Mergers, acquisitions and takeovers: the takeover of Cadbury by Kraft

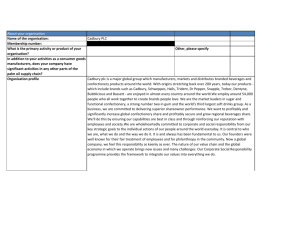

advertisement