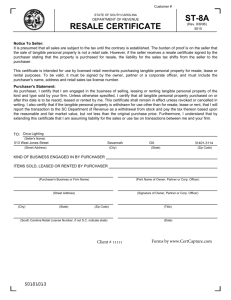

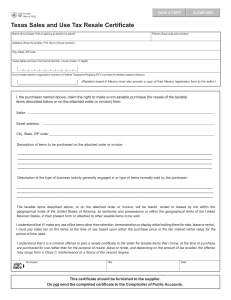

SOUTH CAROLINA TAX COMMISSION ST-8A (Rev 8

advertisement

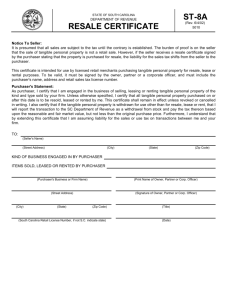

SOUTH CAROLINA TAX COMMISSION CERTIFICATE OF RESALE To: ST-8A (Rev 8-96) PRINTGEAR SPORTSWEAR DISTRIBUTORS 1769 Airport Boulevard Cayce, SC 29033 The UNDERSIGNED HEREBY CERTIFIES that I am engaged in the business of selling tangible personal property of the kind and type sold by your firm and that all tangible personal property purchased on and after this date is to be resold by me, unless otherwise specified on each order, and that this certificate shall remain in effect until or unless revoked or canceled in writing. Further, I certify that if the tangible personal property is withdrawn for use other than for an exempt/excluded purpose. I will report this transaction to the South Carolina Tax Commission as a withdrawal from stock and pay the tax due thereon based on the reasonable and fair market value, but no less than the original purchase price. KIND OF BUSINESS ENGAGED IN BY PURCHASER __________________________________ ITEMS SOLD BY PURCHASER _________________________________________________ ____________________________________ (Purchaser’s Business or Company Name) ____________________________________ (Street Address) _______________________________________ (Title) ____________________________________ (City _______________________________________ (Signature of Owner, Partner, or Corporate Officer) State Zip Code) _______________________________________ (Date) ____________________________________ (South Carolina Retail License Number) NOTICE FOR SUPPLIER/SELLER: Each space must be filled in and the certificate must be signed by the owner, partner, or if a corporation, by a corporate officer authorized to sign. This certificate is intended for use by licensed retail merchants purchasing tangible personal property for resale purposes only. THE CERTIFICATE DOES NOT RELIEVE A SELLER FROM THE TAX BUT SERVES ONLY TO SHIFT THE BURDEN OF PROOF APPLICABLE TO RETAIL SALES. The seller, therefore, should exercise due care to determine that the property so sold is customarily purchased for resale. Sales of tangible personal property for use, storage or consumption are sales at retail and the tax thereon must be paid at the time of sale.