Improving Organizational Governance

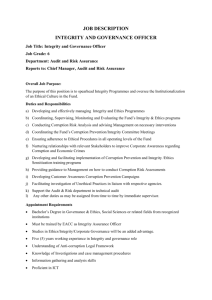

advertisement