AP GOVERNMENT CHAPTER 19:

advertisement

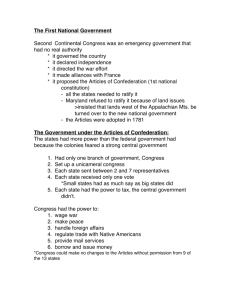

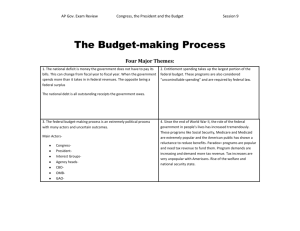

AP GOVERNMENT CHAPTER 19: MAKING ECONOMIC AND REGULATORY POLICY The 1996 Telecommunications Act brought new competition into the telephone industry by giving smaller companies such as Sprint and MCI a chance to take on long-distance giants such as AT&T. It also created thousands of new jobs in an industry that had shown little growth. The market, not the federal government, would decide where phone companies would operate and what they could sell. One out of every ten jobs lost in the 2001-2002 economic downturn was in telecommunications, with no end in sight to the downsizing. Telecommunications deregulation is just one of several types of economic policy that affect the overall performance of the US economy. Presidents and Congress influence the economy by spending money and collecting taxes, both of which influence the behavior of consumers. The goal of economic policy is to keep the economy on a steady course. MAKING PUBLIC POLICY The US government has been making public policy since 1789. The Bill of Rights was clearly an early attempt at public policy. The first successes provided a foundation for other public policies. The Policy Making Process: PG. 476-Chart 1. Problem Identification-what is the problem, who does it effect? 2. Policy Formulation- What should be done? What alternatives? 3. Policy Adoption-Who needs to act? Which branch of govt? 4. Policy Implementation-How should the policy be carried out? 5. Policy Evaluation- Is it working? Is it effective? The first public policies were as much a product of intense debate, even conflict and compromise, as any policies of today. These policy makers clearly believed that the nation had to be more than just the sum of the 13 individual states. Real policies were needed that answered the problems of the day. The absence of government activity does not necessarily mean that government is without a policy in that area- for inaction is itself a policy. ECONOMIC POLICY The framers wanted a government strong enough to promote free trade, protect patents and trademarks, and enforce contracts between individuals and businesses. The framers did not concentrate economic policy in any branch. Instead, they divided economic policy-making control between the legislative and executive branches and between the House and the Senate. Article I, Sec. 8 of the Constitution gives Congress the power to borrow, coin, and print money yet requires that all bills for raising revenue originate in the Ho use. Article II, Sec. 2 gives the president the power to appoint the officers of government who would actually do the borrowing, coining, spending and taxing, yet requires that all officers be confirmed by the Senate. Article I gives Congress the power to regulate commerce with foreign nations, among the states, and with Native American tribes, while Article II gives the president authority to negotiate the treaties and enforce the laws. By creating a national government of limited powers and providing constitutional guarantees to protect property from excessive regulation, the framers succeeded in protecting capitalism. Part of the government’s role is to stay out of the way as individuals and businesses create wealth through new ideas and hard work, but also to promote the national welfare. Fiscal Policy- uses federal spending and taxation to stimulate or slow the economy Monetary Policy- manipulates the supply of money that individuals and businesses have in their hands to keep the economy from swinging wildly from boom to bust. Normal Business Cycle 1. Expansion, in which the economy produces new jobs and growth 2. Contraction, as the economy starts to slow down 3. Recession, in which the economy reaches a trough of low growth 4. Recovery, in which the economy rebounds Inflation- a rise in the general price level (and decrease in dollar value) owing to an increase in the volume FISCAL POLICY Congress and the president make fiscal policy by taxing, borrowing, and spending money. The Federal Budget Federal, state and local governments spend an amount equal to about one-third of the income of all Americans. Annual spending by the national government accounts for some 23% of the gross domestic product, or nearly one dollar out of every four spent in the US economy. Federal government gets most of its funds from personal and corporate income taxes. Other moneys come from borrowing, special fees and fines, grants and gifts, and administrative and commercial revenues. Tariffs- tax levied on imports to help protect a nation’s industries, labor, or farmers from foreign competition. It can also be used to raise additional revenue. Excise tax- consumer tax on a specific kind of merchandise, such as tobacco. Raising money is only one objective of taxation. Regulation and more recently, promoting economic growth are other objective. Progressive tax- a tax graduated so that people with higher incomes pay a larger fraction of their income than people with lower incomes. Federal Receipts include: 1. Individual Income taxes- account for 48% of the federal government’s tax revenue. 2. Corporate Income Taxes- accounts for just under 10% of the national tax revenues. Payroll Receipts- payroll taxes are the second-largest and most rapidly rising source of federal revenue, accounting for 33.2% of all federal revenue. Most people pay in more SS taxes than income taxes. Regressive tax- a tax whereby people with lower incomes pay a higher fraction of their income than people with higher incomes. 4. Excise Taxes- taxes on liquor, tobacco, gas, telephones, air travel, and other “luxury” items accounts for 4% of federal revenue. 5. Customs Duties & Tariffs- $20 billion in revenue each year. 6. Borrowing- Since WWII, the government has regularly resorted to borrowing money to finance itself. Deficit- the difference between the annual revenues raised and the expenditures of government, including the interest on past borrowing. Debt- the accumulated total of federal deficits, minus surpluses, over the years. Borrowing costs money. The federal government borrows from investors who buy Treasury notes, Treasury bills, and US savings bonds. These investors include individuals (foreign and domestic) US government accounts, banks, and other investors. Where the Money Goes? Most of the money is spent on benefit payments to individuals and national defense. In absolute dollars spent in 2003, 49% of revenues went to required benefit payments for individuals (like Social Security, Medicare, etc), 16% to national defense, 9% to interest on the national debt, 10% to grant programs such as highways, medical research, and the environment, and 19% to all other required operations and interest. CHART PG. 480 GDP- Gross Domestic Product, the total output of all economic activity in the nation, including goods and services. Entitlement- government programs, such as unemployment insurance, disaster relief, disability, that provide benefits to all eligible, or “entitled” participants-runs at 11% of the GDP. Many federal programs are open to all eligible citizens, much of the federal budget is therefore “uncontrollable” The Budget Process The federal government’s fiscal year begins on October 1st each year. Departmental budgets are detailed; they include estimates of expected needs for personnel, supplies, office space, etc. Office of Management and Budget- OMB handles the next phase- the budget examiners review each agency’s budget and reconcile it with the president’s overall plans. OMB director gives the president a single, consolidated set of estimates of both revenue and expenditures. This may take a year to work out. The president must submit the budget recommendations and accompanying message to Congress between the first Monday in January and the first Monday in February. The Legislative Branch Congress must appropriate the funds and raise the taxes. Since all appropriations and tax proposals are subject to a presidential veto- check and balance. When Congress acts on the budget, it does so by first approving the overall budget resolution. Then the actual appropriation of funds is detailed in 13 different bills, each of which is presented to the president for approval. Budget and Impoundment Control Act of 1974- enhanced the role of Congress in the budget process- it specifies that the president must include proposed changes in tax laws, estimates of amounts of revenue lost through existing preferential tax treatments, and fi e-year estimates of the costs of new and continuing federal programs. It also calls on the president to seek authorizing legislation for a program a year before asking Congress to fund it. Congressional Budget Office- CBO- created in 1974, gave Congress its own independent agency to prepare budget data and analyze budgetary issues. By February 15 of each year. CBO furnishes its analysis of the presidential recommendations to the House and Senate budget committees and forecasts of the economy, as well as monitoring the results of congressional action on individual appropriations. The economic boom of the 1990s generated huge tax revenues and helped achieve the first budget surplus in 30 years. The Politics of Taxing and Spending Taxes raise funds for the government, but they also promote economic growth and reward certain types of behavior, such as owning a home, contributing to charities, etc. It is also an additional and important function of raising campaign funds. Progressive Income Tax- seem better by some because it is relatively easy to collect, hits hardest those who are most able to pay, and hardly touches those at the bottom of the income ladder. Excise Tax- argues by some to be the fairest because they are paid by people who spend money for luxury goods and thus obviously have money to spare. They are more expensive to collect than income taxes. Excise taxes face strong resistance from affected industries- tobacco especially. Sales tax- general tax on sales transactions, exempting some food and medications. Many see it as unfair, since it taxes all persons, regardless of their ability to pay, and poor persons pay a higher percentage of their income in sales taxes for the goods and services they buy than rich people do. Value-Added Tax- VAT, a tax on in creased value of a product at each stage of production and distribution rather than just at the point of sale. Tax Expenditures Tax Expenditures- loss of tax revenue due to federal laws that provide special tax incentives or benefits to individuals or businesses. They give special tax incentives or benefits to individuals and businesses for economic goals such as home ownership, retirement savings and college education. These benefits total $400 billion each year, and come from special exclusions, exemptions, or reductions from gross income or from special credits. Tax expenditures are one means by which the national government carries out its public policy objectives. Not all of these expenditures benefit all levels of society. MONETARY POLICY Monetary policy is the second way the national government manages the economy. Monetarism- the idea that prices, incomes and economic stability reflect growth in the money sup ply. They contend that money supply is the key factor affecting the economy’s performance and that restrained yet steady growth in the money supply will encourage solid economic growth but not inflation. The Federal Reserve System Federal Reserve System- the “Fed” a system created by Congress in 1913 to establish banking practices and regulate currency in circulation and the amount of credit available. It consists of 12 regional banks supervised by the Board of Governors. The Fed Board of Governors consists of a chair and 6 other members who are appointed by the President with the consent of the Senate to 14-year terms with one member’s term expiring every two years The long terms are intended to insulate members from politics as much as possible. They supervise 12 regional fed reserve banks, each headed by a president and governed by a 9-member board of directors chosen from the private banking business in that region. All members are professional economists or bankers, meet every 6-8 weeks to decide how much money will be allowed to enter the economy, and manage foreign currency operation while regulating banks. They do this by buying and selling government securities which can encourage either lower or higher interest rates. Alan Greenspan- current Fed Chair- under his leadership he has helped foster economic growth and is widely respected by world financial leaders. The staff of the Federal Reserve System reports directly to the chair and he is the one who appears before Congress and the country to explain the policies of the Federal Reserve System. Government and Economic Policy Laissez-Faire Economics- Some economists urged the government to reduce spending, lower taxes, curb the power of labor and generally leave business and the economy alone. Keynesian Economics- created by economist John Keynes, recommended that when consumer spending and investment decline, government spending and investing should increase. Government should do the spending and investing during a recession because private enterprise will not or cannot. This presents a political problem- it is much easier to increase spending and government programs than it is to curb them. Deficit spending became a habit in this country for 50 years. PROMOTING ECONOMIC GROWTH Federal economic policy also involves efforts to promote economic growth, often measured by the number of new jobs or businesses created. Promoting Business The Department of Commerce is the most visible business promoter within the federal bureaucracy and is sometimes known as the nation’s “Service center for business.” It serves as a spokesperson for business interests and is at the center of government efforts to promote economic growth and encouraging business research and development. It also encourages innovation through the protection of intellectual property. PTO- Patent and Trademark Office issues more than 100,000 patents each year to provide owners certain exclusive rights for 17 years over their invention. The Department of Agriculture continues to provide ample support for farmers, including federal subsidies for corn, barley, oats, wheat, soybeans, cotton and rice which either guarantees farmers a minimum price for their crops or pays a fee or not planting them. It also teaches farm education and does research. Promoting Trade Trade Deficit- an imbalance in international trade in which the value of imports exceeds the value of exports. First one occurred in 1971. Many leaders claim that the trade deficit justifies the imposition of trade sanctions. The problem, however, is not that the US is importing too much but that it is exporting too little. Another question is whether or not US products are given fair treatment by other nations. Some countries exploit the US advantage in technology by slavishly copying our products and then selling them back to us or to other countries at a profit. Dumping- selling products below their cost of manufacturing or below their domestic price with the intention o driving other producers out of the market and then raising prices to profitable levels. World Trade Organization- WTO was created to form a trade organization to negotiate free trade and lower tariffs and quotas and other disadvantages faced when trading. It includes more than 130 countries and its membership accounts for 4/5 of the world’s trade. Labor unions and human rights activists argue that US trade policies spur the creation of low-wage jobs abroad and encourage child labor, pollution, and worker abuse. NAFTA 1992- US, Canada and Mexico signed the North American Free Trade Agreement which formed the largest geographical free trade zone in the world, even surpassing the European. NAFTA had a tremendous impact on the economies of all three countries- Mexico is the US’ third most important trading partner and US is Mexico’s most important trading partner. Mexican antipollution laws are significantly less stringent than those in the US, and they work for lower wages, making Mexico attractive to many US companies. Removing Barriers to Trade Protectionism- erecting barriers to protect domestic industry. Trade deficits are symptomatic of more profound economic problems. Most economists favor free trade and strongly dislike protectionism because it prevents efficient use of resources and because consumers pay much more for protected products than they otherwise would. Smoot-Hawley Tariff- highest general tariff US ever had- other nations retaliated with high tariffs on American goods- demand fell, and the depression intensified. Congress later gave the president the power to negotiate mutual tariff reductions with other nations, subject to certain restrictions, and by the early 1970s tariffs n industrial products had been substantially reduced. Free trade and globalization policies do not confer equal benefits on everyone. US economic policy in the future will probably be a combination of free trade and selective protectionism. Though protectionism shields highly visible industries from competition at home or abroad, such measures often constitute a kind of subsidy that protects one industry at the expense of another- and always at high cost to American consumers. REGULATING THE ECONOMY The Constitution explicitly authorizes Congress to regulate commerce among the states and with foreign nations. Federal government created a number of agencies to regulate the conduct of citizens and commercial enterprises with an eye toward promoting economic development in the 19th Century- like Patent Office, Army Corps of Engineers, Copyright Office, et.c Additional regulations came into existence to break up monopolies and to respond to discrimination in employment, to protect citizens from raw sewage in river lead in paint and gasoline. Expenditures mandated by the federal regulations are estimated to cost $200 billion annually for environmental, health, and safety rules alone. In 1935 there were 4,000 pages of regulations in the Federal Register, there are now about 70,000 pages of regulations. Regulations add as much as 33% to the cost of building an airplane engine and as much as 95% to the price of a new vaccine. These regulations produce important benefits in the form of lower airplane noise, safer vaccines and cleaner air. Regulation Defined Regulation- is the attempt by government to control the behavior of corporations, other governments, or citizens through altering the natural workings of the open market to achieve some goal. Even opponents of regulation recognize that the market dos not always solve every problem. Types of Regulation Economic- generally refers to government controls on the behavior of businesses in the marketplace: the entry of individual firms in to particular lines of business, the prices that firms may charge, the standards of service they must offer. Ex: public utilities, transportation. ICC- Interstate Commerce Commission- created in 1887 to enforce federal regulations. Social- refers to government attempts to correct a wide variety of side effects, usually unintended, brought about by economic activity. They are also the efforts of the government to ensure equal rights in employment, education and housing. In economic terms, producers regulated by social regulation must now pay for external costs that once were free, such as using rivers, landfills, or the atmosphere for waste disposal. These costs are then passed along to the consumer. Some goods subsequently become too costly and demand drops, others become more popular and demand increases. The final goal of social regulation is the socially beneficial allocation of resources. Congress has created two types of regulatory agencies: those within the executive branch and those that have a degree of independence from Congress and the president. Both serve at the pleasure of the president. Regulating Business Four major waves of regulatory legislation occurred in the 20th Centuryin the 1910s, in the 1930s, and in the late 1960s-1980s, in each case, changing circumstances gave way to the legislation. The number one responsibility of government regulation in our free market system is to maintain competition. Monopoly- domination of an industry by a single company Trusts- a monopoly that controls goods and services, often in combinations that reduce competition. In 1890 Congress passed the Sherman Antitrust Act to protect commerce from monopolies. Clayton Act- 1914- outlawed specific abuses such as charging different prices to different buyers in order to destroy a weaker competitor, granting rebates, making false statements about competitors’ and their products. Interlocking Directorates- having an officer or director in one corporation serve on the board of a competitor. Regulating Labor Government regulation of business is essentially restrictive. Many labor laws do not touch labor directly; instead they regulate relations with employers. Federal regulations protect workers in the following areas; 1. Public contracts. 2. Wages and hours. 3. Child Labor 4. Industrial safety and occupational health. During the first half of the 20th century, the struggle was for the right to organize unions. 1935 National Labor Relations Act- the federal government prohibited 5 types of anti-union employer action: 1. Interfering with workers in their attempt to organize unions or bargain collectively. 2. Supporting company unions 3. Discriminating against members of unions. 4. Firing or otherwise victimizing an employee for having taken action under the act. 5. Refusing to bargain with union representatives. Outlawed closed s h op and permitted union shops Allowed labor injunction- a court order forbidding specific individuals or groups to perform acts considered harmful to the rights or property of an employer. Regulating Markets SEC- Securities Exchange Commission, created in 1934- companies that offer stock for sale to the public must tell the truth about their businesses, which means full disclosure of all financial statements as well as the stocks they are selling and the risks involved in investing. Anyone in he business of selling stocks, must treat investors fairly and honestly putting investors’ interests first. Regulating the Environment Air and water pollution vividly illustrates the regulatory dilemma. The pursuit of a clean environment increases costs of products and causes unemployment. The national government has taken on new responsibilities, primarily because local governments failed to act. Environmental Impact Statements- a statement required by federal law from all agencies for any project using federal funds to assess the potential effect of the new construction or development on the environment. 1990-Clean Air Act- most expensive piece of environmental legislation ever passes. Regulating the Global Environment as globalization has expanded, so have the environmental challenges and hazards associated with that growth. Kyoto protocol in 1997- a treaty requiring participating countries to make substantial cuts in greenhouse gas emissions year by year until 2012. THE DEREGULATION DILEMMA Deregulation- a policy promoting cutbacks in the amount of federal regulation in specific areas of economic activity. Deregulating Transportation No industry has undergone more extensive deregulation than the transportation industry. 1938- created the Civil Aeronautics Board to protect airlines from unreasonable competition by controlling rates and fairs. Because there was no competition over price, consumers were forced to pay high rates for services they may not have desired. 1978- Congress passed the Airline Deregulation Act- CAB abolished, airlines were free to set whatever fares their markets would bear. Many rural and some medium-sized cities lost cities because carriers found it more profitable to use their aircraft in busier markets. Airlines were raising fares on routes over which they had monopolies in order to subsidize lower fares on more competitive routes. It has resulted in generally lower fares, greater choice of routes and fares in most markets and more efficient use of assets by the industry. Deregulation has strengthened the industry by forcing companies to streamline their operations in order to survive in a competitive market. Deregulating Telecommunications Telecommunications deregulation may have the greatest impact on daily life, whether in the form of lower phone bills, easier access to the internet, or better cellular technology. Telecommunication Act of 1996- one massive act that opened up large areas of telecommunication to companies that once were regulated both in the services they could provide and the prices they could charge. The main objective of the new law was to increase competition among companies. Restrictions were removed so that cable television and local and longdistance phone companies could effectively compete with one another. Evaluating Regulatory Policy There are concerns over the negative consequences of regulation. Regulations generally increase the cost of products and may hamper some industries: Regulation distorts and disrupts the operation of the market. Regulation may discourage competition Regulation may discourage technological development Regulatory agencies are often “captured” by the industries they regulate. Regulation increases costs to industry and consumers. Regulation has often been introduced without cost-benefit analysis. Regulatory agencies may lack qualified personnel.