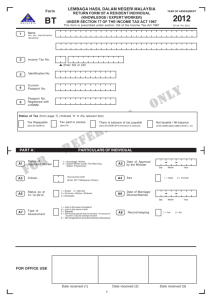

BT 2013 2013 - Lembaga Hasil Dalam Negeri

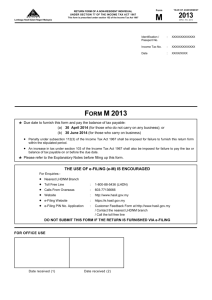

advertisement

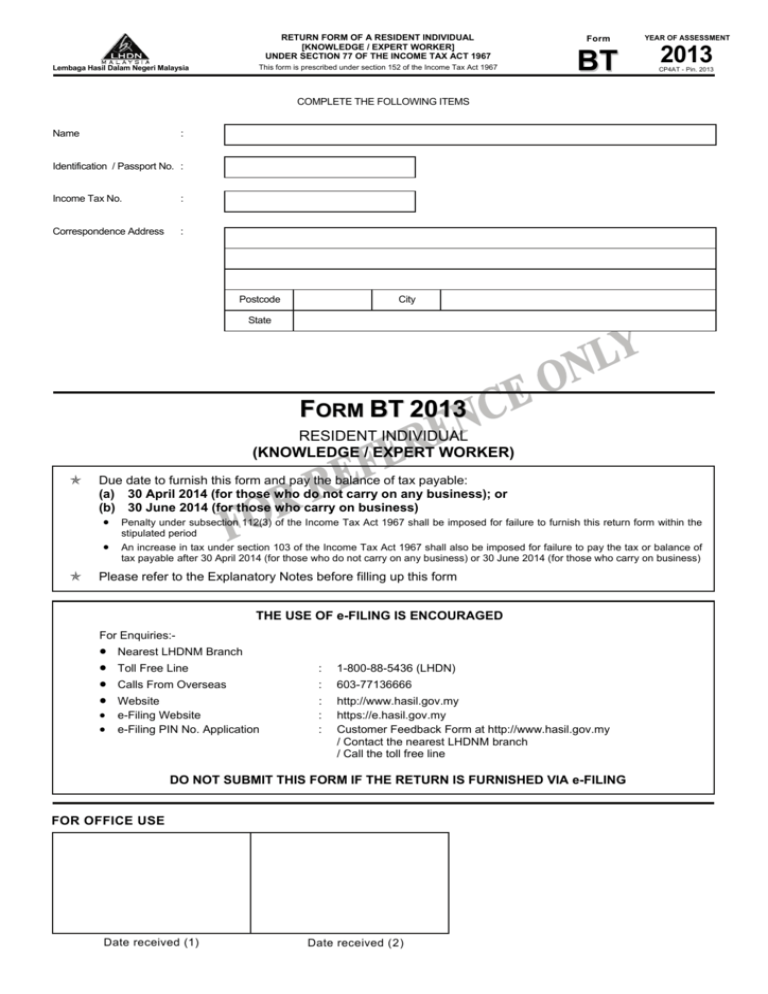

RETURN FORM OF A RESIDENT INDIVIDUAL [KNOWLEDGE / EXPERT WORKER] UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 Lembaga Hasil Dalam Negeri Malaysia Form BT YEAR OF ASSESSMENT 2013 CP4AT - Pin. 2013 COMPLETE THE FOLLOWING ITEMS Name : Identification / Passport No. : Income Tax No. : Correspondence Address : Postcode City State FORM BT 2013 RESIDENT INDIVIDUAL (KNOWLEDGE / EXPERT WORKER) Due date to furnish this form and pay the balance of tax payable: (a) 30 April 2014 (for those who do not carry on any business); or (b) 30 June 2014 (for those who carry on business) • Penalty under subsection 112(3) of the Income Tax Act 1967 shall be imposed for failure to furnish this return form within the • stipulated period An increase in tax under section 103 of the Income Tax Act 1967 shall also be imposed for failure to pay the tax or balance of tax payable after 30 April 2014 (for those who do not carry on any business) or 30 June 2014 (for those who carry on business) Please refer to the Explanatory Notes before filling up this form THE USE OF e-FILING IS ENCOURAGED For Enquiries:- • • • • Nearest LHDNM Branch Toll Free Line : 1-800-88-5436 (LHDN) Calls From Overseas : 603-77136666 Website : : : http://www.hasil.gov.my https://e.hasil.gov.my Customer Feedback Form at http://www.hasil.gov.my / Contact the nearest LHDNM branch / Call the toll free line • e-Filing Website • e-Filing PIN No. Application DO NOT SUBMIT THIS FORM IF THE RETURN IS FURNISHED VIA e-FILING FOR OFFICE USE Date received (1) Date received (2) RETURN FORM OF A RESIDENT INDIVIDUAL [KNOWLEDGE / EXPERT WORKER] UNDER SECTION 77 OF THE INCOME TAX ACT 1967 Form BT This form is prescribed under section 152 of the Income Tax Act 1967 Lembaga Hasil Dalam Negeri Malaysia CP4AT - Pin. 2013 BASIC PARTICULARS 1 Name (as per identification document) 2 Income Tax No. 3 Identification No. 4 Current Passport No. 5 Passport No. Registered with LHDNM PART A: A1 A3 PARTICULARS OF INDIVIDUAL 1 = Knowledge Worker 2 = Expert Worker Status of Approved Worker Citizen A5 Status as at 31-12-2013 A7 Type of Assessment A8 Record-keeping PART B: A2 Date of Approval by the Minister Use Country Code (Enter ‘MY’ if Malaysian Citizen) A4 Sex 1 = Male 1 = Single 2 = Married A6 Date of Marriage / Divorce / Demise 3 = Divorcee/Widow/Widower 4 = Deceased 1 = Joint in the name of husband 3 = Separate 4 = Self whose spouse has no income / no source of 2 = Joint in the name of wife income / has tax exempt income 1 = Yes 5= Self (single/divorcee/widow/widower/deceased) 2 = No STATUTORY INCOME, TOTAL INCOME AND CHARGEABLE INCOME RM B1 Statutory income from businesses B1 B2 Statutory income from partnerships B2 B3 Aggregate statutory income from businesses ( B1 + B2 ) B3 B4 LESS: Business losses brought forward (Restricted to amount in B3) B4 B5 Total ( B3 – B4 ) B5 B6 Statutory income from employment B6 B7 Statutory income from dividends and rents B7 B8 Statutory income from interest, discounts, royalties, premiums, pensions, annuities, other periodical payments, other gains or profits and additions to pursuant to paragraph 43(1)(c) B8 B9 AGGREGATE INCOME ( B5 + B6 + B7 + B8 ) B9 B10 LESS: Current year business losses (Restricted to amount in B9) B10 B11 TOTAL ( B9 – B10 ) B11 B12 LESS: Other deductions [ Qualifying prospecting expenditure and Qualifying farm expenditure ] ( Restricted to amount in B11) B12 B13 LESS: Approved Donations / Gifts / Contributions B13 B14 TOTAL ( B11 – B12 – B13 ) (Enter “0” if value is negative) B14 B15 TAXABLE PIONEER INCOME B15 B16 TOTAL INCOME (SELF)( B14 – B15 ) B16 B17 TOTAL INCOME TRANSFERRED FROM HUSBAND / WIFE * FOR JOINT ASSESSMENT B17 Sen . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 1 = With business income 2 = Without business income * Type of income transferred from Husband / Wife B18 AGGREGATE OF TOTAL INCOME ( B16 + B17 ) B18 B19 Total Relief (Amount from H19) B19 B20 CHARGEABLE INCOME ( B16 – B19 ) or ( B18 – B19 ) (Enter “0” if value is negative) B20 B20a Special Relief RM2,000 [if B9 does not exceed RM96,000] B20a B20b CHARGEABLE INCOME ( B20 – B20a ) (Enter “0” if value is negative) B20b PART CA: 2 = Female TOTAL INCOME TAX . 00 . 00 . 00 . 00 . 00 [ Note: Fill in Part CA for Knowledge Worker (If A1 = 1) ] CA1 Chargeable Income subject to Part XIV of Schedule 1 A = B= C= Gross income from employment with a designated company Total gross income from all sources Chargeable income (From B20 or B20b) Income Tax A C X B Income Tax Computation In Respect of Chargeable Income Subject to Part I of Schedule 1 CA2 (Refer to the tax rate schedule provided at the LHDNM website, http://www.hasil.gov.my) . 00 . 00 CA2a Tax on the first CA2b Tax on the balance Income Tax CA3 PART CB: TOTAL INCOME TAX CB1 Chargeable Income subject to Part XV of Schedule 1 CB2 . . . CA2a CA2b At Rate (%) CA3 TOTAL INCOME TAX ( CA1 + CA2a + CA2b ) A = Statutory income from employment with the person resident in Malaysia B = Aggregate income (From B9) C = Chargeable income (From B20 or B20b) . At Rate 15% [ Note: Fill in Part CB for Expert Worker (If A1 = 2) ] A C X = B Income Tax Computation In Respect of Chargeable Income Subject to Part XV of Schedule 1 . 00 . 00 CB2a Tax on CB2b Tax on the balance 1 Income Tax At Rate 15% CB2a At Rate 15% CB2b . . Name : ……………………………………………………………………………………… . Income Tax No. : ……………………………………………………… Income Tax Computation In Respect of Chargeable Income Subject to Part I of Schedule 1 (Refer to the tax rate schedule provided at the LHDNM website, http://www.hasil.gov.my) Income Tax At Rate (%) . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 CB2c Tax on the first CB2d Tax on the balance CB2e Tax on the balance CB2f Tax on the balance CB2g Tax on the balance CB2h Tax on the balance CB2i Tax on the balance CB2j Tax on the balance CB3 TOTAL INCOME TAX [CB2a to CB2j] PART D: Total Rebate D1 CB2e CB2f CB2g CB2h CB2i CB2j CB3 .00 Self TAX PAYABLE AND STATUS OF TAX . 00 Husband / Wife . Zakat and Fitrah TOTAL TAX CHARGED [ ( CA3 – D1 ) or ( CB3 – D1 ) ] (Enter “0” if value is negative) D3 LESS: D4 TAX PAYABLE ( D2 – D3 ) D5 OR: TAX REPAYABLE ( D3 – D2 ) D5 D6 Instalments / Monthly Tax Deductions paid for 2013 income – SELF and HUSBAND / WIFE for joint assessment D6 D7 Balance of Tax Payable ( D4 – D6 ) / Tax Paid in Excess ( D6 – D4 ) D7 . Section 110 (others) D2 Section 132 and 133 . . . . . . . . D1 D2 Section 51 of Finance Act 2007 (dividends) . . . . . . . . . CB2c CB2d . D3 D4 (Enter “ X “ if Tax Paid in Excess) PART E: Name of Husband / Wife E1 (as per identification document) E2 PARTICULARS OF HUSBAND / WIFE E3 Identification No. PART F: F1 Passport No. OTHER PARTICULARS Address of F2 Business Premise Telephone No. F3 e-Mail F4 Name of Bank * F5 Bank Account No. * F6 Employer’s No. Postcode E City State * Note: Complete Name of Bank and Bank Account No. for the refund of “Tax Repayable” or “Tax Paid in Excess” PART G: INCOME OF PRECEDING YEARS NOT DECLARED Type of Income Year for which Paid Provident and Pension Fund Contribution Gross Amount . 00 . 00 G1 G2 PART H: H1 Individual and dependent relatives . 00 . 00 DEDUCTIONS 6,000 . 00 . 00 . 00 . 00 RESTRICTED TO 5,000 . 00 9,000 Medical treatment, special needs and carer expenses for parents (certified by medical practitioner) RESTRICTED TO 5,000 H3 Basic supporting equipment for disabled self, spouse, child or parent RESTRICTED TO 5,000 H4 Disabled individual Education fees (self): (i) other than a degree at Masters or Doctorate level - for acquiring law, accounting, Islamic financing, technical, H2 H5 H6 H7 H8 H9 H10 H11 H12 vocational, industrial, scientific or technological skills or qualifications (ii) degree at Masters or Doctorate level - for acquiring any skill or qualification Medical expenses on serious diseases for self, spouse or child Husband/Wife/Payment of alimony to former wife H14 Disabled husband/wife H15 Child RESTRICTED TO 3,000 RESTRICTED TO 6,000 RESTRICTED TO No. H15b Child - 18 years & above and studying Child - Disabled child 100% Eligibility . 00 . 00 3,500 H15a . 00 H15b . 00 H15c . 00 . 00 . 00 . 00 . 00 RESTRICTED TO 10,000 50% Eligibility No. X 1,000 = X 500 = X 1,000 = X 500 = X 6,000 = X 3,000 = X 5,000 = X 2,500 = X 11,000 = X 5,500 = Life insurance and provident fund RESTRICTED TO 6,000 H17 Private Retirement Scheme and Deferred Annuity RESTRICTED TO 3,000 H18 Education and medical insurance RESTRICTED TO 3,000 H19 Total relief (H1 to H18) (Transfer this amount to B19) 2 . 00 . 00 . 00 . 00 . 00 . 00 . 00 300 RESTRICTED TO 3,000 H15a Child - Under the age of 18 years H16 RESTRICTED TO 1,000 The Sale and Purchase Agreement has been executed within 10/03/09 - 31/12/10 H13 H15c RESTRICTED TO 5,000 Complete medical examination for self, spouse or child (restricted to 500) Purchase of books/magazines/journals/similar publications (except newspapers and banned reading materials) for self, spouse or child Purchase of personal computer for individual (deduction allowed once in every 3 years) Net deposit in Skim Simpanan Pendidikan Nasional (total deposit in 2012 minus total withdrawal in 201) Purchase of sports equipment for any sports activity as defined under the Sports Development Act 1997 Interest on housing loan (Conditions for eligibility to claim must be fulfilled) Name: ………………………… … ………………………… ………………………… ……………… FINANCIA AL PARTICULA ARS OF INDIVIIDUAL [MAIN BU USINESS ONLY] PART J: J J1 J2 Income e Tax No. : ………… ….…………………… ………………………… ………………. Na ame of Business Bu usiness Code BALANCE SH HEET TR RADING, PROFIT T AND LOSS ACC COUNT J3 Fixed Assets: . 00 Sa ales / Turnover LE ESS : J4 Op pening Stock J5 Pu urchases and Cosst of Production J6 Closing Stock J7 Co ost of Sales ( J4 + J5 - J6 ) J8 GR ROSS PROFIT / L LOSS ( J3 – J7 ) . 00 . 00 . 00 . 00 . 00 (Enter ‘X’ iff negative) IN NCOME: J9 Otther Business J10 Dividends J11 Intterest and Discounts J12 Re ents, Royalties an nd Premiums J13 Otther Income J14 To otal ( J9 to J13 ) EX XPENSES: J15 Lo oan Interest J16 Sa alaries and Wagess J17 Re ental / Lease J18 Co ontracts and Subccontracts J19 Co ommissions J20 Ba ad Debts J21 Trravelling and Transport J22 Re epairs and Mainte enance J23 Prromotion and Adve ertisement J24 Otther Expenses OTAL EXPENDIT TURE TO ( J15 J to J24 ) J26 NE ET PROFIT / LOS SS J25 J28 8 Land and Buildings J29 9 Plant and Mac chinery J30 0 Motor Vehicles J31 Other Fixed Assets A D ASSETS TOTAL FIXED ( J28 to J31 ) Investments J32 2 3 J33 . 00 . 00 . 00 . 00 . 00 . 00 Current Asse ets: J34 4 Stock J35 5 Trade Debtors s . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 6 J36 Sundry Debtors J37 7 Cash in Hand 8 J38 Cash at Bank . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 . 00 J41 RENT ASSETS TOTAL CURR ( J34 to J39 ) ETS TOTAL ASSE ( J32 + J33 + J40 ) LIABILITIES : 2 J42 Loans and Ov verdrafts J43 3 Trade Creditors 4 J44 Sundry Creditors (Enter ‘X’ if negative) 9 J39 J40 0 J45 5 Other Current Assets . 00 . 00 . 00 . 00 . 00 . 00 TOTAL LIABIILITIES ( J42 to J44 ) OWNER’S EQ QUITY : 6 J46 Capital Account J47 7 unt Balance Brougght Current Accou Forward 8 J48 . 00 . 00 . 00 (Enter ‘X’ if negative) . 00 Current Year Profit / Loss (Enter ‘X’ if negative) J49 9 . 00 Net Advance / Drawing (Enter ‘X’ iff negative) (Enter ‘X’ if negative) . 00 J27 No on-Allowable Expe enses J50 0 unt Balance Carrieed Current Accou Forward . 00 (Enter ‘X’ if negative) DECLARATION N I Identification / Passport No. hereby declare that the in nformation regarding the income an nd claim for deducctions and reliefs given g by me in this s return form and in any document attached is true, correct c and com mplete. 1 = This return form is made on myy own behalf 3 = as an executor of the deceased d person's estate (if A5 A = 4)* 2= T This return form is mad de on behalf of the individual in item 1 * This form iis not a notification pursuant to subsection 74(3) of the Incom e Tax Act 1967. Plea ase furnish Form CP57 (Notificatio on of Taxpayer’s Dem mise) which is available from the LHDNM M website, http://www w.hasil.gov.my Siggnature Date PART K: K K1 K3 PARTICULARS OF TAX AGEN NT WHO COMPLETES THIS RE ETURN FORM Name of Firm K2 o. Telephone No K4 Signature ax Agent’s Approva al No. Ta IMP PORTANT REMIN NDER Co omplete all relevant items in BLOCK K LETTERS and use u black ink penn. METHOD OF PAYM MENT 1. Payment can be made as follows: 1.1 Bank - Inform mation regarding pa ayment via bank iis available at the LHDNM website, http://www.hasil.ggov.my 1.2 LHDNM - e-Payment through FPX X (Financial Proceess Exchange) at the LHDNM webs site, http://www.haasil.gov.my - Payme ent counters of LH HDNM in Peninsullar Malaysia (Colle ections Branch of LHDNM in Kualaa Lumpur), Sabah and FT Labuan (L LHDNM branch h in Kota Kinabalu u) and Sarawak (LLHDNM branch in Kuching) or by mail: Chequ ues, money orderrs and bank draftts must be crosse ed and made pay yable to the Direector General of Inland Revenue e. When making g payment, use th he Remittance Slipp (CP501) which can c be obtained at the LHDNM webbsite, http://www.h hasil.gov.my. If sentt by post, paymentt must be sent sepparately from the form. Payment by y CASH must not bbe sent by post. 1.3 Pos Malaysiia Berhad - Counte er and Pos Online e 2. Write down the n name, address, telephone t numbe er, income tax nu umber, year of as ssessment, paym ment code “084” aand instalment no. n “99” on the reverse side of the financcial instrument. 3. Check the receip pts / bank paymen nt slips before leav ving the payment counter. In accordance with section 89 of the e Income Tax Actt 1967, a change of address must be furnished to LHDNM L within 3 m months of the cha ange. Notification can be made via e-Kemaskkini or by using Fo orm CP600B (Notiification of Changee of Address) which can be obtaine ed from the LHDN NM website, http:///www.hasil.gov.myy 3