Intangible assets are

advertisement

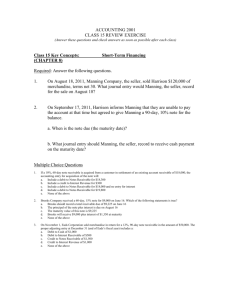

INTANGIBLE ASSETS Intangible assets are rights, privileges, and competitive advantages that result from the ownership of long-lived assets that do not possess physical substance. Intangibles may arise from government grants, acquisition of another business, and private monopolistic arrangements. ACCOUNTING FOR INTANGIBLE ASSETS In general, accounting for intangible assets parallels the accounting for capital assets. Intangible assets are: 1. recorded at cost; 2. written off over useful life in a rational and systematic manner; 3. at disposal, book value is eliminated and gain or loss, if any, is recorded. ACCOUNTING FOR INTANGIBLE ASSETS Differences between the accounting for intangible assets and the accounting for capital assets include: To record amortization, Amortization Expense is debited and the specific intangible asset is credited. The amortization period is the shorter of its useful life and its legal life. In no case can the amortization period exceed 40 years. Amortization is typically computed on a straight-line basis. PATENTS A patent is an exclusive right issued by the Federal Government that enables the recipient to manufacture, sell, or otherwise control his or her invention for a period of 20 years from the date of filing the application. The initial cost of a patent is the cash or cash equivalent price paid when the patent is acquired. Legal costs incurred in successfully defending the patent are added to the Patent account and amortized over the remaining useful life of the patent. The cost of the patent should be amortized over its 20-year legal life or its useful life, whichever is shorter. RECORDING PATENTS National Labs purchases a patent at a cost of $60,000 with a remaining legal life of the patent of 12 years. If the useful life of the patent is eight years, the annual amortization expense is $7,500 ($60,000 ÷ 8). Patent Expense is classified as an operating expense in the income statement. The entry to record the annual patent amortization is: Date Account TitlesandExplanation Dec. 31 AmortizationExpense Patents Torecordpatent amortization. Debit Credit 7,500 7,500 COPYRIGHTS Copyrights are granted by the federal government, giving the owner the exclusive right to reproduce and sell an artistic or published work. Copyrights extend for the life of the creator plus 50 years or useful life, whichever is shorter. The cost of a copyright consists of the cost of acquiring and defending it. TRADEMARKS AND TRADE NAMES A trademark or trade name is a word, phrase, jingle, or symbol that distinguishes or identifies a particular enterprise or product. If the trademark or trade name is purchased, the cost is the purchase price. If it is developed by a company, the cost includes legal fees, registration fees, design costs, and successful legal defence fees. Intangible assets with indefinite useful lives are not amortized. FINANCIAL STATEMENT PRESENTATION In the balance sheet, property, plant and equipment, natural resources, and intangible assets are often combined under the heading Capital Assets. There should be disclosure of the balances in the major classes of assets and accumulated amortization of major classes of assets or of assets in total. The amortization methods used should be described and the amount of amortization expense for the period disclosed. PRESENTATION OF CAPITAL ASSETS The capital assets of Andres Wines Ltd at March 31, 2000 is summarized in the balance sheet and detailed in Note 3 to the financial statements: ANDRES WINES LTD. 3. Capital Assets (thousands of dollars) Land Vineyards Buildings Machinery and equipment Goodwill Accumulated Cost Amortization 2,349 0 5,937 0 17,181 4,971 38,914 21,744 25,000 2,906 89,381 29,621 Net 2,349 5,937 12,210 17,170 22,094 59,760 The notes to the financial statements reports that amortization is calculated on the straight-line basis using the following rates and useful lives: Buildings, 2.5 percent per year, manufacturing machinery and equipment, 7.5 percent per year, other equipment 10-20 percent per year and goodwill, 15 years. CURRENT ASSETS RECEIVABLES The term receivables refers to amounts due from individuals and other companies; they are claims expected to be collected in cash. Three major classes of receivables are: 1. Accounts Receivable 2. Notes Receivable 3. Other Receivables ACCOUNTS RECEIVABLE The three primary accounting problems associated with accounts receivable are: 1. Recognizing accounts receivable. 2. Valuing accounts receivable. 3. Disposing of accounts receivable. RECOGNIZING ACCOUNTS RECEIVABLE GENERAL JOURNAL Date July 1 Account Titles and Explanation Accounts Receivable - Adorable Junior Sales To record sales on account. Debit 1,000 Credit 1,000 When a business sells merchandise to a customer on credit, Accounts Receivable is debited and Sales is credited. RECOGNIZING ACCOUNTS RECEIVABLE GENERAL JOURNAL Date July 5 Account Titles and Explanation Sales Returns and Allowances Accounts Receivable - Adorable To record merchandise returned. Debit 100 Credit 100 When a business receives returned merchandise previously sold to a customer on credit, Sales Returns and Allowances is debited and Accounts Receivable is credited. RECOGNIZING ACCOUNTS RECEIVABLE GENERAL JOURNAL Date July 31 Account Titles and Explanation Cash ($1,000 - $100) Accounts Receivable - Adorable To record collection of account. Debit 900 Credit 900 When a business collects cash from a customer for merchandise previously sold on credit, Cash is debited and Accounts Receivable is credited. RECOGNIZING ACCOUNTS RECEIVABLE GENERAL JOURNAL Date July 31 Account Titles and Explanation Accounts Receivable - Adorable Interest Revenue To record interest on amount due. Debit 13.50 Credit 13.50 When financing charges are added to a balance owing, Accounts Receivable is debited and Interest Revenue is credited. VALUING ACCOUNTS RECEIVABLE To ensure that receivables are not overstated on the balance sheet, they are stated at their net realizable value. Net realizable value is the net amount expected to be received in cash and excludes amounts that the company estimates it will not be able to collect. VALUING ACCOUNTS RECEIVABLE • Two methods of accounting for uncollectible accounts are: 1. Allowance method 2. Direct write-off method DISPOSING OF ACCOUNTS RECEIVABLE To accelerate the receipt of cash from receivables, owners frequently: 1. sell to a factor, such as a finance company or a bank, and 2. make credit card sales. DISPOSING OF ACCOUNTS RECEIVABLE A factor buys receivables from businesses for a fee and collects the payments directly from customers. Credit cards are frequently used by retailers who wish to avoid the paperwork of issuing credit. Retailers can receive cash more quickly from the credit card issuer. CREDIT CARD SALES Three parties are involved when credit cards are used in making retail sales: 1. the credit card issuer, 2. the retailer, and 3. the customer. The retailer pays the credit card issuer a percentage fee of the invoice price for its services. From an accounting standpoint, sales from bank cards (e.g., Visa and MasterCard) are treated differently than sales from non-bank cars (e.g., American Express). BANK CARD SALES Sales resulting from the use of VISA and MasterCard are considered cash sales by the retailer. These cards are issued by banks. Upon receipt of credit card sales slips from a retailer, the bank immediately adds the amount to the seller’s bank balance. BANK CARD SALES GENERAL JOURNAL Date July 31 Account Titles and Explanation Cash Credit Card Expense ($1,000 x 3.5%) Sales To record VISA credit card sales. Anita Ferreri purchases a number of compact discs for her restaurant from Karen Kerr Music Co. for $1,000 using her Royal Bank VISA card. The service fee that the Royal charges is 3.5 percent. Debit 965 35 Credit 1,000 NON--BANK CARD SALES NON Sales using American Express and other non-bank cards are reported as credit sales, not cash sales. Conversion into cash does not occur until American Express remits the net amount to the seller. NON--BANK CARD SALES NON GENERAL JOURNAL Date July 31 Account Titles and Explanation Accounts Receivable Credit Card Expense ($500 x 5%) Sales To record American Express credit card sales. Kerr Music Co. accepts an AMERICAN EXPRESS card for a $500 sale. The service fee that AMERICAN EXPRESS charges is 5 percent. Debit 475 25 Credit 500 NOTES RECEIVABLE A promissory note is a written promise to pay a specified amount of money on demand or at a definite time. The party making the promise is the maker. The party to whom payment is made is called the payee. ILLUSTRATION 9-8 FORMULA FOR CALCULAT ALCULATING ING INTEREST The basic formula for calculating interest on an interest-bearing note is: Face Value of Note X Annual Interest Rate X Time in Terms of One Year = Interest The interest rate specified on the note is an annual rate of interest. RECOGNIZING NOTES RECEIVABLE GENERAL JOURNAL Date Account Titles and Explanation May 1 Notes Receivable Accounts Receivable — Brent Company To record acceptance of Brent Company note. Debit Credit 1,000 1,000 Wilma Company receives a $1,000, 6% promissory note, due in two months (July 31) from Brent Company to settle an open account. VALUING NOTES RECEIVABLE Like accounts receivable, short-term notes receivable are reported at their net realizable value. The notes receivable allowance account is Allowance for Doubtful Notes. HONOUR OF NOTES RECEIVABLE GENERAL JOURNAL Date Account Title and Explanation Sept. 30 Cash Notes Receivable - Higly Interest Revenue To record collection of Higly note. Debit Credit 10,150 10,000 150 • A note is honoured when it is paid in full at its maturity date. • Wolder Co. lends Higly Inc. $10,000 on June 1, accepting a 4.5% interest-bearing note, due in 4 months, on September 30. • Wolder collects the maturity value of the note from Higley on September 30. DISHONOUR OF NOTES RECEIVABLE GENERAL JOURNAL Date Account Title and Explanation Sept. 30 Accounts Receivable - Higly Notes Receivable - Higly Interest Revenue To record the dishonour of Higly note. Debit Credit 10,150 10,000 150 • A dishonoured note is a note that is not paid in full at maturity. • A dishonoured note receivable is no longer negotiable. • Since the payee still has a claim against the maker of the note, the balance in Notes Receivable is usually transferred to Accounts Receivable. BALANCE SHEET PRESENTATION OF RECEIVABLES • Each of the major types of receivables should be identified in the balance sheet or in the notes to the financial statements. • In the balance sheet, short-term receivables are reported within the current assets section below cash and temporary investments. • Both the gross amount of receivables and the allowance for doubtful accounts should be reported. CASH Cash includes coins, currency, cheques, money orders, and money on hand or on deposit at a bank or similar depository. Internal control over cash is imperative in order to safeguard cash and assure the accuracy of the accounting records for cash. CONTROL OVER CASH RECEIPTS Only designated personnel should be authorized to handle or have access to cash receipts. Different individuals should: 1. receive cash 2. record cash receipt transactions 3. have custody of cash CONTROL OVER CASH RECEIPTS Documents should include: 1. remittance advices 2. cash register tapes 3. deposit slips Cash should be stored in safes and bank vaults. Access to storage areas should be limited to authorized personnel. Cash registers should be used in executing over-the-counter receipts. CONTROL OVER CASH RECEIPTS Daily cash counts and daily comparisons of total receipts should be made. All personnel who handle cash receipts should be bonded and required to take vacations. An important tool in control of over-thecounter receipts is cash registers that are visible to customers. CONTROL OVER CASH DISBURSEMENTS Payments are made by cheque rather than by cash, except for petty cash transactions. Only specified individuals should be authorized to sign cheques. Different departments or individuals should be assigned the duties of approving an item for payment and paying it. CONTROL OVER CASH DISBURSEMENTS Prenumbered cheques should be used and each cheque should be supported by an approved invoice or other document. Blank cheques should be stored in a safe. 1. Access should be restricted to authorized personnel. 2. A cheque writer machine should be used to imprint the amount on the cheque in indelible ink. CONTROL OVER CASH DISBURSEMENTS Each cheque should be compared with the approved invoice before it is issued. Following payment, the approved invoice should be stamped PAID. PETTY CASH FUND A petty cash fund is used to pay relatively small amounts. Operation of the fund, often called an imprest system, involves 1. establishing the fund, 2. making payments from the fund, and 3. replenishing the fund. Accounting entries are required when 1. the fund is established, 2. the fund is replenished, and 3. the amount of the fund is changed. ESTABLISHING THE FUND GENERALJOURNAL Date Account TitlesandExplanation Mar. 1 PettyCash Cash Toestablishapettycashfund. Debit Credit 100 100 When the fund is established, a cheque payable to the petty cash custodian is issued for the stipulated amount. REPLENISHING THE FUND GENERAL JOURNAL Date Mar. 15 Account Titles and Explanation Postage Expense Freight Out Miscellaneous Expense Cash To replenish petty cash fund. Debit Credit 44 38 5 87 On March 15 the petty cash custodian requests a cheque for $87. The fund contains $13 cash and petty cash receipts for postage, $44, freight out, $38, and miscellaneous expenses, $5. REPLENISHING THE FUND GENERAL JOURNAL Date Mar. 15 Account Titles and Explanation Postage Expense Freight Out Miscellaneous Expense Cash Over and Short Cash To replenish petty cash fund/ Debit 44 38 5 1 Credit 88 On March 15 the petty cash custodian requests a cheque for $88. The fund contains $12 cash and petty cash receipts for postage, $44, freight out, $38, and miscellaneous expenses, $5. USE OF A BANK The use of a bank minimizes the amount of currency that must be kept on hand and contributes significantly to good internal control over cash. A company can safeguard its cash by using a bank as a depository and clearing house for cheques received and cheques written. BANK STATEMENTS A bank statement shows: 1. cheques paid and other debits charged against the account 2. deposits and other credits made to the account 3. account balance after each day’s transactions ACCOUNT W. A. LEE COMPANY STATEMENT 500 QUEEN STREET FREDERICTON, NB, E3B 5C2 Statement Date/Credit Line Closing Date April 30, 2003 457923 ACCOUNT NUMBER Balance Last Statement 13,256.90 Deposits and Credits Cheques and Debits Balance No. Total Amount Total Amount This Statement 20 34,805.10 26 32,154.55 15,907.45 DEPOSITS AND CREDITS Date Amount DAILY BALANCE Date Amount 4-2 435 644.95 4-5 436 3,260.00 4-4 437 1,185.79 4-3 438 776.65 4-8 439 1,781.70 4-7 440 1,487.90 4-8 441 2,420.00 4-11 442 1,585.60 4-12 443 1,226.00 ================= 4-29 NSF 425.60 4-29 459 1,080.30 4-30 DM 30.00 4-30 461 620.15 4-2 4,276.85 4-3 2,137.50 4-5 1,350.47 4-7 982.46 4-8 1,320.28 4-9 CM 1,036.00 4-11 2,720.00 4-12 757.41 4-13 1,218.56 ============== 4-27 1,545.57 4-29 2,929.45 4-30 2,128.60 4-2 16,888.80 4-3 18,249.65 4-4 17,063.86 4-5 15,154.33 4-7 14,648.89 4-8 11,767.47 4-9 12,802.47 4-11 13,936.87 4-12 13,468.28 ============= 4-27 13,005.45 4-29 14,429.00 4-30 15,907.45 Symbols: Error Correction CHEQUES AND DEBITS Date No. Amount CM Credit Memo EC DM Debit Memo INT Interest Earned NSF Not Sufficient Funds Reconcile Your SC Service Charge Account Promptly RECONCILING THE BANK ACCOUNT Reconciliation is necessary because the balance per bank and balance per books are seldom in agreement due to time lags and errors. A bank reconciliation should be prepared by an employee who has no other responsibilities pertaining to cash. Terms Deposits in transit Deposits recorded by depositor that have not been recorded by bank Outstanding cheques Cheques written (issued) and recorded by company that have not been presented to/paid by bank Adjusted balance Reconciled or correct cash balance Terms Debit memoranda Charges against depositor’s account (e.g. service charges, RC (returned)/NSF (insufficient funds) cheques) Credit memoranda Amounts that increase depositor’s account (e.g., interest earned) Bank Reconciliation Procedures $ Per Bank Statement -outstanding cheques +deposits in transit +/- bank errors = correct cash amount $ Per Books -NSF cheques -cheque printing or other service charges +notes collected by bank +/- book errors Illustration 8-11 Reconciling Journal Entries Books Each reconciling item in determining the adjusted balance per books MUST be journalized and posted Bank Do NOT journalize any entries on bank side REPORTING CASH Cash reported on the Balance Sheet includes: 1. Cash on hand 2. Cash in banks 3. Petty cash Cash is listed first in the balance sheet because it is the most liquid asset. CASH EQUIVALENTS Cash equivalents are highly liquid investments, with maturities of three months or less when purchased, that can be converted into a specific amount of cash. Examples include money market funds, short-term notes, and treasury bills. USING THE INFORMATION IN THE FINANCIAL STATEMENTS Most important asset Pervasive impact Vulnerable to theft or misuse Balancing act needed to ensure sufficient, but not excess, quantity USING THE INFORMATION IN THE FINANCIAL STATEMENTS Cash Flow Statement : shows where cash came from and what is was used for. Management report: states management’s responsibility for internal controls.