Chapter 1 - The Role of Managerial Finance - Savoir

advertisement

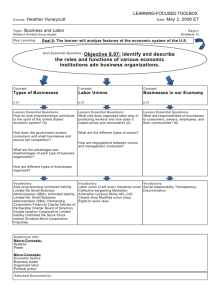

Chapter 1 - The Role of Managerial Finance August 19, 2015 1 Learning Goals • Define finance and managerial finance • Describe the legal forms of a business • Describe the goal of the firm - why is maximizing value better than maximizing profit? • Describe how the managerial function is related to economics and accounting • Identify the primary activities of the financial manager • Describe the nature of the principal-agent relationship and explain how various corporate governance mechanisms attempt to manage agency problems 2 What is Finance Finance can be described as the science of managing money 1) Personal finance - individual decisions on how much is earned, consumed, saved, and invested. 2) Business finance - how firms decide to earn money, invest & reinvest, save, and distribute back to investors . Careers in finance can either be classified as financial services or managerial finance. Financial services - providing advice and financial products to individuals, businesses, and governments. CFP designation Managerial finance - administer financial affairs of both public and private companies, profit and non-profit. They will develop financial plans, budgets, terms of credit for customers, evaluate investments/expenditures, plans for raising capital, strategies, risk management, and much more. CFA designation 1 3 Legal forms of Business Organizations • Sole Proprietorship unlimited liability and limited life • Partnership unlimited liability and limited life • Limited Partnership One (or more) partners has unlimited liability while other partners (typically passive) may have limited liability. • Limited Liability Partnership Partners have unlimited liability for their own actions. • Corporation limited liability and unlimited life • S Corporation Less than 100 stockholders - tax as partnership (organization benefits of a corp and tax benefit of partnership). • Limited Liability Company Limited liability and partnership tax rate, and can own upto 80% of another company 4 Goal of the Firm What goal should the manager pursue? • Maximize Profit • Earnings are typically measured in terms of EPS • Max shareholder value vs. Max profit • Timing of profits, cash flows, risk, etc... * * * * 5 Risk Aversion Risk return trade-off - Assumption of minimize risk and maximize return Investors require compensation for assuming risk Shareholder -owner of the firm(stake holder or equity holder or stock holder) Debt holder -promised cashflow ... no ownership! Relationship to Economics Marginal cost vs. marginal benefit trade-off ... analysis; Max benefit till MB = MC If MB ¡ MC What should be done? 6 Relationship to Accounting Accrual based vs. cash flows refer to the income statement and free cash flow Free Cash Flow monies available to be paid out to investors - stockholders (owners) and debtholders (lenders of capital) Cash is King 2 7 Corporate Governance Rules, processes, and laws by which companies are operated, controlled, and regulated. Shaped by the goals of the shareholders, board of directors, officers, lenders of capital and credit, supply chain partners, competitors and government regulation. 8 Individual vs. Institutional Investor Individual typically owns relatively small quantities of shares to meet personal investment goals Institutional investment professionals such as banks, insurance, mutuals, hedge funds, and pension funds that are paid to manage large quantities of securities for other investors. 9 Government Regulation Typically shapes the governance of all firms. Sets rules to provide consistency and transparency - to prevent scandals lending to investor loss. Scandals typically due to: • False disclosure in financial reporting or other material information releases • Undisclosed conflicts of interest between firms and their agents as well as owners Sarbanes-Oxley Act of 2002 (SOX) Goal of regulation/deregulation should be to maximize total societal benefit relative to total societal cost of regulation. 10 Agency Issues Who is the Principal? Who is the Agent? Principal-Agent Problem The agent (manager) should have the same goal as the shareholder (principal) = MAXIMIZE FIRM VALUE. However, the agent maximize his/her own utility at the expense of the shareholder’s wealth • Corporate jet for personal use • Hunting trips or corporate retreats • Company CC • Share repurchases to increase metrics employed for calculating compensation Aligning Shareholder and Manager Interests 3 • Incentive plans - compensation linked to share price • Stock options - again linked to share price • Performance plans - compensation linked to growth or EPS • Performance shares Page 23, How closely are pay and performance linked? Agency Costs - costs that owner’s bear resulting from an agent’s actions 4