Virginia Sales Tax Rules Summary - Pixel Optics

advertisement

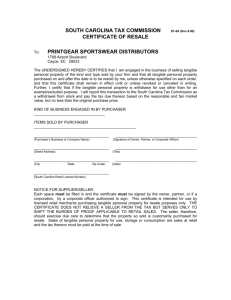

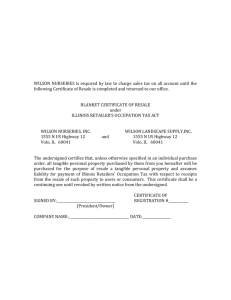

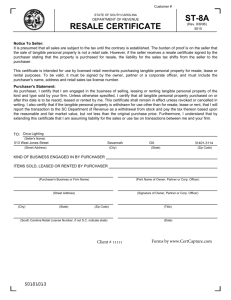

Hilco Industrial, LLC Virginia Sales and Use Tax Summary Pixel Optics 5241 Valleypark Drive Roanoke, VA 24019 Tax Rate: 5.3% EXEMPTIONS: Manufacturing: In general, the retail sales and use tax does not apply to the following types of tangible personal property when used or consumed by an industrial manufacturer or processor of products for sale or resale: • Industrial materials for future processing, manufacturing, refining, or conversion into articles of tangible personal property for resale where such materials either enter into the production of or become a component part of the finished product; • Industrial materials that are coated upon or impregnated into the product at any stage of its processing, manufacture, refining, or conversion for resale; • Machinery or tools, including repair parts and replacements, fuel, power, energy or supplies, used directly in processing, manufacturing, refining or conversion of products for sale or resale; • Materials, containers, labels, sacks, cans, boxes, drums or bags for future use for packaging tangible personal property for shipment or sale (whether returnable or nonreturnable); • Tangible personal property purchase for use or consumption directly and exclusively in basic research in the experimental or laboratory sense or research and development in the experimental or laboratory sense; • Gas, electricity or water received through mains, lines, or pipes; and • Equipment, printing, or supplies used directly to produce a publication described in Sec. 58.1-609.6(3) (generally, any publication issued daily or regularly at average intervals not exceeding three months), whether it is ultimately sold at retail or for resale or distribution at no cost. See also ¶60-640 Publishing and Broadcasting. ( Sec. 58.1-609.3(2), Code ; 23 VAC 10-210-920(A) ) Unless otherwise specified, only the types of tangible personal property listed above may be purchased exclusive of the tax by an industrial manufacturer or processor for direct use in producing products for sale or resale. Other production items and items of tangible personal property used indirectly in production activities are deemed subject to tax. ( 23 VAC 10-210-920(A) ) Machinery, tools, and equipment, or repair parts or replacements, are exempt if their predominant use is directly in processing, manufacturing, refining, mining, or converting products for sale or resale. ( Sec. 58.1-609.3(2), Code ) Research and Development: In Virginia, sales and use taxes do not apply to tangible personal property purchased for use or consumption directly and exclusively in basic research or research and development in the experimental or laboratory sense. ( Sec. 58.1-609.3(5), Code ; 23 VAC 10-210-920(A)(5) ; 23 VAC 10-210-3070(B) ) Research does not include testing or inspection of materials or products for quality control. However, in the case of an industrial manufacturer, processor, refiner or converter, testing and inspection for quality control is deemed to be an exempt activity under the manufacturing and processing exemption discussed above. Also, research does not include environmental analysis, testing of samples for chemical or other content, operations research, feasibility studies, efficiency surveys, management studies, consumer surveys, economic surveys, research in the social sciences, metaphysical studies, advertising, promotions, or research in connection with literary, historical, or similar projects. ( 23 VAC 10-210-3070(B) ) Resale: Sales of tangible personal property for resale in the regular course of business are exempt from the sales tax. [ Va. Code Ann. §58.1-602.] The dealer has the burden of proving a sale is not taxable unless the dealer takes from the buyer/consumer a certificate that the property is exempt. [ Va. Code Ann. §58.1-623 ; Va. Admin. Code 23 §10-210280(A).] A taxpayer may use a resale certificate to buy items that will be resold to foreign customers, and the resale will also be exempt provided that title to or possession of items does not pass within Virginia. Forms: Exemption Certificate form may be accessed at: http://www.tax.virginia.gov/taxforms/Business/Sales%20and%20Use%20Tax/ST-11.pdf Resale Certificate form may be accessed at: http://www.tax.virginia.gov/taxforms/Business/Sales%20and%20Use%20Tax/ST-10.pdf Virginia has not adopted the Multistate Tax Compact through which the Multistate Tax Commission was created and so does not recognize the Uniform Sales and Use Tax Certificate approved by the MTC Interstate or Foreign Commerce: Sales in interstate or foreign commerce occur only if title or possession to the property being sold passes to the purchaser outside of Virginia and no use of the property is made within Virginia. For example: • the sale of tangible personal property delivered to the out-of-state purchaser in the seller's vehicle [ Va. Admin. Code 23 §10-210-780(A)(1) ]; • the sale of tangible personal property delivered to the out-of-state purchaser by an independent trucker or contract carrier hired by the seller [ Va. Admin. Code 23 §10-210-780(A)(2) ]; • the sale of tangible personal property delivered by the seller to a common carrier or to the U.S. Post Office for delivery to the out-of-state purchaser [ Va. Admin. Code 23 §10-210-780(A)(3) ]; or • the purchase of tangible personal property for resale and immediate transportation out of state by a dealer properly registered in another state if a valid exemption certificate of exemption is secured by the Virginia seller. [ Va. Admin. Code 23 §10-210-780(A)(4) .] Tangible personal property delivered out of state for use or consumption out of state is not a taxable sale. Delivery of goods destined for foreign export to a factor or export agent is deemed delivery of goods for use or consumption outside Virginia. [ Va. Code Ann. §58.1-609.10(4) .] “Foreign commerce” includes the delivery to a factor or agent of tangible personal property for foreign export, provided the property is delivered by the seller in the seller's vehicle, by common carrier, by licensed contract carrier or independent trucker hired by the seller or by U.S. mail. [ Va. Admin. Code 23 §10-210-780(A) .]