Tying Free Cash Flows To Market Valuations

advertisement

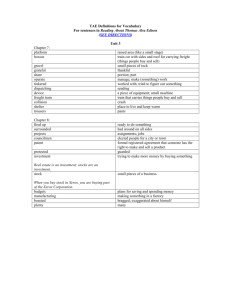

Article 21 Tying Free Cash Flows To Market Valuations In a companion piece to his article in the last issue*, Robert Howell turns his attention to the importance of free cash flows in determining valuations. By Robert A. Howell L model would capitalize that annuity stream using the firm’s cost of capital (assume 10 percent) as the discount rate. Free cash flow of $100 million divided by 0.10 yields an NPV of $1 billion. This $1.0 billion is equal to the “entity value” of the company, and represents the NPV for a stream of $100 million in perpetuity; in essence, it represents the most that should be paid today, to access that future stream of cash flows. Any debt has to be subtracted from the firm’s entity value to determine how much value accrues to the equity shareholders or the equity value. If debt is $200 million, the equity value is $800 million. If the market value exceeds the equity value, the market is “saying” that it expects the free cash flows of the business to improve; if the market value is less, the market expects eroding cash flows. It is also possible to work in the opposite direction, starting with the company’s current market value, adding back any debt; then calculating the rate at which current free cash flows must grow, in perpetuity, to support the current market value. If that required rate of growth is high, say in excess of 10 percent, one has to question how likely that is. In mid-2001, even after the securities markets had fallen considerably from their early March 2000 highs, companies such as Oracle Corp., EMC Corp., Cisco Systems and Siebel Systems’ free cash flows would have had to grow at 14, 18, 18 and 21 percent, respectively—very unlikely. Since then, all of these companies’ market values have dropped further, as could be expected. Startup and high-growth may be particularly difficult to analyze. Perpetuating negative cash flows would result in a negative value, and calculating a growth rate from a negative starting cash flow to generate a positive market ast month, in this magazine, this author argued in Fixing Financial Statements: Financial Statement Overhaul that the traditional formats of the primary financial statements—income statement, balance sheet, and cash flow statement—need major redesign to again be useful for meaningful financial analysis, decision-making and value creation. Since the fundamental objective of a business is to increase real shareholder value, this means increasing the net present value (NPV) of the future stream of cash flows. Financial statements must, therefore, put much more emphasis on the free cash flows that a business generates. A vivid example of the different impressions one can get from focusing on profits and cash flows is Xerox Corp. (see page 18). Focusing on profits could suggest Xerox is doing well; free cash flows tell another story. Relating Free Cash Flows To Market Values A firm’s market value reflects the collective judgment of the shareholders’ expectations of its future cash flows. If the company produces expected cash flows or expectations remain constant, the market value should remain constant. If cash flows, or the expectations, turn out better, market value should rise; if cash flows or the expectations for them turn down, as with Xerox, value should erode. Recasting financial statements into a much more explicit and clear free cash flow format permits one to at least relate the current period’s free cash flows to the current market valuation and reach some conclusions regarding those valuations. As a starting point, assume that a firm has positive free cash flows of $100 million, and that it will continue to produce that amount in perpetuity. A perpetuity valuation 1 ANNUAL EDITIONS good cost management may mean a) spending to develop new products or support customers, rather than drastically cutting those costs; b) finding ways to take costs out of products without affecting their perceived value; or c) reducing administrative costs. value is mathematically impossible. However, one may start with the firm’s market value, then multiply by the firm’s estimated cost of capital, to calculate how much free cash flow, in perpetuity, would be required to justify the market price. This amount may be compared to the firm’s current (negative) free cash flows to determine how much improvement is required. So, a dot-com with a market value of $10 billion and an estimated cost of capital of 15 percent would need to generate $1.5 billion in free cash flows, assuming no debt (which would have had to be added to the market value have had to be added to the market value to establish the firm’s entity value), in perpetuity, to justify its market value. If the dot-com had negative cash flow, one could see how much improvement was needed, and decide if that was even likely. In most cases, it was very unlikely, as eventually became clear. These examples make simple assumptions regarding free cash flows. In the first case, it is assumed that the cash flows remain constant in perpetuity; in the second case, it is assumed that they grow constantly in perpetuity. One may also develop a set of free cash flow projections for a specific firm, over a period of 5 to 10 years, put a terminal value on the firm at the end of the period and discount the projected cash flows at the firm’s cost of capital to determine its value. This is the process management should go through when considering acquisition candidates to determine how much it can pay and still add value for shareholders. Management should regularly undertake the same process for its own firm; and investors should do the same for each investment(s). Indeed, it is possible to directly relate a business’ free cash flows to its market value. Financial statements should make this connection easy. Today, they do not. 2. Reduce investments means managing working capital and fixed and other assets more tightly. That might mean collecting receivables more quickly—such as Dell Computer Corp.; turning inventories faster; such as Toyota Motor Corp.; and getting out from under fixed assets via outsourcing, such as Nike Inc. has done—and focusing more attention on intangible asset performance, which placing them on the balance sheet would have a tendency to do. 3. Financial management has two primary elements. First, managing the mix of capital to minimize the firm’s weighted average cost of capital. Generally, this means increasing the proportion of debt capital that is less expensive than equity capital. Because fixed assets are frequently undervalued and intangible assets are not even recognized, many companies understate their book equity, and overstate their debt to capital. They actually have additional debt capacity before their cost of capital begins to rise, due to increased risk. Second, using free cash flows, or free cash flows after interest payments and debt service, to increase the company’s future value. Historically, more mature companies with positive cash flows have paid dividends—in effect, giving cash back to shareholders, assuming that shareholders can invest elsewhere to achieve higher returns. That’s not saying much for the firm—the shareholder must pay taxes on the dividends, and the company itself could leverage up the cash it held by not paying dividends. Unless a firm has run out of good investment opportunities, it should think long and hard about the economics of cash dividends. That’s also true for stock buybacks. Only if reducing the number of shares outstanding increases the per-share value of the remaining shareholders is this appropriate. For many companies, buying back stock has proven dilutive for continuing shareholders. Managing for Free Cash Flows And Shareholder Value Creation It is management’s fundamental responsibility—some would say obligation—to increase shareholder value. This requires increasing the NPV of the future stream of cash flows. There are only three ways to do it: increase cash earnings, reduce investments and employ financial management. 1. Increase cash earnings by growing the business “valuably.” Growth, in and of itself, won’t do it, nor will “profitable growth,” if the impact on free cash flows is actually negative. It’s important that growth improve free cash flows, which has to take into account additional investments in working capital and capital expenditures required to support the growth. A second approach, cost management, differs from cost reduction; it may mean spending more to increase cash earnings and free cash flows, not less. Depending on the categories of costs across a company’s value chain, Most businesses have a variety of products and product groups. Each product’s stage of life cycle, positioning, competitive strength and investment requirements influences its cash flow pattern and value-creating contribution. Disaggregating firm-wide cash flows will, in all likelihood, identify groups and individual products that are actually destroying, rather than creating value—some of which may come as a real surprise to management. The ultimate financial management challenge is to use free cash flows to invest in new business opportunities that build shareholder value. Every investment a firm makes, be it a standalone piece of equipment, a new plant, an acquisition or the business itself, should be evaluated accordingly. 2 Article 21. Tying Free Cash Flows To Market Valuations Xerox Corp. — Profits vs. Cash Flows 1999 A Revenues Total Costs and Expenses 1998 1997 G. Richard Thoman, who had been appointed CEO only 13 months before, was ousted, attributed in part to a failed sales force reorganization that he had spearheaded. By that autumn, speculation emerged that Xerox might file for bankruptcy. The stock fell to $5 per share, having lost more than 90 percent of its value. Looking at Xerox’s reported profits (before restructuring, as management would want the reader to do) provides one impression (See exhibit A). Revenues were up in 1998; margins before restructuring were better and, without restructuring, profits would have been up slightly. Revenues dropped slightly in 1999, but profits held up, at least relative to 1997 and 1998, before restructuring. The market expected more, however, and the market valuation slid. Looking at the consolidated statements of cash flows, it would be difficult to discern a cash flow problem. however, by rearranging the cash flow data to present it on a “free cash flow” basis, the picture changes dramatically. (See exhibit B). This says that for the three-year period 1997–1999— including 1998, which was described in such glowing terms—Xerox “burned” close to $2 billion in cash before interest payments and dividend distributions. Yet, before the problems came to light, the company’s market capitalization soared. That would imply the unsuspecting shareholders were willing to pay $42 billion, plus any outstanding debt, for the opportunity to acquire this stream of negative cash flows! When one takes into account the interest and dividends, the story gets grimmer. (See exhibit C). During this three-year period, reported earnings aggregated more than $3 billion, yet cash flows were more than negative $5 billion. Where were its bankers? It has recently come to light that Xerox had pursued aggressive accounting during this period. In early April, it agreed to restate earnings for a four-year period and pay a $10 million fine to the Securities and Exchange Commission. Separately, the SEC announced that it was widening its probe of Xerox to include ex-executives and its external audit firm. What Xerox did was attribute more of its leasing transactions to current (e.g., ‘98 and ‘99) revenues and profits than it shoudl have. Looking at the cash flows eliminates these overstatements, because the added revenues booked only increased its receivables and had no beneficial effect on cash flows. $19,228 $19,447 $18,144 17,192 Restructuring Charge and Inventory Writedown Net Income 1,424 (Before Restructuring) 17,153 16,003 1,644 395 1,452 1998 1997 (all figures in millions of dollars) B Net Income +Interest (1-tax rate) Net Operating Profit A.T. +\- Non Cash Adjustments Cash Earnings Changes in Working Capital Investments in Capex, etc. Cash Charges-'98 Restructure FREE CASH FLOWS C Interest Payments (A.T.) Dividends CASH FLOWS AFTER INTEREST and DIVIDENDS 1999 $1,424 $395 $1,452 543 627 528 1,967 1,212 1,980 1,316 2,817 1,037 3,283 4,029 3,017 (2,547) (4,235) (2,017) (627) (867) (1,251) (437) (332) (335) (1,405) (251) (543) (586) (627) (531) (528) (475) (1,464) (2,563) (1,254) X erox Corp. provides a classic example of how potentially misleading accounting profits can be, especially in the context of a troubled company. In early 1999, Xerox management stated in the company’s annual report that 1998 was "an excellent year" in which "earnings per share (EPS) from continuing operations were up 16 percent before the restructuring. Income was up 17 percent." Management went on to say, "Our company has never been stronger in the marketplace nor our opportunity greater." And so it might seem from the market’s reaction. Shortly after the annual report was released, Xerox stock climbed to nearly $64 per share, resulting in a market capitalization of more than $42 billion. Throughout 1999, Xerox reported a spate of bad news: softness in its significant Brazilian market, a profit warning for the third quarter that stunned Wall Street, then another warning and large earnings shortfall for the fourth quarter. By year-end 1999, its stock had dropped to $20. But the problems didn’t end there. By May 2000, 3 ANNUAL EDITIONS ceed its liabilities—is deficient on at least two counts: First, it fails to recognize the “flow” characteristics of working capital. Typically, when a firm grows, so do its working capital requirements. Next, having fewer resources tied up in working capital is better in that it reduces the amount of cash required to support growth and improves ROIC by lowering the investment base. The most frequently utilized “solvency” measures are the times-interest earned ratio and various debt-to-capital ratios. Ratios, however, really say little about absolute cash flows. If a firm lacks adequate free cash flows to cover its debt service, it is insolvent, regardless of what the ratios say. Important measures tracked in a cash and value orientation are such things as: cash earnings to sales; the relationship of cash earnings to the changes in working capital (a measure of liquidity, in that it reflects whether enough cash is being earned to support the required changes in working capital); cash earnings to reinvestments (both in working capital and fixed and intangible assets); free cash flows to sales (the single most important measure); and free cash flows to interest and to total debt service, two measures of solvency. Metrics to Monitor Free Cash Flows And Value Creation Traditional financial statement analysis has focused on measures of “profitability” and “risk.” Profitability has typically focused on “return on assets” and “return on equity;” risk measures have focused on “liquidity” and “solvency.” For many of the reasons that financial statements need drastic overhaul, so, too, do performance measures. Return on assets (ROA) suffers on two counts. The “return” numerator of net operating profit after taxes (NOPAT), based on managed earnings, is suspect because of the many deficiencies of accrual-based earnings. Because the “assets” denominator is stated at book value, which is frequently understated, ROA is often overstated. Return on equity (ROE) measures fail for the same reasons. Here, the return numerator, net income, is divided by average book equity. Again, in most cases, the resulting calculation is overstated. The ultimate financial management challenge is to use free cash flows to invest in new business opportunities that build shareholder value. In summary, free cash flows have to be the focus of ma- jor financial statement overhaul, and may be directly related to current market valuations to determine if the current free cash flows support current market values. Focusing on free cash flows also necessitates establishing a new set of “metrics” that have a cash and value orientation. Management teams and investors who embrace the new cash and value-oriented statements and associated metrics will find that they have new insights into their businesses and investments, and the opportunity to create real value for their shareholders—and themselves. If one wants to use accounting-based return measures, instead of ROA, one should measure “return on invested capital” (ROIC), NOPAT divided by the “investments” in the business—working capital, property, plant and equipment and intangible assets. Excess cash and other financial assets should be netted against any debt. To create shareholder value, ROIC must exceed the firm’s weighted average cost of capital (WACC). To use ROE, the equity base must be the market value. If the marketbased ROE exceeds the estimated shareholder cost of capital, then the firm is creating value for shareholders. The classic “liquidity” measures, such as the “current” and “quick” ratios, focus on the relationship of current assets to current liabilities. The implication for years that “more” is better—that a firm is more liquid if its assets ex- [*See Financial Executive, April 2002.] Robert A. Howell is a Visiting Professor of Business Administration at the Tuck School of Business at Dartmouth. He can be reached at Robert. A. Howell@Dartmouth.edu Reprinted with permission from Financial Executive, May 2002, pp. 17-20. © 2002 by Financial Executives International, 10 Madison Avenue, Morristown, NJ 07962. 4