Flying High in

advertisement

CONTENTS

2

4

6

10

11

Profile

Financial Highlights

Message from the Chairman

Board of Directors

Corporate Governance

Excellence At Work

14

16

18

22

26

28

29

2007 at a Glance

Business at a Glance

Passenger Business

Cargo Business

Aerospace Business

Catering Business

Hotel & In-Flight Sales Business

Excellence In Action

32

33

34

35

36

40

42

Maintenance & Engineering

Safety

Fuel Management

SkyTeam Alliance

Social Contributions

Environmental Management

Human Resources

Financial Section

46

64

Management’s Discussion &

Analysis

Financial Statements

113

114

116

118

119

Organization Map

Executive Officers

Overseas Network

Domestic / China / Japan Network

Corporate Information

Flying High in

Excellence

2007 ANNUAL REPORT

Korean Air’s New Boeing

Freighter(B747-8)

A Passion for Excellence in Flight,

Our Total Commitment to the Future

Established as the nation’s flagship carrier in 1969, Korean Air has continuously expanded its operations

and focused on customer satisfaction. Today, with a fleet of 126 planes including the world’s most

advanced aircraft, Korean Air’s effective management systems and customer-oriented policies have

enabled the airline to achieve outstanding performances and meet the customers’ needs during the last

four decades.

As a world’s leading carrier in terms of quality and quantity, Korean Air is now faced with higher expectations and more opportunities to move forward. In 2008, Korean Air will fly to 115 cities on the world’s

six continents, truly defining us as a leading global airline in service networks. With the ultimate goal of

becoming a Respected Leader in the world airline industry, we have a clear mission of providing “Excellence in Flight,” a firm commitment to delivering value to our customers, shareholders and the communities we serve. The passion for innovation and creativity will continue to be an underlying core competency of Korean Air as its management and 17,000 dedicated employees strive to achieve Excellence in

Flight.

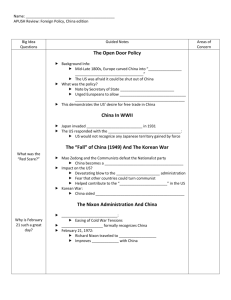

FINANCIAL HIGHLIGHTS

Operating Revenues

(In billions of KRW)

Total Assets

(In billions of KRW)

Operating Income

(In billions of KRW)

Net Income

(In billions of KRW)

KOREAN AIR ANNUAL REPORT 2007

004 · 005

Financial Highlights

In millions of USD*

(Years ended December 31)

In billions of KRW*

2007

2007

2006

2005

2004

2003

Operating revenues

9,392.4

8,812.0

8,077.9

Gross profit

2,155.9

2,022.7

1,773.4

7,584.2

7210.9

6,177.2

1,692.3

1,668.9

1,413.5

Selling, general & administrative expenses

1,477.1

1,385.8

678.8

636.8

1,276.0

1,259.8

1,284.9

1,102.1

497.4

432.5

384.0

311.4

OPERATING RESULTS

Operating income

Income before tax

98.4

92.3

487.9

253.0

723.0

(198.9)

Net income

11.4

10.7

383.0

200.4

519.5

(241.1)

Total assets

16,150.5

15,152.4

13,584.7

13,568.6

13,739.0

14,115.2

Total liabilities

11,451.4

10,743.7

9,209.3

9,539.7

9,927.9

10,758.9

4,699.1

4,408.7

4,375.4

4,028.9

3,811.1

3,356.3

0.2

9.1

5.1

5.8

Net loss

FINANCIAL CONDITION

Total shareholders’ equity

FINANCIAL RATIOS (%)

Return on average equity

Return on average assets

Debt-to-equity ratio

EBITDAR margin

Fixed charge coverage ratio (times)

PBR

0.1

2.8

1.5

3.7

Net loss

243.7

210.5

236.8

260.5

320.6

19.4

19.3

19.3

20.5

22.7

2.2

2.0

2.0

1.9

1.7

117.5

54.8

52.9

33.1

36.8

148

5,725

2,989

7,765

(3,607)

PER SHARE DATA

Earnings Per Share(In USD, KRW)

0.2

*Korean Won figures are translated, solely for the convenience of readers into U.S. dollars at KRW938.20 : USD1.00, the rates prevailings as of December 31, 2007

Operational Results

Revenue Passengers Carried

2007

2006

2005

2004

22,834,003

22,353,169

21,708,821

21,454,574

2003

21,546,086

Change (%)

2.2%

Available Seat-Kilometers ('000ASK)

76,181,620

71,894,436

68,658,976

64,651,689

59,073,776

6.0%

Revenue Passenger-Kilometers ('000RPK)

55,353,818

52,177,665

49,046,290

45,999,676

40,507,002

6.1%

Revenue Freight Tons Carried

Available Freight Ton-Kilometers ('000AFTK)

Revenue Freight Ton-Kilometers ('000FTK)

2,281,671

2,115,089

1,981,708

2,017,994

1,767,927

7.9%

12,992,069

11,661,645

10,830,838

11,014,965

9,794,140

11.4%

9,677,679

8,857,155

8,139,959

8,345,244

7,061,863

9.3%

MESSAGE FROM THE CHAIRMAN

KOREAN AIR ANNUAL REPORT 2007

With every challenge comes the opportunity for success, and

Korean Air faced each test with courage, dignity and talent.

Dear Shareholders,

Last year again was challenging to the global airline industry, and Korean Air was not immune to the effects.

But with every challenge comes the opportunity for success, and Korean Air faced each test with courage,

dignity and talent.

Despite the formidable environment, Korean Air grew revenues of KRW 8,812 billion and an operating

income of KRW 637 billion largely by strengthening our route networks in emerging markets such as China

and Southeast Asia, improving our global sales activities, focusing our emphasis on our premium classes,

and managing fluctuating exchange and interest rates.

The company launched passenger flights to new high growth destinations like Madrid, Melbourne, and

Chiang Mai, while further solidifying and expanding our cargo network by adding Moscow, Munich, and

Houston.

In addition, we created an affiliated budget carrier, Air Korea, to compete in the low cost airline market that

is blossoming throughout Asia. We launched operations for Grandstar, the cargo airline we jointly established with Sinotrans, China’s largest logistics company. This will allow us to tap into the energetic Chinese

market and reinforce our international competitiveness.

We have invested significantly to deliver Excellence in Flight, and continue to pursue improvements that will

add to our shareholders’ and brand equity. We are concentrating on flying the most advanced and environmentally-sensitive fleet, providing a memorable and rewarding in-flight experience and having the ability to

take anyone anywhere at any time. Internally, we are committed to our 10-10-10 strategy designed to

increase revenues, reduce costs without impacting quality, and improve productivity by 10 percent respectively.

All these efforts have helped make Korean Air the global leader it is today.

006 · 007

Every one of Korean Air’s management and employees is

dedicated to securing global leadership through stronger

competitiveness and substantial growth.

Last year, IATA ranked Korean Air Cargo as the world’s top commercial airline freight carrier for the third

consecutive year. Business Traveler readers voted Korean Air as being the Best Airline in Asia and having the

Best Transpacific Business Class service. For the third year in a row, Korean Air received the coveted Mercury

Award by the International Travel Catering for exceptional inflight catering. Our catering services also were

praised by PAX International, an important trade magazine, that chose Korean Air as Airline of the Year in

Asia.

And our SkyTeam Alliance, of which Korean Air is a founding member, was selected as the best airline

alliance by Business Traveler magazine’s readers, further reinforcing our position as a leading global airline

in our association with other leading global airlines.

This coming year will present challenges equal to and, perhaps, exceeding years’ past.

We expect fuel prices to continue to escalate, a jittery world financial market made more nervous by the US

subprime mortgage crisis, and a general slowdown in major market economies. Domestically, we have

obstacles as well, including a strong Korean Won that is weakening our export competitiveness, and a real

estate market mirroring those that are declining around the world. Despite these obstacles, we have planned

for and expect robust growth in outbound travel due to the new administration’s policy of economic

improvements. We also are optimistic about the upcoming Beijing Olympics, the proposed visa exemption

accord with the U.S., and the brisk economies of China and India that are expected to add opportunities.

Based on this cautious optimism, we set our 2008 target at KRW 9,490 billion in revenues and KRW 820 billion in operating income. This is tangible evidence of the company’s commitment to producing strong profits under tough conditions.

To maintain substantial growth and reinforce our competitive edge, we will continue to strengthen our focus

on profitable routes and enterprises, products that customers demand and view as valuable, and a corporate

KOREAN AIR ANNUAL REPORT 2007

culture that fosters innovation and foresight. In addition, we are investing our time and efforts to substantially promote and protect our environment and have been publishing an annual sustainability report that

communicates our efforts worldwide.

Our emphasis on IT has resulted in 100% domestic and about 90% worldwide e-ticketing, saving time and

trees over paper tickets. This coincides with IATA’s goal of 100% e-ticketing globally by year’s end, making

the paper ticket obsolete.

We will continue to improve and enhance our inflight experience so each customer leaves wanting to return.

This means creating an environment that fosters Service Excellence, from check-in through baggage claim.

Our inflight experience will be second to none with a true focus on customer satisfaction, enjoyment and

comfort. In addition, we anticipate adding new routes to our global network, including Sao Paulo, Brazil. In

2008, Korean Air will fly to at least 115 cities on at least five of the world’s six continents, truly defining us as

a leading global airline.

Each of Korean Air’s 17,000 management and employees is dedicated to securing global leadership through

stronger competitiveness and substantial growth, and your continued encouragement and support is essential to our success. We thank you for your past loyalties and look forward to your trust in the future.

Thank you.

Cho, Yang Ho

Chairman & CEO

008 · 009

BOARD OF DIRECTORS

“ To maintain substantial growth and reinforce our

competitive edge, we will continue to strengthen our focus

on profitable routes and enterprises, products that

customers demand and view as valuable. ”

01

02

03

04

05

06

08

01. Cho, Yang Ho

Chairman & CEO

02. Lee, Jong Hee

President & COO

04. Kim, Seung-Yu

Director

Chairman & CEO

Hana Financial Group

General Counsel

Senior Partner

LEE & KO

05. Hong, Young Chul

Director

Chairman & CEO

KISWIRE

Director

Professor

Seoul National University

Director

Laywer

Doo-re Law Firm

09. Cho, Hang Jin

Executive Vice President

Korean Air Aerospace

Business Division

10

03. Lee, Tae Hee

06. Park, Oh Soo

08. Lee, Sog Woo

09

07

10. Suh, Yong Won

Executive Vice President

Korean Air Human

Resources Development

07. Kim, Jae Il

Director

Professor

Seoul National University

KOREAN AIR ANNUAL REPORT 2007

010 · 011

CORPORATE GOVERNANCE

Korean Air emphasizes corporate ethics in the activities of all of our employees and

management. The Company is also fully aware that corporate openness will enhance

our corporate image and strengthen our competitiveness.

Korean Air is fully committed to shareholder value through ethical behavior and social responsibility. In an effort to effectively

deliver corporate transparency, the Company continues to maintain regulatory systems and operational processes ranging

from major decision-making to everyday activities.

The Board of Directors makes important decisions of the company and guarantees independence in its work. Korean Air’s

executive team reports to the Board at meetings so that all decisions can be made based upon a clear understanding of the business situation. The three committees under the Board - the Audit, Outside Director Nominating and Executive committees maintain objectivity in business, impartiality in nominating directors, and expertise in decision-making.

Korean Air continues its efforts to encourage fair competition. Since the company announced its fair trade policies in 2004,

Korean Air has maintained a ‘self-observance educational program’ to allow fair trade practices to take root and extend, while

preventing unfair trade practices. Korean Air also is strengthening training programs to promote ethical practices among

management and employees.

The Company emphasizes corporate ethics in the activities of all of its employees and management. Korean Air introduced

standards for value judgment and behavior through its Corporate Code of Ethics and Practice Guidelines, and continues to

make all employees aware of the importance of corporate ethics by providing relevant information and recurring training.

Since 2001, in particular, the Company has been helping all employees make corporate ethics a habit through mandatory corporate ethics courses, and all new employees are required to submit a written corporate ethics pledge. In 2006, Korean Air

strengthened its ethical behavior principles on conducting business with interested parties.

In addition, Korean Air operates an Internal Misconduct Reporting System to help eliminate potential solicitations within the

organization, unfair or unethical conduct, and irregularities in transactions with outside parties. Any of the above activities

that are reported are thoroughly investigated by the Audit Department.

To achieve corporate transparency, Korean Air is committed to increasing the reliability of all disclosed financial information

and strengthening accounting transparency through our Internal Accounting Control system. Through an advanced internal

accounting control system, we regularly monitor the efficiency of the internal accounting management and the operating status of internal controls.

Korean Air is fully aware that corporate openness will enhance our corporate image and strengthen our competitiveness. We

will continue our efforts and practices to further achieve our goal of true corporate transparency.

EXCELLENCE

AT WORK

Despite enormous challenges in 2007, Korean Air recorded a strong

growth of 9.1% with KRW8,812 billion in revenues by strengthening its route

networks and improving global sales activities. Last year, we accepted five new

airplanes and upgraded three existing ones. Since 2004, Korean Air has consecutively been ranked the world’s No.1 in FTKs by IATA and expects to retain that

top position again in 2007. Customers have shown a very positive response to

our upgraded premium seats, a state-of-the-art inflight entertainment system

and improved inflight food service. The year provided Korean Air with platforms for maximizing its potential for future growth.

8,812

KRW

billion in revenues

Up 9.1%

EXCELLENCE AT WORK

2007 AT A GLANCE

Korean Air: A Year in Review

Despite huge challenges in 2007,

Korean Air countinued to expand

with operating revenue increased by

an impressive margin. SkyTeam

retained its worldwide leadership

with the addtion of the new carriers to

the alliance. Korean Air also positioned itself as the airline company

that contributes to cultural exchanges

by partnering with Musée du Louvre.

All these efforts were acknowledged

by the world’s prestigious awards

Korean Air won last year.

Korean Air to Establish New

Low Cost Carrier

In June 2007, Korean Air announced

that it would launch a low cost carrier,

provisionally named “Air Korea”, and

disclosed its details in November, saying that the carrier would begin operation in 2008. Air Korea will use

Incheon International Airport as its

base airport, and after launching

domestic routes, it plans to gradually

widen its network to short-or-middistance international destinations.

Korean Air: A Launch

Customer for the B787

Dreamliner

On July 8, 2007, Korean Air participated as a launch customer at the rollout ceremony of the Boeing 787

Dreamliner at the Boeing Everett facility near Seattle. The rollout ceremony

was especially meaningful to Korean

Air because the airline is not only part

of the launch customer team awaiting

delivery, but also one of the suppliers

participating in the manufacturing of

the state-of-the-art airplane. Delivery

will begin in 2009 and extend through

2013.

Korean Air Welcomes China

Southern to SkyTeam and

Three Associate Airlines

In November 2007, Korean Air welcomed SkyTeam’s eleventh full member - China Southern Airlines - to the

alliance, of which the airline is a

founding member. “We look forward

to fostering closer ties with our new

Chinese partner to expand our presence in China,” said Mr. Yang ho Cho,

Chairman and CEO of Korean Air.

Meanwhile, in September, SkyTeam

added Air Europa, Copa Airlines and

Kenya Airways as the first official

SkyTeam Associate Airlines to the

alliance.

Korean Air Sponsors Louvre

Museum’s New Multimedia

Guide

In February 2008, Korean Air

announced it was partnering with

Musée du Louvre to enhance art and

cultural understanding for people all

over the world. As part of the agreement to co-sponsor the Louvre’s

innovative new multimedia guide,

commentary is translated into seven

languages including English, German

and Korean. Being the first of its kind

between a global airline and international museum of this stature, it is also

the first time any guide has been available in their mother-tongue for the

tens of thousands of Korean visitors

who visit Louvre.

KOREAN AIR ANNUAL REPORT 2007

014 · 015

Korean Air’s Major Awards in 2007

One of the Best “Cellars in the

Sky”

In February 2007, Korean Air’s world

class wine service has been recognized

by Business Traveller magazine (UK)

as having one of the industry’s best

wine services. In its annual competition to find the finest airline wines in

First and Business class, Business

Traveller honored Korean Air in six

categories including best business class

white wine. Korean Air offers wines

from nine different countries to meet

the diverse tastes and preferences of its

international passengers.

Korean Air Wins 3rd Mercury

Award for “A Letter From

Flying Mom”

On March 9, 2007, Korean Air

received the prestigious ‘Mercury

Award’ from the International Travel

Catering Association (ITCA) for the

development and service implementation of “A Letter From Flying Mom”

service for unaccompanied minor

passengers and their families. Started

in 2002, the service is designed to provide closer personal service for unaccompanied minor passengers and give

reassurance to parents that their children are being well taken care of.

Best Economy Class in World

Airline Awards

Korean Air was named the world’s

Best Economy Class 2007 in the

Skytrax 2006/7 World Airline Awards

in July 2007. The World Airline

Awards, regarded around the globe as

the leading independent monitor of

passenger opinions, recognized

Korean Air’s “new level of achievement,” which reflects “ a strong combination of both product and staff service quality.”

“Excellence in Entertainment”

Recognized by WAEA

In September 2007, Korean Air won

top honors in the World Airline

Entertainment Association’s (WAEA)

2007 Avion Awards, ranking among

the top airlines for “Best Achievement

in In Flight Entertainment” and one of

the top in “Best in Region - Asia &

Australasia” category. Korean Air was

recognized for its vast investment such

as AVOD in all cabins and creative service enhancements such as the launch

of its new entertainment guide

‘Beyond.’ Top rankings in the Avion

Awards are confirmation that Korean

Air’s in-flight entertaiment is on the

right track to realizing its mantra

“Excellence in Entertainment,” staying true to the airline’s mission,

“Excellence in Flight.”

EXCELLENCE AT WORK

BUSINESS AT A GLANCE

Passenger Business

Cargo Business

Business Profile

With continued efforts in fleet and

network expansion and the introduction of new services, Korean Air passenger business grew 9.7% in operating revenue in 2007, an impressive

growth attained despite enormous

challenges and competitions it faced

last year.

Operating Revenues

(in billions of KRW)

For three consecutive years since 2004,

Korean Air’s cargo business has been

ranked the world’s number one in

FTKs by IATA and it expects to retain

that top position again in 2007.

Korean Air will continue to be successful and solidify its position as the

leader of global air cargo industry.

Passenger Business

Cargo Business

5,217

2,533

KOREAN AIR ANNUAL REPORT 2007

Aerospace Business

For the last three decades Korean Air

has been leading the nation’s aerospace industry and has become the

Asia-Pacific hub for aircraft maintenance, delivering over 3,500 aircraft so

far. Now it produces commercial aircraft structure components including

the B787s and expands to satellite

development and other operations.

Catering Business

In 2007, Korean Air provided almost

50,000 meals per day and recorded a

significant sales growth of 13.8% to

KRW 58.4 billion. Korean Air offers a

wide range of dishes to cater to its passengers’ tastes and is continuing its

efforts to develop traditional Korean

inflight meals as a way to promote

Korean culture.

016 · 017

Hotel & In-Flight Sales Business

Korean Air’s efforts to maximize customer satisfaction continued last year.

Despite an overall revenue decrease by

4.6% due to competition and large

investments, Hyatt Regency Incheon

grew 14.5% in 2007. Two other business sectors, KAL Limousine Bus and

In-flight Sales, increased by 4.8% and

20% respectively.

Aerospace Business

Catering Business

Hotel & In-Flight Sales Business

235

58

35

* In-Flight Sales revenues are not included

EXCELLENCE AT WORK

PASSENGER BUSINESS

Through a wide range of sales and profit

enhancement activities, the Passenger

Business Division strengthened its revenue

management and increased high-yield

destinations to protect earnings and meet

changing demands.

22.8

mil.

total passengers carried

Passenger Business Review 2007

In 2007, Korean Air faced enormous challenges due to newly

established low-cost airlines, Korea’s economic recession,

and a prolonged slump in exports. In addition, oil prices

soared to unprecedented levels, severely impacting the global airline industry in general. Conversely, expectations were

and remain high because of a strengthened Korean Won, an

increase in outbound travel due to the five-day workweek,

and openings of the Chinese, Japanese, and Southeast Asian

markets.

The Passenger Business Division concentrated on a wide

range of sales and profit enhancement activities including

identifying new markets and demand, expanding our global

route network, promoting our premium class seats,

strengthening our revenue management and operating

flight schedules in a convenient as well as profitable manner.

We reduced under-performing routes and increased highyield destinations to protect earnings by adjusting supply to

meet changing demands. At the same time, we spared no

Composition of Revenues by Route(%)

KOREAN AIR ANNUAL REPORT 2007

018 · 019

efforts on developing new markets by launching new regular

passenger flights to Cebu, Madrid, Zhengzhou, Melbourne,

Chiang Mai, and between Busan and Manila.

Passenger Business

To further enhance the Sky Team Alliance’s market leadership, China’s largest airline, China Southern Airlines, joined

our Alliance and started providing convenient flights to

international passengers traveling between China and the

Americas, Europe, and Oceania. We also started codeshare

service with Hawaiian Airlines, followed by welcoming Air

Europa, Copa Airlines and Kenya Airways into SkyTeam as

our first associate airlines, further expanding our network

covering Europe, the Americas, and Africa.

Following the year 2006, Korean Air has been keeping on

identifying and creating a series of new programs to differentiate its service for premium passengers and VIP members

of our frequent flyer program, thereby offering more value

for loyalty to the airline.

Our automatic e-ticketing service in domestic airports has

reached 100 percent and includes a system to collect excess

baggage charges. And in international airports, 99 percent

of our passengers are using e-tickets, allowing travelers to

check in for their international flights at self check-in kiosks.

Description

2007

2006

Capacity (‘000 ASK)

76,181,620

71,894,436

5.96%

Traffic (‘000 RPK)

55,353,818

52,177,665

6.09%

Passengers Carried

22,834,003

22,353,169

2.15%

Yield (KRW/RPK)

88.4

81.9

7.94%

Yield (¢/RPK)

9.42

8.81

6.92%

Fleet Utilization

YoY (%)

(Unit : Flight Hours/Day)

2007

2006

2005

YoY (%)

11.3

10.5

9.9

7.6%

EXCELLENCE AT WORK

The new IT systems also provide improved baggage-tagging

for our priority passengers.

Last year, we accepted five new airplanes, and Korean Air’s

engineering expertise was put into use upgrading 17 existing

ones since 2005. Customers are showing a very positive

response to our upgraded premium seats, an extensive and

state-of-the art inflight, on-demand entertainment system

and improved meals and food service.

International Passenger Market Share

(Korea In/Outbound, No. of Passengers)

Business Plan 2008

The world’s economic landscape is expected to remain

volatile, and Korean Air is meeting these industry and global

challenges head-on with a motto of “solidifying growth on a

foundation of substance and efficiency”.

In order to strengthen substance and efficiency, we are using

flexible strategies to make sure our fleet and schedules are

efficient and meeting demands in our core target markets.

We’ll also employ flexible strategies to prepare for Korea’s

airline deregulation and the challenge low cost carriers bring

Domestic Passenger Market Share

(No. of Passengers)

KOREAN AIR ANNUAL REPORT 2007

to our market. One of our most visible tactics is to launch a

low cost carrier of our own, Air Korea (provisional name), to

meet changing market demands.

To maintain a continued momentum for dynamic growth,

we will launch passenger service to Sao Paulo to secure a

foundation in South and Latin America. We are also establishing a second hub in Germany by launching flights to

Munich. And we always are poised to review emerging markets to determine profitability and potential demand.

Meanwhile, in our quest for improving work process and

efficiency, e-ticket database and the PAXIS will be brought

in, providing a passenger information processing system

that uses global market information to support us in making

informed decisions.

We are constantly striving to lead our industry with remarkable customer service by further strengthening our existing

systems and activities, as well as determining new services

that increase and enhance customer demand while providing efficiencies and profitability.

Seat Class Composition by Revenue Terms

020 · 021

EXCELLENCE AT WORK

CARGO BUSINESS

Maintaining its strategy of expanding the

service neworks, Korean Air Cargo continues

to retain its leadership as the world’s number

one cargo carrier.

2.3

mil.

total tons of freight carried

Business Review in 2007

With a steadfast revenue increase of 6.8% compared to 2006,

Korean Air Cargo posted KRW 2.5 trillion in revenue for

2007 despite a yield drop by 0.6% caused by an increasingly

competitive market situation in Korea. On the freight capacity side, with a flexible schedule policy patterned by the actual market demand, Korean Air Cargo marked 9,678 million

ton-kilometers - a 9.3% increase over the previous year.

With such strong capacity, Korean Air Cargo recorded 2.3

million tons of total freight and mail carried. This figure is a

7.9% increase over 2006.

ously since 2001, which is at the core of its cargo strategy, and

again extended its network to four new cities in 2007, including Moscow, Houston, Xiamen and Munich.

Korean Air Cargo has solidified its position in the China air

cargo market through adding frequencies to our existing

cargo power points such as Shanghai and Tianjin and new

freighter service to emerging cargo centers like Xiamen. By

forging this proactive market development, China has

become the 2nd largest market base of Korean Air Cargo,

only after our Korean market.

For three consecutive years since 2004, Korean Air’s Cargo

business has been ranked the world’s number one in FTKs

by the International Air Transportation Association (IATA)

and Korean Air Cargo expects to retain that top position

again in 2007. All of these achievements were made possible

by Korean Air’s strengthening of overseas sales capabilities

and our continuing efforts to develop new markets.

Meanwhile, Korean Air Cargo has focused on developing

new products to offline destinations. ‘Latino Express’ is the

effective sales vehicle to highly profitable Latin American

destinations. By providing the seamless connections and

real-time cargo status information, the ‘Latino Express’ has

proven itself as option that competes effectively with the online service of other airlines.

Revenue Enhancing Activities

Cost Saving Activities

Korean Air Cargo has been expanding its network continu-

As ever increasing fuel prices erode profitability in the air

KOREAN AIR ANNUAL REPORT 2007

cargo industry, Korean Air Cargo is rearming its fleet with

more fuel efficient aircraft. By ordering five each new B7478Fs and B777Fs, Korean Air Cargo has set its path of transforming itself into the world’s most fuel efficient cargo fleet.

This transition of fleet type is expected to start in 2011.

Additionally, through precise demand forecasting, Korean

Air was able to reduce the cost of leased freighters by reducing the less-than-expected load factor flights.

2008 Plans for the Cargo Business

On top of such remarkable achievements in 2007, Korean

Air is preparing for many new challenges in 2008.

Continuously escalating fuel prices will have the greatest

affect on the profitability of Korean Air Cargo in this year

and in the foreseeable future. Therefore, Korean Air Cargo’s

overall business plan is designed to minimize the negative

impact of fuel cost pressure on the cargo business while preserving the vitality and potential for continuous, strong

growth.

Korean Air Cargo will focus on maximizing the revenue

potential of capacity while adding the least number of new

aircraft. In 2008, Korean Air Cargo takes delivery of only two

B747-400 freighters converted from passenger aircraft.

022 · 023

However, with three outgoing freighters (one B747F and

two Airbus freighters) to Grand Star, Korean Air’s cargo

joint venture in China, total capacity of freighters of Korean

Air Cargo will remain almost the same throughout 2008.

Instead of adding new freighters to our fleet, Korean Air

Cargo will reorganize its network and revise its schedule to

ensure increased freighter operating hours and more intraAsia frequencies from which Korean Air Cargo expects

lower costs and high yields.

The total revenue target of Korean Air Cargo in 2008 is set as

KRW 2,665 billion, an increase of 12% over 2007. To attain

this impressive target, Korean Air Cargo has formulated the

strategy matrix for 2008 as follows:

First, Quality as the momentum for the further growth

As the air cargo industry becomes saturated in most global

markets, quantity-oriented strategies will fail to secure

momentum for further growth. Korean Air Cargo, by reinforcing and improving its logistics value chain, will focus on

the more profitable quality-oriented market segments. To

achieve this strategic drive for quality, Korean Air Cargo is

proactively redesigning its quality matrix on every critical

logistics path, with the goal to exceed all other air logistics

providers in terms of quality.

EXCELLENCE AT WORK

Second, retaining Leadership the world air cargo industry

Korean Air Cargo will continue to retain its position as the

world’s number one freight carrier, a position it has attained

in a mere 40 years. Retaining this position demands us to

strengthen our brand, increase our abilities and create a

vitality in the global air cargo business.

Third, Profitability through customer satisfaction

Korean Air Cargo’s value to the worldwide logistics business

and to Korean Air’s shareholders can be achieved by attaining the above strategic goals. By tapping into every opportunity for quality markets and higher efficiency, Korean Air

Cargo will continue to be an impressive factor in the world

cargo business. Moreover, winning and keeping our customers’ loyalty is essential to maintaining our global leadership position in 2008 and beyond.

Cargo Business

Description

2007

2006

12,992,069

11,661,645

11.4%

Tarffic (‘000 FTK)

9,677,679

8,857,155

9.3%

Carried Tons

2,281,671

2,115,089

7.9%

Yield (KRW/FTK)

244.6

246.7

-0.9%

Yield (¢/FTK)

26.07

26.23

-0.6%

Capacity (‘000 AFTK)

YoY (%)

Outlook in 2008

Korean Air Cargo is impacted by the issues facing the world

economy. Still, demands for high-priced consumer electronics, which is the major commodity from Asian countries

to US and EU, should remain at the current demand level.

The Korean export market in particular, which relies heavily on sophisticated consumer and industrial electronics,

should maintain the same demand level as 2007. Eastbound

traffic from China and Southeast Asia will remain strong as

in 2007, but increased market competition and accelerated

pressure from fuel costs on the long hauls could erode a significant portion of profitability.

In the US, the weak dollar (against other major currencies,

including Euro, Yen or the Korean Won), could show a

noticeable increase in westbound demand. However,

despite such a strong surge in demand, the weaker dollar

might offset the net contribution.

Fleet Utilization

(Unit : Flight Hours/Day)

2007

2006

2005

YoY (%)

14.2

15.0

15.0

-5.3

KOREAN AIR ANNUAL REPORT 2007

The EU will remain strong in both export and import,

regardless of its strong Euro. However, as global repositioning of Asian manufacturing companies becomes complete,

there will be a need for reenergizing markets and placing

increased value in the brand.

Though there is cautious optimism in the market for 2008,

Korean Air Cargo will continuously focus on profitability

through optimizing its network and resources. In addition,

by extending its long time tradition of winning the customers, Korean Air Cargo will continue to be successful and

solidify its position as the leader of global air cargo industry.

KE’s Share in Korean Market

024 · 025

EXCELLENCE AT WORK

AEROSPACE BUSINESS

Through teaming up with such worldleading aircraft manufacturers as Boeing and

Airbus, Korean Air marks a turning point to

becoming a more technology-oriented

company.

Introduction

Korea’s aerospace history began with the production of

500MD helicopter by Korean Air in 1976. In a relatively

short period, Korean Air has manufactured and delivered

the F-5 ‘Jegongho’ fighter - representing a milestone in

Korean aerospace industry. Also it has produced the UH-60

‘Black Hawk’ helicopter featuring superior mobility and sustainability.

Korean Air Aerospace division has been expanding its capabilities to commercial aircraft structure manufacturing,

satellite development and other business areas to optimize

its business structure. And it has been successfully managing

all business sectors for more than 30 years.

Aerospace Division’s main plant, the Tech Center, is located

in Busan on a 170-acre site with aircraft hangars, painting

and electronic components overhaul facilities, etc. Korean

Air also operates the ‘Korea Institute of Aerospace

Technology’ in Daeduck Science Town on a 40-acre site, to

promote state-of-the-art technology in aerospace design and

development.

Since 1978 Aerospace Division has become the Asia-Pacific

hub for aircraft maintenance, delivering over 3,500 aircraft

so far.

With its vast experience, it now provides logistic supports for

F-4 fighter, P-3C anti-submarine patrol aircraft, 500MD,

UH-60, CH-47, LYNX, ALT-III helicopters for Korean government and A-10 Attacker, F-15 and F-16 fighters, and CH53 helicopters for the US government.

Business Review in 2007

Korean Air’s Aerospace Division has participated in

KHP(Korea Helicopter Program) which has been develop-

20

aircraft to be modified to

freighters by 2014

ing the aft fuselage and tail rotor system. It also performed

the crash damage recovery program for C-130 Hercules. The

Division recently commenced its B747 cargo conversion

program and successfully delivered three aircraft by the end

of 2007.

The Aerospace Division has been working with Boeing to

develop the next generation B787 Dreamliner aircraft for

years, and is playing a leading role in the joint development

and manufacturing of the aircraft. Korean Air is one of seven

international partners for the 787 development program.

The Aerospace Division has invested in equipment and facilities to manufacture the advanced composite product for the

B787 and has developed new equipment for the advanced

design and manufacturing techniques required for B787

parts development. The participation in these programs,

teamed up with major companies around the world, will

definitely be a turning point to becoming a more technology-oriented company.

In 2007, the first articles such as raked wing tips, flap support

fairings and section 48 aft body for the B787, were delivered

to the customer. For excellent performance in quality and

on-time delivery, Boeing selected Korean Air Aerospace

Division as “Supplier of the Year”. By winning this prize the

second time since 2001, Korean Air Aerospace Division has

been recognized as one of Boeing’s best partners in the new

aircraft development.

Korean Air Aerospace Division signed a contract with

Airbus to supply Elevator Assemblies for its best-selling

A320 family and delivered the first Elevator in 2007. Based

on this seed program, the Aerospace Division is now in discussions with Airbus to participate in the development of the

A350 extra wide body.

KOREAN AIR ANNUAL REPORT 2007

The Aerospace Division has experienced continued growth

in the space business. Major ongoing space projects include

KSLV-I (Korea Space Launch Vehicle) System integration

and ARIRANG 3/5 satellite Main Bus and Solar Array

System structure development. The COMSAT(Communication, Ocean and Meteorological Satellite) antenna development project was also successfully completed and preliminary research activities on Liquid Rocket Engine System

integration and test facilities were begun.

026 · 027

and civilian.

Korean Air Aerospace Division has plans to increase synergy

and efficiency, and will reform its military business structures according to the government’s regulation relief. We

also are targeting a revenue of $300 million in 2008.

Revenue

Close-range surveillance UAV(Unmanned Aerial Vehicle)

and high-precision GPS navigation system development

projects were also successfully completed. The Aerospace

Division began efforts to develop next generation

UAS(Unmanned Aerial System) as the next step toward

becoming Korea’s UAV market leader.

(In billions of KRW)

Commercial

(In billions of KRW)

Military

Going Forward

Based on the remarkable and successful results of 787 development and manufacturing through on-time, high quality

delivery, Korean Air Aerospace Division has started the

development of 787 derivatives. In 2008, the Aerospace

Division will continue to expand its active participation in

the development of new aircraft such as B787-9, B747-8 and

A350 XWB. And it will align available resources and capacity to ramp up the production line for sharply increased rate

of the 787 programs.

Korean Air Aerospace Division will expand its business area

to commercial aircraft heavy maintenance and component

overhaul of various kinds of military aircraft.

The Aerospace Division will continue its research efforts on

Liquid Rocket Engine system integration and test facilities

development in an effort to expand its space business and

focus on the UAS(Unmanned Aerial System) for defense

EXCELLENCE AT WORK

CATERING BUSINESS

To satisfy different tastes and cultural

backgrounds of passengers, Korean Air offers

a wide range of international cuisines and

provides specially-prepared meals.

Business Review in 2007

With more than 30 years of experience, Korean Air Catering

(KAC) supplies in-flight catering services not only to Korean

Air, but also to 33 foreign carriers such as Singapore, United

Airlines, Air France, JAL, China Southern and others. In

2007, KAC provided almost 50,000 meals per day and

recorded a significant sales growth of 13.8% to KRW 58.4

billion, up from KRW 51.3 billion in 2006. This is mainly

attributed to the increase in demand from domestic and

international airlines with increase in international passenger flights. KAC is the first airline catering organization in

Korea to be certified by the government authority assuring a

commitment to HACCP professional standards. Such

recognition demonstrates KAC’s competitiveness as a leading inflight caterer and affirms Korean Air’s superior quality

in the airline catering business.

Automated Facilities

Korean Air’s Catering Center at Incheon was customdesigned by a consulting company specializing in the construction of such automated facilities. In line with similar

facilities worldwide, the plant utilizes the latest energy-saving systems and equipment. The facilities make use of hitech equipment and systems such as electric monorail cart

transportation and storage systems. Additionally, a Gantry

Crane Robot System, designed to move and store cleaned

transit carts, was introduced for the first time in the airline

catering industry. With these automated systems, KAC can

offer competitive prices while maintaining superior quality.

Food Quality Assurance

In-flight cuisine plays a vital role in assuring satisfaction to

the air traveler who is always looking for the best in service.

The research and development team at KAC works continuously to develop meals and menus that render a more

delightful culinary experience during flight. Currently, KAC

offers a wide range of Western, Korean, Chinese, and

Japanese dishes as well as children’s meals, and provides specially-prepared meals in response to personal, religious or

medical requests. KAC is continuing its efforts to develop

traditional Korean inflight meals as a way to promote

Korean culture to world travelers. Currently, almost 30 traditional meals, such as Bibimbab, Bibimguksoo, Bulgogi and

Galbi are served on Korean Air flights.

Flight Kitchen in Busan

Korean Air’s Flight Kitchen in Busan, which opened in 1987,

provides high quality meals to international flights departing

from Busan. In 2007, Korean Air’s Flight Kitchen in Busan

offered almost 4,000 meals a day to 17 international carriers.

Going Forward

Korean Air will continue to maintain the world’s best inflight meals as we strive to meet the diversified needs of our

passengers. As Incheon Airport positions itself as a hub of

Northeast Asia, Korean Air’s catering business expects to

attract a host of new clients with the increasing number of

passengers enjoying the delights of Korean Air Catering.

KOREAN AIR ANNUAL REPORT 2006

028 · 029

HOTEL & IN-FLIGHT SALES BUSINESS

While passenger sales increased 9.1% in 2007,

in-flight sales jumped over 20% during the

same period. Korean Air also provides quality

lodging, and creates synergies between hotels

and its core air transportation business.

Business Review in 2007

Korean Air Hotels

Korean Air operates three hotels in Korea[Jeju KAL Hotel,

Seogwipo KAL Hotel and Hyatt Regency Incheon] and one

in the United States[Wilshire Grand Hotel & Center].

Through the hotel business, Korean Air not only maximizes

customer satisfaction by providing high quality service, but

also creates synergy between hotels and its core air transportation.

Combining its contemporary design and state-of-the-art

technology with classic standards of service excellence, Hyatt

Regency Incheon offers high quality service with world-class

comfort and luxury.

While KAL hotels recorded decreases in revenues by 4.6%

due to the fierce competition in leisure market of Jeju, Hyatt

Regency Incheon achieved a strong performance, posting

14.5% revenue increase from a year earlier.

Meanwhile, with the completion of ballroom renovation in

2007, Wilshire Grand Hotel has been in the middle of large

long-term investments for the main facilities including guest

rooms and restaurants. These investments will make it more

profitable and provide customers with upgraded hospitality.

KAL Limousine Bus

KAL Limousine Bus Service provides customers with the

most convenient transportation by connecting domestic and

international airports with major areas in Seoul. Revenue

from KAL limousine bus service increased by 4.8% over

2006 to KRW 17.4 billion.

KAL Limousine Bus Service is striving to ensure safe and

speedy operations as well as to improve its service qualities

by offering better schedules and routes.

In-Flight Sales

Korean Air’s in-flight sales recorded revenues of $209 million in 2007.

Passenger sales increased 9.1% in 2007 whereas in-flight

sales jumped over 20% during the same period. This outstanding in-flight sales record was due to the cabin crews’

endeavors as well as the continuous support from the management.

In 2008, Korean Air expects revenues to increase again. One

of the main reasons for this sales record was based on the

Korean Air’s “pre-order system”, which allows customers to

view and pre-order items prior to flights online. Because of

various marketing strategies and promotions, these online

passenger orders have constantly increased.

This past year, Korean Air introduced 43 new items and 77

upgraded items in order to adapt the passengers’ rapidly

changing demands.

In 2008, Korean Air aims to further improve the in-flight

sales to passengers through continuous cabin crew training,

introduction of specialty and upgraded items, and an

enhanced pre-order service.

EXCELLENCE

IN ACTION

Korean Air continues to live up to its ‘Operational Excellence’ vision.

As one of the world’s most punctual airlines, Korean Air’s operational reliability supports the airline’s mission of quality maintenance and excellence in safety. As a proud architect and founding member of SkyTeam, Korean Air is gradually increasing strategic alliances with the world’s major airlines as part of its

vision of offering ‘Service Excellence’ to its passengers. Setting our sights on

achieving ‘Innovative Excellence,’ we are continuously innovating our cabins

and upgrading fleet with next generation aircraft, strengthening our position

as a carrier with a reputation of global reliability and quality.

9,490

KRW

billion

2008 revenue target

EXCELLENCE IN ACTION

MAINTENANCE & ENGINEERING

With a global reputation for high standards and technical excellence, Korean Air enjoys

one of the world’s best dispatch reliability records, and is providing comprehensive

maintenance support and service for aircraft, engines and components to more than 30

customer airlines operating in Korea.

Overview of Maintenance & Engineering

Korean Air has one of the world’s best dispatch reliability

records and has provided comprehensive maintenance support and service for aircraft, engines and components since

1969. About 3,600 highly skilled and motivated personnel

are working in the four major maintenance bases located in

Gimpo, Incheon, Bucheon, and Gimhae. With a full capability of airframe heavy maintenance, Korean Air performs

major repair and modification on its own fleet and offers

overall maintenance support for more than 650 international flights in a week. Korean Air also has an overhaul capability on PW4000 series and JT9D engines and an internationally acclaimed reputation for engine MRO (Maintenance,

Repair, and Overhaul).

Korean Air’s maintenance operation continues to live up to

its ‘Operational Excellence’ vision. In April 2007, Airbus and

Boeing announced Korean Air as the best on-time operator

in the world. In December 2007, China’s World Traveler

magazine and the US’s Forbes economic magazine acknowledged Korean Air as one of the world’s most punctual airlines. Korean Air’s operational reliability supports the airline’s mission of quality maintenance and excellence in

safety.

Our highly reliable maintenance capability and technical

excellence has led Korean Air to contract with a variety of

global customers. For example, United Airlines selected

Korean Air as a partner to perform cabin upgrades because

of its excellent heavy maintenance experience with Korean

Air. Worldwide aviation authorities such as FAA(Federal

Aviation Administration), EASA(European Aviation Safety

Agency), and CAAC(Civil Aviation Administration of

China) have all lauded Korean Air’s expertise, and we will

continue to invest in better service of our customers .

Korean Air has been achieving the highest quality in all

aspects of its operation and as a major partner in the

SkyTeam alliance, we are gradually increasing strategic

maintenance alliances with other airlines. Korean Air’s ERP

project will replace current Maintenance & Engineering

Systems with state-of-the-art information and technology

systems. The airline will spare no expense in order to be a

competitive leader in Maintenance & Engineering with a

reputation of global top reliability and quality.

KOREAN AIR ANNUAL REPORT 2007

032 · 033

SAFETY

Korean Air’s management policy is to continue substantial growth and increase its global

competitiveness, based on an absolutely safe operational system. With the spirit of

operational excellence, Korean Air is now looking to be known and acknowledged as one

of the world’s safest airlines.

Operational Safety for Accident Prevention

Korean Air has maintained the management policy of

Operational Excellence, and completed its eighth consecutive year of accident-free operations. We are now looking to

be known and acknowledged as one of the world’s safest airlines.

In support of this core value, we nourish our accident prevention system by identifying, analyzing and correcting any

safety hazard before it becomes an issue. Any unsafe element

detected during operation leads to a comprehensive investigation to find the cause and prevent the recurrence of a similar irregularity. All information gathered from this procedure is thoroughly recorded into a database system that will

be reinforced by the Safety Management System (SMS),

scheduled to operate this year. SMS will be the international

standard by ICAO beginning 2009. Last July, we launched

the corporate SMS task force to establish the SMS that will be

the foundation for a superb safety reputation.

In addition, Korean Air has focused on safety activities during aircraft ground handling at both home base (ICN &

GMP) and the other domestic and overseas stations. The

efforts resulted in an outstandingly low ground damage rate.

It was reduced to 0.06 case per 10,000 flights; a rate of 1/3 of

the 2007 goal of 0.18. We will keep supporting ground safety

by analyzing job hazards and activating a thorough safety

training program.

Korean Air’s management policy of 2008 is to continue substantial growth and increase our global competitiveness,

based on an absolutely safe operational system.

Moreover, to strengthen flight safety, Korean Air’s FOQA

(Flight Operation Quality Assurance) animation program

will be up-graded and FOQA irregularities intensively con-

trolled. Last but not least, our safety culture will be increased

through safety policy revisions, activation of safety reporting, and the encouragement of employees’ participation in

safety education activities.

EXCELLENCE IN ACTION

FUEL MANAGEMENT

Last year, Korean Air achieved a fuel cost savings of 46.1 billion won directly attributable

to our concerted initiative efforts. We are reinforcing our performance monitoring and

continuing our focus on our outcomes in order to become the world’s leading carrier in

fuel management.

Oil prices began escalating starting in 2003 and have continued to rise in 2007. Korean Air’s efforts to achieve fuel cost

savings and environmental responsibility have continued to

increase as well.

In June 2007, we were evaluated for the implementation of

our advanced fuel managing process by an IATA Fuel GoTeam (which is a fuel management expert group) and we are

ranked as top global carrier in fuel management.

Korean Air founded a fuel management team in 2004 and

this group has been hard at work ever since, including the

formation of a fuel management database since 2005 and

inclusion of representation of all divisions into this group.

From 2008, we will continue to maintain our initiatives to

achieve the level of global best practice in fuel management.

We are reinforcing our performance monitoring and continuing our focus on our outcomes in order to become the

world’s leading carrier in fuel management, all in the effort

to achieve profitability and sustainability.

In 2007 we achieved a fuel cost savings of 46.1 billion won

that can be directly attributed to the 22 initiatives we have

been performing since 2006 and 18 newly incorporated initiatives. Additionally, various fuel efficiency indexes, such as

fuel consumption per ATK, block time and flying time are

showing a 2.0%~2.5% improvement in fuel efficiencies

compared to those of year 2006.

KOREAN AIR ANNUAL REPORT 2007

034 · 035

SKYTEAM ALLIANCE

Since its launch, SkyTeam has grown into a leading global airline alliance with 11

member airlines. SkyTeam now serves approximately 428 million annual passengers

through a worldwide system of over 16,400 daily flights covering 841 destinations in 162

countries.

Recently, the number of partner airlines increased to 11 with

the addition of China Southern Airlines.

Korean Air founded SkyTeam, the first customer-focused

global airline alliance, with Delta Airlines, Air France and

Aero Mexico in June 2000. Since its launch, SkyTeam has

grown into a leading global airline alliance with 11 member

airlines. CSA Czech Airlines and Alitalia joined SkyTeam in

2001 and Continental Airlines, KLM Royal Dutch Airlines,

Northwest Airlines became members of SkyTeam in 2004.

Aeroflot became a member in 2006 and the number of

member airlines increased to 11 with the addition of China

Southern Airlines in November 2007. China Southern is the

first Chinese air carrier to join any global alliance. Recently,

SkyTeam recruited three associate airlines: Air Europa, Copa

Airlines and Kenya Airways.

Today, SkyTeam is the world’s second largest airline alliance

group serving 841 destinations in more than 162 countries,

with 16,409 daily flights available on an extensive global network of hubs and destinations. SkyTeam Cargo is the largest

cargo alliance, serving more than 728 unduplicated destinations in more than 149 countries.

For the last seven years, SkyTeam has accomplished remarkable development. Its market share was only 11% at the time

of foundation, but increased to 25% in 2007. The number of

FFP members increased from 40 million to 110 million

members, and destinations increased from 451 cities to 841

cities.

Through SkyTeam’s extended network, passengers enjoy

more benefits while traveling on any SkyTeam carrier, with

more choices of flights and departure times, plus frequent

flyer program benefits and seamless service. SkyTeam offers

customers worldwide access to lounges, improved choice

and convenience, consistent service and the ability to be recognized and rewarded for their loyalty.

As expressed in its slogan, “Caring more about you”,

SkyTeam will continue to develop new benefits, services, and

products that will improve the customers’ experience.

EXCELLENCE IN ACTION

SOCIAL CONTRIBUTIONS

Korean Air supports the needy and offers worldwide social contributions and disaster

relief activities in the countries we serve. These activities constitute not only social welfare but scholarships, support of the environment, medical service and natural disaster

relief.

Korean Air’s “Sharing” Management

Under the slogan, ‘Wings of Love, Wings of Hope’, Korean

Air has been concentrating its efforts on “sharing” management through a number of social contributions. As social

responsibilities of companies become increasingly important, Korean Air is extending its contributions to the world’s

societies.

It has been five years since staff and management first started the “Kkut Jun Fund Raising Movement”, which was the

starting point of Korean Air’s social contribution activity.

The accumulated fund is used to support voluntary service

organizations inside and outside the company.

Korean Air supports the needy, volunteerism, worldwide

social contributions and disaster relief activities in the countries we serve. These activities constitute not only social welfare but scholarships, support of the environment, medical

service and natural disaster relief.

Currently there are 20 social service groups under Korean

Air’s Social Service Organization. Each group provides voluntary services such as scholarships for the under-aged in

charge of households, bathing service for the physically challenged/elderly living alone and participating in social welfare

organizations. We use the benefits of an airline company by

offering round-trip tickets from/to Jeju Island to the underaged in charge of households, the physically challenged, children with leukemia and the elderly living alone.

We also donate daily necessities to villagers and deliver

donations from social welfare organizations. For example,

some voluntary social service groups under Korean Air’s

Social Service Organization continuously visit underdeveloped regions in Southeast Asia. For the past three years,

Korean Air has been aiding the Ministry of Health and

Welfare-sponsored “Disabled Youth Dream Team, Face the

World” program with round-trip tickets, volunteer translators and helpers.

Profits from Korean Air’s annual ‘Love the Sky Bazaar’,

sponsored by cabin crew members (Goni-hwae,

Sweungwoo-hwae) are used to support those in need.

Kimchi or ‘Rice of Love’ delivery events also are voluntary

social services we are providing each year.

KOREAN AIR ANNUAL REPORT 2007

On a larger front, Korean Air has been providing medical

service for residents of its sister village in Gangwon Province

and all staff and management voluntarily take part in the

‘Love House Construction’ and ‘Wee-ahja Sharing Market’.

Korean Air also is leading in disaster relief activities. We

funded aid and necessities during the year-end Jeju snow

storm disaster and delivered oil absorption materials from

overseas to support cleaning up of the worst-ever crude oil

spill on the West Coast, driven by the Ministry of Maritime

Affairs and Fisheries. Furthermore, all of Korean Air’s staff

and management worked long hours to help mitigate the

effects of an oil slick Taean, joining in nationwide efforts to

protect the environment.

Based on the honorable efforts and dynamic culture of

Korean Air, we will not only provide creative and reliable

service focused on customer satisfaction, but also endeavor

to make greater contributions to the society in which we

operate. Korean Air will continue to make its stand in its

“sharing” management by giving back time and attention to

society through substantial and continuous support.

036 · 037

EXCELLENCE IN ACTION

ENVIRONMENTAL MANAGEMENT

To satisfy our customers’ demand for services while minimizing environmental impact,

Korean Air has been continuously modernizing its fleet and raising efficiencies in

transport operations. Despite increasing demand for air travel, Korean Air has been

successfully reducing pollutants by improving fuel-efficiency.

Environmental Vision

Korean Air seeks to fulfill its corporate responsibility of preserving the environment by reducing the environmental

footprint of its operations. We have established a vision:

“Improving the Value of Life through the Harmonization of

Aviation and the Environment” and are actively involved in

worldwide efforts to make our airline operations environmentally friendly by adopting environmental management

practices and setting mid-to-long-term environmental

goals. Korean Air is dedicated to taking a proactive approach

to environmentally and economically sustainable growth.

Environmental Impact of Flying

All operations of an airline including flights, cabin service,

aircraft maintenance and ground maintenance and support

activities, have an impact on our environment. The most significant impact is flight itself because aircraft consume fossil

fuels and emit carbon dioxide. In addition, noise from

departures and landings may significantly affect neighborhoods adjacent to the airport.

Airlines have continued to make efforts to decrease the

impact of their operations on the global environment and, in

recent times, such efforts have begun to show results. For

example, many airlines, including Korean Air, have invested

in efficient new airplanes and improved operational procedures, resulting in reductions in oil consumption, fuel emissions and noise. Korean Air also looks to invest further in

environmentally-friendly technologies with an eye towards a

healthy future for our next generation.

Environment Management System

Korean Air has received the ISO14001 certification, the

international standard for environment management systems, and has introduced a corporate-wide environment

management system comprised of five sectors; the

Headquarters & General, the Aerospace Business Division,

the Maintenance & Engineering Division, the Catering

Center, and the Jeju & Seogwipo KAL Hotel.

We also aim to prevent potential damage to the environment

through environmentally friendly processes and procedures

which ensure the use of green resources, recycled wastes, and

adherence to relevant environmental laws and regulations.

Over the mid-to-long term, Korean Air seeks to fully

KOREAN AIR ANNUAL REPORT 2007

embrace green management practices across the Company.

In line with our effort, we will adopt environmental policies

and procedures in areas such as cabin service and ground

support activities.

the ‘Korean Air Ecological Park’ in China’s Kubuchi Desert.

Through 2011, Korean Air will be helping grow 1.8 million

trees at this park.

UN Global Compact

Korean Air announced in July 2007 that it joined the UN

Global Compact which is designed to promote corporate

responsibility and pursue ethical management in companies

around the world. The UN Global Compact is an international treaty launched in 2000 declaring 10 principles covering human rights, labor standards, environment and anticorruption. We expressed our decision to enter the treaty

saying that Korean Air’s ethical management guidelines are

in line with the ten principles of the UN Global Compact.

We expect this decision will boost employee and customer

loyalty through greater corporate transparency and social

responsibility.

●

Sustainability Activities in 2007

Overseas Forestation Activities

The “Korean Air Forest” is spread across more than 13 acres

outside the town of Baganuur, 80 miles east of the

Mongolian capital Ulaanbaatar. This is a living testament to

the airline’s commitment to its social responsibilities. Over

the past four years, more than 15,000 trees have been planted at Baganuur to help stem the “desertification” of the area

that is afflicted by seasonal “yellow sand” storms.

●

On October 31, 2007, Korean Air launched a five-year largescale reforestation program in the Kubuchi Desert of Inner

Mongolia, China, as well as in Mongolia itself.

Around 70 Korean Air staff members including Mr. Yang

Ho Cho, Chairman and CEO of the Company, participated

in the October tree-planting event to signify the beginning of

038 · 039

EXCELLENCE IN ACTION

Climate Change

Unlike the problem of aircraft noise, which remains a concern for communities in close proximity to airports, greenhouse gas from fuel emissions is perceived as a worldwide

issue, captivating the attention of stakeholders throughout

the world.

Though air passenger travel and cargo transportation have

dramatically increased, recent scientific research on aviation

and climate change has shown that CO2 emissions from aircraft accounts for a mere 2% of the total amount of manmade CO2 emissions. Although aviation’ s overall contribution to carbon dioxide emissions remains a small percentage

relative to the rapid growth of air transport, the airline

industry worldwide takes climate change seriously and is

committed to finding effective measures in limiting aviation's impact.

To satisfy our customers’ demand for services while minimizing the impact on the environment, Korean Air is modernizing its fleet and raising efficiencies in transport operations as a matter of policy. Our efforts to reduce

consumption of fossil fuels and curtail emissions are part of

our overall effort to promote the sustainable development of

Share of Air Transport in Global man-made CO2

emissions

Source : IPCC

(Intergovernmental Panel on Climate Change, UN)

The amount of CO2 emissions by Korean Air’s domestic operations

amounts to 0.2% of Korea’s total CO2 emissions and 1% of the total in

the transportation sector. If we include emissions by Korean Air’s

international operations, which are currently excluded from the Kyoto

Protocol, the Company emits around 2% of Korea’s total CO2 emissions.

※Data Reference: 2004 Greenhouse Gas Inventory Policy Report/ Korea Energy Economics

Institute

KOREAN AIR ANNUAL REPORT 2007

the Company while reducing its impact on the environment.

040 · 041

Korean Air has long sought to decrease fuel use by modernizing our fleet, expanding transportation networks, raising

load factors, improving maintenance and flight procedures

and reducing the weight of loads.

The Kyoto Protocol urges states to address emissions from

international aviation through ICAO. Both the Protocol and

ICAO endorse emissions trading as a mechanism to achieve

this. Given the global nature of aviation and climate change,

it is essential that emissions trading initiatives respect the

global policies and guidance developed by ICAO.

Reduction of Aircraft CO2 Emissions Ratio

Despite increasing demand for air travel, Korean Air has

been successfully reducing pollutants by improving fuel-efficiency. Indeed, much data shows that environmental pollution does not grow in direct proportion to the increase in

transport volume. For example, while ATK has increased

9.6% since 2005, Korean Air’s CO2 emissions increased only

8.3% over the same period. This signifies that a 1.3% growth

was achieved without environmental impact.

CO2 and ATK(Available Ton Kilometer)

●

EU to Include Aviation in Emissions Trading Scheme

In December 2006, the European Commission published a

proposal to include air transport in its existing Emissions

Trading Scheme (ETS). This would include flights within the

EU from 2011 and all flights to and from the EU starting in

2012.

●

It is important to note that a greenhouse gas policy should be

based on a broader international agreement. Single-handed

enforcement of a regional policy, without the support of

international stakeholders, will only distort competition and

discourage airlines in their efforts to expand their investment in the environment.

■ 2007 CO2 Emisson=12,084,850 ton

(Calculation on formula : IPCC 2006 Guideline, Tier 1)

EXCELLENCE IN ACTION

HUMAN RESOURCES

Korean Air places a significant focus on creating effective human resources policies

and strategies. Korean Air also places high value on employees’ integrity and teamwork

proficiency. Such values are strongly reflected in the employment, education,

appointment and evaluation of all our personnel.

Outline of the HR Policy

The “Company is the People” is a philosophy that has guided Korean Air’s human resources (HR) strategies and management philosophies. The philosophy is based on the late

Chairman and founder Joong Hoon Cho’s corporate principle that “People create the company and the company

evolves upon the people’s endeavors”. Since its founding,

Korean Air has placed a significant focus on creating effective human resources policies and strategies. Although many

companies highlight human resources, Korean Air has consistently been at the forefront in effectively practicing human

resource management.

Korean Air’s HR philosophy encompasses three basic principles:

a) People are the company’s most valuable resource.

b) Corporate development is achieved through people.

c) Co-development of company and people is essential.

KALMANSHIP is the term to describe the ideal type of

employee that Korean Air wants and needs to hire and retain

to succeed.

Korean Air respects and supports those who have a very

proactive mindset, possess a high sense of the global nature

of our business, are highly service-oriented, and have good

discipline. This KALMANSHIP is based on the HR philosophy, “Company is the People” and is reflected in the HR

policies.

a) Proactive Mindset

- Always think innovatively

- Future-oriented mindset breaking the stereotypes

An active and creative mindset is a significant factor and criteria in recruiting new employees to Korean Air. Korean Air

offers a number of educational programs to enhance a

proactive mindset of our employees. Korean Air also evaluates innovative thinking in our employee appraisal system.

b) Global Sense

- Be able to understand and embrace different cultures from

around the world without being self-centered.

- Be open-minded with profound cultural knowledge as well

as language proficiencies.

KOREAN AIR ANNUAL REPORT 2007

Korean Air implements various policies and guidelines to

enhance a global sense with all employees.

Korean Air instills an obligation of cosmopolitan citizenship

to our new employees by holding mandatory international

volunteer service every year.

Korean Air dispatches assistant manager level employees to

foreign stations for one year term, thus providing opportunities to acquire foreign cultures and lifestyles. Also several

employees are sent each year to one of the world’s most

renowned MBA schools to acquire advanced academic

knowledge.

c) Service-minded and Politeness

- Neat appearance, warm-hearted, good manners

- Professionalism and polite actions in all situations involving customers

Service and safety are the core and crucial factors of an airline’s business, and Korean Air places high value on employees’ integrity and teamwork proficiency. Such values are

strongly reflected in the employment, education, appointment and evaluation of all our personnel.

Personnel Breakdown

Personnel Breakdown

d) Good discipline

- Be fully responsible for the job assigned

- Maintain good interpersonal relationships with other

employees in the organization

As of December 31, 2007

Category

Male

Female

Total

Administration

2,464

1,851

4,315

Cockpit Crew

1,896

5

1,901

Cabin Crew

446

2,687

3,133

Engineering

5,152

22

5,174

348

19

367

10,306

4,584

14,890

Female

Total

Others