National Innovation Systems, PESTLE and SWOT Synthesis Report

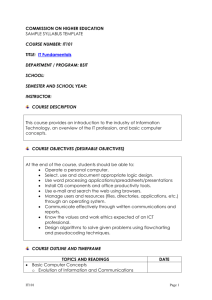

advertisement