Corporate Law Alert

J. Sagar Associates

May 22, 2013

advocates and solicitors

Overseas Direct Investment – RBI Clarification

The Reserve Bank of India (“RBI”) has, vide

Circular No. A.P. (DIR Series) Circular No. 100

dated April 25, 2013, clarified that any overseas

entity having equity participation directly/ indirectly

shall not offer financial products linked to Indian

rupee (e.g. non-deliverable trades involving

foreign currency, rupee exchange rates, stock

indices linked to Indian markets, etc.) without the

specific approval of the RBI since the Indian

rupee is not currently fully convertible and such

products could have implications for the exchange

rate management of the country. Any incidence of

such product facilitation would be treated as a

contravention of the regulations framed under the

Foreign Exchange Management Act, 1999

(“FEMA”) regulations and would consequently

attract action under the relevant provisions of

FEMA.

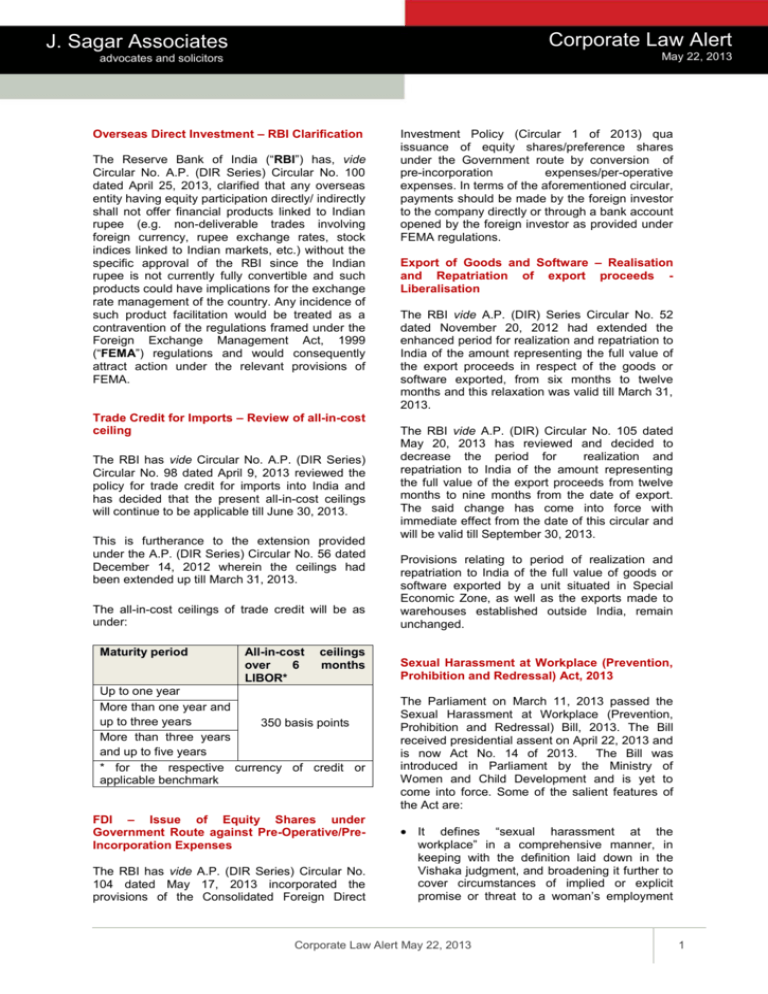

Trade Credit for Imports – Review of all-in-cost

ceiling

The RBI has vide Circular No. A.P. (DIR Series)

Circular No. 98 dated April 9, 2013 reviewed the

policy for trade credit for imports into India and

has decided that the present all-in-cost ceilings

will continue to be applicable till June 30, 2013.

This is furtherance to the extension provided

under the A.P. (DIR Series) Circular No. 56 dated

December 14, 2012 wherein the ceilings had

been extended up till March 31, 2013.

The all-in-cost ceilings of trade credit will be as

under:

Maturity period

All-in-cost

over

6

LIBOR*

ceilings

months

Up to one year

More than one year and

up to three years

350 basis points

More than three years

and up to five years

* for the respective currency of credit or

applicable benchmark

FDI – Issue of Equity Shares under

Government Route against Pre-Operative/PreIncorporation Expenses

The RBI has vide A.P. (DIR Series) Circular No.

104 dated May 17, 2013 incorporated the

provisions of the Consolidated Foreign Direct

Investment Policy (Circular 1 of 2013) qua

issuance of equity shares/preference shares

under the Government route by conversion of

pre-incorporation

expenses/per-operative

expenses. In terms of the aforementioned circular,

payments should be made by the foreign investor

to the company directly or through a bank account

opened by the foreign investor as provided under

FEMA regulations.

Export of Goods and Software – Realisation

and Repatriation of export proceeds Liberalisation

The RBI vide A.P. (DIR) Series Circular No. 52

dated November 20, 2012 had extended the

enhanced period for realization and repatriation to

India of the amount representing the full value of

the export proceeds in respect of the goods or

software exported, from six months to twelve

months and this relaxation was valid till March 31,

2013.

The RBI vide A.P. (DIR) Circular No. 105 dated

May 20, 2013 has reviewed and decided to

decrease the period for

realization and

repatriation to India of the amount representing

the full value of the export proceeds from twelve

months to nine months from the date of export.

The said change has come into force with

immediate effect from the date of this circular and

will be valid till September 30, 2013.

Provisions relating to period of realization and

repatriation to India of the full value of goods or

software exported by a unit situated in Special

Economic Zone, as well as the exports made to

warehouses established outside India, remain

unchanged.

Sexual Harassment at Workplace (Prevention,

Prohibition and Redressal) Act, 2013

The Parliament on March 11, 2013 passed the

Sexual Harassment at Workplace (Prevention,

Prohibition and Redressal) Bill, 2013. The Bill

received presidential assent on April 22, 2013 and

is now Act No. 14 of 2013.

The Bill was

introduced in Parliament by the Ministry of

Women and Child Development and is yet to

come into force. Some of the salient features of

the Act are:

It defines “sexual harassment at the

workplace” in a comprehensive manner, in

keeping with the definition laid down in the

Vishaka judgment, and broadening it further to

cover circumstances of implied or explicit

promise or threat to a woman’s employment

Corporate Law Alert May 22, 2013

1

Corporate Law Alert

J. Sagar Associates

May 22, 2013

advocates and solicitors

prospects or creation of hostile work

environment or humiliating treatment, which

can affect her health or safety.

The Act covers organised or unorganised

sectors, public or private and covers clients,

customers and domestic workers as well

The term workplace has been broadly defined

to include within its scope organisations,

department, office, branch unit etc in the public

and

private

sector,

organized

and

unorganized, hospitals, nursing homes,

educational institutions, sports institutes,

stadiums, sports complex and any place

visited by the employee during the course of

employment including the transportation.

The

meaning

of

employee

covers

regular/temporary/ad

hoc/daily

wage

employees, whether for remuneration or not

and can also include volunteers.

The redressal mechanism provided in the Act

is in the form of Internal Complaints Committee

(“ICC”) and Local Complaints Committee

(“LCC”). All workplaces employing 10 or more

than 10 workers are mandated under the Act

to constitute an ICC. The ICC will be a 4

member committee under the Chairpersonship

of a senior woman employee and will include 2

members from amongst the employees

preferably committed to the cause of women or

has experience in social work/legal knowledge

and includes a third party member (NGO. Etc.) as

well.

A complaint must be filed within a period of

three (3) months, unless, the aggrieved

woman is able to prove grave circumstances.

The Act provides for conciliation where the

ICC has to make an effort to settle the matter

between the aggrieved woman and the

respondent.

The Committee is to recommend action in

case the compliant is found to be proved.

Punishment includes monetary punishment,

There is serious action prescribed in case the

complaint is found to be a malicious complaint,

The Act casts a duty on every employer to

create a safe environment which is free from

sexual harassment.

An employer will be liable to fine of Rs. 50,000

in case of violation of any of his obligations

under the Act.

In case of a domestic worker they can

approach the LCC.

The Act has been published in the Official Gazette

of India but will come into force only at a later date

as will be prescribed by the Central Government.

For further information please contact:

corporatecommercial@jsalaw.com

Disclaimer:

This newsletter is not an advertisement or any form of solicitation. This

newsletter has been compiled for general information of clients and does

not constitute professional guidance or legal opinion. Readers should

obtain appropriate professional advice.

J. Sagar Associates I advocates & solicitors

Gurgaon

New Delhi

Mumbai

Bangalore

Hyderabad

Copyright © J. Sagar Associates | all rights reserved

Corporate Law Alert May 22, 2013

2