Fall 2015 - Capozzi Adler

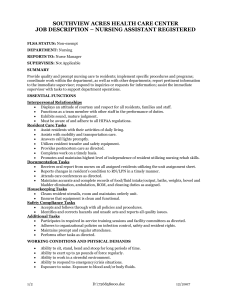

advertisement

The Quarterly Capozzi Adler, P.C. Attorneys at Law www.capozziadler.com Capozzi Adler, P.C. Attorneys at Law ATTORNEY GENERAL UPDATE PENNSYLVANIA ATTORNEY GENERAL FILES CONSUMER PROTECTION COMPLAINT AGAINST GOLDEN LIVING NURSING FACILITIES Glenn A Parno, Esquire- glennp@capozziadler.com On July 1, 2015, the Pennsylvania Attorney General took the unprecedented action of filing a Civil Complaint against Golden Gate National Senior Care alleging that 14 “Golden Living” nursing facilities located throughout the state committed violations of the Pennsylvania Unfair Trade Practices and Consumer Protection Law. Complaint also alleges breach of contract and unjust enrichment claims against Golden Gate and seeks an injunction prohibiting Golden Gate from engaging in further deceptive and unlawful conduct. Pursuant to the provisions of the Consumer Protection Law, the Attorney General is seeking penalties against Golden Gate ranging from $1,000.00 to $3,000.00 per violation. Additionally, the Consumer Protecly the most serious of abuses;” that it tion Law allows for the Attorney General to is “not targeted toward honest recover treble (triple) damages and attorney’s providers and suppliers t fees against Golden Gate. In light of the number of violations alleged in the Complaint, the potential damages are staggering. In September, the Attorney Generalamended the Complaint to add claims for alleged violations at an additional 11 Golden Living facilities based on over 350 consumer Inside this issue complaints received after the filing of the original Complaint. Interestingly, the case against Golden Gate was developed with the help of the Cohen, Milstein, Sellers & Toll law firm in Washington, D.C. Apparently, the firm will be entitled to 21 percent of any monies recovered by the Commonwealth. The use of private counsel to assist the Attorney General’s Office with a civil lawsuit is not unique, but remains controversial. Obviously, there is a financial incentive for a law firm to over reach with respect to identifying and pursuing regulatory violations if it is entitled to a portion of the fines. Although not a defense to the current lawsuit, the financial interest of Cohen, Milstein, Sellers & Toll in the ultimate outcome of this matter is potentially a powerful argument to sway a jury. Criminal vs. Civil Liability The charges against Golden Living were investigated and prosecuted by the Attorney General’s Civil Division, specifically the Consumer Protection Section, rather than the Medicaid Fraud Control Unit of the Criminal Division. This is 1 Same-Sex Marriage & Property Law 4 Update on Staffing Agency Employees 4 Your Resident’s Legal Representative 5-6 surprising since much of the misconduct alleged in the Complaint could have easily formed the basis for criminal violations of the Pennsylvania Crimes Code or Medicaid Fraud and Abuse Act. For instance, the Complaint alleges that Golden Living, “engaged in a pervasive, chain-wide practice of billing consumers and the Commonwealth for services not provided” and made “deceptive, misleading, and unfair representations” regarding services available and provided. These allegations could readily provide a basis for charges of theft, theft by deception, criminal conspiracy, and even corrupt organizations (the state version of the federal Racketeer Influenced and Corrupt Organizations (RICO) Act). At one point, the Complaint makes the startling allegation that Golden Living falsified resident records to cover up omissions of care. This allegation could easily form the basis for a criminal charge of tampering with public records or unsworn falsification to authorities. Additionally, the allegations of omissions of care with respect to nursing home residents could arguably support a criminal charge of reckless endangerment. Nonetheless, the Attorney General opted to pursue a civil action rather than a criminal action against Golden Living. The rationale for this decision could be based on the fact that the Attorney General’s burden of proof in a civil action (preponderance of evidence) is much lower than the burden of proof in a criminal action (beyond a reasonable doubt). Additionally, monetary damages are more readily available and enhanced under the Consumer Protection Law as opposed to the applicable state criminal statutes. Interestingly, the Attorney General did not pursue this matter pursuant to the civil provisions of the Medicaid Fraud and Abuse Act, 62 P.S. 1407. Again, this decision was probably based on the higher burden of proof of intent which the Attorney General determined would be best to avoid. It should also be noted that civil and criminal actions are not mutually exclusive and “parallel proceedings” could have been pursued by the Attorney General. In typically not candidates for legal essence, the Attorney General could representation by corporate legally have brought both civil and counsel and are rarely represented criminal actions against Golden Living by private counsel when speaking for the same conduct at issue. with government investigators. Finally, nursing facilities are Accordingly, the government has subject to federal penalties for submitunfettered access to former ting false claims for poor quality care employees and carte blanch to ask under the False Claims Act, 31 U.S.C. any questions in whatever form it “We believe that frequent §§ 3729 - 3733. That statute provides claim denials should provider that theredesires. may beAlthough there is nothing for payment of aalert civil the penalty of that can be done to prevent former an$5,500 issue and with its claim submission and that between $11,000 for each employees from providing inaccuremedial action may be required. We do false claim knowingly submitted. rate information to government not believe that anbrought interim Accordingly, the allegations by notification investigators, there are measures from CMS example, the Attorney General(for against Goldena “warning that a facility can implement to should be patient a prerequisite for taking Living letter”) with respect to poor care limit the usefulness of this could arguably be actionable under the action under § 424.535(a)(8)(ii). information. False Claims Actifasthe well.provider has questions Further, Although it doesn’t appear regarding CMS’s billing and coding that investigators interviewed Sources of Information requirements, it should review CMS’s current Golden Living employees, manuals, educational It appears as though the Attorneyarticles, and other it is not unusual for such interdocuments Webto be conducted during the Generalinformational relied upon several different at CMS’sviews site (www.cms.hhs.gov); may information sources to conduct its the provider course of a civil or criminal also contact itsLiving’s local MAC if it hasinvestigation. If a nursing facility investigation of Golden additional questions.” conduct: is aware that a government investigation is ongoing, steps should be taken to (1) ensure that current employees are represented (1) by counsel before they are interFormer Employees of the viewed, and (2) ensure that the Corporation—The Complaint government entity conducting the references 16 unidentified former investigation receives written employees of Golden Living’s notice of said legal representation. facilities and bases many of its It is highly unlikely that a current claims on information provided by employee, even a low level staff those individuals. Former employmember, will be interviewed ees of an organization are often without counsel present if the valuable sources of information for investigator knows the government investigators. Of employee has counsel. special interest are employees who separated service on less than favorable terms. These individuals (2) are often anxious to provide Family Members of Current and incriminating information against Former Residents – The Comtheir former employer. Unfortuplaint also cites three unnamed nately, disgruntled employees often relatives of Golden Living embellish and sometimes manuresidents as having provided facture information they perceive information regarding poor to be “helpful” to the government quality of care at Golden Living’s and detrimental to their previous facilities. Family members of employer. Former employees are 2 residents are a potential source of valuable information for government investigators as they often have extensive first-hand knowledge of the operations of a nursing facility. Unfortunately, family members who are dissatisfied with quality of care, cost of care, staff members, or any other care related issue, may be inclined to embellish or manufacturer problems at the facility when interviewed by investigators. It is difficult to prevent family members from providing damaging information during a government investigation. Again, there are measures that a facility can implement to limit the usefulness of this information. (3) Self-reported Information -- The Complaint identifies self-reported staffing levels as a source of information forming the basis for the allegations against Golden Living. Not surprisingly, information voluntarily supplied by a nursing facility to the state or federal government is often utilized by investigators as the basis for an enforcement action. Consequently, nursing facilities should ensure that any information supplied to the government is complete and accurate, no matter how innocuous that information may appear. It is entirely possible that Golden Living unwittingly under reported its staffing levels to state and federal authorities during annual licensure surveys. However, attempting to raise that argument as a defense at trial is problematic. Consequently, compliance measures, including periodic internal audits, should be implemented to ensure that any and all information reported to the government is complete, timely and accurate. If an internal audit identifies errors or omissions with respect to self-reported data, immediate remedial measures should be taken. (4) Department of Health (DOH) Survey Results – Deficiencies identified by the DOH during periodic surveys (inspections) of Golden Living’s facilities appear to have played a prominent role in the Attorney General’s investigation and are cited repeatedly in the Civil Complaint. This fact underscores the need for a nursing facility to pay careful attention to survey results and challenge findings that are inaccurate. Although most survey deficiencies are resolved with the payment of a monetary penalty, these uncontested deficiencies become part of a facility’s compliance history which is readily available to both the government and the general public. Additionally, there is a danger that uncontested deficiencies may be deemed “admitted” by the facility for purposes of subsequent legal actions. In the case of Golden Living, it is possible that many of the deficiencies cited by the Attorney General could have been successfully challenged. However, it could prove difficult for Golden Living to dispute the accuracy of these deficiencies at trial since the deficiencies were not disputed in the first instance. If a facility is not willing or able to challenge a deficiency and chooses instead to pay a monetary penalty, there are strategies available to limit the government’s ability to use the deficiencies against the facility in a subsequent, unrelated proceeding. 3 Conclusion In light of the positive public reaction to the Attorney General’s lawsuit against Golden Living, as well as the likelihood of a significant monetary award, it is very likely that the Attorney General will continue to pursue consumer protection and/or criminal actions against nursing facilities in Pennsylvania. Consequently, it is imperative that facilities have compliance policies and strategies in place to help them avoid government investigations in the first place, and to limit their exposure with regard to government investigations that have already been initiated. Capozzi Adler, P.C. has a highly qualified staff of attorneys experienced with issues specific to nursing home operations, as well as attorneys with prior experience conducting government investigations, and will be happy to review your facility’s current compliance policies to assess the level of protection afforded in the current aggressive regulatory atmosphere. -glennp@capozziadler.com I NOW PRONOUNCE YOU TENANTS BY THE ENTIRETIES: HOW SAME-SEX MARRIAGE IS AFFECTING PROPERTY LAW. Nicholas Luciano, Esquire - nicholasl@capozziadler.com Earlier this summer, the Supreme Court paved the way for same-sex couples to legally marry in all 50 states. This was not only a watershed moment in civil rights law, but property law as well. Previously, same-sex couples that wanted to purchase property together had the choice of taking title either as tenants in common, or as joint tenants with the right of survivorship. While taking title as joint tenants allows for the automatic transfer of title in the event of the death of one of the title holders, it is a lesser “strength” title mechanism when Revalidation of Medical Assistance Provider Enrollment. The Department of Human Services is reminding all Medical Assistance provider types, including all associated service locations, that the Affordable Care Act (ACA) requires revalidation of their enrollment every five years. All providers (including all associated service locations - 13 digits) who enrolled on or before March 25, 2011, must revalidate their enrollment information no later than March 24, 2016, by completing a new enrollment application. Providers who enrolled after March 25, 2011 (including Changes of Ownership after March 25, 2011), will need to revalidate their enrollment information every five years and should check their provider file for their revalidation date. compared to holding title as tenants by the entireties—a designation reserved strictly for married couples. Tenants by the entireties hold an undivided, 100% interest in the land, which cannot be severed without both title holders consenting. If one party wants to sell, divest, or mortgage their interest in land held as tenants by the entireties, the spouse has to agree. The main advantage of tenancy by the entireties is the ability to shield the land from creditors. If Debtor A is in debt to Creditor X, Creditor X cannot get a judgment levied against land owned by Debtor A so long as Debtor A’s spouse is also on the title. While there are exceptions, namely a tax debt to the IRS, this is the general rule. This is not the case with joint tenants with right of survivorship. A judgment against Debtor A, is a lien against their share of any property owned at the time of judgment. This can have significant ramifications for the other title holder. Same-sex couples that decide to get married have a choice to make. They can keep title they currently own together as joint tenants, or convert that title into a tenancy by the entireties. This is a relatively easy—and inexpensive—endeavor, as it simply requires the filing of a new deed. It may be well worth it to gain the protections afforded by the stronger title designation. - nicholasl@capozziadler.com. NLRB RULES STAFFING AGENCY EMPLOYEES ARE EMPLOYEES OF Both the Agency and the Healthcare Organization Where They Work Brandon Williams, Esquire – BrandonW@capozziadler.com Recently the National Labor Relations Board issued an opinion that will impact the relationship between healthcare organizations and staffing agency employees. In Sutter Tracy Community Hospital, the Board ruled that staffing agency employees are employed by both the staffing agency and the healthcare organization where they're working and that both organizations should be involved in collective bargaining with the staffing agency employees. The Board also indicated that the healthcare organizations could be held liable for unfair labor practices against staffing agency employees. The Board’s decision was issued on 4 August 28, 2015. As of the time this article was written, it was unclear whether the decision would be appealed. For now, all employers using a staffing agency should review their agreements with the staffing agency with this new ruling in mind. Although the Board’s reach extends to both unionized and nonunionized employees, if your staffing agency employees are represented by a Union, or if you have reason to believe that staffing agency employees may attempt to Unionize you need to pay particular attention as this new rule evolves. Contact Brandon Williams at BrandonW@capozziadler.com or (717) 233 4101 with questions regarding this issue or other employment related questions. MANAGING AND COLLECTING YOUR ACCOUNTS RECEIVABLE - Your Resident’s Legal Representative Andrew R. Eisemann, Esquire -andrewe@capozziadler.com This is the twelfth installment of our firm’s series known as “Managing and Collecting your Accounts Receivable”. As you are already aware, the financial survival of most nursing facilities in Pennsylvania depend on how aggressively and effectively their business office managers administer their accounts receivable. This series is devoted solely to the design, management, and improvement of your accounts receivable program and collections efforts. Also, here we share with you tips, legal updates, personal observations, and “lessons learned” to help you improve the effectiveness of your Accounts Receivable Management Program. (5) The Admission Director fails to identify a Legal Representative or neglects to name the person on the first page of the Admissions Agreement; (6) The Admission Director neglects to have the Legal Representative sign the last page of the Admission Agreement, which is a legally enforceable contract; (7) The Admission Director fails to adequately explain to the Legal Representative his or her duties or responsibilities, including assistance in the MA application process. Or, worse, the Admission Director directs the Legal Representative to not make any payments or escrow the resident’s income while Medicaid is pending; I want to focus this installment on a critical player in your efforts to watch your bottom line: the resident’s “Legal Representative”, or, as some nursing facilities in Pennsylvania refer to this person, the “Responsible Party” or “Designated Representative”. Why do I want to devote this space to a discussion of the Legal Representative? The weakest link in the admissions and account management process that negatively impacts a nursing facility’s bottom line is frequently the identification and preparation of a resident’s Legal Representative. (8) The Admission Director fails to adequately explain to the Legal Representative that the Admission Agreement is a legally enforceable and binding contract; (9) The Admission Director or Business Office fails to explain to the Legal Representative the benefits of arranging direct deposit of the resident’s Social Security income either as Representative Payee or through the Resident Fund Management System. The same issue applies to the resident’s pension income; The reasons for this weak link include one or more of the following: (1) The Admission Agreement lacks a clear definition, or any definition whatsoever, of a Legal Representative, or it lacks a description of the duties and responsibilities of the Legal Representative; (10) The Business Office fails to mail a monthly bill to the Legal Representative during the first several months after the facility admits the resident as a matter of policy while MA is pending; and, (2) The Admission Agreement properly explains that a Legal Representative will not be held personally liable for the debt, but, it fails to disclose that a Legal Representative can potentially be held financially liable in the amount that he or she fails to transfer from the resident’s income or assets despite having access to the resident’s resources; (11) Finally, the Business Office simply allows the Legal Representative to avoid payment or not cooperate for too long. In other words, the Legal Representative is taking advantage of a disorganized Business Office or its passive attempts at collection. When the weak link breaks . . .. I am certain that you (3) The Admission Director identifies the resident on the first page of the Admission Agreement as the Legal Representative, although a member of the resident’s family or a friend signs the signature line on the last page of the Admission Agreement; have experienced one or more of the following situations as a result of the weaknesses above: (1) The family spends the resident’s money on non-allowable expenses although the relative or resident ttruly believes that these expenditures were justified; (4) The signature line of the Admission Agreement for the Legal Representative does not identify the signatory as the resident’s Legal Representative; (2) A relative intentionally or fraudulently diverts the 5 Why do you need to take a look at the Legal Representative clauses of your Admission Agreement? resident’s funds for personal consumption or investments; (3) The Legal Representative fails to fully cooperate in the Medicaid application process, including the transfer of financial documents or information; or, Although Pennsylvania court case law regarding the legal financial liability of a Legal Representative is scarce, the Allegheny County Court of Common Pleas recently addressed this issue in Five Star Quality Care, Inc d/b/a Overlook Green v. Joyce and Charles Yablonski. The opinion of this Court will have a strong persuasive effect on other county courts throughout Pennsylvania. In summary, the Court disallowed the nursing facility’s claim against a resident’s “Responsible Party” because the Admission Agreement did not “clearly and unambiguously” define the term “Responsible Party” or obligate the Responsible Party to guarantee payment. In fact, the Court expressly preferred the term “Legal Representative”, rather than “Responsible Party”, because the usage of “Legal Representative” is more widely accepted and defined in state statutes. (4) Although the CAO directs the Legal Representative to “spend down” the resident’s funds to qualify for Medicaid, he or she refuses, even if the amount is nominal. As a result of this last scenario, you’re attempting to collect against a private pay resident with insignificant financial resources. What law allows you to contract with a resident’s family member or friend to act as the Legal Representative? Because it is the nursing facility or its management company that drafts the Admission Agreement, the burden is on the nursing facility to ensure the requirements and obligations of a Legal Representative are “clear and unambiguous.” Otherwise, the nursing facility’s attempts to collect a debt against a Legal Representative in a court may be weakened or unsuccessful. The term, “Legal Representative,” is generally accepted under the law. The Nursing Home Reform Act of 1987 permits the nursing facility to contract with a person who has access to the resident’s income and resources to transfer payments from the resident’s income and resources. 42 U.S.C. §1396r(c)(5)(B)(ii). If you would like more information on how your Admission Agreement can be used or modified to protect your facility’s bottom line, including an analysis and revision of the contract terms related to the Legal Representative, you may contact Andrew R. Eisemann at our Firm at andrewe@capozziadler.com Furthermore, the Pennsylvania Administrative Code permits a resident to name a Legal Representative. 28 Pa. Code §201.24(a). This section of the Code defines the Legal Representative as someone who can make decisions on behalf of the resident, but it does not obligate a Legal Representative to make payments. In addition, this section prevents a nursing facility from naming an employee as a resident’s Legal Representative, unless a court appoints the employee as the resident’s guardian. Accordingly, an Admission Agreement must be clear as to the definition, duties, and responsibilities of a Legal Representative to be legally enforceable. If the Admission Agreement is clear, the Legal Representative can be held legally liable for his or her failure to perform his duty to remit payment form the resident’s funds. Of course, the Legal Representative may also be held liable personally if he diverts the resident’s funds for non-allowable purposes, which requires a court order. Andrew Eisemann Presenting at our Semi-Annual Seminar in Pittsburgh, PA. Is a Legal Representative a Guarantor? No. As most of you are aware, Medicaid law expressly restricts a nursing facility that is eligible for Medicaid or Medicare reimbursement from requiring a third party guarantee of payment to the facility as a condition of admission or continued stay. A Guarantor is someone who is personally liable for a debt from his or her own assets. An example of a Guarantor is the father who co-signs a car loan for his daughter. The law does not prohibit a third person voluntarily guarantee payment to the nursing facility. I continue to see, however, the term Guarantor in admission agreements, admission fact sheets, or account invoices even though the admission agreement does not clearly obligate a third party as a guarantor. Bruce Baron Presenting at our Semi-Annual Seminar in Pittsburgh, PA. 6 6th Annual Summer Party! Pig Roast for Annual Summer Party Glenn Parno Presenting at our Semi-Annual Seminar in Pittsburgh, PA Celebrating Capozzi Adler’s 18th Anniversary The Drifters Performing at the 6th Annual Summer Party Lou Capozzi Presenting at our Semi-Annual Seminar in Pittsburgh, PA. Capozzi Adler Employees enjoy the Summer Party Dan Natiboff Presenting at our Semi-Annual Seminar in Pittsburgh, PA. 7 eS emin ar Flyer Capozzi Adler, P.C. Attorneys at Law P.O. Box 5866 Harrisburg, PA 17110 ua lF re Return Service Requested PRSRT STD U.S. POSTAGE PAID HARRISBURG, P PA PERMIT NO.792 Enclosed is Our Se m n i-A n The Quarterly Capozzi Adler, P.C. Attorneys at Law The Quarterly Capozzi Adler, P.C. Attorneys at Law RECENT AND UPCOMING EVENTS Jul. 10 Jul. 15 Capozzi Adler, P.C. held its 6th Annual File Burning and Pool Party, with performances by “The Drifters,” a Fireworks Show by Fireworks Extravaganza of Erie, and a special fundraiser for the United Leukodystrophy Foundation, Inc. and the Boiling Springs Band Association (South Middleton School District), at the Historic Woodburn Farm in Carlisle. Daniel K. Natirboff, Esq., presented a Webinar in cooperation with LeadingAge PA on “Buying, Selling, Transferring, and Renovating Skilled Nursing Beds in Pennsylvania.” Aug. Andrew R. Eisemann, Esq. presented a Webinar in cooperation with LeadingAge PA on “Taking Control of Your Resident Accounts Receivable: Prevention and Reaction to Problem Accounts.” 6 Glenn A. Parno, Esq. presented a Continuing Legal Education program at the Delaware County Bar Association in Media, on “Environmental Enforcement: Defending Criminal and Civil Enforcement Actions.” Aug. Glenn A. Parno, Esq. presented a Continuing Legal Education program at the Dauphin County Bar Association in Harrisburg, on “Environmental Enforcement: Defending Criminal and Civil Enforcement Actions.” Oct. Capozzi Adler, P.C. Semi-Annual Continuing Education Seminar – “Current Issues in 2015 for Nursing Facilities in Pennsylvania” – at the John Henry Room, Hollywood Casino, in Grantville. Admission is free along with 7 continuing education credits for NHA’s, lawyers, and CPA’s. For a brochure and registration information, email Gabriella Marchi at our Firm: GabriellaM@CapozziAdler.com. Nov. Bruce G. Baron, Esq. is scheduled to present a full-day seminar as part of Penn State Greater Allegheny’s licensing program for nursing home administrators on “The Government’s Role in Health Care Policy, Regulation and Reimbursement” at the campus in McKeesport. Nov. Andrew R. Eisemann, Esq. will be partnering with Liberty Lutheran Services to present for LeadingAge PA’s Financial Seminar at Masonic Village, Elizabethtown. 11 24 16 Andrew R. Eisemann, Esq. presented a seminar on legal and business issues facing Long Term Care Facilities for Saber Healthcare Group in Scranton, Pennsylvania. Jul. 16 Aug. 5 19 Enclosed is Our Semi-Annual Free Seminar Flyer CAPOZZI ADLER, P.C. Attorneys at Law Presents its Semi-Annual Continuing Education Seminar CURRENT LEGAL ISSUES AFFECTING PENNSYLVANIA NURSING FACILITIES Friday, October 16, 2015 (8:30 a.m. – 5:00 p.m.) Hollywood Casino at Penn National Race Course (John Henry Room) 777 Hollywood Blvd, Grantville, PA 17028 Approved for 7 professional education credit hours for NHAs, Attorneys, and Accountants at no cost to you 8:00 a.m. – 8:30 a.m. - Registration 8:30 a.m. – 8:40 a.m. Lobby in front of The Hall of Champions Administrative Remarks Welcome & Opening Comments: Andrew R. Eisemann, Esq. Louis J. Capozzi, Jr., Esq. 8:40 – 8:50 UPDATE FROM THE LITIGATION DEPARTMENT Donald R. Reavey, Esq. 8:50 a.m. – 9:50 a.m. Brandon S. Williams, Esq. LIFE CYCLE AND COSTS OF EMPLOYEE DISCRIMINATION CLAIMS 9:50 a.m. – 10:50 a.m. Louis J. Capozzi, Jr., Esq. NLRB & UNION ACTIVITY UPDATE, including NEW NLRB ELECTION RULES 10:50 a.m. – 11:00 a.m. – Mid-Morning Break 11:00 a.m. – 12:30 p.m. TAKING CONTROL OF YOUR PHARMACY COSTS: Same Pills; Smaller Bills TAKING CONTROL OF YOUR RESIDENT ACCOUNTS RECEIVABLE: Maximize your Reimbursement from Private and Medicaid Residents 12:30 p.m. – 1:20 p.m. --- LUNCH BUFFET (provided) 1:20 p.m. – 1:50 p.m. UPDATE FROM FINANCING AND REAL ESTATE DEPARTMENT BUILDING A PATH TO RETIREMENT Saul Greenberger, LNHA Andrew R. Eisemann, Esq. John Gentile, Esq. Craig I. Adler, Esq. Nicholas J. Luciano, Esq. Questmont, Strategic Wealth Advisor 1:50 p.m. – 3:20 p.m. MEDICAID RATES AND SETTLEMENT ISSUES UPDATE Timothy T. Ziegler, Senior Reimbursement Analyst UPDATE ON MEDICIAD LITIGATION AND Daniel K. Natirboff, Esq. BUYING, SELLING, FINANCING, AND RENOVATING NURSING HOME BEDS 3:20 p.m. – 3:30p.m. – Mid-Afternoon Break 3:30 p.m. – 4:30p.m. Bruce G. Baron, Esq. COMPLIANCE ISSUES: PROVIDER ENROLLMENT REVALIDATION; PROPOSED NEW CONDITIONS OF PARTICIPATION IN MEDICAID/MEDICARE; NURSING HOME COMPLIANCE LITIGATION UPDATE 4:30 p.m. – 5:00 p.m. Glenn A. Parno, Esq. ATTORNEY GENERAL CONSUMER PROTECTION ACTIONS AGAINST NURSING FACILITIES 5:00 p.m. – 6:00 p.m. INFORMAL SOCIAL AND NETWORKING REGISTRATION INFORMATION Credits: This program has been approved by the National Continuing Education Review Service (NCERS) of the National Association of Boards of Examiners for Nursing Home Administrators for 7 clock hours; has been submitted for approval by PACLE for 7 participant hours and 7 substantive credit hours of CLE for attorneys; and is approved by the Pennsylvania State Board of Accountancy (No. PX177781) for continuing education credits for CPAs. Certificates of Attendance will be provided to Seminar participants. Participants must sign in and out in order to obtain Continuing Education Credits for Program Hours actually attended. Attorneys seeking PA CLE Credits must file Certificates of Attendance and pay the required fee directly to PACLE in order to obtain CLE credits. Cost. None. Limited Supply of Special Hotel Rates Available at the Hampton Inn Harrisburg/Grantville/Hershey (717-469-7689). The cutoff date for the special rate is Thursday, October 1st. Directions to the JOHN HENRY ROOM (SEMINAR ROOM): Parking Garage, Casino Entrance Closest to the Race Track: Park on any level of the Parking Garage. Take the elevator to Level F (Boxed Seats/Banquets) Make a Left off of the elevator down the ramp. You will enter the third floor of the Casino. Walk past the first Mutual Window and you will see the entrance to the elevator and stairs on your left. Take the elevator to the fourth floor and follow the hallway to the banquet rooms. Registration Deadline: Submit the Registration information below no later than Monday, October 5, 2015 to: Gabriella Marchi, Capozzi Adler, P.C., P.O. BOX 5866, Harrisburg, PA 17110; or, by email to: GabriellaM@CapozziAdler.com; or, by FAX to: (717) 233-4103: 1. 2. 3. 4. 5. NAME: POSITION: EMPLOYER: ADDRESS: TELEPHONE NUMBER: EMAIL (for confirmation of your registration only): NHA LICENSE NO. & STATE (if appl.): PA ATTORNEY I.D. NO. (if appl.):