In Re: DHB Industries, Inc. Class Action Litigation 05-CV

advertisement

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 1 of 162

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF NEW YORK

In re DHB INDUSTRIES, INC. CLASS

ACTION LITIGATION

This Document Relates To:

ALL ACTIONS.

x

:

:

:

:

:

:

:

x

Civil Action No. 2:05-cv-04296-JS-ETB

CLASS ACTION

CONSOLIDATED CLASS ACTION

COMPLAINT FOR VIOLATION OF THE

FEDERAL SECURITIES LAWS

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 2 of 162

TABLE OF CONTENTS

Page

INTRODUCTION ...........................................................................................................................1

OVERVIEW OF THE ACTION .....................................................................................................4

Brooks and DHB Have a Controversial Past .......................................................................4

The Fraudulent Pump-and-Dump Scheme...........................................................................5

DHB’s Vest Programs had Major, Undisclosed Problems ..................................................8

Defendants’ Massive Fraud is Fully Revealed in August 2005.........................................12

JURISDICTION AND VENUE ....................................................................................................24

THE PARTIES...............................................................................................................................24

BACKGROUND TO THE CLASS PERIOD ...............................................................................34

CLASS PERIOD EVENTS ...........................................................................................................42

POST-CLASS PERIOD EVENTS ..............................................................................................103

FALSE FINANCIAL STATEMENTS........................................................................................107

DHB’s Failure to Accrue for Losses Caused by Its Sale of Defective Products

and Improper Accounting for Inventory ..............................................................109

DHB’S INADEQUATE INTERNAL CONTROLS ...................................................................114

ADDITIONAL SCIENTER AND SCHEME ALLEGATIONS.................................................121

DHB’s Insiders’ Long-Standing Knowledge of Problems with Zylon and its

Interceptor Program .............................................................................................131

DHB EXECUTIVES’ INSIDER TRADING, SALARIES AND BONUSES ............................133

DEFENDANTS’ FALSE AND MISLEADING PROXY...........................................................136

LOSS CAUSATION....................................................................................................................138

NO SAFE HARBOR ...................................................................................................................143

APPLICABILITY OF PRESUMPTION OF RELIANCE: FRAUD-ON-THE-MARKET

DOCTRINE .....................................................................................................................144

-i-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 3 of 162

Page

CLASS ACTION ALLEGATIONS ............................................................................................145

COUNT I .....................................................................................................................................146

Violation of §10(b) of the 1934 Act and Rule 10b-5 Promulgated Thereunder

Against All Defendants........................................................................................146

COUNT II ....................................................................................................................................148

Violation of §20(a) of the 1934 Act Against Defendants DHB, Brooks, Hatfield,

Schlegel, Chasin, Krantz, Nadelman and Berkman.............................................148

COUNT III...................................................................................................................................149

For Violation of §20A of the 1934 Act Against All Defendants....................................149

COUNT IV...................................................................................................................................150

Violation of §14(a) of the 1934 Act and Rule 14a-1 Promulgated Thereunder

Against All Defendants........................................................................................150

PRAYER FOR RELIEF ..............................................................................................................154

JURY DEMAND .........................................................................................................................155

- ii -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 4 of 162

INTRODUCTION

1.

This is a class action on behalf of all purchasers of the publicly traded securities of

DHB Industries, Inc. (“DHB” or the “Company”), between March 24, 2004 and August 29, 2005

(the “Class Period”), against DHB, David H. Brooks (“Brooks” or “David Brooks”), DHB’s

Chairman and Chief Executive Officer (“CEO”) and his wife, Terry Brooks,1 Sandra Hatfield,

DHB’s Chief Operating Officer (“COO”) since December 2000, and Dawn M. Schlegel, its Chief

Financial Officer (“CFO”) since September 1999, and members of DHB’s Board of Directors (Barry

Berkman, Cary Chasin, Jerome Krantz and Gary Nadelman). DHB, through its Point Blank Body

Armor and PACA subsidiaries (collectively, “DHB” or the “Company”), designs, manufactures and

sells body armor products, particularly bulletproof vests. DHB’s bulletproof vest business is divided

into two main product lines – vests produced for the United States military (“Interceptor”-class

vests) and vests produced for domestic law enforcement agencies.

2.

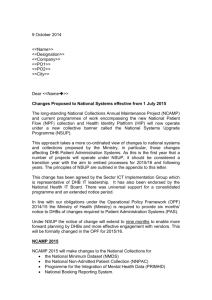

In a classic fraudulent “pump-and-dump” scheme, DHB’s officers and directors

inflated DHB’s stock price by 316% – from $5.46 to $22.70 – through a series of false and

misleading statements and financial reports issued during the Class Period. As the price of DHB

stock spiraled upward, the DHB insiders held their holdings and granted themselves tens of

thousands of options to purchase DHB shares for pennies on the dollar. Then, precisely when the

stock reached peak prices in late 2004, defendants exercised their options and collectively dumped

over 10.2 million shares of stock at $18.57-$20.94 per share, receiving over $200 million in illegal

insider trading proceeds over a thirty day period. Brooks sold 60% of the shares he actually

1

The David H. Brooks’ controlled entities, David Brooks International Inc., Andrew Brooks

Industries, Inc., and Elizabeth Brooks Industries, Inc., through which David and Terry Brooks owned

DHB stock and through which they exercised control of DHB and insider traded, are also

defendants.

-1-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 5 of 162

owned, Hatfield sold 100% of the stock she owned and Schlegel sold 84% of the stock she owned.2

Krantz also sold 100% of his stock and Nadelman sold 89% of his shares. Defendants’ illegal

insider sales occurred in two discreet periods. The first wave of selling occurred over a two day

period in late November just after DHB stock reached its then all-time high share price. The second

wave of selling occurred over a five day period in late December just as DHB stock reached its

record all-time high price. In total, defendants’ dumped 22% of DHB’s then outstanding shares in

these two periods of selling. As the chart below demonstrates, defendants’ sales were timed

perfectly to take advantage of the stock price inflation:

2

Even these huge stock sales did not dilute Brooks’ control of DHB. Cleverly, Brooks had

used his control of the Company to cause it to issue to him warrants to purchase millions of shares of

DHB stock at $1 per share. This assured Brooks’ continued control of DHB even as he unloaded

huge amounts of stock, as he could “reload” his stockholdings at a low price to keep control of DHB.

-2-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 6 of 162

DHB insiders finished the massive sell-off just after the stock reached its all-time high price and the

Company announced its largest-ever contract, which Brooks said on December 23, 2004 was the

“catalyst that will propel and sustain” DHB “into the future as the clear, preeminent leader in the

design, development and production of technologically superior life-saving body armor systems.”

Over the next four days, as DHB stock climbed to its all-time high share price of $22.70, Brooks

sold more than five million shares for more than $100 million in illegal insider trading proceeds.

3.

Then, only days after DHB’s insiders completed their November-December 2004

stock bail-out, defendants were forced to begin leaking quality problems with DHB’s domestic law

enforcement and military vest programs and disappointing financial results. DHB would later take a

huge $60 million charge against earnings as a result of its concealed widespread use and stockpiling

-3-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 7 of 162

of “Zylon,” a ballistics material DHB used extensively. PACA, DHB’s other body-armor subsidiary,

also produced vests containing Zylon. The $60 million charge taken at the end of the Class Period

wiped out over 100% of DHB’s previously reported Class Period profits and almost 50% of its

reported shareholders’ equity! As DHB insiders dumped their stock en masse and the truth about

both DHB’s military and domestic law enforcement vest programs subsequently entered the market,

the price of DHB stock fell precipitously to just $4.48 per share, erasing over $800 million in market

capitalization from the Class Period high and inflicting hundreds of millions of dollars of damages

on public investors who were victimized by defendants’ scheme.

OVERVIEW OF THE ACTION

4.

Prior to the Class Period, in 2000-2001, DHB was a small company with annual sales

of less than $100 million and net income of less than $5-$10 million. DHB has been controlled by

David H. Brooks and his wife, defendant Terry Brooks (collectively, “the Brooks’”), its largest

shareholders, since its inception.

Brooks and DHB Have a Controversial Past

5.

As described fully at ¶31(a), David Brooks and DHB have a checkered past. For

example, Brooks and his brother, Jeffrey Brooks, were fined and barred for five years from brokerdealer activities by the United States Securities and Exchange Commission (“SEC”) in 1992. In

1993, he and his brother entered into a consent agreement with a public Company of which they

were part owners, agreeing to forego involvement with the entity for 10 years after being accused of

stock manipulation. In 1995, the National Association of Securities Dealers (“NASD”) denied

DHB’s application for listing on the NASDAQ Small Cap Market because it “was troubled by

Brooks’ prior misconduct.” The SEC upheld the NASD’s ruling on appeal and expressly concluded

that “We find that the NASD’s concerns as to Brooks are legitimate” because Brooks’ conduct

-4-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 8 of 162

“undermines both the regulation of securities firms and its registered representatives, and

protection of investors” and “that Brooks has a history of serious securities law violations.”

6.

DHB’s past is similarly controversial. The Company has a long history of self-

dealing which has illegally enriched Brooks and his immediate family to the tune of tens of millions

of dollars (¶158). The full extent of Brooks’ taking from DHB is still unknown to investors.

Brooks’ high-profile anti-union activities embroiled the Company in labor disputes which threatened

its ability to increase production of its body armor products to meet surging demand and subjected

DHB to shareholder disputes and an SEC investigation, which is still ongoing. DHB also tore

through outside accountants, which changed year after year as a result of DHB’s failure to disclose

large related-party transactions with the Brooks’ and inventory pricing and Audit Committee

weaknesses, among other problems. By the time the Weiser LLP accounting firm resigned in April

2005, DHB had burned through four outside accounting firms since 2002.

The Fraudulent Pump-and-Dump Scheme

7.

Because of DHB’s small size, its limited potential for growth and questions about

Brooks’ past behavior and integrity, DHB’s stock has historically traded at a low price. After the

catastrophic “9/11” terrorist attacks on our country in 2001 and the resulting war on terrorism,

including United States military interventions in Afghanistan and Iraq, the demand for body armor

products to protect domestic law enforcement, security personnel and members of the United States

military skyrocketed amid significant increases in spending for domestic security and national

defense. These events greatly increased the interest of investors in the stocks of companies which

stood to profit from increased “security” spending. Defendants were determined to take advantage

of this anticipated windfall and increased investor interest in companies like DHB provided a perfect

opportunity for Brooks and his cohorts to profit enormously if they could use our national crisis to

pump up DHB’s stock price. But despite increased investor interest in security companies and the

-5-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 9 of 162

Company’s own efforts to allay investor concerns about the integrity of its management (such as its

2003 enactment of a Code of Business Conduct & Ethics), DHB’s stock continued to under-perform

and was sold for only $5-$6 per share in the spring of 2004.

8.

By late 2003-early 2004, Brooks and his cohorts realized that in order to pump up

DHB’s stock price to permit them to personally profit from their stock holdings, they had to

convince the market, at least temporarily, that DHB’s business was a tremendous success by causing

DHB to consistently report very strong financial results (i.e., increasing assets, profits, income and

shareholder equity) coupled with credible forecasts of continuing profitable future growth. In the

spring of 2004, DHB resolved the labor difficulties which had been adversely impacting the

Company and secured dismissal of a shareholder derivative suit which had challenged Brook’s’ selfdealing transactions with DHB. With the stage set, DHB’s officers and directors achieved their

fraudulent goals by reporting increasing and large sales of vests to domestic law enforcement

agencies, large supply contracts with the U.S. military and record profits and shareholders’ equity for

the Company. Indeed, during the first three quarters of 2004, DHB reported consistently growing

and “record” sales, net income, EPS and shareholders’ equity, as shown below:

Net Sales

Gross Margin

Net Income

EPS

Shareholders’ Equity

1stQ 04

2ndQ 04

3rdQ 04

$74.40M

27.91%

$6.36M

$0.14

$53M

$86.07M

27.75%

$7.66M

$0.17

$60.7M

$89.41M

27.82%

$8.15M

$0.18

$68.8M

Each time DHB reported “record” results during the Class Period, the Company assured investors

that it had “continue[d] to meet or exceed” all of its financial “operating goals” and the previous

guidance it had given to analysts. It said, for example, that this “surging operating performance and

earnings leverage” created a “future outlook for DHB [that was] exceptionally strong.” Due to

DHB’s significant operating and earning leverage, Brooks told investors, “I can say only this, this is

-6-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 10 of 162

just the beginning, the future is ours.” In short, DHB was “in a league of [its] own” with its

“world class products.”

9.

Defendants’ credited DHB’s purported newfound success on soaring sales fueled by

the high quality of the Company’s products (an indispensable element for success of a company

manufacturing body armor products), which DHB repeatedly emphasized exceeded its customers’

requirements and expectations. For example, defendants told investors during the Class Period that

the Company’s market share was “highly dependent upon the quality of its products,” and therefore

management’s “strategic focus is on quality,” which was the “key element[]” of future orders from

“governmental agencies.”

DHB also assured investors that its military contract awards

demonstrated the U.S. Department of Defense’s “continued confidence in [its] ability to deliver

life-saving body armor systems to the armed forces of the United States,” and that its products

“exceed[ed] the requirements and expectations of the United States military.” The Company also

repeatedly assured investors that customer orders showed “confidence of . . . customers in [its]

products,” and that DHB “continue[d] to provide exceptional products . . . that exceed the

requirements and expectations of [its] customers,” the U.S. Military and domestic police forces. In

short, DHB assured investors its “industry leading” products were the result of the “strength of

DHB’s technology” which “strengthen[ed] our capability to manufacture quality products,” that

were the “best that [have] ever been developed.”

10.

While DHB was reporting “record” financial results and its ever strengthening

financial condition, it also assured investors that its internal financial and accounting and SEC

disclosure controls were well-designed, had been tested and were functioning effectively, and thus

complied in all material respects with federal law and regulations. Such assurances were

particularly important given DHB’s track history of changing (through resignation and dismissal) its

-7-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 11 of 162

outside accountants annually and investors’ concerns over Brooks’ prior misconduct and integrity.

Each quarter during 2004-2005, Brooks and Schlegel, as the CEO and CFO of DHB, represented

that they had recently evaluated these control systems, that they were effective and that any

previously identified weaknesses had been corrected. Thus, they certified that DHB’s 2004-2005

quarterly reports and financial results were true and correct and that they had disclosed any

deficiencies in the design and/or operation of those control systems and any fraud involving them,

whether or not material. DHB also attached its Code of Business Conduct & Ethics as an exhibit to

its fiscal year 2003 and 2004 10-Ks filed with the SEC.

DHB’s Vest Programs had Major, Undisclosed Problems

11.

Despite statements made by the Company about its “exceptional” and “world-class”

products and record financial results, nothing about DHB’s core lines of business (the production of

bulletproof vests for the military and domestic law enforcement agencies) and financial condition

was what DHB claimed it to be. In fact, defendants were actually concealing serious, known

problems in DHB’s military and domestic law enforcement body armor programs throughout the

Class Period, including persistent failures of ballistic tests, an inability to meet contract performance

requirements and technical specifications and non-performance of a critical quality assurance plan.

Defendants had also failed to disclose, write-off or properly accrue loss contingencies for known

liabilities associated with DHB’s widespread use and stockpiling of a defective material.

12.

DHB’s production of Interceptor-class Outer Tactical Vests (“Interceptor” or

“OTVs”) began in 1999 after the United States Army Natick Soldier Center (“Natick”) awarded

DHB a five-year contract to produce Interceptors for the United States military in 1998. The

Interceptor program itself, and what the military and those involved with the program decisionmaking knew but did not disclose about vest design and quality problems from the program’s

inception, has itself recently came under heavy scrutiny. In 1998, as now, there were a limited

-8-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 12 of 162

number of companies capable of successfully bidding on such body armor contracts, body armor and

bullet proof vest-manufacturing being a specialty industry with relatively few producers. There are

also significant barriers to entry to this market. Internal government memoranda made public by The

Marine Times in May 2005 revealed that DHB’s original bid on the Interceptor contract was among

several “technically acceptable” proposals, but “one of the deciding factors” in awarding the contract

to DHB was the Company’s quality assurance plan, for which the military paid DHB an extra $50

per vest. Despite “pleading” from the military, DHB never implemented the plan and failed to

perform these essential quality assurance procedures. DHB also came under scrutiny with regard to

the Interceptor vest contract because it hired Edward Lavigne, a contracting officer at Natick charged

with administering the DHB contract, 2001, in apparent violation of the Procurement Integrity Act

(41 USC §423 et seq.).

13.

The Marine Times’ startling expose, coming only a few months after insiders dumped

over $200 million in DHB stock, detailed extensive problems at the Company which, as explained

herein (¶¶99-101), revealed that the Interceptor program was not what DHB said it was. According

to the expose and supporting documentation (attached hereto as Exs. A and B, respectively), DHB

shipped thousands of defective and non-conforming “Interceptor” vests to the United States Marine

Corps with “critical, life-threatening flaws in the vests” in 2003-2004, which the Marines were then

forced to recall. The expose documented that military and ballistics experts and the Defense

Contract Management Agency had identified thousands of defective DHB vests beginning as early

as January 2003, when a DHB vest first failed a ballistics test, and that DHB vests repeatedly failed

ballistics tests throughout 2003-2004. DHB was indifferent – Hatfield, who was present day-to-day

at the DHB facility, discussed the vest failures with subordinates, some whom then quit in frustration

when she refused to address the issue substantively. The military required DHB officers to

-9-

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 13 of 162

repeatedly sign “Requests for Deviation/Waivers” which privately admitted major vest deficiencies

throughout 2004. Hatfield in fact signed such a waiver on November 30, 2004, only one day after

massive insider sales by Brooks, Hatfield, Schlegel, Nadelman, Krantz, Chasin and Berkman

resulting in windfall profits of more than $81 million on their sale of 4.3 million shares.

14.

As a result of DHB’s consistent failures to produce quality products and perform

adequate quality control, military officials recommended disciplinary action against DHB. The

military only accepted DHB’s defective vests because it had failed to adequately stock up on body

armor in advance of the ground invasion of Afghanistan and Iraq and, by 2004 when ground fighting

in Afghanistan and Iraq intensified, the military had a dire, urgent need for armor which meant that it

would accept a “sub-par product because it is preferable to none at all.” In total, the military recalled

more than 23,000 DHB vests from use in the field.

15.

The situation with DHB’s vests produced for domestic law enforcement officers was

no better, although defendants successfully concealed the full extent of their problems until August

30, 2005. As explained herein, DHB concealed from investors that, since 2001, the Company had

shipped thousands of vests to domestic law enforcement officers and other security personnel made

with the ballistic material Zylon, which was unsuited for use in bulletproof vests. Point Blank

produced 15 models of vests for use by domestic law enforcement and security personnel, eight of

which were made with Zylon. PACA also produced Zylon vests. Each vest carried a five-year

warranty. But DHB knew prior to the Class Period that Zylon degrades and that its vests could not

meet the Company’s warranty. According to the Arizona Attorney General, in an action commenced

against Second Chance (a DHB competitor), Zylon’s manufacturer, Toyobo Co., Ltd. (“Toyobo”),

conducted tests “and provided [the results] to Second Chance during December 1998 through

January 2003 . . . . Second Chance knew that Zylon rapidly and permanently loses strength when

- 10 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 14 of 162

exposed to such common conditions as high humidity and heat, fluorescent light, and sunlight.”

State v. Second Chance Body Armor, Inc., No. CV2004-000736 (Maricopa County, Ariz., Super. Ct.,

amended complaint filed 8/13/2004). DHB, along with its competitors who used Zylon in the

manufacturing of bullet proof vests, also received these test results as well as quarterly and semiannual updates from Toyobo regarding Zylon beginning January 1, 2002. Accordingly, DHB

possessed considerable information regarding problems with Zylon prior to and throughout the Class

Period. Rather than act on what defendants knew about Zylon, DHB continued to sell vests made

with Zylon and stockpiled the unusable and unsaleable material, bloating the Company’s Class

Period inventories, which grew by nearly 100% between 3rdQ 04 and 1stQ 05. When questioned

about Zylon and their fast-growing inventories, DHB lied to investors, explaining at first that it was

“stockpiling raw materials” in anticipation of “future shortages,” and later that it had a large number

of finished goods awaiting shipping. DHB also falsely told investors during the Class Period that it

was no longer selling Zylon vests and that there were few Zylon vests in use in the field when it had

actually sold at least 50,000 Zylon vests which were incapable of meeting DHB’s five-year

warranty.

16.

On January 3, 2005 (just days after insiders finished their massive November 2004-

December 2004 sell-off), DHB announced that it had been sued by the Southern States Police

Benevolent Association over its sale of vests containing Zylon. On February 15, 2005, DHB

announced the settlement of the suit, indicating that the Zylon vest problem was settled for $1.5

million – the cost for replacing 2,000 vests – stating, “Zylon itself was not the issue” and “We still

have a high degree of confidence in the vests.” On August 8, 2005, Brooks, Schlegel, Krantz and

Nadelman signed the DHB 2ndQ 05 SEC filing – DHB disclosed therein only that its settlement of

lawsuits regarding Zylon would not have a material adverse impact on the Company.

- 11 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 15 of 162

Defendants’ Massive Fraud is Fully Revealed in August 2005

17.

On August 30, 2005, DHB suddenly announced a massive $60 million write-off,

revealing that it had “ceased production of all Zylon-containing bullet resistant products,” that it

would be implementing a replacement program for all customers with Zylon body armor and that

these actions would result in a $60 million charge for the replacement costs and Zylon inventory

write-off. The Zylon write-off shocked the market and analysts, as DHB had earlier indicated that it

was no longer producing Zylon vests, that only a small number remained in the field and that its

increasing inventories were due to its stockpiling of raw materials to manufacture valuable products

and finished goods awaiting shipment. This huge $60 million charge wiped out all of DHB’s

reported earnings during the Class Period and eliminated a large part of its net

worth/shareholders’ equity! The write-off revealed that throughout the Class Period, defendants

failed to properly account for its use and stockpiling of Zylon by failing to take write-downs, accrue

liabilities and take the reserves required by GAAP, concealed the scope of DHB’s Zylon usage and

associated liability and mislead investors about the likely impact of the Company’s use and

stockpiling of Zylon on the Company’s financial position. DHB subsequently announced on March

17, 2006 that the Company could not timely file its 2005 10-K because it continued to suffer

inventory pricing problems and needed to reassess the sufficiency of its estimates for the cost of the

Zylon vest replacement program. DHB indicated that it may need to restate its 1stQ 2005-3rdQ

2005 financial results as a result.

18.

As explained in detail herein, (¶¶159-166), DHB’s stock declined significantly after it

reached its all-time high in late December 2004 as the undisclosed truth about DHB began to enter

the market. Although defendants attempted to “walk” DHB’s stock price down slowly to cover their

tracks, DHB shares declined in value as news of the massive insider bail-out, potential and then

actual Zylon liabilities, vest quality issues, and worsening financial results entered into and were

- 12 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 16 of 162

absorbed by the market. As defendants’ prior misrepresentations and other fraudulent conduct was

revealed, DHB stock declined from its high of $22.70 on December 27, 2004 as the scope of the

insider sell-off become known and reported by the media and, after further revelations, fell all the

way to $4.50 on August 30, 2005 after the announcement of the $60 million Zylon write-off.

Throughout this period, DHB stock experienced large, company-specific stock declines that were not

due to general market movements or industry factors or even company-specific negative information

unrelated to the alleged fraud. The attendant economic loss, i.e. damages, to plaintiffs and other

members of the class was a direct result of defendants’ fraudulent scheme to artificially inflate

DHB’s stock price.

19.

Both the Interceptor vest program and DHB’s models of Zylon vests were large

product lines, crucial to the success of DHB. Zylon was used by Point Blank in half of the models

produced as part of DHB’s domestic law enforcement body armor program and the Interceptor vest

was the lifeblood of DHB’s military armor program. In total, DHB’s sale of body armor products

produced 98% of the Company’s total revenue. These product lines were infected with pervasive

undisclosed problems for a period of years. DHB’s top officers had direct knowledge of these

product lines and the undisclosed problems detailed herein. If the top officers of the Company did

not know about pervasive problems with either the Interceptor or with Zylon, which in fact increased

in magnitude throughout the Class Period, they were grossly reckless in making any public

representations regarding the success of the domestic and military vest lines of business and either

line’s financial impact on DHB. At bottom, the method of accounting for the Company’s Zylon use

and inventories, the performance of DHB’s Interceptor vests sold to the U.S. military are simply not

matters relegated to lower-level managers – these are the very matters which the top executives of

the Company are involved in on a day-to-day basis and with which they must be intimately familiar.

- 13 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 17 of 162

And, if they are not, then there is absolutely no factual basis for the affirmative and positive

representations they chose to make about the success of DHB’s business and their strong

contribution to DHB’s reported net income/EPS.

20.

As detailed in this Complaint, there were material undisclosed conditions inside

DHB’s business throughout the Class Period which defendants (DHB’s top insiders) knew of, or

were reckless in not knowing of. Defendants knew or were reckless in not knowing that these

conditions would ultimately become public and have a very serious adverse impact on DHB’s

financial results and condition, perceptions as to the quality of its products and DHB’s prospects for

and ability to actually achieve continued profitable growth (as well as the integrity of Brooks and his

DHB management team) and thus cause its stock price to decline sharply. For example, by the

outset of the Class Period, DHB had accumulated a very large inventory of Zylon raw materials

which it used to manufacture body armor products for domestic law enforcement personnel. DHB’s

insiders had become aware through actions and statements of competitors, its Zylon supplier, as well

as DHB’s own experience with its own Zylon body armor products that, due to exposure to light,

heat and moisture, such products deteriorated much more quickly in the field, i.e., in actual service

use, than had been expected or was necessary for DHB’s five-year warranty to be honored, thus

exposing police officers to the risk of serious harm or death and DHB to huge potential product

liability, warranty and recall costs. So serious was this problem with Zylon that certain of DHB’s

competitors had stopped using Zylon to manufacture products and even recalled their own Zylonbased body armor products. DHB, however, took no such action whatsoever and instead falsely told

analysts that it was not still manufacturing Zylon-based products, that there were very few DHB

Zylon vests in use in the field and disclosed only that its settlement of lawsuits regarding Zylon

would not have an adverse material impact on the Company. Unknown to investors, DHB sold at

- 14 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 18 of 162

least 50,000 Zylon vests during 2001-2005, all of which were still under warranty during the Class

Period. Moreover, DHB continued to manufacture Zylon-based body armor products in the hope of

using up the huge inventory of Zylon materials it had accumulated before the Company was forced

to disclose that its inventory was worthless. In addition, DHB’s insiders knew that the Company

was encountering very serious problems with the quality of its flagship product line, the Interceptor

vest, manufactured for the U.S. military. These vests, of course, were required to meet very

stringent technical specifications and quality standards, as they were to be worn by military

personnel in the field. In order to lower production costs and artificially boost its profits, however,

DHB failed to implement or follow required and necessary manufacturing and quality controls for

which they were being paid. As a result, the DHB Interceptor vest line was plagued by high

numbers of defective vests which did not meet contract requirements or military specifications.

These non-conformities/defects had been detected by Department of Defense procurement and

quality assurance personnel during 2003-2004. These military personnel recommended rejection of

the defective vests and that action be taken against DHB because DHB was producing poor quality,

non-conforming vests and the military had granted DHB huge contracts on the basis of explicit

representations by DHB of the Company’s superior ability to meet technical requirements and

perform quality assurance procedures as compared to its competitors. While DHB was able to get

the military to waive the rejection of these defective products because of the military’s

overwhelmingly urgent need for body armor to protect its soldiers in Afghanistan and Iraq, DHB

knew it was only a matter of time until these defects became publicly known and before the military

stopped accepting delivery of defective vests and likely took action against DHB. And they knew,

of course, that the disclosure of any of the Company’s problems with Zylon and the Interceptor

would have had an immediate negative impact on DHB’s business and its financial results, as it

- 15 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 19 of 162

would require huge write-offs of inventory, reserves for known contingencies and product

replacement costs which, in turn, would crush DHB’s stock price. Thus, DHB’s insiders lied to

investors to conceal these adverse facts and to inflate the stock so they could profit personally by

pushing the stock up higher, exercising their options and selling off their shares.

21.

DHB’s reported financial results and conditions, as well as the other statements made

between March 24, 2004 and August 29, 2005 concerning DHB’s business, products, financial

condition and future prospects were each false when made and were misleading in failing to disclose

the true financial results and conditions of DHB and adverse facts and conditions concerning DHB’s

business, products, finances and future outlook as set forth below:

(a)

Orders received by DHB from the Department of Defense (“DOD”) were not

an indication of the confidence of the U.S. military in, or satisfaction with, DHB’s products because,

in fact, many thousands of units of DHB’s main military product, the Interceptor vest, shipped to the

U.S. Marines were non-conforming and defective, and orders for vests were being placed and

defective vests were being accepted only because the military was suffering from extreme shortages

of body armor which was desperately necessary for American troops in Afghanistan and Iraq;

(b)

DHB’s products were not “world class,” “exceptional” or “the best that’s ever

been developed” or “technologically superior”; in fact, DHB had, since 2001, shipped at least 50,000

defective and non-conforming Zylon-based body armor products to domestic law enforcement

agencies which did not meet and could not fulfill DHB’s five-year warranty. DHB had also shipped

thousands of defective and non-conforming Interceptor vests to the U.S. Marines which failed to

comply with DOD/U.S. military contract specifications and requirements;

(c)

DHB’s systems of quality control, which were necessary for its successful

operation, were defective and inadequate, which led to the shipment of thousands of defective

- 16 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 20 of 162

Interceptor vests to the U.S. Marines and also prevented DHB from being able to trace identified

defective vests to specifically identified lots of raw material, a major manufacturing processing and

quality control defect, which contaminated 100% of DHB’s Interceptor vest production;

(d)

DHB had accumulated many millions of dollars of defective and useless

Zylon raw material which its insiders knew could no longer be used to manufacture body armor

products because Zylon degraded rapidly when exposed to heat, light and body perspiration. DHB’s

excessive inventory of useless and unsaleable Zylon materials should have been and would have to

be written off, which would result in a multi-million dollar charge and adversely impact DHB’s

financial condition and results from operations;

(e)

It was not true, as represented by DHB, that there were very few Zylon vests

manufactured by DHB still in use by police departments in the field; on the contrary, there were at

least 50,000 Zylon vests still used in the field and still under warranty, that would have to be

replaced by DHB at a huge cost, which would have a material adverse impact on DHB’s financial

results and condition;

(f)

DHB’s financial reports and statements for the periods ending March 31,

2004-June 20, 2005 were materially false and misleading in overstating the value of DHB’s

inventories, failing to accrue material loss contingencies, i.e., Zylon vest replacement costs, and

overstating DHB’s net income, EPS and shareholders’ equity by material amounts;

(g)

DHB’s top insiders were aware that thousands of DHB Interceptor vests were

defective and did not conform to government standards, even though DHB had been paid an extra

$50 per vest to assure the high quality of such vests, that the DOD/U.S. military’s quality control

assurance personnel had discovered these defects and were recommending rejection of the vests and

disciplinary action against DHB, and that even if DHB was able to persuade the government to

- 17 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 21 of 162

accept these defective vests because of the government’s urgent need for body armor for U.S. troops,

the U.S. military would, when body armor became more available, curtail its purchases of DHB’s

products;

(h)

DHB’s vests did not meet or exceed the expectations or requirements of

DHB’s domestic law enforcement and U.S. military customers, as thousands of these vests were

defective and non-conforming and its customers had objected to these defects, demanding or taking

remedial actions. Defendants privately acknowledged on multiple occasions throughout 2004,

including as early as February 2004 and, specifically, on November 30, 2004, that its Interceptor

vests did not meet or exceed expectations when officers of the Company signed military “Requests

for Deviation/Waiver” forms indicating major vest defects;

(i)

The reason for the increase in DHB’s inventories during 2004-2005 was not

that DHB was stockpiling raw materials, which were purportedly in short supply so that it would

have those materials to produce armor body products to meet increasing demand as claimed, but

rather, DHB’s inventories were increasing because the Company had accumulated and continued to

carry on its books millions of dollars of Zylon raw materials and Zylon-based vests which were, in

fact, unusable, worthless and should have been written off in accordance with Generally Accepted

Accounting Principles (“GAAP”) standards;

(j)

DHB’s internal financial and accounting and disclosure controls were not

adequately designed, had not been properly tested and, in fact, were defective, which was leading to

material fraud in the presentation of DHB’s financial results and condition. The internal control

deficiencies in DHB’s quality control systems, inventory pricing mechanisms and operations of its

Audit Committee were serious and pervasive and had not been corrected or had been overridden by

management, with the result that DHB had accumulated millions and millions of dollars of excessive

- 18 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 22 of 162

and worthless inventory of Zylon raw material, was manufacturing and shipping thousands of

defective Interceptor vests to the U.S. military and not properly accounting for or reporting these

matters in its SEC filings and other public statements;

(k)

It was not true that the insider stock sales by DHB’s top officers and directors

were merely due to those individuals wanting to diversify their holdings; but rather, those sales took

place as part of a plan and scheme to inflate DHB’s stock price by false and misleading statements

and then bail out of the stock so that the Individual Defendants could personally profit at the expense

of public investors;

(l)

DHB’s officers and directors were violating multiple provisions of the DHB

Code of Business Conduct & Ethics;

(m)

DHB’s reported multi-hundred million dollar order backlog was false and

misleading because, due to its shipment of defective and non-conforming merchandise to the U.S.

Marines, the U.S. military had the right to cancel or refuse to accept future shipments or to cancel as

yet unfulfilled portions of future orders, and by late 2004, the U.S. Marines had done so; and

(n)

As a result of the foregoing, DHB’s forecasts of continued future profitable

growth and other optimistic statements regarding the future of DHB’s business were completely

false and were known by defendants to be false when made, because the adverse facts and conditions

detailed herein would cause DHB’s business to perform much worse than promised or forecast and

its financial results to be far short of those forecast.

22.

As detailed in ¶¶119-133 (“False Financial Statements”), DHB’s inventories, assets,

net income and EPS were materially inflated during the Class Period. Its shareholders’ equity was

also massively overstated, as the chart below sets forth:

- 19 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 23 of 162

3/31/04

6/30/04

9/30/04

12/30/04

3/31/05

6/30/05

Shareholders’ equity

as reported

$53,087,000

$60,737,000

$68,795,000

$77,026,000

$85,201,000

$92,799,000

Shareholders’ equity

assuming required

charge* had been

recorded

$15,887,000

$23,537,000

$31,595,000

$39,826,000

$48,001,000

$55,599,000

234%

158%

118%

93%

77%

67%

Overstatement %

* Assumes charge of $60 million, reduced by tax rate of 38%.

23.

Defendants’ “pump-and-dump” scheme was successful. The individual defendants

unloaded huge amounts of stock, as shown below:

Defendant

Berkman

Brooks

Chasin

Hatfield

Krantz

Nadelman

Schlegel

TOTALS:

Shares

Sold

44,620

9,498,025

108,496

269,545

116,226

102,374

149,503

Proceeds

$

864,748

$185,893,751

$ 2,063,127

$ 5,292,041

$ 2,251,557

$ 2,007,554

$ 2,931,754

10,288,789

$201,304,532

This insider selling was unusual in both timing and amount.

- 20 -

% of Actually

Owned Shares

Sold

29.4%

59.7%

100.0%

100.0%

89.0%

58.7%

84.2%

Case 2:05-cv-04296-JS-ETB

24.

Document 80-1

Filed 03/20/2006

Page 24 of 162

In addition, defendants’ direct knowledge or reckless disregard of the matters

explained herein and their top executive and directorial positions, which perforce required

defendants’ intimate involvement in the matters central to this suit, defendants’ insider trading

strongly demonstrates their knowledge of the problems alleged herein. (See also ¶¶156-158 “Insider

Trading”). The timing and magnitude of these sales is highly supportive of an inference of

knowledge on the part of Defendants, DHB’s top insiders, of the adverse conditions and problems

existing inside DHB and the accounting manipulations and false statements engaged in to conceal

them. As the table graphs presented in this Complaint demonstrate (¶¶23-24, 31(a)-(g), 157), these

sales were unusual in timing and amount, both individually and in the aggregate. DHB’s top

executives and directors sold, either zero or a relatively small number of shares prior to the

- 21 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 25 of 162

beginning of the Class Period. Yet, during the Class Period, as their affirmative misrepresentations

pushed DHB’s stock to its all-time high, they unloaded millions of shares of stock. Their market

trading was clearly designed to maximize their personal profits. If, in fact, DHB’s insiders believed

what they were saying about the current period success and future anticipated success of DHB’s

stock, the Individual Defendants would have had no reason to sell off such large portions of their

holdings. If their statements about DHB’s prospects were true, their shares would have been even

more valuable as DHB’s forecasted future successes came to fruition. Their statements were

completely inconsistent with their public representations about DHB’s business, and reported

financial results, but completely consistent with and supportive of the allegations made herein of

their knowledge of the adverse conditions and problems inside DHB’s business and the accounting

manipulations they were engaging in to cover them up, as detailed in the following chart:

- 22 -

tions"

ty to

or."

l

$5.46

1stQ 04 10-Q Internal

financial and accounting and

disclosure controls effective.

Results accurate. No fraud,

material or otherwise.

w orders.

+ million.

gth of DHB's

ts." Products

ts and

omers." DHB

vels of service

15-20% sales growth

"next few years."

come $6.3 million/EPS

million. Inventories

met or exceeded ... all

ed as guidance to

11/29/04-12/29/04 Insiders

sell 10,288,789 shares for

$201,304,532.

10/5-29/04 $54 million in new orders

"substantiate the confidence of ... customers in

... products." "Exceptional products and service

that exceed the requirements and expectations

of ... customers."

8/5/04 "Record" 2ndQ 04 results. Net income $7.6

million/EPS $.17. Shareholder equity $60.7 million.

Inventory $74.3 million. " Met or exceeded all ...

operating goals ... provided as guidance" to

analysts. "Beginning to realize significant ...

earnings leverage." Shareholder equity has

increased by 30% since 12/31/04. "Future outlook

for DHB ... remains exceptionally strong."

Internal financial and accounting and disclosure

controls effective. Results accurate. No fraud,

material or otherwise.

7/14/04 "our facilities ... [here]

allowed us to strengthen our

capability to manufacture

quality products."

1/24/05 Roth Cap Ptnrs.

Attributes stock's activity

to insider selling. Also

group of police officers

claim Zylon vests

defective.

States: "Minimal amount"

in the field.

Class Period

3/24/04 - 8/29/05

3/16/05 4thQ 04

Net income and

refused to provid

conference call o

Inventories incre

scarce raw materi

accounting and di

accurate. No fra

$6.97

8/29/05 DHB will dis

help customers repl

for Zylon inventory

out class period ear

shareholder equity.

5/10/05 1stQ 05 results. Below

expectations. Shareholder

equity $85.2; Inventories

$102.9 million. Growing

inventories due to stockpiling of

scarce raw materials.

10-Q Internal financial and

accounting and disclosure

controls effective. Results

accurate. No fraud, material or

otherwise.

5/9/05 Marine CorpsTimes expos

-- Thousands of DHB Marine Cor

Interceptor vests defective. Quali

control procedures not followed.

Marine Corps recalls thousands o

vests. Marine Corps stopped

purchase of vests.

4/15-16/05 DHB's auditor resign

4 years. Inventory pricing/Audit

weaknesses. Assures analysts n

adjustments required. Inventorie

$85.9 million.

4/9/05 Miami Herald article on in

Speculation of trouble at Compan

spokesperson says "things are go

1/11/05 Newsday -- $200 million insider selling.

Brooks says sellers "just wanted to diversify ...

holdings ... company ... look[s] forward to brilliant

year in 2005 ... insider selling is no reflection of

the business going forward."

2/14/05 Settles Zylon class

action vest suit. Cost $1.5

million. Still have high

degree of confidence in

vests. No material adverse

impact on DHB.

$14.19

$22.70

1/3/05 Class action suit by Southern

States Police Benevolent Ass'n re:

defective Zylon vests.

1/7/05 Roth Cap. Ptnrs -- Shares of DHB weak

due to nervous market after DHB insiders' stock

sales. "Sign of a red flag or bad news."

12/23/04 Huge Army Interceptor vest and Baltimore

Police contracts. "Catalyst that will propel and sustain

us into future." "Preeminent leader in design ... and

production of technologically superior life-saving body

armor" products. "Order demonstrates [DOD's]

confidence in [DHB's] ability to deliver life-saving body

armor." "Puts us in a league of our own as world's

premier provider of protective solutions surpassing our

customers' expectations." "World class products."

11/9/04 Record 3rdQ 04 results.

Net income $8 million/EPS $.18.

Shareholder equity $68.8 million.

Inventories $81.9 million. Continue

"to meet or exceed all ... operating

and performance goals." "Surging

operating performance and earnings

leverage --- this is just the beginning,

the future is ours."

Internal financial and accounting and

disclosure controls effective.

Results accurate. No fraud, material

or otherwise.

9/28/04 DHB refutes

rumor of stock sales by

Brooks.

$15.01

6/9/04 Kudlow & Kramer -- Order "changes the

whole complexion of DHB" -- Interceptor is

"certainly the best that's ever been developed

... it exceded the expectations of what the

military was looking for."

6/8/04 Big US Army contract for

$239 million. Order "a testament

to our industry-leading research

and development efforts."

g

old: 10,288,789

: $201,304,532

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 27 of 162

JURISDICTION AND VENUE

25.

The claims asserted in this complaint arise under and pursuant to §§10(b), 14(a),

20(a) and 20A of the 1934 Act [15 U.S.C. §§78j(b) and 78t(a) and 78t-1] and Rules 10b-5 and 14a-1

promulgated thereunder by the SEC [17 C.F.R. §240.10b-5; 17 C.F.R. §240.14a-1 to 240.14a-9].

26.

This Court has jurisdiction over the subject matter of this action pursuant to 28 U.S.C.

§§1331 and 1337, and §27 of the 1934 Act.

27.

Venue is proper in this district pursuant to §27 of the 1934 Act and 28 U.S.C.

§1391(b). Many of the acts and practices complained of herein occurred in substantial part in this

District.

28.

In connection with the acts alleged in this complaint, defendants, directly or

indirectly, used the means and instrumentalities of interstate commerce, including, but not limited to,

the mails, interstate telephone communications and the facilities of the national securities markets.

THE PARTIES

29.

(a)

Plaintiff NECA-IBEW Pension Fund (the Decatur Plan) (“NECA”) purchased

the securities of DHB at artificially inflated prices during the Class Period and suffered damages, as

a result of the artificial inflation coming out of the securities as defendants’ fraud was revealed.

NECA’s transactions are detailed in their certification, which was previously filed with the Court.

NECA is a multi-employer, defined-benefit pension plan headquartered in Decatur, Illinois.

(b)

Plaintiff Dr. George Baciu, Ph.D. (“Mr. Baciu”) purchased the securities of

DHB at artificially inflated prices during the Class Period and suffered damages as a result of the

artificial inflation coming out of the securities as defendants’ fraud was revealed. Mr. Baciu’s

transactions are detailed in the certification, which was previously filed with the Court. Mr. Baciu is

a Canadian citizen resident in Hong Kong where he is a Professor at Hong Kong Polytechnic

University.

- 24 -

Case 2:05-cv-04296-JS-ETB

(c)

Document 80-1

Filed 03/20/2006

Page 28 of 162

Plaintiff Robino Stortini Holdings, LLC (“RS Holdings”) purchased the

securities of DHB at artificially inflated prices during the Class Period and suffered damages as a

result of the artificial inflation coming out of the securities as defendants’ fraud was revealed. RS

Holdings is a limited liability corporation which makes investments on its own behalf. Michael

Stortini is the Principal and Managing Member of RS Holdings. RS Holdings is registered in

Delaware and Michael Stortini is a resident of that state.

30.

Defendant DHB is a public corporation incorporated in Delaware and headquartered

in Westbury, New York. DHB designs and manufactures body armor products which it sells to

police departments and the U.S. military through its Point Blank Body Armor (“Point Blank”) and

PACA subsidiaries. The sale of body armor and associated products provides 98% of DHB’s annual

revenue. DHB and its predecessor-entity, DHB Capital Group, are collectively referred to herein as

“DHB” or the “Company.”

31.

(a)

David H. Brooks was founder, CEO and Chairman of DHB. Defendant Terry

Brooks is David Brooks’ wife and she works cooperatively with him and at his direction with regard

to DHB and the DHB shares they own and/or control individually and through entities they

cooperatively control, including defendants David Brooks International Inc., Andrew Brooks

International Inc., and Elizabeth Brooks International Inc. (the “Brooks Entities”). Brooks sold

millions of shares of DHB stock, personally and by and through the Brooks Entities, during the Class

Period. DHB has also granted millions of “cashless warrants” exercisable into DHB shares to David

and Terry Brooks (collectively, “the Brooks”). Brooks has a long history of securities laws

violations, acknowledged by securities regulators:

(1)

In 1992, Brooks and his brother, Jeffrey Brooks, were implicated by the SEC

in an insider trading scheme at an entity – JBSI – over which Brooks exerted de facto

control. The SEC further charged that David and Jeffrey Brooks aided and abetted

reporting violations at JBSI. Brooks and his brother later settled the litigation by

- 25 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 29 of 162

accepting a civil fine of $405,000 and consenting to a bar on involvement in any

broker-dealer activities for a period of five years. Before settling with the SEC,

Brooks used JBSI as the placement agent for a private offering of shares in DHB’s

predecessor entity, DHB Capital Group, Inc., and JBSI received considerable

compensation.

(2)

In 1992, David and Jeffrey Brooks purchased over 17% of the shares of

USAT, a small intoxication-testing company. David Brooks served as a consultant to

USAT, while his brother was USAT’s investment banker. In 1993, David and

Jeffrey Brooks entered into a consent decree and injunction with USAT whereby

they severed all ties with the company and were banned from dealing with the

company for 10 years after shareholders accused Brooks of stock manipulation.

(3)

In 1995, the NASD denied an application by DHB to include the company’s

securities on the Nasdaq SmallCap Market, in part because of the SEC’s prior

enforcement action against Brooks and because the NASD was “troubled by Brooks’

prior misconduct.” SEC Release No. 34-37069, 1996 SEC LEXIS 989, *11 (April 5,

1996). Brooks and DHB made an unsuccessful appeal of the ruling to the SEC. The

SEC expressly concluded in the course of denying the company’s appeal of the

NASD ruling that “[W]e find that the NASD’s concerns as to Brooks are legitimate.

. .” because Brooks’ conduct “undermines both the regulation of securities firms

and its registered representatives, and protection of investors. . .” and “that Brooks

has a history of serious securities law violations. . .” Id. at *11-*12.

(4)

In 1998, the NASD agreed to list DHB on the Nasdaq SmallCap Market, but

placed significant restrictions on Brooks, requiring him to resign as CEO and take on

a Co-Chairman (Nadelman assumed the position) through 2000. The replacement

CEO hired by Brooks quit after only weeks on the job because he had concerns about

Brooks’ integrity and his unwillingness to actually relinquish control of DHB’s dayto-day operations, as required by Nasdaq. Nasdaq also implemented measures to

prevent stock manipulation and insider trading by David and Jeffrey Brooks. Nasdaq

required that (1) Brooks place all the shares he beneficially owned into a three year

voting trust administered by an independent trustee required to vote the shares

according to the majority shareholders vote; (2) Brooks be prevented from buying or

selling any shares for a three year period; (3) Brooks resign as a Director of the Audit

Committee; and (4) Jeffrey Brooks lower his ownership of the Company to not more

than 4.9 percent of the outstanding shares, forgo buying any additional shares of the

Company for three years and place all the shares he owned into a Voting Trust. The

Nasdaq restrictions were intended to prevent the exact kind of illegal, fraudulent

activity in which Brooks and his cohorts have now engaged and which are the

subject of this lawsuit.

(5)

In 2003, the SEC began an investigation into a litany of undisclosed or

improperly disclosed self-dealing transactions at DHB which improperly funneled

DHB moneys to Terry Brooks, corporations owned or controlled by the Brooks’

and/or Jeffrey Brooks (collectively, the “Brooks family”). That self-dealing, which

has enriched the Brooks family to the tune of tens of millions of dollars at the

- 26 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 30 of 162

expense of DHB’s public investors, is set forth in detail herein at ¶149. The SEC

investigation is still ongoing. DHB still has not fully described the nature and extent

of its related-party transactions with David, Terry and Jeffrey Brooks and entities

they own or control.

During the Class Period, Brooks sold 9,498,025 shares of his DHB common stock (59.7% of the

shares he owned) for $185.9 million in insider trading proceeds. These sales were unusual in timing

and amount and are inconsistent with Brooks’ historical DHB stock sales, as the following chart

shows:

Brooks received “other compensation” for 2003 and 2004 of $1 million and $2 million based on

DHB’s apparent business success and false profits. Brooks’ total 2004 compensation, including

options exercised as part of his $186 million stock sale, was $73.3 million. In total, Brooks and

members of his immediate family received $98 million in compensation and payments in 2004

- 27 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 31 of 162

(described fully herein at ¶149). DHB’s total reported net income in 2004 was $30.44 million and

the Company’s gross profit before expenses was only $94 million. As noted above, the Brooks’

2004-2005 windfall is only their latest illegally-obtained profit-taking at the expense of DHB’s

public investors. (¶149). Brooks also possesses significant knowledge of the accounting rules and

principles abused by himself and others as part of the massive fraud at DHB – he earned a Bachelor

of Science degree in accounting from New York University.

(b)

Sandra Hatfield (“Hatfield”) was COO of DHB since December 2000 and

during the Class Period. From October 1996-December 2000, she was President of the Point Blank

Body Armor subsidiary. Hatfield worked day-to-day in the Oakland Park, Florida facility where

DHB produced Interceptor vests. During the Class Period, Hatfield sold 269,545 shares of DHB

stock (100% of the shares she owned) for $5.3 million in illegal insider trading proceeds. Prior to

the Class Period, Hatfield made no sale of DHB stock. Hatfield’s stock sales were unusual in timing

and amount and out of line with her historical DHB stock sales, as the chart below shows:

- 28 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 32 of 162

Hatfield received “other compensation” for 2003 and 2004 of $695,000 and $750,000 based on

DHB’s apparent business success and false profits.

(c)

Defendant Dawn Schlegel (“Schlegel”) was the Chief Financial Officer of the

Company during the Class Period since 1999 and throughout the Class Period. During the Class

Period, Schlegel sold 149,503 shares of her DHB common stock, 84.2% of her holdings, for $2.9

million in illegal insider trading proceeds. Prior to the Class Period, Schlegel made no sales of DHB

stock. These sales were unusual in timing and amount and out of line with Schlegel’s historical sales

of DHB stock, as shown by the following graph:

- 29 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 33 of 162

Schlegel received “other compensation” for 2003 and 2004 of $100,000 and $500,000 based on

DHB’s apparent business success and false profits. Schlegel is also involved in defendant Terry

Brooks’ Tactical Armor Products, Inc., as she is listed as the Company’s “Point of Contact” by the

United States government.

(d)

Defendant Cary Chasin (“Chasin”) was a director of DHB since October 2002

and during the Class Period. He has a longstanding relationship with DHB and Brooks, having been

a high-level employee/consultant of the Company since the late 1990s. Chasin was a member of the

DHB Audit and Compensation Committees. He sold 108,496 shares of his DHB stock, 100% of the

shares he owned, for $2 million in illegal insider trading proceeds. Prior to the Class Period, Chasin

- 30 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 34 of 162

made no sales of DHB stock. These sales were out of line with his historical sales of DHB stock, as

shown by the following graph:

(e)

Defendant Jerome Krantz (“Krantz”) was a director of DHB since July 2000

and during the Class Period. Krantz was a member of the DHB Audit and Compensation

Committees. He sold 116,226 shares of his DHB stock, 89% of the shares he owned, for $2.2

million in illegal insider trading proceeds. Prior to the Class Period, Krantz sold no shares of DHB

stock. These sales were out of line with his historical sales of DHB stock, as shown by the following

graph:

- 31 -

Case 2:05-cv-04296-JS-ETB

(f)

Document 80-1

Filed 03/20/2006

Page 35 of 162

Defendant Gary Nadelman (“Nadelman”) was a director of DHB since July

2001 and during the Class Period. Nadelman was a business associate of Brooks as far back as 1992

when they, along with Brooks’ brother, Jeffrey Brooks, purchased over 17% of the shares of USAT.

As detailed above (¶31(a)(2)), David and Jeffrey Brooks entered into a consent decree and injunction

with USAT whereby they severed all ties with the company and were banned from dealing with the

company for 10 years. In addition, Nadelman served as one of two directors of Medi Data

International, Inc. (“Medi Data”), a corporation that is 97% owned by David Brooks’ wife,

defendant Terry Brooks, who serves as President and the other director. Medi Data is headquartered

out of the Brooks’ Long Island, New York, residence. Nadelman was also Co-Chairman of DHB

between 1998-2000 when Brooks was required by Nasdaq to share Chairmanship with a purportedly

- 32 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 36 of 162

independent director. Nadelman was a member of the DHB Audit and Compensation Committees.

He sold 102,374 shares of his DHB stock, 58.7% of the shares he owned, for $2 million in illegal

insider trading proceeds. Prior to the Class Period, Nadelman made no sales of DHB stock. These

sales were out of line with his historical sales of DHB stock, as shown by the following graph:

(g)

Defendant Barry Berkman (“Berkman”) was a director of DHB during the

Class Period. He sold 44,620 shares of his DHB stock, 29.4% of the shares he owned, for $864,748

in illegal insider trading proceeds. Prior to the Class Period, Berkman made no sales of DHB stock.

These sales were out of line with his historical sales of DHB stock, as shown by the following graph:

- 33 -

Case 2:05-cv-04296-JS-ETB

32.

Document 80-1

Filed 03/20/2006

Page 37 of 162

The parties listed in 31(a)-(g) are referred to herein as the “Individual Defendants.”

They are liable for the false statements pleaded herein at ¶51-52, 54-55, 58, 60, 62-64, 66, 69-73, 7778, 83, 85, 87, 91-92, 102-104, 108, and 110, and DHB’s false statements (including, but not limited

to, press releases, financial reports and SEC filings), as those statements were each “group

published” information for which they were collectively responsible.

BACKGROUND TO THE CLASS PERIOD

33.

Defendant DHB is a public corporation. DHB designs and manufactures body armor

products which it sells to police departments and the U.S. military. DHB also owns NDL Products,

Inc. 98% of DHB’s revenue is derived from its sale of body armor and closely associated products.

- 34 -

Case 2:05-cv-04296-JS-ETB

34.

Document 80-1

Filed 03/20/2006

Page 38 of 162

In late 1998, Natick awarded DHB a five-year contract to produce Interceptor OTVs.

Interceptor OTV body armor was designed by a joint Army and Marines development team and

issued to troops beginning in 1999. Then, as now, there were a limited number of companies

capable of successfully bidding on such body armor contracts, body armor and bullet proof vests

being a specialty industry with relatively few producers and, according to DHB, “significant”

barriers to entry. Natick originally awarded the Interceptor contract to DHB in large part because

DHB promised to perform additional quality assurance procedures which its competitors did not

offer. The additional quality assurance procedures separated DHB’s bid from a number of

“technically acceptable proposals.” The military paid DHB $50 a vest extra to perform this quality

assurance program.

35.

Throughout the Class Period, it was known, but undisclosed to investors, that

Interceptor OTV body armor was not as effective as other body armor systems despite claims by

DHB and the military as to the technological superiority of Interceptor vests. In fact, Interceptor

body armor produced by DHB and fielded by troops in Afghanistan and Iraq did not fit correctly,

degraded under use in combat and with age, and left soldiers vulnerable to potentially fatal torso

wounds. As far back as 1996, the military knew of superior body armor, but which had been

developed privately, rather than by the military itself. Instead of supplying troops with the betterconstructed and technologically advanced body armor, bureaucratic entrenchment caused military

officials to contract for and then issue their own inferior vest, the Interceptor, the underlying

technology for which had been developed in the 1970s. Unknown to investors, more modern,

technologically superior body armor is and has been fielded by the United States Secret Service,

among other public and private entities and organizations.

- 35 -

Case 2:05-cv-04296-JS-ETB

36.

Document 80-1

Filed 03/20/2006

Page 39 of 162

In April 2003, three Members of the United States Congress, including Congressman

Neil Abercrombie (D-HI), a member of the Committee on Armed Services, Ranking Member on the

Tactical Air and Land Forces Subcommittee and a member of the Readiness Subcommittee, formally

requested that the Defense Logistics Agency and the Army Material Command investigate whether

DHB violated the Procurement Integrity Act (41 USC §423 et seq.) in connection with the

Interceptor contract because, on January 19, 2001, DHB hired Edward Lavigne as Vice President of

its wholly owned subsidiary, NDL Products. NDL Products manufactures sports products, a

business with which career military officer Lavigne had no experience whatsoever, but which

operates out of the same facility in Oakland Park, Florida where DHB manufactures Interceptor

vests. DHB hired Lavigne away from Natick, where Lavigne had been a contracting officer

administering DHB’s Interceptor contract. The Procurement Integrity Act prohibits contracting

officers from working for companies whose contracts they oversaw in the previous twelve months.

The military’s response was not made public. Lavigne died in 2003.

37.

DHB purchased body armor raw materials from Toyobo Co., Ltd., including synthetic

PBO (poly p-phenylene-2, 6-benzobisoxazole) fiber, commonly referred to as “Zylon,” which it used

to manufacture bulletproof vests sold to domestic law enforcement agencies beginning in 2001.

Eight of the 15 different model vests produced for domestic law enforcement agencies by Point

Blank Body Armor contained Zylon. DHB’s other armor products subsidiary, PACA, also produced

vests containing Zylon. Each model was available in three different “threat levels.” The greater the

“threat level,” the more Zylon DHB used in the construction of the vest.

38.

Zylon first debuted in the body armor industry in the late 90s as a lighter and more

wearable alternative to other armed fabrics, such as Kevlar®. Toyobo is the sole supplier of Zylon

sold to DHB and DHB’s competitors. Zylon is manufactured as continuous filament yarn which is

- 36 -

Case 2:05-cv-04296-JS-ETB

Document 80-1

Filed 03/20/2006

Page 40 of 162

converted into fabric by weaving and layering. Prior to and during the Class Period, DHB and

Toyobo were in frequent contact with each other. Beginning in summer 2001, when Toyobo first

obtained conclusive test results indicating that Zylon had significant degradation problems, Toyobo

shared the results of its tests with the body armor industry, including DHB. Beginning January 1,

2002, Toyobo consistently provided the results of its Zylon testing to the body armor industry,

including DHB, on a quarterly and then semi-annual basis. Toyobo was also in frequent contact

with its customers via e-mail and facsimile transmissions and at body armor manufacturers’

meetings.

39.

Testing provided by Toyobo to the body armor industry, including DHB, clearly

indicated problems with Zylon. On or about August 28, 2001, Toyobo reported to Zylon vest

manufacturers, including DHB, test data that showed degradation in Zylon strength in less than 100

days at high temperatures and humidity. On or about September 14, 2001, Toyobo published a

technical bulletin describing Zylon properties under extreme conditions and announcing that there

was a 25%-35% loss of Zylon strength when Zylon was exposed to fluorescent lamps for several

weeks.

40.

In September 2003, ongoing testing of used vests containing Zylon showed

degradation problems with the fiber that shortened the wearable life of the vest. This process, which

is called “hydrolytic degradation,” potentially reduces the efficacy of the protective nature of the

clothing. Based on these tests, a DHB competitor named Second Chance recalled vests made

entirely of Zylon. According to Second Chance, “‘The problems associated with Zylon are not

specific to Second Chance’” – these problems were industry-wide and impacted DHB. Since 2001,