The Most Controversial Companies of 2012

advertisement

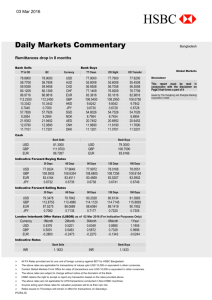

The Most Controversial Companies of 2012 January 2013 RepRisk® is a registered trademark RepRisk AG, January 2013 1 of 13 The Most Controversial Companies of 2012 Over the past 12 months, RepRisk has detected news on thousands of companies across the globe in relation to their environmental, social and corporate governance (ESG) risks. This report analyzes documented controversies, both fact and allegation, related to the 10 firms that received the highest Peak RepRisk Index1 in 2012. The information has been taken from a wide range of sources analyzed by RepRisk including newspapers, news sites, NGO and governmental sites, blogs and social media. The Top Ten Most Controversial Companies of 2012 were: 1. Tazreen Fashions Ltd 2. Olympus Corp 2. Lonmin PLC [Equal Ranking] 4. News Corp Ltd 4. Samsung Group [Equal Ranking] 6. HSBC Holdings PLC 6. Reebok International Ltd [Equal Ranking] 6. ING Bank NV [Equal Ranking] 9. Wyeth LLC 10. TeliaSonera AB The 10 most controversial companies of 2012 were headquartered in different countries in Europe and Asia as well as the US, stemmed from a range of industries including telecommunications, pharmaceutical, media, banking and mining, and spanned the spectrum of ESG issues. Notably, poor labor conditions and human rights violations as well as bribery, fraud and money laundering, were the main issues criticized. Two of the top-ranking firms were included in the report due to specific incidents at their facilities in the second half of the year: a fatal fire at Tazreen Fashions’ factory in Bangladesh; and violent clashes between police and 3,000 striking workers at Lonmin’s Marikana mine in South Africa that led to 34 deaths and many more injuries. Corporate governance scandals that erupted in 2011 and continued to plague the companies in 2012 saw two further companies make the list: Olympus for its alleged decade-long accounting fraud; and News Corp for the hacking and bribery scandal in the UK. HSBC and ING Bank made the top 10 due to accusations of inadequate controls to counter money laundering; the former also for its alleged role in the Libor manipulation. Also on the list, Samsung faced a number of investigations and lawsuits in 2012 for reported anti-competitive practices in the past as well as poor conditions at supplier factories. Wyeth was accused of fraudulently misrepresenting its drugs and neglecting to outline risks to the public and shareholders. TeliaSonera came under fire for alleged corruption and aiding oppressive regimes, while Reebok was also linked to labor breaches within its supply chain and to a fraud scandal in India. 1. The Peak RRI is a risk indicator; it is calculated based on the harshness of the criticism or the gravity of the legal violations, combined with the influence of the source from which the news was taken as well as the newness of the accusation for the particular company. Companies with a Peak of over 50 are considered in the high-risk category. The Peak RRI covers a 2 year period. For this report however, only the Peak RRIs within a 1 year period (2012) were considered. RepRisk® is a registered trademark RepRisk AG, January 2013 2 of 13 1. Tazreen Fashions Ltd – Peak RRI in 2012: 80 [Bangladesh] Garment manufacturer Tazreen Fashions came into the spotlight in late 2012 following a fatal fire at its factory in Bangladesh in which 112 workers died and many more were injured. The company, a subsidiary of the Tuba Group, operated within the highly controversial Bangladeshi textile industry, where numerous activists had long expressed concern about general working conditions, pay, and health and safety. Reportedly, in the months before the fire, employees had staged protests demanding wages owed to them; it was also alleged that the factory improperly stored flammable materials in a nonfireproof area, and lacked a fire safety certificate. It was reported that when the blaze began and the alarm sounded, managers prevented employees from leaving their workstations. According to survivors, exit doors at the factory were locked and stacks of materials blocked the stairways, trapping many people. Bystanders claimed that people were forced to jump from the windows of the eight-story building in an attempt to escape the flames. A preliminary report based on a government inquiry into the incident has recommended that criminal charges be brought against Tazreen’s owner for ‘unpardonable negligence’. Labor rights groups however called for further action, in particular from sourcing companies and demanded a change in industry standards. In particular, NGOs such as Worker Rights Consortium disagree with the findings of the government report that the fire was an act of sabotage. Others have suggested that many more workers were in fact killed and state that authorities have been evasive about the total number of casualties. The amount of compensation offered to victims’ families has also been deemed incredibly insufficient. International retailers and brands such as Wal-Mart, Disney, Sears, Enyce, Teddy Smith, and Edinburgh Woollen Mill have been linked to Tazreen Fashions. In the resulting furor, several of the firms including WalMart and Disney have claimed that their suppliers were not authorized to use the Tazreen factory. RepRisk Index for Tazreen Fashions RepRisk® is a registered trademark RepRisk Relationships for Tazreen Fashions RepRisk AG, January 2013 3 of 13 2. Olympus Corp – Peak RRI in 2012: 73 [Japan] A major corporate governance scandal that first erupted in 2011, the exposure of massive accounting fraud at Olympus dating back to the 1990s, kept the company in the spotlight in early 2012. Following the allegedly improper dismissal of its new CEO in 2011, after he began probing suspicious payments at the company, Olympus was forced to admit to fraudulent activities. This not only led to a high-profile case brought by the former CEO himself, which was reportedly settled for an estimated GBP 10 million, but also to a series of agency investigations across the globe after the improper transfers became public knowledge. Japanese authorities as well as the UK’s Serious Fraud Office and the US Federal Bureau of Investigation conducted related probes. Reportedly, Olympus used fake or existing investment portfolios to illegitimately transfer funds and thereby conceal up to USD 1.7 billion in investment losses from investors and auditors. Furthermore, the company was accused of involvement in questionable mergers and acquisitions over the past two decades for similar purposes. Tokyo police made a number of arrests and three executives pleaded guilty in September 2012 to having filed false financial reports. Four financial advisers were also charged with violation of securities laws and face up to 10 years in jail. The company’s own audit committee filed suit against 19 former and current executives, including several board members, following an investigation commissioned to determine responsibility for the accounting fraud. Moreover, a number of shareholder suits have been lodged in Japan against Olympus executives and the company’s share value reportedly fell at one point by 60 percent. Additionally, the company’s supply chain came under fire during the year with accusations of the use of conflict minerals in its products as well as links to poor working conditions at supplier Chitwig Mould Industry’s factory in China, where employees work up to 220 hours of overtime per month and are penalized for taking leave. Olympus was additionally identified as one of several companies that use suppliers in Vietnam, where there have apparently long been problems with freedom of association and unionization. RepRisk Index for Olympus RepRisk® is a registered trademark World Map for Olympus RepRisk AG, January 2013 4 of 13 2. Lonmin PLC [Equal Ranking] – Peak RRI: 73 [United Kingdom of Great Britain and Northern Ireland] British mining company Lonmin came under fire in August when strikes over wages at its Marikana platinum mine in South Africa escalated, leading to deadly clashes between miners and police forces. On August 10, an estimated 3,000 workers, who allegedly live on USD 2 a day, participated in a strike over their salaries at the mine. Prior to the strike and the resulting massacre, at least 10 people including union representatives, security guards and 2 police officers were killed in clashes. A few days later, on August 16, 34 protesters were shot dead, 78 were injured, and 259 were arrested following violent clashes with police. Lonmin and the South African government were criticized for allowing the protest to escalate. Allegedly, several hundred police officers fired at the demonstrators after unsuccessful attempts to silence them with water cannons and rubber bullets. On August 20, nearly a quarter of the workers returned to the Marikana mine in response to alleged threats by Lonmin to dismiss the 3,000 striking miners if they failed to return. In September, South African President Jacob Zuma announced a Judicial Commission of Inquiry into the Marikana tragedy. Following the incident, the mine was provisionally shut down and Lonmin reportedly considered a USD 1 billion rights issue in order to make up for the losses due to the temporary closure. Xstrata, one of the company’s main shareholders, announced that it was willing to contribute to Lonmin’s fundraising. In the wake of Marikana, South Africa has seen continuing labor unrest at several mines. Companies such as AngloGold Ashanti, Gold One, Anglo American Platinum (Amplats), and Gold Fields have been affected by strikes and protests by some 75,000 miners. Unrest continued throughout November and December at various mines in the country, including Harmony Gold Mining’s Kusasalethu mine in Carletonville and Amplats’ sprawling facilities in Rustenburg. RepRisk Index for Lonmin RepRisk® is a registered trademark RepRisk Relationships for Lonmin RepRisk AG, January 2013 5 of 13 4. News Corp Ltd – Peak RRI in 2012: 70 [United States of America] In 2012, News Corp continued to be plagued by the UK phone hacking scandal that broke the previous year. Tabloid papers operated by the company’s UK subsidiary, News International, were accused of having gathered information illegally. Journalists allegedly tapped into phone lines and computer files of almost 5000 victims. The scandal led to the closure of the News of the World paper and to numerous lawsuits. The Leveson Inquiry into News International reportedly found that making illegal payments to corrupt public officials was common practice at the company’s Sun newspaper in the UK and that senior managers at the company knew about illegal phone hacking activities as early as 2006. The company was thus also probed in relation to alleged bribery and money laundering. Over 50 people were arrested in the corruption investigation while at least 6 people, including the chief of News International, faced charges. News Corp has reportedly spent several hundred million in litigation and settlement costs. Furthermore, the US Justice Department conducted an investigation into whether hacking and bribery occurred in the US, while UK authorities addressed insider trading concerns, checking emails between a company executive and the UK’s Culture Secretary that related to News Corp’s GBP 8 billion take-over bid for BSkyB. In light of the scandal, shareholders and corporate governance experts expressed concern over executive compensation and board nominations. Rupert and James Murdoch reportedly received USD 10.4 million and 5 million pay packages respectively, and one of the new board members included Colombia’s former president, whose administration was linked to a wiretapping scandal in that country. In the US, News Corp and four of its subsidiaries were sued for anti-competitive practices for allegedly stifling competition at 40,000 stores between 2004 and 2012 through illegitimate deals. News Corp’s other businesses did not escape controversy either. HarperCollins was accused of sourcing paper from endangered Indonesian forests for printing books. Conservationists called on the company to refrain from doing business with Asia Pacific Resources International (APRIL) and Asia Pulp and Paper (APP) as both are allegedly linked to rainforest destruction and illegal harvesting of wood. Furthermore, HarperCollins was forced to arrange a settlement with EU regulators to avoid antitrust litigation related to accusations that it conspired to fix e-book prices. Several other News Corp subsidiaries or former subsidiaries also faced bribery or antitrust probes including News Outdoor Russia, Times Newspapers, 20th Century Fox and cable companies Hulu and NDS. RepRisk Index for News Corp RepRisk® is a registered trademark World Map for News Corp RepRisk AG, January 2013 6 of 13 4. Samsung Group [Equal Ranking] – Peak RRI in 2012: 70 [South Korea] Throughout 2012, Samsung was harshly criticized for poor conditions at its supplier factories, links to child labor, violations of national legislations and anti-competitive practices. In January, the South Korean Fair Trade Commission fined Samsung Electronics and LG Electronics a combined KRW 44.64 billion for anti-competitive practices related to home appliance products. According to the allegations, the two companies conspired to fix the prices of washing machines, flat panel TVs and laptop computers between 2008 and 2009. Several reports published by the Chinese NGO China Labor Watch denounced child labor, student labor exploitation and other violations of Chinese labor law at Samsung’s suppliers, such as HEG Electronics and HTNS Shenzhen. The reports also accused the suppliers of discrimination in the hiring process, excessive and unhealthy working hours with forced overtime, legal issues regarding contracts, punishments, and poor remuneration systems. Furthermore, the reports criticized harsh and often dangerous working conditions that led to employee injuries. Following the release of one of these reports in August, Samsung Electronics announced an internal audit of its 249 Chinese suppliers and reportedly confirmed certain violations among 105 companies. In September, Samsung Electronics, together with other electronics companies, was sued by the US state of Illinois in a Chicago state court over claims that the companies inflated costs for televisions and computer monitors from 1995 through 2007, creating USD billions in profits. Eventually, the company faced several class action lawsuits in the US for alleged price-fixing. Consumers claim that the companies have collectively monopolized the global rechargeable battery market since 2000. In early December 2012, the EU hit Samsung SDI and five other electronic companies with a record fine of EUR 1.47 billion for alleged price fixing and other anti-competitive practices related to the production of cathode ray tubes between 1997 and 2006. RepRisk Index for Samsung RepRisk® is a registered trademark United Nations Global Compact Spider for Samsung RepRisk AG, January 2013 7 of 13 6. HSBC Holdings PLC – Peak RRI in 2012: 69 [United Kingdom of Great Britain and Northern Ireland] Two major scandals undermined HSBC’s reputation in 2012: a series of international money laundering charges, and the alleged involvement of the bank in the manipulation of the London interbank offered rate (Libor). In early 2012, HSBC was the subject of several investigations related to alleged money laundering issues. In May, its subsidiary HSBC Bank USA was investigated by several US departments. The company was also criticized for failing to install effective due diligence processes despite being ordered to do so in 2003; failing to adequately review hundreds of billions of dollars in transactions that could be linked to drug trafficking, terrorism and organized crime; intentionally failing to review suspicious transactions while creating a false impression of due diligence; and for dismissing an employee after he raised concerns. In December, HSBC agreed to pay a record sum of USD 1.9 billion in fines to settle a series of money laundering charges brought by various US government agencies. According to documents filed in a district court, the bank had bypassed regulations related to sanctioned nations, such as Iran, Libya, Sudan, Myanmar, Cuba and Syria. Meanwhile in the UK, the bank had to reach a settlement on similar charges with the country’s Financial Services Authority. Furthermore, the US Senate accused the company of having deficient money laundering controls and thus exposing its HSBC Mexico unit to illicit transactions linked to drug cartels. HSBC has also been involved in the notorious Libor scandal. In early 2012, a class action lawsuit was filed in New York on behalf of the City of Baltimore and New Britain against 16 banks including HSBC for alleged manipulation of the Libor rate. Additionally, European authorities began investing more than a dozen banks, including HSBC, for allegedly manipulating the Euro interbank offered rate (Euribor). Moreover, in the course of 2012, the bank was also accused of being complicit in tax evasion schemes in UK and the USA. RepRisk Index for HSBC RepRisk® is a registered trademark World Map for HSBC RepRisk AG, January 2013 8 of 13 6. Reebok International Ltd [Equal Ranking] – Peak RRI in 2012: 69 [United States of America] Reebok saw a sudden spike in its RRI in mid 2012, which was in part due to the company’s inclusion in two NGO reports detailing alleged abuses of worker rights in Asia at factories in its supply chain. During the same period, the company became embroiled in a reported EUR 125 million fraud scandal in India. Two former senior executives of Reebok India were charged with fraud in an ongoing criminal probe by the Indian Ministry of Finance and the Ministry of Corporate Affairs. The company was also accused of systematic fraudulent practices in its governance and operations totaling INR 8.7 billion, including tax evasion worth INR 1.4 billion. Adidas filed a criminal complaint against its subsidiary over the alleged embezzlement of Reebok merchandise, falsification of receipts and also for allegedly hiding Adidas-owned goods in warehouses, to be sold by fake distributors. Reebok International also reportedly settled accusations of false advertising over the benefits of its toning shoe products with the US Federal Trade Commission. In Cambodia, workers in a Reebok supplier factory were allegedly abused by police who used tear gas and electric shock batons. According to a report by NGO War on Want, women were forced back to work after they began a strike to protest the suspension of a union representative over sick leave. A Play Fair Campaign report also linked the company to supply factories in China, the Philippines, and Sri Lanka, where workers are allegedly paid poverty wages, forced to work excessive and illegal overtime, prohibited from joining unions, hired only as contractual workers without benefits, exposed to unsafe and poor working conditions, and threatened with dismissal for complaining. Another supplier in China was fined USD 150 million by the Guangdong Environmental Protection Bureau and State Environmental Protection Administration for river pollution. RepRisk Index for Reebok RepRisk® is a registered trademark World Map for Reebok RepRisk AG, January 2013 9 of 13 6. ING Bank NV [Equal Ranking] – Peak RRI in 2012: 69 [Netherlands] ING Bank saw a sharp increase in its RepRisk Index in the second half of the year stemming from accusations that it facilitated money laundering. It was investigated for alleged involvement in illicit transactions linked to drug trafficking, terrorism, and sanctioned countries, which led to a record settlement with US authorities for related violations. In June 2012, it was reported that ING Bank had agreed to pay USD 619 million to settle accusations that it facilitated illegal transactions from Cuba and Iran, countries sanctioned by the US Treasury Department in an attempt to isolate and put economic pressure on oppressive regimes and human rights abusers. The bank reportedly used a system to remove references to Cuba and Iran and moved approximately 20,000 transactions worth USD 2 billion through the US financial system. It was alleged that ING Bank engaged in transactions with Iran’s central bank and National Iranian Oil, and with the Netherlands Caribbean Bank in relation to Cuban transactions. Furthermore, it apparently threatened to dismiss employees who failed to strip records of its dealings with the two countries. Additionally, the bank was probed for allegedly colluding to set loan rates in Turkey. It was also criticized for investing in both Netapp and weapons manufacturer EADS. The former is reportedly under investigation by the US Commerce Department Bureau of Industry and Security in relation to its sale of advanced data storage systems to Syria, which enables intensive Internet-monitoring; the latter is linked to alleged arms exports to human rights violators, relations with Libya, abuse of export credits for arms export, and the sending of gifts to German political parties. RepRisk Index for ING RepRisk® is a registered trademark World Map for ING RepRisk AG, January 2013 10 of 13 9. Wyeth LLC – Peak RRI in 2012: 68 [United States of America] Wyeth LLC, acquired by Pfizer in 2009, is ranked in the top 10 most controversial firms owing to problems with its pharmaceutical products. In 2012, the company had to settle several shareholder lawsuits and faces numerous others. In addition, it has been linked to bribery and anti-competitive practices. Wyeth faced a class action lawsuit, which it reportedly agreed to settle for USD 67.5 million, for allegedly misleading shareholders regarding business risks related to its Pristiq antidepressant drug. Plaintiffs claimed that Wyeth should have revealed potential adverse effects of the drug sooner than it did, stating that this delay caused stock prices to be inflated between June 2006 and July 2007. Wyeth shares lost over USD 7.6 billion in market value when the US Food and Drug Administration decided not to approve Pristiq until more information was received about potential serious heart and liver problems associated with its use. Pfizer has reportedly agreed to settle over the incident. This follows an earlier USD 164 million settlement in October for not disclosing the adverse health effects of Wyeth’s arthritis drug Celebrex. More than 10,000 lawsuits have also been filed over menopause drug Prempro, which has allegedly been linked to breast cancer. Wyeth officials were accused of downplaying or hiding the drug’s health risks and the company has so far paid out USD 896 million in settlements. In relation to anti-competitive practices, Wyeth allegedly engaged in a ‘pay-for-delay’ patent agreement with Teva for the latter to delay the launch of a generic medication. A New Jersey lawsuit also alleged that the companies fraudulently obtained patents, engaged in serial sham litigation to block and delay generic market entry, entered into a price-fixing and market allocation agreement, and offered settlements to other generic drug makers to preserve Wyeth’s monopoly and the market division agreement with Teva. Wyeth was implicated in Pfizer’s USD 60 million settlement for allegedly having bribed government officials in China, Croatia, Russia, Saudi Arabia and and other European and Asian countries. Furthermore, it was named in a settlement with the US Securities and Exchange Commission in relation to illicit payments to medical practitioners for the purpose of increasing sales in Serbia, China, the Czech Republic and Italy. RepRisk Index for Wyeth RepRisk® is a registered trademark World Map for Wyeth RepRisk AG, January 2013 11 of 13 10. TeliaSonera AB – Peak RRI in 2012: 67 [Sweden] Telecommunications group TeliaSonera has been associated with bribery, corruption, money laundering, human rights violations and complicity with oppressive regimes. The company operates in Russia, Turkey and Central Asian countries, among others. In the past 12 months, TeliaSonera has repeatedly been criticized for its alleged close cooperation with the security services of authoritarian states such as Kazakhstan and Belarus. Accusations relate to aiding state authorities to monitor and counter opposition groups. In Turkey, Turkcell, in which TeliaSonera has 38 percent ownership, came under fire for allegedly helping Turkish secret police to intercept telephone calls, which prosecutors then used to press charges against trade union representatives. In Tajikistan, various groups including the NGO Reporters without Borders, targeted TeliaSonera and its Tcell operation for allegedly blocking news portals in Tajikistan on orders of the regime, thus violating citizens’ freedom of information rights. In February, a Swedish district court directed TeliaSonera to pay SEK 144 million in fines to the state for the alleged abuse of its dominant market position between 2000 and 2003. Furthermore, authorities in Switzerland and Sweden have opened an investigation into possible links between a high-level fraud and corruption scandal in Uzbekistan and TeliaSonera. The investigation is reportedly examining a USD 300 million payment made by TeliaSonera to a small company called Takilant for the rights to operate a 3G mobile phone service in Uzbekistan. Subsequent investigations found that the payment TeliaSonera claimed to have made to Takilant never appeared in the company’s books. In Azerbaijan, TeliaSonera was accused of paying SEK 200 million to a group of American investors, who were allegedly involved in attempts to bribe the Azerbaijani government to facilitate the purchase of its state-owned oil company. Moreover, Nepalese authorities have been conducting investigations concerning the company’s acquisition of Ncell in 2008. Allegedly, TeliaSonera paid SEK 4.2 billion to Raj Group, a company controlled by the Nepalese king’s son-in-law, Raj Bahadur Singh, when it took over Ncell. The deal was apparently conducted through a complex and opaque network of businesses to conceal the real ownership. RepRisk Index for TeliaSonera RepRisk® is a registered trademark World Map for TeliaSonera RepRisk AG, January 2013 12 of 13 DISCLAIMER The information contained in this report (“Report”) is not intended to be relied upon as, or to be a substitute for, specific professional advice. No responsibility for loss occasioned to any persons and legal entities acting on or refraining from action as a result of any material in this publication can be accepted. With respect to any and all the information contained in this Report (“Information”), RepRisk makes no representation or warranty of any kind, either express or implied, with respect to the Information, the results to be obtained by the use thereof or any other matter. RepRisk merely collects information from public sources and distributes them in the form of this Report. RepRisk expressly disclaims, and the buyer or reader waives, any and all implied warranties, including, without limitation, warranties of originality, accuracy, completeness, merchantability, fitness for a particular purpose and warranties related to possible violations of intellectual property rights, trademark rights or any other rights of any third party. This report may be quoted, used for business purposes and may be shared with third parties, provided www.reprisk.com is explicitly mentioned as the source. METHODOLOGY RepRisk special reports are compiled using information from the RepRisk database, which consists of facts, criticism and controversies related to projects and companies’ environmental, social and governance performance. The RepRisk database currently contains criticism on more than 30,000 private and publicly listed companies. RepRisk analysts monitor the issues related to environmental, social and governance risk across a broad shareholder and other stakeholder audience of NGOs, academics, media, politicians, regulators and communities. Once the negative news has been identified with advanced search algorithms and analyzed for its novelty, relevance and severity, risk analysts enter an original summary into the database and link it to the companies and projects in question. No article is entered twice unless it has been escalated to a more influential source, contains a significant development, or has not appeared for the past 6 weeks. This helps to ensure the balanced and objective rating and weighting of the negative news, and thus the company’s quantitative measure of risk exposure, the RepRisk Index (RRI). The RRI measures the risk to a company’s reputation, not its actual reputation in general. RepRisk objectively monitors the level of criticism to which a company is exposed. All data is collected and processed through a strictly rule-based methodology. Controversial issues covered include breaches of national or international legislation, controversial products and services, environmental footprint and climate change, human rights and community relations, labor conditions and employee relations as well as fraud, anti-competitive behavior, tax evasion and corruption. In particular, all principles of the UN Global Compact are addressed. ABOUT REPRISK RepRisk is the leading provider of business intelligence on environmental, social and governance (ESG) risks. It systematically collects and analyzes facts, criticism, and controversies related to companies and projects worldwide. It does so on a daily basis and in 13 languages from thousands of public sources including international and local media, government sites, nongovernmental organizations (NGOs), newsletters, social media and blogs. The RepRisk database currently includes information on over 30,000 companies, 6,500 projects, 5,000 NGOs and 4,000 governmental bodies. These numbers are continuously growing as relevant ESG information is added. The use of RepRisk business intelligence allows companies and financial institutions to proactively assess ESG issues that may present financial, reputational and compliance risks. For more information about the usage and benefits of RepRisk in relation to the effective management of ESG Risk, please visit our website: www.reprisk.com Contact Information For more information about the RepRisk tool or this Most Controversial Companies report, please contact media@reprisk.com, or visit our website: www.reprisk.com. RepRisk® is a registered trademark RepRisk AG, January 2013 13 of 13