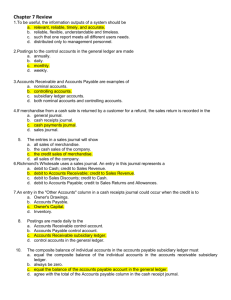

Chapter 7 Accounting Information Systems

advertisement