Managerial Finance

advertisement

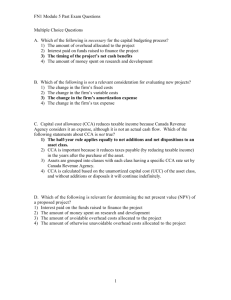

Managerial Finance Introduction Objectives What is Financial Management? Types of Decisions and Theories 10 basic finance principles What is Finance Management? Financial management is simply “the ways and means of managing money” (MacMenamin, 1999, p. 9). What is Finance Management? “Concerns the acquisition, financing, and management of assets with some overall goal in mind” (Van Horne & Wachowicz, 2001). Investment Decisions Most important of the three decisions. What specific assets should be acquired? What assets (if any) should be reduced or eliminated? Financing Decisions Determine how the assets (LHS of balance sheet) will be financed (RHS of balance sheet). What is the best type of financing? What is the best financing mix? What is the best dividend policy? How will the funds be physically acquired? Asset Management Decisions How do we manage existing assets efficiently? Financial Manager has varying degrees of operating responsibility over assets. Greater emphasis on current asset management than fixed asset management. What is the Goal of the Firm? Maximization of Shareholder Wealth! Value creation occurs when we maximize the share price for current shareholders. Strengths of Shareholder Wealth Maximization Takes account of: current and future profits and EPS; the timing, duration, and risk of profits and EPS; dividend policy; and all other relevant factors. Thus, share price serves as a barometer for business performance. What is Financial Management? MacMenamin (1999) further develops this definition: “analyzing financial situations, making financial decisions, setting financial objectives, formulating financial plans to attain those objectives, and providing effective systems of financial control to ensure plans progress towards the set objectives” (p. 9). What is Financial Management? What is Financial Management? MacMenamin, (as seen in Figure 1), proffers that financial management is concerned with analysis, decisionmaking, planning, and control. The key ingredient in these interrelated activities is financial data and information. What is Financial Management? INFORMATION: the quality of the information used and processed, and the professionalism of the financial manger are determining factors in financial analysis, decision-making, planning and control. FINANCIAL ANALYSIS AND REVIEW refers to the process by which managers evaluate and review the current financial situation of an organization, and based on this review, make decisions, objectives and strategies What is Financial Management? FINANCIAL PLANNING is the tool that makes the achievement of goals and objectives possible. An example of a key financial planning tool is the budget. The essence of financial planning is to plan the allocation, coordination, and prioritizing of human capital and financial resources, e.g., to ensure that financial resources and input are available for the good or service that will be provided. FINANCIAL CONTROL: ensures that all activities and strategies are in accordance with the overall plan, consisting of accounting, reporting and control management system(s) What is Financial Management? McKinney, (as seen in Figure 2), expands the definition of financial management to include not only financial activities and processes, but also management activities, with both processes depending on the financial administrative system. He further defines these two processes into six sequential components: 1) planning, 2) strategy, 3) budgeting, 4) financing, 5) controlling and 6) evaluation. Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting PLANNING is the first step and establishes the mission, vision, values, goals, and objectives that will be pursued. Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting STRATEGY translates the values and mission of the organization into detailed and measurable goals and objectives to be achieved within a specific time-frame. Financing MIS What is Financial Management? Financial Activities Organizational Planning Activities BUDGETING Planning Evaluating Strategy Controlling Budgeting is the mechanism that makes it possible to achieve these goals and objectives via allocation, coordination, and prioritizing between the services needed and resources available. Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting FINANCING: Financial resources facilitate and make possible the achievement of the desired outcomes detailed in strategic plans, goals, and objectives. Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting Financing CONTROLLING “assures that the activities planned and programmed are carried out according to the detailed preestablished work plan” (McKinney, 1986, p. 3). The major functions involved are accounting, auditing, reporting, and MIS purchasing. Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting EVALUATION of activities and results is also essential to determine whether the organization is complying with its overall goals and objectives. Financing MIS Financial Activities Organizational Planning Activities What is Financial Management? Planning Evaluating Strategy Controlling Budgeting MIS: 1. Provides timely information when needed 2. Allows to monitor, control and solve problems 3. Facilitates managers to respond to the needs of the organization Financing MIS Review Question TAKE TEN MINUTES In your groups of 3 or 4, in your own words describe what is financial management. Ten Principles That Form The Foundations of Financial Management 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Risk & Return Trade Off Time Value of Money Cash (Not Profits) Incremental Cash Changes Curse of Competitive Market Efficient Capital Markets Agency Theory Tax Effect All risk is not equal Ethical Behavior Is Doing the Right Thing Principle 1: The Risk-Return Trade-off We won’t take on additional risk unless we expect to be compensated with additional return. Investment alternatives have different amounts of risk and expected returns. The more risk an investment has, the higher its expected return will be. Principle 2: The Time Value of Money A dollar received today is worth more than a dollar received in the future. Because we can earn interest on money received today, it is better to receive money earlier rather than later. Principle 3: Cash—Not Profits—Is King Cash Flow, not accounting profit, is used as our measurement tool. Cash flows, not profits, are actually received by the firm and can be reinvested. Principle 4: Incremental Cash Flows It is only what changes that counts The incremental cash flow is the difference between the projected cash flows if the project is selected, versus what they will be, if the project is not selected. Principle 5: The Curse of Competitive Markets It is hard to find exceptionally profitable projects If an industry is generating large profits, new entrants are usually attracted. The additional competition and added capacity can result in profits being driven down to the required rate of return. Product Differentiation, Service and Quality can insulate products from competition Principle 6: Efficient Capital Markets The markets are quick and the prices are right. The values of all assets and securities at any instant in time fully reflect all available information. Principle 7: The Agency Problem Modern Corporation Shareholders Management There exists a SEPARATION between owners and managers. Role of Management Management acts as an agent for the owners (shareholders) of the firm. An agent is an individual authorized by another person, called the principal, to act in the latter’s behalf. Agency Theory Jensen and Meckling developed a theory of the firm based on agency theory. Agency Theory is a branch of economics relating to the behavior of principals and their agents. Agency Theory Principals must provide incentives so that management acts in the principals’ best interests and then monitor results. Incentives include, stock options, perquisites, and bonuses. Principle 8: Taxes Bias Business Decisions The cash flows we consider are the after-tax incremental cash flows to the firm as a whole. Principle 9: All Risk is Not Equal Some risk can be diversified away, and some cannot The process of diversification can reduce risk, and as a result, measuring a project’s or an asset’s risk is very difficult. Principle 10: Ethical Behavior Is Doing the Right Thing, and Ethical Dilemmas Are Everywhere in Finance Each person has his or her own set of values, which forms the basis for personal judgments about what is the right thing Review Question In groups of 2 or 3: Provide an example for each principle