizations designed to strengthen the education,

empowerment and economic development of children, women and families within the

communities in which they reside .

Emergency assistance programs, such as disaster relief intervention projects, are also supported

through the Foundation.

Corporate Contributions Fund

This fund was established to support projects that would benefit The TJX Companies, Inc .

through promotional vehicles such as ad space purchases and dinner table sponsorships .

4

The TJX Foundation Giving Guidelines / Mission Statement

General Funding Guidelines

Populations Served:

"

"

"

"

Children

Teens

Women

Families

Persons with disabilities

(mental / physical)

Persons with AIDS / HIV

"

"

"

"

Disadvantaged

Underprivileged

Underserved

Low income

Racially and ethinically diverse

populations

Populations Declined :

"

"

International organizations /

programs

Other giving organizations

"

"

"

Offenders

Ex-offenders

Prison population

Funding Restrictions - the Foundation will not fund :

"

"

"

"

"

"

"

"

"

"

"

Requests for salaries

Individuals

Unrestricted grants

Seed money / start up costs

Computer purchases

Cash reserves

Education loans

Fellowships

Political organizations

Programs in operation for less

than 12 months

Training $ / Stipends

"

"

"

"

"

"

"

"

"

"

"

"

5

Travel grants / Transportation

Films / photography

Conference / seminar

Publications

Environmental issues

Endowments

Public policy research / advocacy

New construction

Capital campaign requests

Renovations / Building expansions

Conventions

Consultant fees / salaries

The TJX Foundation Giving Guidelines / Mission Statement

Mission Statement Categories

Civic / Community:

Support:

"

"

"

"

"

"

Decline support:

Anti-racism

Civil rights

Intercultural relations

Housing equal opportunity / access

Housing support

Public safety / crime prevention

Independent living for the disabled

Volunteerism

"

"

"

"

"

"

"

"

Business development

Community organizing

Consumer education protection

Leadership development

Non-profit development / technical

Tenant rights

Public policy research / advocacy

Voter education