Reconciliation of Canadian GAAP to IFRS

advertisement

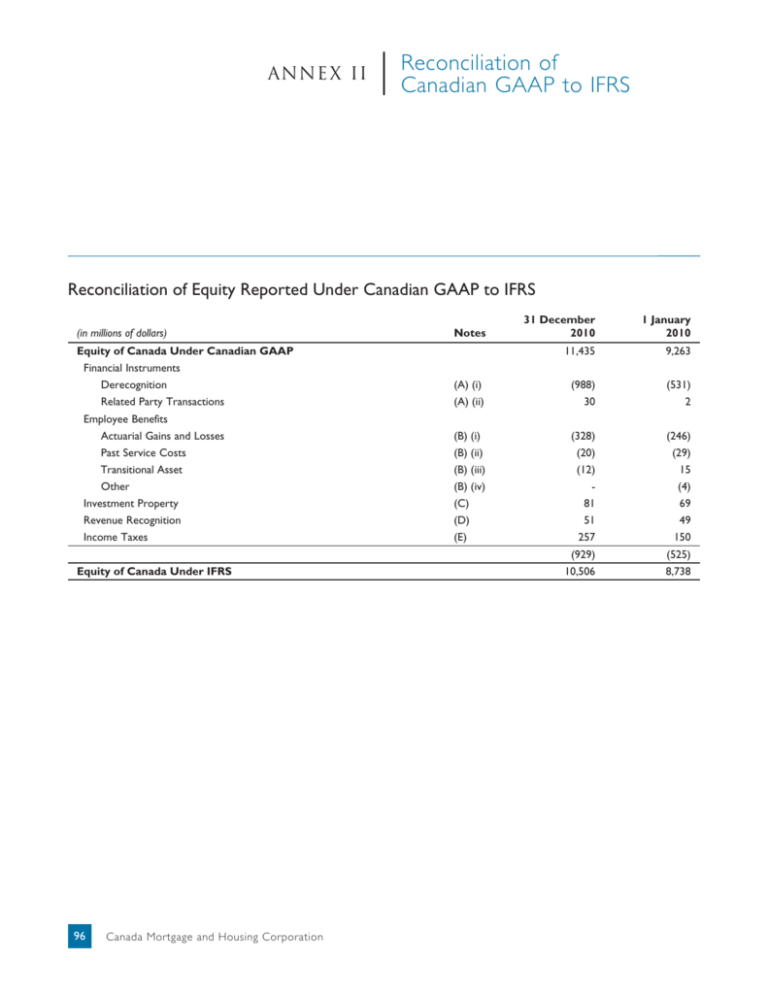

ANNE X II Reconciliation of Canadian GAAP to IFRS Reconciliation of Equity Reported Under Canadian GAAP to IFRS (in millions of dollars) Equity of Canada Under Canadian GAAP Financial Instruments Derecognition Related Party Transactions Employee Benefits Actuarial Gains and Losses Past Service Costs Transitional Asset Other Investment Property Revenue Recognition Income Taxes Equity of Canada Under IFRS 96 Canada Mortgage and Housing Corporation 31 December 2010 1 January 2010 11,435 9,263 (a) (i) (a) (ii) (988) 30 (531) 2 (b) (i) (b) (ii) (b) (iii) (b) (iv) (c) (d) (e) (328) (20) (12) 81 51 257 (246) (29) 15 (4) 69 49 150 (929) 10,506 (525) 8,738 Notes Annex II Reconciliation of Canadian GAAP to IFRS Reconciliation of Net Income Reported Under Canadian GAAP to IFRS Notes (in millions of dollars) Net Income Under Canadian GAAP Differences Increasing (Decreasing) Previously Reported Net Income: Financial Instruments Derecognition Related Party Transactions Year ended 31 December 2010 1,768 Employee Benefits Actuarial Gains and Losses Past Service Costs Transitional Asset Other Investment Property Revenue Recognition Income Taxes (a) (i) (a) (ii) (455) 28 (b) (i) (b) (ii) (b) (iii) 14 9 (27) 4 12 2 106 (c) (d) (e) (307) 1,461 Net Income under IFRS Reconciliation of Comprehensive Income Reported Under Canadian GAAP to IFRS Notes (in millions of dollars) Comprehensive Income Under Canadian GAAP Differences Increasing (Decreasing) Previously Reported Net Income Differences Increasing (Decreasing) Previously Reported Other Comprehensive Income: Employee Benefits - Actuarial Gains and Losses Year ended 31 December 2010 2,171 (307) (b) (i) (96) (403) 1,768 Comprehensive Income under IFRS Differences between Canadian GAAP and IFRS Accounting Policies (a) Financial Instruments The reconciling items in the preceding tables represent the significant differences between CMHC’s previous accounting policies under Canadian GAAP and its current accounting policies under IFRS. The policy differences are explained in the following narratives. The explanations are not a complete summary of all the differences between Canadian GAAP and IFRS. Under GAAP, the NHA MBS were considered to have been transferred to the purchaser and therefore were “derecognized” on the tranferors’ books. Under IFRS, title is not deemed to have passed and therefore the NHA MBS are moved back onto the seller’s Balance Sheet. CMHC, as a buyer of NHA MBS through the CMB and IMPP program, will no longer be able to (i) Derecognition Canada Mortgage and Housing Corporation 97 201 2 - 2 0 1 6 S u m m a r y o f t h e C o r p o r a t e P l a n record the NHA MBS as a security but rather as financing secured by NHA MBS and reinvestment assets as collateral. As a result, the following changes occurred: n As a result, the following changes occurred: n n Net Income for the period ending 31 December 2010 decreased by $339 million; and Retained Earnings at 1 January 2010 decreased by $395 million (31 December 2010 - $736 million), the net of tax impact of the differences for Financial Instruments – Derecognition. (ii) Related Party Transactions Under GAAP, Borrowings from the Government of Canada classified as Other Financial Liabilities were recognized as related party transactions and recorded at the amount of consideration received as established and agreed to with the government. Under IFRS, the concept of related parties does not exist. Therefore, the Borrowings from the Government of Canada classified as Other Financial Liabilities must be recognized at fair value. n Under GAAP, Past Service Costs were amortized to Net Income on a straight-line basis over the expected average remaining service period of active employees under the plans. Under IFRS, Past Service Costs are recognized in Net Income on a straight-line basis over the average period until the benefits become vested. If the benefits are already vested upon any changes to a defined benefit plan, Past Service Costs are recognized in Net Income immediately. As a result, the following changes occurred: n n Net Income for the period ending 31 December 2010 increased by $21 million; and Retained Earnings at 1 January 2010 decreased by $1 million (31 December 2010 - $23 million), the net of tax impact of the differences for Financial Instruments – Related Party Transactions. (b) Employee Benefits (i) Actuarial Gains and Losses Under GAAP, excesses of Net Actuarial Gains and Losses over 10% of the greater of the benefit obligation and the fair value of the plan assets were amortized to Net Income on a straight-line basis over the expected average remaining service period of active employees under the plans. Under IFRS, Actuarial Gains and Losses must be recognized in Other Comprehensive Income as incurred. 98 Canada Mortgage and Housing Corporation Retained Earnings decreased at 1 January 2010 by $206 million (31 December 2010 - $293 million), the net of tax impact of the differences for Employee Benefits - Actuarial Gains and Losses. (ii) Past Service Costs As a result, the following changes occurred: n Net Income for the period ending 31 December 2010 increased by $10 million; and Other Comprehensive Income decreased by $96 million n Net Income for the period ending 31 December 2010 increased by $7 million; and Retained Earnings decreased at 1 January 2010 by $22 million (31 December 2010 - $15 million), the net of tax impact of the differences for Employee Benefits – Past Service Costs. (iii) Transitional Asset and Obligation Under GAAP, a Transitional Asset (Obligation) was set up when CMHC first applied CICA Section 3461, Employee Future Benefits and amortized to Net Income on a straight-line basis over the expected average remaining service period of active employees under the plans. Under IFRS, this Transitional Asset (Obligation) had to be eliminated. As a result, the following changes occurred: n Net Income for the period ending 31 December 2010 decreased by $21 million; and Annex II Reconciliation of Canadian GAAP to IFRS n Retained Earnings increased at 1 January 2010 by $11 million (decreased 31 December 2010 - $9 million), the net of tax impact of the differences for Employee Benefits – Transitional Asset and Obligation. (iv) Other Under IFRS an additional liability for certain shortterm employee benefits was recognized resulting in the following: n n Net Income for the period ending 31 December 2010 increased by $4 million. Retained Earnings decreased at 1 January 2010 by $4 million (31 December 2010 - $0 million), the net of tax impact of this difference. related to the issuance and ongoing administration of Timely Payment Guarantees are recognized in Operating Expenses as incurred. As a result, the following changes occurred: n n Net Income for the period ending 31 December 2010 increased by $2 million; and Retained Earnings increased at 1 January 2010 by $36 million (31 December 2010 - $38 million), the net of tax impact of the differences for Revenue Recognition. (E) Income Taxes Differences for income taxes include the effect of recording the deferred tax effect of differences between Canadian GAAP and IFRS. (c) Investment Property Under GAAP, Investment Property was measured at cost less accumulated amortization and any impairment losses. Under IFRS, Investment Property must be measured at fair value. As a result, the following changes occurred: n n Net Income for the period ending 31 December 2010 increased by $9 million; and Retained Earnings increased at 1 January 2010 by $52 million (31 December 2010 - $61 million), the net of tax impact of the differences for Investment Property. (d) Revenue Recognition Under GAAP, Securitization Application and Compensatory fees were deferred and recognized as Revenues over the term of the security issue on a straight-line basis and costs directly related to the issuance and ongoing administration of Timely Payment Guarantees were deferred and recognized as Operating Expenses over the term of the security issue. Under IFRS, Application and Compensatory fees are recognized as revenue immediately and costs directly Canada Mortgage and Housing Corporation 99