DP 1104-96 - Institute for Research on Poverty

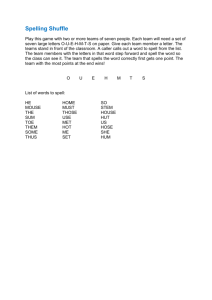

advertisement